Beruflich Dokumente

Kultur Dokumente

Three Basic Candlestick Formations To Improve Your Timing

Hochgeladen von

Deepti SanaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Three Basic Candlestick Formations To Improve Your Timing

Hochgeladen von

Deepti SanaCopyright:

Verfügbare Formate

Trading Strategies

Three Basic Candlestick Formations to Improve Your Timing

By Michael C. Thomsett

Article Highlights You may be able to improve your timing by focusing only on a short list of reversal candlesticks. Three of the strongest reversal candlestick patterns are the abandoned baby, white soldiers and black crows, and the engulng pattern. The smart use of candlesticks includes picking high-quality companies and making sure there is a trend.

This article demonstrates and explains three of the strongest candlestick reversal patterns. These are the bullish or bearish abandoned baby, the bullish white soldiers and the bearish black crows, and the bullish and bearish engulng pattern. These simple but powerful indicators are formed as chart patterns, giving you a lot of information just with a glance. The more time you spend studying candlestick patterns, the more comfortable you are going to be. The origin of candlesticks traces back several hundred years. Candlesticks originally were developed in Japan to track rice futures. Many of the early candlestick experts were able to demonstrate an ability to anticipate market trends and reversals. In the U.S. candlesticks were rst introduced by Steve Nison, who has written several books on the topic. However, the candlestick has become popular only after the Internet made charting fast and easy. Before they were available on the Internet, charting services had to be purchased, often consisting of open/high/low/close charts (those vertical sticks for the trading range with smaller horizontal limbs for opening and closing prices). These services could be quite expensive, especially if you also paid for advice and interpretation.

stick charts is mysterious to many. You might recognize the basic signicance of the chart patterns, but not know how to spot strong and reliable reversal signals.

The study of candle-

With automated and free online charting services (such as StockCharts.com), you can now get candlestick charts instantly by just punching in a trading symbol. Some sites also allow you to tailor your charts by choosing the date range and adding the volume; many offer technical indicators and volume or momentum indicators as well. So no matter how much information you want to use to time entry or exit, todays candlestick chart is accessible and easy to use. Four Steps to Using Candlesticks Among the dozens of candlestick indicators consisting of a single session or multiple sessions, you can rely on a few very strong ones. A study of hundreds of charts by Thomas Bulkowski (Encyclopedia of Candlestick Charts, John Wiley & Sons, 2008) has concluded that some candlestick patterns lead to reversal more often than not. If you focus only on a short list of highly reliable reversal candlesticks, you may be able to improve the timing of your buys and sells. The smart use of candlestick indicators requires four steps: 1. Pick high-quality companies. Identify companies whose fundamentals justify investment, and then track them regularly through chart analysis. The use of fundamentals to narrow down your search is a method for limiting your risk to the highest-quality companies. Among the best fundamentals are revenue and earnings (why invest in a company with

April 2012

29

Figure 1. Candlestick Attributes

close high open

upper shadow

real body

lower shadow

open low close

Because no signal is reliable all by itself all of the time, nding conrmation in one form or another just makes sense. And many are surprised to discover that conrmation among the components of trends (price, volume, and momentum) is going to occur most of the time. In addition to conrming reversal, some conrming indicators contradict what the candlestick foreshadows. In this case, dont act until you get additional conrmation or contradiction, or pick the indicator you believe to be the most reliable. Following these four basic rules vastly improves your timing and adds to overall prots. Many of the candlestick formations that appear frequently were described as being highly reliable in the Bulkowski study. These are among the indicators worth adding to your charting strategy. Candlestick Indicators to Watch

