Beruflich Dokumente

Kultur Dokumente

State Bank of India, Sydney Branch: Terms and Conditions

Hochgeladen von

Sujib BarmanOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

State Bank of India, Sydney Branch: Terms and Conditions

Hochgeladen von

Sujib BarmanCopyright:

Verfügbare Formate

STATE BANK OF INDIA, SYDNEY BRANCH

(Incorporated in India with limited liability to our company's members) ARBN 082 610 008 AFSL 238340

Suite 2 & 3, Level 12 234 George Street Sydney, NSW 2000 Tel: 02-9241-5643 Fax: 02-9247-0536

Terms and Conditions

International Money Transfers (IMTs) are electronic payments of cleared funds that are credited directly to a nominated bank account almost anywhere in the world. They are a fast and reliable way of making international payments. We recommend that you read all terms provided in this document relating to IMTs and that you ask us about any issues that concern you.

1. Use of a Correspondent

State Bank of India Sydney (SBIS) may use the services of another bank ('the Correspondent Bank') or agency ('the Correspondent Agency') or another branch of State Bank of India (SBI) to give effect to the instructions of the Applicant. A Correspondent bank or Correspondent Agency or a SBI branch overseas may charge additional fees or charges and either: a. deduct those fees or charges from the funds transferred to the beneficiary by the Applicant, so that the beneficiary may receive less than the amount sent by the Applicant; or b. pay the funds transferred by the Applicant to the beneficiary by debit to SBIS account held at the Correspondent Bank or Correspondent Agency or SBI branch, with those fees and charges. The Applicant must then reimburse SBIS for those fees and charges debited to SBIS account by the Correspondent Bank or Correspondent Agency or SBI branch.

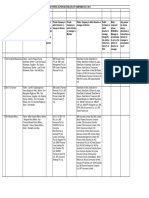

Making amendments to original payment details (in addition to the fee for initially providing the service) Making enquiries regarding a payment to the beneficiary (for example querying the non receipt of funds) Return of the payment by the Correspondent (in addition to the fee for initially providing the service)

$30.00 plus any out of pocket expenses incurred by SBIS

$30.00

$30.00 plus any out of pocket expenses incurred by SBIS

All SBIS fees are denominated in Australian dollars. These fees do not include any fees and charges that a Correspondent Bank, Correspondent Agency or SBI branch may charge.

2. SBIS fees and charges

SBIS fees and charges are as follows:

3. Delayed Payment

The transfer of funds will normally be received within 48 hours by the branch of SBI / Correspondent Banks (The Expected Time). If the branch / Correspondent is not the beneficiary's branch / bank, it may take additional time to on forward funds to the beneficiary's branch / bank. Further delay may occur in cases if the beneficiary's branch / bank is not a branch of SBI. The transfer of funds may be delayed past the Expected Time due to circumstances beyond SBIS' control (which include but are not limited to) cut off times for transmissions imposed by cut off time imposed by the Correspondent Bank, Correspondent Agency or SBI branch; delays or complications in post or

Providing the TT service Cancelling the TT after it has been requested (in addition to the fee for initially providing the service)

$15.00 $30.00 plus any out of pocket expenses incurred by SBIS

Revised 19/04/2007

Page 1 of 6

otherwise; delays, errors or omissions in transit or transmission; acts or omissions of a Correspondent Bank, a Correspondent Agency or SBI branch or any other third party; or delays and complications in overseas banking systems. To the maximum extent permissible by law, SBIS and its employees and agents accept no responsibility and will not be liable for any loss or damage resulting from delays that arise as a result of the circumstances specified above or any act or thing done or omitted to be done by SBIS while acting in good faith on the Applicant's instructions. Where the funds are not available for payment to the beneficiary by the Expected Time, the Applicant may request that SBIS generate, on behalf of the Applicant, an enquiry into the delay ('the Enquiry'). Where the delay is not caused by SBIS, the Applicant will indemnify SBIS for all or any costs or expenses incurred by SBIS as a result of generating, carrying out and completing the Enquiry including, without limitation, legal costs on a solicitor and client basis.

You declare and undertake to SBIS that the payment of monies to the beneficiary in accordance with your instructions by SBIS will not breach any law in Australia or in any other country.

