Beruflich Dokumente

Kultur Dokumente

A9PS Marked

Hochgeladen von

Muffet LkrOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

A9PS Marked

Hochgeladen von

Muffet LkrCopyright:

Verfügbare Formate

Economics Problem Sets

Submitted to Prof. Arindam DasGupta

Submited By Manas khandelwal (2012027) Nayantara gupta (2012032) Pallavi aggarwal (2012037) Shashank shekhar (2012053) Shivam sinha (2012054) Siddharth jhunjhunwala (2012055) 2+1.5+1.5+2+0+0+1.5+1.5+0+2=12 (answer to 7.4a identical to Group B2. 6.5b identical to group B4; 8.8b,c,d identical to group B5) Zero marks

Solutions: 3.9 Elasticity:

a. The own price elasticity of demand is the percentage by which the quantity demanded will change if the price of the item rises by 1%. Short run own-price elasticity for demand = = -0.4/1 = Proportionate change in quantity demanded Proportionate change in price

-0.4

Similarly, Long run own- price elasticity for demand = -0.75/1 = c. Price rise due to tax = 5% In short run, Proportionate change in quantity demanded = Elasticity * Proportionate change in price = -0.4 * 5% = - 2.0% The proportionate change in expenditure = 5 % - 2.0 % = 3% In long run, Proportionate change in quantity demanded = -0.75 * 5% = -3.75% Proportionate change in expenditure = 5% - 3.75% = 5.7 Market Equilibrium: 1.25 %

-0.75

a) Due to the sabotage of the oil pipeline, there was reduction in the supply of oil to the city of Kirkuk. Oil having an inelastic demand people started demanding oil through the tankers. Thus, the demand curve for tanker shifts to the right. In the short-run increase in supply is not possible. Hence, the price of oil tankers increased. The quantity of tanker services would be less in the short run equilibrium, and in turn, higher the long run. b) In the long run, the price would be higher than the original equilib rium, but lower than 39,000 per day. c) Sunk costs are larger in transport of oil via pipeline as the initial investment is higher in laying down the network of pipeline as compare to tanker. As well if the long runs rates become fall lower than the average costs, one can scrap the tanker and recover some of the initial costs d) Prices are more volatile in tanker services. Due to lower sunk costs involved in tanker services, the entry / exits are easier. For example - If the short run rate is below the average variable cost, the owner should lay up the tanker. The choice between operating and scrapping is a long run decision. If the long run rate is below the average cost, the owner should scrap the tanker.

6.2 Economic Efficiency: a) The long waiting lists at urban hospitals are due to market inefficiency in the way Pluto Health operates. Here the first condition for efficient markets i.e All users draw same marginal benefit isnt satisfied. With higher household incomes, people in urban areas draw more marginal benefits from the same medical services than rural areas. People staying in the urban areas have a high income and thus better purchasing power as compared to other areas. So they can pay higher prices for treatment in hospitals, this has lead to the long queues. The rate at which the urban population is charged is same as that of people in rural areas; this gives them higher buyer surplus. b) The cost of living is higher in urban than rural areas but the professionals are offered same salary. Other hospitals in urban have the capacity to pay their staff better because they charge people according to the purchasing power in urban areas and not at the rural price levels. Thus, with higher costs of living professionals would prefer to work in rural areas with lower marginal cost and same salary to draw larger profits. The 2nd condition of market efficiency to have same marginal costs for all the sellers isnt getting satisfied.

c)

Advice to management 1) Higher salary to urban professionals 2) Charge higher for medical services in urban hospitals

6.5 Economic Efficiency: For Fish

Fish Price ($)/tonne P2 P1

Supply

Japan- Marginal Benefit Developed Economies Marginal Benefit

Quantity demanded (tonnes)/year Japanese people draw more benefit from eating fish than meat hence the marginal benefit curve lies towards right as compare to the curve for other developed economies. Thus the fish will be priced at P2 (>P1 ) with quantity demanded D2 for economic efficient markets. D1 D2 For Meat Meat Price ($)/tonne P2 P1 Developed Economies Marginal Benefit Japan - Marginal Benefit D1

Supply

D2

Quantity demanded (tonnes)/year

Opposite is true for Meat with lower benefits the meat prices will be lower (P1) in Japan as compare to other developed economies. b) Increase in Chinese demand for fish would raise the overall demand for fish in the world. But the supply cannot be increased beyond certain levels (Assuming supply is inelastic). Therefore the price of fish would go up. This in turn forces Japanese with comparatively low Marginal benefit to reduce their consumption for fish because price commanded by fish would be more than their Marginal Benefit. c) No, it is not likely that Chinese would consume the entire fish catch. There would be people across the globe whose marginal benefit would be higher than marginal benefit derived by low benefit buyers of Chinese people for fish consumption; hence they would be ready to pay more. This would mean that even though Chinese demand potentially can consume the entire wish catch but they wouldnt pay for it.

