Beruflich Dokumente

Kultur Dokumente

Corporate Governance, Employee Competence & Financial Reporting

Hochgeladen von

Oral RobertsOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Corporate Governance, Employee Competence & Financial Reporting

Hochgeladen von

Oral RobertsCopyright:

Verfügbare Formate

CORPORATE GOVERNANCE, EMPLOYEE COMPETENCE, INFORMATION INDUCTANCE AND FINANCIAL REPORTING AMONG COMMERCIAL BANKS IN RWANDA

BY: OLIVE MUKANKWAYA 02/ 00113/ 122701 ACCA

A RESEARCH PROPOSAL SUBMITTED TO THE SCHOOL OF POST GRAGUATE STUDIES AND RESEARCH IN PARTIAL FULFILLMENT FOR THE REQUIREMENTS FOR THE AWARD OF THE DEGREE OF MASTERS OF BUSINESS ADMINISTRATION OF CAVENDISH UNIVERSITY RWANDA

MAY 2013

Declaration I, OLIVE MUKANKWAYA, declare that this proposal is my original work and has never been presented to any other university for award of any academic certificate or anything similar to such. I solemnly bear and stand to correct any inconsistency.

Signature

.. OLIVE MUKANKWAYA DATE : .

Approval This is to acknowledge that this research proposal has been under my supervision as university supervisors and is now ready for submission.

Signature ...

Date .

Mr Simon Mwesigwa Mr Bill Nkeeto

Supervisor Supervisor

ii

ACRONYMS

ICGU: USAID: ICB: GBL: CEO: MD: CLERP: PWC: CK: RWAs: NPA: ROA: ROE:

INSTITUTE OF CORPORATE GOVERNANCE UNITED STATES AGENCY FOR INTERNATIONAL DEVELOPMENT INTERNATIONAL CREDIT BANK GREENLAND BANK CHIEF EXECUTIVE OFFICER MANAGING DIRECTOR CORPORATE LAW ECONOMIC REFORM PROGRAM PAPER PRICE WATER COPPERS CORE CAPITAL RISKY WEIGHTED ASSETS NON PERFORMING ASSETS RETURN ON ASSETS RETURN ON EQUITY

iii

TABLE OF CONTENTS ACRONYMS..................................................................................................................iii TABLE OF CONTENTS...............................................................................................iv 1.0 Introduction ...............................................................................................................1 A minimum capital requirement is currently US$ 8.5million for establishing banking operations and the sector is regulated by the National Bank of Rwanda.........................1 The domestic financial sector faces a weak environment in Rwanda. Economic activity is concentrated in a few sectors and credit culture is weak. Normalized accounting standards and appropriate auditing rules for the nonfinancial sector are lacking. There are limitations in the legal and judicial frameworks and corporate governance, including in some commercial banks. In addition, there is a lack of human capital in the financial sector as well as in the accounting and auditing profession.......................1 1.9 Literature Review...........................................................................................................6 1.9.1 The relationship between Corporate Governance and Financial Reporting ..............6 1.9.1.2 Financial Reporting .........................................................................................13 1.9.2 Relationship between Corporate Governance and Employee Competence..............19 1.9.3 The Relationship between Corporate Governance and Information Inductance......21 1.10 Research Methodology..............................................................................................25 Key Informative Interviews .............................................................................................27 1.10.8 Validity and Reliability.......................................................................................27 1.10.9. Measurement of the Variables ..............................................................................27 1.10.10 Ethical Consideration............................................................................................27 1.10.11 Data Analysis....................................................................................................28 1.10.12 Limitation likely to be encountered during the study .....................................28 References: ....................................................................................................................28

iv

1.0 Introduction The Rwandan financial sector comprises of insurance services and banking (commercial banks, development bank and microfinance institutions). The banking sector has seen tremendous growth over the past 5 years and seen increased participation by multinational banks and foreign equity. The market capitalization of the banking sub sector is US$200 million supporting US$1 billion in assets. There is a Financial Sector Development Program that is aimed at deepening financial services and increasing the reach of financial services to the Rwandan population. 14% of Rwandas adult population is banked (518 million persons) which offers investment opportunities for investors keen on reaching untapped markets. Key players in the banking sector are Access Bank, Banque Commerciale du Rwanda, Banque de Kigali, Banque Populaire du Rwanda, Ecobank, and Kenya Commercial Bank. A minimum capital requirement is currently US$ 8.5million for establishing banking operations and the sector is regulated by the National Bank of Rwanda. The domestic financial sector faces a weak environment in Rwanda. Economic activity is concentrated in a few sectors and credit culture is weak. Normalized accounting standards and appropriate auditing rules for the nonfinancial sector are lacking. There are limitations in the legal and judicial frameworks and corporate governance, including in some commercial banks. In addition, there is a lack of human capital in the financial sector as well as in the accounting and auditing profession. Privatizations and recapitalizations have strengthened the short term resilience of banks but the system remains vulnerable to shocks, in particular a sharp decline in aid flows. Five financial institutions out of the nine in operation in Rwanda have been recapitalized recently, two of which have been privatized. Financial soundness indicators have improved markedly, and supervision has been upgraded. However, asset quality remains weak; the structure of the economy results in risk concentration; and governance problems in some banks have generated vulnerabilities. 1

Stress tests indicate that banks would have difficulties coping with the second order effects from a prolonged decline in foreign aid inflows. Given the structure and activity of banks, credit risk is the main source of vulnerability as banks are highly exposed to a few large borrowers.

1.1 Background to the Study Corporate Governance has come to mean many things. Traditionally and at a fundamental level, the concept refers to corporate decision making and control, particularly the structure of the board and its working procedures. Jenifer, (2002) defines Corporate Governance as a set of interlocking rules by which corporations, shareholders and management govern their behaviour. In each country, this is a combination of a legal system that sets some common standards of governance and systems of behaviour determined by firms themselves. Employee competence According to Moor, Cheng & Dainty (2002) is what people need to be able to perform a job well. Its an ability to meet reporting expectations in a role and deliver the required results. Competencies include specific skills, knowledge, attitude, behaviors and techniques which include expertise resulting from training and experience necessary to fulfill a task. Pearce & Robinson (1996) noted that, a Bank is said to be competent if its management demonstrates a good knowledge of the industry in terms of how to position the Bank in the market, how and where to mobilize the startup and or growth capital and how to deal with suppliers and competitors. Information inductance is the extent to which a persons behaviour is affected by the information they are required to communicate. For example, the directors of a company required to produce an annual report and accounts (Pearce & Robinson, 1996) may emphasize the favourable aspects of the financial reporting and may even adopt creative accounting. According to Morck, Shleifer and Vishny (1989), among the main factors that support the stability of any countrys financial system include: good corporate governance; effective marketing discipline; strong prudential regulation and supervision; accurate and reliable accounting financial reporting systems; a sound disclosure regimes and an appropriate savings deposit protection system.

1.2 Statement of the problem Financial reporting purport to communicate a true and fair view of the financial position, reporting and cash flows of a business entity so that the same is useful to the stakeholders for making proper economic decisions. The managers can however manage the financial reporting by exploiting the flexibilities in GAAP like those in accruals, by going beyond GAAP, or even by taking real economic decisions to mislead the stakeholders. In order to enable the stakeholders to take correct economic decisions and to win their confidence on the business entity, it becomes necessary to assure that its financial reporting are not managed to give them a look as desired by the manager. Banks act as the custodian of public deposits. Therefore, public confidence is utmost important for their stability and growth. Any slightest loss of public confidence on a bank can bring in bank failures, which can convert into a worldwide contagion in no time. Since loss in public confidence can arise from any small adverse news about the financial reporting or position of banks and the severity of its impact can be greater than that in any other industry, it becomes all the more important to assure the credibility of the financial reporting of banks. Despite of the financial reporting support systems provided for in the banks, reporting is increasingly declining in most banks as profit after tax reduced by 69% to Fr. 7.2 billion from Fr. 9.2 billion in 2012 (Various annual bank reports, 2012). This could be due to poor corporate governance and poor financial reporting among other reasons. This study therefore will investigate the relationship between corporate governance, employee competence, information inductance and financial reporting in commercial banks in Rwanda. 1.3 Purpose of the Study To examine the relationship between corporate governance, employee competence, information inductance and financial reporting of commercial banks in Rwanda 1.4 Objectives of the Study i) ii) iii) To examine the relationship between corporate governance and financial reporting. To examine the relationship between corporate governance and employee competence. To establish the relationship between corporate governance and information inductance

iv)

To examine the factor structure of corporate governance, employee competence, information inductance and financial reporting.

