Beruflich Dokumente

Kultur Dokumente

Foreclosure Filing

Hochgeladen von

Statesman JournalCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Foreclosure Filing

Hochgeladen von

Statesman JournalCopyright:

Verfügbare Formate

1

2 3' 4 5

JUN 18 2013

Marion County Circuit Court

IN THE CIRCUIT COURT OF THE STATE OF OREGON

6

FOR THE COUNTY OF MARION

7

CITY OF KEIZER, a municipal corporation,

8

Plaintiff,

No. a flO ~ COMPLAINT RAWLINS HOLDING COMPANY, INC., an Oregon corporation; RAWLINS INVESTMENT PROPERTIES L.L.C., an Oregon limited liability company; the UNKNOWN HEIRS of OTIS D. RAWLINS and LOENE E. RAWLINS, husband and wife, deceased; LORRAINE SCHULTZ; TIMOTHY R. RAWLINS and PETER R. RAWLINS, TRUSTEES OF THE RAWLINS FAMILY TRUST; NORTHWEST NATIONAL LLC, an Oregon limited liability company; and all other persons or parties unknown claiming any right, title, lien, or interest in the property described in the complaint herein Defendants. (Foreclosure of Local Improvement District Lien) NOT SUBJECT TO ARBITRATION Lien Amount: approximately $6,667,000

10 11 12 13 14 15 16 17 18 19 20 21 22 23 24, 25

Plaintiff City of Keizer alleges as follows:

PARTIES

1.

City of Keizer (the "City") is an existing municipal corporation duly formed under the laws

of the State of Oregon. 11

26

Defendant Rawlins Holding Company, Inc. ("Rawlins Holding") is an Oregon corporation.

K &L GATES LLP

Page 1- COMPLAINT

PO-355820 V4

222 SW COLUMBIA STREET SUITE ]400 PORTLAND, OR 97 20 16 6 3 2 TELEPHONE: (503) 228-3200

PAX: (503) 248.9085

1 2 3 4 5 6 7 8 9 10 11 12 13 14'. 15 16 17''. 18 19 20 21 22 23 24 25 26 known.

3. Defendant Rawlins Investment Properties L.L.C. ("Rawlins Investment") is an Oregon limited liability company. 4. The heirs of Otis D. Rawlins and Loene E. Rawlins, deceased (the "Rawlins Heirs"), are not 5. Defendants Lorraine Schultz ("Schultz") is an individual residing in the state of Oregon. 6. Defendants Timothy R. Rawlins and Peter R. Rawlins, in their capacity as Trustees (the "Rawlins Trustees") of the Rawlins Family Trust, are residents of the state of Oregon. 7. Defendant Northwest National LLC ("Northwest") is an Oregon limited liability company. 8. All other persons or parties unknown claiming any right, title, lien, or interest in the property described in the complaint herein are named as Defendants pursuant to ORCP 21 J. FACTS 9. In 2005, the City formed a local improvement district known as the "Keizer Station Area A Local Improvement District" (the "LID") pursuant to Resolution Nos. 2005-1593 and 2005-1594, duly adopted by the Keizer City Council. 10. Located within the LID are the parcels of real property described on Exhibit A attached hereto and known as Tax Lot 063W2504200 (the "4200 Property") and Exhibit B'attached hereto and known as Tax Lot 063W2504500 (the "4500 Property"; and together with the 4200 Property, the "Properties"). 11. Defendants Rawlins Holding and Rawlins Investment each own an undivided one-half interest in the Properties as tenants-in-common. 12. The City assessed the 4200 Property in the amount of $2,299,571.82 on January 31, 2008 (the "4200 Property Assessment").

K&L GATES LLP

Page . 2- COMPLAINT

222 SW COl-UM13IA STREET SUITE 1400 PORTLAM, OR 97201-6632 TELEPHONE: (503) 228-3200 PAN: (503) 249 -9085

13.

The City assessed the 4500 Property in the amount of $3,671,246.24 on January 31, 2008 (the "4500 Property Assessment"). 14.