7.4 Costs: (a) No. Assuming that elevator breakdowns are independent, then the average rate of breakdowns will obey the law of large numbers. Shan On should be able to predict the number of breakdowns with relatively less error when it maintains a larger number of elevators. Hence, it need not increase the number of service people by the same proportion as the number of elevators to be maintained. (b) Economies of scale. (c) Economies of Scope are experienced when total costs of operations are lower with joint than separate operations. Operating escalators and elevators is a case of economies of scope the as shan on already provides services for elevators and the skill set required for maintenance of escalators is also similar. Therefore minor training would make the human resource already available competent to perform both the operations.

8.8 Monopoly: a) Indian law will hinder the ability of Private Televi sion Channels to differentiate itself from Doordarshan. Private broadcasters will have to share their broadcasting rights with Doordarshan even after winning the bid. This would lead to change in the differentiating factors from exclusivity of broadcast to focus on factors such as better picture quality, expert talk shows etc. Also lot of times the private broadcasters get a privilege that National broadcaster will show the match after a delay of 5 seconds b) Law would reduce the amount that a private television would bid for broadcasting rights because they wont have the exclusive right to broadcast the Indian cricket matches. This will divide the viewership, reducing the margins for private broadcasters hence bidding capacity reduces for them. In the long run private broadcasters will refrain from placing a bid because gradually their marginal cost will overpower marginal benefit they can derive from getting broadcasting rights. c) Doordarshans market power relative to television viewers in the short run will increase by a rather smaller proportion. In the long run as the private players will stop bidding, Doordarshan will be able to achieve a monopoly. Thus at this point profits will now be maximized and revenues will also increase. As Doordarshan after the new regulation will enjoy the broadcasting rights irrespective of their bids they will be a monopoly in the market. Thus they will now enjoy greater market power. Hence there will no longer be any bid process; rather the BBCI will now be price takers d) Our prediction will be based on two market conditions the short-run and the long-run. In the short run the private players will still continue to bid, but the bids will decrease. Whereas in the long run the private players will stop placing bids.

10.4 Strategic Thinking

a) As stated, if Bush and Kerry both visit the same state, the probability of Kerry winning each state is 50%, so Kerry's overall probability of winning the election is 0.5 x 0.5 = 25%. If Kerry visits Ohio and Bush goes to Florida, Kerry's probability in Ohio becomes 60%, and his probability in Florida falls to 40%, for an overall probability of 0.6 x 0.4 = 24%. If Kerry visits Florida and Bush goes to Ohio, Kerry's overall probability of winning becomes 0.6 x 0.4 = 24%. Since Bush has conceded Pennsylvania to Kerry, Kerry would ideally want to go wherever Bush would finally land up (either Ohio or Florida). Bush would want to avoid going to the state where Kerry visits as that will reduce Kerrys overall probability to ( .24 + .24 = .48 versus if they visit the same state, in that case the probability for Kerry will be .25 + .25 = .50) . What Bush ought to realize here is that, whatever Kerry does, Bush is better off if he visits Ohio! Visiting Ohio is what game theorists call a dominant strategy, and it makes game theory pretty easy: Bush should go to Ohio and ignore Kerry. We will find that going to Ohio is a dominant strategy for Kerry, too, which means that if both campaigns act rationally they'll converge at Ohio cancel each other out. This is Nash Equilibrium b) It is Nash equilibrium in pure strategy as it does not involve randomization and we use arrow technique to reach the conclusion. Both parties act strategically & it seems reasonable for the m to choose the Nash Equilibrium. Ultimately both parties will finally land up in the same location.

