Beruflich Dokumente

Kultur Dokumente

Brazil Fights A Real Battle

Hochgeladen von

hongyen1Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Brazil Fights A Real Battle

Hochgeladen von

hongyen1Copyright:

Verfügbare Formate

Brazil Fights A Real Battle

In 1994, with inflation running at close to 50% monthly and Brazils economy near collapse, Fernando Cardoso was elected president. A former socialist mugged by reality, Cardoso opened the economy, adopted a number of free-market policies, stabilized the currency, and brought inflation down to just 7% annually by 1997. Now the Asian financial turmoil is threatening President Cardosos proudest achievement and the cornerstone of his popularity: a stable Brazilian real. Fallout from the Asian crisis has been more acute in Brazil than elsewhere in Latin America, partly because speculators believe that the real is overvalued. They also see parallels to Asia in Brazils large trade deficit financed by foreign capital inflows. The pressure on the real has been ratcheted up because Brazilian financial players are unusually aggressive and sophisticated, traits that are a legacy of the past three decades when rampant inflation and abrupt policy shifts forced traders to be brutally pragmatic and move quickly to survive.

The speculators may have met their match in President Cardoso, however. Cardoso is unlikely to give up easily because he has staked Brazils fortunes, and his own, on the Real Plan, which he had introduced in 1993 while he was finance minister. Its linchpin is a crawling peg designed to end the cycle of runaway inflation followed by massive devaluations that has given Brazil 30 years of economic chaos and eroded living standards for much of the population. By permitting only a tightly controlled

1 Copyright 2005 John Wiley & Sons, Inc.

and limited 0.6% depreciation of the real against the dollar each month (see Exhibit I 2.1), Cardoso has managed to halt Brazils hyperinflation and bring a new confidence that is spurring foreign investment (see Exhibit I 2.2 for statistics on the Brazilian economy). However, Brazils current account deficit is mounting, its foreign exchange reserves are falling, and financial markets are getting nervous that the real will suffer the same fate as that of the Asian currencies. The loss of confidence in the real is showing up in the form of capital flight, with $10 billion fleeing Brazil in the last two weeks of October 1997 alone. In addition, a fractious Congress has kept President Cardoso from carrying out the budgetary reforms that would allow him to control the fiscal deficits that have been the engine of hyperinflation and thereby institutionalize Brazils newfound macroeconomic stability. These reforms, which include revamping the tax, civil service, and social security system and privatizing key industries from telecom to mining, would allow Brazil to consolidate the economic gains it has already made, give investors greater confidence in the economys future, and speed up Brazils growth rate. As of now, Brazil has a bloated public sector (government workers cannot be dismissed, regardless of performance), large budget deficits (5.9% of GDP in 1997), protected industries, high tax rates with low tax collections, and one of the most unequal distributions of income and wealth in the world. One legacy of Brazils large budget deficits is that the country must now roll over about $20 billion a month in government debt.

2 Copyright 2005 John Wiley & Sons, Inc.

Nonetheless, until the Asian crisis hit, investors had responded to currency stabilization and the free-market reforms already begun by pushing up the Brazilian bolsa (stock market) by about 158% from January 1994, when the Real Plan took hold, to October 1997 (see Exhibit I 2.3). However, contagion from the Asian crisis has recently pummeled the bolsa, sending it down 29% from August through October.

Although it now appears that Cardoso will have to wait until his second term in office to carry out most of the proposed reforms, he is nonetheless reputed to be preparing a new push on his longstalled reform program. One of the stalled reforms is a bill to privatize the Brazilian social security system. This system, which pays out benefits to some workers in their 40s, is widely viewed as contributing to a Brazilian savings rate of just 16% of GDP (to put this number into perspective, Asian countries average closer to 30%). Until the presidential election in October 1998, Cardoso expects to maintain a tight-money policy that will support the real and, it is hoped, prevent the trade deficit from spiraling out of control. In addition to raising interest rates, the governments main weapon to stanch Brazils fiscal and trade deficits is a newly invigorated privatization program. In the first half of 1997, a large share of the $7.4 billion in foreign direct investment came in the form of purchases of state-owned businesses. Altogether, Brazil expects to take in an estimated $17 billion from privatizations in 1997 and at least $22 billion in 1998. Fortunately, the government is making enough progress toward economic reform to continue to entice foreign investors, who appear mesmerized by Brazils enormous potential. With a population of

3 Copyright 2005 John Wiley & Sons, Inc.

160 million and an estimated GDP of about $800 billion that has grown at an average rate of more than 4% annually since 1993 (see Exhibit I 2.4), Brazil is by far the largest market in Latin America (representing about 45% of total Latin American GDP) and provides a launching pad for investments throughout the region. Moreover, it is rapidly industrializing, as evidenced by the fact that industrial products now account for 75% of Brazils exports. Historically, coffee made up 80% of exports; now it accounts for only about 5%.

