Beruflich Dokumente

Kultur Dokumente

GEO Group Report

Hochgeladen von

Kevin RippeyOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

GEO Group Report

Hochgeladen von

Kevin RippeyCopyright:

Verfügbare Formate

Kevin Rippey, Analyst krippey@indiana.

edu 219-775-5075 6/11/2013

Rating Price Target Price: Fully Diluted Shares (mm): 52-Week High: 52-Week Low: Market Cap (bln) : Avg Daily Vol: Debt/Cap: Cash/Shr: Dividend Yield: Book Value/Shr:

Adj. EPS 2012A 2013E

Sell $26.25 $34.36 71.60 $38.84 $19.96 $2.48 643,050 53.3% $1.17 5.77% $14.52

2014E

GEO Group, Inc.

GEO NYSE

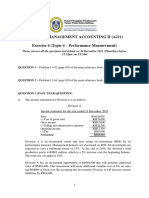

Recent REIT conversion has resulted in record high valuation despite questionable fundamentals; private state prison inmate populations experiencing low-single digit decline and immigration reform would likely threaten key revenue stream Highlights At 43% above historic average multiples, GEO trades at near record high valuation despite limited growth opportunities Inmate populations at privately operated state prisons experiencing low-single digit declinesassociated revenues represent 35% of company sales 40% of previous decades growth driven by a one-time transfer of immigrant detention facilities from public to private operation Immigration reform could drive declines in what had been key growth segment accounting for 32% of 2012 revenue

Mar Jun Sep Dec FY P/E AFFO/ Share Rev

$0.56A $0.65A $0.66A $0.67A $1.49A 23.2x $2.79A

$0.38A $0.43E $0.44E $0.45E $1.64E 21.0.x $2.61E

$0.30A $0.32E $0.33E $0.35E $1.30E 26.5.x $2.30E

Thesis The private prison industrys decade long growth was largely fueled by the privatization of a large number of federal facilities. Between 2000 and 2011, the number of privately housed federal inmates tripled from 9,381 to 29,776. Of the 20,395 private federal prisoners added in the past decade, an estimated 15,000 are being held for immigration related crimes. With more than two-thirds of the immigration detainee population now held in private facilities, it will be difficult to replicate previous growth. The growth in privately operated state prisons was much less dramatic. During the same period, the number of inmates in private state prisons increased by 17,104 from 75,291 to 92,395. Privately operated state prison population has been declining at 2% per year since 2010. The economics of private prison operation only allow for a relatively small subset of the overall prison population to be housed in private facilities. Healthy, non-violent inmates without ties to organized crime are the low cost input for the industry. Outside of this subset, the cost advantages provided by privately operated prisons disappear given the much larger potential liabilities associated with high-risk inmates. As such, GEO will not likely be able to offset the loss current inmates with others housed in state operated facilities. 40% of the past decades growth can be attributed to the one-time transfer of immigrant detainees from public to private facilities. In addition, the number of inmates in privately operated state prisons has been experiencing low-single digit decline. Despite these headwinds,

$1,409M

$1,1505M

$1,435M

The GEO Group, Inc. provides management of correctional, detention, mental health, residential treatment and re-entry facilities and the provision of community based services and youth services in the U.S., Australia, South Africa, the United Kingdom and Canada. The company operates correctional and detention facilities as well as security monitoring services.

