Beruflich Dokumente

Kultur Dokumente

Pakistan's External Debt and Liabilities - Outstanding: R R R R P

Hochgeladen von

Mübashir KhanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Pakistan's External Debt and Liabilities - Outstanding: R R R R P

Hochgeladen von

Mübashir KhanCopyright:

Verfügbare Formate

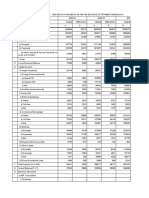

Pakistan's External Debt and Liabilities - Outstanding

(Million US$)

ITEM

A. Public debt (1+2+3) 1. Government debt i) Long term(>1 year) Paris club Multilateral Other bilateral Euro/Sukuk global bonds Military debt Commercial loans/credits Local Currency Securities (PIBs) Saudi fund for development. (SFD) SAFE China deposits NBP/BOC deposits ii) Short term (<1 year) IDB* Local Currency Securities (TBills) 2. From IMF i) Federal government ii) Central bank 3. Foreign exchange liabilities i) Central bank deposits ii) Foreign currency bonds (NHA / NC) iii) Other liabilities (SWAP) iv) Allocation of SDR

1

31-Mar-12R 30-Jun-12R 56,035 45,435 45,028 14,935 25,280 2,428 1,550 135 0 0 200 500 0 407 400 7 8,066 1,942 6,124 2,534 1,000 0 0 1,531 3 1,531 236 0 38 198 0 0 1,295 878 417 1,888 690 94 0 94 596 392 204 1,198 56 1,142 3,500 0 3,500 2,447 2,438 9 124 675 254 2,677 65,631 58,014 12,075 55,862 46,123 45,742 15,014 25,406 2,469 1,550 103 0 0 200 1,000 0 381 377 4 7,337 1,894 5,443 2,402 900 0 0 1,500 2 1,524 226 0 35 191 0 0 1,298 843 455 1,844 860 92 0 92 768 653 115 983 52 932 3,576 0 3,576 2,447 2,437 9 124 675 331 2,672 65,478 58,091 10,856

30-Sep-12R 56,286 46,855 46,445 15,329 25,660 2,603 1,550 103 0 0 200 1,000 0 410 388 22 7,004 1,855 5,149 2,427 900 0 0 1,525 2 1,586 220 0 35 185 0 0 1,366 821 545 1,808 816 87 0 87 729 622 107 992 47 945 3,555 0 3,555 2,429 2,420 9 124 675 327 2,638 65,873 58,541 10,410

31-Dec-12R 31-Mar-13P 53,940 45,351 45,219 14,557 25,058 2,751 1,550 103 0 0 200 1,000 0 132 132 0 6,164 1,827 4,337 2,425 900 0 0 1,519 5 1,776 473 0 289 185 0 0 1,303 718 585 1,651 738 85 0 85 654 477 177 913 48 864 3,295 0 3,295 2,181 2,163 18 124 675 315 2,644 63,305 56,240 9,028 51,429 43,741 43,740 13,874 24,177 2,836 1,550 103 0 0 200 1,000 0 0 0 0 5,300 1,693 3,607 2,388 900 0 0 1,482 6 1,826 544 0 289 255 0 0 1,282 680 602 1,816 907 78 0 78 829 433 396 909 47 861 3,254 0 3,254 2,146 2,128 18 124 675 309 2,545 60,869 53,735 7,147

v) Nonresident LCY deposits with central bank B. Public sector enterprises (PSEs) a. Guaranteed debt Paris club Multilateral Other bilateral Commercial loans Sandak metal bonds b. Non guaranteed debt i) Long term(>1 year) ii) Short term (<1 year) C. Banks a. Borrowing i) Long term(>1 year) i) Public sector ii) Private sector ii) Short term (<1 year)2 i) Public sector ii) Private sector b. Nonresident deposits (LCY & FCY) i) Public sector ii) Private sector D. Private Sector a. Guaranteed debt b. Non guaranteed debt i). Loans i) Long term(>1 year) ii) Short term (<1 year) ii) non-guaranteed bonds iii) Trade credits iv) Other debt liabilities3 E. Debt liabilities to direct investors - Intercompany debt Total external debt & liabilities (A+B+C+D+E) Public debt including PSEs (A+B+C.a.i.i+C.a.ii.i+C.b.i) Official liquid reserves4

P

Provisional; RRevised *: The amount of short term debt from IDB rolled over in Dec 2011 for more than one year has been reclassified under the category of Long term government debt from multilateral donors.

