Beruflich Dokumente

Kultur Dokumente

ABC Level 3 Series 4 2008

Hochgeladen von

Leslie GrayOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ABC Level 3 Series 4 2008

Hochgeladen von

Leslie GrayCopyright:

Verfügbare Formate

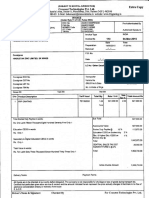

LCCI International Qualifications

Advanced Business Calculations Level 3

Model Answers

Series 4 2008 (3003)

For further information contact us:

Tel. +44 (0) 8707 202909 Email. enquiries@ediplc.com www.lcci.org.uk

Advanced Business Calculations Level 3

Series 4 2008

How to use this booklet Model Answers have been developed by EDI to offer additional information and guidance to Centres, teachers and candidates as they prepare for LCCI International Qualifications. The contents of this booklet are divided into 3 elements: (1) (2) Questions Model Answers reproduced from the printed examination paper summary of the main points that the Chief Examiner expected to see in the answers to each question in the examination paper, plus a fully worked example or sample answer (where applicable) where appropriate, additional guidance relating to individual questions or to examination technique

(3)

Helpful Hints

Teachers and candidates should find this booklet an invaluable teaching tool and an aid to success. EDI provides Model Answers to help candidates gain a general understanding of the standard required. The general standard of model answers is one that would achieve a Distinction grade. EDI accepts that candidates may offer other answers that could be equally valid.

EDI 2009 All rights reserved; no part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise without prior written permission of the Publisher. The book may not be lent, resold, hired out or otherwise disposed of by way of trade in any form of binding or cover, other than that in which it is published, without the prior consent of the Publisher.

QUESTION 1 Rajesh deposits 15,000 in a bank account at 4% per annum simple interest. (a) How much interest will Rajesh have earned after 3 years and 56 days? (4 marks) Rajesh deposits a further 15,000 in another account at 4% per annum compound interest, for the same period. Interest is added annually and at the end of the period, and is calculated as compound interest throughout. (b) How much more interest will Rajesh have earned from this account than from the simple interest account? (6 marks) (Total 10 marks)

MODEL ANSWER TO QUESTION 1 (a) 56 days = 56 / 365 years = 0.15342466 years Interest = PRT/100 = 15,000 x 4 x 3.15342466 / 100 = 1,892.05 (b) Amount = Principle x (1 + percentage rate)Number of years Amount = 15,000 x (1.04)3.15342466 = 16,974.80 Interest = 16,974.80 15,000 = 1,974.80 Greater than simple interest by: 1,974.80 - 1,892.05 = 82.75

3003/4/08/MA

Page 1 of 9

QUESTION 2 Amanda buys shares in three companies and later receives a dividend from each. She tabulates the figures as follows: Number of shares Nominal value of one share Buying price per share Brokers commission Total cost of shares, including commission Dividend (percentage of nominal value) Dividend () Supply the missing figures. (Total 12 marks) Company A 3,000 5 11.72 30 ? 6% ? Company B 12,000 ? 3.71 ? 44,545 9.8% 588 Company C ? 5 232p 40 58,040 ? 1,750

MODEL ANSWER TO QUESTION 2 Number of shares Nominal value of one share Buying price per share Brokers commission Total cost of shares, including commission Dividend (percentage of nominal value) Dividend () Company A Total cost of shares = 3,000 x 11.72 + 30 = 35,190 Dividend = 3,000 x 5 x 6% = 900 Company B Brokers commission = 44,545 (12,000 x 3.71) = 25 Nominal value of one share = 588 / (12,000 x 9.8%) = 0.50 Company C Number of shares = (58,040 - 40) / 2.32 = 25,000 Dividend (%) = 1,750 / (25,000 x 5) = 0.014 = 1.4% Company A 3,000 5 11.72 30 35,190 6% 900 Company B 12,000 0.50 3.71 25 44,545 9.8% 588 Company C 25,000 5 232p 40 58,040 1.4% 1,750

