Beruflich Dokumente

Kultur Dokumente

XII Accountancy

Hochgeladen von

Aahna AcharyaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

XII Accountancy

Hochgeladen von

Aahna AcharyaCopyright:

Verfügbare Formate

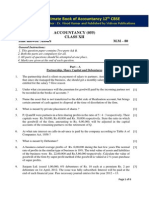

MODEL TEST PAPER

CLASS - XII ACCOUNTANCY

Time allowed : 3 hours Maximum Marks : 80

General Instructions : (i) This question paper contains 25 questions (ii) All questions are compulsory Question No. 1 to 7 (1 marks each)

1. 2. 3. 4. 5. 6. 7. List any two items appearing on the debit side of a partners capital account when capitals are fluctuating. Who should compensate whom in case of a change in profit-sharing ratio of existing partners. Write the name of compensation which is paid by new partners to the sacrificing partners for sacrificing their share of profits. Is the retirement of a partner means reconstitution of a firm ? Explain. What do you mean by subscribed share capital ? What rate of interest to be payable on calls in advance ? What do you mean by Registered Debenture ? Calculate the Interest on drawings of Mr. Goel @10% p.a. for the year ended 31 st March, 2009 in each of the following cases. Case I. If he withdrew Rs.8000 in the beginning of each quarter. Case II. If he withdrew Rs.8000 at the end of each quarter. Case III. If he withdrew Rs.8,000 during the middle of each quarter. A limited Company took a loan of Rs.20,000 from a Bank and deposited 300, 6% debentures of Rs.100 each as a collateral security. The Company, after one month again took a loan of Rs.60,000 from a bank and deposited 700, 6% debentures of Rs.100 each as a collateral security. Prepare Balance Sheet as per 2nd Method. Anirudha Ltd. has 4,000, 8% Debentures of Rs.100 each due for redemption on March 31, 2010. The company has a debenture redemption reserve of Rs.1,50,000 on that date. Assuming that no interest is due, record the necessary journal entries at the time of redemption of debentures.

Question No. 8 to 10 (3 marks each)

8.

9.

10.

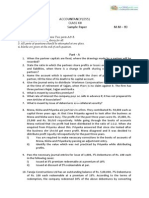

Question No. 11 to 14 (4 marks each) 11. 12. What do you mean by Goodwill ? In which situations do we value goodwill ? Discuss any one method of Goodwill valuation. A, B and C are partners in a firm sharing profits in the ratio of 5 : 3 : 2. On 31 st March, 2009, their Balance sheet was as follows : Liability Amount Assets Amount Creditors 7,000 Buildings 20,000 Reserves 10,000 Machinery 30,000 As capital 30,000 Stock 10,000 Bs capital 25,000 Patents 6,000 Cs capital 15,000 70,000 Cash 11,000 Goodwill 10,000 87,000 87,000 C died on 1st October, 2009. The executor of C will get the following : (a) Goodwill will be valued at 2 years purchase of the average profits of previous five years, which are for 2005 = Rs.15,000, for 2006 = Rs.13,000 for 2007 = Rs.12,000, for 2008 = Rs.15,000 and for 2009 = Rs.20,000. (b) Profits for 2009-10 be taken as having accrued at the same rate as the previous year. (c) Interest as capital to be provided @10% p.a. prepare Cs capital account only.

13.

14.

A company issued 1,000 shares of Rs.10 each at premium of Rs.5 per share, payable as to Rs.8 (including the premium) on application, Rs.4 on allotment and the balance on Call which was duly made. A shareholder to whom 100 shares were allotted, failed to pay the allotment and call money and his shares were forfeited. The forfeited shares were subsequently re-issued as fully paid for Rs.900. Pass necessary entries to record the forfeiture and their re-issue in the books of the company. A company issued a prospectus inviting applications for 20,000 shares of Rs.100 each, payable as follows : Rs.30 on Application; Rs.50 on allotment; and Rs.20 on Call. Applications for all these shares were received. Give necessary journal entries.