Kevin Rippey, Analyst krippey@indiana.edu 219-775-5075 6/11/2013

investors seem to anticipate accelerating growth given the historic high multiples afforded to GEO and competitor CXW. The above analysis ignores the real possibility that currently proposed comprehensive immigration reform (CIR) could lead to a decline in the number of immigrant detainees as many undocumented immigrants would be able to gain a form of amnesty. As it pertains to GEO, 32% of the companys 2012 revenue was tied to immigration enforcement services. Contracts representing 80% of this total are set to expire by the end of 2014. The margin accretion provided by this revenue stream in addition to the companys operating leverage and debt loads exacerbate the effects of a top line decline. In its current form, CIR would create the status of Registered Provisional Immigrant. Individuals could apply for this status given they pay a $500 fine plus any owed back taxes, have no felony record, and can demonstrate they have resided within the U.S. since the start of 2012. This status could provide potential amnesty for approximately 70-75% of the 12 million undocumented immigrants residing in the U.S. REIT Premium Some investors argue that GEO shares are cheap given shares trade at a discount to other REITS specifically health care REITs on a price-to-FFO/AFFO basis. Given the unique operating risks of the private prison industry as well as their limited history as REITs, determining a proper premium or discount relative to the sector is an inexact science. Historic cash flow multiples likely provide a rough guide. The long run average FCF multiple for GEO is 9.5. This is a 45% discount to the long run average 17.5 multiple applied to health care REITs. This compares closely to the 40% P/AFFO discount that GEO currently trades at to the sector. Scenario Analysis An analysis of three scenarios gives a sense of the legislations potential magnitude on GEOs operating results (See next page for detailed income statement analysis of each scenario). Price targets derived by assigning 12x multiple to 2014 AFFO estimate. Scenario 1 (Bull case): CIR is not passed, GEO maintains current growth profile- PT: $30.00

Investors seem to assign 100% probability to this scenario given current valuation. Should immigration reform not pass, consensus is that revenues should increase in the lowsingle digits on flat bed count, slightly higher per diem rates, and mid-single digit growth in non-detention services. Scenario 2 (Mixed case): A mild form of CIR is signed into law and GEO is unable to fill 1,200 of its current 10,500 immigrant detention beds and revenue from immigrant monitoring declines 25%. All other business activity held constant relative to base case- PT: $26.50 This scenario results in a 5% decline in total revenue, 90bps operating margin contraction and an 11% decline in AFFO relative to base case. Scenario 3 (Bear case): CIR is passed in its current form and GEO losses its current immigrant monitoring contract and is unable to fill 1,200 of its current 10,500 immigrant detention beds All other business activity held constant relative to base case.- PT: $18.75 This scenario assumes an 18% revenue decline, 300 bps operating margin compression, and a 37% decline in AFFO relative to base case. Valuation $26 price target based on a probability weighted average of the above mentioned scenarios. 50% probability assigned to base case and 25% probability assigned to both mixed case and bear case. Conclusion GEO has demonstrated a track record of impressive growth. And in light of current valuation, investors believe this growth is likely continue if not accelerate. However, a large part of the industrys growth is due to a one-time shift from public to private operation of federal immigrant detention facilities. Without a similar catalyst, growth going forward is likely to be subdued as private state prison populations continue to experience mild decline. The risks associated with potential comprehensive immigration reform could provide additional headwinds. While GEO shares current 5.7% yield may initially appear attractive, the sustainability of this yield is highly suspect in light of challenging industry dynamics.

