Beruflich Dokumente

Kultur Dokumente

WCT - 130422 - Loses Arbitration Proceeding

Hochgeladen von

liewst_wctCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

WCT - 130422 - Loses Arbitration Proceeding

Hochgeladen von

liewst_wctCopyright:

Verfügbare Formate

News Flash

(Member of Alliance Bank group) PP7766/03/2013 (032116)

WCT

Construction

Sell

Bloomberg Ticker: WCT MK | Bursa Code: 9679

22 April 2013

Analyst Jeremy Goh, CFA jeremygoh@alliancefg.com +603 2604 3905

Loses arbitration proceeding

The Gamuda-WCT JV has lost the arbitration proceeding against BAE. This arbitration is related to the Dukhan Highway job in Qatar. The JV is required to pay BAE a total of RM52.4m. WCTs stake in the JV is 49% and the earnings impact is RM26.3m (-15% cut). Impact to our sum-of-parts valuation is RM0.02/ share (<1%). As such, there will be no changes to our RM2.05 TP and SELL rating which already imputes a 10% discount.

12-month upside potential Target price Current price (as at 19 Apr) Capital upside (%) Net dividends (%) Total return (%)

2.05 2.39 -14.2 2.6 -11.6

Whats in the news

Key stock information Syariah-compliant? Market Cap (RM m) Shares outstanding (m) Free float (%) 52-week high / low (RM) 3-mth avg volume ('000) 3-mth avg turnover (RM m) Share price performance 1M Absolute (%) 3.1 Relative (%) -1.4

Yes 2,586.7 1,082.3 52.7 2.47 / 1.87 2,914.6 6.6 3M 8.1 3.2 6M 3.2 0.5

The Gamuda-WCT JV has lost the arbitration proceedings against Bahrain Asphalt Establishment (BAE). The JV shall be required to pay QAR 45.7m (RM38.1m) as claims to BAE, QAR17.1m (RM14.3m) as legal costs and USD412k (RM1.3m) for arbitrator costs. WCT has a 49% stake in the JV and stated that the impact to its FY13 (Dec) earnings is RM26.3m.

Recap of past events

In Feb 2006, BAE was appointed as a subcontractor by the JV for a project in Qatar known as the Dukhan Highway which involves a 43km road from Shahaniya to Zekreet. In March 2010, BAE has served a request for arbitration against the JV, claiming a total sum of QAR109.3m (RM101.1m) which comprises of (i) prolongation, escalation, collateral and associated cost, (ii) overcharging of aggregates and (iii) wrongful deduction for supply of bitumen.

Our comments

Share price chart

This arbitration claim would reduce our FY13 earnings by 15.1% from RM174.3m to RM148m. However, we would regard this as an exceptional item. Impact on our sum-of-parts valuation is marginal at RM0.02 per share or less than 1%.

Valuation and recommendation

We make no changes to our RM2.05 TP as our valuation already inputs a 10% discount to SOP. This implies 11.7x and 11.5x FY13-14. We maintain our SELL rating on WCT.

All required disclosure and analyst certification appear on the last two pages of this report. Additional information is available upon request. Redistribution or reproduction is prohibited without written permission

News Flash | WCT | 22 April 2013

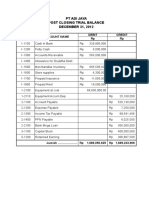

Figure 1 : Key financial data FYE 31 Dec Revenue (RM m) EBITDA (RM m) EBIT (RM m) Pretax profit (RM m) Reported net profit (RM m) Core net profit (RM m) EPS (sen) Core EPS (sen) Alliance / Consensus (%) Core EPS growth (%) P/E (x) EV/EBITDA (x) ROE (%) Net gearing (%) Net DPS (sen) Net dividend yield (%) BV/share (RM) P/B (x)

Source: Alliance Research, Bloomberg

FY10 1,708.5 316.5 300.1 266.8 150.3 150.3 15.1 15.1 2.2 15.9 10.1 12.0 37.4 5.9 2.5 1.26 1.9

FY11 1,538.6 266.6 257.4 207.5 166.0 166.0 16.6 16.6 10.4 14.4 12.0 11.2 39.3 9.5 4.0 1.48 1.6

FY12 1,560.4 262.0 255.5 202.7 364.6 153.6 36.5 15.4 (7.5) 15.5 12.2 8.5 41.1 7.0 2.9 1.82 1.3

FY13F 1,767.5 293.0 281.9 217.9 148.0 174.3 14.8 17.5 79.7 9.4 13.7 10.9 10.4 38.0 6.1 2.6 1.68 1.4

FY14F 1,827.6 301.8 289.9 222.8 178.3 178.3 17.9 17.9 71.1 2.3 13.4 10.6 9.9 39.1 6.2 2.6 1.80 1.3

News Flash | WCT | 22 April 2013

DISCLOSURE

Stock rating definitions

Strong buy Buy Neutral Sell Trading buy High conviction buy with expected 12-month total return (including dividends) of 30% or more Expected 12-month total return of 15% or more Expected 12-month total return between -15% and 15% Expected 12-month total return of -15% or less Expected 3-month total return of 15% or more arising from positive newsflow. However, upside may not be sustainable