7. Privacy

Collection of your information is essential for us to service both your relationship with us and our business operations. Without your information that we request you to provide to us, we would not be able to provide you with our products and services. We will usually disclose information of the kind that comprises (or will comprise) your information to any of us and to the following types of organisation (including individuals): (a) our agents, contractors and external advisers who we engage to carry out our functions and activities from time to time or who assist us to carry out our functions and activities; your executor, administrator, trustee, guardian or attorney; regulatory bodies, government agencies and law enforcement bodies; and other parties we are authorised or required by law to disclose information to.

4.

Stopping or cancelling a payment

SBIS may not be able to stop or cancel a payment if it has already been processed. SBIS fee for requesting stopping or cancelling of a payment is set out in the table in Section 2 above.

(b) (c) (d)

5.

Fax Instructions

If SBIS determines that it will act on fax messages, an indemnity in the form acceptable to SBIS must be signed by you. In case of instructions received from you through fax, SBIS shall act upon such instructions only after satisfying itself about the genuineness of the same. SBIS reserves the right to seek reconfirmation of such instructions over telex/fax/telephone.

Subject to any restrictions imposed on us by the Privacy Act 1988, you agree and consent to any disclosures by us of your information to an organisation of these types for any of our purposes listed above. Subject to the provisions of the Privacy Act 1988, you may access your information at any time by requesting to do so at SBIS. A reasonable fee may apply for this service. If you are able to establish that your information held by us is not accurate, complete and up to date, we must take reasonable steps to ensure that the information is accurate, complete and up to date. The words "we" and "us" are used in this clause mean State Bank of India and each and every one of its related companies (including subsidiaries), whether acting collectively or alone. The words "your information" used in this clause mean personal information about you

6. Anti Money Laundering

You agree SBIS may delay, block or refuse to make payment if SBIS believes on reasonable grounds that making the payment may breach any law in Australia or any other country, and SBIS will incur no liability to you if it does so. You agree to provide all information to SBIS, which SBIS reasonably requires to comply with any law in Australia or any other country. You agree SBIS may disclose information which you provide to SBIS where required by law in Australia or any other country.

Revised 19/04/2007

Page 2 of 6

that we obtain from you or from any one else, regardless of how or when it comes to us. If you are a company, then: by applying for this service ('the service'), you agree and consent to the matters following. If you supply us with personal information about an individual, you agree to tell that person that: (a) we are holding personal information about that person and he or she can contact us at any of our branches; personal information collected about that person will be used for the primary purpose of assessing your application for the requested service and, if your application is approved, for the initial establishment of the service and then for the subsequent administration and eventual finalisation of your service and that without that personal information, this purpose cannot be fulfilled;

(a) performing our internal administration and operations including accounting, risk management, record-keeping, archiving, systems development and testing, credit scoring and staff training; (b) compliance with legislative and regulatory requirements; and (c) prevention and investigation of crime or fraud to protect your interest and our interest.

8.

Code of Banking Practice

If you are an individual or a small business (as defined in the Code of Banking Practice), the Code of Banking Practice applies to this product.

(b)

9.

Making a Complaint

If SBIS makes a mistake, or SBIS service does not meet your expectations, SBIS wants to know.

Internal Dispute Resolution

For resolution to your complaint: Contact us on 02 9241 5643 or Write to us at Suite 2 & 3, Level 12, 234 George Street Sydney NSW 200 Attention: CEO, State Bank of India Sydney Branch or Email us at ceo@sbisyd.com.au or You can call on us in person, weekdays between 9.00 am to 4.00 pm. In most cases, we will be able to solve your problem on the spot. If we are unable to do so promptly, then we will take responsibility to work with you to resolve the matter within 21 working days. If this is not possible, we will keep you informed of our progress and how long we expect it will take to resolve your complaint.

(c) personal information collected about that person will usually be disclosed to any of us and to the following types of organisations(i) regulatory bodies, government agencies and law enforcement bodies; and (ii) other parties we are authorised or required by law to disclose information to. (d) that person has the right to access and correct personal information we hold about him or her. If you are not a company then: by applying for this service ('the service'), you agree and consent to the matters following. We collect and will collect your information primarily for the purpose of the initial establishment of the service and then for the subsequent administration and eventual finalisation of the service. You agree and consent to us using and disclosing your information for this purpose. You also agree whether you are a company or an individual and consent to us using or disclosing your information for each of the following additional purposes:

External Dispute Resolution

If you are not satisfied with the steps taken by SBI to resolve the complaint, or with the result of our investigation, you may wish to contact an alternative financial services dispute resolution scheme.

