Beruflich Dokumente

Kultur Dokumente

Binder - Forman - Ethics

Hochgeladen von

My-Acts Of-SeditionCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Binder - Forman - Ethics

Hochgeladen von

My-Acts Of-SeditionCopyright:

Verfügbare Formate

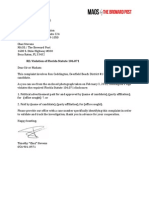

Tuesday, July 9, 2013

State of Florida

Commission on Ethics

PO Drawer 15709

Tallahassee, FL 32317

Timothy "Chaz" Stevens

PO Box 1123

Deerfield Beach, FL 33443

RE: Ethics Violation Against Broward Clerk of the Court Howard Padding the Numbers

Forman

Dear Sir or Madam:

Please accept this letter as my formal complaint against Broward Clerk of the Court Howard Forman for

possible violation of the State of Florida ethics law.

In support of this allegation, I offer the following for your consideration.

1. On Formans 2012 Form 6 Disclosure of Financial Interests, he claims a net worth of $89,000 and

a home worth $250,000.

2. Not. True.

3. Ive calculated his homes value at $164,830, meaning he overinflated his assets by $85,170,

putting his actual 2012 net worth at $3,380.

4. Forman swore an oath that the information disclosed is true, accurate, and complete.

5. Pun!

6. For the record, the Broward County Property Appraisers 2012 Assessed Just Value was

$164,830.

Bingo. Theres a violation!

Therefore, I ask the Florida Commission on Ethics to fully investigate this matter, and where appropriate,

apply the applicable sanctions, fines, kicks in the ass, and if necessary, send Forman to the timeout chair.

I stand ready to assist.

Happy hunting;

Timothy Chaz Stevens

818-468-5433

Attachments (2)

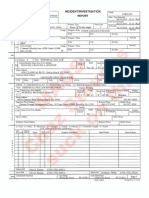

FORM6 FULL AND PUBLIC DISCLOSURE OF 2012

Please print or type your name, mailing :I

address, agency name, and position below :

FINANCIAL INTERESTS

I I

FOR OFFICE USE ONLY:

I

LAST NAME- FIRST NAME- MIDDLE NAME:

~ ? . ~ l o Y

Forman Howard c.

MAILING ADDRESS:

201 SE 6th Street

MTE RECEIVED

CITY: ZIP: COUNTY:

JUN Z 7 1Ul3

Fort Lauderdale 33301 Broward

NAME OF AGENCY :

PROCESSED

Broward County Clerk of Courts

NAME OF OFFICE OR POSITION HELD OR SOUGHT :

Clerk

CHECK IF THIS IS A FILING BY A CANDIDATE 0

PART A-- NET WORTH

Please enter the value of your net worth as of December 31, 2012, or a more current date. [Note: Net worth is not calculated by subtracting your reported

liabilities from your reported assets, so please see the instructions on page 3.]

My net worth as of December 31 201l__ was$

89,000

PART 8 --ASSETS

HOUSEHOLD GOODS AND PERSONAL EFFECTS:

Household goods and personal effects may be reported in a lump sum if their aggregate value exceeds $1,000. This category includes any of the following,

if not held for investment purposes: jewelry; collections of stamps, guns, and numismatic items; art objects; household equipment and furnishings; clothing;

other household items; and vehicles for personal use.

The aggregate value of my household goods and personal effects (described above) is $

50,000

ASSETS INDIVIDUALLY VALUED AT OVER $1,000:

DESCRIPTION OF ASSET (specific description is required -see instructions page 4) VALUE OF ASSET

Home@ 11720 NW 12 St.- Pembroke Pines, FL 250,000

Savings & Checking- Valley Bank 12,500

2006 Chrysler LTD 4,000

2008 Chrysler Sebring 12,000

PART C -- LIABILITIES

LIABILITIES IN EXCESS OF $1,000 (See Instructions on page 4):

NAME AND ADDRESS OF CREDITOR AMOUNT OF LIABILITY

Chase- P.O. Box 94014, Paletine, IL 60094 210,500

Greentree Servicing LLC- P.O. Box 6172, Rapid City, S. Dakota 57729 12,500

Valley Bank- 300 W. Broward Blvd., Fort Lauderdale, FL 33312 12,300

Chrysler Motors 4,200

JOINT AND SEVERAL LIABILITIES NOT REPORTED ABOVE:

NAME AND ADDRESS OF CREDITOR AMOUNT OF LIABILITY

CE FORM 6- Effective January 1, 2013. Refer to Rule 34-B.002(1), FAC. (Continued on reverse side) PAGE 1

PART D -- INCOME

You may EITHER (1) file a complete copy of your 2012 federal income tax return, including all W2's, schedules, and attachments, OR (2) file a sworn statement

identifying each separate source and amount of income which exceeds $1 ,000, including secondary sources of income, by completing the remainder of Part

D, below.