Sector rating definitions

Overweight Neutral Underweight - Industry expected to outperform the market over the next 12 months - Industry expected to perform in-line with the market over the next 12 months - Industry expected to underperform the market over the next 12 months

Commonly used abbreviations

Adex = advertising expenditure bn = billion BV = book value CF = cash flow CAGR = compounded annual growth rate Capex = capital expenditure CY = calendar year Div yld = dividend yield DCF = discounted cash flow DDM = dividend discount model DPS = dividend per share EBIT = earnings before interest & tax EBITDA = EBIT before depreciation and amortisation EPS = earnings per share EV = enterprise value FCF = free cash flow FV = fair value FY = financial year m = million M-o-m = month-on-month NAV = net assets value NM = not meaningful NTA = net tangible assets NR = not rated p.a. = per annum PAT = profit after tax PBT = profit before tax P/B = price / book ratio P/E = price / earnings ratio PEG = P/E ratio to growth ratio q-o-q = quarter-on-quarter RM = Ringgit ROA = return on assets ROE = return on equity TP = target price trn = trillion WACC = weighted average cost of capital y-o-y = year-on-year YTD = year-to-date

News Flash | WCT | 22 April 2013

DISCLAIMER

This report has been prepared for information purposes only by Alliance Research Sdn Bhd (Alliance Research), a subsidiary of Alliance Investment Bank Berhad (AIBB). This report is strictly confidential and is meant for circulation to clients of Alliance Research and AIBB only or such persons as may be deemed eligible to receive such research report, information or opinion contained herein. Receipt and review of this report indicate your agreement not to distribute, reproduce or disclose in any other form or medium (whether electronic or otherwise) the contents, views, information or opinions contained herein without the prior written consent of Alliance Research. This report is based on data and information obtained from various sources believed to be reliable at the time of issuance of this report and any opinion expressed herein is subject to change without prior notice and may differ or be contrary to opinions expressed by Alliance Researchs affiliates and/or related parties. Alliance Research does not make any guarantee, representation or warranty (whether express or implied) as to the accuracy, completeness, reliability or fairness of the data and information obtained from such sources as may be contained in this report. As such, neither Alliance Research nor its affiliates and/or related parties shall be held liable or responsible in any manner whatsoever arising out of or in connection with the reliance and usage of such data and information or third party references as may be made in this report (including, but not limited to any direct, indirect or consequential losses, loss of profits and damages). The views expressed in this report reflect the personal views of the analyst(s) about the subject securities or issuers and no part of the compensation of the analyst(s) was, is, or will be directly or indirectly related to the inclusion of specific recommendation(s) or view(s) in this report. Alliance Research prohibits the analyst(s) who prepared this report from receiving any compensation, incentive or bonus based on specific investment banking transactions or providing a specific recommendation for, or view of, a particular company. This research report provides general information only and is not to be construed as an offer to sell or a solicitation to buy or sell any securities or other investments or any options, futures, derivatives or other instruments related to such securities or investments. In particular, it is highlighted that this report is not intended for nor does it have regard to the specific investment objectives, financial situation and particular needs of any specific person who may receive this report. Investors are therefore advised to make their own independent evaluation of the information contained in this report, consider their own individual investment objectives, financial situations and particular needs and consult their own professional advisers (including but not limited to financial, legal and tax advisers) regarding the appropriateness of investing in any securities or investments that may be featured in this report. Alliance Research, its directors, representatives and employees or any of its affiliates or its related parties may, from time to time, have an interest in the securities mentioned in this report. Alliance Research, its affiliates and/or its related persons may do and/or seek to do business with the company(ies) covered in this report and may from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies), may sell or buy such securities from customers on a principal basis and may also perform or seek to perform significant investment banking, advisory or underwriting services for or relating to such company(ies) as well as solicit such investment, advisory or other services from any entity mentioned in this report. AIBB (which carries on, inter alia, corporate finance activities) and its activities are separate from Alliance Research. AIBB may have no input into company-specific coverage decisions (i.e. whether or not to initiate or terminate coverage of a particular company or securities in reports produced by Alliance Research) and Alliance Research does not take into account investment banking revenues or potential revenues when making company-specific coverage decisions. In reviewing this report, an investor should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest. Additional information is, subject to the overriding issue of confidentiality, available upon request to enable an investor to make their own independent evaluation of the information contained herein. Published & printed by: ALLIANCE RESEARCH SDN BHD (290395-D) Level 19, Menara Multi-Purpose Capital Square 8, Jalan Munshi Abdullah 50100 Kuala Lumpur, Malaysia Tel: +60 (3) 2604 3333 Fax: +60 (3) 2604 3921 Email: allianceresearch@alliancefg.com