4

5 6 7 8

Rawlins Holding and Rawlins Investment agreed to pay the 4200 Property Assessment in 42 semi-annual installments pursuant to an Installment Payment Contract dated February 19, 2008 (the "4200 Installment Contract"). 15. Rawlins Holding and Rawlins Investment agreed to pay the 4500 Property Assessment in 42 semi-annual installments pursuant to an Installment Payment Contract dated February 19, 2008 (the "4500 Installment Contract" and together with the 4200 Installment Contract, the "Installment Contracts"). 16. The Recorder of the City of Keizer (the "City Recorder") has prepared a list of all real property in the LID appearing on the tax rolls that are delinquent and have not been paid. According to the list prepared by the City Recorder, Rawlins Holding and Rawlins Investment have failed to pay the installments due under the Installment Contracts since August 21, 2010, and thus have refused to pay the installments under the Installment Contracts as contemplated by ORS 223.265. 17. The total amount owed to the City with respect to the 4200 Property Assessment, including interest and penalties, is $2,566,453.49 as of May 31, 2013, which amount includes principal in the amount of $2,179,095.39 (the "4200 Property Assessment Principal"), accrued unpaid interest in the amount of $327,149.61, late payment penalties in the amount of $59,272.72, real estate taxes paid by the City on the 4200 Property in the amount of $890.51 (the "4200 Property Tax Principal") together with interest accrued thereon in the amount of $45.26, plus additional interest accruing on the 4200 Property Assessment Principal and the 4200 Property Tax Principal at the rate of 5.76135% per annum from and after May 31, 2013 and costs of collecting the 4200 Property Assessment, including attorney fees (collectively, the "4200. Property Assessment Amount"). 18. The total amount owed to the City with'respect to the 4500 Property Assessment, including interest and penalties, is $4,100,435.46 as of May 31, 2013, which amount includes principal in the amount of $3,478,906.64 (the "4500 Property Assessment Principal"), accrued unpaid interest in the amount of $522291.48, late payment penalties in the amount of $94,637.68, real estate taxes paid by the City on the 4500 Property in the amount of $4,377.28 (the "4500 Property Tax Principal") together with interest accrued thereon in the amount of $222.48, plus additional interest accruing on the 4500 Property Assessment Principal and the 4500 Property Tax Principal at the rate of 5.76135% per annum from and after May 31, 2013 and costs of collecting the 4500 Property Assessment, including attorney fees (collectively, the "4500 Property Assessment Amount"). 19. Defendants the Rawlins Heirs have a record interest in the Properties by virtue of a Mortgage dated December 23, 1994 and recorded on December 30, 1994 with the Marion County

K&L GATES LLP

222 SW COLUMBIA STREET SUITE 1400 PORTLATND, OR 97201-6632 TELEPHONE: (503) 228-3200 FAX (503) 248-9085

a

ID]

11 12 13 14 15 16 17 18 19 20 21

22

23 24

25 26

Page 3- COMPLAINT

Recorder at Reel 1213, Page 454. 2'. 3 4 5 6 7 Defendant Schultz has a record interest in the Properties by virtue of an indenture of Mortgage dated March 15, 1996 and recorded on March 18, 1996 with the Marion County Recorder at Reel 1297, Page 449. 22. Defendant Northwest may have an interest in the Properties by virtue of a Ground Lease dated October 1, 2005, among Northwest, Rawlins Holding and Rawlins Investment. 23. As provided by ORS 223.230(3), the lien of the City for unpaid assessments is paramount and prior to any interest of the Defendants in the Properties. 20. Defendants the Rawlins Trustees have a record interest in the Properties by virtue of a Trust Deed dated August 19, 1998 and recorded on January 20, 1999 with the Marion County Recorder at Reel 1560, Page 40. 21.

9 10 11 12 13 14

FIRST CLAIM FOR RELIEF (Foreclosure of the 4200 Property) 24.

The City realleges and incorporates by reference the allegations of paragraphs 1 - 23 above. 25. The City is entitled to a judgment declaring the City's interest in the 4200 Property to be superior to that of the Defendants and foreclosing the City's interest in the 4200 Property. 26. The City is entitled to a judgment in the amount of the 4200 Property Assessment Amount, together with penalties equal to 0.5% of the 4200 Property Assessment Amount as provided in the 4200 Installment Contract interest on the 4200 Property Assessment Principal and the 4200 Property Tax Principal at the rate of 5,76135% per annum from May 31, 2013 to the date of judgment, and any accruing interest from the date of judgment at the legal rate of nine percent (9%) per annum as provided by ORS 82.010, plus the City's attorneys' fees as provided in ORS 223.615 and the 4200 Installment Contract.

15 16

17 18 19 20 21 22 23 24 25 26

SECOND CLAIM FOR RELIEF (Foreclosure of the 4500 Property) 27.

The City realleges and incorporates by reference the allegations of paragraphs 1 - 23 above.

Page 4- COMPLAINT

K&L GATES LLP 222 3W COLUMBIA STREET SUITE 1400 PORTLAND, OR 97201-6632 TELEPHONE: (503) 220.3200

FAX (503) 248-9065

28. 2 3 4 5 6 7 The City is entitled to a judgment declaring the City's interest in the 4500 Property to be superior to that of the Defendants and foreclosing the City's interest in the 4500 Property. 29. The City is entitled to a judgment in the amount of the 4500 Property Assessment Amount, together with penalties equal to 0.5% of the 4500 Property Assessment Amount as provided in the 4500 Installment Contract interest on the 4500 Property Assessment Principal and the 4500 Property Tax Principal at the rate of 5.76135% per annum from May 31, 2013 to the date of judgment, and any accruing interest from the date of judgment at the legal rate of nine percent (9%) per annum as provided by ORS 82.010, plus the City's attorneys' fees as provided in ORS 223.615 and the 4500 Installment Contract.