D 1 elect to file a copy of my 2012 federal income tax return and all W2's, schedules, and attachments.

[If you check this box and attach a copy of your 2012 tax return, you need not complete the remainder of Part D.]

PRIMARY SOURCES OF INCOME (See instructions on page 5):

NAME OF SOURCE OF INCOME EXCEEDING $1 ,000 ADDRESS OF SOURCE OF INCOME AMOUNT

Broward County Clerk of Courts 201 SE 6th Street, Ft. Lauderdale, 33301 163,629.91

SECONDARY SOURCES OF INCOME [Major customers, clients, etc., of businesses owned by reporting person--see instructions on page 5]:

NAME OF NAME OF MAJOR SOURCES ADDRESS PRINCIPAL BUSINESS

BUSINESS ENTITY OF BUSINESS' INCOME OF SOURCE ACTIVITY OF SOURCE

No other sources of Income

PARTE -- INTERESTS IN SPECIFIED BUSINESSES [Instructions on page 6)

BUSINESS ENTITY# 1 BUSINESS ENTITY # 2 BUSINESS ENTITY# 3

NAME OF

BUSINESS ENTITY

ADDRESS OF

BUSINESS ENTITY

PRINCIPAL BUSINESS

ACTIVITY

POSITION HELD

WITH ENTITY

I OWN MORE THAN A 5%

INTEREST IN THE BUSINESS

NATURE OF MY

OWNERSHIP INTEREST

IF ANY OF PARTS A THROUGH E ARE CONTINUED ON A SEPARATE SHEET, PLEASE CHECK HERE 0

OATH

STATE OF FLORIDA &

COUNTY OF

I, the person whose name appears at the

Sworn to (or affirmed) and subscribed before me this d S"" day of

beginning of this form, do depose on oath or affirmation

and say that the information disclosed on this form

2oQ by t!.'

t0J . ' I, A A \,t1 \.-, /1

and any attachments hereto is true, accurate,

and complete

P)fl;tk{/v.v/_ o( ///t::f-//1-/A

(Print, Type, or ic)

SI<;J.IA'f1mE OF Oull!iAL OR r:ANDIDATE Personally Known V OR Produced Identification ____ _

Type of Identification Produced

FILING INSTRUCTIONS for when and where to file this form are located at the top of page 3.

INSTRUCTIONS on who must file this form and how to fill it out begin on page 3.

OTHER FORMS you may need to file are described on page 6.

CE FORM 6- Effective January 1. 2013. Refer to Rule 34-8.002(1). F.A.C. PAGE2

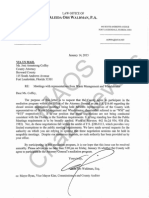

Site Address 11720 NW 12 STREET, PEMBROKE PINES

Property Owner FORMAN,HOWARD C

Mailing Address 4101 W SILVERADO CIR DAVIE FL 33024

ID # 5140 12 12 1191

Millage 2613

Use 01

Abbreviated

Legal

Description

PEMBROKE LAKES SECTION EIGHT 108-47 B POR TR A DESC AS COMM AT SE COR

TR A,N ALG E BNDRY TR A,62.35,NW ALG E BNDRY 144.61,CONT N 858.70 W 165.50,N

119.83,W 135.99 TO POB,CONT W 32.01,S .92,W 8.24,N 78.76,E 40.27,S 75.18 TO POB

AKA: UNIT 11720 CLUSTER 15 PIERPOINTE THREE

The just values displayed below were set in compliance with Sec. 193.011, Fla. Stat., and include a

reduction for costs of sale and other adjustments required by Sec. 193.011(8).

Property Assessment Values

Click here to see 2012 Exemptions and Taxable Values as reflected on the Nov. 1, 2012 tax bill.

Year Land Building

Just / Market

Value

Assessed /

SOH Value

Tax

2013 $21,600 $126,750 $148,350 $118,540

2012 $21,600 $118,410 $140,010 $116,560 $1,831.59

2011 $21,600 $124,220 $145,820 $113,170 $1,777.13

2013 Exemptions and Taxable Values by Taxing Authority

County School Board Municipal Independent

Just Value $148,350 $148,350 $148,350 $148,350

Portability 0 0 0 0

Assessed/SOH 94 $118,540 $118,540 $118,540 $118,540

Homestead 100% $25,000 $25,000 $25,000 $25,000

Add. Homestead $25,000 0 $25,000 $25,000

Wid/Vet/Dis 1 $500 $500 $500 $500

Senior 0 0 0 0

Exempt Type 0 0 0 0

Taxable $68,040 $93,040 $68,040 $68,040

Sales History

Date Type Price Book Page

1/1/1987 WD $95,800 14139 535

Land Calculations

Price Factor Type

$7.00 3,085 SF

Adj. Bldg. S.F. (See Sketch) 1635

Units/Beds/Baths 1/4/2

11720 NW 12 STREET http://bcpa.net/RecInfo.asp?URL_Folio=514012121191

1 of 2 7/9/13 8:50 PM

Special Assessments

Fire Garb Light Drain Impr Safe Storm Clean Misc

26 B7

R B7

1 .07

11720 NW 12 STREET http://bcpa.net/RecInfo.asp?URL_Folio=514012121191

2 of 2 7/9/13 8:50 PM

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Single Line DiagramDokument1 SeiteSingle Line DiagramGhanshyam Singh100% (2)

