Beruflich Dokumente

Kultur Dokumente

Whle 97

Hochgeladen von

pramit04Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Whle 97

Hochgeladen von

pramit04Copyright:

Verfügbare Formate

What leading banks are learning about big databases and marketing

Ruediger Adolf, Stacey Grant-Thompson, Wendy Harrington, and Marc Singer

any banks believe they can improve prots through information-based continuous relationship marketing (CRM).* A better understanding of customer needs can help them acquire new customers, sell more products to those customers, and prevent other customers from taking their business elsewhere. In two years, one large North American bank trebled the number of products it sold per client household by using needs-based proling; another pursuing the same approach saw a 60 percent increase. Yet others have acquired new customers for loan and investment products who hold transaction accounts elsewhere. And, intelligently used, database marketing has reduced mailing sizes for direct mail campaigns by as much as two-thirds. But this type of marketing approach has to be developed carefully. Many of the fast-growing and protable US nancial companies (such as Capital One) that have stolen business from traditional multiproduct banks are expert at it. To build the same skills, many banks are spending tens of millions of dollars on databases and marketing techniques with no guarantee of success. The fact is that CRM cannot simply be grated onto the multiproduct, multichannel organization of most banks. The huge amount of information available to these banks, coupled with the wide array of products and services they sell, can make implementing CRM a complicated and time-consuming task entailing broad institutional change. The marketing formula, related business processes, and supporting technology may all have to be redesigned. In particular, customer acquisition and management processes will have to be adapted and channels coordinated. As Nigel Morris, chief operating ocer at Capital One, put it, People talk about Capital One and how its all in the databases. Its not. Its in the process and the technology. Aware of this challenge, many bankers embark on highstakes reform. They invest heavily in large databases to market all or many of their products to all their customers; in state-of-the-art statistical models to analyze new data and products; and in organizational structures designed around customers rather than products. But they risk biting of more than they can chew. Although the goals are laudable, those who try to achieve too much, too fast, are likely to nd the payof elusive at best.

CRM refers to informationbased marketing that is integrated with customer acquisition and management processes; see Peter Child, Robert J. Dennis, Timothy C. Gokey, Tim I. McGuire, Mike Sherman, and Marc Singer, Can marketing regain the personal touch?, The McKinsey Quarterly, 1995 Number 3, pp. 11225. Quoted in Datamation, September 1997. Rudy Adolf is a principal in McKinseys New York office, Stacey Grant-Thompson is a consultant in the Toronto office, and Wendy Harrington and Marc Singer are consultants in the San Francisco office. Copyright 1997 McKinsey & Company. All rights reserved.

C U R R E N T

R E S E A R C H

187

THE McKINSEY QUARTERLY 1997 NUMBER 3

C U R R E N T

R E S E A R C H

Refining elements of the marketing campaign

Select target segment Before CRM Based on demographic profile Volume based on direct mail budget After CRM Attractive Offer varies prospects based by segment on response, risk, profitability Campaign ROI accounted for in firms budget Designed from clean sheet to incorporate best ideas Continual testing of offers Processes are tracked and measured in all channels Program manager with responsibility; clear operating performance measures Statistical analysis at individual, segment, and campaign levels to uncover patterns and opportunities Aim is to reduce marketing costs per margin dollar One size fits all Incremental change from previous campaign (Seldom performed) Fragmented responsibility; no real accountability Focus on overall response and sales rates Comparisons made with previous campaign Define value proposition Develop offer Update business system Execute campaign Analyze results

In our experience, banks that have taken a more modest, gradual approach building competitive advantage in certain geographic regions or product segment by product segment, and learning by trial and error have made considerable gains. Those tempted to go for the big bang should reexamine the rationale behind their strategy. They are likely to uncover ve myths: Myth 1: Excellent CRM capabilities constitute a successful strategy Many banks are tempted to spend time and efort building CRM capabilities in the belief that these alone will deliver success. But without a clear, compelling value proposition, the power of marketing is limited. What, for example, is the point of building a marketing database or developing attractive promotional and enrollment materials if the product is a high-load, unbranded mutual fund that no one wants? Instead, banks must develop value propositions that give them an edge over product-focused rivals. They can then use CRM tools to extract maximum value from their competitive advantage. An emphasis on relationships can indeed become part of their strategy, but rst they must make sure that enough customers value the proposition suciently to make it protable, and that they can deliver on that promise. Once a powerful set of value propositions has been dened, a CRM approach can be used to identify which ofers are likely to be most attractive to which people. Using databases to test and rene ofers can be an element of a strategy, but it is not a strategy in itself.