3003/4/08/MA

Page 2 of 9

QUESTION 3 An industrial product may be manufactured by two methods of production. Using Method One, fixed costs are 7,770,000 per period and variable costs are 208 per unit. Using Method Two, fixed costs are 8,750,000 per period and variable costs are 180 per unit. (a) Calculate the level of output per period for which the total costs are the same. (4 marks) (b) State the total cost per period for Method One and Method Two at this output. (2 marks) (c) Using the information provided and your answer to (a) above, state which of the two methods of production will be cheaper for an output of 50,000 units per period. Explain your answer. (2 marks) Method Two is chosen for production, and the product is sold at 250 per unit. (d) Calculate the total income from sales at break-even. (4 marks) (Total 12 marks)

MODEL ANSWER TO QUESTION 3 (a) Let Q be the quantity produced per period Total cost for Method One = 7,770,000 + 208Q Total cost for Method Two = 8,750,000 + 180Q For the same total cost: 7,770,000 + 208Q = 8,750,000 + 180Q Q(208 180) = 8,750,000 7,770,000 Output per period = 980,000 / 28 = 35,000 units (b) Total cost per period = 8,750,000 + 180 x 35,000 = 15,050,000 (c) A production level of 50,000 units per period is higher than the output in (a) and therefore the lower variable unit cost of Method Two will make it cheaper than Method One. (d) Contribution per unit = 250 - 180 = 70 Break even: number of units = 8,750,000 / 70 = 125,000 Total cost of sales = 250 x 125,000 = 31,250,000

3003/4/08/MA

Page 3 of 9

QUESTION 4 At the end of the year 2007 the current ratio for Company P was 3.2 : 1. Its current liabilities were 4,750,000. (a) Calculate the current assets for Company P at that time. (2 marks) At the end of the same year, 2007, Company P had an acid test ratio of 3.0 : 1. (b) Calculate the stock held by Company P at that time. (3 marks) (c) State whether you think the liquidity of Company P was healthy or not. Explain your answer. (3 marks) In the previous year, 2006, the rate of stockturn for Company P was 12. At the start of that year the company held stock to the value of 180,000, and at the end of that year the value of stock held was 150,000. (d) Calculate the net purchases of Company P for that year. (4 marks) The actual purchases for Company P during 2006 were 2,175,000. (e) Calculate the difference between this and your answer to (d), and say what this difference represents. (3 marks) (Total 15 marks) MODEL ANSWER TO QUESTION 4 (a) Current assets = 3.2 x 4,750,000 = 15,200,000 (b) Current assets stock = 3.0 x 4,750,000 = 14,250,000 Stock = 15,200,000 - 14,250,000 = 950,000 (c) The current ratio of the company is greater than 2 The acid test ratio of the company is greater than 1 Each of these is good However, the acid test ratio in particular is a lot higher than the advisory targets, and therefore the current assets of the company could be better used. (d) Average stock = (180,000 + 150,000) = 165,000 Net purchases + opening stock closing stock = 12 x 165,000 Net purchases = 1,980,000 180,000 + 150,000 = 1,950,000 (e) Purchases net purchases = purchase returns = 2,175,000 1,950,000 = 225,000 3003/4/08/MA Page 4 of 9

QUESTION 5 A business owner has a choice of 2 investment projects. The estimated costs and returns are as follows: Cost Year 1 Net cash inflow/(outflow) Year 2 Net cash inflow Year 3 Net cash inflow Year 4 Net cash inflow Project One 2,500,000 500,000 1,200,000 1,200,000 600,000 Project Two 2,000,000 (250,000) 1,500,000 1,500,000 150,000 (3 marks) The payback period for Project One is 2 years 8 months. (b) On the basis of payback, advise the business owner which project is the better investment. Give a reason. (2 marks) The business owner requires that the project chosen must earn a return of at least 15%. (c) Using a discount factor of 15%, and the following table, calculate the net present value for Project Two. Discounting factor Year 1 Year 2 Year 3 Year 4 15% 0.870 0.756 0.658 0.572 (5 marks) Using the same discount factor, Project One has a negative net present value of 25,000. (d) Advise the business owner further, with reasons. (2 marks) (e) A business advisor calculates that the internal rate of return for Project One is 15.2%. Without carrying out further calculations, comment on the advisors figure. (2 marks) (Total 14 marks)

(a) For Project Two calculate the payback period. Give your answer in years and months.

