Beruflich Dokumente

Kultur Dokumente

Ibf 2012-13

Hochgeladen von

lulughoshOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ibf 2012-13

Hochgeladen von

lulughoshCopyright:

Verfügbare Formate

Course Plan

KF2IBF3 International Banking and Finance Mr. Dennis Thomas

Term VI December 2012 to March 2013

Post Graduate Diploma in Management (PGDM) SCMS - COCHIN

Table of Contents 1. COURSE PROFILE:...................................................................................5 2. COURSE OBJECTIVES:..............................................................................5 ENABLE STUDENTS -...................................................................................5 TO GET FAMILIARIZE WITH THE CONCEPT OF INTERNATIONAL FINANCE. TO GET ACQUAINTED WITH THE NOTION OF FOREIGN EXCHANGE RATES.. 5 TO GET ACQUAINTED WITH INTERNATIONAL BANKING TRANSACTIONS, FOREX EXPOSURE AND RISK MANAGEMENT................................................5 TO GET IDENTIFIED WITH THE CONCEPT OF INTERNATIONAL FINANCE MANAGEMENT..............................................................................................5 3. COURSE OUTLINE (SYLLABUS) ..............................................................5 4. COURSEWARE:.........................................................................................6 5. COURSE IMPLEMENTATION: PEDAGOGY & EVALUATION APPROACH ....7 5.1 MODULE 1: ..........................................................................................7 5.1.1 LEARNING OBJECTIVE.......................................................................7 5.1.3. 5.1.4. PEDAGOGY / STRUCTURE OF LESSONS...........................................8 COURSEWARE OF THE MODULE:.....................................................8

5.1.5 LEARNING OUTCOME FUNDAMENTAL KNOWLEDGE ABOUT INTERNATIONAL FINANCE, THE INTERNATIONAL MONETARY SYSTEM AND FOREIGN EXCHANGE MARKET.. 8 5.1.6. EVALUATION FOR THE MODULE ....................................................................................................................8 5.2 MODULE 2: ..........................................................................................8 5.2.1 LEARNING OBJECTIVE.......................................................................8 5.2.2 PRE REQUISITE ...............................................................................8 5.2.3. 5.2.4. PEDAGOGY / STRUCTURE OF LESSONS...........................................8 COURSEWARE OF THE MODULE:.....................................................8 .................................................................................................................8 5.2.5 LEARNING OUTCOME.........................................................................9 AWARENESS OF THE MECHANISMS THAT ARE FOLLOWED IN INTERNATIONAL REMITTANCES AND ACCOUNT MAINTENANCE. ...........................................9 THE UNDERSTANDING ABOUT THE DIFFERENT DESCRIPTIONS IN INTERNATIONAL BANKING DEPARTMENTS.................................................9 5.2.6. EVALUATION FOR THE MODULE......................................................9 5.3 MODULE 3: .........................................................................................9 5.3.1 LEARNING OBJECTIVE/OUTCOME......................................................9 2

5.3.2 PRE REQUISITE ...............................................................................9 5.3.3. 5.3.4. PEDAGOGY / STRUCTURE OF LESSONS...........................................9 COURSEWARE OF THE MODULE:.....................................................9