1.5 i) ii) iii) iv)

Research questions What is the relationship between corporate governance and financial reporting? What is the relationship between corporate governance and employee competence? What is the relationship between corporate governance and information inductance? What is the relationship between corporate governance, employee competence, information inductance and financial reporting?

1.6 Scope of the Study 1.6.1 Subject Scope The study will concentrate on corporate governance, employee competence, information inductance and financial reporting of commercial banks in Rwanda. 1.6.2 Geographical Scope The study will be carried out in Kigali City, focusing on Fina Bank, Development Bank of Rwanda, Bank commercial du Rwanda, Bank Populaire du Rwanda.The Commercial Banks are concentrated in the City centre. 1.6.3 Time scope The researcher will review documents from 2005 to 2012 .The timeline to conduct the study will be from April to September, 2013. 1.7 Significance of the Study The study will be beneficial to the following people: i. Academic: The study will benefit to other scholars who will conduct studies in related field in the future. ii. Industry :The research will benefit Banking sector in Rwanda through providing information on the influence of information inductance on internal controls, 4

iii.

The research will help the policy makers like government to formulate policies that will improve on the performance of the banking sector.

1.8 Conceptual Framework

Corporate Governance

Transparency Accountability Ethical conduct Board size Board roles Ownership concentration

Information Inductance

Illegal acts Smoothing Accounting system Window dressing

Financial reporting

Accuracy Reliability Comprehensiveness Timeliness Dependency Consistency Comparability Relevance

Employee competence

Cognitive skill Skills Experience Knowledge Attitudes Behavior

Description of the conceptual framework The conceptual framework explains the underlying process, which is applied to guide this study. Gavin & Geoffrey, (2004) measured corporate governance through (board size, policy and decision making, board roles, and ownership concentration) and Parasuraman et al., (1988), used the SERVQUAL model with five dimensions; transparency, accountability, Ethical conduct, business culture and power, representing corporate governance and financial reporting. Munene (2005),Employee competence operant , used dimensions like cognitive skill, skills, experience ,knowledge, attitudes, behavior to measure employee competence and financial reporting. Sejjaka (2008), information inductance and financial reporting considered four dimensions (illegal acts, independence, smoothing and accounting system).

1.9 Literature Review

1.9.1 The relationship between Corporate Governance and Financial Reporting 1.9.1.1 Corporate Governance Corporate governance is referred to the manner in which the power of an organization is exercised in the stewardship of the Corporations total portfolio of assets and resources with the objective of maintaining and increasing shareholders value with the satisfaction of other stakeholders in the context of its corporate mission (Private Sector Corporate Governance trust, (1999). The committee on the financial aspects of corporate governance (the Cadbury Committee), defines corporate governance as the system by which companies are directed and controlled. Corporate Governance is both about ensuring accountability of management in order to minimize downside risks to shareholders and about enabling management to exercise enterprise in order to enable shareholders to benefit from upside potential of firms Keasey and Wright, (1993), Tricker, (1984). Gedajlovic et al., (2004) extend an agency perspective on governance to suggest that particular blend of incentives, authority relations and norms of legitimacy in founder firms interacts with the external environment to affect the nature and pace of learning and capability development. Zahra and Filatochev, (2004) argues that corporate governance systems and organizational learning are independent, and in some cases may substitute or complement each other. The decision making style of the board has been linked to corporate reporting Pearce and Zahra, (1991). Prior research has investigated the immergence of corporate governance in developing economies in the context of corporate governance reforms, Rwegasira, (2000) has examined Africa. Krambia and Psaros (2006) investigated the implementation of Corporate Governance principles in an emerging economy of Cyprus and the findings indicated only a minimal impact unless it is supported by other initiatives. Further noted that Cyprus was making serious endeavors to improve the corporate governance of its listed companies. Solomon et al., (2000, 2003) argues that for developing countries to be internationally competitive and attract foreign capital they need to adopt commonly accepted standards of corporate governance implies standards based on the Anglo-Saxon model. Rwegasira (2000)

states that for the Anglo- Saxon model to be effective, company shares need to be owned by widely dispersed owners. The Organisation of Economic Co-operation and Development (OECD), (2004) provides the most authoritative functional definition of Corporate governance: Corporate governance is a system by which business corporations are directed and controlled. The corporate governance structure specifies the distribution of rights and responsibilities among different participants in the corporation, such as the board, managers, shareholders and other stakeholders and spells out the rules and procedures for making decisions on corporate affairs. By doing this, it also provides the structure through which the company objectives are set and the means of attaining those objectives and monitoring reporting. Witherell ,(2004) noted that regional roundtables on corporate governance set up in partnership with the world Bank have allowed the OECD principles to become a widely accepted global benchmark that is adaptable to varying social, legal and economic contexts in individual countries. Indeed the outcome of a survey by Mckinsey in collaboration with the World Bank in June 2000 attested to the strong link between corporate governance and stakeholders confidence (Mark, 2000). Corporate governance is important because it promotes good leadership within the corporate sector. Corporate governance has the following attributes; leadership for accountability and transparency, leadership for efficiency, leadership for integrity and leadership that respects the rights of all stakeholders, Institute of Corporate Governance of Rwanda, (2000). Lack of sound corporate governance has enabled bribery, acquaintance and corruption to flourish and has suppressed sound and sustainable economic decisions. Some key pillars (Private Sector Corporate Governance trust, (1999) on which good governance is framed include; The institution must be governed with a framework which should provide an enabling environment within which its human resources can contribute and bring to bear their full creative powers towards finding solutions to shared problems. Rossette,(2002) carried out the extent to which board composition affects team processes, (orientation, communication, feedbacks, coordination, leadership and monitoring), board effectiveness and reporting of the commercial financial institutions in Rwanda.

Matama, (2005) used three basic tenets of Corporate governance; transparency, disclosure and trust in relation to commercial bank financial reporting in Rwanda which is a profit making organization. Masibo, (2005) focused on the board structure and board process in relation to state owned corporations set for divestiture and those listed on Rwanda securities exchange which are profit making. In line Gavin and Geoffrey (2004), the current study focuses on board size, policy & decision making as indicators of Corporate Governance in relation to board roles, contingency, board effectiveness and financial reporting of banks in Rwanda. The concept of accountability though not listed in the scope of the study the accountability concept cannot be overlooked when reviewing corporate governance literature. Accountability relationships occur in every sector of the society including the commercial sector (Wheelers, 2000). Where there is inadequate accountability resources will be used inefficiently and ineffectively; thus, inadequate accountability can result in devastating consequences for millions of people and compromising the operations of an organization (Kluver, 2001). Accountability is multifaceted and complex, at the heart of which is the notion of one party rendering an account of the use of resources to another party. Gray and Jenkins (1993) have the opinion that accountability is an obligation to present an account of and answer for the execution of responsibilities to those who entrusted those responsibilities, the principal/agent relationship Kluver, (2001). Accountability forms the basis of the trust in organizations, so when accountability relationships are undermined then our trust in organizations is damaged. While accountability might at first seem to be easily defined the reality is that it is a complex multifaceted concept. Much of the earlier researches focused on accountability as measure of Corporate governance, this study is focused on board size, policy and decision making. Board size

