Beruflich Dokumente

Kultur Dokumente

SBI Loan Schemes

Hochgeladen von

Jitendra BagalCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SBI Loan Schemes

Hochgeladen von

Jitendra BagalCopyright:

Verfügbare Formate

1.

AGRICULTURAL GOLD LOANS Purpose Bank extends hassle free finance to farmers / agriculturists against Gold Ornaments / gold wares to increase their liquidity to meet crop production expenses, Investment expenses related to agriculture and / or allied agricultural activities. Eligibility Any person engaged in agriculture or allied activities as well as persons engaged in activities permitted to be classified under agriculture. Quantum of Loan Upto 70% of the value of the ornaments .Value will be as advised by the bank to the branches periodically. Security Pledge of gold ornaments. How do you repay Credit / Overdraft: Like KCC, it is a running account for a period of 3 years. Demand Loan / Term Loan :The repayment period of the loan should be fixed so as to coincide with the harvesting and marketing season / generation of income from the activity, allowing 2 to 3 months time after harvesting to market the produce and realize the proceeds. However, the total period will not generally exceed one year from the disbursement of the loan in the case of short-term loan / production credit and 36 months in other cases. How to apply for this loan Contact your nearest Branch engaged in Agricultural advance.

2. KISAN CREDIT CARD (KCC)

Purpose: To provide timely and adequate credit to farmers to meet their production credit needs (cultivation expenses) besides meeting contingency expenses, and expenses related to ancillary activities through simplified procedure facilitating availment of the loans as and when needed. Who are eligible for the loan? Owner cultivators, tenant cultivators and Share croppers. Agricultural borrowers having good track record for the last 2 years (i.e., Maintaining standard loan accounts). Creditworthy new borrowers can also be financed. Loan amount Loan amount is based on operational land holding ,cropping pattern and ancillary and contingency needs of the farmer for the full year 100% of the cultivation cost available as loan uptoRs 50000/ and 85 % of the cost as loan above Rs 50000/. Expenses to meet important ancillary activities to production can also be financed in addition to the above The total limit is inclusive of 20% of production credit, which includes crop production expenses and working capital for allied agricultural activity, as contingency credit /consumption loan. Disbursement of the Loan As per the cultivation requirements of the crop, the loan will be disbursed in cash . Security Loan amount uptoRs 50000/ Hypothecation of Crops. (1) Hypothecation of crops. (2) Mortgage of land or third party guarantee * (1) Hypothecation of crops (2) Mortgage of lands

Above Rs 50000/ uptoRs 100000

Above Rs 100000/

*For loans uptoRs 1 lac to farmers having legal ownership of agricultural lands with good rack record for last 2 years, no collateral is required How do you repay It is a revolving cash credit limit with any number of withdrawals and repayments and Limit is valid for 3 years.

How to apply for the loan You may contact our nearest braches engaged in agricultural advance or even talk to the marketing officers visiting village.

3. PRODUCE MARKETING LOAN

Purpose: To help farmers avoid distress sale of their produce To enable prompt repayment of crop loan dues and provide liquidity to farmers to meet contingency needs. To offer the facility of loan against the stocks stored in farm houses, in addition to loan against warehouse receipts. Who are eligible for the loan?

1. All non-defaulter borrowers of our branches, who can store the produce either in their own farm/premises itself or in a Warehouse / cold storage. Crop loan borrowers of other Banks and also Non-Borrower Farmers, who 2. store their produce/ stocks in a Warehouse / cold storage.

Loan amount 60 to 80% of value of produce depending upon the place of storage subject to a maximum of Rs.10 lacs. Documents you need to produce Stock statement for valuation and evidence of stocks at your residence/ godown Warehouse receipt, duly endorsed , if stocked at warehouse. SECURITY : Loan sanctioned against goods stored in Farmers godown: Primary : Hypothecation of stocks. Collateral : Mortgage / Charge over Land or Third Party guarantee for loans above Rs. 50,000/-. 2. Loans sanctioned against Warehouse Receipts (WHR) : Primary : Pledge of stocks. Collateral : No collateral is required for loans upto the maximum permitted limit of Rs.10 lakhs under the scheme. DISBURSEMENT: After liquidating the crop loan ,surplus will be disbursed in cash. How to repay? Loan has to be repaid within a maximum period of 12 months depending upon the crop. How to apply for this loan Contact your Branch Manager/Field staff.

