Beruflich Dokumente

Kultur Dokumente

John Keells Holdings PLC Company Snapshot

Hochgeladen von

Charitha Jayasri ThabrewOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

John Keells Holdings PLC Company Snapshot

Hochgeladen von

Charitha Jayasri ThabrewCopyright:

Verfügbare Formate

Company Snapshot John Keells Holdings PLC

300.00 250.00 200.00 150.00 100.00 50.00 JKH ASPI S&P SL 20

JKH.N Rs. 216.9 HOLD |Target Price Rs.253 Upside 16.4%

John Keells Holdings PLC (JKH) is the largest listed company on the Colombo Stock Exchange, with business interests primarily in Transportation, Leisure, Property, Consumer Foods & Retail, Financial Services and Information Technology, among others. Started in early 1870s as a produce and exchange broking business. The Group has been known to constantly re-align, re-position and re-invent itself in pursuing growth sectors of the time. JKH is one of the top players in Hotel industry while being the largest city hotel operator of the country. Market Leader in soft drinks and ice creams. Leisure Sector Profits are expected to grow further with the increasing tourist arrivals. OnThree20 and, K Zone mall in Ja-Ela is expected to complete during next Year Growth in Revenue, EBIT and Profit after Tax is at 16.3%, 26.34% and 33.38% CAGR during last 10 years.

Revenue Breakdown

Financial Services 10% IT 8% Others 3% Transporta tion 22%

Leisure 23%

Consumer Foods & Retail 29%

Risks

Property 5% Revenue (Rs Mn) Revenue Growth (%)

30% 25% 20% 15% 10% 5% 0% -5%

90,000 80,000 70,000 60,000 50,000 40,000 30,000 20,000 10,000 0

High Competition in Consumer Foods & Retail sector. Countries shrinking external trade due to Rescission in EU and USA would impact on profit margins due to high dependency on Transportation industry.

Valuation

Valuation is based on Relative valuation method using average PE of 21.75x for the last ten years. Company is fairly valued at Rs.253 which is a gain of 16.4%. Based on above Valuation John Keells Holdings PLC is recommended HOLD.

All figures in Rs..Mn Group revenue Revenue Growth EBIT EBIT Growth Attributable to Equity holders Total Equity EPS EPS Growth NAVPS Market Price (Adjusted) P/E 1H2013 40,696 21% 2,133,550 63% 4,071 83,558 4.79 49% 87.97 229.10 23.91 2012 76,700 27% 13,581 19% 9,775 80,041 11.6 17% 84.32 206.0 17.76 2011 60,500 26% 11,425 44% 8,245 67,195 9.9 57% 70.59 214.2 21.64 2010 47,980 17% 7,908 -1% 5,201 56,262 6.3 11% 59.03 138.0 21.9 2009 41,023 -2% 7,986 -3% 4,733 50,467 5.7 -7% 53.91 47.1 8.26

16,000 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0

EBIT (Rs. Mn) EBIT Growth (%)

50% 40% 30% 20% 10% 0% -10%

Disclaimer: This Document is prepared and issued using publically available information. The writer has made every effort to ensure the accuracy but will not be responsible for any errors, losses or damages. The recipients of this report must take their own independent decisions.

Charitha Jayasri Thabrew 2012-11-13

Das könnte Ihnen auch gefallen

- In Re The Thirteenth Amendment To The Constitution 2 SLR 1987Dokument97 SeitenIn Re The Thirteenth Amendment To The Constitution 2 SLR 1987Charitha Jayasri Thabrew90% (10)

- Business Analytics Case Study - NetflixDokument2 SeitenBusiness Analytics Case Study - NetflixPurav PatelNoch keine Bewertungen

- John Keells Holdings PLC (JKH) - Q3 FY 16 - BUYDokument10 SeitenJohn Keells Holdings PLC (JKH) - Q3 FY 16 - BUYSudheera IndrajithNoch keine Bewertungen

- Astra International: All's Still in OrderDokument11 SeitenAstra International: All's Still in OrdererlanggaherpNoch keine Bewertungen

- Asian Paints - ER ReportDokument11 SeitenAsian Paints - ER Reportjainpratik092Noch keine Bewertungen

- GSK Consumer Result UpdatedDokument9 SeitenGSK Consumer Result UpdatedAngel BrokingNoch keine Bewertungen

- JCP Research ReportDokument21 SeitenJCP Research Reportapi-239586293Noch keine Bewertungen

- Performance Highlights: NeutralDokument12 SeitenPerformance Highlights: NeutralAngel BrokingNoch keine Bewertungen