When the board has adopted a clear view of its responsibilities in governing the company, the directors can then move to discuss and agree the most effective way of structuring the board. Consideration could be given to the size of the board itself; is the board too small or too large to adequately fulfill its requirements, given the size and complexity of the organization? The balance of the executive and non-executive directors and whether independent directors are

necessary is another structural issue to consider. Likewise does the board have the optimal skills mix to deliver effective governance considering the nature of the company governed? Depending on the circumstances, the board may benefit from having a member with industry experience, legal expertise or perhaps a director representative of stakeholder. Gavin and Geoffrey, (2004). Board size defined as the total number of directors on a board (Panasian et al., 2003), has been regarded as an important determination of effective Corporate governance (Bonn et al., 2004). The optimal board size according to Goshi et al., (2002) includes both the executive directors and non executive directors. Forbes and Daniel (1999) argued that although board size is not truly a demographic attribute, it is unlikely to have effect on board functioning. Despite the considerable amount of effort in research on board size for more than a decade there is still lack of consensus among researchers on its relevancy. This inconclusive nature in board size research quality and experience of independent directors on the board than sheer numbers of individuals (Keegen & Gilmour, 2001). There has been considerable debate on whether large boards perform better than smaller boards. Daily (1995) argue that greater number of directors might increase available expertise and resource pool while Bonn et al., (2004) contends expanding the size of the Board provides an increased pool of expertise, information and advice quality not obtained from other corporate staff. In contrast, the difficulty inherent in coordinating the contributions of many members can be complex, hindering them to use their knowledge and skills effectively (Forbes & Daniel 1999, Epstein et al., 2004). From agency perspective, increase in board increases the Boards monitoring capacity but costs that accrue from large boards may facilitate CEO dominance over board members. For instance large boards have difficulty in building the interpersonal relationships that further cohesiveness, or maintain high board effort norms owing to social loafing that exists in large boards (Forbes & Daniel, 1999). Studies such as Bonn et al., (2004) have also supported previous authors and concluded that when the board size is very large, the disadvantages such as lack of cohesiveness, coordination difficulties and fractionalization are most severe and they became less prevalent as board size decreases. In contrast very small boards cannot enjoy the advantages of the pool of expertise, information and advice of a larger board and these benefits emerge when the board becomes larger. To date there are still wide views on an optimal board size. According to

Leblanc & Gillies (2003), an 8-11 persons board may be considered optimal. In a recent study by Epstein et al., (2004), a board of 9-13 members is typically right for most companies but too small for large ones. Goshi et al., (2002) considered an average of 16 directors (3 within and 13 outside directors) to be appropriate for larger companies, though respondents in this study believed that 12 is the most effective board size. The study by Connelly & Limpaphayom (2003) revealed that the average board size of insurance firms in Thailand was 10 but ranged from a low number of 4 members to a high number of 16 members. The current study is focused on Board size in terms of the number of University Council and Senate Members as stipulated by the Statute. Policy and decision making

The final function that a board needs to consider is its duty with respect to delegating authority. Given the complexity of the business environment, it is impossible for the board to be the sole decision making body in the company. Instead, each board needs to work on developing an appropriate method and level of delegation of authority. Obviously this will again vary with the context facing the board but, in all circumstances, the board needs to clearly articulate and document the delegations it makes Gavin and Geoffrey, (2004). Board roles

Board effectiveness occurs via the execution of roles set that is conceptualized by different researchers in different ways Hung, (1998), Johnson et al, (1996), Lipton and Lorsch, (1992). What is clear is that the roles of the board have evolved over time. Defining a clear role set is difficult as different disciplines concentrate on different areas of interest. Pettigrew, (1992) identified six themes of academic research on the role of managerial elites such as chairpersons, presidents, Chief executive Officers (CEOs) and Directors. These include the study of interlocking directorates and the study of institutional and societal power, the study of boards and Directors, the composition and correlation of top management teams, studies of strategic leadership, decision making and change, CEO compensation and CEO selection and succession. There are, however board roles that receive board support Gavin and Geoffrey, (2004) as explained below. Contingency, board roles and board effectiveness

While all boards are required to undertake activities within the spectrum of this roles set, they contend that each organization will need a different emphasis among these roles. Thus, there is 10

need to explicitly incorporate a contingency perspective Heracleous, (2001), Donaldson and Davis, (1994), Johnson et al, (1996). Since a particular board composition or behavior that is advantageous for one corporation may prove inappropriate or even detrimental in another Heracleous, (2001). There is need to identify the control variables and gaps in understanding how the board can impact on firm performance. The particular contingencies that will impact on board roles corporate performance would include organizational size Daily and Dalton, (1992), Dalton et al,(1999), diversity Siciliano, (1996), management experience Coulson- Thomas,(1993) industry turbulence, industry lifecycle, and firm lifecycle Johnson, (1997). It is these contingencies that moderate the relationship between board roles and board effectiveness. Thus the current study includes external and internal contingencies to moderate the relationship between board role execution and board effectiveness. This study will use management experience, University turbulence, University lifecycle as contingencies that will impact on board roles and corporate performance. Board effectiveness

Individuals perceive effectiveness partially or in different ways. The social constructionists conception, for instance, holds that there only judgments of effectiveness, thus effectiveness are judgmental (Herman et al., 1997). According to Triscott, (2004) effectiveness is about doing the right things to achieve the results. In terms of measurement, Novick (1997) suggests that the current approaches measure elements associated with effectiveness rather than effectiveness rather than effectiveness itself. Board effectiveness can be conceptualized as a function of overall contribution of the board to the organization performance, standard of support provided by the organization, individual contribution of directors to organization performance, board dynamics, Board performance evaluation and review Van der Walt and Ingley, (2001). Close inspection of earlier literature revealed that board effectiveness is almost based on individual experience Jackson & Holland, (1998). According to Higgs & Dulewicz (1998), the issue of measuring team outcomes is a difficult one and the literature abounds with debates around team performance, which mirror those surrounding organizational performance. However, while there are various definitions of group effectiveness, Huat & David (2001) argue that board performance has been measured along the dimension of the boards ability to perform its functions. Indeed, an earlier study by Forbes & Daniel (1999) defined board effectiveness as the boards ability to perform its

11

control and service tasks effectively. From empirical perspective, Bardwaji & Vuyyuri (2003) found that overall judgments by respondents of board effectiveness were strongly related to how effectively the boards were judged to perform various functions. Basing on the above literature, it fairly holds that board performance has been largely defined in terms of roles played by the BODs. These roles have been identified from various perspectives including; agency, service, resource dependency, legal and strategic theories. However, some of these perspectives are interrelated, for instance resource dependency, service and strategy, agency and legal. Using these perspectives, the following roles have been identified; Skills and knowledge

Presence and use of skills and knowledge has been identified as another important dimension of board effectiveness. Board members must have the right mix of skills and knowledge. For instance, they should possess both functional knowledge in traditional areas of business such as accounting, finance, legal or marketing as well as industry specific knowledge that will enable members to truly understand specific company issues and challenges. In addition, board members must have enough general knowledge to provide good input on all topics of discussion, ask questions of all special interest until they are comfortable enough to cast votes Espstein et al, (2002). Thus, for boards to work effectively, Nicholson & Geoffrey (2004) emphasize that board members must possess necessary knowledge and skills, given the unique nature of their tasks. Similarly, for a board to effectively perform the supervisory role, it should be composed in a manner that enhances the presence of skills and knowledge Namisi, (2002). Committees