0 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26

PRAYER FOR RELIEF

WHEREFORE, Plaintiff City of Keizer prays for relief against the Defendants as follows: 1. With respect to its First Claim for Relief A. For ajudgment that the 4200 Property Assessment Amount, together with interest, penalties and attorneys' fees, is a first lien on the 4200 Property; B. For judgment of foreclosure and decree against the Defendants, ordering that each of them, and all persons claiming through or under them, either as purchasers, encumbrances, or otherwise be foreclosed of all interest or claim in the 4200 Property except to the extent of the statutory right of redemption any of them may have in the 4200 Property; C. For a judgment and decree that the 4200 Property be sold at a foreclosure sale by the.Marion County Sheriff following advertisement and notice as required by law; D. That the City shall be permitted to appear and credit bid all or a portion of the amount of its judgment at the execution sale of the 4200 Property; E. Requiring that the Marion County Sheriff issue a sheriffs certificate of sale or equivalent covering the 4200 Property subject only to the right of redemption in the Property as provided by ORS 223.593; F. That the purchaser at the execution sale be entitled to such remedies as are available at law to secure such purchaser's position as owner of the 4200 Property, including a writ of assistance, if the Defendants or any other parties or persons refuse to immediately surrender possession to such purchaser; and Such other and further relief as the Court shall deem equitable. G. With respect to its Second Claim for Relief: A.For a judgment that the 4500 Property Assessment Ar ount, together with interest, penalties and attorneys' fees, is a first lien on the 4500 Property; B. For judgment of foreclosure and decree against the Defendants, ordering that each of them, and all persons claiming through or under them, either as purchasers, encumbrances, or otherwise be foreclosed of all interest or claim in the 4500 Property except to the extent of the statutory right of redemption any of them may have in the 4500 Property;

K&L GATES LLB'

222 SW COLUMBIA STREET SUITE 1400 PORTLAND, OR 97201-6632 TELEPHONE: (503) 228-3200 PAX :(503)248-9085

2.

Page 5- COMPLAINT

2 3 0 5 6 7 8

For a judgment and decree that the 4500 Property be sold at a foreclosure C. sale by the Marion County Sheriff following advertisement and notice as required by law; That the City shall be permitted to appear and credit bid all or a portion of the D. amount of its judgment at the execution sale of the 4500 Property; Requiring that the Marion County Sheriff issue a sheriff's certificate of sale E. or equivalent covering the 4500 Property subject only to the right of redemption in the Property as provided by ORS 223.593; That the purchaser at the execution sale be entitled to such remedies as are F. available at law to secure such purchaser's position as owner of the 4500 Property, including a writ of assistance, if the Defendants or any other parties or persons refuse to immediately surrender possession to such purchaser; and Such other and further relief as the Court shall deem equitable. G.

k

DATED this day of June, 2013. K&L GATES LLP

II

9

10 11

12 13 14

R. Gibson -M sters; OS15156

Email: ,gib.ma.sters ~ a,klg_ates.com 7 Philip S. Van Der Weele, OSB #863650 Email: phil.vanderweeleOklaates.com Attorneys for Plaintiff

15

Trial Attorney: Philip Van Der Weele

16

17 18 19 20 21 22 23 24 25

26

K&L GATES LLP

222 SW COLUMBIA STREET

Page 6- COMPLAINT

SUITE 1400 PORTLAN12, OR 97201-6632 TELCPHONE: (503) 228-3200 9AX: (503) 248-9085

Order No. FT130041781-FTMWV23

LEGAL DESCRIPTION

Beginning at the Southwest corner of that tract of land conveyed by Deed recorded in Volume 73, Page 128, of Marion County Deed Records and being 994.69 feet South 8935' East along the Section line from the South one quarter corner of Section 25, Township 6 South, Range 3 West, Willamette Meridian, Marion County, Oregon; thence North 89 35' West along said Section line, 328.99 feet to the East line of that property described in that Deed to the United States of America and recorded in Volume 445, Page 668, of Marion County Deed Records; thence North 00 2141" West along said East line 846.81 feet to a point; thence North 8950'15" East a distance of 328.99 feet to a point being North from the point of beginning; thence South 0021'41" East 850.14 feet, more or less, to the point of beginning.