Question No. 15 to 16 (6 marks each) 15. A, B and C were partners in a firm having capitals of Rs.60,000; Rs.60,000 and Rs.80,000 respectively. Their Current Account balances were A : Rs.10,000; B : Rs.5,000 and C : Rs.2,000 (Dr.) According to the partnership deed the partners were entitled to an interest on capital @5% p.a. C being the working partner was also entitled to a salary of Rs.6,000 p.a. The profits were to be divided as follows : (a) The first Rs.20,000 in proportion to their capitals; (b) Next Rs.30,000 in the ratio of 5 : 3 : 2; and (c) Remaining profits to be shared equally, The firm made a profit of Rs.1,56,000 before charging any of the above items. Prepare the Profit & Loss Appropriation Account and pass necessary journal entry for apportionment of profit. Dipali and Rajshri are partners in a firm sharing profits and losses in the ratio of 3 : 2. They decided to dissolve their firm on 31st December, 2009, when their Balance Sheet was as under : Rs. Rs. Capitals : Freehold Property 16,000 Dipali 17,500 Investments 4,000 Rajshri 10,000 27,500 Sundry Debtors 2,000 Sundry Creditors 2,000 Stock 3,000 Profit & Loss A/c 1,500 Bank 2,000 Cash 4,000 31,000 31,000 The partners decide to dissolve the firm on the above date. Dipali took over the investments at an agreed value of Rs.3,800. Other assets were realized as follows : Freehold Property Rs.18,000; Sundry Debtors Rs.1,800 and Stock Rs.2,800. Creditors of the firm agreed to accept 5% less. Expenses of realization amounted to Rs.400. There was a typewriter in the firm, which was bought out of the firms money, was not shown in the above Balance Sheet. The typewriter is now sold for Rs.1,000. Close the firms books of accounts by preparing Realisation Account, Partners Capital Accounts and Bank Account.

16.

Question No. 17 & 18 (8 marks each) 17. On 31st March, 2009 the Balance Sheet of Ram and Shyam, who were sharing profits in the ratio of 3 : 1 was as follows : Liabilities Amount Assets Amount (Rs.) (Rs.) Creditors 2,800 Cash at Bank 2,000 Employees Provident Fund 1,200 Debtors 6,500 General Reserve 2,000 Less : Reserve for bad debts 500 6,000 Capitals : Stock 3,000 Ram 6,000 Investments 5,000 Shyam 4,000 10,000

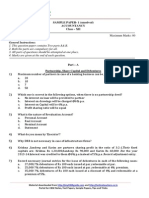

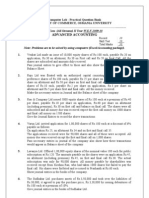

16,000 16,000 They decided to admit, Mohan on April 1st 2009 for 1/5th share on the following terms : (i) Mohan shall bring Rs.6,000 as his share of premium. (ii) That unaccounted accrued income of Rs.100 be provided for. (iii) The market value of investments was Rs. 4,500. (iv) A debtor whose dues of Rs.500 was written off as bad debts paid Rs.400 in full settlement. (v) Mohan to bring in capital to the extent of 1/5th of the total capital of the new firm. Prepare Revaluation A/c, Partners Capital A/c and the Balance Sheet of the new firm. OR Manoj, Naveen and Deepak were partners sharing profit in 3 : 2 : 1. On 1st January, 2010 Naveen retired. On that date their Balance Sheet was stood as follows : Liabilities Amount Assets Amount (Rs.) (Rs.) General Reserve 6,000 Plant and Machinery 30,000 Expense Owing 2,000 Patents 11,000 Bills Payable 5,000 Debtors 3,000 Creditors 10,000 Stock 9,500 Capital Accounts : Cash 500 Manoj 12,000 Naveen 10,000 Deepak 9,000 31,000 54,000 54,000 The terms are : (i) Goodwill was to be valued at Rs.12,000 but no Goodwill Account was to be raised; (ii) New ratio between Manoj and Deepak will be 3 : 2; (iii) Expenses owing are to be brought down to Rs.1,500, Plat is to be valued at 10% less and Patents at Rs.12,000; and (iv) The total capital of new firm will be fixed at Rs.25,000 to be contributed by partners in profit sharing ratio. Prepare ledger accounts to record to the above and prepare Balance Sheet after Naveens retirement. 18. Y Ltd. Invited applications for issuing 10,000 equity shares of Rs.100 each at discount of 6%. The amount was payable as follows : On application Rs.20 per share. On allotment Rs.44 per share and the balance on first and final call. Applications for 13000 shares were received. Applications for 500 shares were rejected and pro-rata allotment was made to the remaining applicants. Over payments received with applications were adjusted towards sums due on allotment. All calls were made and were duly recived except Kanwar who had applied for 250 shares failed to pay allotment and call money. His shares were forteited. The forfeited shares were re-issued at Rs.22,000 fully paid-up. Pass necessary Journal Entries in the books of the company. OR A Co. issued to the public for subscription 40,000 shares of Rs.10 each at a discount of 10% payable as Rs.2 each on application, Allotment and First call and Rs.3 on the Final call. Applications were received for 60,000 shares and allotment was made pro-rata to 80% of applicants. R to whom 1,600 shares were allotted paid only the application money, and S who had applied for 2,400 shares paid the entire call money due along with the allotment. Pass necessary journal entries to record the above transactions. PART B Question No. 19 & 21 (1 mark each) 19. Write any two tools of financial statement Analysis. 20. Rent received on Building comes under which activity. 21. Payment of interest comes under which activity in Financial corporation. Question No. 22 (3 marks) 22. Current Ratio = 2 : 1 Working capital : 80,000