Significant research effort has focused on the impact of committees, Klein , (1989), most notably the audit committee Klein, (2002), remuneration committee Conyon and peak, ( 1989) and nominating committee Vafeas, (1999) with findings that there is a link between the presence of board committees and board effectiveness. A committee is a group of members to whom some specific role has been delegated by a full board. Committees can be used to gather, review and summarize information and report back to the full board for decision or can be delegated specific decision making powers, Gavin and Geoffrey, (2004). Delegation

12

The final function that a board needs to consider is its duty with respect to delegation authority. Given the complexity of the business environment, it is impossible for the board to be the sole decision- making body in the company. Instead, each board needs to work on developing an appropriate method and level of delegation of authority. Obviously this will again vary with the context facing the board but, in all circumstances, the board needs to clearly articulate and document the delegations it makes Gavin and Geoffrey, (2004). Risk management

Risk management includes the identification of all significant risks faced by the company and ensuring that appropriate policies are in place to moderate the impact of these risks Klein, (2004). This study will focus on council committees like appointments board committee, staff welfare committee, students welfare committee and Finance tender and general purposes committee and the roles delegated by council to the committees. Appropriate policies put in place to moderate the impact of risks in public Public Universities will be considered Ownership concentration

This is another element of corporate governance mechanism examined in this study. It refers to the proportion of a firms shares owned by a given number of the largest shareholders .A high concentration of shares tends to create more pressure on managers to behave in ways that are value maximizing .in support of this argument ,Gorton and Schmid (1996),Shleifer and Vishnu (1997),Morck et al.(1998),and Wruck (1998)suggest that at low levels of ownership concentration , an increase in concentration will be associated with an increase in firm value, but that beyond a certain level of concentration ,the relationship might be negative . Other studies such as Renneboog (2000) reported results not totally in agreement with the hypothesis of a positive relationship. Using a set of variables suggested by Agrawal and Knoeber (1996), the author reported no evidence to support the hypothesis of a positive relationship between firm performance and ownership concentration .Holderness and Sheehan (1988) find little evidence that high ownership concentration directly affects performance.

1.9.1.2 Financial Reporting Financial soundness is a situation where depositors funds are safe in a stable banking system. The financial soundness of a financial institution may be strong or unsatisfactory varying from one bank to another BOU, (2002). External factors such as deregulation; lack of information 13

among bank customers; homogeneity of the banbusiness, connections among banks do cause bank failure. The role of corporate governance has been gaining momentum over the past two centuries. Although initially established as a legal requirement for incorporation, corporate governance has become a critical link between firms and those who have vested interests in the firm. Vinten (1998) states that corporate governance is needed not only to protect the interests of the stockholders but also other stakeholders. Corporate governance is mandated to ensure the interests of public sector and private-sector organizations are represented. In addition, corporate governance aids in securing confidence not only for stockholders but also for other stakeholders such as customers, suppliers, employees, and the government in ensuring that firms are accountable for their actions. Some useful measures of financial performance, which is the alternative term as financial soundness, are coined into what is referred to as CAMEL. The acronym "CAMEL" refers to the five components of a bank's condition that are assessed: Capital adequacy, Asset quality, Management, Earnings and Liquidity. A sixth component, a bank's Sensitivity to market risk was added in 1997; hence, the acronym was changed to CAMELS. Note that the bulk of the academic literature is based on pre -1997 data and is thus based on CAMEL ratings. Ratings are assigned for each component in addition to the overall rating of a bank's financial condition (Jose, 1999). Capital Adequacy: This ultimately determines how well financial institutions can cope with shocks to their balance sheets. The bank monitors the adequacy of its capital using ratios established by The Bank for International Settlements. According to bank of Rwanda, (2002) Capital adequacy in commercial banks is measured in relation to the relative risk weights assigned to the different category of assets held both on and off the balance sheet items. Asset Quality

The solvency of financial institutions typically is at risk when their assets become impaired, so it is important to monitor indicators of the quality of their assets in terms of overexposure to specific risks trends in non- performing loans, and the health and profitability of bank borrowers especially the corporate sector. Credit risk is inherent in lending, which is the major banking business. It arises when a borrower defaults on the loan repayment agreement. A financial

14

institution whose borrowers default on their repayments may face cash flow problems, which eventually affect its liquidity position. Ultimately, this negatively impacts on the profitability and capital through extra specific provisions for bad debts Bank of Rwanda, (2002). Earnings: The continued viability of a bank depends on its ability to earn an adequate return on its assets and capital. Good earnings performance enables a bank to fund its expansion, remain competitive in the market and replenish and /or increase its capital. A number of authors have argued that, banks that must survive need higher Return on Assets, better return on net worth/Equity, sound capital base i.e. the Capital Adequacy Ratio, adoption of corporate governance ensuring transparency to stakeholders that is equity holders, regulators and the public. Liquidity: Initially solvent financial institutions may be driven toward closure by poor management of short-term liquidity. Indicators should cover funding sources and capture large maturity mismatches. An unmatched position potentially enhances profitability but also increases the risk of losses according to the Rwandan Banker, (June 2001). The M represents Management, given that this paper is hinged on financial performance, the management component in not considered in the measure. The National Commission on Fraudulent Financial Reporting (Treadway Commission, 1987) performed a landmark study of fraudulent financial reporting. One of the Commissions three major objectives was to identify attributes of the corporate structure that may contribute to the incidence of fraudulent financial reporting. The majority of the Commissions recommendations for the public company deal with strengthening aspects of the corporate governance structure, particularly in the areas of internal audit and the audit committee (Treadway Commission 1987, Chapter 2). The Committee of Sponsoring Organizations (COSO) of the Treadway Commission supported follow-up research that investigated fraudulent financial reporting during the period 1987-1997 (Beasley, Carcello, and Hermanson 1999). Consistent with the findings of the Treadway Commission (1987) report, this report indicates that top management involvement in the fraud and the presence of a weak audit committee and board of directors are common fraud factors.

15

Focus on corporate governance, and on the audit committee in particular, has intensified in the decades following the Treadway Commission report. The Blue Ribbon Committee on Improving the Effectiveness of Corporate Audit Committees (BRC) recognized that the audit committee is an integral part of the larger governance process related to financial reporting oversight (BRC 1999, 7). The BRCs ten recommendations for strengthening the audit committee are aimed specifically at enhancing financial reporting and the oversight of the financial reporting process. The BRCs recommendations took on increased importance in December 1999, when the New York Stock Exchange (NYSE), National Association of Securities Dealers (NASD), and the American Stock Exchange (AMEX) amended their listing requirements to incorporate the BRC recommendations (SEC 1999a; SEC 1999b; SEC 1999c). The Sarbanes-Oxley Act (2002) has focused additional attention on the audit committee by setting forth a stricter definition of audit committee independence, and by requiring the external auditors to report directly to the audit committee. The main hypothesis of this study is that the existence of a strong corporate governance structure plays an important role in minimizing the incidence of fraudulent financial reporting. The relation between financial reporting integrity and selected aspects of the corporate governance structure has been examined in prior studies using a variety of research h designs. There is a considerable amount of empirical evidence that suggests that director independence (Beasley 1996; DeChow et al. 1996), audit committee existence (Defond and Jiambalvo 1991; Dechow et al. 1996; McMullen 1996; Beasley et al. 2000), and audit committee independence (Abbott et al. 2000; Beasley et al. 2000; Abbott et al. 2002) are positively related to the integrity of financial reporting. However, several other aspects of the corporate governance structure that have been the subject of policy-makers recommendations have not been addressed thoroughly in the extant literature. For example, the BRC (1999) made recommendations about audit committee size, financial literacy of directors, and the audit committee charter. The Treadway Commission (1987) likewise made recommendations about the audit committee charter, and also recommended the maintenance of an internal audit function. While there is some limited empirical evidence in these areas in the financial reporting context (McMullen and Raghunandan 1996; Beasley et al. 2000; Abbott et al. 2002), the evidence is much less compelling. A more thorough empirical analysis of audit committee size, financial literacy, and the audit committee charter, as well consideration of other aspects of the corporate governance structure, would contribute to a more complete understanding of corporate governance.