5.3.5 LEARNING OUTCOME.......................................................................10 TO UNDERSTAND THE IMPORTANCE OF EXCHANGE RATE MECHANISM IN INTERNATIONAL TRANSACTIONS AND BASIC KNOWLEDGE OF CALCULATING EXCHANGE RATES FOR FOREIGN CURRENCIES..........................................10 5.3.6. EVALUATION FOR THE MODULE ..................................................................................................................10 ................................................................................................................10 5.4 MODULE 4: ......................................................................................10 5.4.1 LEARNING OBJECTIVE/OUTCOME....................................................10 5.4.2 PRE REQUISITE .............................................................................10 5.4.3. 5.4.4. PEDAGOGY / STRUCTURE OF LESSONS.........................................10 COURSEWARE OF THE MODULE:...................................................10 ...............................................................................................................10 5.4.5 LEARNING OUTCOME.......................................................................11 ABILITY TO UNDERSTAND THE UNIQUE INSTRUMENTS OF DERIVATIVES AND KNOWLEDGE ABOUT THE RISKS INVOLVED IN CROSS BORDER TRANSACTIONS. ..................................................................................................................11 5.4.6. EVALUATION FOR THE MODULE ..................................................................................................................11 ................................................................................................................11 5.5 MODULE 5: ........................................................................................11 5.5.1 LEARNING OBJECTIVE/OUTCOME ..................................................................................................................11 5.5.2 PRE REQUISITE .............................................................................11 5.5.3. 5.5.4. PEDAGOGY / STRUCTURE OF LESSONS.........................................11 COURSEWARE OF THE MODULE:...................................................11 ...............................................................................................................11 5.2.5. LEARNING OUTCOME......................................................................12 ATTAIN THE ABILITY TO UNDERSTAND THE INTERNATIONAL BOND MARKET, EQUITY MARKET AND DIFFERENT INSTRUMENTS FOR OFFSHORE INVESTMENT. ..................................................................................................................12 5.5.6. EVALUATION FOR THE MODULE ..................................................................................................................12 5.6 MODULE 6: .......................................................................................12 5.6.1 LEARNING OBJECTIVE.....................................................................12 3

5.6.2 PRE REQUISITE .............................................................................12 5.6.3. 5.6.4. PEDAGOGY / STRUCTURE OF LESSONS.........................................12 COURSEWARE OF THE MODULE:...................................................12 ...............................................................................................................12 5.6.5. LEARNING OUTCOME......................................................................13 ATTAIN THE CAPACITY TO UNDERSTAND THE FUNCTIONING OF FINANCE MANAGEMENT OF MULTINATIONALS AND THE INDIAN EXCHANGE CONTROL. ..................................................................................................................13 5.6.6. EVALUATION 6. FOR THE MODULE....................................................13 THE INTERNAL ASSESSMENT ............................................................13

7. MILESTONES / IMPORTANT DATES ......................................................13

..................................................................................................................14 ..................................................................................................................14

9. SESSION PLAN ......................................................................................14 10. MID TERM EXAMINATION COVERAGE AND QP PATTERN....................16 11. END TERM EXAMINATION COVERAGE AND QP PATTERN ..................16

1. Course Profile: Course Title Number Programme Total Credits Total Number of Sessions Session Duration Faculty/course facilitator

International Banking and Finance KF2IFB3 Post Graduate Diploma in Management (PGDM) 3 24 1 hr 15 minutes Mr. Dennis Thomas

2. Course Objectives: Enable students To get familiarize with the concept of International Finance. To get acquainted with the notion of Foreign Exchange Rates. To get acquainted with International Banking Transactions, Forex Exposure and Risk Management. To get identified with the concept of International Finance Management. 3. Course Outline (Syllabus) Module No 1 WeightSessions age % 16% 4 Description International Finance-Introduction- Evolution of International Monetary System- Balance of Payments- Foreign Exchange Market International Banking Transactions- International RemittancesConcepts and Techniques- Nostro and Vostro Accounts-Mirror Accounts-Estimating Exchange Profits- International Banking Offices-Dealing Room and Treasury Exchange Rate Mechanism- Determinants of Exchange RateNominal, Real and Effective Exchange Rate-Theories of Exchange Rate Behavior- Merchant Rates- Forward Transactions Foreign Exchange Exposure and Risk ManagementIntroduction and Concept- Swaps, Futures, Options International Capital Markets- International Bond and Equity Markets- Interest Rate Swap vs. Currency Swap- Foreign Portfolio Investment- FDI and Cross Border Acquisitions 5

12%

20%

16%

16%

20% 100%

International Finance Management and Indian Exchange Control - Capital Structure and Cost of Capital of MNCsInternational Capital Budgeting- MNC Cash ManagementInternational Trade Finance, International Tax EnvironmentIndian Exchange Control & FEMA

Total

24

4. Courseware: Book/ Author Journal/ Article/case studies Title International Financial Eun and Resnick Management International Vyuptakesh Sharan Financial Management International Finance P.G.Apte Fundamentals of Rupnarayan Bose International Banking International Sathye/Rose/Allen/Weston Financial Management Options, John Hull Futures and other Derivatives SAPM Fischer and Jordan Foreign B. Srinivasan Exchange Simplified Other references: Year/ edition/volume Publisher