1 2

Since Mar 2010 and onwards, Allocations of SDRs are recorded as foreign liability as per BPM6. The stock of short term borrowings by banks as on June 30th, 2011 and onwards has been obtained from banks for each currency of transaction and converted into equivalent US$. Previously, it was captured from data being reported by banks in equivalent Pak rupees. 3 Other debt liabilities of others sector in IIP statement. 4 Includes sinking fund and cash foreign currency, excludes CRR and unsettled cliams on RBI. Notes: 1. SBP enhanced the coverage and quality of external debt statistics w.e.f March 31, 2010. For Revision study, see link : http://www.sbp.org.pk/ecodata/Revision-EDS.pdf 2. The data for quarters ended March 2012, June 2012, September 2012 and December 2012 have been revised due to finalization of annual International Investment Position (IIP) Statement for 2011. 3. TBills-Treasury Bills, PIBs-Pakistan Investment Bonds, SAFE-Soverign Authority of Foreign Exchange, NHA-National Highway Authority, NCNational Construction, RBI-Reserve Bank of India, LCY= Local Currency, FCY=Foreign Currency

Source: For A.1 except local currency securities ( PIBs & Tbills), A.2 and B.a, Economic Affairs Division,for rest State Bank of Pakistan.

Contact Person :Muhammad Zarar Askari, Senior Joint Director Phone No.. 021-99221112; Fax: 021-99212569 Email: zarar.askari@sbp.org.pk For Feedback: http://www.sbp.org.pk/stats/survey/index.asp

Das könnte Ihnen auch gefallen

- Ever Gotesco: Quarterly ReportDokument35 SeitenEver Gotesco: Quarterly ReportBusinessWorld100% (1)

- IndiaDokument1 SeiteIndiaKarthik RamNoch keine Bewertungen

- Exhibit 99.1 Message To ShareholdersDokument8 SeitenExhibit 99.1 Message To ShareholdersWilliam HarrisNoch keine Bewertungen

- Binder - HCT - Collusion - MartinDokument9 SeitenBinder - HCT - Collusion - MartinMy-Acts Of-SeditionNoch keine Bewertungen

- Bank financial statements H1 2011 vs 2010Dokument1 SeiteBank financial statements H1 2011 vs 2010Novianto_Setia_1088Noch keine Bewertungen

- Abc Limited: Balance Sheet As at September 30, 2012 Amount in RupeesDokument24 SeitenAbc Limited: Balance Sheet As at September 30, 2012 Amount in RupeesSharbani ChowdhuryNoch keine Bewertungen

- 2011 01 Q3 2011 Investor PresentationDokument29 Seiten2011 01 Q3 2011 Investor PresentationRuchi SharmaNoch keine Bewertungen

- Source: Annual Accounts of BanksDokument6 SeitenSource: Annual Accounts of BanksARVIND YADAVNoch keine Bewertungen

- Components of Broad Money (M2Dokument8 SeitenComponents of Broad Money (M2Ahsan Ali MemonNoch keine Bewertungen

- India External Debt March 2013Dokument7 SeitenIndia External Debt March 2013Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- BPI: Q1 Balance SheetDokument1 SeiteBPI: Q1 Balance SheetBusinessWorldNoch keine Bewertungen

- AB Bank Limited Consolidated FinancialsDokument26 SeitenAB Bank Limited Consolidated FinancialsSourav KarmakarNoch keine Bewertungen

- June Financial Soundness Indicators - 2007-12Dokument53 SeitenJune Financial Soundness Indicators - 2007-12shakira270Noch keine Bewertungen

- DebtDokument28 SeitenDebtArslan ShabbirNoch keine Bewertungen

- SPI November 2014Dokument211 SeitenSPI November 2014rahdaianNoch keine Bewertungen

- DOST 2020 Executive SummaryDokument7 SeitenDOST 2020 Executive SummaryMarco Rafael CrespoNoch keine Bewertungen

- Data On Monetary Aggregates: 1) Broad Money (M2) ComponentsDokument37 SeitenData On Monetary Aggregates: 1) Broad Money (M2) Componentsshahswar khanNoch keine Bewertungen

- ProfileDokument1 SeiteProfileshahzadshahNoch keine Bewertungen

- City of Windsor Capital Budget Documents For 2013.Dokument362 SeitenCity of Windsor Capital Budget Documents For 2013.windsorstarNoch keine Bewertungen

- 13TH FC RECOMMENDATIONSDokument3 Seiten13TH FC RECOMMENDATIONSSushama VermaNoch keine Bewertungen