Rather than devaluing the currency, the traditional response by Brazilian governments faced with speculative attacks, Brazils central bankthe Banco Central do Brasilhas defended the Real Plan by doubling the basic interest rate to 43% (see Exhibit I 2.5) and spending the nations dollar reserves to buy up excess reais (plural of real). In early November 1997, Cardoso also managed to push through Congress some budgetary reforms along with $18 billion in spending cuts and tax increases, equivalent to more than 2% of GDP. The reals defense is not cost-free, however. The high real interest rates are expected to slow GDP growth in 1998 to 1.5%, from 3% in 1997. They are also pushing up the unemployment rate and worsening the credit quality of Brazils banks. Cardosos economic reforms have been attacked as benefiting the wealthy and coming at the expense of the poor, who are the first to lose their jobs. These charges are worrisome in a presidential-election year. Some observers have argued that by increasing the pace of the devaluations, Brazil could afford to lower interest rates and boost growth and jobsand at the same time improve Cardosos prospects in next Octobers presidential elections. However, many analysts believe that any significant deviation from the Real Plan, especially before an election, would look like politics as usual and cast doubt on the sustainability of all economic reforms. Backsliding on currency stability is also likely to be unpopular. The Real Plan has made

4 Copyright 2005 John Wiley & Sons, Inc.

politicians and the populace aware of the strong link between devaluation and inflation. Thus, any policy changes that threaten the low inflation wrought by currency stability are likely to be politically risky. However, the recent austerity measures are also unpopular and are corroding Cardosos approval ratings. With a recession looming as Brazil enters into an election year, Cardosos supporters fear that rising joblessness will cut deeply into his electoral chances.

Banks and other financial institutions have found that speculating against the real is an expensive and difficult proposition because the Banco do Brasil maintains a wide range of controls on the foreign exchange market. One of the most onerous and costly requires that buyers of dollars deposit a large portion of them in special, low-interest accounts with the central bank. In times of intense speculative pressure, the central bank has cut the interest rate paid on these accounts to zero. Thus investors who borrowed reais and converted them to dollars would start losing money the moment they deposited them with the central bank, unless the real fell enough to offset the loss of interest.

Questions 1. How does Brazil hope to control its current account deficit through a tight monetary policy? What alternatives are available to control Brazils current-account deficit? 2. How will Brazils tight money policy affect its fiscal deficit? How will it affect Brazils real (inflation-adjusted) interest rates, both short-term and long-term rates?

5 Copyright 2005 John Wiley & Sons, Inc.

3. Why have Brazils interest rates generally fallen in recent years? 4. How would reform and privatization of the social security system improve Brazils savings rate? What would be the likely consequences of this improvement for Brazils current-account balance and the reals value? Explain. 5. What are the costs and benefits of using currency controls to defend the real? 6. Why might speculators view the real as being overvalued? Based on the data in the case, what is your best estimate as to the reals degree of overvaluation? 7. What are the tradeoffs that President Cardoso must consider in deciding whether to accelerate the reals depreciation? 8. Could Brazil have avoided the recessionary impacts of its monetary policy if it had devalued the real instead? 9. What would a Brazilian devaluation do to the currencies and economies of Argentina and Chile, its neighbors and largest trading partners? 10. What is the link between Brazils budget deficits and its historical hyperinflation? 11. What mix of fiscal and monetary policy would you recommend to President Cardoso? Should he devalue or defend the real?

6 Copyright 2005 John Wiley & Sons, Inc.

Das könnte Ihnen auch gefallen

- Brazil's Macroeconomic StabilityDokument6 SeitenBrazil's Macroeconomic StabilityKhalisah Kamar ShahNoch keine Bewertungen

- Juggling Technocrats and Party HatsDokument3 SeitenJuggling Technocrats and Party HatsAndreea FloreaNoch keine Bewertungen

- BR G20 PDFDokument10 SeitenBR G20 PDFjjopaNoch keine Bewertungen

- Faculty of Business and Economic Department of Finance and Banking FINN432 Project (Part 1)Dokument29 SeitenFaculty of Business and Economic Department of Finance and Banking FINN432 Project (Part 1)Aya alawiNoch keine Bewertungen

- What Is The Outlook For BRICsDokument7 SeitenWhat Is The Outlook For BRICstrolaiNoch keine Bewertungen

- Brazil Launches FreshDokument2 SeitenBrazil Launches FreshRosi DonadioNoch keine Bewertungen