Revised 19/04/2007

Page 3 of 6

Banking & Financial Services Ombudsman Ltd G P O Box 3A, Melbourne Vic 3001 Telephone: 1300 780 808 Fax: 03 9613 7345 Internet:http: // www.bfso.org.au

10.

Glossary

In this document, the following words have the following meanings:

You

The person or persons named as Applicant in this document. If details of more than one person are given, then "you" means all of them together and each of them individually.

Correspondent

Another bank or agency chosen by SBIS to convey the funds directly or indirectly to the beneficiary and includes any intermediary correspondent.

Delayed Payment

Occurs when a transfer of funds occurs, for some reasons outside of SBIS' control, more than 48 hours after SBIS has accepted your instructions.

Revised 19/04/2007

Page 4 of 6

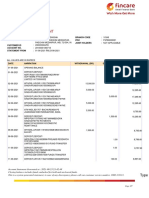

E: remit@sbisyd.com.au

Customer Reference No

Agreement and authorisation: By signing this Application for International Money Transfer, I/we acknowledge and agree that: a. I/we have read and understood the terms and conditions below and agree to be bound by them; b. I/we warrant and confirm that all particulars I/we have provided to SBIS in connection with this Application are true and correct; c. SBIS will not be liable for any costs, losses or damages if a Delayed Payment occurs and SBIS has acted in good faith on my/our instructions. d. I/we agree to indemnify and reimburse SBIS for any costs and expenses incurred by SBIS if I/we make any inquiry at my/our request, or take any other action, in relation to any Delayed Payment including legal costs on a solicitor and client basis. e. IMT will be effected only after the confirmation of credit of cleared funds in SBIS account. f. Unless I/we have disclosed that I am / we are acting in a trustee capacity or on a behalf of another party, I/we warrant that I/we are acting on my/our own behalf in entering into this agreement. * g. I/we agree that cash transactions will be charged of 0.25% by SBIS correspondent Bank and this will be recovered from me/us. h. I/we confirm that I/we have received, read and understood the Standard Terms and Conditions relating to International Money Transfers and agree to be bound by them. i. I/we confirm that the amount to be transmitted is AUD$

.

Date:

Applicant / Sender Signature:

200

Revised 19/04/2007

Page 6 of 6

Das könnte Ihnen auch gefallen

- Credit Guide SummaryDokument5 SeitenCredit Guide SummaryPromila SikkaNoch keine Bewertungen

- BSBDA TNCDokument16 SeitenBSBDA TNCAneesh MathewNoch keine Bewertungen

- Virgin Money Australia Privacy PolicyDokument2 SeitenVirgin Money Australia Privacy PolicyJoby PowersNoch keine Bewertungen

- Terms of Business - Comfort FinanceDokument9 SeitenTerms of Business - Comfort FinanceHimanshu KatariaNoch keine Bewertungen

- Freedom FinanceDokument7 SeitenFreedom FinanceckkNoch keine Bewertungen

- DL Standard Terms of Engagement at 1 Nov 22Dokument6 SeitenDL Standard Terms of Engagement at 1 Nov 22Juliet DewhirstNoch keine Bewertungen

- Notice To Customers/ Guarantors/ Obligors/ Authorised Signatories or Dealers On Privacy StatementDokument6 SeitenNotice To Customers/ Guarantors/ Obligors/ Authorised Signatories or Dealers On Privacy Statementfauziahsamah80Noch keine Bewertungen

- Intermediary Mortgage Application FormDokument2 SeitenIntermediary Mortgage Application Formgenid.ssNoch keine Bewertungen

- Direct Debit Request Service AgreementDokument5 SeitenDirect Debit Request Service AgreementSujib BarmanNoch keine Bewertungen

- Agreement WordDokument2 SeitenAgreement Wordbiswajit mandalNoch keine Bewertungen