- Asian Paints Result UpdatedDokument10 SeitenAsian Paints Result UpdatedAngel BrokingNoch keine Bewertungen

- Finolex Cables-Initiating Coverage 22 Apr 2014Dokument9 SeitenFinolex Cables-Initiating Coverage 22 Apr 2014sanjeevpandaNoch keine Bewertungen

- GSK Consumer: Performance HighlightsDokument9 SeitenGSK Consumer: Performance HighlightsAngel BrokingNoch keine Bewertungen

- HT Media, 1Q FY 2014Dokument11 SeitenHT Media, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Colgate Result UpdatedDokument10 SeitenColgate Result UpdatedAngel BrokingNoch keine Bewertungen

- Colgate: Performance HighlightsDokument10 SeitenColgate: Performance HighlightsAngel BrokingNoch keine Bewertungen

- John Keells Holdings: Key HighlightsDokument14 SeitenJohn Keells Holdings: Key HighlightsSupunDNoch keine Bewertungen

- Britannia: Performance HighlightsDokument11 SeitenBritannia: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Ll& FS Transportation NetworksDokument14 SeitenLl& FS Transportation NetworksAngel BrokingNoch keine Bewertungen

- HUL Result UpdatedDokument11 SeitenHUL Result UpdatedAngel BrokingNoch keine Bewertungen

- Hex AwareDokument14 SeitenHex AwareAngel BrokingNoch keine Bewertungen

- Performance Highlights: CMP '46 Target Price '60Dokument14 SeitenPerformance Highlights: CMP '46 Target Price '60Angel BrokingNoch keine Bewertungen

- Kia Motors JPM 20111030Dokument9 SeitenKia Motors JPM 20111030Kevin YoonSeok ChungNoch keine Bewertungen

- Colgate: Performance HighlightsDokument9 SeitenColgate: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Asian Paints: Performance HighlightsDokument10 SeitenAsian Paints: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Larsen & ToubroDokument15 SeitenLarsen & ToubroAngel BrokingNoch keine Bewertungen

- GSK Consumer, 21st February, 2013Dokument10 SeitenGSK Consumer, 21st February, 2013Angel BrokingNoch keine Bewertungen

- Stock Update Eros International Media: July 06, 2011Dokument8 SeitenStock Update Eros International Media: July 06, 2011narsi76Noch keine Bewertungen

- L&T 4Q Fy 2013Dokument15 SeitenL&T 4Q Fy 2013Angel BrokingNoch keine Bewertungen

- TCS Analysts Q3 12Dokument31 SeitenTCS Analysts Q3 12FirstpostNoch keine Bewertungen

- CFA Equity Research Challenge 2011 - Team 9Dokument15 SeitenCFA Equity Research Challenge 2011 - Team 9Rohit KadamNoch keine Bewertungen

- Abercrombie & Fitch Co.: Matt's Fundamental Stock AnalysisDokument11 SeitenAbercrombie & Fitch Co.: Matt's Fundamental Stock Analysismclennan68_13Noch keine Bewertungen

- Bluedart Express (Bludar) : Best Financial Year Momentum Remains KeyDokument12 SeitenBluedart Express (Bludar) : Best Financial Year Momentum Remains KeyAnkur MittalNoch keine Bewertungen

- Relaxo Footwear 1QFY2013RU 070812Dokument12 SeitenRelaxo Footwear 1QFY2013RU 070812Angel BrokingNoch keine Bewertungen

- Asian Paints Result UpdatedDokument10 SeitenAsian Paints Result UpdatedAngel BrokingNoch keine Bewertungen

- Cost Management Key For 2012: Ksa Telecom SectorDokument13 SeitenCost Management Key For 2012: Ksa Telecom Sectorapi-192935904Noch keine Bewertungen

- Havell Q4 FY2011Dokument6 SeitenHavell Q4 FY2011Tushar DasNoch keine Bewertungen

- Bank of Kigali 1H 2010 Results UpdateDokument48 SeitenBank of Kigali 1H 2010 Results UpdateBank of KigaliNoch keine Bewertungen

- Tulip Telecom LTD: Results In-Line, Retain BUYDokument5 SeitenTulip Telecom LTD: Results In-Line, Retain BUYadatta785031Noch keine Bewertungen

- Relaxo Footwear: Performance HighlightsDokument16 SeitenRelaxo Footwear: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Hexaware Result UpdatedDokument13 SeitenHexaware Result UpdatedAngel BrokingNoch keine Bewertungen

- Yes Bank: Emergin G StarDokument5 SeitenYes Bank: Emergin G StarAnkit ModaniNoch keine Bewertungen