Calculate current Asset & Current Liabilities. Question No. 23& 24 (4 marks each) 23. For the following information, calculate the following ratios : (i) Debt-Equity Ratio; (ii) Proprietary Ratio; (iii) Total Assets to Debt Ratio Balance Sheet of Hazi Ali Ltd. as at 31st March, 2008 Liabilities Rs. Assets Rs Equity Share Capital 15,00,000 Fixed Assets 16,50,000 General Reserve 6,00,000 Investments (Long-term) 1,60,000 12% Debentures 5,00,000 Stock-in-Trade 9,10,000 Bank Overdraft 2,00,000 Debtors 12,40,000 Sundry Creditors 12,00,000 Cash at Bank 40,000 40,00,000 40,00,000 24. Following are the summarized Balance Sheets of R.P. Ltd. Prepare Sheet. Liabilities 1994 1995 Assets Rs. Rs. Share Capital 7,50,000 9,00,000 Fixed Assets Reserve and Surplus 1,50,000 2,25,000 Current Assets Loans 4,20,000 3,00,000 Current Liabilities 5,85,000 5,55,000 19,05,000 19,80,000 Comparative Balance 1994 1995 Rs. Rs. 12,45,000 11,55,000 6,60,000 8,25,000

19,05,000 19,80,000

Question No. 25 (8 marks) 25. Following are the summarized Balance Sheets of AMCO as on 31st December 2000 and 2001. Prepare Cash Flow Statement. Liabilities 2000 2001 Assets 2000 2001 Rs. Rs. Rs. Rs. Share Capital 2,00,000 2,50,000 Land and Buildings 2,00,00 1,90,000 General Reserve 50,000 60,000 Machinery and Plant 1,50,000 1,69,000 Profit and Loss A/c 30,500 30,600 Stock 1,00,000 74,000 Bank Loans (Long70,000 - Sundry Debtors 80,000 64,000 terms) Cash 500 600 Sundry Creditors 1,50,000 1,35,200 Bank 8,000 Provision for Taxation 30,000 35,000 Goodwill 5,000 5,30,500 5,10,800 5,30,500 5,10,800 Depreciation provided during the year was Rs.40,000 on Land and Building and Rs.30,000 on Machinery and Plant.

Das könnte Ihnen auch gefallen

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Dokument7 SeitenCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNoch keine Bewertungen

- XII - Accy. QP - Revision-15.2.14Dokument6 SeitenXII - Accy. QP - Revision-15.2.14devipreethiNoch keine Bewertungen

- CBSE Class 12 Accountancy Sample Paper-03 (For 2014)Dokument17 SeitenCBSE Class 12 Accountancy Sample Paper-03 (For 2014)cbsestudymaterialsNoch keine Bewertungen

- Accountancy Model QuestionsDokument19 SeitenAccountancy Model QuestionsSunil Kumar AgarwalaNoch keine Bewertungen