- AUDITED FINANCIAL RESULTS FOR THE YEAR ENDED MARCH 31 2014Dokument1 SeiteAUDITED FINANCIAL RESULTS FOR THE YEAR ENDED MARCH 31 2014Robert MillerNoch keine Bewertungen

- ICI Pakistan Limited: Balance SheetDokument28 SeitenICI Pakistan Limited: Balance SheetArsalan KhanNoch keine Bewertungen

- Final Accounts 2005Dokument44 SeitenFinal Accounts 2005Mahmood KhanNoch keine Bewertungen

- EU Transparency ExerciseDokument39 SeitenEU Transparency ExerciseAlexander LueNoch keine Bewertungen

- Chap-3 2Dokument5 SeitenChap-3 2Tahreem SyedNoch keine Bewertungen

- Economic Survey: 6.2: Balance of PaymentsDokument4 SeitenEconomic Survey: 6.2: Balance of PaymentsAkhil RupaniNoch keine Bewertungen

- 01 SKDM Draft - Recasted Balance - Sheet - 21.11.2012Dokument25 Seiten01 SKDM Draft - Recasted Balance - Sheet - 21.11.2012saifulcrislNoch keine Bewertungen

- Balance of PaymentsDokument15 SeitenBalance of PaymentsBalavarshini Rajasekar0% (2)

- Capital Flows, Economic Performance and Economic Policy: Argentina's Experience During The Last DecadeDokument13 SeitenCapital Flows, Economic Performance and Economic Policy: Argentina's Experience During The Last DecadeKrunal BhuvaNoch keine Bewertungen

- B. LiabilitiesDokument1 SeiteB. LiabilitiesSamuel OnyumaNoch keine Bewertungen

- Chapter - Iii: 13 FC RecommendationsDokument3 SeitenChapter - Iii: 13 FC RecommendationsSushama VermaNoch keine Bewertungen

- Group 3 Finn 21ADokument22 SeitenGroup 3 Finn 21AMICAH ARGUSONNoch keine Bewertungen

- Balance of PaymentsDokument7 SeitenBalance of PaymentsthokachiNoch keine Bewertungen

- Local Water UtilitiesDokument75 SeitenLocal Water UtilitiesadsleeNoch keine Bewertungen

- Q2-2011 Performance Review: 18.8% Increase in Profit After TaxDokument30 SeitenQ2-2011 Performance Review: 18.8% Increase in Profit After TaxRuchi SharmaNoch keine Bewertungen

- 2008 Annual Report Balance SheetDokument2 Seiten2008 Annual Report Balance SheetfoggynytNoch keine Bewertungen

- 1.accounts 2012 AcnabinDokument66 Seiten1.accounts 2012 AcnabinArman Hossain WarsiNoch keine Bewertungen

- Unaudited Financial Results (Quarterly) : As at Third Quarter of The Financial Year 2070/71 (13/04/2014)Dokument2 SeitenUnaudited Financial Results (Quarterly) : As at Third Quarter of The Financial Year 2070/71 (13/04/2014)nayanghimireNoch keine Bewertungen

- 2 CARD BankDokument70 Seiten2 CARD BankSean CarloNoch keine Bewertungen

- Microsoft Corporation: United States Securities and Exchange CommissionDokument75 SeitenMicrosoft Corporation: United States Securities and Exchange Commissionavinashtiwari201745Noch keine Bewertungen

- Kaspi Bank 21Dokument4 SeitenKaspi Bank 21Serikkizi FatimaNoch keine Bewertungen

- Ashok Leyland Annual Report 2012 2013Dokument108 SeitenAshok Leyland Annual Report 2012 2013Rajaram Iyengar0% (1)

- Sourcebook 2071 72 - 20140713015447Dokument54 SeitenSourcebook 2071 72 - 20140713015447praveendehsarNoch keine Bewertungen

- Lagos State Audited Financial Statements, 2015Dokument77 SeitenLagos State Audited Financial Statements, 2015Justus OhakanuNoch keine Bewertungen

- BD Bank Balance Sheet AnalysisDokument46 SeitenBD Bank Balance Sheet AnalysisSaiful Islam JewelNoch keine Bewertungen

- The FY 2011 Expenditure Program: General IntroductionDokument6 SeitenThe FY 2011 Expenditure Program: General IntroductionKharen SanchezNoch keine Bewertungen

- Central Bank of Eutopia Statement of Financial Position (Continued.)Dokument0 SeitenCentral Bank of Eutopia Statement of Financial Position (Continued.)Sanath FernandoNoch keine Bewertungen