- Infosys Result UpdatedDokument15 SeitenInfosys Result UpdatedAngel BrokingNoch keine Bewertungen

- Colgate 2QFY2013RUDokument10 SeitenColgate 2QFY2013RUAngel BrokingNoch keine Bewertungen

- Marico 4Q FY 2013Dokument11 SeitenMarico 4Q FY 2013Angel BrokingNoch keine Bewertungen

- Rambling Souls - Axis Bank - Equity ReportDokument11 SeitenRambling Souls - Axis Bank - Equity ReportSrikanth Kumar KonduriNoch keine Bewertungen

- Jagran Prakashan Result UpdatedDokument11 SeitenJagran Prakashan Result UpdatedAngel BrokingNoch keine Bewertungen

- Oman Banking 062011Dokument37 SeitenOman Banking 062011rehmani1970Noch keine Bewertungen

- Dabur India Result UpdatedDokument12 SeitenDabur India Result UpdatedAngel BrokingNoch keine Bewertungen

- FY 2011-12 Third Quarter Results: Investor PresentationDokument34 SeitenFY 2011-12 Third Quarter Results: Investor PresentationshemalgNoch keine Bewertungen

- Bosch: Performance HighlightsDokument10 SeitenBosch: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Sharekhan Top PicksDokument7 SeitenSharekhan Top PicksLaharii MerugumallaNoch keine Bewertungen

- DB Corp.: Performance HighlightsDokument11 SeitenDB Corp.: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Market Outlook Market Outlook: Dealer's DiaryDokument20 SeitenMarket Outlook Market Outlook: Dealer's DiaryangelbrokingNoch keine Bewertungen

- GCPL, 4th February, 2013Dokument11 SeitenGCPL, 4th February, 2013Angel BrokingNoch keine Bewertungen

- TVS Srichakra Result UpdatedDokument16 SeitenTVS Srichakra Result UpdatedAngel Broking0% (1)

- 17.8.10 - RBC - אלביט מערכות אנליסטיםDokument10 Seiten17.8.10 - RBC - אלביט מערכות אנליסטיםNoam ShpalterNoch keine Bewertungen

- Loblaws Writting SampleDokument5 SeitenLoblaws Writting SamplePrakshay Puri100% (1)

- SharekhanTopPicks 31082016Dokument7 SeitenSharekhanTopPicks 31082016Jigar ShahNoch keine Bewertungen

- Ama CT - 2Dokument8 SeitenAma CT - 2aadal arasuNoch keine Bewertungen

- Li - Ningco.ltd ReportDokument6 SeitenLi - Ningco.ltd ReportzeebugNoch keine Bewertungen

- FAG Bearings Result UpdatedDokument10 SeitenFAG Bearings Result UpdatedAngel BrokingNoch keine Bewertungen

- Hemas Annual Report 2010 - 11Dokument110 SeitenHemas Annual Report 2010 - 11sam713Noch keine Bewertungen

- Cosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryVon EverandCosmetology & Barber School Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Weerasinghe v. SamarasingheDokument8 SeitenWeerasinghe v. SamarasingheCharitha Jayasri Thabrew67% (3)

- BULANKULAMA AND OTHERS v. SECRETARY, MINISTRY OF INDUSTRIAL DEVELOPMENT AND OTHERS (EPPAWELA CASE)Dokument61 SeitenBULANKULAMA AND OTHERS v. SECRETARY, MINISTRY OF INDUSTRIAL DEVELOPMENT AND OTHERS (EPPAWELA CASE)Charitha Jayasri ThabrewNoch keine Bewertungen

- High Cap OutlookDokument86 SeitenHigh Cap OutlookCharitha Jayasri ThabrewNoch keine Bewertungen

- I Am A Filipino by Carlos RomuloDokument7 SeitenI Am A Filipino by Carlos RomuloKimberly NgNoch keine Bewertungen

- MCQ Class VDokument9 SeitenMCQ Class VSneh MahajanNoch keine Bewertungen

- Bibliografia Antenas y RadioDokument3 SeitenBibliografia Antenas y RadioJorge HerreraNoch keine Bewertungen

- Assignment # (02) : Abasyn University Peshawar Department of Computer ScienceDokument4 SeitenAssignment # (02) : Abasyn University Peshawar Department of Computer ScienceAndroid 360Noch keine Bewertungen

- Toba Tek SinghDokument4 SeitenToba Tek Singhrupal aroraNoch keine Bewertungen

- HTTP WWW - Aphref.aph - Gov.au House Committee Haa Overseasdoctors Subs Sub133Dokument3 SeitenHTTP WWW - Aphref.aph - Gov.au House Committee Haa Overseasdoctors Subs Sub133hadia duraniNoch keine Bewertungen