- FlagDokument2 SeitenFlagSarah HeadNoch keine Bewertungen

- Service Agreement for Accredited Employer Work VisaDokument15 SeitenService Agreement for Accredited Employer Work VisaJohn Albert BaltazarNoch keine Bewertungen

- Credit Guide and Privacy V8.2Dokument2 SeitenCredit Guide and Privacy V8.2Mark RalphNoch keine Bewertungen

- Simple Bank AgreementDokument30 SeitenSimple Bank AgreementNora RadovanNoch keine Bewertungen

- Business Customer Details AgreementDokument2 SeitenBusiness Customer Details AgreementNurul Effandy Bin MokhtarNoch keine Bewertungen

- Future Immigration Consultants Visa AgreementDokument9 SeitenFuture Immigration Consultants Visa AgreementKazandra Cassidy GarciaNoch keine Bewertungen

- Engagementletter - Business Closure20Dokument4 SeitenEngagementletter - Business Closure20Dv AccountingNoch keine Bewertungen

- My Credit File, My Veda Alert and Veda Credit Report You Are Dealing With VedaDokument4 SeitenMy Credit File, My Veda Alert and Veda Credit Report You Are Dealing With VedaSteven GerrardNoch keine Bewertungen

- Standard Terms of Engagement TemplateDokument2 SeitenStandard Terms of Engagement TemplateTolu RomioNoch keine Bewertungen

- Revolut Sutton Bank TermsDokument17 SeitenRevolut Sutton Bank TermsKevin Parker100% (1)

- EziDebit - DDR Form - CompletePTDokument2 SeitenEziDebit - DDR Form - CompletePTAndrewNeilYoungNoch keine Bewertungen

- (Privacy and CGQ) Brandon Parkes 00274368Dokument10 Seiten(Privacy and CGQ) Brandon Parkes 00274368brandon pNoch keine Bewertungen

- Manage Family Takaful Contributions with Bank Auto DebitDokument3 SeitenManage Family Takaful Contributions with Bank Auto DebitmdrazifrazaliNoch keine Bewertungen

- Engagementletter-SEC REGISTRATION - DVDokument4 SeitenEngagementletter-SEC REGISTRATION - DVDv AccountingNoch keine Bewertungen

- Disaster Business Loan ApplicationDokument4 SeitenDisaster Business Loan ApplicationalexNoch keine Bewertungen

- Bond - Standard Client AgreementDokument4 SeitenBond - Standard Client AgreementEnos PhillipsNoch keine Bewertungen

- Kebenaran Potongan Debit Terus / Auto Sumbangan Takaful KeluargaDokument3 SeitenKebenaran Potongan Debit Terus / Auto Sumbangan Takaful KeluargaHelmi HusniNoch keine Bewertungen

- Terms and Conditions Governing Accounts PDFDokument13 SeitenTerms and Conditions Governing Accounts PDFlontong4925Noch keine Bewertungen

- Cred Account AgreementDokument24 SeitenCred Account AgreementJermaine ReynoldsNoch keine Bewertungen

- Digital Services Agreement: WelcomeDokument28 SeitenDigital Services Agreement: WelcomeMonkees LabsNoch keine Bewertungen

- ENGAGEMENT AND CONSULTANT NDA WITH SSBDokument6 SeitenENGAGEMENT AND CONSULTANT NDA WITH SSBlexsolutionshub2020Noch keine Bewertungen

- Inbound 9221318495160028905Dokument5 SeitenInbound 9221318495160028905surajbhandari722Noch keine Bewertungen

- Terms of Business: MORGAN CHEX - How We Conduct BusinessDokument8 SeitenTerms of Business: MORGAN CHEX - How We Conduct BusinessckkNoch keine Bewertungen

- Mortgages Important Information NW 13Dokument4 SeitenMortgages Important Information NW 13plendina50Noch keine Bewertungen

- PDPA FORM - V.dec2020Dokument6 SeitenPDPA FORM - V.dec2020Kris JNoch keine Bewertungen

- Loan Repayment Demand NoticeDokument2 SeitenLoan Repayment Demand NoticeRakesh dasNoch keine Bewertungen

- Standard Terms and Conditions for Corporate AccountsDokument26 SeitenStandard Terms and Conditions for Corporate AccountsOdang PermanaNoch keine Bewertungen