FDOR0249.rdw

Combination Form Guarantee Oregon Title Insurance Rating Organization (OTIRO) OTIRO No. G-01

Order No. FT130041780-FTMWV23

LEGAL DESCRIPTION

Commencing at the Southwest corner of that tract of land conveyed by Deed recorded in Volume 73, Page 128, of Marion County Deed Records and being 994.69 feet South 8935' East along the Section line from the South one quarter corner of Section 25, Township 6 South, Range 3 West, Willamette Meridian, Marion County, Oregon; thence North 89 35' West along said Section line, 328.99 feet to the East line of that property described in that Deed to the United States of America and recorded in Volume 445, Page 668, of Marion County Deed Records; thence North 00 2141" West along said East line 846.81 feet to the True Point of Beginning of the parcel herein described; thence South 8950'15" West along the North line of said last mentioned property and that property described in that Deed to the United States of America and recorded in Volume 357, Page 526, of Marion County Deed Records, 1150.00 feet to the East right-of-way line of the Oregon Electric Railroad; thence North 0012'22" West along said East right-of-way line 210.82 feet; thence South 8941'54" East 323.60 feet; thence North 7837'18" East 274.91 feet; thence North 7717'41" East 163.19 feet; thence North 8013'23" East 445.82 feet; thence North 7803'09" East 271.67 feet; thence North 80 52'31" East 19.82 feet; thence South 00 2141" East 430.21 feet to a point being North 895015" East from the True Point of Beginning; thence South 8950'15" West a distance of 328.99 feet, more or less, to the True Point of Beginning.

4.

FDOR0249.rdw

Combination Form Guarantee Oregon Title Insurance Rating Organization (OTIRO) OTIRO No. G-01

Das könnte Ihnen auch gefallen

- Inverse CondemnationDokument36 SeitenInverse CondemnationLas Vegas Review-Journal100% (1)

- No Hearing Required Unless RequestedDokument22 SeitenNo Hearing Required Unless RequestedChapter 11 DocketsNoch keine Bewertungen

- ) in Re:) ) Innkeepers Usa Trust, Et Al.,) Case No. 10-13800 (SCC) ) Debtors.) Jointly Administered)Dokument15 Seiten) in Re:) ) Innkeepers Usa Trust, Et Al.,) Case No. 10-13800 (SCC) ) Debtors.) Jointly Administered)Chapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Central District Santa Ana DivisionDokument6 SeitenUnited States Bankruptcy Court Central District Santa Ana DivisionChapter 11 DocketsNoch keine Bewertungen

- CMS Report PDFDokument15 SeitenCMS Report PDFRecordTrac - City of OaklandNoch keine Bewertungen

- Entered On Docket April 30, 2009: - Hon. Linda B. Riegle United States Bankruptcy JudgeDokument10 SeitenEntered On Docket April 30, 2009: - Hon. Linda B. Riegle United States Bankruptcy JudgeChapter 11 DocketsNoch keine Bewertungen

- ) in Re:) ) Innkeepers Usa Trust, Et Al.,) Case No. 10-13800 (SCC) ) Debtors.) Jointly Administered)Dokument4 Seiten) in Re:) ) Innkeepers Usa Trust, Et Al.,) Case No. 10-13800 (SCC) ) Debtors.) Jointly Administered)Chapter 11 DocketsNoch keine Bewertungen

- Provincial Officials Suspension CaseDokument45 SeitenProvincial Officials Suspension CaseRobin ScherbatskyNoch keine Bewertungen

- ) in Re:) ) Innkeepers Usa Trust, Et Al.,) Case No. 10-13800 (SCC) ) Debtors.) Jointly Administered)Dokument10 Seiten) in Re:) ) Innkeepers Usa Trust, Et Al.,) Case No. 10-13800 (SCC) ) Debtors.) Jointly Administered)Chapter 11 DocketsNoch keine Bewertungen

- CMS Report PDFDokument8 SeitenCMS Report PDFRecordTrac - City of OaklandNoch keine Bewertungen

- Hearing Date: September 25, 2008 at 2:00 P.M. Objections Due: September 18, 2008 at 4:00 P.MDokument7 SeitenHearing Date: September 25, 2008 at 2:00 P.M. Objections Due: September 18, 2008 at 4:00 P.MChapter 11 DocketsNoch keine Bewertungen

- Real News Project Dba WhoWhatWhy v. Dickert Complaint PDFDokument18 SeitenReal News Project Dba WhoWhatWhy v. Dickert Complaint PDFMark JaffeNoch keine Bewertungen

- Attorneys For First Industrial, L.P.: ONTARIO/REGGER/294868.1Dokument6 SeitenAttorneys For First Industrial, L.P.: ONTARIO/REGGER/294868.1Chapter 11 DocketsNoch keine Bewertungen