3003/4/08/MA

Page 5 of 9

MODEL ANSWER TO QUESTION 5 (a) Cumulative cash inflow totals for Project Two: Year 1 (250,000) Year 2 1,250,000 Year 3 2,750,000 Year 4 2,900,000

Payback requires years 1 & 2, plus 750,000 during year 3 Number of months = 12 x 750,000 / 1,500,000 = 6 months Hence, payback period for Project Two is 2 years and 6 months (b) On the basis of payback, Project Two requires a shorter time to payback the original investment, and it therefore preferred. (c) Year 0 Year 1 Year 2 Year 3 Year 4 Project Two Initial cost Cash outflow Cash inflow Cash inflow Cash inflow In/outflow D.F. 15% Present value -2,000,000 - 217,500 1,134,000 987,000 85,800 -10,700

2,000,000 1.000 250,000 0.870 1,500,000 0.756 1,500,000 0.658 150,000 0.572 Net present value =

(d)

Neither project meets the requirement of providing a return of 15%. The business owner is therefore advised not to proceed with either project. As the net present value of the project at 15% is negative, then the internal rate of return must be less than 15%, and the advisors figure for internal rate of return is incorrect.

(e)

3003/4/08/MA

Page 6 of 9

QUESTION 6 The following information relates to the business of a bankrupt trader. Cash in hand Creditors Machinery Bank overdraft Trade debtors Stock Office equipment Vehicles Total assets Total liabilities 105 ? 11,500 25,300 6,090 16,420 ? 17,000 59,140 97,500 (4 marks) The assets were realised in full at their book values, listed above. Creditors include 3,700, which, together with the bank overdraft, are secured. Hence, 29,000 of the liabilities, made up of the bank overdraft and other secured creditors, must be paid first and in full. Calculate: (b) the rate in the that an unsecured creditor will receive. (4 marks) (c) the amount owed to an unsecured creditor who receives 13,420. (2 marks) (Total 10 marks)

(a) Calculate the value of her office equipment and the amount owed to creditors.

MODEL ANSWER TO QUESTION 6 (a) Total assets = (105 + 11,500 + 6,090 + 16,420 + office equipment + 17,000) = 59,140 Value of office equipment = 59,140 51,115 = 8,025 Total liabilities = (creditors + 25,300) = 97,500 Owed to creditors= 97,500 25,300 = 72,200 (b) Assets available for unsecured creditors = 59,140 - 29,000 = 30,140 Owed to unsecured creditors = 97,500 - 29,000 = 68,500 Rate payable = 1 x 30,140 / 68,500 = 0.44 (c) Owed to unsecured creditor who receives 13,420 = 13,420 = 30,500 0.44

3003/4/08/MA

Page 7 of 9

QUESTION 7 A factory machine that costs 350,000 is estimated to have a life of 5 years and a scrap value of 25,000. (a) Using the equal instalment method, prepare a depreciation schedule that shows, for each year, the annual depreciation, the accumulated depreciation and the book value at the end of each year. (6 marks) (b) Using the diminishing balance method of depreciation, calculate: (i) (ii) (iii) (iv) the annual rate of depreciation the depreciation in the first year the book value after 3 years the accumulated depreciation after 3 years. (4 marks) (2 marks) (2 marks) (1 mark) (Total 15 marks)