188

THE McKINSEY QUARTERLY 1997 NUMBER 3

Myth 2: To capture value from CRM, a bank must organize around customer segments rather than products CRMs focus on the lifetime value of a customer and the ability to segment actual and prospective customers by needs, behavior, propensity to buy, and other characteristics lead, not unreasonably, to the assumption that a bank should be organized around customer segments. Yet reorganizing a multiproduct (and usually business-unit-oriented) institution around customer segments, at the same time as building data-driven marketing and customer management capabilities, creates extraordinary complexities for systems, processes, and people. As a result, the payof is likely to be slow. Moreover, almost all the winners in the US nancial services market (such as Charles Schwab and MBNA) are focused on products or product segments. Although the nature of competition varies from market to market, it is true to say that most bankers business is now threatened on a product-by-product basis. The most successful banks respond by viewing their product groups as individual businesses each with their own competitors, and accordingly build and apply CRM capabilities unit by unit. Although banks do not have to organize around customer segments, they do have to consider how their CRM capabilities will be integrated within their organization. Too much attention paid to building a narrow set of CRM skills, without enough thought as to the impact CRM can have on the rest of the organization and on how the integration will be managed, is wasted efort. The links between CRM and channel strategy are particularly important. Ideally, marketing eforts should be coordinated across channels so that a customer does not receive diferent ofers from diferent parts of the bank. Without this coordination, a customer might receive a direct mail shot ofering to renew a mortgage at a 0.5 percent discount, for example, then be ofered a cheaper (or more expensive) deal by a branch or via a telephone channel. Myth 3: Successful CRM means building a large, integrated database with complete customer proles, behavioral data, and protability measures A comprehensive, centrally managed database that enables a bank to build the closest possible relationship with customers across all products and services may be the endgame of CRM. It is not a prerequisite. With a few exceptions, successful nancial services companies have approached CRM product by product,

C U R R E N T

R E S E A R C H

189

THE McKINSEY QUARTERLY 1997 NUMBER 3

C U R R E N T

R E S E A R C H

keeping their focus narrow and selling via inexpensive direct delivery channels. This approach ofers banks two advantages: rst, it simplies system design and maintenance; second, it simplies customer ownership issues. Moreover, the falling cost of storing, processing, and gaining access to customer data makes it economic for individual business units to develop their own systems. Ultimately, most banks will have to explore cross-product opportunities in order to diferentiate themselves from product specialists. There are two primary design requirements to ensure that all the pieces come together at this stage: common standards for core systems (for database structure, for example) so that separate systems can be linked, and a central databank (with clean customer address les and third-party data) that is accessible to all. This is not to say that companies should never try to build a cross-product database from the outset. If data needs to be cleaned up across many products, a single project may focus eforts and eliminate duplication. Similarly, a single project may prove more efective where substantial additional data is required and capturing it would mean redesigning a number of existing single-product systems. In either case, building a database should not be allowed to hold up progress. Organizations that learn quickly resist the urge to try to harness more data than they can efectively analyze; they ask How could this information be used to raise prots? before they add yet another eld to the database. Without this discipline, there is a risk that some of the most valuable information may be overlooked in what becomes a directionless quest for more and more data. Myth 4: The most sophisticated analytical techniques are needed to mine historical data Some banks have been seduced by the most elaborate (and expensive) analytical techniques, which they hope will x poor products, service, or pricing. But the best database marketers know that these techniques oten have only limited incremental value. Although success does depend on obtaining the right data, then developing meaningful variables, simpler tools exist that deliver more comprehensible and relevant insights. Important though it is to analyze historical data, too many rms overrate it. Data is frequently incomplete, inaccurate, and outdated, and garbage in invariably means garbage out. We therefore make two recommendations: Be forward looking. Banks should avoid spending too much time and resources on analyzing why old ofers failed. They should understand the main lessons that can be drawn from the information available, then create and test new