- Riad v. LW Wireless, Inc. Et Al 2.13-Cv-02596 Doc 1 Filed 13 May 13Dokument41 SeitenRiad v. LW Wireless, Inc. Et Al 2.13-Cv-02596 Doc 1 Filed 13 May 13scion.scionNoch keine Bewertungen

- CMS Report PDFDokument8 SeitenCMS Report PDFRecordTrac - City of OaklandNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument11 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- ) in Re:) ) Innkeepers Usa Trust, Et Al.,) Case No. 10-13800 (SCC) ) Debtors.) Jointly Administered)Dokument11 Seiten) in Re:) ) Innkeepers Usa Trust, Et Al.,) Case No. 10-13800 (SCC) ) Debtors.) Jointly Administered)Chapter 11 DocketsNoch keine Bewertungen

- Ee D"R:) Al, L) Debtors.)Dokument5 SeitenEe D"R:) Al, L) Debtors.)Chapter 11 DocketsNoch keine Bewertungen

- Kaizen BuildersDokument21 SeitenKaizen Buildersayesha jaafarNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument7 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- In Re:) : Debtors.)Dokument9 SeitenIn Re:) : Debtors.)Chapter 11 DocketsNoch keine Bewertungen

- Rdio V Sony Re MFNsDokument118 SeitenRdio V Sony Re MFNsChristopher S. HarrisonNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument4 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- Portsmouth ComplaintDokument24 SeitenPortsmouth ComplaintFinney Law Firm, LLCNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument6 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument3 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument7 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- Kevin Singer Receiver Unauthorized Practice of Law Receivership Specialists John Rachlin - Gregg Foster - Richard Marquis - California Attorney General Kamala Harris - State Bar of California Office of Chief Trial Counsel Jayne Kim Chief Trial Counsel - UPL Business & Professions Code Sec. 6125 Unauthorized Practice of Law - Whistleblower Leaked Court RecordsDokument9 SeitenKevin Singer Receiver Unauthorized Practice of Law Receivership Specialists John Rachlin - Gregg Foster - Richard Marquis - California Attorney General Kamala Harris - State Bar of California Office of Chief Trial Counsel Jayne Kim Chief Trial Counsel - UPL Business & Professions Code Sec. 6125 Unauthorized Practice of Law - Whistleblower Leaked Court RecordsCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasNoch keine Bewertungen

- Goldstein V Climate Action Network Et AlDokument74 SeitenGoldstein V Climate Action Network Et Alclimatehomescribd100% (1)

- Et Al.: Debtor (Other Names, If Any, Used by The Debtor in The Last 8 Years Appear in Brackets) Address Case No. Taxid#Dokument2 SeitenEt Al.: Debtor (Other Names, If Any, Used by The Debtor in The Last 8 Years Appear in Brackets) Address Case No. Taxid#Chapter 11 Dockets100% (1)

- LNV Corporation vs. Catherine GebhardtDokument20 SeitenLNV Corporation vs. Catherine Gebhardtbealbankfraud100% (2)

- 05-55927-swr Doc 10184 Filed 11/07/08 Entered 11/07/08 18:13:21 Page 1 of 7Dokument7 Seiten05-55927-swr Doc 10184 Filed 11/07/08 Entered 11/07/08 18:13:21 Page 1 of 7Chapter 11 DocketsNoch keine Bewertungen

- In Re: Collins & Aikman Corp., - Debtors. Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. RhodesDokument29 SeitenIn Re: Collins & Aikman Corp., - Debtors. Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. RhodesChapter 11 DocketsNoch keine Bewertungen

- In Re: : Debtors.!Dokument22 SeitenIn Re: : Debtors.!Chapter 11 DocketsNoch keine Bewertungen

- CMS Report PDFDokument8 SeitenCMS Report PDFRecordTrac - City of OaklandNoch keine Bewertungen

- Motion For Joint Administration PendingDokument6 SeitenMotion For Joint Administration PendingChapter 11 DocketsNoch keine Bewertungen

- Icearizona 6-25Dokument56 SeitenIcearizona 6-25NocoJoeNoch keine Bewertungen

- Jointly AdministeredDokument7 SeitenJointly AdministeredChapter 11 DocketsNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument8 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- Hearing Date (If Necessary) : April 30, 2007 at 2:00 P.M. Objection Deadline: April 27, 2007 at 4:00 P.MDokument16 SeitenHearing Date (If Necessary) : April 30, 2007 at 2:00 P.M. Objection Deadline: April 27, 2007 at 4:00 P.MChapter 11 DocketsNoch keine Bewertungen

- Nunc Pro TuncDokument117 SeitenNunc Pro TuncChapter 11 DocketsNoch keine Bewertungen