1.

4.KISAN GOLD CARD SCHEME (KGC)

KGC is a general-purpose loan meant for meeting credit needs of farmers for productive and consumption purposes. Consumption loans to meet domestic expenses like Childrens education, marriage, medical expenses etc will be included to the extent of 20% of the limit. Who are eligible? Farmers with excellent repayment record for at least past 2 years, new farmers with sizeable deposits with our branches for 2 years, .good borrowers with other banks,Farmers who have closed accounts are eligible for this loan. Loan amount Loan amount is fixed on the basis of Five times the annual farm income or 50% of the value of land (to be) mortgaged as collateral security, whichever is less, with a maximum of Rs. 10 lacs Documents you need to provide Land records, other than that is already given to the bank, encumbrance certificates,if required . Security (a) UptoRs 50000/ (b) Above Rs 50000 to Rs 100000 Hypothecation of assets created. Hypothecation of assets and mortgage of land Or Third party guarantee Hypothecation of assets and mortgage/ Charge over land or any other tangible security

(c) Above Rs 100000

How do you repay Repayment will be in Quarterly/Half yearly/Yearly installments depending on the harvest of the crops or the liquidity created by the agriculture activity undertaken with a maximum of 6 -7 years However, the limits availed for setting up of Horticultural Orchards can be repaid over a period of 9 years from the date of sanction. How to apply for this loan You may contact our nearest branch or talk to the marketing officers.

5. LAND PURCHASE SCHEME

Purpose: To assist Small & Marginal farmers and landless agricultural labourers for purchase of Land, who are our existing borrowers to consolidate land holdings & development of Wasteland & fallow lands. Who are eligible? Small & Marginal Farmers owning less than 5 acres of unirrigated / 2.5 acres of irrigated land in their own names , landless agricultural labourers. The borrowers should have a record of prompt repayment of the loan for at least two years. Good borrowers of other Banks are also eligible provided they liquidate their Outstandings to other banks. Loan amount: Loan may be considered for: Cost of land Provision of irrigation facilities & land development (shall not exceed 50% of the cost of the land). Purchase of farm equipments. Registration charges & stamp duty.

Loan amount will be 85 % of the cost of the land, as assessed by the bank, subject to the maximum of Rs 5 lakhs Security Mortgage of land to be purchased How to repay the loan Max. 9-10 years beginning after the expiry of gestation period, with half-yearly instalments.. .Gestation period will be maximum of 1 year for the developed land and 2 years for the land to be developed.. How to apply for this loan Contact your Branch You may contact our nearest branch or talk to the marketing officers visiting your village.

6. SCORING MODEL FOR TRACTOR LOANS

Purpose Agricultural term loans are sanctioned for purchase of new tractors, accessories and implements Who are eligible for tractor loan? Agriculturists (individually or jointly ) and Persons offering security like NSCs, KVPs, the Banks Fixed Deposits, surrender value of LIC policy, gold ornaments etc. to cover more than 60% of the loan amount are eligible for the loan .The applicants should score minimum score of 40 under the Scoring model of the bank. Loan amount Upto 95 % of the cost of the Tractor, trailer and accessories. (Depending on the scores in the scoring model).The cost includes the Registration charges and insurance premium not exceeding Rs 15,000/-. Additional loan equal to 10% of tractor loan for repairs may be provided for at the time of sanction. Bank will finance only for those models of tractors which have completed the commercial test from organizations viz. Central Farm Machinery Training and Testing Institute (CFMTTI) Budni (Madhya Pradesh) or Farm Machinery Training and Testing Institute (FMTTI), Hissar Security 1. Hypothecation of the tractor, accessories and implements. Noting of Banks hypothecation charge in the RC Book of the tractor is compulsory in all the cases. Collateral Security like NSCs, KVPs, Banks Fixed Deposits ,Surrender 2. value of LIC policy etc OR Mortgage of agricultural lands .However no collateral security is required, if the score is 70 and above on the scoring model of the bank How to repay the loan Within a maximum period of 9 years, including a grace period not exceeding 12 months. The installments shall be payable half-yearly / yearly, coinciding with the harvesting and marketing period of the crops proposed to be grown by you How to apply for this loan You may contact our nearest branch or talk to the marketing officers visiting your village .