16

This study contributes to the corporate governance literature by analyzing descriptive corporate governance variables that have not been thoroughly examined in prior studies. These variables are important because they provide a more thorough description of the composition, activity, and overall quality of the corporate governance structure. The sample period examined in this study precedes the 1999 amendment of listing requirements made by the national stock exchanges. This timing provides an opportunity to examine the effects of certain corporate governance mechanisms (e.g., financial literacy, quality of corporate charter) in a period before these mechanisms were mandated. Relevance

Relevance makes accounting information useful for decision making .to be relevant information must be capable of making a difference in a decision, Khomsiya(2010). It needs predictive or feedback value presented on a timely basis. Relevant information helps users predict the ultimate outcome of past ,present and future events, helps users to confirm or correct prior expectations and available to decision makers before it loses its capacity to influence their decisions, Breda 1992. Reliability

Reliability is necessary because most users have neither the time nor the expertise to evaluate the factual content of the information, Palepu(2001).the information is reliable to the extent that it is verifiable, is a faithful representation and is reasonably free of error and bias. Verifiability occurs when independent measures, using the same method obtain similar results. Representation faithfulness means the numbers and descriptions match what really exited or happened, Healy(2001). Comparability

Information that is measures and reported in a similar manner for different companies is considered comparable (Wulandari,2007).Comparability enables users to identify the real similarities and differences in economic events between companies. Consistency

Companies show consistent using of accounting standards when they apply the same accounting treatment to similar events.

17

The convention of consistency means that same accounting principles should be used for preparing financial statements for different periods. It enables the management to draw important conclusions regarding the working of the concern over a longer period. It allows a comparison in the performance of different periods. If different accounting procedures and processes are used for preparing financial statements of different years then the results will not be comparable because these will be based on different postulates. The concept of consistency does not mean that no change should be made in accounting procedures. There should always be a scope for improvement but the changes should be notified in the statements. The impact of changes of procedures should be clearly stated. It will enable the readers to analyze information according to new procedures. In the absence of any information regarding the change, it will be presumed that old methods have been used this time also. Whenever, consistency is not followed this fact may be fully disclosed. For example, if a change in the method of charging depreciation is made or a change is made in the method of allocating overhead expenses to different products, a foot note to the financial statements should be given indicating the extent of change. If possible, net monetary effect of these changes should also be given. Consistency may be of three types: vertical consistency, horizontal consistency and third dimensional consistency. The vertical consistency is maintained within inter-related financial statements of the same period. If a change has been made in dealing with two aspects of the same statement then it will be vertical inconsistency. For example, if one method of depreciation is used while preparing profit and loss account and another method is followed while preparing balance sheet, it will be a case of vertical inconsistency. When figures of one financial year are compared with the figures of another financial year of the same organization it will be a case of horizontal consistency. Third dimensional consistency will arise when financial statements of two different organizations, in the same industry, are compared. (Accounting and Financial Management; 2003) Corporate governance has also been linked to fraudulent financial reporting. Dechow et al (1996) determined that the incidence of fraud is highest among firms with week corporate governance systems. Further he finds that fraud firms are more likely to have Boards dominated by insiders and are less likely to have an audit committee to be used to predict which forms are more likely

18

to be involved in fraudulent activities. Financial reporting constitutes an integral part of corporate governance; can provide pressure for improved financial performance.

1.9.2 Relationship between Corporate Governance and Employee Competence 1.9.2.1 Employee competence Employee competencies are sets of knowledge, skills, behaviors and attitudes that contribute to personal effectiveness (Hellriegel et al., 2008). This is supported by Henderson (2000) who defines a competency as a combination of knowledge and skills required to successfully perform an assignment. Its attainment is evidenced by the ability of an individual to gather data, process it into useful information, access it and arrive at an appropriate and useful decision in order to initiate the actions necessary to accomplish the assignment in an acceptable manner. The Hay Group (2003) puts it that, a competency is an underlying characteristic of a person which enables him/her to deliver superior performance in a given job, role, or situation Lenssen et al (2006) noted that, defining the competencies required for any particular job role allows managers and those responsible for their development, to grasp what is required to reach improved levels of excellence and performance by providing a common framework which articulates the skills, knowledge and attitudes relevant to successful business practice. Boyatzis (1982) urged that, in the era of competitiveness, managerial competencies emerge as a basis for competitive edge as these are underlying characteristics of a person that have casual relationship with superior performance. Rene. S. et al (2002) states that, competencies provide a basis for needs assessments to help programs identify areas for program improvement. They add that, Performance indicators operationally define each competency and that these performance indicators identify skills, behaviors, or practices that demonstrate the existence of the competency. Scholars like Rychen and Salganik (2003) argued that Individuals need a wide range of competencies in order to face the complex challenges of todays world, but it would be of limited practical value to produce very long lists of everything that they may need to be able to do in various contexts at some point in their lives. They went ahead and argued that, Key

19

competencies are not determined by arbitrary decisions about what personal qualities and cognitive skills are desirable, but by careful consideration of the psychosocial prerequisites for a successful life and a well-functioning society. However they observed that though competencies are needed to help accomplish collective goals, the selection of key competencies needs to some extent to be informed by an understanding of shared values. According to ACCA (2006 b), the level of managerial skill is gauged based on the level of not only education but also natural administrative talent and practical experience possessed by an enterprises managers in the given business area. Whereas administrative talent is measured using the managers innate managerial capacity (Aaron & Warren, 2004), the level of education is established basing on the educational qualification possessed by the manager and employees (Kayongo 2005). The practical experience, which indicates the level of the SMEs industrial knowledge, is determined in terms of period of time spent in the business which is usually measured in terms of number of month or years spent by the SMEs in a given business (Kayongo, 2005). The enterprise is considered to be competent if its managers are educated in the relevant field of the enterprises business and if the managers have accumulated enough practical experience in the field (Myers, 1997). In a more globalized, interconnected and competitive world, the way that environmental, social and corporate governance issues are managed is part of companies overall management quality needed to compete successfully. Companies that perform better with regard to these issues can increase shareholder value by, for example, properly managing risks, anticipating regulatory action or accessing new markets while at the same time contributing to the sustainable development of the societies in which they operate. Moreover these issues can have a strong impact on reputation and brands, an increasingly important part of company value. Company boards of directors are bodies entrusted with power to make economic decisions affecting the well-being of investors capital, employees security, communities economic health, and executive power and perquisites (Banks, 2004). Hence, boards of directors have the ultimate internal authority within a company (Renton, 1994).

20

The history of boards of directors came to the forefront of corporate life in the mideighteenthcentury in Britain, when the state or the crown created them to ensure business stability (Tricker, 1984). Prior to that time, the only way to do business was as a sole trader or partnership. Within this simple structure, when a business became insolvent, the owner and family held all liabilities (Tricker, 2003). When the concept of joint-stock limited companies with separate legal entities between the owner and the company (called separation of ownership and control) was introduced, the owner or shareholders were able to elect a manager of a firm (Garratt, 1997). There is a relationship between corporate governance and employee competence in the sense that the board is responsible for elaborating the human resource manuals, different organizations policies, recruiting the competent staff who will implement the board decisions. And if these decisions havent been done in good faith, it will affect a competent staff and can lead to this one departure.