- Customer Declaration: Each Page To Be Signed by at Least 1 Signatory As Per Mandate / Board ResolutionDokument3 SeitenCustomer Declaration: Each Page To Be Signed by at Least 1 Signatory As Per Mandate / Board ResolutionShanuNoch keine Bewertungen

- Solverise Infotech Management PVT - LTDDokument12 SeitenSolverise Infotech Management PVT - LTDokmoneymatters108Noch keine Bewertungen

- Mobile Deposit TermsDokument6 SeitenMobile Deposit TermsHussein El BeqaiNoch keine Bewertungen

- Province Immigration Canada PR Visa Consulting AgreementDokument17 SeitenProvince Immigration Canada PR Visa Consulting AgreementAmandeepNoch keine Bewertungen

- New Zealand Working Visa-Draft Legal Contract AgreementDokument4 SeitenNew Zealand Working Visa-Draft Legal Contract Agreementabisankar333Noch keine Bewertungen

- ST George LeaseDokument6 SeitenST George LeasejoNoch keine Bewertungen

- Card Terms Conditions MDD Game Dionwired m2023 1 FTDokument11 SeitenCard Terms Conditions MDD Game Dionwired m2023 1 FTRathabeng ModiseNoch keine Bewertungen

- ND THDokument5 SeitenND THjyash8475Noch keine Bewertungen

- Terms and Conditions Eu PhoneDokument14 SeitenTerms and Conditions Eu Phonelittle blingNoch keine Bewertungen

- CTOS FormDokument1 SeiteCTOS FormPaul SamuelNoch keine Bewertungen

- Sms Legalnotice 6093535-27788993Dokument2 SeitenSms Legalnotice 6093535-27788993Prince AbhiNoch keine Bewertungen

- ND THDokument5 SeitenND THjyash8475Noch keine Bewertungen

- Online Account Opening Terms and ConditionsDokument3 SeitenOnline Account Opening Terms and ConditionsMaRkZzz081Noch keine Bewertungen

- Welcome Letter 131706428Dokument3 SeitenWelcome Letter 131706428rupesh.gunjan90823Noch keine Bewertungen

- HSBC - Personal Banking Agreement en PDFDokument52 SeitenHSBC - Personal Banking Agreement en PDFRuslan ParisNoch keine Bewertungen

- ANZ Bank New Zealand International Payment Terms and ConditionsDokument4 SeitenANZ Bank New Zealand International Payment Terms and Conditionstwo4sevsNoch keine Bewertungen

- Fair Practice Code SeilDokument11 SeitenFair Practice Code SeilSiddharth KumarNoch keine Bewertungen

- Unclaimed Money - Step by Step Guide how you claim your moneyVon EverandUnclaimed Money - Step by Step Guide how you claim your moneyNoch keine Bewertungen

- Welcome Letter 193521762Dokument3 SeitenWelcome Letter 193521762Deeptej Singh MatharuNoch keine Bewertungen

- PL App Form TCDokument2 SeitenPL App Form TCrevathirajakrishnanNoch keine Bewertungen

- TermsDokument19 SeitenTermshussain korirNoch keine Bewertungen

- Account Upgrade FormDokument3 SeitenAccount Upgrade FormDesmond Prince OmorogiuwaNoch keine Bewertungen

- Dozer Hrs Calc: How to Estimate Time for Earthmoving ProjectDokument2 SeitenDozer Hrs Calc: How to Estimate Time for Earthmoving ProjectSujib BarmanNoch keine Bewertungen

- Sheet 1Dokument12 SeitenSheet 1Sujib BarmanNoch keine Bewertungen

- Sheet 1Dokument12 SeitenSheet 1Sujib BarmanNoch keine Bewertungen

- Women and Man Are Commonly Seen As Having Different Strengths and WeaknessesDokument82 SeitenWomen and Man Are Commonly Seen As Having Different Strengths and WeaknessesSujib Barman100% (1)

- Plague Words or Phrases-IELTSDokument2 SeitenPlague Words or Phrases-IELTSSujib BarmanNoch keine Bewertungen

- Vedic maths shortcuts for multiplication, division, and finding reciprocalsDokument4 SeitenVedic maths shortcuts for multiplication, division, and finding reciprocalsSujib BarmanNoch keine Bewertungen