190

THE McKINSEY QUARTERLY 1997 NUMBER 3

approaches, rather than trying to make incremental improvements to existing ones. Be hypothesis driven. Bank executives should decide what they expect to nd, then conduct analysis to conrm and/or deny the hypothesis, rather than reviewing reams of data rst in the hope of drawing some conclusions from it. What banks must review, however, is how well they manage individual customers and segments. Most institutions do not think of acquiring customers as a business process. As a result, prospects slip through their ngers. Banks should integrate all data on prospects, leads, and conversion of contacts in order to establish a closed-loop system that tracks every lead and provides a basis for evaluating the efectiveness of specic channels, and even of individual salespeople. Here again, it is important not to get mired in reports. The priority is to select a few key performance measures that are clearly linked to program goals and objectives, such as acquisition, cross-selling, and retention. These are business processes that can be measured to get a handle on the nuts-and-bolts economics (the cost of acquiring a customer and his or her expected lifetime value), and that can also be managed. Myth 5: Everything needs to be in place database, infrastructure, and processes before CRM can begin to work An iterative approach that tests ofers, technology, and business processes can be cheaper and more efective than one that waits until all the components are exactly right partly because lessons can be learned from mistakes. Institutions that strive for early perfection not only take a long time to get a project of the ground, but will probably fall short of the mark without necessarily knowing why. A try it, x it approach to system and business process development means a core system can be up and running quickly; ofers, processes, and models can be tested with minimal investment; and design can be improved as a bank goes along. Marketing programs can be tried out before systems are completed, and monitored by rudimentary tracking systems. What the bank learns about data quality and report needs and the success of the campaign itself will guide the eventual overall design. Failures are a token of the test, learn, test process. The aim is to test and learn on a scale where the value of

