Beruflich Dokumente

Kultur Dokumente

Dream's Trade Ideas 07.16.2013

Hochgeladen von

dreamytraderCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Dream's Trade Ideas 07.16.2013

Hochgeladen von

dreamytraderCopyright:

Verfügbare Formate

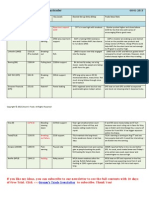

Dreams Trade Ideas by Dreamytrader

Stock Name

last Close Price Status Key Levels Desired Set-up Entry &Stop Trade Ideas Note

07-16-2013

Current Watch-list

S&P500 Index ETF (SPY) $167.52 Attempted rally Near-term resistance $170 SPYs steady and attempted rally Market under pressure ahead of Fed near its $170 mark. First down day Chairman show tomorrow and also $170 level in 8 days. above it. AAPLs mini-rally from $423 working well, as mentioned before. Long-term in Bullish mode. Waiting for new entry if you are in this stock before. UPS found some support near its $85 level zone. I expect more basing at this level. LNKD is facing pressure from $200 mark and retreated a bit. AAPL really need some game-changing plan to boost the stock price. The up-trend is intact for NKE despite recent market chills. Recent price action was not showing much trading interest. UPS had its own price moving catalyst, but not for the upside. Earning warning ahead its planned earning release triggered big sell-off last Friday. LNKD supporters not getting out. A good earning would initialize a new upside move.

Apple(AAPL)

$430.20

Attempted mini rally Try to hold 50D MA

$420ish area nearterm support. $62ish lower support

Nike (NKE)

$62.70

UPS (UPS)

$85.98

Stable

$85ish support zone

LinkedIn (LNKD)

$193.65

Retreating $200ish resistance zone

Boeing (BA)

$104.23

Recovering

$99ish support

BA recovered most of its damage due to new Dreamliner incident. Still Bullish on stock price action.

Boeings Dreamliner came back for bad news and earning is coming. I think this would create another buying opportunity when people cooling down. GPS is expect another quarter of solid earning growth. Good for stock. A bullish stock.

GAP.INC (GPS)

$44.67

stalling

Pulling back

GPS steady rise shown some sign of weakness, normal after a run. It needs a rest. As expected, it is stalling.

Copyright 2013 Dream's Trade. All Rights Reserved

Discover Financial. (DFS)

$49.64

Breaking high failed

In defense mode

DFS is ready to test the high with ranging price action. Entry was $49.50 with volume. Visas price action has been Bullish for a long time, while it is Longterm intact, short swing is normal. TSLA suffered bleeding panic selloff after GS report, profit booking and short-sellers drove price down. AMZN is one of many stocks that stayed strong during the correction and now it is very bullish for many days. NFLX is recovering from its loss since it topped $300 two years ago. Price action suggesting it has ability to move higher from here.

DFS about to post its new earning report and people are expecting a good-looking result.

Visa (V)

$189.38

Retreating

Pulling back from new high

Years of strong earning and growing and not showing sign of slowing down, this is what people look for as a Bull Stock. An investing report from GS, suggesting that TSLA has a target for $84 based on average price three scenarios. AMZN continued to rise amid non-stopping questionable its profitability. But so far, its price is saying people still in favor of its business. NFLX made very successful business change from DVD rental to online streaming provider and also create Netflix only series and are welcomed by many. More subscribers than HBO is a powerful proof that it is smart ass.

Tesla(TSLA)

$109.05

Bleeding Smoked

Turning around

Amazon (AMZN)

$306.87

stalling

Charged rally

Netflix (NFLX)

$260.48

Recovering

Attempted to rally

If you like my ideas, you can subscribe to our newsletter to see the full contents with 10 days of Free Trial. Click >>>Dream's Trade Newsletter to subscribe. Thank You!

Copyright 2013 Dream's Trade. All Rights Reserved

Current Watch-list Featured Chart: N/A Market retreating ahead of Fed Chairman and near $170 mark. TSLA proved that GSs influence and you should always have a stop when you are on the wrong sideand you happened to short TSLA, good for you.