- ObjectionDokument10 SeitenObjectionMy-Acts Of-SeditionNoch keine Bewertungen

- HSTE User GuideDokument26 SeitenHSTE User GuideAnca ToleaNoch keine Bewertungen

- Chaz - Misuse Seal DonnellyDokument3 SeitenChaz - Misuse Seal DonnellyMy-Acts Of-SeditionNoch keine Bewertungen

- Cooked Chaz Stevens: United States Bankruptcy CourtDokument56 SeitenCooked Chaz Stevens: United States Bankruptcy CourtMy-Acts Of-SeditionNoch keine Bewertungen

- Maos Chaz Stevens Suck On This: L L L LDokument3 SeitenMaos Chaz Stevens Suck On This: L L L LMy-Acts Of-SeditionNoch keine Bewertungen

- Coddington - 106.071 - Sign - ElecCommDokument2 SeitenCoddington - 106.071 - Sign - ElecCommMy-Acts Of-SeditionNoch keine Bewertungen

- Sasser Decision - 022315Dokument7 SeitenSasser Decision - 022315My-Acts Of-SeditionNoch keine Bewertungen

- BinderDokument17 SeitenBinderMy-Acts Of-SeditionNoch keine Bewertungen

- Cooked Chaz Stevens: United States Bankruptcy CourtDokument56 SeitenCooked Chaz Stevens: United States Bankruptcy CourtMy-Acts Of-SeditionNoch keine Bewertungen

- Delrabian Chaz Stevens: Filing# 23315866 E-Filed 02/03/2015 03:39:01 PMDokument1 SeiteDelrabian Chaz Stevens: Filing# 23315866 E-Filed 02/03/2015 03:39:01 PMMy-Acts Of-SeditionNoch keine Bewertungen

- RedactedDokument2 SeitenRedactedMy-Acts Of-SeditionNoch keine Bewertungen

- Maos Cease and Desist RobbDokument2 SeitenMaos Cease and Desist RobbMy-Acts Of-SeditionNoch keine Bewertungen

- Binder 2Dokument12 SeitenBinder 2My-Acts Of-SeditionNoch keine Bewertungen

- Suggestion of BankruptcyDokument5 SeitenSuggestion of BankruptcyMy-Acts Of-SeditionNoch keine Bewertungen

- Waste ManagementDokument38 SeitenWaste ManagementMy-Acts Of-SeditionNoch keine Bewertungen

- Coffey Wheelbrator BullshitDokument1 SeiteCoffey Wheelbrator BullshitMy-Acts Of-SeditionNoch keine Bewertungen

- Ron Gilinsky EvictionDokument4 SeitenRon Gilinsky EvictionMy-Acts Of-SeditionNoch keine Bewertungen

- H Inners SettlementDokument18 SeitenH Inners SettlementMy-Acts Of-SeditionNoch keine Bewertungen

- Cooked Chaz Stevens: Case 11-33802-PGH Doc 655 Filed 05/23/14 Page 1 of 5Dokument13 SeitenCooked Chaz Stevens: Case 11-33802-PGH Doc 655 Filed 05/23/14 Page 1 of 5My-Acts Of-SeditionNoch keine Bewertungen

- Unpaid LienDokument1 SeiteUnpaid LienMy-Acts Of-SeditionNoch keine Bewertungen

- Florida Elections Commission: W. Gaines Street Collins Building, 224 Ta Ahassee, Florida 32399 1050 (850) 922-4539Dokument4 SeitenFlorida Elections Commission: W. Gaines Street Collins Building, 224 Ta Ahassee, Florida 32399 1050 (850) 922-4539My-Acts Of-SeditionNoch keine Bewertungen

- Gha Oig Letter 10 2014Dokument47 SeitenGha Oig Letter 10 2014My-Acts Of-Sedition100% (1)

- Appeal Letter Purchasing AgentDokument7 SeitenAppeal Letter Purchasing AgentMy-Acts Of-SeditionNoch keine Bewertungen

- RE: Donation of Pabst Blue Ribbon Festivus PoleDokument1 SeiteRE: Donation of Pabst Blue Ribbon Festivus PoleMy-Acts Of-SeditionNoch keine Bewertungen