Kevin Rippey, Analyst krippey@indiana.edu 219-775-5075 6/11/2013

Immigration Reform Scenario Analysis for GEO Group CIR not passed 2011A Revenue Producing beds State and federal non-immigration beds Immigrat detention beds International GEO Community Services Total Beds Per Diem State and federal non-immigration beds Immigrat detention beds International GEO Community Services Occupancy State and federal non-immigration beds Immigrat detention beds International GEO Community Services Days in year Total Revenue State and federal non-immigration beds Immigrat detention beds International GEO Community Services ICE monitoring contract Revenue Total Revenue y/y change Gross Margins State and federal non-immigration beds Immigrat detention beds International GEO community services ICE monitoring Gross Profit State and federal non-immigration beds Immigrat detention beds International GEO Community Services ICE monitoring Total Gross Profit Gross marign Depreciation Corp. SG&A % of sales EBIT EBIT margin Interest expense Earnings before taxes Income tax expense Tax rate Net income Net margin y/y change Shares outstanding FFO per share less maintenace capex plus share based compensation AFFO per share Current Stock price Price-to-AFFO Price Target 37,002 9,519 7,149 3,936 57,606 1200 ICE bed reduction and 25% decline in monitoring revenue 2011A 2012A 2013E 2014E Revenue Producing beds State and federal non-immigration beds 37,002 38,357 37,781 38,281 Immigrat detention beds 9,519 10,719 11,319 10,119 International 7,149 7,149 7,149 7,149 GEO Community Services 3,936 3,916 3,779 3,779 Total Beds 57,606 60,141 60,028 59,328 Per Diem State and federal non-immigration beds Immigrat detention beds International GEO Community Services Occupancy State and federal non-immigration beds Immigrat detention beds International GEO Community Services Days in year Total Revenue State and federal non-immigration beds Immigrat detention beds International GEO Community Services ICE monitoring contract Revenue Total Revenue 1200 ICE bed reduction and loss of monitoring contract 2011A 2012A 2013E Revenue Producing beds State and federal non-immigration beds 37,002 38,357 37,781 Immigrat detention beds 9,519 10,719 11,319 International 7,149 7,149 7,149 GEO Community Services 3,936 3,916 3,779 Total Beds 57,606 60,141 60,028 Per Diem State and federal non-immigration beds Immigrat detention beds International GEO Community Services Occupancy State and federal non-immigration beds Immigrat detention beds International GEO Community Services Days in year Total Revenue State and federal non-immigration beds Immigrat detention beds International GEO Community Services ICE monitoring contract Revenue Total Revenue

2012A 38,357 10,719 7,149 3,916 60,141

2013E 37,781 11,319 7,149 3,779 60,028

2014E 38,281 11,500 7,149 3,779 60,709

2014E 38,281 10,119 7,149 3,779 59,328

$57.00 57.00 78.33 30.00

$57.00 57.00 81.56 31.00

$57.50 57.50 84.70 31.00

$57.50 57.50 87.00 31.00

$57.00 57.00 78.33 30.00

$57.00 57.00 81.56 31.00

$57.50 57.50 84.70 31.00

$57.50 57.50 87.00 31.00

$57.00 57.00 78.33 30.00

$57.00 57.00 81.56 31.00

$57.50 57.50 84.70 31.00

$57.50 57.50 87.00 31.00

95.6% 95.6% 99.7% 81.0% 365

95.5% 95.5% 99.7% 83.0% 365

96.0% 96.0% 99.7% 83.0% 365

96.0% 96.0% 99.7% 83.0% 365

95.6% 95.6% 99.7% 81.0% 365

95.5% 95.5% 99.7% 83.0% 365

96.0% 96.0% 99.7% 83.0% 365

96.0% 96.0% 99.7% 83.0% 365

95.6% 95.6% 99.7% 81.0% 365

95.5% 95.5% 99.7% 83.0% 365

96.0% 96.0% 99.7% 83.0% 365

96.0% 96.0% 99.7% 83.0% 365

736.0 189.3 203.8 34.9 245.0 $1,407.2

762.1 213.0 212.2 36.8 255.0 $1,479.0 5.1%

761.2 228.1 220.4 35.5 260.0 $1,505.1 1.8%

771.3 231.7 226.3 35.5 275.0 $1,539.8 2.3%

736.0 189.3 203.8 34.9 245.0 $1,409.0

762.1 213.0 212.2 36.8 255.0 $1,479.0 5.0%

761.2 228.1 220.4 35.5 260.0 $1,505.1 1.8%

771.3 203.9 226.3 35.5 195.0 $1,432.0 (4.9%)

736.0 189.3 203.8 34.9 245.0 $1,409.0

762.1 213.0 212.2 36.8 255.0 $1,479.0 5.0%

761.2 228.1 220.4 35.5 265.0 $1,510.1 2.1%

771.3 203.9 226.3 35.5 0.0 $1,237.0 (18.1%)