- 7 Expectations For Latin AmericaDokument3 Seiten7 Expectations For Latin AmericaHojaAmarillaNoch keine Bewertungen

- China's policies that fueled explosive economic growthDokument8 SeitenChina's policies that fueled explosive economic growthHenry ZhuNoch keine Bewertungen

- Brazil Fight A REAL Battle: Case Conditions Current ProblemDokument12 SeitenBrazil Fight A REAL Battle: Case Conditions Current ProblemArjit JainNoch keine Bewertungen

- 09.07.12 JPM Fiscal Cliff White PaperDokument16 Seiten09.07.12 JPM Fiscal Cliff White PaperRishi ShahNoch keine Bewertungen

- Investment and Tax Planning Strategies For Uncertain Economic TimesDokument16 SeitenInvestment and Tax Planning Strategies For Uncertain Economic TimesMihaela NicoaraNoch keine Bewertungen

- The Brazilian EconomyDokument37 SeitenThe Brazilian Economyرامي أبو الفتوحNoch keine Bewertungen

- 2012Q3 - Newsletter October 2012 - PDF Single PageDokument4 Seiten2012Q3 - Newsletter October 2012 - PDF Single PagePacifica Partners Capital ManagementNoch keine Bewertungen

- Exchange Rate Regimes: The Brazilian CaseDokument9 SeitenExchange Rate Regimes: The Brazilian CaseSalma AbdelaalNoch keine Bewertungen

- Brazil 1Dokument2 SeitenBrazil 1emelia87Noch keine Bewertungen

- Building Brazil's Derivative CapabilityDokument7 SeitenBuilding Brazil's Derivative CapabilityKc CruzNoch keine Bewertungen

- The Case of Brazil: Working PaperDokument63 SeitenThe Case of Brazil: Working PaperVFCNoch keine Bewertungen

- Economic Stimulus House Plan 0121091Dokument18 SeitenEconomic Stimulus House Plan 0121091AnicaButlerNoch keine Bewertungen

- Brazil - Little To Do About Growth - Nomura10Apr12Dokument6 SeitenBrazil - Little To Do About Growth - Nomura10Apr12CMCNevesNoch keine Bewertungen

- Manmohan Singh and Sonia Gandhi Are The CIA Agents of UsaDokument13 SeitenManmohan Singh and Sonia Gandhi Are The CIA Agents of UsaSogno100% (3)

- Arida, Bacha e Lara-Resende - Incerteza JurisdicionalDokument25 SeitenArida, Bacha e Lara-Resende - Incerteza JurisdicionalAndré Nascimento NoggeriniNoch keine Bewertungen

- Brazil Economy Spotlight: Politics, Inflation and Interest RatesDokument4 SeitenBrazil Economy Spotlight: Politics, Inflation and Interest RatesCharlesson1Noch keine Bewertungen

- Region Views: Latin America: A Changing of The GuardDokument13 SeitenRegion Views: Latin America: A Changing of The Guardapi-128097200Noch keine Bewertungen

- Chapter 5 BordarioDokument16 SeitenChapter 5 BordarioMichael Jay LingerasNoch keine Bewertungen

- India's Bubble Economy Headed Towards Iceberg?: CategorizedDokument6 SeitenIndia's Bubble Economy Headed Towards Iceberg?: CategorizedMonisa AhmadNoch keine Bewertungen

- Brazil Trade Liberalization ProgramDokument18 SeitenBrazil Trade Liberalization ProgramMoisés MotaNoch keine Bewertungen

- Jin Zhijia SES Term 2 Graded AssignmentDokument2 SeitenJin Zhijia SES Term 2 Graded AssignmentZENG XIANYU JASON HCINoch keine Bewertungen

- Brazil Commercial & Sovereign RisksDokument1 SeiteBrazil Commercial & Sovereign RisksjearodriguesNoch keine Bewertungen

- Congressional Testimony on Monetary Policy, Technology, and Economic GrowthDokument6 SeitenCongressional Testimony on Monetary Policy, Technology, and Economic GrowthSayed PiousNoch keine Bewertungen

- Brazil BubbleDokument1 SeiteBrazil BubbleDanillo Gabriel NakanoNoch keine Bewertungen

- Minsky Meets Brazil - New Economic PerspectivesDokument11 SeitenMinsky Meets Brazil - New Economic PerspectivesLeonardo GabrielNoch keine Bewertungen

- The USA Financial Crisis and Its RepercussionsDokument24 SeitenThe USA Financial Crisis and Its RepercussionsRox BenaducciNoch keine Bewertungen