- Sujib Weekly ScheduleDokument3 SeitenSujib Weekly ScheduleSujib BarmanNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Sujib Weekly ScheduleDokument3 SeitenSujib Weekly ScheduleSujib BarmanNoch keine Bewertungen

- MBA (IB) 2010-13 For Working Executives: WWW - Iift.eduDokument1 SeiteMBA (IB) 2010-13 For Working Executives: WWW - Iift.eduSujib BarmanNoch keine Bewertungen

- Math ReferenceDokument24 SeitenMath ReferenceSujib BarmanNoch keine Bewertungen

- Godrej To Acquire Megasari of IndonesiaDokument1 SeiteGodrej To Acquire Megasari of IndonesiaSujib BarmanNoch keine Bewertungen

- How To Solve A Rubik's Cube, For Lazy PeopleDokument9 SeitenHow To Solve A Rubik's Cube, For Lazy PeopleMichiel van der Blonk100% (129)

- Lever ProblemsDokument7 SeitenLever ProblemsSujib Barman67% (3)

- Algebraic RepresentationDokument5 SeitenAlgebraic RepresentationSujib Barman100% (1)

- Circles: AOB Arc ABDokument10 SeitenCircles: AOB Arc ABSujib BarmanNoch keine Bewertungen

- Indian Institute of Foreign Trade: Mba (International Business) : Part-TimeDokument4 SeitenIndian Institute of Foreign Trade: Mba (International Business) : Part-TimeSujib BarmanNoch keine Bewertungen

- How To Solve A Rubik's Cube, For Lazy PeopleDokument9 SeitenHow To Solve A Rubik's Cube, For Lazy PeopleMichiel van der Blonk100% (129)

- 33 - Sbi Mock Test PaperDokument1 Seite33 - Sbi Mock Test PaperSujib BarmanNoch keine Bewertungen

- Exercise Ur BrainDokument4 SeitenExercise Ur BrainSujib BarmanNoch keine Bewertungen

- Algebraic RepresentationDokument5 SeitenAlgebraic RepresentationSujib Barman100% (1)

- Math ReferenceDokument24 SeitenMath ReferenceSujib BarmanNoch keine Bewertungen

- Lever ProblemsDokument7 SeitenLever ProblemsSujib Barman67% (3)

- Math Cheat SheetDokument33 SeitenMath Cheat SheetSanjeevG100% (6)

- Circles: AOB Arc ABDokument10 SeitenCircles: AOB Arc ABSujib BarmanNoch keine Bewertungen

- Beauty of MathsDokument3 SeitenBeauty of MathsAshley PhilanderNoch keine Bewertungen

- Vedic maths shortcuts for multiplication, division, and finding reciprocalsDokument4 SeitenVedic maths shortcuts for multiplication, division, and finding reciprocalsSujib BarmanNoch keine Bewertungen

- 33 - Sbi Mock Test PaperDokument1 Seite33 - Sbi Mock Test PaperSujib BarmanNoch keine Bewertungen

- 01.02.2012 - NR - Clariant Mining Solutions To Exhibit at Explosives and Mining Industry ConferencesDokument2 Seiten01.02.2012 - NR - Clariant Mining Solutions To Exhibit at Explosives and Mining Industry ConferencesSujib BarmanNoch keine Bewertungen

- Essential Business Environment DocumentsDokument25 SeitenEssential Business Environment DocumentsSujib BarmanNoch keine Bewertungen

- RELATED PARTIES AS PER SECTION 2(76) OF COMPANIES ACT, 2013Dokument5 SeitenRELATED PARTIES AS PER SECTION 2(76) OF COMPANIES ACT, 2013createriNoch keine Bewertungen

- AsssDokument100 SeitenAsss9415697349Noch keine Bewertungen

- Govt mulls unified packaged insurance for farmersDokument8 SeitenGovt mulls unified packaged insurance for farmersAjinkya NakhaleNoch keine Bewertungen

- Project Reort New ShubhamDokument92 SeitenProject Reort New ShubhamDinesh ChahalNoch keine Bewertungen

- Credit Appraisal Methods in State Bank of India (Sbi) : Project Report ONDokument61 SeitenCredit Appraisal Methods in State Bank of India (Sbi) : Project Report ONKajal MathurNoch keine Bewertungen