CASE 1 States Ohio

George W. Bush Ohio B - 0.50 K 0.50 Florida B - 0.40 K 0.60 B - 0.50 K 0.50

Legend G.W.Bush J Kerry

John Kerry

Florida

B - 0.60 K 0.40

The same is applicable in Case 2 when we change the probability for Bush to go to Florida instead of Ohio CASE 2 States Ohio George W. Bush Ohio B - 0.50 K 0.50 Florida B - 0.60 K 0.40 B - 0.50 K 0.50

Legend G.W.Bush J Kerry

John Kerry

Florida

B - 0.40 K 0.60

13.4 Asymmetric Information: a) The borrowers have better information of their repayment capacity than the lenders. This asymmetric information results in imperfect information of the borrower. b) A better investment grade by a credit rating agency generally ensures borrowers credit worthiness. Borrowers want to convince potential lenders that they will repay their loan in time along with interest payments and wont put money into excessively risky projects. A good ratings by credit rating agency provides platform for borrowers to market themselves in an effective manner and come induce more investment. c) The whole purpose of the ratings is to reduce the risks of information asymmetries for potential investors. This is possible only when the grades given, actually correlates to the actual defaults. This Provides authenticity to the reports and assists investors to make decisions.

14.1 Incentive & Organization a) Doctors are subject to moral hazard in the situation when medical insurer pays the bills .They charge high rates/ prices for tests and other treatments to consumer as compare to situation when the consumer himself pays the bill. The asymmetric information with insurer about the actual medical treatments and medical state of the customer establishes this moral hazard. Also, doctors are aware of the fact that customers wont go in detail to check everything in the bill with insurer paying.. b) Managed Health care limits the moral hazard of doctors that comes from overuse of health care, thus keeping the insurance company better off. In managed care, covered patients could get treatment only from specific doctors and at specified facilities. That is insurance companies form contracts with doctors depending upon services and price. In the presence of such conditions doctors wont be able to charge more as compare to medical insurance. c) Managed care is less costly than medical insurance since it limits the insured party to get treatment only form a specified list of doctors and facilities. As the insurance providers now make contracts with hospitals and doctors on the basis of services and the price they offer which led to competition in the health care market resulting in lower prices. Medical insurance paid the providers on a cost basis. The more that was spent, the more that was received. So health care providers competed in market along the lines of higher -quality services .This increased the price of health care.

15.9 Regulation: a) Public good is a good where use by one individual does not reduce availability to others. The scientific formula for a new vaccine is a public good as the new vaccine would be non-excludable as

well as for non-rival consumption. The usage of a scientific formula by one user doesnt limit the usage by another user. b) Vaccination ensures immunity for the person who is vaccinated. So non-vaccinated people are benefitted by a vaccinated person as the risk of getting infected is reduced. This benefit is not reduced by the number of people in the non-vaccinated community. Thus, it is a public good. c) When GAVI started to purchase raw material in bulk, it experienced economies of scale which led to reduction in marginal cost enabling it to supply more quantity at same price. Therefore, there was a rightward shift in supply curve as shown below:

Price per Carton in Rupees

Where,

D1 = Demand for Vaccines S1 = Supply of Vaccines before bulk purchase S2 = Supply of vaccines after bulk purchases P0 = Equilibrium price before the bulk purchase P1= Equilibrium price after the bulk purchase Q0 = Equilibrium quantity before the bulk purchase Q1= Equilibrium quantity after the bulk purchase

Now, when GAVI started to give subsidies, consumers could buy more vaccination at current price levels. Thereby, it leads to a rightward shift in demand curve as shown below.

Price per Carton in Rupees

Where,

D1 = Demand for Vaccines before subsidy D2 = Demand for Vaccines after subsidy S1 = Supply of Vaccines P1 = Equilibrium price before subsidy P2 = Equilibrium price after the subsidy Q1 = Equilibrium quantity before the subsidy Q2 = Equilibrium quantity after the subsidy