- Almi - LK Audit 2012Dokument64 SeitenAlmi - LK Audit 2012Christina GintingNoch keine Bewertungen

- Case Solution - A New Financial Policy at Swedish Match - ANIDokument20 SeitenCase Solution - A New Financial Policy at Swedish Match - ANIAnisha Goyal33% (3)

- Financial Statements - 37Dokument52 SeitenFinancial Statements - 37Liliana MNoch keine Bewertungen

- IMF Balance of Payments Manual data for IndiaDokument6 SeitenIMF Balance of Payments Manual data for IndiaJatin ThakkarNoch keine Bewertungen

- Debt SituationDokument101 SeitenDebt SituationFatima LimNoch keine Bewertungen

- SummaryDokument1 SeiteSummarySadia ParveenNoch keine Bewertungen

- Philippine Charity Sweepstakes Office Executive Summary 2013Dokument6 SeitenPhilippine Charity Sweepstakes Office Executive Summary 2013Den Mark AngudongNoch keine Bewertungen

- TABLE 5.1 Components of Monetary AssetsDokument9 SeitenTABLE 5.1 Components of Monetary AssetsfaysalNoch keine Bewertungen

- Cochin International Airport Limited: Annexure-IDokument2 SeitenCochin International Airport Limited: Annexure-Ipravit08Noch keine Bewertungen

- MFM-103 Balance of Payment-Current ScenarioDokument8 SeitenMFM-103 Balance of Payment-Current ScenarioAhel Patrick VitsuNoch keine Bewertungen

- Cambodia Health Equity and Quality Improvement Project Audited Financial Statement Year Ended 31dec18 - 2Dokument31 SeitenCambodia Health Equity and Quality Improvement Project Audited Financial Statement Year Ended 31dec18 - 2Ann RomioNoch keine Bewertungen

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaVon EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNoch keine Bewertungen

- Next Steps for ASEAN+3 Central Securities Depository and Real-Time Gross Settlement Linkages: A Progress Report of the Cross-Border Settlement Infrastructure ForumVon EverandNext Steps for ASEAN+3 Central Securities Depository and Real-Time Gross Settlement Linkages: A Progress Report of the Cross-Border Settlement Infrastructure ForumNoch keine Bewertungen

- Hard Ware Software PresentationDokument20 SeitenHard Ware Software PresentationMübashir KhanNoch keine Bewertungen

- Regression Analysis ResultsDokument7 SeitenRegression Analysis ResultsMübashir KhanNoch keine Bewertungen

- Term PaperDokument35 SeitenTerm PaperMübashir KhanNoch keine Bewertungen

- Hard Ware Software PresentationDokument20 SeitenHard Ware Software PresentationMübashir KhanNoch keine Bewertungen

- Vocabulary Sample ListDokument6 SeitenVocabulary Sample ListShaheen ShaziaNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 1 VAQAR Personal Income Taxation in PakistanDokument17 Seiten1 VAQAR Personal Income Taxation in PakistanMübashir KhanNoch keine Bewertungen

- IncomeDokument771 SeitenIncomeMübashir KhanNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Current Affairs Past Papers MCQS Till 2011Dokument17 SeitenCurrent Affairs Past Papers MCQS Till 2011khan_2009Noch keine Bewertungen

- Tax Reforms in PakistanDokument53 SeitenTax Reforms in PakistanMübashir Khan100% (2)

- Roll No:42Dokument18 SeitenRoll No:42Mübashir KhanNoch keine Bewertungen

- NTS Book For GAT General Free Download PDFDokument142 SeitenNTS Book For GAT General Free Download PDFMuhammad Ramzan100% (3)

- NTS Book For GAT General Free Download PDFDokument142 SeitenNTS Book For GAT General Free Download PDFMuhammad Ramzan100% (3)

- Fourth ChapterDokument29 SeitenFourth ChapterMübashir KhanNoch keine Bewertungen

- FinalBudgetSpeech 13 14 EnglishDokument42 SeitenFinalBudgetSpeech 13 14 EnglishMübashir KhanNoch keine Bewertungen

- Learn How To Write A Review of LiteratureDokument2 SeitenLearn How To Write A Review of LiteratureMübashir KhanNoch keine Bewertungen

- Third ChapterDokument32 SeitenThird ChapterMübashir KhanNoch keine Bewertungen

- Dasar Genetik GandumDokument282 SeitenDasar Genetik GandumAlekkyNoch keine Bewertungen

- 1644 CV Europass Daniel MatosDokument2 Seiten1644 CV Europass Daniel MatosDaniel MatosNoch keine Bewertungen