- Sbi General InsuranceDokument2 SeitenSbi General Insurancegimigek401Noch keine Bewertungen

- Banking Structure in India: A Project OnDokument22 SeitenBanking Structure in India: A Project OnnehaNoch keine Bewertungen

- Revitalizing State Bank of IndiaDokument11 SeitenRevitalizing State Bank of IndiaPratyush BaruaNoch keine Bewertungen

- Account Statement From 6 Apr 2023 To 22 Jun 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument11 SeitenAccount Statement From 6 Apr 2023 To 22 Jun 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceNishant Sagar DewanganNoch keine Bewertungen

- Loans - 38614136897 - 01 04 2020 - 31 03 2022Dokument3 SeitenLoans - 38614136897 - 01 04 2020 - 31 03 2022gopal cNoch keine Bewertungen

- General Awareness Basic Banking & Financial Issues (PDF) StarkDokument108 SeitenGeneral Awareness Basic Banking & Financial Issues (PDF) StarkRaghav Rao100% (1)

- Service Portfolio Analysis of Banking Sector: A Comparative StudyDokument9 SeitenService Portfolio Analysis of Banking Sector: A Comparative StudySonal ChandraNoch keine Bewertungen

- Mergers Acquisitions and DivestituresDokument58 SeitenMergers Acquisitions and DivestituresAditya SinghNoch keine Bewertungen

- Finance Project AnjaliDokument37 SeitenFinance Project AnjaliRushikesh MaidNoch keine Bewertungen

- SBI circular on payment of undistributed portion of salary revision cost to employees as special balancing allowanceDokument14 SeitenSBI circular on payment of undistributed portion of salary revision cost to employees as special balancing allowancevinbrkrishnaNoch keine Bewertungen

- Central Bank of India Recruitment 2009 Probationary Officer Agriculture Finance Officer Law OfficerDokument4 SeitenCentral Bank of India Recruitment 2009 Probationary Officer Agriculture Finance Officer Law Officerprasathkrp100% (3)

- Letter To Bank On ESOP or ESPPDokument5 SeitenLetter To Bank On ESOP or ESPPAnonymous 3pTM9WCY100% (2)

- Banks and Franchise: By-Janhavi PancholiDokument10 SeitenBanks and Franchise: By-Janhavi PancholiJNoch keine Bewertungen

- Employment Advertisement No. 02/2012: The Maharashtra State Electricity Transmission Co. LTD.Dokument10 SeitenEmployment Advertisement No. 02/2012: The Maharashtra State Electricity Transmission Co. LTD.Sumit PatilNoch keine Bewertungen

- Final ReportDokument56 SeitenFinal ReportsushantaNoch keine Bewertungen

- Sbi Sme Results 2017Dokument1 SeiteSbi Sme Results 2017KshitijaNoch keine Bewertungen

- Green Banking Initiatives by Indian BanksDokument16 SeitenGreen Banking Initiatives by Indian BanksVisalakshy K mNoch keine Bewertungen

- State Bank of IndiaDokument25 SeitenState Bank of IndiabsragaNoch keine Bewertungen

- Credit Recovery ManagementDokument75 SeitenCredit Recovery ManagementSudeep Chinnabathini75% (4)

- Canara - Epassbook - 2023-08-07 21:13:55.177708Dokument13 SeitenCanara - Epassbook - 2023-08-07 21:13:55.177708muhammedashfin0Noch keine Bewertungen

- TransactionsDokument7 SeitenTransactionsBHARAT TECHNoch keine Bewertungen

- Sbi Banlce SheetDokument1 SeiteSbi Banlce SheetANIKET VISHWANATH KURANENoch keine Bewertungen

- Applied Principles and Concepts Sources of Primary and Secondary DataDokument10 SeitenApplied Principles and Concepts Sources of Primary and Secondary DataHimanshu KashyapNoch keine Bewertungen

- State Bank of IndiaDokument14 SeitenState Bank of IndiaMahadevan KrishnamurthyNoch keine Bewertungen

- Tally - Erp 9 Complete CourseDokument12 SeitenTally - Erp 9 Complete CourseMeghaNoch keine Bewertungen