29.2% 29.2% 7.5% 28.0% 31.0%

29.2% 29.2% 5.9% 29.0% 32.0%

30.0% 30.0% 8.0% 29.0% 32.0%

30.0% 30.0% 8.0% 29.0% 32.0%

Gross Margins State and federal non-immigration beds Immigrat detention beds International GEO community services ICE monitoring Gross Profit State and federal non-immigration beds Immigrat detention beds International GEO Community Services ICE monitoring Total Gross Profit Gross marign Depreciation Corp. SG&A % of sales EBIT EBIT margin Interest expense Earnings before taxes Income tax expense Tax rate Net income Net margin y/y change Shares outstanding FFO per share less maintenace capex plus share based compensation AFFO per share Current Stock price Price to AFFO

29.2% 29.2% 7.5% 28.0% 31.0%

29.2% 29.2% 5.9% 29.0% 32.0%

30.0% 30.0% 8.0% 29.0% 32.0%

30.0% 30.0% 8.0% 29.0% 32.0%

Gross Margins State and federal non-immigration beds Immigrat detention beds International GEO community services ICE monitoring Gross Profit State and federal non-immigration beds Immigrat detention beds International GEO Community Services ICE monitoring Total Gross Profit Gross marign Depreciation Corp. SG&A % of sales EBIT EBIT margin Interest expense Earnings before taxes Income tax expense Tax rate Net income Net margin y/y change Shares outstanding FFO per share less maintenace capex plus share based compensation AFFO per share Current Stock price Price to AFFO

29.2% 29.2% 7.5% 28.0% 31.0%

29.2% 29.2% 5.9% 29.0% 32.0%

30.0% 30.0% 8.0% 29.0% 32.0%

30.0% 30.0% 8.0% 29.0% 32.0%

214.9 55.3 15.3 9.8 76.0 $371.2 26.4% 81.5 110.0 7.8% $179.69 12.8% 68.3 $111.4 43.2 38.8% $68.2 4.8%

222.5 62.2 12.5 10.7 81.6 $389.5 26.3% 91.7 113.8 7.7% $184.03 12.4% 75.5 $108.6 8.7 8.0% $99.9 6.8% 46.5% 61.3 $3.12 30.7 10.4 $2.79 34.61 11.1x

228.4 68.4 17.6 10.3 83.2 $407.9 27.1% 92.0 112.9 7.5% $203.02 13.5% 75.0 $128.02 10.2 8.0% $117.78 7.8% 17.9% 71.6 $2.93 30.0 7.0 $2.61 34.61 11.8x

231.4 69.5 18.1 10.3 88.0 $417.3 27.1% 92.0 123.2 8.0% $202.11 13.1% 75.0 $127.11 10.2 8.0% $116.94 7.6% (0.7%) 72.0 $2.90 30.0 7.0 $2.58 34.61 11.9x $29.70

214.9 55.3 15.3 9.8 76.0 $371.2 26.3% 81.5 110.0 7.8% $179.69 12.8% 68.3 $111.4 43.2 38.8% $68.2 4.8%

222.5 62.2 12.5 10.7 81.6 $389.5 26.3% 91.6 112.2 7.6% $185.71 12.6% 75.5 $110.2 8.8 8.0% $101.4 6.9% 48.7% 61.3 $3.15 30.7 10.4 $2.82 34.61 11.0x

228.4 68.4 17.6 10.3 83.2 $407.9 27.1% 92.0 112.9 7.5% $203.02 13.5% 75.0 $128.02 10.2 8.0% $117.78 7.8% 16.2% 71.6 $2.93 30.0 7.0 $2.61 34.61 11.8x

231.4 61.2 18.1 10.3 62.4 $383.3 26.8% 92.0 111.0 7.8% $180.37 12.6% 75.0 $105.37 8.4 8.0% $96.94 6.8% (17.7%) 72.0 $2.62 30.0 7.0 $2.30 34.61 13.2x $26.50

214.9 55.3 15.3 9.8 76.0 $371.2 26.3% 81.5 110.0 7.8% $179.69 12.8% 68.3 $111.4 43.2 38.8% $68.2 4.8%