7. FINANCING FOR COMBINE HARVESTERS

Purpose Finance is given for the purpose of combined harvesters'. Makes in the approved list of the bank will only be financed Who are eligible? a. For self propelled Combine Harvester 1. Farmers who are in a position to operate the Harvester successfully and owning minimum of 8 acres of irrigated land (corresponding acreage for other types of land). 2. Farmers owning lesser acreage than that prescribed above, are also eligible for availing combine harvester loans provided they could operate the harvesters successfully and generate sufficient income .Additionally they should provide additional collateral security like NSCs,Bank Fixed Deposits,LIC policies urban property etc to the value of at least 50% of the loan amount. b. For Combine Harvesters as an attachment /equipment Farmers who are in a position to operate the Harvester successfully and owning minimum of 6 acres of irrigated land (corresponding acreage for other types of land)..They should own a tractor of not less than 50 HP . Farmers owning lesser acreage than that prescribed above, are also eligible for availing combine harvester loans provided they could operate the harvesters successfully and generate sufficient income, additionally they should provide additional collateral security like NSCs, Bank Fixed Deposits, urban property etc the value of at least 50% of the loan amount Loan amount Upto 85 % of the cost of combine harvester and accessories. Security 1. Hypothecation of assets financed 2. Mortgage of land/buildings How do you repay Repayment of the loan will be in Quarterly/half yearly/yearly installments depending on the liquidity your activity creates AND a maximum period of residual economic life of the tractor owned which is assumed as 9 years,.

8. DAIRY PLUS SCHEME FOR FINANCING DAIRY UNITS

PURPOSE For construction of shed, purchase of milch animals, milking machine, chaff cutter or any other equipment required for the purpose. Who are eligible? (1) Individual farmers who are members of the milk procuring societies or located on milk route (2) They should be less than 65 years of age . (3) Individual dairy unit having less than 10 animal - should own minimum 0.25 acre of land for every 5 animals for growing fodder and be in a position to procure the balance requirements locally. (4) Individual dairy unit having 10 animals and above - should own or lease a minimum of one acre of land for cultivation of fodder for every 5 animals. Other terms Animal purchase should be in 2 batches Only buffaloes producing more than 7 litres of milk per day and cows producing more than 8 litres of milk per day are financed Animals in first and second lactation alone are eligible for finance LOAN AMOUNT: 100% of the cost for loans uptoRs 50000/ 90% of the cost for loans above Rs 50000/ with a maximum of Rs 5 lakhs as Term loan WORKING CAPITAL: A working capital @ Rs.2500/- per animal per year may be Sanctioned for purchase of feed, fodder and medicine along with the term loan Security Hypothecation of assets created out of bank finance for loans uptoRs 1.00 lac . For loans Over Rs.1 lac -Mortgage of landed property (or) third party guarantee Worth for loan amount (or) group guarantee of other 2 dairy farmers. How do you repay The loan should be repaid in monthly installments over a period of 5 lactations.

9. BROILER PLUS

(Scheme for financing Broiler Farmers under Contract farming)

Purpose Under this scheme loans can be extended to both existing farmers and new farmers having Contract Broiler Farming arrangements for enabling them to construct poultry shed and feed room and for purchase of equipments Who are eligible for Broiler plus loan? Those who have experience or undergone training in poultry farming They should have entered a contract with the companies undertaking broiler production through contract farming. ii.The farmers should possess adequate land for construction of poultry shed which should be at least 500 meters away from any existing poultry farm. Potable water source should also be available . ECONOMIC FLOCK SIZE: The minimum flock size should be 5000 birds. However,financing can be done for 10,000 and 15, 000 birds or part thereof. Loan amount Upto 75 % of the cost. UptoRs 3 lacs for every 5000 bird planned to be reared Maximum loan amount under the scheme will beRs 9.00 lacs per farmer Security: Hypothecation of assets created out of Bank finance and Mortgage of land on which the poultry shed and other infrastructure is available How do you repay The entire loan should be repaid within 5 years inclusive of a grace period of 6 months, with installments at bi monthly intervals