- Babylon NaturalDokument31 SeitenBabylon NaturalJoana CaeiroNoch keine Bewertungen

- Jee Mathmatic PaperDokument16 SeitenJee Mathmatic PaperDeepesh KumarNoch keine Bewertungen

- English Full Book PaperDokument2 SeitenEnglish Full Book PaperSaira BatoolNoch keine Bewertungen

- 20 Đề thi thử tốt nghiệp THPT năm 2021 - có đáp ánDokument131 Seiten20 Đề thi thử tốt nghiệp THPT năm 2021 - có đáp ánThanh NganNoch keine Bewertungen

- Filed: Patrick FisherDokument12 SeitenFiled: Patrick FisherScribd Government DocsNoch keine Bewertungen

- 20 Dumbbell WorkoutsDokument7 Seiten20 Dumbbell WorkoutsAlessandro BenedettiNoch keine Bewertungen

- Surimi Technology: Submitted To: Dr.A.K.Singh (Sr. Scientist) Submitted By: Rahul Kumar (M.Tech, DT, 1 Year)Dokument13 SeitenSurimi Technology: Submitted To: Dr.A.K.Singh (Sr. Scientist) Submitted By: Rahul Kumar (M.Tech, DT, 1 Year)rahuldtc100% (2)

- Wp406 DSP Design ProductivityDokument14 SeitenWp406 DSP Design ProductivityStar LiNoch keine Bewertungen

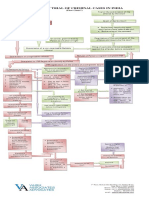

- Process of Trial of Criminal Cases in India (Flow Chart)Dokument1 SeiteProcess of Trial of Criminal Cases in India (Flow Chart)Arun Hiro100% (1)

- Q. 15 Insurance Regulatory and Development AuthorityDokument2 SeitenQ. 15 Insurance Regulatory and Development AuthorityMAHENDRA SHIVAJI DHENAKNoch keine Bewertungen

- Kenya's Top 10 Tourist SpotsDokument23 SeitenKenya's Top 10 Tourist SpotsAaron LopezNoch keine Bewertungen

- (NewResultBD - Com) Mymensingh Board JSC Scholarship Result 2019Dokument80 Seiten(NewResultBD - Com) Mymensingh Board JSC Scholarship Result 2019rthedthbdeth100% (1)

- Personal Details: Your Application Form Has Been Submitted Successfully. Payment Is SuccessfulDokument6 SeitenPersonal Details: Your Application Form Has Been Submitted Successfully. Payment Is SuccessfulKanchanNoch keine Bewertungen

- Narrative Report PatternDokument2 SeitenNarrative Report PatternAngelo DomingoNoch keine Bewertungen

- PRE-TEST (World Religion)Dokument3 SeitenPRE-TEST (World Religion)Marc Sealtiel ZunigaNoch keine Bewertungen

- A Comparative Study of Intelligence in Children of Consanguineous and Non-Consanguineous Marriages and Its Relationship With Holland's Personality Types in High School Students of TehranDokument8 SeitenA Comparative Study of Intelligence in Children of Consanguineous and Non-Consanguineous Marriages and Its Relationship With Holland's Personality Types in High School Students of TehranInternational Medical PublisherNoch keine Bewertungen

- To Hemiette (Hette) Sitter-Zoetlief-Tromp Oegstgeest, Holland Bernhard (Ben) T Agnes Zoe/lief-Tromp Tournesol-, Breteuil Sur Lton, FranceDokument45 SeitenTo Hemiette (Hette) Sitter-Zoetlief-Tromp Oegstgeest, Holland Bernhard (Ben) T Agnes Zoe/lief-Tromp Tournesol-, Breteuil Sur Lton, FrancerathkiraniNoch keine Bewertungen

- MVP Teacher 12Dokument6 SeitenMVP Teacher 12Ivan ChuNoch keine Bewertungen

- Hermle C42 ENDokument72 SeitenHermle C42 ENKiril AngelovNoch keine Bewertungen

- Knock Knock GamesDokument1 SeiteKnock Knock GamesArsyta AnandaNoch keine Bewertungen

- Argumentative Essay-2Dokument4 SeitenArgumentative Essay-2api-385385980Noch keine Bewertungen

- Dragon Is The Fifth in The 12Dokument3 SeitenDragon Is The Fifth in The 12Waylon CahiligNoch keine Bewertungen

- 9701 w19 QP 21 PDFDokument12 Seiten9701 w19 QP 21 PDFFaiza KhalidNoch keine Bewertungen