- City of Carmel-By-The-sea Et Al. v. County of Monterey Et Al. (m125153)Dokument11 SeitenCity of Carmel-By-The-sea Et Al. v. County of Monterey Et Al. (m125153)L. A. PatersonNoch keine Bewertungen

- ) in Re:) ) Innkeepers Usa Trust, Et Al.,) Case No. 10-13800 (SCC) ) Debtors.) Jointly Administered)Dokument6 Seiten) in Re:) ) Innkeepers Usa Trust, Et Al.,) Case No. 10-13800 (SCC) ) Debtors.) Jointly Administered)Chapter 11 DocketsNoch keine Bewertungen

- CMS Report 1 PDFDokument7 SeitenCMS Report 1 PDFRecordTrac - City of OaklandNoch keine Bewertungen

- Chicago Great Western R. Co. v. Kendall, 266 U.S. 94 (1924)Dokument5 SeitenChicago Great Western R. Co. v. Kendall, 266 U.S. 94 (1924)Scribd Government DocsNoch keine Bewertungen

- Foot Locker - Referee Logo Trademark Copyright Complaint PDFDokument48 SeitenFoot Locker - Referee Logo Trademark Copyright Complaint PDFMark JaffeNoch keine Bewertungen

- CMS Report PDFDokument8 SeitenCMS Report PDFRecordTrac - City of OaklandNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument27 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- Bankruptcy CaseDokument65 SeitenBankruptcy CaseChapter 11 DocketsNoch keine Bewertungen

- Attorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionDokument17 SeitenAttorneys For The Christian Brothers' Institute, Et Al. Debtors and Debtors-in-PossessionChapter 11 DocketsNoch keine Bewertungen

- City of Camden and Camden Redevelopment Agency v. Victor Urban Renewal Et Al.Dokument120 SeitenCity of Camden and Camden Redevelopment Agency v. Victor Urban Renewal Et Al.jalt61Noch keine Bewertungen

- United States Court of Appeals, Second Circuit.: No. 873, Docket 81-7781Dokument17 SeitenUnited States Court of Appeals, Second Circuit.: No. 873, Docket 81-7781Scribd Government DocsNoch keine Bewertungen

- Valeri v. Mystic IndustriesDokument34 SeitenValeri v. Mystic IndustriesPriorSmartNoch keine Bewertungen

- A Buyer of Realty With Annotation Pursuant To Rule 74, Section 4 of The Rules of Court Is Not A Buyer in Good FaithDokument5 SeitenA Buyer of Realty With Annotation Pursuant To Rule 74, Section 4 of The Rules of Court Is Not A Buyer in Good FaithHangul Si Kuya AliNoch keine Bewertungen

- CMS Report PDFDokument8 SeitenCMS Report PDFRecordTrac - City of OaklandNoch keine Bewertungen

- Inversiones Alsacia Disclosure StatementDokument648 SeitenInversiones Alsacia Disclosure StatementDealBookNoch keine Bewertungen

- G.R. No. 183360 September 8, 2014 ROLANDO C. DE LA PAZ, Petitioner, L & J Development COMPANY, RespondentDokument197 SeitenG.R. No. 183360 September 8, 2014 ROLANDO C. DE LA PAZ, Petitioner, L & J Development COMPANY, RespondentJulieta ManiegoNoch keine Bewertungen

- Mbia/assured Guaranty Complaint Re GO Unsecured Status in Detroit Bankruptcy Case PDFDokument31 SeitenMbia/assured Guaranty Complaint Re GO Unsecured Status in Detroit Bankruptcy Case PDFChris HerzecaNoch keine Bewertungen

- Attorneys For Debtors and Debtors in PossessionDokument121 SeitenAttorneys For Debtors and Debtors in Possessionpaxton powellNoch keine Bewertungen

- The Law of Property Valuation and Planning in South AfricaVon EverandThe Law of Property Valuation and Planning in South AfricaNoch keine Bewertungen

- Letter To Judge Hernandez From Rural Oregon LawmakersDokument4 SeitenLetter To Judge Hernandez From Rural Oregon LawmakersStatesman JournalNoch keine Bewertungen

- Roads and Trails of Cascade HeadDokument1 SeiteRoads and Trails of Cascade HeadStatesman JournalNoch keine Bewertungen

- Matthieu Lake Map and CampsitesDokument1 SeiteMatthieu Lake Map and CampsitesStatesman JournalNoch keine Bewertungen

- Windigo Fire ClosureDokument1 SeiteWindigo Fire ClosureStatesman JournalNoch keine Bewertungen

- School Board Zones Map 2021Dokument1 SeiteSchool Board Zones Map 2021Statesman JournalNoch keine Bewertungen