222.5 62.2 12.5 10.7 81.6 $389.5 26.3% 91.6 112.2 7.6% $185.71 12.6% 75.5 $110.2 8.8 8.0% $101.4 6.9% 48.7% 61.3 $3.15 30.7 10.4 $2.82 34.61 11.0x

228.4 68.4 17.6 10.3 84.8 $409.5 27.1% 92.0 113.3 7.5% $204.24 13.5% 75.0 $129.24 10.3 8.0% $118.90 7.9% 17.3% 71.6 $2.95 30.0 7.0 $2.62 34.61 11.7x

231.4 61.2 18.1 10.3 0.0 $320.9 25.9% 92.0 99.0 8.0% $129.99 10.5% 75.0 $54.99 4.4 8.0% $50.59 4.1% (57.5%) 72.0 $1.98 30.0 7.0 $1.66 34.61 17.5x $19.10

63.4 $2.36 33.8 7.9 $1.95 34.61

63.4 $2.36 33.8 7.9 $1.95 34.61

63.4 $2.36 33.8 7.9 $1.95 34.61

Das könnte Ihnen auch gefallen

- Caso Biovail Corportation - RespuestasDokument6 SeitenCaso Biovail Corportation - RespuestasSergioNoch keine Bewertungen

- Circuit City Accounting CaseDokument4 SeitenCircuit City Accounting CasePookguyNoch keine Bewertungen

- DG Case StudyDokument9 SeitenDG Case StudyRitz Tan CadeliñaNoch keine Bewertungen

- JPM CDO Research 12-Feb-2008Dokument20 SeitenJPM CDO Research 12-Feb-2008Gunes KulaligilNoch keine Bewertungen

- Airtel - A Case StudyDokument30 SeitenAirtel - A Case StudyTanya Dutta57% (7)

- The Aircraft Value Reference: Commercial JetsDokument34 SeitenThe Aircraft Value Reference: Commercial Jetslaurentius46Noch keine Bewertungen

- CostaDokument12 SeitenCostaPuneet BhardwajNoch keine Bewertungen

- STRAMA Dont Like You She Likes Evreryone.. 1Dokument128 SeitenSTRAMA Dont Like You She Likes Evreryone.. 1Jasper MonteroNoch keine Bewertungen

- IB Economics SL9 - AD and ASDokument10 SeitenIB Economics SL9 - AD and ASTerran75% (4)

- Leader Capital News: The Cost of CapitalDokument7 SeitenLeader Capital News: The Cost of CapitalLeaderCapitalNoch keine Bewertungen

- Learning Stock Trading  Frame  Tip of Symbols For UK Governmentstock Symbols February.20121109.113640Dokument1 SeiteLearning Stock Trading  Frame  Tip of Symbols For UK Governmentstock Symbols February.20121109.113640anon_749956252Noch keine Bewertungen

- Q4 2011 Investor PresentationDokument53 SeitenQ4 2011 Investor Presentation404 System ErrorNoch keine Bewertungen

- The Pensford Letter - 3.12.12Dokument5 SeitenThe Pensford Letter - 3.12.12Pensford FinancialNoch keine Bewertungen

- Popular, Inc. Conference Call PresentationDokument24 SeitenPopular, Inc. Conference Call PresentationRubén E. Morales RiveraNoch keine Bewertungen

- Banks To Benefit From Recent CBE Cut To RRR: Egypt - BankingDokument2 SeitenBanks To Benefit From Recent CBE Cut To RRR: Egypt - BankingAmina K. KhalilNoch keine Bewertungen

- Ebook PDF Byrd Chens Canadian Tax Principles 2019 2020 Edition PDFDokument42 SeitenEbook PDF Byrd Chens Canadian Tax Principles 2019 2020 Edition PDFtony.rodriguez470100% (30)

- USMO White Paper (Updated)Dokument3 SeitenUSMO White Paper (Updated)ContrarianIndustriesNoch keine Bewertungen

- Middle East Salary Survey 2007Dokument18 SeitenMiddle East Salary Survey 2007arifsarwoNoch keine Bewertungen