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- DFS Limited CaseDokument3 SeitenDFS Limited CaseSach SehgalNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Ans Ass 3Dokument1 SeiteAns Ass 3Muffet LkrNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Ans Ass 2Dokument1 SeiteAns Ass 2Muffet LkrNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Expression of Interest Sop: Date of Issue Process Owner Approved byDokument6 SeitenExpression of Interest Sop: Date of Issue Process Owner Approved byMuffet LkrNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Q3 FY21 Investor PresentationDokument33 SeitenQ3 FY21 Investor PresentationMuffet LkrNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Ans Ass1Dokument1 SeiteAns Ass1Muffet LkrNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grade ExplanationDokument1 SeiteGrade ExplanationMuffet LkrNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Birla - Alokhya - Services Ageement With Loyalie - FM Review - 14.12.2019Dokument24 SeitenBirla - Alokhya - Services Ageement With Loyalie - FM Review - 14.12.2019Muffet LkrNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- AccountingFundamentalsCoursePresentation 1546293587507 PDFDokument67 SeitenAccountingFundamentalsCoursePresentation 1546293587507 PDFZab Jaan100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- RD FD Growth Calculator 1.0Dokument18 SeitenRD FD Growth Calculator 1.0dantroliyaNoch keine Bewertungen

- Rationale: 1 I Godrej I Title of Presentation I DateDokument3 SeitenRationale: 1 I Godrej I Title of Presentation I DateMuffet LkrNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- 2015 CFA Level 2 Study NoteBook5Dokument272 Seiten2015 CFA Level 2 Study NoteBook5Muffet LkrNoch keine Bewertungen

- CFI Accountingfactsheet-1499721167572 PDFDokument1 SeiteCFI Accountingfactsheet-1499721167572 PDFMuffet LkrNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Student Resources PDFDokument943 SeitenStudent Resources PDFMuffet Lkr100% (3)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Agreement For SaleDokument8 SeitenAgreement For SaleMuffet LkrNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- GD TopicsDokument6 SeitenGD TopicsMuffet LkrNoch keine Bewertungen

- Agreement For Sub-LeaseDokument18 SeitenAgreement For Sub-LeaseMuffet LkrNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Agreement For SaleDokument8 SeitenAgreement For SaleMuffet LkrNoch keine Bewertungen

- Brand Naming AssignmentDokument1 SeiteBrand Naming AssignmentMuffet LkrNoch keine Bewertungen

- Case Analysis - Exploring RelationshipsDokument16 SeitenCase Analysis - Exploring RelationshipsMuffet LkrNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Assessor Model NPDDokument0 SeitenAssessor Model NPDMuffet LkrNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Biopure FinalDokument22 SeitenBiopure FinalMuffet LkrNoch keine Bewertungen

- Bank One - Discussion QuestionsDokument1 SeiteBank One - Discussion QuestionsMuffet LkrNoch keine Bewertungen

- Forecasting Problem Set - SolutionsDokument8 SeitenForecasting Problem Set - SolutionsRajaram IyengarNoch keine Bewertungen

- About Unitech GroupDokument2 SeitenAbout Unitech GroupMuffet LkrNoch keine Bewertungen

- LIME 5 Case Study TIGI PDFDokument6 SeitenLIME 5 Case Study TIGI PDFsatish230289Noch keine Bewertungen

- EMailDokument1 SeiteEMailMuffet LkrNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

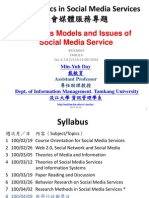

- 992SMS07 Social Media ServicesDokument28 Seiten992SMS07 Social Media ServicesMuffet LkrNoch keine Bewertungen

- Gera Pune Realty Report July13Dokument10 SeitenGera Pune Realty Report July13Muffet LkrNoch keine Bewertungen

- 01 Reliability and ValidityDokument17 Seiten01 Reliability and ValidityMuffet LkrNoch keine Bewertungen

- Performance Evaluation Night AuditorDokument6 SeitenPerformance Evaluation Night AuditorMary Jean Devela BalasabasNoch keine Bewertungen

- PGMA-Credit For Growth of IndustryDokument3 SeitenPGMA-Credit For Growth of IndustryarielramadaNoch keine Bewertungen

- Excel-Based Model To Value Firms Experiencing Financial DistressDokument4 SeitenExcel-Based Model To Value Firms Experiencing Financial DistressgenergiaNoch keine Bewertungen

- Selecting Best EmployeeDokument5 SeitenSelecting Best EmployeeLuciana JuliawatiNoch keine Bewertungen

- Performance Appraisal Methods: Traditional and Modern Methods!Dokument22 SeitenPerformance Appraisal Methods: Traditional and Modern Methods!BhargaviNoch keine Bewertungen