2007 Fourth Edition 2006 Fourth Edition Fourth Edition 2007 First Edition 2006 Edition 2006 Sixth Edition 2006 Edition 2005 Edition

Tata McGraw Hill Prentice Hall India Tata McGraw Hill McMillan India

WSE Pearson Education

Pearson Education Tata McGraw Hill

Glossary for International Finance www.rbi.org (for exchange control regulations) International Banking and Finance Capital Market and news analysis The International Journal of Banking and Finance Various International Business Magazines and offline and online journals www.invetopedia.com

http://pages.stern.nyu.edu/~igiddy/gfmgloss.html Reserve Bank of India http://www.euromoney.com/ http://epublications.bond.edu.au/ijbf/

Case Study :

SHREWSBURY HERBAL PRODUCTS, LTD

Group Presentation on relevant topics in International Finance and Banking

(Class will be divided into groups and each group should select one topic from the list given below).

1).Libor, 2).US recession and its impact on international finance, 3).Euro zone crisis,4). Renminbi as a universally accepted currency, 5).FIIs in India and their impact on the economy, 6).FDI in infrastructure in India, 7).Currency futures and Options, 8). Recession in Greece and its causes, 9).Rise of China as the largest economy in the world, 10). Icelandic financial crisis, 11).CDOs- A structured asset back security, 12).Cross border acquisitions by Indian Companies 13).US fiscal Cliff, 14)Oil Prices and World Economy, 15)Basel III norms

5. Course implementation: Pedagogy & Evaluation Approach 5.1 Module 1: Module name Sessions (Reference No.) Weightage (% of total content) 5.1.1 Learning objective Introduce students to the concepts in International Finance. 5.1.2 Pre requisite 7 International Finance 1-4 16%

Students are expected to know basics of the state of affairs of Global Economic Scenario. 5.1.3. Pedagogy / Structure of lessons Lecture and discussions 5.1.4. Courseware of the module: International Financial Management Eun and Resnick 2007 Fourth Edition Tata McGraw Hill International Financial Management Vyuptakesh Sharan 2006 Fourth Edition Prentice Hall India Chapters 1,2,3 and 5

Chapters 1,2,3 and 5

5.1.5 Learning Outcome Fundamental knowledge about International Finance, the International Monetary System and Foreign Exchange Market. 5.1.6. Evaluation for the module Evaluation Assignment Weightage 5 Marks Topic No and/ or specification History of Euro and its future/Depreciating Indian Rupee good or bad for the Indian Economy

5.2 Module 2: Module name Sessions (Reference No.) Weightage (% of total content) International Banking Transactions 5-7 12%

5.2.1 Learning objective To get acquainted with the different types of International transactions and their settlements. 5.2.2 Pre requisite Students are expected to be familiar with basics on International Finance covered in Module 1. 5.2.3. Pedagogy / Structure of lessons Lecture and discussions 5.2.4. Courseware of the module: Text Book & Chapter References 8

Fundamentals of International Banking Rupnarayan Bose 2007 First Edition McMillan India International Financial Management Vyuptakesh Sharan 2006 Fourth Edition Prentice Hall India International Financial Management Eun and Resnick 2007 Fourth Edition Tata McGraw Hill 5.2.5 Learning Outcome

Chapters 15-17

Chapter 17

Chapter 11

Awareness of the mechanisms that are followed in International Remittances and Account Maintenance. The understanding about the different descriptions in International Banking Departments. 5.2.6. Evaluation for the module Evaluation Weightage Test 10 Marks

Topic No and/ or specification Module 1 and Module 2

5.3 Module 3: Module name Sessions (Reference No.) Weightage (% of total content) Exchange Rate Mechanism 8- 12 20%

5.3.1 Learning objective/Outcome To familiarize with the essentials of Exchange Rate Mechanism and Exchange Rate Calculation 5.3.2 Pre requisite Students are expected to be familiar with Module 1 and Module 2 5.3.3. Pedagogy / Structure of lessons Lecture and discussions 5.3.4. Courseware of the module: Text Book & Chapter References Fundamentals of International Banking Rupnarayan Bose 2007 First Edition McMillan India International Financial Management Chapters 3,4,6,13-14

Chapter 4 9

Vyuptakesh Sharan 2006 Fourth Edition Prentice Hall India International Financial Management Eun and Resnick 2007 Fourth Edition Tata McGraw Hill 5.3.5 Learning Outcome

Chapter 5

To understand the importance of exchange rate mechanism in international transactions and basic knowledge of calculating exchange rates for foreign currencies.