- Social-Emotional & Behavioral Health Supports: Timeline Additional StaffDokument1 SeiteSocial-Emotional & Behavioral Health Supports: Timeline Additional StaffStatesman JournalNoch keine Bewertungen

- Complaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Dokument4 SeitenComplaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Statesman JournalNoch keine Bewertungen

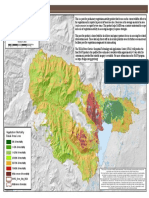

- Cedar Creek Vegitation Burn SeverityDokument1 SeiteCedar Creek Vegitation Burn SeverityStatesman JournalNoch keine Bewertungen

- Cedar Creek Fire Soil Burn SeverityDokument1 SeiteCedar Creek Fire Soil Burn SeverityStatesman JournalNoch keine Bewertungen

- Cedar Creek Fire Sept. 3Dokument1 SeiteCedar Creek Fire Sept. 3Statesman JournalNoch keine Bewertungen

- Cedar Creek Fire Aug. 16Dokument1 SeiteCedar Creek Fire Aug. 16Statesman JournalNoch keine Bewertungen

- Mount Hood National Forest Map of Closed and Open RoadsDokument1 SeiteMount Hood National Forest Map of Closed and Open RoadsStatesman JournalNoch keine Bewertungen

- LGBTQ Proclaimation 2022Dokument1 SeiteLGBTQ Proclaimation 2022Statesman JournalNoch keine Bewertungen

- Revised Closure of The Beachie/Lionshead FiresDokument4 SeitenRevised Closure of The Beachie/Lionshead FiresStatesman JournalNoch keine Bewertungen

- BG 7-Governing StyleDokument2 SeitenBG 7-Governing StyleStatesman JournalNoch keine Bewertungen

- Salem Police 15-Year Crime Trends 2007 - 2015Dokument10 SeitenSalem Police 15-Year Crime Trends 2007 - 2015Statesman JournalNoch keine Bewertungen

- WSD Retention Campaign Resolution - 2022Dokument1 SeiteWSD Retention Campaign Resolution - 2022Statesman JournalNoch keine Bewertungen

- Salem Police 15-Year Crime Trends 2007 - 2021Dokument10 SeitenSalem Police 15-Year Crime Trends 2007 - 2021Statesman JournalNoch keine Bewertungen

- Proclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedDokument1 SeiteProclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedStatesman JournalNoch keine Bewertungen

- Salem-Keizer Parent and Guardian Engagement in Education Month ProclamationDokument1 SeiteSalem-Keizer Parent and Guardian Engagement in Education Month ProclamationStatesman JournalNoch keine Bewertungen

- All Neighborhoods 22X34Dokument1 SeiteAll Neighborhoods 22X34Statesman JournalNoch keine Bewertungen

- Salem Police Intelligence Support Unit 15-Year Crime TrendsDokument11 SeitenSalem Police Intelligence Support Unit 15-Year Crime TrendsStatesman JournalNoch keine Bewertungen

- Zone Alternates 2Dokument2 SeitenZone Alternates 2Statesman JournalNoch keine Bewertungen

- Failed Tax Abatement ProposalDokument8 SeitenFailed Tax Abatement ProposalStatesman JournalNoch keine Bewertungen

- All Neighborhoods 22X34Dokument1 SeiteAll Neighborhoods 22X34Statesman JournalNoch keine Bewertungen

- Crib Midget Day Care Emergency Order of SuspensionDokument6 SeitenCrib Midget Day Care Emergency Order of SuspensionStatesman JournalNoch keine Bewertungen

- Salem-Keizer Discipline Data Dec. 2021Dokument13 SeitenSalem-Keizer Discipline Data Dec. 2021Statesman JournalNoch keine Bewertungen

- Oregon Annual Report Card 2020-21Dokument71 SeitenOregon Annual Report Card 2020-21Statesman JournalNoch keine Bewertungen

- SIA Report 2022 - 21Dokument10 SeitenSIA Report 2022 - 21Statesman JournalNoch keine Bewertungen

- SB Presentation SIA 2020-21 Annual Report 11-9-21Dokument11 SeitenSB Presentation SIA 2020-21 Annual Report 11-9-21Statesman JournalNoch keine Bewertungen

- Registered Legal NoticeDokument3 SeitenRegistered Legal NoticeKristel BunaganNoch keine Bewertungen

- Kolin Electronics Co., Inc. v. Kolin Phils. International, Inc., G.R. No. 228165, Feb. 9, 202Dokument28 SeitenKolin Electronics Co., Inc. v. Kolin Phils. International, Inc., G.R. No. 228165, Feb. 9, 202Christopher ArellanoNoch keine Bewertungen