1.9.3 The Relationship between Corporate Governance and Information Inductance 1.9.3.1 Information Inductance Information Inductance is a process whereby the behavior of and individual is affected by the information he is required to communicate, Prakash et al (2009). Since employment is viewed primarily in terms of its economic instrumentality, values that can be realized through economic outcomes are more likely to influence work related behaviour (Shafer, Morris and Ketchand, 2001). Academic literature is replete with studies of the relationship between personal values and their influence on personal decisions, especially in the organizational context (see Finegan, 1994; Akaah and Lund, 1994; Fritzsche, 1995). There is also growing consensus that unethical behaviour in the organizational context may be understood by examining cultures effects on peer reporting (Zhuang, Thomas and Miller, 2005; Hodge, Hopkins and Pratt, 2006).It is expected that the more an individual values a comfortable life and/or pleasure, and the less self respect is valued, the more likelihood that the individual would choose a fraudulent response/course of action (Brief, Dukerich, Brown and Brett, 1996). Using personalist phenomenology, it can be shown how the development of technical and moral values is crucial to the long-run survival of organizations. The process of discovering peoples

21

values and helping to develop their technical potential is a substantial part of the organizations internal mission (Rosanas and Velilla, 2005), which essentially consists of building unity and mutual trust between the members of the organization. The control process must appeal to work (moral) values, as it is crucially important that people learn about the actions that are desirable to the organization itself as well as to its customers. In order for us to execute an efficient control system, we must have a reasonable understanding of the real needs of the persons responsible for manning the accounting information system of the organization. In the personalist phenomenology referred to by Rosanas and Velilla (2005), we begin to see a nexus between work values and the control environment. Empirical research in self determination theory (SDT) has also shown that that holding an extrinsic, relative to an intrinsic, work value orientation was associated with less positive outcomes and more with negative outcomes (Vansteenkiste et al. , 2007). Values are an organized set of preferential standards that are used in making selections of objects and actions, resolving conflict, invoking social sanctions, and coping with needs or claims for social and psychological defences of choices made or proposed. Values are an enduring belief that a specific mode of conduct or end-state of existence is personally or socially preferable to an opposite or converse mode of conduct or end-state of existence (Rokeach, 1979, p. 5). They may be held collectively within firms, subcultures and occupational groups. It is thus assumed that values are homogenous within groups, even though this would not preclude conflict between different value domains. If values are viewed from the context of specific domains, then they have a more specific meaning within that context. Values influence the way employees see the organization and how they conform to shared perceptions. Thus in the work domain we talk about work values which we consider to be salient, basic and influential to the control process of the organizations accounting information environment/system. They are a source of motivation for individuals in performing organizational roles. Work values include intrinsic (personal growth, autonomy, interest, and creativity), extrinsic (pay and security), social (contact with people and contribution to society) and power (prestige, authority, influence). They are more specific than individual values in the way that they refer to goals in the work place (Schwartz, 1999). The pursuit of power and extrinsic values is more likely to be associated with

22

favourable reporting to gain influence, while intrinsic and social values would be associated with a more professional attitude (autonomy) and openness. Accounting systems, on the other hand, are considered to be uncertainty-reducing rituals, which are used to construct reality through generally accepted accounting principles (GAAP). However if accountants find themselves operating outside such a structured and measurable framework, would their response be an effort to distort the information to suit the desired ends? The conditions that determine the behaviour and nature of outputs depend on the ability to anticipate the extent to which the anticipated outcomes would be desirable to the person distorting the information (also referred to as information inductance herein). If the individual/manager can affect the operations of the accounting information system in one or more ways, he/she can alter the impact of the control process on him/herself. The manager will use the existence of the information system to affect the behaviour of his superior by manipulating the nature of the message received by the superior. It is assumed by the manager that certain messages will yield particular behaviour by the superior, either on the basis of prior formal agreements (incentive systems) or upon assumptions about the superiors expectations. As long as information is generated for evaluative purposes, users and producers will attempt to manipulate it to suit their own purposes. The behavioral responses related to information manipulation are divided into six broad categories. These are smoothing, biasing, focusing, gaming, filtering and illegal Acts (Birnberg, et al., 1983). Smoothing

Smoothing occurs when employee affect the pre planned flow of information without alerting the actual activities of the organization. Messages can be accelerated when in fact the event reported does not even occur until some future period. While biasing suggests those situations where the manager selects from a set of possible messages, the signal that is likely to be accepted and is most favorable to him/her. (Goddard, 1997). Illegal acts

Illegal acts violate private (organizational rules) or public laws. Where administrative rules can prevent securing a more beneficial position, managers can manipulate reported data to achieve their reporting goals. (Ssejjaka,2010).

23

Window dressing

A strategy used by mutual fund and portfolio managers near the year or quarter end to improve the appearance of the portfolio/fund performance before presenting it to clients or shareholders. To window dress, the fund manager will sell stocks with large losses and purchase high flying stocks near the end of the quarter. These securities are then reported as part of the fund's holdings. (Investopedia,2nd May 2013 )

Accounting system

Accounting is the art of recording, summarizing, reporting, and analyzing financial transactions. An accounting system can be a simple, utilitarian check register, organized set of manuals, computerized accounting methods, procedures and controls established to gather, record, and classify financial transactions. There is a relationship between corporate governance and information inductance because it is the governance which influences the quality of the records if they compromise on the quality of the financial statement, there will be information inductance. (Sejjaaka, 2010). 1.9.4. The Factor Structure of Corporate governance, employee competence, information inductance and Financial Reporting Corporate governance is increasingly becoming a global concern because organizations with good governance are likely to focus on the competencies of their employees to give them competitive advantage since it is the employees who are in charge of the organization operations (Rychen and Salganik ,2003; Krambia and Psaros,2006; Triscott,2004). Organizations with good corporate governance, work values and ethics minimize information inductance which in most cases affects the financial reporting, company image (Sejjaka ,2010, Shafer, Morris and Ketchand, 2001). Corporate governance is needed not only to protect the interests of the stockholders but also other stakeholders. Corporate governance is mandated to ensure the interests of public sector and private-sector organizations are represented. In addition, corporate governance aids in securing confidence not only for stockholders but also for other stakeholders such as customers, suppliers, employees, and the government in ensuring that firms are accountable for their actions (Vinten ,1998,) . 24

There is a relationship between corporate governance, employee competence, information inductance and financial reporting since worldwide businesses thrive, attract resources, markets because of the sound financial practices (Jose, 1999).

1.10 Research Methodology 1.10.1 Research Design The research design will be a cross sectional, descriptive using qualitative and quantitative approaches. Qualitative approaches will be used to have a deep understanding of the phenomena under the study. The importance of quantitative techniques will be to generate numerical data using the questionnaire 1.10.2 Area of Study The study will be carried out in Kigali among headquarters of the Commercial Banks . 1.10.3 The study population All employees of Commercial Banks departments comprising marketing and PR, Internal Audit, account clerks, customers, secretaries, drivers, security officers and messengers constituted the target population. 1.10.4 Sampling techniques Stratified sampling technique will be used in selecting the departments to participate in the study and simple random sampling will be used in selecting the respondents from stratified departments. Purposive sampling will be used in selecting the managers to participate in the study. 1.10.5 Sample size A sample size of 343,000 customers, 172 bank staff members will be used as determined from Krejcie and Morgan (1970) table. Proportionate stratified random sampling will be used to select the sample of 406 respondents in 4 commercial banks as shown in Table 2 below.

25

Table 2: Proportionate Stratified Random Sampling Bank/ Stratum Fina Bank Rwanda Development Bank No. of staff banks 30 of 35 du 62 95 222 Sample Size 27 29 50 36 142 No. of customers '000 45 50 98 150 343 Sample Size 34 42 75 113 264

Rwanda Bank Commercial Rwanda Bank Populaire Total Source: primary data

1.10.6 Sources of Data The researcher collected/got data from both primary and secondary sources. Primary Data

This data will be collected from the respondents using the research tools. Secondary data

The data will be collected will be got from journals, books, magazines, internet, news papers and any other information that is talking about training and employees reporting. 1.10.7 Research instruments Questionnaire

The researcher will use both closed ended and open-ended questionnaires to collect data from respondents.