5.3.6. Evaluation for the module Evaluation Quiz Case Study Weightage 5 Marks 5 Marks Topic No and/ or specification Based upon Module 3

SHREWSBURY HERBAL PRODUCTS, LTD

5.4 Module 4: Module name Sessions (Reference No.) Weightage (% of total content) 5.4.1 Learning objective/Outcome Enable the students to understand the Foreign Exchange Risk Management through swaps, options and currency futures. 5.4.2 Pre requisite Students are expected to be familiar with International Banking Transactions and Exchange Rate Mechanism. 5.4.3. Pedagogy / Structure of lessons Lecture and discussions 5.4.4. Courseware of the module: Text Book & Chapter References 10 Foreign Exchange Exposure and Risk Management 13 - 15 16%

International Financial Management Eun and Resnick 2007 Fourth Edition Tata McGraw Hill International Financial Management Vyuptakesh Sharan 2006 Fourth Edition Prentice Hall India 5.4.5 Learning Outcome

Chapters 7,8,9,10,14

Chapters 6,7,8,13,19

Ability to understand the unique instruments of derivatives and knowledge about the risks involved in cross border transactions. 5.4.6. Evaluation for the module Evaluation Test 5.5 Module 5: Module name Sessions (Reference No.) Weightage (% of total content) 5.5.1 Learning objective/Outcome To attain basic awareness of International Bond and Equity markets. 5.5.2 Pre requisite Students are expected to know basics taught in Module 1 and 2 and specifically in Foreign Exchange Exposure and Risk Management. 5.5.3. Pedagogy / Structure of lessons Lecture and discussions 5.5.4. Courseware of the module: Text Book & Chapter References International Financial Management Eun and Resnick 2007 Fourth Edition Tata McGraw Hill Chapters 12,13,14,15,16 International Capital Markets 16 - 19 16% Weightage 5 Marks Topic No and/ or specification Swaps, options and currency futures

11

5.2.5. Learning Outcome Attain the ability to understand the International Bond Market, Equity Market and different instruments for offshore investment.

5.5.6. Evaluation for the module (List as applicable) Assignment Weightage 5 Marks Topic No and/ or specification International Investment for Raising capital Relevant topics in International Finance

Group Presentation to be held 10 marks in the 5-6 module 5.6 Module 6: Module name Sessions (Reference No.) Weightage (% of total content)

International Finance Management and MNCs, Indian Exchange Control 20 - 24 20%

5.6.1 Learning objective To get familiarized with the concepts in Finance Management of MNCs. To get acquainted with the classification of Indian Exchange Control. 5.6.2 Pre requisite Students are expected to know International Banking Transactions Exchange Rate Mechanism, Foreign Exchange Exposure and Risk Management and International Capital Markets. 5.6.3. Pedagogy / Structure of lessons Lecture and discussions 5.6.4. Courseware of the module: Text Book & Chapter References International Financial Management Eun and Resnick 2007 Fourth Edition Tata McGraw Hill www.rbi.org Chapters 17,18,19,20,21

For exchange control regulations in India

12

5.6.5. Learning Outcome Attain the capacity to understand the functioning of Finance Management of Multinationals and the Indian Exchange Control. 5.6.6. Evaluation for the module Evaluation Continuation of the Group Presentation Quiz 5 marks Weightage Topic No and/ or specification Relevant topics in International Finance Module 5-6

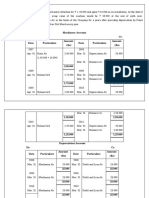

6. The internal assessment The internal assessment shall be based on the following Evaluation Criteria Criteria Pre Mid Ter m 05 05 10 05 25 Pos t Mid Ter m 05 05 05 10 25 Maximum Marks