10. SCHEME TO COVER LOANS FOR GENERAL PURPOSE UNDER - GENERAL CREDIT CARD (GCC)

Purpose The scheme is to provide hassle-free credit to our customers based on the assessment

of cash flow without insistence on security, purpose or end-use of the credit. Who are eligible for the loan? Eligibility: i. All our existing customers with the branch having satisfactorily conducted deposit accounts including no frills deposit accounts in our books; say, for the last 6 months, or so, and / or loan accounts classified as standard assets will be eligible for availing loan under the scheme. ii. GCC facility should, however, not be extended to the KCC borrowers. Loan amount Maximum Rs 25000 / Security: Nil How to repay the loan Account will be in the nature of cash credit. The outstanding amount in the GCC should be cleared in full when the applicant is fluid with cash which may be at yearly/ half yearly / quarterly / monthly intervals based on the occupation of the applicant / his family. In case the entire amount is not repaid a minimum of 20 % of the amount due along with upto date interest debited should at least be repaid.

11. MINOR IRRIGATION SCHEMES

Purpose

Loan covers various activities like digging of new wells (open / bore wells), deepening of existing wells, energisation of wells (oil engine/electrical pump set ),laying of pipelines, installing drip / sprinkler system and lift irrigation system. Who are eligible? All farmers having a known source of water available for irrigation purpose are eligible for the loan. Loan amount For loans uptoRs 50000/ 100 % of the project cost upto 85 % of the project cost will be provided as loan cost

For loans above Rs 50000/

What are documents you need to provide? (1) (2) (3) (4) (5) Land records Quotation for the assets to be purchased An estimate for the civil works to be undertaken Geologist certificate wherever applicable Feasibility certificate from the EB Dept

Security A) Where movable assets are not created (a) UptoRs 10000/ (b) above Rs 10000/ Personal guarantee Personal guarantee and Mortgage of land

B) Where movable assets are created (a) UptoRs 50000/ (b) Above Rs 50000 How to repay the loan Repayment will be in Quarterly / half yearly / yearly installments over a period of 5 to 7 years depending on the crops or the liquidity created by the agriculture activity undertaken. Hypothecation of assets created Hypothecation of assets and mortgage of land

12. SCHEME FOR FINANCING SEED PROCESSORS

Purpose

To extend financial assistance to the seed processors against their receivables due to them from the seed growers. Who are eligible? Seed processors / units Enjoying good reputation & credit worthiness. Holding a valid license from the concerned State Department of Industries for Installation of Seed Processing Plant. Having valid certificate from Seed Certification Department. Doing business for the last 3 years. Having receivables from the farmers. Who have posted profits during the past two years of operation are eligible to avail credit limits under the scheme. Loan amount 60 % of the value of the receivables. Minimum Rs 2.00 lacs. No upper limit Security (1) Assignment/hypothecation of receivables from the farmers. (2) Equitable mortgage of residential/ commercial property worth 1.5 times of the limit sanctioned belonging to either the applicant or the guarantor. How to repay the loan? Loan to be liquidated within a maximum period of 6 months for each crop season i.e.,Rabi&kharif.

13. CAPITAL INVESTMENT SUBSIDY SCHEME FOR COMMERCIAL PRODUCTION UNITS OF ORGANIC INPUTS UNDER NATIONAL PROJECT ON ORGANIC FARMING

Purpose This scheme is to promote organic farming in the country on a large scale. Under this scheme manufacturing of organic inputs such as biofertilisers, vermicompost, fruit and vegetable waste compost are considered. Who are eligible for the loan Individuals, group of farmers/growers, proprietary and partnership firms, cooperatives, fertiliser industry, seed industry, Companies, Corporations, NGOs are eligible New as well as existing units (for expansion / renovation) engaged in the production are eligible under the scheme. Loan amount 50% of the Project cost as Bank loan 25% of the cost will be provided as subsidy from Government, subject to ceiling Cost of the project depends on the location, capacity, technology, invoice prices etc SECURITY Security will be as per norms prescribed from time to time. How to repay the loan? Repayable in 8 10 years, with a grace period of 2 years.