- General Indications: AnticoagulantsDokument15 SeitenGeneral Indications: AnticoagulantswahidNoch keine Bewertungen

- Chloe Kho - Assignment 5 - MTT PracticeDokument5 SeitenChloe Kho - Assignment 5 - MTT PracticeanthonyNoch keine Bewertungen

- Integration of The Saprobic System Into The European Union Water Framework DirectiveDokument14 SeitenIntegration of The Saprobic System Into The European Union Water Framework DirectiveMihaela MirabelaNoch keine Bewertungen

- Infants and ToddlersDokument14 SeitenInfants and ToddlersJosias Smith100% (1)

- Cooling & Heating: ShellmaxDokument3 SeitenCooling & Heating: Shellmaxvijaysirsat2007Noch keine Bewertungen

- Makalah Silverius Simatupang A24050072Dokument5 SeitenMakalah Silverius Simatupang A24050072Maul MaulanaNoch keine Bewertungen

- Veterinary Medicines ReportDokument28 SeitenVeterinary Medicines Reportvikram chhabraNoch keine Bewertungen

- Grade 8 Science Activity 1 Quarter 4Dokument8 SeitenGrade 8 Science Activity 1 Quarter 4yoshirabul100% (2)

- Konseling Kreatif Dan Jarak JauhDokument66 SeitenKonseling Kreatif Dan Jarak JauhNindyani BudiNoch keine Bewertungen

- King Khalid University College of Engineering Department of Chemical EngineeringDokument9 SeitenKing Khalid University College of Engineering Department of Chemical EngineeringbaderNoch keine Bewertungen

- Fuel Gas Superheater 195-E-301 A/B: Mechanical - Data SheetDokument3 SeitenFuel Gas Superheater 195-E-301 A/B: Mechanical - Data SheetZulfikar N JoelNoch keine Bewertungen

- Our Vision For Copenhagen 2015: Eco-MetropoleDokument11 SeitenOur Vision For Copenhagen 2015: Eco-MetropolePascal van den Noort100% (1)

- Cyclopropane, Ethynyl - (Cas 6746-94-7) MSDS: CyclopropylacetyleneDokument5 SeitenCyclopropane, Ethynyl - (Cas 6746-94-7) MSDS: CyclopropylacetyleneMiMi JoyNoch keine Bewertungen

- Time ManagementDokument30 SeitenTime ManagementVaibhav Vithoba NaikNoch keine Bewertungen

- BOM Eligibility CriterionDokument5 SeitenBOM Eligibility CriterionDisara WulandariNoch keine Bewertungen

- Success On The Wards 2007Dokument32 SeitenSuccess On The Wards 2007mnNoch keine Bewertungen

- FAO Shrimp Culture - Pond Design, Operation and ManagementDokument53 SeitenFAO Shrimp Culture - Pond Design, Operation and Managementfanuskhan80% (5)

- Cottonhill - Red Collection PDFDokument33 SeitenCottonhill - Red Collection PDFVioricaNoch keine Bewertungen

- Cooking - Sauces and Marinade RecipesDokument96 SeitenCooking - Sauces and Marinade Recipesagape_1st7100% (3)

- Frontline ArticleDokument7 SeitenFrontline Articleapi-548946265Noch keine Bewertungen

- Review of LitetaureDokument8 SeitenReview of LitetaureeswariNoch keine Bewertungen

- Respiratory Medicine 1 50Dokument33 SeitenRespiratory Medicine 1 50Ahmed Kh. Abu WardaNoch keine Bewertungen

- HLF Sharing Fitness Business CooperationDokument17 SeitenHLF Sharing Fitness Business Cooperationbhardwajharsh2706Noch keine Bewertungen

- Presentation On: Perfetti Van MelleDokument20 SeitenPresentation On: Perfetti Van MelleAkash RaiNoch keine Bewertungen

- Product and Service Costing: Job-Order System: Questions For Writing and DiscussionDokument22 SeitenProduct and Service Costing: Job-Order System: Questions For Writing and Discussionsetiani putriNoch keine Bewertungen

- PTSD Checklist (PCL)Dokument1 SeitePTSD Checklist (PCL)Manikanta Sai KumarNoch keine Bewertungen

- Grade 6 School Lesson on Propagating Trees and Fruit TreesDokument10 SeitenGrade 6 School Lesson on Propagating Trees and Fruit TreesGhrazy Ganabol LeonardoNoch keine Bewertungen

- M Shivkumar PDFDokument141 SeitenM Shivkumar PDFPraveen KumarNoch keine Bewertungen