Copyright 2013 Dream's Trade. All Rights Reserved

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Dream's Trade Ideas by Dreamytrader: Stock NameDokument3 SeitenDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Dream's Trade Ideas 07.18.2013Dokument3 SeitenDream's Trade Ideas 07.18.2013dreamytraderNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Dream's Trade Ideas 07.29.2013Dokument3 SeitenDream's Trade Ideas 07.29.2013dreamytraderNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Dream's Trade Ideas 07.25.2013Dokument3 SeitenDream's Trade Ideas 07.25.2013dreamytraderNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Dream's Trade Ideas 07.22.2013Dokument3 SeitenDream's Trade Ideas 07.22.2013dreamytraderNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Dream's Trade Ideas 07.23.2013Dokument3 SeitenDream's Trade Ideas 07.23.2013dreamytraderNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Dream's Trade Ideas 07.24.2013Dokument3 SeitenDream's Trade Ideas 07.24.2013dreamytraderNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Dream's Trade Ideas 07.17.2013Dokument3 SeitenDream's Trade Ideas 07.17.2013dreamytraderNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Dream's Trade Ideas by Dreamytrader: Stock NameDokument3 SeitenDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Dream's Trade Ideas 07.22.2013Dokument3 SeitenDream's Trade Ideas 07.22.2013dreamytraderNoch keine Bewertungen

- Dream's Trade Ideas 07.15.2013Dokument3 SeitenDream's Trade Ideas 07.15.2013dreamytraderNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Dream's Trade Ideas 07.15.2013Dokument3 SeitenDream's Trade Ideas 07.15.2013dreamytraderNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Dream's Trade Ideas 07.07.2013Dokument3 SeitenDream's Trade Ideas 07.07.2013dreamytraderNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Dream's Trade Ideas 07.08.2013Dokument3 SeitenDream's Trade Ideas 07.08.2013dreamytraderNoch keine Bewertungen

- Dream's Trade Ideas by Dreamytrader: Stock NameDokument3 SeitenDream's Trade Ideas by Dreamytrader: Stock Namedreamytrader100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Dream's Trade Ideas 05.19.2013Dokument3 SeitenDream's Trade Ideas 05.19.2013dreamytraderNoch keine Bewertungen

- Dream's Trade Ideas by Dreamytrader: Stock NameDokument3 SeitenDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNoch keine Bewertungen

- Dream's Trade Ideas by Dreamytrader: Stock NameDokument3 SeitenDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Dream's Trade Ideas by Dreamytrader: Stock NameDokument3 SeitenDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Dream's Trade Ideas 05.28.2013Dokument3 SeitenDream's Trade Ideas 05.28.2013dreamytraderNoch keine Bewertungen

- Dream's Trade Ideas by Dreamytrader: Stock NameDokument3 SeitenDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Dream's Trade Ideas by Dreamytrader: Stock NameDokument3 SeitenDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNoch keine Bewertungen

- Dream's Trade Ideas 05.14.2013Dokument3 SeitenDream's Trade Ideas 05.14.2013dreamytraderNoch keine Bewertungen

- Dream's Trade Ideas 04.30.2013Dokument9 SeitenDream's Trade Ideas 04.30.2013dreamytraderNoch keine Bewertungen

- Dream's Trade Ideas 05.06.2013Dokument4 SeitenDream's Trade Ideas 05.06.2013dreamytraderNoch keine Bewertungen

- Dream's Trade Ideas 04.30.2013Dokument9 SeitenDream's Trade Ideas 04.30.2013dreamytraderNoch keine Bewertungen

- Dream's Trade Ideas by Dreamytrader: Stock NameDokument3 SeitenDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNoch keine Bewertungen

- Dream's Trade Ideas by Dreamytrader: Stock NameDokument3 SeitenDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Dream's Trade Ideas by Dreamytrader: Stock NameDokument3 SeitenDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderNoch keine Bewertungen

- Amor Vs FlorentinoDokument17 SeitenAmor Vs FlorentinoJessica BernardoNoch keine Bewertungen

- Moon and SaturnDokument4 SeitenMoon and SaturnRamanasarmaNoch keine Bewertungen

- Amtek Auto Analysis AnuragDokument4 SeitenAmtek Auto Analysis AnuraganuragNoch keine Bewertungen

- A Tool For The Assessment of Project Com PDFDokument9 SeitenA Tool For The Assessment of Project Com PDFgskodikara2000Noch keine Bewertungen

- Villegas vs. Subido - Case DigestDokument5 SeitenVillegas vs. Subido - Case DigestLouvanne Jessa Orzales BesingaNoch keine Bewertungen