falling revenues or net losses?); dividend yield (and a record of increasing dividends over many years), moderate price-earnings ratio (meaning between 10 and 25, and tracked as a long-term trend); and nally, the trend of the debt ratio (the portion of total capitalization in debt compared to the overall debt and equity, remembering that a high and growing debt ratio is a danger signal). 2. Look for strong reversal signals. Find exceptionally strong reversal signals at the top of an uptrend and time your exit, or at the bottom of a downtrend and time your entry. Reversal signals come in many shapes and sizes, in candlesticks as well as other forms. To give you an idea of the range of reversals, there are approximately 100 different candlestick indicators. You cannot possibly expect to look for all of these, and some are more easily spotted than others. For this reason, it makes sense to identify the more reliable reversal signals and focus on looking for those. Some indicators work as price reversal signals about half the time and as price continuation signals the other half of the time. Given this fact, they are not very useful for timing buys and

sells. You can do as well by guessing, and you might be right half the time. 3. Make sure there is a trend to reverse. Remember, reversal only works if there is a trend to reverse. You cannot expect to nd a bullish reversal unless a downtrend is in effect, and you cannot nd a bearish reversal unless the current trend is moving upward. When you nd those signals in the wrong places, they usually are continuation patternsa sign that the price trend will continue in its current direction. The fact that the same indicator can be either a reversal or a continuation signal should not be confusing. It is just a matter of where it appears within the existing trend. But what if the price is moving sideways and no clear trend has been set? In this case, the prudent course is to wait patiently for some kind of movement to appear. If you act too quickly, you will be right half the time and wrong the other half. 4. Always look for conrmation before you act. Before acting, nd independent conrmation of the predicted reversal. Only when you have conrmation should you take action. Conrmation is one of the basic techniques used by technicians to time entry and exit.

A candlestick formation reveals a great amount of information in a mere glance: the range between open and close, the extension of trading range, and the direction of movement. Many additional signals have meaning, such as unusually long or short trading ranges, and extended moves above or below the open/close range. All of this shows up in the basic candlestick, as Figure 1 shows. The white candlestick is found when prices move up during the session, and the black candlestick represents a downward-moving session. The real body denes the distance between opening and closing price, and the upper and lower shadows (the thin lines at the top and bottom of a candlestick) represent the complete trading range. When you see a very long upper or lower shadow, it reveals lost momentum among buyers (upper) or sellers (lower). This loss of momentum is one of the most important aspects of trends and how they exhaust and then reverse.

The Abandoned Baby

Candlesticks often have imaginative names. The abandoned baby is one of these, and it can be either bullish or

30

AAII Journal

Trading Strategies

bearish. The bullish version (shown on the left in Figure 2) signals the end of a downtrend. The key here is in the gaps and the doji session (the abandoned segment with little or no distance between opening and closing. In this three-session indicator, note the gaps between sessions 12 and 23. The middle session is the doji, and this signals a likely end of the downtrend and the start of a new uptrend. According to Bulkowskis research, the bullish abandoned baby often leads to a reversal. The bearish variety has the same formation, but with the gaps moving in the opposite directions. This is shown on the right in Figure 2. The pattern is a strong forecast of the end to the current uptrend and signals a bearish reversal.

White Soldiers and Black Crows

Figure 2. Abandoned Baby

The white soldiers and black crows are three-session indicators that appear quite often. The white soldiers pattern is bullish and consists of three upwardmoving sessions. Each session opens within the real body of the previous session and then closes higher, as shown in Figure 3. Also referred to as three white soldiers, this pattern can actually continue beyond the three sessions. The consecutive higher lows and higher highs is a very strong reversal signal as long as it shows up after a period of downtrend movement. This signal can be a reliable reversal sign. The opposite of white soldiers is the black crows pattern. It is a strong bearish reversal when it is found at the top of an uptrend. Each session opens within the real body range of the previous one and then moves lower. Lower highs and lower lows characterize this pattern, as shown in Figure 4. This is another exceptionally strong reversal signal.