26

Key Informative Interviews

Unstructured questions will be used by the researcher in interviewing key respondents like managers who are gate keepers of information. 1.10.8 Validity and Reliability To ensure the validity and reliability of the instrument, the researcher will employ expert judgment method. After constructing the questionnaire, the researcher will contact experts in this area to go through it to ensure that the instrument is clear, relevant, specific and logically arranged. Also a pre-test will be conducted in order to test and improve on the reliability and validity of the instrument. A formula for Lawshe will be used to measure the validity of research, as indicated below: CVR = (n - N/2) / (N/2) CVR= Content Validity Ratio, n= number of respondents indicating essential, N total number of respondents. Inter-rater reliability will be employed. To calculate this kind of reliability, the researcher will report the percentage of agreement on the same subject between his raters and that of the assistants. 1.10.9. Measurement of the Variables Corporate governance will be measured using the 5 Likert Scale using strongly disagree to strongly agree , Allan & Meyer (1990),MacDonald (1970) Employee competency will be measured using Munene 2005 Competence Operant which measures it using 5 Likert scale of strongly disagree to strongly agree Information inductance will be measured using a 4 point interval Likert scale ranging from strongly disagree to strongly agree ,Thurston (2006) Financial Reporting will be measured using 5 Likert scale of strongly disagree to strongly disagree, Burke (2010). 1.10.10 Ethical Consideration Before embarking on the data collection process, the researcher will obtain an introductory letter from Cavendish University. This letter will be then presented to the Banks of concern. After getting the clearance from the Banks human resource managers, the researcher will obtain the

27

knowledgeable consent from the respondents and inform them about the purpose of the study. The data will be aggregated to avoid having data being related to an individual and the questionnaires will be destroyed after data analysis. 1.10.11 Data Analysis The data will be collected from the field coded, edited and analyzed using descriptive analysis options of SPSS version 11.0. The data will then be presented using Pearsons correlations statistical techniques which are used to test and establish whether there exists a relationship between corporate governance, employee competence, information inductance and financial reporting while multiple regression analysis was used to test the potential predictors of the dependent variable.

1.10.12 Limitation likely to be encountered during the study i) Confidentiality and data sensitivity: some respondents declined to give information for fear of releasing personal and confidential information. ii) Time constraints: The problem may arise from the respondents who dont have the researchers time to attend to interviews and even fill in the questionnaires. This may lead to limited information from the respondents. iii) Some respondents may be unable to complete the questionnaire by themselves because of failure to interpret the questions. iv) Attritions: some respondents may interpret questions differently and others may have their own biases which may affect the quality of the responses

References: Abowd, J. M. and Kaplan, D. S. (1999), Executive Compensation: Six Questions That Need Answering, Journal of Economic Perspectives, Vol.13, pp: 145-168. 28

ACCA. (2002).Audit and internal review.London: BPP Holdings Plc Advisory Group on corporate governance (AGCG) (2001), Report on corporate governance n and International Standards, Reserve Bank of India Allen, F. and Gale, D. (2000), corporate governance and Competition in Xavier Vives (ed :) corporate governance: Theoretical and Empirical Perspectives , Cambridge: Cambridge University Press. Arun, T.G and Turner, J. D. (2002c), Financial Liberalization in India, Journal of International Banking Regulation (Forthcoming) Basel Committee on Banking Supervision (BCBS) (1999) Enhancing corporate governance for Banking Organizations, Bank for International Settlements, Switzerland. Boot, A.W.A and Thakor, A.V (1993) Self-Interested Bank Regulation American Economic Review, Vol.83, No.2, pp.206-212. Cadbury, A. (2002, 1999). Corporate Governance and Chairmanship. Oxford University Press Capiro, G, Jr and Levine, R (2002), Corporate Governance of Banks: Concepts and International Observations, paper presented in the Global Corporate Governance Forum research Network Meeting, April 5. Claessens, S., Demirguc-Kunt, A. and Huizanga, H. (2000), The Role of Foreign Banks in Domestic Banking Systems in S. Claessens and M. Delloitte,(2003) Meeting new standards regarding governance and supervision. London: Delloitte and Touche. Jansen, (eds.) The Internationalization of Financial Services: Issues and Lessons for Developing Countries, Boston, MA: Kluwer Academic Press. Demsetz, R. S., Saidenberg, M. R. and Strahan, P. E. 1996.Banks With Something to Lose: The Disciplinary Role of Franchise Value, Federal Reserve Bank of Minneapolis Quarterly Millstein, &Avoy, M. (2003).The recurrent crisis in corporate governance.Carlifinia: Stanford Business books. Sejjaaka,S(2010) Work values and inductance of accounting information in an emerging market, Makerere Business Journal ,2010, Vol 10,No.1,p72 Shleifer, A. and Vishny, R. (1997), A Survey of Corporate Governance, Journal of Finance, Vol.52, pp: 737-783.

29

Stiglitz, J. E. (1994), The Role of the State in Financial Markets, Proceedings of the World Bank Annual Conference on Development Economics 1993, pp.19-52 Stiglitz, J.E (1999) Reforming the Global Financial structure: Lessons from Recent Crises, Journal of Finance, Vol.54, No.4, pp.1508-22. Vives, X. (2000) Corporate Governance: Does it Matter, in Xavier Vives (ed.) Corporate Governance: Theoretical and Empirical Perspectives, Cambridge: Cambridge University Press.

Appendix I - Research Instrument 1. QUESTIONNAIRE TO RESPONDENTS

30

Dear Sir/ Madam I am a candidate for Masters Degree of Business Administration at Cavendish University Rwanda and currently pursuing a Thesis entitled corporate governance, employee competence, information inductance and financial reporting among Commercial Banks in Rwanda. In view of this empirical investigation, may I request you to be part of this study by answering the questionnaires? Rest assured that the information that you provide shall be kept with utmost confidentiality and will be used for academic purposes only. As you answer the questionnaire, be reminded of respond to the items in the questionnaire thus not leave any item unanswered. Further, may I retrieve the filled out questionnaire within 5 days from the date of distribution? Thank you very much in advance

Yours faithfully CPA Olive Mukankwaya

SECTION A: PROFILE OF RESPONDENTS Please fill in and use a tick () to indicate your response, (where applicable) 1. Age:

31

2. Sex: .. 3. Qualification Masters Degree 1 Bachelors Degree 2 3 Diploma Secondary school 4 Primary School 5 Other specify 6

4. Professional training (e.g.) CIPS CPA CPS ACCA NEVI Other specify 1 2 3 4 5 .. 6

5. How long have you worked with the company?

Please rate /indicate/ tick () appropriately your response with respect to the importance of the statements below: 1. 2. 3. Not sure 4. I agree 5. I strongly agree I strongly disagree I disagree

SECTION B: CORPORATE GOVERNANCE 5 Openness Bank managers do not tell clients what is really going on in the 4 3 2 1

32

bank The MD/CEO openly shares personal information with managers Competence Managers in the bank are competent in doing their work Bank believes that its clients are competent in bank services Benevolence/kindness The MD does not show concern for managers Managers in this bank typically look for each other Honesty Managers have faith in the integrity of the MD MD keeps his/her word When managers tell you something you can believe it. Reliability The MD in this bank typically acts in the best interests of bank mangers Mangers in this bank can rely on the MD Customers are reliable.