MODEL ANSWER TO QUESTION 7 (a) Annual depreciation = (350,000 - 25,000)

5 = 65,000

Depreciation schedule () End of year 0 1 2 3 4 5 Annual Depreciation 0 65,000 65,000 65,000 65,000 65,000 Accumulated Depreciation 0 65,000 130,000 195,000 260,000 325,000 Book Value 350,000 285,000 220,000 155,000 90,000 25,000

(b) (i) 25,000 / 350,000 = 0.071428571

5

0.071428571 = 0.5898946

1 0.58989 = 0.4101054 (ii) Depreciation in the first year = 350,000 x 0.4101054 = 143,537

(iii) Book value after 3 years = 350,000 x (1 0.4101054)3 = 71,844 (iv) Accumulated depreciation after 3 years = 350,000 71,844 = 278,156

3003/4/08/MA

Page 8 of 9

QUESTION 8 (a) An index of retail prices at January 2008 is shown below: Group Food Housing Fuel and light Durable household goods Clothing and footwear Transport Weight 150 321 82 199 63 185 Index (Jan 2000 = 100) 134.1 187.8 171.5 115.6 94.3 127.1

A statistician calculates the weighted index for the above table to be 146.9. She wishes to know the effect of the increase in food costs on the index. (i) (ii) Calculate the weighted index for the above items that are not Food. (5 marks) Comment in percentage terms on the change in non-food retail prices in the period from January 2000 to January 2008. (3 marks)

(iii) Comment on any difference between your figure and the statisticians weighted figure above. (2 marks) (b) An index of industrial production is shown below: 2006 (2000 =100) 125 2007 (2006=100) 104 (2 marks) (Total 12 marks) MODEL ANSWER TO QUESTION 8 (a) (i) Group Food Housing Fuel and light Durable household goods Clothing and footwear Transport Weighted index = 126,805.6 / 850 = 149.2 (ii) Retail prices, excluding food, increased by 49.2% between January 2000 and January 2008. Weight 150 321 82 199 63 185 850 Index 134.1 187.8 171.5 115.6 94.3 127.1 60,283.8 14,063.0 23,004.4 5,940.0 23,513.5 126,805.6 WxI

Calculate the index of industrial production for 2007 with 2000 = 100.

(iii) The inclusion of food costs has reduced the index by 2.3% of its 2000 value. (b) Index for 2007 with 2000 as the base year = 104 x 125 / 100 = 130

3003/4/08/MA

Page 9 of 9

EDI International House Siskin Parkway East Middlemarch Business Park Coventry CV3 4PE UK Tel. +44 (0) 8707 202909 Fax. +44 (0) 2476 516505 Email. enquiries@ediplc.com www.ediplc.com

3003/4/08/MA

Page 9 of 9

Das könnte Ihnen auch gefallen

- Introduction To Statistics PGDBDokument42 SeitenIntroduction To Statistics PGDBHein Linn KyawNoch keine Bewertungen

- Accounting/Series 2 2007 (Code3001)Dokument16 SeitenAccounting/Series 2 2007 (Code3001)Hein Linn Kyaw100% (3)

- Organization DataDokument23 SeitenOrganization DataHein Linn KyawNoch keine Bewertungen

- Management Accounting/Series-3-2007 (Code3023)Dokument15 SeitenManagement Accounting/Series-3-2007 (Code3023)Hein Linn Kyaw100% (1)

- GMAT Reading ComprehensionDokument5 SeitenGMAT Reading ComprehensionHein Linn KyawNoch keine Bewertungen

- Book Keeping & Accounts/Series-3-2007 (Code2006)Dokument11 SeitenBook Keeping & Accounts/Series-3-2007 (Code2006)Hein Linn Kyaw100% (3)

- Cost Accounting/Series-3-2007 (Code3016)Dokument18 SeitenCost Accounting/Series-3-2007 (Code3016)Hein Linn Kyaw50% (6)