- Credit Rating, Downgrade and SolutionsDokument16 SeitenCredit Rating, Downgrade and SolutionsArjun ChadhaNoch keine Bewertungen

- (IMF Working Papers) COVID-19 and SME FailuresDokument49 Seiten(IMF Working Papers) COVID-19 and SME FailuresDR. OMID R TabrizianNoch keine Bewertungen

- Pension Fund Crisis in UsaDokument5 SeitenPension Fund Crisis in UsaHa PhamNoch keine Bewertungen

- B&F Article 07052014Dokument4 SeitenB&F Article 07052014Radhika RamachandranNoch keine Bewertungen

- FPDWeek Insurance DiazDokument37 SeitenFPDWeek Insurance DiazVenkata Rao NaiduNoch keine Bewertungen

- Agcapita July 12 2013 - Central Banking's Scylla and CharybdisDokument5 SeitenAgcapita July 12 2013 - Central Banking's Scylla and CharybdisCapita1Noch keine Bewertungen

- Fitch 1302013Dokument27 SeitenFitch 1302013Nakasaki ImitoNoch keine Bewertungen

- Gondolin Capital LP Investor Letter 2Q22 (Prospective)Dokument10 SeitenGondolin Capital LP Investor Letter 2Q22 (Prospective)Josh WeissNoch keine Bewertungen

- Averting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0 0Dokument53 SeitenAverting A Fiscal Crisis - Why America Needs Comprehensive Fiscal Reform Now 0 0 0 0 0 0 0 0Committee For a Responsible Federal BudgetNoch keine Bewertungen

- The Vilas Fund LP - Quarterly Letter Q4 2017 v1Dokument6 SeitenThe Vilas Fund LP - Quarterly Letter Q4 2017 v1Michael BenzingerNoch keine Bewertungen

- Punjab National Bank: CMP: INR760 TP: INR964 Buy Asset Quality Deteriorates Asset-Liability Well-MatchedDokument14 SeitenPunjab National Bank: CMP: INR760 TP: INR964 Buy Asset Quality Deteriorates Asset-Liability Well-MatchedDavid ThambuNoch keine Bewertungen

- JPM InitiatingCoverageDokument11 SeitenJPM InitiatingCoveragePauline Da CostaNoch keine Bewertungen

- How Payments Can Adjust To The Coronavirus Pandemic and Help The World AdaptDokument10 SeitenHow Payments Can Adjust To The Coronavirus Pandemic and Help The World AdaptMaría Victoria AlbanesiNoch keine Bewertungen

- Recoveries at Non-Record High: Big PictureDokument7 SeitenRecoveries at Non-Record High: Big Pictureemerging11Noch keine Bewertungen

- 2014 Investment Management Fee Survey: U.S. Institutional Fund Sponsors and Investment ManagersDokument56 Seiten2014 Investment Management Fee Survey: U.S. Institutional Fund Sponsors and Investment ManagersCallan100% (2)

- Multiple Choice Questions: Top of FormDokument96 SeitenMultiple Choice Questions: Top of Formchanfa3851Noch keine Bewertungen

- Research Sample - IREDokument7 SeitenResearch Sample - IREIndepResearchNoch keine Bewertungen

- Moderate Growth in IT Spending Across Economies: Published DateDokument12 SeitenModerate Growth in IT Spending Across Economies: Published DateVikky MasterNoch keine Bewertungen

- Snack With Dave: David A. RosenbergDokument9 SeitenSnack With Dave: David A. RosenbergroquessudeNoch keine Bewertungen

- 06 - Jake Rosser - Valuex Vail Oshkosh PresentationDokument18 Seiten06 - Jake Rosser - Valuex Vail Oshkosh PresentationcurrygoatNoch keine Bewertungen

- Low Interest RatesDokument2 SeitenLow Interest RatescaitlynharveyNoch keine Bewertungen