Engulng Pattern

Bull

Figure 3. White Soldiers

Bear

Figure 4. Black Crows

The engulng pattern is so named because the rst session is engulfed by the second. In other words, the real body extends higher and lower. This is always a two-session development and appears frequently. When conrmed,

it is one of the most reliable of the candlestick reversal signals. In the bullish version of the engulfing pattern, a black session is followed by the engulng white session. There is a price gap between the rst sessions close and the lower opening of the

second session. This is shown on the left in Figure 5. The bullish engulng pattern is easy to spot, and it will mark the end of the downtrend and the start of a

April 2012

31

Figure 5. Engulng Pattern

Bull

new uptrend. The bearish engulng pattern is the opposite of the bullish one, as shown on the right in Figure 5. This pattern is even more reliable as a reversal than the bullish one. The bearish engulng pattern can lead to a reversal in which a price decline occurs. The Basic Rules When you nd often-appearing candlestick indicators with high reliability, you can proceed with condence, assuming that you also seek and nd conrmation. This is an essential part of the process for improving entry and

Bear

exit. Candlesticks can serve as the rst signals to be conrmed by another; they can also serve as conrmation for another signal. Nothing works 100% of the time, of course, but even conservative and fundamental investors can vastly improve the timing of entry and exit in long stock positions by studying and confirming candlesticks. Forms of conrmation include: Doji sessions, also called narrowrange days (NRDs), often signal the end of the current trend. Volume spikes, a signal of possible exhaustion after a trend, often appear on the same session as other

reversal signs. Unusually long shadows, those sticks above and below the real body. A big upper shadow is a sign of lost momentum among buyers, meaning sellers will probably take the lead next; a long lower shadow means the same thing among sellers. Traditional western indicators, such as gapping price action, head and shoulders, double tops or bottoms, and other well-known signals based on price patterns. Volume indicators, such as onbalance volume (OBV), track dominance among buyers or sellers and, as this shifts, indicate a change in price direction. Momentum oscillators are among the most valuable conrming signs. The strongest of these include the moving average convergencedivergence (MACD), which tracks changes in two moving averages; and the relative strength index (RSI), which measures the strength and direction of price movement. You do not have to know how to calculate these, as many free charting sites allow you to add them to charts. You can learn a lot about candlestick trading by applying what you already know and then expanding your knowledge base through reading books and going online to various websites, where you can nd free and fast learning tools for candlesticks and methods for improving your basic skills. Analysis of charting of all types is improved with practice, whether you are a very conservative value investor or a speculative trader.

Michael C. Thomsett (www.MichaelThomsett.com) wrote the recently released Bloomberg Visual Guide to Candlestick Charting (John Wiley & Sons, 2012) and also authored Trading with Candlesticks (FT Press, 2010). He blogs on several sites and has written over 70 books. Find out more at www.aaii.com/authors/michael-thomsett.

32

AAII Journal

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Aircraftdesigngroup PDFDokument1 SeiteAircraftdesigngroup PDFsugiNoch keine Bewertungen

- A Review Paper On Improvement of Impeller Design A Centrifugal Pump Using FEM and CFDDokument3 SeitenA Review Paper On Improvement of Impeller Design A Centrifugal Pump Using FEM and CFDIJIRSTNoch keine Bewertungen

- Vangood Quotation - Refrigerator Part - 2023.3.2Dokument5 SeitenVangood Quotation - Refrigerator Part - 2023.3.2Enmanuel Jossue Artigas VillaNoch keine Bewertungen

- My CoursesDokument108 SeitenMy Coursesgyaniprasad49Noch keine Bewertungen

- Getting StartedDokument45 SeitenGetting StartedMuhammad Owais Bilal AwanNoch keine Bewertungen

- SCDT0315 PDFDokument80 SeitenSCDT0315 PDFGCMediaNoch keine Bewertungen

- MSDS - Tuff-Krete HD - Part DDokument6 SeitenMSDS - Tuff-Krete HD - Part DAl GuinitaranNoch keine Bewertungen