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Dokument20 SeitenClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatNoch keine Bewertungen

- CBSE Class 12 Accountancy Sample Paper-02 (For 2012)Dokument20 SeitenCBSE Class 12 Accountancy Sample Paper-02 (For 2012)cbsesamplepaperNoch keine Bewertungen

- CBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013Dokument5 SeitenCBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013Manish SahuNoch keine Bewertungen

- Accountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Dokument7 SeitenAccountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Bhoj SinghNoch keine Bewertungen

- Class 12 Accountancy Solved Sample Paper 1 - 2012Dokument34 SeitenClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNoch keine Bewertungen

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Dokument58 SeitenAccountancy: Time Allowed: 3 Hours Maximum Marks: 809chand3Noch keine Bewertungen

- SAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDokument5 SeitenSAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDeepakPhalkeNoch keine Bewertungen

- 2015 12 SP Accountancy Unsolved 07Dokument6 Seiten2015 12 SP Accountancy Unsolved 07BhumitVashishtNoch keine Bewertungen

- Isc Accounts 5 MB: (Three HoursDokument7 SeitenIsc Accounts 5 MB: (Three HoursShivam SinghNoch keine Bewertungen

- Accountancy For Class XII Full Question PaperDokument35 SeitenAccountancy For Class XII Full Question PaperSubhasis Kumar DasNoch keine Bewertungen

- Sample Paper 4Dokument6 SeitenSample Paper 4Ashish BatraNoch keine Bewertungen

- AccountancyDokument0 SeitenAccountancyJaimangal RajaNoch keine Bewertungen

- 12 Accountancy Sample Paper 2014 04Dokument6 Seiten12 Accountancy Sample Paper 2014 04artisingh3412Noch keine Bewertungen

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDokument8 SeitenSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General Instructions9chand3Noch keine Bewertungen

- Sample Paper (Cbse) - 2009 Accountancy - XiiDokument5 SeitenSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoNoch keine Bewertungen

- SAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80Dokument6 SeitenSAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80AcHu TanNoch keine Bewertungen

- Sardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksDokument3 SeitenSardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksRiteshHPatelNoch keine Bewertungen

- TH TH STDokument3 SeitenTH TH STsharathk916Noch keine Bewertungen

- Accountancy Set-1 Time Allowed: 3 Hours Maximum Marks: 90 General InstructionsDokument8 SeitenAccountancy Set-1 Time Allowed: 3 Hours Maximum Marks: 90 General InstructionsVijayNoch keine Bewertungen

- Module-2 Sample Question PaperDokument18 SeitenModule-2 Sample Question PaperRay Ch100% (1)

- ACCOUNTANCY-Practice QuestionsDokument6 SeitenACCOUNTANCY-Practice QuestionsMary JaineNoch keine Bewertungen

- Suraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Dokument5 SeitenSuraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Shalini SharmaNoch keine Bewertungen

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Dokument50 SeitenAccountancy: Time Allowed: 3 Hours Maximum Marks: 80Sidharth NahataNoch keine Bewertungen

- Accountancy Sample Question PaperDokument20 SeitenAccountancy Sample Question PaperrahulNoch keine Bewertungen

- 03 - Accounts - Prelims 1Dokument7 Seiten03 - Accounts - Prelims 1Pawan TalrejaNoch keine Bewertungen

- Accountancy 12th Class PaperDokument5 SeitenAccountancy 12th Class PaperSanjana SinghNoch keine Bewertungen

- CBSE 12th Accountancy 2009 Unsolved Paper Delhi BoardDokument7 SeitenCBSE 12th Accountancy 2009 Unsolved Paper Delhi Boardbrainhub50Noch keine Bewertungen

- 12 2006 Accountancy 4Dokument5 Seiten12 2006 Accountancy 4Akash TamuliNoch keine Bewertungen

- Accountancy 2018Dokument18 SeitenAccountancy 2018MohamedZiaudeenNoch keine Bewertungen

- 2016 12 SP Accountancy Solved 01Dokument8 Seiten2016 12 SP Accountancy Solved 01Sto BreakerNoch keine Bewertungen