- SAP CRM Tax ConfigurationDokument18 SeitenSAP CRM Tax Configurationtushar_kansaraNoch keine Bewertungen

- Man Is Made by His BeliefDokument2 SeitenMan Is Made by His BeliefLisa KireechevaNoch keine Bewertungen

- Brain and LanguageDokument3 SeitenBrain and LanguageJasper AngelesNoch keine Bewertungen

- Defending A Dogma: Between Grice, Strawson and Quine: Elvis ImafidonDokument10 SeitenDefending A Dogma: Between Grice, Strawson and Quine: Elvis ImafidonYang Wen-LiNoch keine Bewertungen

- Internship Report On Effects of Promotion System On Employee Job Satisfaction of Janata Bank Ltd.Dokument57 SeitenInternship Report On Effects of Promotion System On Employee Job Satisfaction of Janata Bank Ltd.Tareq Alam100% (1)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hard Soft Acid Base TheoryDokument41 SeitenHard Soft Acid Base TheorythinhbuNoch keine Bewertungen

- COMM 103 Floyd Chapters Study GuideDokument4 SeitenCOMM 103 Floyd Chapters Study GuideMad BasblaNoch keine Bewertungen

- Afia Rasheed Khan V. Mazharuddin Ali KhanDokument6 SeitenAfia Rasheed Khan V. Mazharuddin Ali KhanAbhay GuptaNoch keine Bewertungen

- PlayDokument121 SeitenPlayellennelleNoch keine Bewertungen

- Improving Self-Esteem - 08 - Developing Balanced Core BeliefsDokument12 SeitenImproving Self-Esteem - 08 - Developing Balanced Core BeliefsJag KaleyNoch keine Bewertungen

- Articles 62 & 63: Presented By: Muhammad Saad Umar FROM: BS (ACF) - B 2K20Dokument10 SeitenArticles 62 & 63: Presented By: Muhammad Saad Umar FROM: BS (ACF) - B 2K20Muhammad Saad UmarNoch keine Bewertungen

- Arsu and AzizoDokument123 SeitenArsu and AzizoZebu BlackNoch keine Bewertungen

- REVISION For END COURSE TEST - Criticial ThinkingDokument14 SeitenREVISION For END COURSE TEST - Criticial Thinkingmai đặngNoch keine Bewertungen

- JURDING (Corticosteroids Therapy in Combination With Antibiotics For Erysipelas)Dokument21 SeitenJURDING (Corticosteroids Therapy in Combination With Antibiotics For Erysipelas)Alif Putri YustikaNoch keine Bewertungen

- Linking and Relocation - Stacks - Procedures - MacrosDokument11 SeitenLinking and Relocation - Stacks - Procedures - MacrosJeevanantham GovindarajNoch keine Bewertungen

- Answers To Case Studies 1a - 2dDokument9 SeitenAnswers To Case Studies 1a - 2dOgnen GaleskiNoch keine Bewertungen

- Class NotesDokument16 SeitenClass NotesAdam AnwarNoch keine Bewertungen

- Organigation DeveDokument3 SeitenOrganigation Devemerin sunilNoch keine Bewertungen

- Summarized ACLS ScriptDokument7 SeitenSummarized ACLS Scriptnc.angel.niceNoch keine Bewertungen

- Case Digest GR No 90501 NetDokument4 SeitenCase Digest GR No 90501 Netlawnotesnijan100% (1)

- A Scenario of Cross-Cultural CommunicationDokument6 SeitenA Scenario of Cross-Cultural CommunicationN Karina HakmanNoch keine Bewertungen

- Bug Tracking System AbstractDokument3 SeitenBug Tracking System AbstractTelika Ramu86% (7)

- Tugas, MO - REVIEW JURNAL JIT - Ikomang Aditya Prawira Nugraha (1902612010304)Dokument12 SeitenTugas, MO - REVIEW JURNAL JIT - Ikomang Aditya Prawira Nugraha (1902612010304)MamanxNoch keine Bewertungen

- FreeMarkets: Procurement & Outsourcing StrategiesDokument44 SeitenFreeMarkets: Procurement & Outsourcing StrategiesFarhaad MohsinNoch keine Bewertungen

- ACT December 2018 Form B05 PDFDokument54 SeitenACT December 2018 Form B05 PDFPranav ChatiNoch keine Bewertungen