Mid Term Exam Quiz Assignment Test Group Presentation Case Study Total

20 05 10 15 10 05 70

7. Milestones / Important Dates Sl. No. Assignment / Class Test / Project/ Presentation etc. 1 Assignment 2 3 4 5 6 7 Test Quiz Case Study Test Assignment Quiz

Tentative Date/ SESSION 4 7 12 12 15 20 24

13

9. Session Plan M od ule 1 Session Topics Introduction to International Finance Evolution of International Monetary System Balance of Payments Reading reference / Assignment (Preparatory. Work) Eun & Resnick Chapter 1 Eun & Resnick Chapter 2 Eun & Resnick Chapter 3 Assignment Pedagog y s/ Activities (for evaluation) Lecture and discussio ns Lecture and discussio ns Lecture and discussio ns And Problem Solving Lecture and discussio ns

Foreign Exchange Market

Eun & Resnick Chapter 5

Assignment ;History of Euro and its future/Depr eciating Indian Rupee good or bad for the Indian Economy

International Remittances : Concepts and Techniques Nostro and Vostro Accounts, Mirror Accounts, Estimating Exchange Profit

Rupnarayan Bose Chapter 3,4,5 Rupnarayan Bose Chapter 6,8

Lecture and discussio ns Lecture and discussio ns 14

International Banking Offices, Dealing Room and Treasury Determinants of Exchange Rate

Rupnarayan Bose Chapter 7,9,11,13,14 Rupnarayan Bose Chapter 15 Rupnarayan Bose Chapter 18 Rupnarayan Bose Chapter 17 Rupnarayan Bose Chapter 19

Test

Lecture And Problem Solving

Lecture And Problem Solving Lecture And Problem Solving Lecture , Discussion /problem solving

Nominal, Real and Effective Exchange Rate Theories of Exchange Rate Behavior Merchant Rates

10

11

Lecture and discussio ns Quiz and Case Study

Discussion s

3 4

12 13

Forward Transactions Foreign Exchange Exposure and Risk Management Swaps, Futures, Options

RupnarayanBose Chapter19 Eun & Resnick Chapter 8,9,10 Eun & Resnick Chapter 14,7 Eun & Resnick Chapter 14,7 Eun & Resnick Chapter 12,13 Eun & Resnick Chapter 14 Eun & Resnick Chapter 15 Eun & Resnick Chapter 16

14

15

Swaps, Futures, Options

16

International Bond and Equity Markets Interest Rate Swap vs. Currency Swap Foreign portfolio investment

Lecture and discussio ns Lecture and discussio ns Test Lecture and discussio ns Start of Lecture Group and Presentation discussio ns

Lecture And Problem Solving

17

18

19

FDI and Cross Border Acquisitions

Lecture and discussio ns Lecture and discussio ns

15

20

Capital Structure and Cost of Capital of MNCs

Eun & Resnick Chapter 17

Assignment : Internationa l Investment for Raising capital

Lecture and discussio ns

Lecture And Problem Solving

21

International Capital Budgeting

Eun & Resnick Chapter 18 Eun & Resnick Chapter 19 Eun & Resnick Chapter 20,21 www.rbi.org Quiz

22

MNC Cash Management

23

International Trade Finance, International Tax Environment Indian Exchange Control & FEMA

Lecture and discussio ns Lecture and discussio ns

Lecture and discussion s

24

10. Mid Term Examination Coverage and QP pattern

Section A Section B Section C

Short Questions Practical Questions Contemporary issues Case Study/Descriptive Question

11. End Term Examination Coverage and QP pattern The end term examination shall be for 3 hours and shall cover all the topics that are envisaged in this plan and the pattern will be as follows: Section A Section B Short Questions Contemporary Issues Descriptive Questions

Section C

Contextual Question involving exchange Arithmetic etc

16

Case Study: MINI CASE: SHREWSBURY HERBAL PRODUCTS, LTD. Shrewsbury Herbal Products, located in central England, close to the Welsh border, is an old-line producer of herbal teas, seasonings, and medicines. Their products are marketed all over the United 17