C U R R E N T

R E S E A R C H

191

THE McKINSEY QUARTERLY 1997 NUMBER 3

C U R R E N T

R E S E A R C H

learning outweighs the cost of occasionally disappointing results. It is from such failures that many efective marketers have built their capabilities and learned how to sustain competitive advantage.

~~~

Most leaders in traditional banks understand that CRM threatens their core customer franchise. Many also recognize that, if they build the right skills, they can use it to their own advantage. So the main question for them is not whether to adopt this digital weaponry, but how. CRM calls for fundamental changes in the way sales, customers, and channels are managed. Our advice to these executives is to pick their shots carefully. They are more likely to earn attractive returns if they start small, learn what works, and then grow big.

192

THE McKINSEY QUARTERLY 1997 NUMBER 3

Das könnte Ihnen auch gefallen

- Weighting Cases: Factor % in Population / % in Sample. in Our Example With Assumed 8% of Officials in TheDokument1 SeiteWeighting Cases: Factor % in Population / % in Sample. in Our Example With Assumed 8% of Officials in Thepramit04Noch keine Bewertungen

- Two Way AnovaDokument7 SeitenTwo Way Anovapramit04Noch keine Bewertungen

- Comparing Several Means: AnovaDokument52 SeitenComparing Several Means: Anovapramit04Noch keine Bewertungen

- ExerciseDokument2 SeitenExercisepramit04Noch keine Bewertungen

- ExercisesDokument1 SeiteExercisespramit04Noch keine Bewertungen

- On Way ANOVADokument4 SeitenOn Way ANOVApramit04Noch keine Bewertungen

- Acknowledgement: Mrs. Nivedita Dhal Project Co-Ordinator and H.O.D. (MBA)Dokument1 SeiteAcknowledgement: Mrs. Nivedita Dhal Project Co-Ordinator and H.O.D. (MBA)pramit04Noch keine Bewertungen

- Hospital ArchitectureDokument12 SeitenHospital Architecturepramit04Noch keine Bewertungen

- Exercise 3Dokument3 SeitenExercise 3pramit04Noch keine Bewertungen

- Model Project On Improved Rice MillDokument50 SeitenModel Project On Improved Rice Millpramit04Noch keine Bewertungen

- Kiams ContactsDokument4 SeitenKiams Contactspramit04Noch keine Bewertungen

- Pragati Initial Budget - 2Dokument6 SeitenPragati Initial Budget - 2pramit04Noch keine Bewertungen

- Exercise 3Dokument3 SeitenExercise 3pramit04Noch keine Bewertungen

- Certificate: Sparr DVDDokument44 SeitenCertificate: Sparr DVDpramit04Noch keine Bewertungen

- Feb 6 ExpensesDokument2 SeitenFeb 6 Expensespramit04Noch keine Bewertungen

- X y X y X y X Y: Orientation Mathematics: Mock TestDokument3 SeitenX y X y X y X Y: Orientation Mathematics: Mock Testpramit04Noch keine Bewertungen

- Internal Sales JobDokument2 SeitenInternal Sales Jobpramit04Noch keine Bewertungen

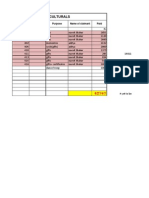

- Culturals: Voucher No. Purpose Name of Claimant Paid DateDokument28 SeitenCulturals: Voucher No. Purpose Name of Claimant Paid Datepramit04Noch keine Bewertungen

- Feb 6 ExpensesDokument2 SeitenFeb 6 Expensespramit04Noch keine Bewertungen

- Culturals Expenses Sheet: S.No Item AmountDokument8 SeitenCulturals Expenses Sheet: S.No Item Amountpramit04Noch keine Bewertungen

- Initial Budget 2008 Strip DownDokument11 SeitenInitial Budget 2008 Strip Downpramit04Noch keine Bewertungen

- Budget FileDokument2 SeitenBudget Filepramit04Noch keine Bewertungen

- Culturals BudgetDokument1 SeiteCulturals Budgetpramit04Noch keine Bewertungen

- Amount Expenditure Income and Expenditure - Pragati-08: (Excluding Borewell of Rs 24200)Dokument2 SeitenAmount Expenditure Income and Expenditure - Pragati-08: (Excluding Borewell of Rs 24200)pramit04Noch keine Bewertungen

- Initial Budget 2008 Strip DownDokument11 SeitenInitial Budget 2008 Strip Downpramit04Noch keine Bewertungen

- Deterministic ModelingDokument66 SeitenDeterministic Modelingpramit04100% (1)

- Culturals BudgetDokument1 SeiteCulturals Budgetpramit04Noch keine Bewertungen

- Economics CasesDokument8 SeitenEconomics Casespramit04Noch keine Bewertungen

- Systems of NonDokument63 SeitenSystems of Nonpramit04Noch keine Bewertungen