- Individual Performance Commitment and Review (Ipcr) : Privatization and Management OfficeDokument4 SeitenIndividual Performance Commitment and Review (Ipcr) : Privatization and Management OfficeJohn Robert BautistaNoch keine Bewertungen

- Output and CostsDokument59 SeitenOutput and CostsMohammad Raihanul HasanNoch keine Bewertungen

- Supplier Evaluation SampleDokument1 SeiteSupplier Evaluation SampleZyrus OyongNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Greenfield City: Rating Assigned: Kolkata 6 Star'Dokument11 SeitenGreenfield City: Rating Assigned: Kolkata 6 Star'kittushuklaNoch keine Bewertungen

- Mba Report - Management Case StudyDokument17 SeitenMba Report - Management Case StudyMhild GandawaliNoch keine Bewertungen

- Pedersen - Wall Street Primer (2009)Dokument262 SeitenPedersen - Wall Street Primer (2009)Cosmin VintilăNoch keine Bewertungen

- CRM BankLoanRating PDFDokument6 SeitenCRM BankLoanRating PDFsushant kamleNoch keine Bewertungen

- CH 14Dokument16 SeitenCH 14Huzaifa Bin SaeedNoch keine Bewertungen

- Thyssenkrupp Industries PDFDokument7 SeitenThyssenkrupp Industries PDFBinoy MtNoch keine Bewertungen

- Impact Assessment TemplateDokument3 SeitenImpact Assessment Templatezio_nanoNoch keine Bewertungen

- Specification For Internal Gear Pumps: 1.0 General DescriptionDokument7 SeitenSpecification For Internal Gear Pumps: 1.0 General DescriptionHassan ShafiqueNoch keine Bewertungen

- EdDokument69 SeitenEdPalak DawarNoch keine Bewertungen

- Microeconomics Final ExamDokument6 SeitenMicroeconomics Final ExamDaniel Mata100% (1)

- Job EvaluationDokument25 SeitenJob EvaluationShivam GoelNoch keine Bewertungen

- MDS - Qualitative Risk Analysis - Wilmont's Pharmacy PDFDokument3 SeitenMDS - Qualitative Risk Analysis - Wilmont's Pharmacy PDFFair Segs100% (1)

- BarsDokument3 SeitenBarssogatNoch keine Bewertungen

- Chain & Accessories That Go The Dista Nce: The Lifting Equipment SpecialistsDokument8 SeitenChain & Accessories That Go The Dista Nce: The Lifting Equipment SpecialistsHong Chee FongNoch keine Bewertungen

- Chapter 5 Theory of ProductionDokument11 SeitenChapter 5 Theory of ProductionAbsolitudeHeartNoch keine Bewertungen

- 05 Euro Aggregate Corporate Index FactsheetDokument2 Seiten05 Euro Aggregate Corporate Index FactsheetRoberto PerezNoch keine Bewertungen

- IPPTCh 008Dokument30 SeitenIPPTCh 008Jacquelynne SjostromNoch keine Bewertungen

- 5 Easy Steps On How To Conduct Spider Web ToolDokument2 Seiten5 Easy Steps On How To Conduct Spider Web ToolAlfeo Del Rosario BubutanNoch keine Bewertungen

- Caspro Metal Industries Private - R - 05102020Dokument6 SeitenCaspro Metal Industries Private - R - 05102020Vipul Braj BhartiaNoch keine Bewertungen

- Fitch Monthly July 2014Dokument1 SeiteFitch Monthly July 2014jaycamerNoch keine Bewertungen

- Step 3: Establish Performance StandardsDokument9 SeitenStep 3: Establish Performance StandardsRachitNoch keine Bewertungen

- Credit RatingsDokument15 SeitenCredit RatingsLalit GuptaNoch keine Bewertungen

- The Voice of God: Experience A Life Changing Relationship with the LordVon EverandThe Voice of God: Experience A Life Changing Relationship with the LordNoch keine Bewertungen

- Confinement (Book #1 in the Love and Madness series)Von EverandConfinement (Book #1 in the Love and Madness series)Noch keine Bewertungen

- Locked Away (Book #2 in the Love and Madness series)Von EverandLocked Away (Book #2 in the Love and Madness series)Noch keine Bewertungen