Kingdom and in many parts of continental Europe as well. Shrewsbury Herbal generally invoices in British pound sterling when it sells to foreign customers in order to guard against adverse exchange rate changes. Nevertheless, it has just received an order from a large wholesaler in central France for 320,000 of its products, conditional upon delivery being made in three months time and the order invoiced in French francs. Shrewsburys controller, Elton Peters, is concerned with whether the pound will appreciate versus the franc over the next three months, thus eliminating all or most of the profit when the French franc receivable is paid. He thinks this is an unlikely possibility, but he decides to contact the firms banker for suggestions about hedging the exchange rate exposure. Mr. Peters learns from the banker that the current spot exchange rate is FF/ is FF7.8709, thus the invoice amount should be FF2,518,688. Mr. Peters also learns that the 90-day forward rates for the pound and the French franc versus the U.S. dollar are $1.5458/1.00 and FF5.0826/$1.00, respectively. The banker offers to set up a forward hedge for selling the franc receivable for pound sterling based on the FF/ cross forward exchange rate implicit in the forward rates against the dollar. What would you do if you were Mr. Peters?

18

Das könnte Ihnen auch gefallen

- Paralympic Committee (IPC) Asian Open Championships With A World-Record Lift. Ali LiftedDokument1 SeiteParalympic Committee (IPC) Asian Open Championships With A World-Record Lift. Ali LiftedlulughoshNoch keine Bewertungen

- India and Vietnam Signed Treaty On The Transfer of Sentenced PrisonersDokument5 SeitenIndia and Vietnam Signed Treaty On The Transfer of Sentenced PrisonerslulughoshNoch keine Bewertungen

- Srishti Rana of India Was Crowned Miss Asia Pacific World 2013Dokument5 SeitenSrishti Rana of India Was Crowned Miss Asia Pacific World 2013lulughoshNoch keine Bewertungen

- 3 MarchDokument1 Seite3 MarchlulughoshNoch keine Bewertungen

- Union Cabinet On 20 February 2014 Gave Its Nod For Classifying Odia As A Classical LanguageDokument1 SeiteUnion Cabinet On 20 February 2014 Gave Its Nod For Classifying Odia As A Classical LanguagelulughoshNoch keine Bewertungen

- Interim Union Budget 2014-15 Tax ProposalDokument2 SeitenInterim Union Budget 2014-15 Tax ProposallulughoshNoch keine Bewertungen

- Renaud Lavillenie Broke 21-Year Pole Vault Record of Sergey BubkaDokument1 SeiteRenaud Lavillenie Broke 21-Year Pole Vault Record of Sergey BubkalulughoshNoch keine Bewertungen

- The Hindus: An Alternative History Written by Wendy DonigerDokument1 SeiteThe Hindus: An Alternative History Written by Wendy DonigerlulughoshNoch keine Bewertungen

- Cadbury and Turnbull ReportDokument10 SeitenCadbury and Turnbull ReportlulughoshNoch keine Bewertungen

- Risk Management For Enterprises and Individuals 1Dokument13 SeitenRisk Management For Enterprises and Individuals 1lulughoshNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Economics Today The Macro View 19th Edition Miller Solutions ManualDokument19 SeitenEconomics Today The Macro View 19th Edition Miller Solutions Manualtusseh.itemm0lh100% (22)

- PESTLE Analysis ToyotaDokument13 SeitenPESTLE Analysis ToyotaSajedul Islam Chy50% (2)

- Tesco Case StudyDokument4 SeitenTesco Case StudyHassan ZulqernainNoch keine Bewertungen

- Financial Management:: The Cost of CapitalDokument94 SeitenFinancial Management:: The Cost of CapitalSarah SaluquenNoch keine Bewertungen

- Corporate Governance in India: Recent Developments in Governance Practice in Indian CorporatesDokument42 SeitenCorporate Governance in India: Recent Developments in Governance Practice in Indian CorporatesArcha ShajiNoch keine Bewertungen

- 3 Users of Financial StatementsDokument2 Seiten3 Users of Financial Statementsapi-299265916100% (1)