- China - More Than 200 Clients Talk Wages in The PRD 05 03 12 05 52Dokument6 SeitenChina - More Than 200 Clients Talk Wages in The PRD 05 03 12 05 52Urmila KhatriNoch keine Bewertungen

- SSRN Id3750133Dokument58 SeitenSSRN Id3750133Shikha GuptaNoch keine Bewertungen

- Case Study 4Dokument2 SeitenCase Study 4nerieroseNoch keine Bewertungen

- Department of Budget & Management: T. Eloise Foster, Secretary Martin O'Malley, Governor Anthony G. Brown, Lt. GovernorDokument38 SeitenDepartment of Budget & Management: T. Eloise Foster, Secretary Martin O'Malley, Governor Anthony G. Brown, Lt. GovernorAnonymous Feglbx5Noch keine Bewertungen

- Oh Africa!: Inside This IssueDokument5 SeitenOh Africa!: Inside This IssuewhartonfinanceclubNoch keine Bewertungen

- Gente 2015Dokument27 SeitenGente 2015Very BudiyantoNoch keine Bewertungen

- Black Stone Webcast - Outlook For US & Europe 2011.10.05Dokument12 SeitenBlack Stone Webcast - Outlook For US & Europe 2011.10.05nicknyseNoch keine Bewertungen

- Top Stories:: Infected Count Death Toll Total RecoveredDokument3 SeitenTop Stories:: Infected Count Death Toll Total RecoveredJNoch keine Bewertungen

- 3Q11 JPM Epr FinalDokument16 Seiten3Q11 JPM Epr FinalpowerpanNoch keine Bewertungen

- The Effectiveness of Industrial Policy in Developing Countries Causal Evidence From Ethiopian Manufacturing FirmsDokument28 SeitenThe Effectiveness of Industrial Policy in Developing Countries Causal Evidence From Ethiopian Manufacturing Firmstesfaye assefaNoch keine Bewertungen

- SFM Assignment 1Dokument6 SeitenSFM Assignment 1Ashi RanaNoch keine Bewertungen

- Why Do Investors Buy Sovereign Default Insurance?: A, B C DDokument63 SeitenWhy Do Investors Buy Sovereign Default Insurance?: A, B C DRohit AroraNoch keine Bewertungen

- JAZZ Short Stock PitchDokument9 SeitenJAZZ Short Stock Pitchrishi bhansaliNoch keine Bewertungen

- Week 6 - Working Capital Management-RDokument31 SeitenWeek 6 - Working Capital Management-RPollsNoch keine Bewertungen

- Why We Need Transparent Pricing in Microfinance November 2008Dokument62 SeitenWhy We Need Transparent Pricing in Microfinance November 2008Vivek ReddyNoch keine Bewertungen

- Reading Lesson 4Dokument7 SeitenReading Lesson 4AnshumanNoch keine Bewertungen

- CH 4 Economics Systems and Market MethodsDokument12 SeitenCH 4 Economics Systems and Market MethodsSadi Mohammad HridoyNoch keine Bewertungen

- Cjenergy ValuationDokument11 SeitenCjenergy Valuationapi-239586293Noch keine Bewertungen

- er20130624BullPhatDragon PDFDokument3 Seitener20130624BullPhatDragon PDFJesse BarnesNoch keine Bewertungen

- Brazil Country OverviewDokument1 SeiteBrazil Country OverviewjearodriguesNoch keine Bewertungen

- Weekly Economic Commentary 7-19-2012Dokument7 SeitenWeekly Economic Commentary 7-19-2012monarchadvisorygroupNoch keine Bewertungen

- McKinsey Global Institute - Define Contributions MarketDokument37 SeitenMcKinsey Global Institute - Define Contributions MarketHugh NguyenNoch keine Bewertungen

- 2011 Jan Wells Fargo CMBS OutlookDokument81 Seiten2011 Jan Wells Fargo CMBS OutlookRyan JinNoch keine Bewertungen

- Macro Update Paper v0Dokument4 SeitenMacro Update Paper v0tonidadaNoch keine Bewertungen