- Advanced Business Calculation/Series-4-2007 (Code3003)Dokument13 SeitenAdvanced Business Calculation/Series-4-2007 (Code3003)Hein Linn Kyaw100% (6)

- Accounting (IAS) /series 4 2007 (Code3901)Dokument17 SeitenAccounting (IAS) /series 4 2007 (Code3901)Hein Linn Kyaw0% (1)

- Book Keeping & Accounts/Series-2-2007 (Code2006)Dokument12 SeitenBook Keeping & Accounts/Series-2-2007 (Code2006)Hein Linn Kyaw100% (2)

- Accounting/Series 3 2007 (Code3001)Dokument18 SeitenAccounting/Series 3 2007 (Code3001)Hein Linn KyawNoch keine Bewertungen

- Management Accounting: Level 3Dokument18 SeitenManagement Accounting: Level 3Hein Linn Kyaw100% (3)

- Management Accounting Level 3: LCCI International QualificationsDokument14 SeitenManagement Accounting Level 3: LCCI International QualificationsHein Linn Kyaw50% (2)

- Book-Keeping and Accounts/Series-4-2011 (Code2007)Dokument16 SeitenBook-Keeping and Accounts/Series-4-2011 (Code2007)Hein Linn Kyaw100% (1)

- Book Keeping & Accounts/Series-4-2007 (Code2006)Dokument13 SeitenBook Keeping & Accounts/Series-4-2007 (Code2006)Hein Linn Kyaw100% (2)

- Accounting/Series 4 2007 (Code3001)Dokument17 SeitenAccounting/Series 4 2007 (Code3001)Hein Linn Kyaw100% (2)

- Management Accounting/Series-4-2011 (Code3024)Dokument18 SeitenManagement Accounting/Series-4-2011 (Code3024)Hein Linn Kyaw100% (2)

- Business Statstics/Series-4-2011 (Code3009)Dokument18 SeitenBusiness Statstics/Series-4-2011 (Code3009)Hein Linn KyawNoch keine Bewertungen

- Cost Accounting/Series-4-2011 (Code3017)Dokument17 SeitenCost Accounting/Series-4-2011 (Code3017)Hein Linn Kyaw100% (2)

- Advanced Business Calculations/Series-4-2011 (Code3003)Dokument12 SeitenAdvanced Business Calculations/Series-4-2011 (Code3003)Hein Linn Kyaw100% (12)

- Cost Accounting Level 3: LCCI International QualificationsDokument20 SeitenCost Accounting Level 3: LCCI International QualificationsHein Linn Kyaw33% (3)

- Business Statistics Level 3: LCCI International QualificationsDokument22 SeitenBusiness Statistics Level 3: LCCI International QualificationsHein Linn Kyaw100% (1)

- Lcci Level3 Solution Past Paper Series 3-10Dokument14 SeitenLcci Level3 Solution Past Paper Series 3-10tracyduckk67% (3)

- Advanced Business Calculations/Series-3-2011 (Code3003)Dokument15 SeitenAdvanced Business Calculations/Series-3-2011 (Code3003)Hein Linn Kyaw86% (21)

- Code 2007 Accounting Level 2 2010 Series 4Dokument15 SeitenCode 2007 Accounting Level 2 2010 Series 4apple_syih100% (1)

- 2011 LCCI Accounting IAS Level-3 Series 2 (Code 3902)Dokument17 Seiten2011 LCCI Accounting IAS Level-3 Series 2 (Code 3902)Hon Loon Seum100% (6)

- Business Statistics Level 3: LCCI International QualificationsDokument19 SeitenBusiness Statistics Level 3: LCCI International QualificationsHein Linn Kyaw100% (1)

- Management Accounting: Level 3Dokument18 SeitenManagement Accounting: Level 3Hein Linn KyawNoch keine Bewertungen

- Accounting Level 3: LCCI International QualificationsDokument17 SeitenAccounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (4)