14. GRAMIN BHANDARAN YOJNA - CAPITAL INVESTMENT SUBSIDY SCHEME FOR CONSTRUCTION / RENOVATION OF RURAL GODOWNS

Purpose This scheme is for creating scientific storage capacity in the rural areas for storing farm produce ,thereby prevent distress sale of produce by the farmers after harvest ,by promoting pledge financing and marketing credit. Who are eligible for the loan? 1. Individuals / Farmers. quality cum inputs testing laboratories. 2. Proprietary and partnership terms.. 3. Co-operatives, Agro-processing co-operative societies. 4. Companies. 5. Corporations, Agro-Industrial corporations. 6. Agricultural Produce Marketing Committees.. 7. Group of Farmers/Growers. 8. NGOs 9. Agro-Processing Corporations.. 10. Self Help Groups.. 11. Marketing Boards etc. The godown can be constructed / located in any area outside the limits of a Municipal Corporation area. Rural godowns located in Food Parks promoted by Ministry of Food Processing Industries are also eligible. Loan amount Depending on the project cost. Maximum Project cost will be Rs 1500/ to 2000/ per tonne capacity for construction and Rs 500/ per tonne for renovation NABARD is providing back end subsidy for the projects financed by the Banks ,depending on the location and capacity of the godowns Bank will financeupto 80 % of the Project cost Security Mortgage /charge of Land and godown How do you repay The loan should be repaid in 11 years, with a grace period of one year. Subsidy will be credited as the final installments .

15. FINANCE TO HORICULTURE

Purpose

Loans for development of fruit orchards like mango, chikoo, Grapes, pomegranate, apple, etc., as well as short term crops like banana, pineapple, Flowers in open and green houses and vegetable crops are financed. Who are eligible? All farmers having cultivable lands. Loan amount UptoRs 50000/ Above Rs 50000/ 100 % of the cost of the asset / project cost upto 85 % of the asset / project is given as loan.

For Short term loans, loans are given under our crop loan / Kisan Credit Card schemes. Documents you need to provide For Orchard development you need to submit the following: i) Water and soil testing report ii) A feasibility certificate from the local Horticulture department iii) Land records iv) Quotation /estimates for the costs to be incurred v) Project Report, if the project is large Disbursement of the loan Generally disbursements are made directly to the suppliers. Cultivation expenses are released in stages as per the schedule set in your proposal. Security Loan amount uptoRs 50000/ Above Rs 50000/ uptoRs 100000 Hypothecation of assets created (1) Hypothecation of assets created (2) Mortgage of land or third party guarantee (1)Hypothecation of assets created (2) Mortgage of lands

Above Rs 100000/

How do you repay? The loan repayment starts after the completion of the gestation period varying from 4 to 7 years for different crops. Repayment commences from the time the crop gives

economic yield and is linked to the income generation of each crop every year and varies between 7 to 12 years.

16. KRISHI KALYAN

FARMERS EASY EMPOWERED LOAN (FEEL): KRISHI KALYAN (Combo Product of ACC and PML) Purpose: To provide timely and adequate credit to farmers to meet production and

consumption expenses. To offer credit against the stocks stored in farmers own premises / godowns/ warehouses/ cold storage, which help farmers avoid distress sale of the produce & promptly repay the loan dues. To reduce the multiple process of separate application, documentation & EM creation for availment of KCC and PML, thereby reduce the time for delivery of credit.

ELIGIBILITY All non-defaulter and credit worthy farmers owner cultivators, tenant farmers, and share croppers, having good track record and cultivating crops , like food grains( cereals), pulses, oilseeds etc., produce of which could be stored in godowns /ware houses/cold storage etc., Farmers cultivating fruits and vegetables, in centers where cold storage facilities are available. Quantum of Loan: Total credit limit will be sanctioned, comprising of following components. Production credit: Annual Credit needs will be sanctioned, depending on the operational land holdings, cropping pattern, and scale of finance. Contingency credit: Contingency credit: Produce Marketing loan: Limit depends on the current market price or the MSP fixed by the Government (less Margin) multiplied by the quantum of stock to be stored. Maximum Limit: a. Production Credit : No upper limit b. Produce Marketing Loan : Max of Rs 10 lac per borrower. Margin: For Production Credit: 15-20% For Produce Marketing loan: 40%

1. sanctioned against goods stored in Farmers own godown 2. Loans against warehouse receipt 20-35% SECURITY Limit up to Rs 1 Lac:

Primary: - Hypothecation of standing crops and / or stocks Stored under produce Marketing Loan Collateral : - NIL