- 29Dokument3 Seiten29sharathk916Noch keine Bewertungen

- Corporate Accounting QUESTIONSDokument4 SeitenCorporate Accounting QUESTIONSsubba1995333333100% (1)

- CBSE 12th Accountancy 2012 Unsolved Paper Delhi BoardDokument7 SeitenCBSE 12th Accountancy 2012 Unsolved Paper Delhi Boardbrainhub50Noch keine Bewertungen

- Model Examination Feb 2010-2011: Computerised AccountingDokument3 SeitenModel Examination Feb 2010-2011: Computerised Accountingsharathk916Noch keine Bewertungen

- Class 12 Accountancy Solved Sample Paper 2 - 2012Dokument37 SeitenClass 12 Accountancy Solved Sample Paper 2 - 2012cbsestudymaterialsNoch keine Bewertungen

- ACCOUNTANCY AND BUSINESS STATISTICS First Paper: Corporate AccountingDokument12 SeitenACCOUNTANCY AND BUSINESS STATISTICS First Paper: Corporate AccountingGuruKPONoch keine Bewertungen

- Part - A Partnership, Share Capital and Debentures: General InstructionsDokument7 SeitenPart - A Partnership, Share Capital and Debentures: General InstructionsGaurav JaiswalNoch keine Bewertungen

- 12th Marking AccountancyDokument52 Seiten12th Marking AccountancyManoj GiriNoch keine Bewertungen

- Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised AccountingDokument3 SeitenGhss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accountingsharathk916Noch keine Bewertungen

- Group II AccountsDokument14 SeitenGroup II AccountsPardeep GuptaNoch keine Bewertungen

- SAMPLE PAPER-1 (Solved) : For CBSE Examination March 2017Dokument16 SeitenSAMPLE PAPER-1 (Solved) : For CBSE Examination March 2017Shreya PalejkarNoch keine Bewertungen

- Bba 3 Sem AccountsDokument9 SeitenBba 3 Sem Accountsanjali LakshcarNoch keine Bewertungen

- CBSE 12th Accountancy 2010 Unsolved Paper Delhi BoardDokument7 SeitenCBSE 12th Accountancy 2010 Unsolved Paper Delhi Boardbrainhub50Noch keine Bewertungen

- New Model Test Paper 1Dokument8 SeitenNew Model Test Paper 1Harry AryanNoch keine Bewertungen

- Mock Paper - FinalDokument11 SeitenMock Paper - FinalNaman ChotiaNoch keine Bewertungen

- Acc Sample Paper 4 Typed by DhairyaDokument6 SeitenAcc Sample Paper 4 Typed by DhairyaMaulik ThakkarNoch keine Bewertungen

- Accounting For Managers MB003 QuestionDokument34 SeitenAccounting For Managers MB003 QuestionAiDLo0% (1)

- Rbse Class 12 Accountancy Question Paper 2020Dokument10 SeitenRbse Class 12 Accountancy Question Paper 2020rajwanikajal24Noch keine Bewertungen

- Test Paper 11Dokument8 SeitenTest Paper 11Sukhjinder SinghNoch keine Bewertungen

- CA IPCC Accounts Mock Test Series 1 - Sept 2015Dokument8 SeitenCA IPCC Accounts Mock Test Series 1 - Sept 2015Ramesh Gupta100% (1)

- 3hr Paper 4feb 2010Dokument3 Seiten3hr Paper 4feb 2010Bhawna BhardwajNoch keine Bewertungen

- Accounting For Partnership Firms: Short Answer Type QuestionsDokument8 SeitenAccounting For Partnership Firms: Short Answer Type QuestionssalumNoch keine Bewertungen

- Class Xii Summer Holiday Homework All MergedDokument97 SeitenClass Xii Summer Holiday Homework All MergedRevathi KalyanasundaramNoch keine Bewertungen

- Class XiithDokument11 SeitenClass XiithSantvana ChaturvediNoch keine Bewertungen

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Von EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- TS Grewal Solutions Class 12 Accountancy Volume 1 Chapter 7 - Dissolution of Partnership FirmDokument17 SeitenTS Grewal Solutions Class 12 Accountancy Volume 1 Chapter 7 - Dissolution of Partnership FirmMayank Garange100% (1)