- For Brazil and The Other BRIC Countries, Credit Quality Is About More Than Just SizeDokument18 SeitenFor Brazil and The Other BRIC Countries, Credit Quality Is About More Than Just Sizemarcos_de_carvalhoNoch keine Bewertungen

- Kinnaras Capital Management LLC: July 2010 Market CommentaryDokument4 SeitenKinnaras Capital Management LLC: July 2010 Market Commentaryamit.chokshi2353Noch keine Bewertungen

- Marking The 11th Hour - Corona Associates Capital Management - Year End Investment Letter - December 24th 2015Dokument13 SeitenMarking The 11th Hour - Corona Associates Capital Management - Year End Investment Letter - December 24th 2015Julian ScurciNoch keine Bewertungen

- Nov 2011 - Libertad y Progreso Paper Rosner-ArgentinaDokument19 SeitenNov 2011 - Libertad y Progreso Paper Rosner-ArgentinaJoshua RosnerNoch keine Bewertungen

- Stimulating DebateDokument2 SeitenStimulating DebatetbwsmNoch keine Bewertungen

- Domestic bond markets in Latin America: achievements and challengesDokument14 SeitenDomestic bond markets in Latin America: achievements and challengesThomas RobertsNoch keine Bewertungen

- SSRN Id224274Dokument39 SeitenSSRN Id224274Kavya GopakumarNoch keine Bewertungen

- Brazil's Financial Crisis & The Potential Aftershocks: World Agriculture & TradeDokument3 SeitenBrazil's Financial Crisis & The Potential Aftershocks: World Agriculture & TradeAnup VermaNoch keine Bewertungen

- Finshastra October CirculationDokument50 SeitenFinshastra October Circulationgupvaibhav100% (1)

- Why Real Yields Matter - Pictet Asset ManagementDokument7 SeitenWhy Real Yields Matter - Pictet Asset ManagementLOKE SENG ONNNoch keine Bewertungen

- Volume 2.4 Still Bullish Apr 13 2010Dokument12 SeitenVolume 2.4 Still Bullish Apr 13 2010Denis OuelletNoch keine Bewertungen

- A Reconsideration of Fiscal Policy in The Era of Low Interest RatesDokument51 SeitenA Reconsideration of Fiscal Policy in The Era of Low Interest RatesJohnclaude ChamandiNoch keine Bewertungen

- Can Colombia's Bond Market Keep Its New Friends From Overseas?Dokument4 SeitenCan Colombia's Bond Market Keep Its New Friends From Overseas?Marlon MarinNoch keine Bewertungen

- BrazilDokument2 SeitenBrazilhana_kimi_91Noch keine Bewertungen

- 5 World Economy Reading BrazilDokument4 Seiten5 World Economy Reading BrazilNeyl Joud BoujemaouiNoch keine Bewertungen

- Argent in ADokument4 SeitenArgent in ASri NadhNoch keine Bewertungen

- SPEX Issue 10Dokument12 SeitenSPEX Issue 10SMU Political-Economics Exchange (SPEX)Noch keine Bewertungen

- Constraints of DollarisationDokument6 SeitenConstraints of DollarisationMohammed Shah WasiimNoch keine Bewertungen

- Crisis Financiera UsaDokument10 SeitenCrisis Financiera UsaRox BenaducciNoch keine Bewertungen

- Chapter 4 of Public FinanceDokument4 SeitenChapter 4 of Public FinanceNathNoch keine Bewertungen

- Financial Crisis Means: IntroductionDokument3 SeitenFinancial Crisis Means: IntroductionKaushlya DagaNoch keine Bewertungen

- Debt Super CycleDokument3 SeitenDebt Super Cycleocean8724Noch keine Bewertungen

- WP 2018-66 0 PDFDokument55 SeitenWP 2018-66 0 PDFRo KohnNoch keine Bewertungen

- Paper MF - Brazil Fights A Real Battle Fix BangetDokument5 SeitenPaper MF - Brazil Fights A Real Battle Fix BangetIntan Saraswati RshNoch keine Bewertungen

- Global Connections 75Dokument11 SeitenGlobal Connections 75henriquepcsNoch keine Bewertungen

- Follow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsVon EverandFollow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsNoch keine Bewertungen

- The Rio de Janeiro Reader, Edited by Daryle Williams, Amy Chazkel, and Paulo KnaussDokument26 SeitenThe Rio de Janeiro Reader, Edited by Daryle Williams, Amy Chazkel, and Paulo KnaussDuke University PressNoch keine Bewertungen