- Deterministic ModelingDokument66 SeitenDeterministic Modelingpramit04100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The 2021 World Class Sales Practices StudyDokument21 SeitenThe 2021 World Class Sales Practices StudyyacanthiuNoch keine Bewertungen

- Management Support SystemsDokument13 SeitenManagement Support SystemserangadddNoch keine Bewertungen

- Credit and Collection Management Practices CreditDokument8 SeitenCredit and Collection Management Practices CreditAilene QuintoNoch keine Bewertungen

- CRM Manager Job DescriptionDokument2 SeitenCRM Manager Job DescriptionCarlos GonzalezNoch keine Bewertungen

- Towngas: Achieving Competitive Advantage Through CRM.: Presented byDokument19 SeitenTowngas: Achieving Competitive Advantage Through CRM.: Presented bypriyankshekhar100% (1)

- CRM Opportunities in Airlines Industry by Rajat JhinganDokument23 SeitenCRM Opportunities in Airlines Industry by Rajat Jhinganrajat_marsNoch keine Bewertungen

- 1C TutorialDokument154 Seiten1C TutorialEric UrangaNoch keine Bewertungen

- SAP Business One CRMDokument4 SeitenSAP Business One CRMyesrh100% (1)

- SAP MDG For ManagersDokument4 SeitenSAP MDG For ManagersSAPMDGCurious67% (3)

- Tata Technologies Automotive BrochureDokument8 SeitenTata Technologies Automotive Brochuresunil481Noch keine Bewertungen

- CVS Caseanalysis FINAL3Dokument23 SeitenCVS Caseanalysis FINAL3Vineel KambalaNoch keine Bewertungen

- LS Brochure Spectrum Management System Solutions For Radio Spectrum Management and Network Planning and EngineeringDokument16 SeitenLS Brochure Spectrum Management System Solutions For Radio Spectrum Management and Network Planning and EngineeringLuqman HadiNoch keine Bewertungen

- CMA - TrainingProgram - August 2023Dokument8 SeitenCMA - TrainingProgram - August 2023gusti dianNoch keine Bewertungen

- CH 1 - TourismDokument49 SeitenCH 1 - TourismLayan AlSayehNoch keine Bewertungen

- Bengt Johanstroemmer CV January 2014Dokument9 SeitenBengt Johanstroemmer CV January 2014johanstr999Noch keine Bewertungen

- S4 HANALicensing Model External V19Dokument28 SeitenS4 HANALicensing Model External V19Edir JuniorNoch keine Bewertungen

- 763 (90) - Customer Relationship Management (AIMA)Dokument67 Seiten763 (90) - Customer Relationship Management (AIMA)Parth VermaNoch keine Bewertungen

- Case 7 - CRM 2.0Dokument1 SeiteCase 7 - CRM 2.0Anh ThuNoch keine Bewertungen

- Transaction Codes and Entity Relationship DiagramDokument59 SeitenTransaction Codes and Entity Relationship Diagramsandeep_1985_7866774Noch keine Bewertungen

- Customer Value Management at Tata SteelDokument28 SeitenCustomer Value Management at Tata SteelRavi RakeshNoch keine Bewertungen

- The Impact of Adopting "Business Intelligence (BI) " in OrganizationsDokument64 SeitenThe Impact of Adopting "Business Intelligence (BI) " in Organizationsmartha_1983Noch keine Bewertungen

- Standardize, Validate and Improve Your Information Assets: Data QualityDokument14 SeitenStandardize, Validate and Improve Your Information Assets: Data QualityerkingulerNoch keine Bewertungen

- A Critical Makeover For Pharmaceutical Companies PDFDokument28 SeitenA Critical Makeover For Pharmaceutical Companies PDFAylin PolatNoch keine Bewertungen

- SAP Project Manager in Chicago IL Resume Russell SpillmanDokument3 SeitenSAP Project Manager in Chicago IL Resume Russell SpillmanRussellSpillmanNoch keine Bewertungen

- Global Marketing - (Part IV Designing The Global Marketing Programme)Dokument1 SeiteGlobal Marketing - (Part IV Designing The Global Marketing Programme)Anastasia TsiripidouNoch keine Bewertungen

- SEO For Enterprise TeamsDokument39 SeitenSEO For Enterprise TeamsMaria QuezadaNoch keine Bewertungen

- Customer Prioritization: Does It Pay Off, and How Should It Be Implemented?Dokument22 SeitenCustomer Prioritization: Does It Pay Off, and How Should It Be Implemented?rkarthik403Noch keine Bewertungen

- Updated - 14 - March - 2018 - Mohd Fahmi Bin Zainal Ariffin - RESUMEDokument7 SeitenUpdated - 14 - March - 2018 - Mohd Fahmi Bin Zainal Ariffin - RESUMEFummy OmnipotentNoch keine Bewertungen

- CRM OverviewDokument61 SeitenCRM OverviewRamesh NikamNoch keine Bewertungen