- Judicial Confirmation DecisionDokument4 SeitenJudicial Confirmation DecisionCha Abaniel100% (1)

- Ipr Important 2 Marks QuestionsDokument6 SeitenIpr Important 2 Marks Questionsnandhu0% (2)

- Deed of Assignment SampleDokument2 SeitenDeed of Assignment SampleKaye LiwanagNoch keine Bewertungen

- Agreement Partition Land TitleDokument5 SeitenAgreement Partition Land Titlesampaguita_r7166100% (1)

- QuitclaimDokument2 SeitenQuitclaimManny B. Victor VIIINoch keine Bewertungen

- 2020 Omnibus AffidavitDokument2 Seiten2020 Omnibus AffidavitCherry PanoNoch keine Bewertungen

- Selden v. Airbnb - Complaint 2016-05-18Dokument15 SeitenSelden v. Airbnb - Complaint 2016-05-18Nancy Leong100% (1)

- Sample Trademark Letter of ProtestDokument3 SeitenSample Trademark Letter of ProtestErik Pelton100% (3)

- Art 804-814 CasesDokument29 SeitenArt 804-814 CasesPrei BaltazarNoch keine Bewertungen

- 08 - Etika ProfesiDokument45 Seiten08 - Etika ProfesiREG.B/0618104021/RIZKY MUHAMMADNoch keine Bewertungen

- 19-03-11 Apple Motion For JMOL On Non-Infringement Willfulness DamagesDokument34 Seiten19-03-11 Apple Motion For JMOL On Non-Infringement Willfulness DamagesFlorian MuellerNoch keine Bewertungen

- Weavers Mills LTD V Balkis AmmalDokument2 SeitenWeavers Mills LTD V Balkis AmmalharshitNoch keine Bewertungen

- Common Law Trusts by Persons Based in Civil Law Jurisdictions: Does New Zealand Offer A Solution?Dokument8 SeitenCommon Law Trusts by Persons Based in Civil Law Jurisdictions: Does New Zealand Offer A Solution?wemoji9738Noch keine Bewertungen

- Capacity, Appointment and Removal of Trustees: ELEMENT 1: State The Parties Element 2: CapacityDokument5 SeitenCapacity, Appointment and Removal of Trustees: ELEMENT 1: State The Parties Element 2: CapacityJusween SatharNoch keine Bewertungen

- EXTRA-JUDICIAL SETTLEMENT OF ESTATE - GideonDokument3 SeitenEXTRA-JUDICIAL SETTLEMENT OF ESTATE - GideonMj ManuelNoch keine Bewertungen

- Surrender of LeaseDokument3 SeitenSurrender of LeaseLegal Forms83% (6)

- Northern Motors v. Sapinoso ruling on barring effects of foreclosureDokument3 SeitenNorthern Motors v. Sapinoso ruling on barring effects of foreclosureNorberto Sarigumba IIINoch keine Bewertungen

- Civil Summons RulesDokument130 SeitenCivil Summons Rulesbarbara3721100% (1)

- Land Titles - Set 3 CompilationDokument29 SeitenLand Titles - Set 3 CompilationnesteamackNoch keine Bewertungen

- EMV 3DS SB255 SpecVersConfig v3 20231221 2Dokument5 SeitenEMV 3DS SB255 SpecVersConfig v3 20231221 2lainey.sebastienNoch keine Bewertungen

- Dan Hils Lawsuit - Initial Complaint - 7-15Dokument17 SeitenDan Hils Lawsuit - Initial Complaint - 7-15WVXU NewsNoch keine Bewertungen

- Video ReleaseDokument1 SeiteVideo ReleaseAngelica TorresNoch keine Bewertungen

- Sappayani vs. Atty. Gasmen - Notarial PracticeDokument2 SeitenSappayani vs. Atty. Gasmen - Notarial PracticeFranchette Kaye LimNoch keine Bewertungen

- Write It Two Times!: Spelling WordsDokument10 SeitenWrite It Two Times!: Spelling WordsDian Nurmala WulansariNoch keine Bewertungen

- Law of Contract ActDokument7 SeitenLaw of Contract ActratenmozenNoch keine Bewertungen

- Numero 8 en A4 Low PolyDokument15 SeitenNumero 8 en A4 Low PolyJesusNoch keine Bewertungen

- Doroteo B. Daguna and Felix D. Carao For Petitioner. Paterno Canlas For Private RespondentsDokument33 SeitenDoroteo B. Daguna and Felix D. Carao For Petitioner. Paterno Canlas For Private Respondentsanon_255172621Noch keine Bewertungen

- Affidavit of ConsentDokument6 SeitenAffidavit of ConsentDeil L. NaveaNoch keine Bewertungen