- 06-Apache SparkDokument75 Seiten06-Apache SparkTarike ZewudeNoch keine Bewertungen

- SILABO 29-MT247-Sensors-and-Signal-ConditioningDokument2 SeitenSILABO 29-MT247-Sensors-and-Signal-ConditioningDiego CastilloNoch keine Bewertungen

- WEEK6 BAU COOP DM NextGen CRMDokument29 SeitenWEEK6 BAU COOP DM NextGen CRMOnur MutluayNoch keine Bewertungen

- Production - The Heart of Organization - TBDDokument14 SeitenProduction - The Heart of Organization - TBDSakshi G AwasthiNoch keine Bewertungen

- Strobostomp HD™ Owner'S Instruction Manual V1.1 En: 9V DC Regulated 85maDokument2 SeitenStrobostomp HD™ Owner'S Instruction Manual V1.1 En: 9V DC Regulated 85maShane FairchildNoch keine Bewertungen

- 4th Sem Electrical AliiedDokument1 Seite4th Sem Electrical AliiedSam ChavanNoch keine Bewertungen

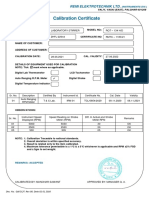

- Calibration CertificateDokument1 SeiteCalibration CertificateSales GoldClassNoch keine Bewertungen

- Escario Vs NLRCDokument10 SeitenEscario Vs NLRCnat_wmsu2010Noch keine Bewertungen

- Expectation Vs Reality: Job Order and Contract of ServiceDokument10 SeitenExpectation Vs Reality: Job Order and Contract of ServiceMikee Louise MirasolNoch keine Bewertungen

- Rofi Operation and Maintenance ManualDokument3 SeitenRofi Operation and Maintenance ManualSteve NewmanNoch keine Bewertungen

- Difference Between Mountain Bike and BMXDokument3 SeitenDifference Between Mountain Bike and BMXShakirNoch keine Bewertungen

- Walmart, Amazon, EbayDokument2 SeitenWalmart, Amazon, EbayRELAKU GMAILNoch keine Bewertungen

- Selvan CVDokument4 SeitenSelvan CVsuman_civilNoch keine Bewertungen

- Evaluating Project Scheduling and Due Assignment Procedures An Experimental AnalysisDokument19 SeitenEvaluating Project Scheduling and Due Assignment Procedures An Experimental AnalysisJunior Adan Enriquez CabezudoNoch keine Bewertungen

- RevisionHistory APFIFF33 To V219Dokument12 SeitenRevisionHistory APFIFF33 To V219younesNoch keine Bewertungen

- LOG-2-8-FLEETWAREHOUSE-TEMPLATE-Waybill-Delivery Note-IFRCDokument1 SeiteLOG-2-8-FLEETWAREHOUSE-TEMPLATE-Waybill-Delivery Note-IFRCMNoch keine Bewertungen

- Photon Trading - Market Structure BasicsDokument11 SeitenPhoton Trading - Market Structure Basicstula amar100% (2)

- Electrical ConnectorsDokument5 SeitenElectrical ConnectorsRodrigo SantibañezNoch keine Bewertungen

- Danby Dac5088m User ManualDokument12 SeitenDanby Dac5088m User ManualElla MariaNoch keine Bewertungen

- Online EarningsDokument3 SeitenOnline EarningsafzalalibahttiNoch keine Bewertungen

- Asphalt Plant Technical SpecificationsDokument5 SeitenAsphalt Plant Technical SpecificationsEljoy AgsamosamNoch keine Bewertungen

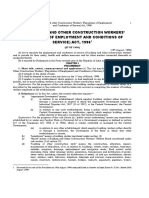

- Building and Other Construction Workers Act 1996Dokument151 SeitenBuilding and Other Construction Workers Act 1996Rajesh KodavatiNoch keine Bewertungen

- CoDokument80 SeitenCogdayanand4uNoch keine Bewertungen