Bernard Ching Executive Director / Head of Research

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- The Use of Geotechnical Baseline ReportsDokument3 SeitenThe Use of Geotechnical Baseline Reportsliewst_wctNoch keine Bewertungen

- Middle East Rail ProjectsfinalDokument23 SeitenMiddle East Rail Projectsfinalliewst_wct100% (1)

- System Tiling BrochureDokument76 SeitenSystem Tiling Brochureliewst_wct100% (2)

- Yourglasspocket 1Dokument123 SeitenYourglasspocket 1liewst_wctNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Principal Smallcap Fund PresentationDokument28 SeitenPrincipal Smallcap Fund PresentationpayalNoch keine Bewertungen

- Vice President Trust Officer On West Coast Resume David MacbethDokument2 SeitenVice President Trust Officer On West Coast Resume David MacbethDavidMacbethNoch keine Bewertungen

- Stock Market Profits With Moon PhasesDokument4 SeitenStock Market Profits With Moon PhaseslunanxlNoch keine Bewertungen

- Research On PSUDokument17 SeitenResearch On PSUDevendra BhagyawantNoch keine Bewertungen

- The Ichimoku TraderDokument11 SeitenThe Ichimoku TraderPui SanNoch keine Bewertungen

- Lecture 8 Professional Venture Capital PDFDokument91 SeitenLecture 8 Professional Venture Capital PDFGladz ReyNoch keine Bewertungen

- CAPE Accounting MCQDokument9 SeitenCAPE Accounting MCQBradlee SinghNoch keine Bewertungen

- Reliance Industries LimitedDokument15 SeitenReliance Industries LimitedBhavNeet SidhuNoch keine Bewertungen

- Marriott Corporation: The Cost of CapitalDokument43 SeitenMarriott Corporation: The Cost of CapitalShamsuzzaman SunNoch keine Bewertungen

- Billerud Annual Report 2010Dokument120 SeitenBillerud Annual Report 2010BillerudNoch keine Bewertungen

- Final Exam - Part IDokument2 SeitenFinal Exam - Part IPriyanka PatelNoch keine Bewertungen

- Topics: Break-Even Analysis, Operating and Financial Leverage, and Optimal Capital StructureDokument5 SeitenTopics: Break-Even Analysis, Operating and Financial Leverage, and Optimal Capital StructuremagoimoiNoch keine Bewertungen

- Gitman Pmf13 Ppt07 GEDokument55 SeitenGitman Pmf13 Ppt07 GEM Farhan Bhatti100% (1)

- Aima Blank DDQDokument24 SeitenAima Blank DDQcmaasset100% (2)

- Chapter 2 PDFDokument36 SeitenChapter 2 PDFLindsay MartinNoch keine Bewertungen

- Options TraderDokument41 SeitenOptions Tradermhosszu50% (2)

- Manual Input Next To Yellow Cells DCF Intrinsic Value CalculatorDokument5 SeitenManual Input Next To Yellow Cells DCF Intrinsic Value CalculatorViren K. GuptaNoch keine Bewertungen

- IAS 7 Statement of Cash Flows PDFDokument3 SeitenIAS 7 Statement of Cash Flows PDFAKNoch keine Bewertungen

- Central Banking and Financial RegulationsDokument9 SeitenCentral Banking and Financial RegulationsHasibul IslamNoch keine Bewertungen

- CFO MagazineDokument84 SeitenCFO MagazinehenrydeeNoch keine Bewertungen

- Share Capital TransactionsDokument65 SeitenShare Capital Transactionsm_kobayashiNoch keine Bewertungen

- Price Discovery Process For IPO PriceDokument30 SeitenPrice Discovery Process For IPO PriceAntora HoqueNoch keine Bewertungen

- Jawaban Silus Adijaya 2015Dokument15 SeitenJawaban Silus Adijaya 2015natsu dragnelNoch keine Bewertungen

- CFA PresentationDokument47 SeitenCFA PresentationBen Carlson100% (8)

- Chapter 16 Solution ManualDokument54 SeitenChapter 16 Solution ManualJose Matalo67% (3)

- Financial Management at Bajaj AutoDokument11 SeitenFinancial Management at Bajaj AutoShikha AgarwalNoch keine Bewertungen

- The Rothschilds Stage Revolutions in Tunisia and EgyptDokument10 SeitenThe Rothschilds Stage Revolutions in Tunisia and EgyptZeka Sumerian OutlawNoch keine Bewertungen

- Psak 19Dokument8 SeitenPsak 19Nadia NathaniaNoch keine Bewertungen

- ACC201 Examination July Semester 2007Dokument7 SeitenACC201 Examination July Semester 2007reflectooNoch keine Bewertungen

- Comparative Study in Equity Schemes of Various Companies Mutual FundDokument71 SeitenComparative Study in Equity Schemes of Various Companies Mutual FundWebsoft Tech-HydNoch keine Bewertungen