Limit above Rs 1 Lac; I) If the Production credit portion does not exceed Rs 1 lac and Produce Marketing Loan is against Warehouse receipt (Max Limit Rs 10 lacs) a) Hypothecation of standing crops and/or Pledge of stocks. b) Warehouse Receipt (duly endorsed) and Letter from the Warehouse Authorities to the effect that the stocks covered by WHR will be released only on a written communication from the bank II)If production credit limit exceeds 1lac & produce loan is against warehouse receipt (below Rs 10 lac) a) Hypothecation of standing crops and/ or Pledge of stocks. b) Mortgage /charge over the land to the extent of Production credit limit. III)If production credit limit exceeds 1lac & produce stored in Farmers own go-down a) Hypothecation of standing crops and stocks b) Mortgage/charge over land c) Declaration of Stocks from the farmer INTEREST RATE As applicable from time to time to crop loans. REPAYMENT Crop Loan (Production Credit) &} Loan amount will be liquidated from Produce Contingency credit Loan } Marketing loan sanctioned to the farmer Produce Marketing Loan is to be repaid within a maximum period of 12 months, from the date of availment of the PML loan, depending on the produce.

17. FINANCING JLG OF TENANT FARMERS

FINANCING JLG OF TENANT FARMERS Objectives:

To augment flow of credit to tenant farmers cultivating land either as oral lessees or sharecroppers and small farmers, who do not have proper title to their land holding, through formation and financing of JLGs. To extend collateral free loans to target clients through JLG mechanism. To build mutual trust and confidence between the Bank and tenant farmers.

Purposes of credit The finance to JLG is a flexible credit product addressing the credit requirements of its members including crop production, consumption, marketing and other productive purposes. Who should constitute the JLG? Members should be of similar socio-economic status and background carrying out farming activities and who agree to function as a joint liability group. The group members should not be a defaulter to any other formal financial institution. JLG should not be formed with members of the same family and more than one person from the same family should not be included in the JLG.

Size of the JLG The group should be formed preferably with 4 to 10 members to enable the group members to offer mutual guarantee. While informal group of upto 20 members could also be considered, such large groups are found to be not effective in fulfilling mutual guarantee obligations in the case of farmers. JLG models: Model A: The group members are eligible for individual loans on executing an inter-se guarantee agreement. Model B: The group is eligible for accessing one loan, which could be combined credit requirement of all its members. Type of loan ACC or ATL depending upon the purpose of loan. Loan limit Maximum amount of loan available is Rs.50, 000/- per individual both under Models A and B Security Norms No collaterals are obtained. Only mutual guarantee is obtained.

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Money and CouplesDokument20 SeitenMoney and CouplesTom ChoNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Entrepreneurship and Small Business Management Diana DumitruDokument14 SeitenEntrepreneurship and Small Business Management Diana DumitruDumitru Dragos RazvanNoch keine Bewertungen

- Power Homes Unlimited Corporation VsDokument2 SeitenPower Homes Unlimited Corporation VsAnthony S. AnguloNoch keine Bewertungen

- Brealey MyersDokument27 SeitenBrealey MyersHachikuroba100% (3)

- 60R 10Dokument28 Seiten60R 10Khaled Abdelbaki100% (3)

- Ias 41 AgricultureDokument23 SeitenIas 41 AgricultureSunshine KhuletzNoch keine Bewertungen

- Sweet Beginnings Company Cash Budget For The Year 2016Dokument15 SeitenSweet Beginnings Company Cash Budget For The Year 2016Jonalyn Lodor100% (4)

- Corporate Restructuring at TATADokument25 SeitenCorporate Restructuring at TATAVaibhav Gupta100% (1)

- Exercise - FANUCDokument175 SeitenExercise - FANUCsubbu.v1987100% (1)

- Quiz Chapter+3 Bonds+PayableDokument3 SeitenQuiz Chapter+3 Bonds+PayableRena Jocelle NalzaroNoch keine Bewertungen

- New Product Development StrategyDokument10 SeitenNew Product Development StrategyJitendra BagalNoch keine Bewertungen

- B 126 GDokument4 SeitenB 126 GJitendra BagalNoch keine Bewertungen

- Crtrdgs Boring BarDokument8 SeitenCrtrdgs Boring BarJitendra BagalNoch keine Bewertungen