- Naked MoneyDokument341 SeitenNaked MoneyIshan SaneNoch keine Bewertungen

- International Financialization and Depreciation: The Brazilian Real in The International Financial CrisisDokument28 SeitenInternational Financialization and Depreciation: The Brazilian Real in The International Financial CrisisDa TyracleNoch keine Bewertungen

- AlgorithmDokument44 SeitenAlgorithmAhmed Samad100% (1)

- Case 37 Baker Adhesives SolutionDokument22 SeitenCase 37 Baker Adhesives SolutionLeopold StaffNoch keine Bewertungen

- Problem 1.9 Americo's Earnings and The Fall of The Dollar: Appreciation CaseDokument4 SeitenProblem 1.9 Americo's Earnings and The Fall of The Dollar: Appreciation CaseSamerNoch keine Bewertungen

- Theme Parks in BrazilDokument5 SeitenTheme Parks in BrazilskaldNoch keine Bewertungen

- Math Unit Pricing and Currency Exchange LessonDokument23 SeitenMath Unit Pricing and Currency Exchange LessonKarol KamienieckiNoch keine Bewertungen

- Unilever Case Study Brazil Ariel SolvedDokument10 SeitenUnilever Case Study Brazil Ariel SolvedMuhammad FahamNoch keine Bewertungen

- MBF13eChap10Pbms Final GEDokument17 SeitenMBF13eChap10Pbms Final GEFelix MorelNoch keine Bewertungen

- Baker Adhesives Foreign Exch PDFDokument6 SeitenBaker Adhesives Foreign Exch PDFEmmelinaErnestineNoch keine Bewertungen

- NNPC Aptitude Test Past Questions and Answers PDFDokument105 SeitenNNPC Aptitude Test Past Questions and Answers PDFADEWOLE EMANUELNoch keine Bewertungen

- MBF13e Chap10 Pbms - FinalDokument17 SeitenMBF13e Chap10 Pbms - FinalYee Cheng80% (5)

- 2.2 ProgrammingoDokument38 Seiten2.2 ProgrammingoYenula StephanosNoch keine Bewertungen

- Poder Executivo: Diário Oficial Do Município de Campos Dos GoytacazesDokument4 SeitenPoder Executivo: Diário Oficial Do Município de Campos Dos GoytacazesBACK UP do DIARIO OFICIAL DE CAMPOS DOS GOYTACAZESNoch keine Bewertungen

- 3P Turbo - Cross Border Investment in BrazilDokument10 Seiten3P Turbo - Cross Border Investment in BrazilRahul KashyapNoch keine Bewertungen

- Notice To Shareholders - Payment of DividendsDokument2 SeitenNotice To Shareholders - Payment of DividendsFibriaRINoch keine Bewertungen

- Multinational Business Finance 10th Edition Solution ManualDokument8 SeitenMultinational Business Finance 10th Edition Solution ManualrspkamalgmailcomNoch keine Bewertungen

- Summer 2021 FIN 6055 New Test 2Dokument2 SeitenSummer 2021 FIN 6055 New Test 2Michael Pirone0% (1)

- Ad HocDokument188 SeitenAd HocCarlosEduardoRivasOchoaNoch keine Bewertungen

- Portuguese Lesson Notes PDFDokument116 SeitenPortuguese Lesson Notes PDFSusan Jackman100% (2)

- Call Notice of The Extraordinary General Shareholders 07.02.2015Dokument2 SeitenCall Notice of The Extraordinary General Shareholders 07.02.2015MPXE_RINoch keine Bewertungen

- MILLS ESTRUTURAS APPROVES CAPITAL INCREASEDokument3 SeitenMILLS ESTRUTURAS APPROVES CAPITAL INCREASEMillsRINoch keine Bewertungen

- Problems - Module#1Dokument14 SeitenProblems - Module#1Abdallah ClNoch keine Bewertungen

- Doing Business in Brazil - AUSDokument105 SeitenDoing Business in Brazil - AUSanacatmaguiar4099Noch keine Bewertungen

- Conference Guide - IsieDokument52 SeitenConference Guide - IsiePaulo CesarNoch keine Bewertungen

- MBF12 CH3 Question BankDokument15 SeitenMBF12 CH3 Question BankwertyuoiuNoch keine Bewertungen

- DFP Klabin S A 2016 EM INGLSDokument87 SeitenDFP Klabin S A 2016 EM INGLSKlabin_RINoch keine Bewertungen

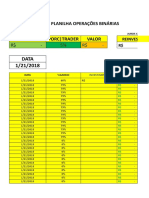

- Binary Options Spreadsheet Tracks Daily ProfitsDokument60 SeitenBinary Options Spreadsheet Tracks Daily ProfitsLeonardo PinheiroNoch keine Bewertungen