- Easterly Government Properties (DEA) - The Long-Term Treasury of REITs - Seeking AlphaDokument20 SeitenEasterly Government Properties (DEA) - The Long-Term Treasury of REITs - Seeking Alphapta123Noch keine Bewertungen

- Mfi AssignmentfinDokument13 SeitenMfi AssignmentfinSamson NdhlovuNoch keine Bewertungen

- The effects of investment regulations on pension funds performance in BrazilVon EverandThe effects of investment regulations on pension funds performance in BrazilNoch keine Bewertungen

- Tax Policy and the Economy, Volume 36Von EverandTax Policy and the Economy, Volume 36Robert A. MoffittNoch keine Bewertungen

- World Scope Datatype Definitions GuideDokument449 SeitenWorld Scope Datatype Definitions GuideSunnyMahajanNoch keine Bewertungen

- Clearing and Settlement - DTCC - Following How A Trade Gets ClearedDokument8 SeitenClearing and Settlement - DTCC - Following How A Trade Gets ClearedAsha Pagdiwalla100% (1)

- The Urja Watch - August - Independence Day EditionDokument49 SeitenThe Urja Watch - August - Independence Day EditionRavi ShankarNoch keine Bewertungen

- Customs Valuation NotesDokument9 SeitenCustoms Valuation NotesSheila ArjonaNoch keine Bewertungen

- National Income - DPP 02 - (Kautilya)Dokument4 SeitenNational Income - DPP 02 - (Kautilya)Name SNoch keine Bewertungen

- The Art of The Variance SwapDokument5 SeitenThe Art of The Variance SwapMatt Wall100% (1)

- Principles of Working Capital ManagementDokument21 SeitenPrinciples of Working Capital ManagementNabinSundar Nayak100% (1)

- 0304 - Ec 1Dokument30 Seiten0304 - Ec 1haryhunter100% (3)

- Solución de Problemas Planteados PresupuestosDokument13 SeitenSolución de Problemas Planteados PresupuestosAndre AliagaNoch keine Bewertungen

- Quiz 2 - 22 - SolutionDokument4 SeitenQuiz 2 - 22 - SolutionJasmeetNoch keine Bewertungen

- J&J CaseDokument5 SeitenJ&J Casechye118Noch keine Bewertungen

- Borromeo V DescallarDokument4 SeitenBorromeo V DescallarM Azeneth JJNoch keine Bewertungen

- Time Value of Money (TVM)Dokument58 SeitenTime Value of Money (TVM)Nistha BishtNoch keine Bewertungen

- Annuity DueDokument21 SeitenAnnuity Duedame wayne100% (1)

- Business Plan On Interior1Dokument6 SeitenBusiness Plan On Interior1Akshatha A BhatNoch keine Bewertungen

- Week05 PPT 2022 Before ClassDokument98 SeitenWeek05 PPT 2022 Before Class罗上宗Noch keine Bewertungen

- Solahart BrochureDokument12 SeitenSolahart Brochureapi-354265505Noch keine Bewertungen

- A211 MA2 EXERCISE 4 (TOPIC 4 Performance Measurement) - Questions - Upoladed 18 Dec 2021Dokument3 SeitenA211 MA2 EXERCISE 4 (TOPIC 4 Performance Measurement) - Questions - Upoladed 18 Dec 2021Amirul Hakim Nor AzmanNoch keine Bewertungen

- Managerial Economics: of Economics in The Business Decisions.' Decisions.Dokument7 SeitenManagerial Economics: of Economics in The Business Decisions.' Decisions.Raghu RallapalliNoch keine Bewertungen

- Share Based NotesDokument5 SeitenShare Based NotesJP MJNoch keine Bewertungen

- Social, Economic, Technological & Competitive ForcesDokument20 SeitenSocial, Economic, Technological & Competitive Forcesprabhatrc423533% (3)

- Basic Points 2007Dokument455 SeitenBasic Points 2007bschwartzieNoch keine Bewertungen