- Four Cylinder Air Engine Dwg.Dokument15 SeitenFour Cylinder Air Engine Dwg.Jitendra BagalNoch keine Bewertungen

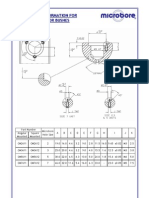

- Microbore UnitDokument1 SeiteMicrobore UnitJitendra BagalNoch keine Bewertungen

- G CodeDokument55 SeitenG CodeArman PinedaNoch keine Bewertungen

- Ceratizit U DrillDokument8 SeitenCeratizit U DrillJitendra BagalNoch keine Bewertungen

- Experience Certificate FormatDokument1 SeiteExperience Certificate FormatJitendra BagalNoch keine Bewertungen

- GDand TDokument83 SeitenGDand TJitendra BagalNoch keine Bewertungen

- THE PORT OF PORT ANGELES v. CERTAIN UNDERWRITERS AT LLOYD'S LONDON Et Al ComplaintDokument33 SeitenTHE PORT OF PORT ANGELES v. CERTAIN UNDERWRITERS AT LLOYD'S LONDON Et Al ComplaintACELitigationWatchNoch keine Bewertungen

- R.A. 9593Dokument31 SeitenR.A. 9593Llorena LorenNoch keine Bewertungen

- BBMF2093 CF Tutorial1Dokument55 SeitenBBMF2093 CF Tutorial1Kar EngNoch keine Bewertungen

- Postova Banka v. Greece - AwardDokument117 SeitenPostova Banka v. Greece - AwardManuel ValderramaNoch keine Bewertungen

- Philippine Financial Reporting Standards Number Title Effective DateDokument3 SeitenPhilippine Financial Reporting Standards Number Title Effective DateBam PamNoch keine Bewertungen

- Chapter 3 - NewDokument14 SeitenChapter 3 - NewNatasha GhazaliNoch keine Bewertungen

- Public Disclosure DocumentsDokument52 SeitenPublic Disclosure DocumentsEdgar Arbey RomeroNoch keine Bewertungen

- Profit and Lossl PDFDokument18 SeitenProfit and Lossl PDFsangili2005Noch keine Bewertungen

- Money MarketDokument21 SeitenMoney MarketPratik ShethNoch keine Bewertungen

- FMGT 7121 Module 6 - 8th EditionDokument11 SeitenFMGT 7121 Module 6 - 8th EditionhilaryNoch keine Bewertungen

- Group Assignment - 2021Dokument26 SeitenGroup Assignment - 2021Nam NguyễnNoch keine Bewertungen

- StockReportsPlus BMW XEDokument11 SeitenStockReportsPlus BMW XEMadalin DavidNoch keine Bewertungen

- FOREXDokument7 SeitenFOREXpoppy2890Noch keine Bewertungen

- MODULE 2 - Introduction To Measuring FDFIDokument37 SeitenMODULE 2 - Introduction To Measuring FDFIEricaNoch keine Bewertungen

- Warren Larsen Chp1 (Principles of Accounting)Dokument147 SeitenWarren Larsen Chp1 (Principles of Accounting)annie100% (1)

- 4 IKEA Branches Out in RussiaDokument2 Seiten4 IKEA Branches Out in RussiaSaniSah50% (2)

- Jaiib Previous Year Question PapersDokument3 SeitenJaiib Previous Year Question PapersAbhijeet RawatNoch keine Bewertungen

- Foreign Direct Investment in Retail: February 23, 2004Dokument42 SeitenForeign Direct Investment in Retail: February 23, 2004Himanshu DwivediNoch keine Bewertungen

- "Merchant Banking: Primary and Secondary Markets": Summer Internship Project Report A.K. Capital Services LimitedDokument78 Seiten"Merchant Banking: Primary and Secondary Markets": Summer Internship Project Report A.K. Capital Services LimitedorangeponyNoch keine Bewertungen

- E Business Customer ExpectationsDokument7 SeitenE Business Customer ExpectationskalladyNoch keine Bewertungen

- Feasibility Study of Furfuryl Alcohol ProductionDokument3 SeitenFeasibility Study of Furfuryl Alcohol ProductionIntratec SolutionsNoch keine Bewertungen