- 2 - FSA1 Handout (Topic 3) - Standard&incomeDokument73 Seiten2 - FSA1 Handout (Topic 3) - Standard&incomeGuyu PanNoch keine Bewertungen

- ReceivablesDokument4 SeitenReceivablesyame teeNoch keine Bewertungen

- Bad DebtsDokument14 SeitenBad DebtsAbdelrahmanAhmedNoch keine Bewertungen

- General Banking Activities and Loan Disbursement and Recovery of RAKUBDokument56 SeitenGeneral Banking Activities and Loan Disbursement and Recovery of RAKUBRussell Alam25% (4)

- Latihan Soal Akm 1Dokument2 SeitenLatihan Soal Akm 1hamidah candradewiNoch keine Bewertungen

- Q6 Deductions From Gross IncomeDokument9 SeitenQ6 Deductions From Gross IncomeNhajNoch keine Bewertungen

- Financial Analyst Assessment of Company Earnings Quality: Robert Bricker" Previts Robinson Stephen YoungDokument14 SeitenFinancial Analyst Assessment of Company Earnings Quality: Robert Bricker" Previts Robinson Stephen Youngmelly amaliaNoch keine Bewertungen

- Akuntansi Account ReceivableDokument8 SeitenAkuntansi Account Receivablem habiburrahman55Noch keine Bewertungen

- ACTBAS 2 Lecture 6 Adjusting EntriesDokument4 SeitenACTBAS 2 Lecture 6 Adjusting EntriescsandresNoch keine Bewertungen

- Partnership Operations - Seatwork PDFDokument3 SeitenPartnership Operations - Seatwork PDFYou're WelcomeNoch keine Bewertungen

- CABWAD 2020 Annual ReportDokument5 SeitenCABWAD 2020 Annual ReportEunicaNoch keine Bewertungen

- Financial Statement FraudDokument6 SeitenFinancial Statement FraudPranay DubeyNoch keine Bewertungen

- Chapter 9Dokument46 SeitenChapter 9Sita Kusuma NugrahaeniNoch keine Bewertungen

- HW On Receivables B PDFDokument12 SeitenHW On Receivables B PDFJessica Mikah Lim AgbayaniNoch keine Bewertungen

- Advanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversityDokument13 SeitenAdvanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversitySaif Uddin33% (3)

- Chapter 2 - Intro To ITDokument12 SeitenChapter 2 - Intro To ITMakiri Sajili IINoch keine Bewertungen

- ACC124 Receivables Quizzer W/ SolutionsDokument43 SeitenACC124 Receivables Quizzer W/ Solutionsジェロスミ プエブラスNoch keine Bewertungen

- Quiz Ak2Dokument23 SeitenQuiz Ak2Andhika YogaraksaNoch keine Bewertungen

- Accounting Made EasyDokument14 SeitenAccounting Made EasyLuna ShiNoch keine Bewertungen

- PWC Worldwide Tax Summaries Corporate 2015 16Dokument2.337 SeitenPWC Worldwide Tax Summaries Corporate 2015 16Osman Murat TütüncüNoch keine Bewertungen

- XI Account Questions PDFFDokument9 SeitenXI Account Questions PDFFnazwaniiharshNoch keine Bewertungen

- Chapter 7Dokument28 SeitenChapter 7Shibly SadikNoch keine Bewertungen

- CPA Review On FARDokument5 SeitenCPA Review On FARYlor NoniuqNoch keine Bewertungen

- Tax Digest FinalsDokument32 SeitenTax Digest FinalsMary Joessa Gastardo AjocNoch keine Bewertungen

- RTP Group 1Dokument129 SeitenRTP Group 1sandhya vNoch keine Bewertungen

- AE 17 M8 ExercisesDokument46 SeitenAE 17 M8 ExercisesKim FloresNoch keine Bewertungen

- BC 304 PI Past PapersDokument29 SeitenBC 304 PI Past PapersBilal AhmadNoch keine Bewertungen

- Accounting TestDokument15 SeitenAccounting TestBenson WencenslausNoch keine Bewertungen

- Chapter14 Audit Revenue Cycle INI PDFDokument48 SeitenChapter14 Audit Revenue Cycle INI PDFdheyaNoch keine Bewertungen