- Sustainability 13 01029 v3Dokument89 SeitenSustainability 13 01029 v3Getacho EjetaNoch keine Bewertungen

- Bond Duration - Dynamic ChartDokument3 SeitenBond Duration - Dynamic Chartapi-3763138Noch keine Bewertungen

- Mondelez: Sales and Distribution ReportDokument17 SeitenMondelez: Sales and Distribution ReportSaumya MittalNoch keine Bewertungen

- DepreciationDokument84 SeitenDepreciationDubai SheikhNoch keine Bewertungen

- Airborne Express Case StudyDokument10 SeitenAirborne Express Case StudyNotesfreeBookNoch keine Bewertungen

- How Reviving Its Original Purpose Reversed 8 Years of Decline For NRMA InsuranceDokument20 SeitenHow Reviving Its Original Purpose Reversed 8 Years of Decline For NRMA InsuranceJibran AhsanNoch keine Bewertungen

- About Nephilia Capital - Oregon and KKR InvestDokument7 SeitenAbout Nephilia Capital - Oregon and KKR InvestAlyson DavisNoch keine Bewertungen

- Outsourced Chief Investment Officer (OCIO) - Details, Activities and BenefitsDokument4 SeitenOutsourced Chief Investment Officer (OCIO) - Details, Activities and BenefitsTanyamagistralNoch keine Bewertungen

- RBI/2007-2008/22 Master Circular No./6 /2007-08 July 2, 2007Dokument53 SeitenRBI/2007-2008/22 Master Circular No./6 /2007-08 July 2, 2007Makarand LonkarNoch keine Bewertungen

- Disney: Sleeping Beauty BondsDokument3 SeitenDisney: Sleeping Beauty Bondschamp10100% (1)

- Burger King 5CDokument10 SeitenBurger King 5CYogesh Kumar0% (1)

- Khadim India LTD - IPO NoteDokument3 SeitenKhadim India LTD - IPO Notenit111Noch keine Bewertungen

- Yes No: Vat-On Business Services-In General VB010 2,108,277.52 252,993.30 2,108,277.52 252,993.30Dokument1 SeiteYes No: Vat-On Business Services-In General VB010 2,108,277.52 252,993.30 2,108,277.52 252,993.30MJ TuliaoNoch keine Bewertungen

- Vodacoin Is The Product Selected To Implement in The Rwandese MarketDokument3 SeitenVodacoin Is The Product Selected To Implement in The Rwandese MarketHamza ZainNoch keine Bewertungen

- Investment Banking: Organizational Structure of An Investment BankDokument9 SeitenInvestment Banking: Organizational Structure of An Investment Banksun2samNoch keine Bewertungen

- A Presentation On Business Plan For Coffeeville: Prepared By: Riccardo Tumminia Student Id: 42211Dokument10 SeitenA Presentation On Business Plan For Coffeeville: Prepared By: Riccardo Tumminia Student Id: 42211JibendraNoch keine Bewertungen

- SwotsDokument2 SeitenSwotsMohd RafiqNoch keine Bewertungen

- Robusta Coffee Shop A Feasibility StudyDokument26 SeitenRobusta Coffee Shop A Feasibility StudysabberNoch keine Bewertungen

- Food Truck Business Plan Instructions Rubric-1Dokument4 SeitenFood Truck Business Plan Instructions Rubric-1Lara WNoch keine Bewertungen

- Accounting For Merchandising Operations: © 2009 The Mcgraw-Hill Companies, Inc., All Rights ReservedDokument41 SeitenAccounting For Merchandising Operations: © 2009 The Mcgraw-Hill Companies, Inc., All Rights ReservedLong DemonNoch keine Bewertungen

- Industrial RelationDokument44 SeitenIndustrial RelationDr. Khem ChandNoch keine Bewertungen

- Trade Surveillance PDFDokument2 SeitenTrade Surveillance PDFBaluNoch keine Bewertungen

- IEOR E4718 Spring2015 SyllabusDokument10 SeitenIEOR E4718 Spring2015 Syllabuscef4Noch keine Bewertungen

- Omnichannel - Team JediDokument14 SeitenOmnichannel - Team JediJntNoch keine Bewertungen