- CHAPTER 22-Audit Evidence EvaluationDokument27 SeitenCHAPTER 22-Audit Evidence EvaluationIryne Kim PalatanNoch keine Bewertungen

- Cylinder Clamp For N2 Cylinder 84L and FM-200 Cylinder 82.5LDokument1 SeiteCylinder Clamp For N2 Cylinder 84L and FM-200 Cylinder 82.5LNguyễn Minh ThiệuNoch keine Bewertungen

- 02 - STD - Bimetal Overload Relay - (2.07 - 2.08)Dokument2 Seiten02 - STD - Bimetal Overload Relay - (2.07 - 2.08)ThilinaNoch keine Bewertungen

- Opposition To Motion For Judgment On PleadingsDokument31 SeitenOpposition To Motion For Judgment On PleadingsMark Jaffe100% (1)

- International Advertising: Definition of International MarketingDokument2 SeitenInternational Advertising: Definition of International MarketingAfad KhanNoch keine Bewertungen

- Pas 38 Pas 41 Pas 40Dokument12 SeitenPas 38 Pas 41 Pas 40Leddie Bergs Villanueva VelascoNoch keine Bewertungen

- Cost Estimate, RevisedDokument6 SeitenCost Estimate, RevisedUdit AmatNoch keine Bewertungen

- (L) Examples of Machine Shop Practice (1910)Dokument54 Seiten(L) Examples of Machine Shop Practice (1910)Ismael 8877100% (1)

- Ems Accounting Term 2Dokument39 SeitenEms Accounting Term 2Paballo KoopediNoch keine Bewertungen

- 1.3.2 SIC/XE Machine Architecture: 1 Megabytes (1024 KB) in Memory 3 Additional Registers, 24 Bits in LengthDokument8 Seiten1.3.2 SIC/XE Machine Architecture: 1 Megabytes (1024 KB) in Memory 3 Additional Registers, 24 Bits in LengthSENTHILKUMAR PNoch keine Bewertungen

- Autodesk Inventor Practice Part DrawingsDokument25 SeitenAutodesk Inventor Practice Part DrawingsCiprian Fratila100% (1)

- Micro Economics SummaryDokument62 SeitenMicro Economics SummaryEVS PRADEEPNoch keine Bewertungen

- HP Training Diagnostics 75 Usage and AdministrationDokument2 SeitenHP Training Diagnostics 75 Usage and AdministrationraviskskskNoch keine Bewertungen

- Uj 76 HD 5 CdivutDokument18 SeitenUj 76 HD 5 Cdivuttfrcuy76Noch keine Bewertungen

- RMU With Eco-Efficient Gas Mixture-Evaluation After Three Years of Field ExperienceDokument5 SeitenRMU With Eco-Efficient Gas Mixture-Evaluation After Three Years of Field ExperienceZineddine BENOUADAHNoch keine Bewertungen

- Model Solar Car DesignDokument21 SeitenModel Solar Car DesignSemih HürmeydanNoch keine Bewertungen

- Module 9 School AgeDokument16 SeitenModule 9 School AgeMichelle FactoNoch keine Bewertungen

- Boarding PassDokument1 SeiteBoarding PassFajarNoch keine Bewertungen

- Contingent Liabilities For Philippines, by Tarun DasDokument62 SeitenContingent Liabilities For Philippines, by Tarun DasProfessor Tarun DasNoch keine Bewertungen

- Using Excel For Business AnalysisDokument5 SeitenUsing Excel For Business Analysis11armiNoch keine Bewertungen

- Apples-to-Apples in Cross-Validation Studies: Pitfalls in Classifier Performance MeasurementDokument9 SeitenApples-to-Apples in Cross-Validation Studies: Pitfalls in Classifier Performance MeasurementLuis Martínez RamírezNoch keine Bewertungen

- Clark Hess1Dokument668 SeitenClark Hess1Jeyner Chavez VasquezNoch keine Bewertungen

- ADMS 2510 Week 13 SolutionsDokument20 SeitenADMS 2510 Week 13 Solutionsadms examzNoch keine Bewertungen

- LTE ID RNP StandardizationDokument9 SeitenLTE ID RNP Standardizationahdanizar100% (1)

- RRB NTPC Previous Year Paper 20: WWW - Careerpower.inDokument16 SeitenRRB NTPC Previous Year Paper 20: WWW - Careerpower.inSudarshan MaliNoch keine Bewertungen

- Am Bio PhonicsDokument21 SeitenAm Bio PhonicsLaura Nataly VillaNoch keine Bewertungen

- Activity Diagram 1Dokument14 SeitenActivity Diagram 1Yousef GamalNoch keine Bewertungen

- EC1002 Commentary 2022Dokument32 SeitenEC1002 Commentary 2022Xxx V1TaLNoch keine Bewertungen