C. EMPLOYEE COMPETENCE To what degree do you use the listed aspects in doing your 5 work? Professional accounting theoretical knowledge Professional Accounting methods and techniques Recent developments and trends in accounting field Information Communication Technology including computer use Legal regulations in Accounting Field Operational Management ( organizational, financial, Administrative) To what degree do you use the listed aspects in doing your work? Quantitative Skills being able to deal with figures or numbers Gathering and documenting information and data management Communication Skills: writing, Speaking and Oral presentations Cooperating: working in a team and negotiating skills Problem solving and ability to work automatically Planning, coordinating and organizing activities To what degree do you use the listed aspects in doing your work? 4 3 2 1

33

Independent in decision making Initiative and creativity Working under pressure and dealing with changes Accuracy and carefulness Loyalty and integrity Adaptability

D. INFORMATION INDUCTANCE Accounting rules are violable if necessary 5 Organizational rules can be violated to achieve reporting objectives Critical aspects of information we report are usually lost through aggregation There is inadequate concern with compliance with reporting Our reporting downplays certain aspects of information Reports are sometimes delayed if they contain unfavorable information When reporting attention is directed to certain aspects of financial reporting Managers can take decisions without financial analysis Annual reports may contain items that were never discovered Managers can interfere with data flow Accounting options that convey the best messages are always selected 4 3 2 1

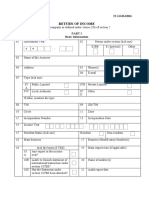

SECTION E: FINANCIAL REPORTING Performance indicator Capitalization Strong capital level The bank is Satisfactory Deficient capital level Asset quality Banks have strong asset quality Satisfactory asset quality Deficient liquidity Earnings Banks have Strong earnings Satisfactory earnings 34 5 4 3 2 1

Deficient liquidity Liquidity Strong liquidity Satisfactory liquidity There is Deficient liquidity in the bank Thank you for your time and kindheartedness in filling this questionnaire. Appendix II - Proposed Budget

Budget estimate ACTIVITY Proposal writing ITEMS REQUIRED 1 ream of foolscaps 6 Bic pens Transport Typesetting costs Photocopying costs COST(Rwf) 1,700 300 10,000 15,000 5,000 32,000 5,000 37,000 research 10,000 20,000 10,000 40,000 20,000 10,000 5,000 35,000 50,000 150,000 50,000 250,000 394,000

SUB-TOTAL Pre-testing SUB-TOTAL Data Collection

Making

enough

copies

of

instruments Transport to the field Refreshment to respondents SUB-TOTAL Reporting findings Binding 3 copies of the thesis Contingency SUB-TOTAL Viva Transport to and from the university Accommodation Meals of Typesetting

SUB-TOTAL GRAND TOTAL Appendix III Work Plan

35

ACTIVITIES Proposal writing Pretesting research Instruments Data Collection Data Analysis Compilation of report findings Presentation of report for examination /

MAY 2013 X

JUNE 2013

JULY 2013

JULY 2013

AUG 2013

SEP 2013

X X X

36

Das könnte Ihnen auch gefallen

- Credit Repair Service Business Plan TemplateDokument24 SeitenCredit Repair Service Business Plan Templatesolomon100% (1)

- Answers To Business AccountingDokument81 SeitenAnswers To Business AccountingNadia NathaniaNoch keine Bewertungen

- Business Accounting Course Notes - Financial AccountingDokument120 SeitenBusiness Accounting Course Notes - Financial AccountingStudy London100% (2)

- Accounts Report-2Dokument40 SeitenAccounts Report-2Aakanksh GuptaNoch keine Bewertungen

- Financial Reporting in BangladeshDokument6 SeitenFinancial Reporting in BangladeshMd. Abdul Momen JibonNoch keine Bewertungen

- Assignment Bdfa2103Dokument12 SeitenAssignment Bdfa2103JULIANA BINTI MAT NANYAN STUDENTNoch keine Bewertungen

- Summer Internship ProgrammeDokument20 SeitenSummer Internship Programme2248019Noch keine Bewertungen

- Financing Your Business in GhanaDokument40 SeitenFinancing Your Business in GhanaKodwoPNoch keine Bewertungen

- Assessment Ii,,,,prince's GroupDokument14 SeitenAssessment Ii,,,,prince's GroupTafadzwaNoch keine Bewertungen

- June, 2021 Haramaya, EthiopiaDokument22 SeitenJune, 2021 Haramaya, EthiopiaJuneydi AhmedNoch keine Bewertungen

- 0601 IndiaDokument3 Seiten0601 IndiaLino GumpalNoch keine Bewertungen

- Martha-The Effects of Asset Liability Management On The Financial Performance of Commercial Banks in KenyaDokument48 SeitenMartha-The Effects of Asset Liability Management On The Financial Performance of Commercial Banks in KenyahtethtethlaingNoch keine Bewertungen

- Consumer Financing: (Type The Company Name) Mohammad Ahsan Dahar I.D: - 8683 Section:-CDokument34 SeitenConsumer Financing: (Type The Company Name) Mohammad Ahsan Dahar I.D: - 8683 Section:-CMohammad Ahsan Dahar100% (2)

- Group 8 TLC Bookkeeping Services Business PlanDokument20 SeitenGroup 8 TLC Bookkeeping Services Business PlanFiona Mae LimNoch keine Bewertungen

- Basic Accounting NotesDokument83 SeitenBasic Accounting NotesUmutoni ornellaNoch keine Bewertungen

- The Influence of Credit Risk ManagementDokument26 SeitenThe Influence of Credit Risk ManagementPia CallantaNoch keine Bewertungen

- Banking Law ProjectDokument9 SeitenBanking Law ProjectPrakhya ShahNoch keine Bewertungen

- Contemporary Issues in Finance - International Aspects of Corporate Finance - Jerralyn AlvaDokument5 SeitenContemporary Issues in Finance - International Aspects of Corporate Finance - Jerralyn AlvaJERRALYN ALVANoch keine Bewertungen

- BAC 200 Accounting For AssetsDokument90 SeitenBAC 200 Accounting For AssetsFaith Ondieki100% (3)

- Proposal MunnaDokument11 SeitenProposal Munnamunna tamangNoch keine Bewertungen

- Npa 119610079679343 5Dokument46 SeitenNpa 119610079679343 5Teju AshuNoch keine Bewertungen

- Mulugeta Abuy FinancialliteracylevelDokument26 SeitenMulugeta Abuy FinancialliteracylevelvelleNoch keine Bewertungen

- Law & Practice of BankingDokument28 SeitenLaw & Practice of BankingArmanNoch keine Bewertungen

- Accounting Standard of BangladeshDokument9 SeitenAccounting Standard of BangladeshZahidnsuNoch keine Bewertungen

- ENGLRES Final PaperDokument16 SeitenENGLRES Final PaperMarvin Joshua ChanNoch keine Bewertungen

- MFI Audit Course Manual1Dokument39 SeitenMFI Audit Course Manual1Amandeep SinghNoch keine Bewertungen

- Bank Reconciliation Statements, Accountability and Profitability of Small Business OrganisationDokument10 SeitenBank Reconciliation Statements, Accountability and Profitability of Small Business OrganisationSalla CheaclyNoch keine Bewertungen

- CreditDokument37 SeitenCreditpetalingstreetNoch keine Bewertungen

- Kamuyu ProDokument30 SeitenKamuyu Prokipngetich392Noch keine Bewertungen

- Accounting Principals Task 1Dokument18 SeitenAccounting Principals Task 1Thivya KrishnanNoch keine Bewertungen

- Group 5 DBA 401 AssignmentDokument13 SeitenGroup 5 DBA 401 AssignmentsharonNoch keine Bewertungen

- CRM - ZuariDokument9 SeitenCRM - ZuariKhaisarKhaisarNoch keine Bewertungen

- Bba Banking Fin1Dokument10 SeitenBba Banking Fin1kotit35Noch keine Bewertungen

- Course Materials BAFINMAX Week6Dokument7 SeitenCourse Materials BAFINMAX Week6emmanvillafuerteNoch keine Bewertungen

- Accounting For Financial Services: Questions Selected byDokument25 SeitenAccounting For Financial Services: Questions Selected byGhulam MurtazaNoch keine Bewertungen