- Management Accounting Level 3: LCCI International QualificationsDokument17 SeitenManagement Accounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Grove RT870 PDFDokument22 SeitenGrove RT870 PDFjcpullupaxi50% (2)

- R WaseemDokument3 SeitenR WaseemWaseem RajaNoch keine Bewertungen

- Cows and ChickensDokument9 SeitenCows and Chickensapi-298565250Noch keine Bewertungen

- Continue or Eliminate AnalysisDokument3 SeitenContinue or Eliminate AnalysisMaryNoch keine Bewertungen

- Targeting and Positioning in Rural MarketDokument17 SeitenTargeting and Positioning in Rural MarketPallavi MittalNoch keine Bewertungen

- Lab Titration of VinegarDokument5 SeitenLab Titration of Vinegardesree07Noch keine Bewertungen

- HZL 4100070676 Inv Pay Slip PDFDokument12 SeitenHZL 4100070676 Inv Pay Slip PDFRakshit KeswaniNoch keine Bewertungen

- Hunslet War DPT 3240Dokument3 SeitenHunslet War DPT 3240pacolopez888Noch keine Bewertungen

- TRH 14 ManualDokument22 SeitenTRH 14 ManualNelson KachaliNoch keine Bewertungen

- CH 12Dokument27 SeitenCH 12DewiRatihYunusNoch keine Bewertungen

- Dolly Madison Zingers (Devil's Food)Dokument2 SeitenDolly Madison Zingers (Devil's Food)StuffNoch keine Bewertungen

- B1342 SavantICDokument3 SeitenB1342 SavantICSveto SlNoch keine Bewertungen

- ELS4 Examples From Oys YdsDokument1 SeiteELS4 Examples From Oys YdsKranting TangNoch keine Bewertungen

- Barwani PDFDokument13 SeitenBarwani PDFvishvarNoch keine Bewertungen

- Problem Set3Dokument4 SeitenProblem Set3Jack JacintoNoch keine Bewertungen

- Godrej Presentation FinalDokument21 SeitenGodrej Presentation FinalAkshay MunotNoch keine Bewertungen

- RSKMGT NIBM Module Operational Risk Under Basel IIIDokument6 SeitenRSKMGT NIBM Module Operational Risk Under Basel IIIKumar SkandaNoch keine Bewertungen

- Valeant Case SummaryDokument2 SeitenValeant Case Summaryvidhi100% (1)

- Managenet AC - Question Bank SSDokument18 SeitenManagenet AC - Question Bank SSDharshanNoch keine Bewertungen

- 2.strategic IntentDokument23 Seiten2.strategic IntentAnish ThomasNoch keine Bewertungen

- Chp14 StudentDokument72 SeitenChp14 StudentChan ChanNoch keine Bewertungen

- Solution Manual For Cost Accounting Foundations and Evolutions Kinney Raiborn 9th EditionDokument36 SeitenSolution Manual For Cost Accounting Foundations and Evolutions Kinney Raiborn 9th Editionsaxonic.hamose0p9698% (49)

- Month To Go Moving ChecklistDokument9 SeitenMonth To Go Moving ChecklistTJ MehanNoch keine Bewertungen

- Economic Risk Analysis - ICRG Index BRAZILDokument6 SeitenEconomic Risk Analysis - ICRG Index BRAZILAthira PanthalathNoch keine Bewertungen

- Roll of Entrepreneurs in Indian EconomyDokument14 SeitenRoll of Entrepreneurs in Indian EconomySāĦılKukrējāNoch keine Bewertungen

- FCE Letter SampleDokument3 SeitenFCE Letter SampleLeezukaNoch keine Bewertungen

- FRBM Act: The Fiscal Responsibility and Budget Management ActDokument12 SeitenFRBM Act: The Fiscal Responsibility and Budget Management ActNaveen DsouzaNoch keine Bewertungen

- Chem Practical QuestionsDokument3 SeitenChem Practical QuestionsSajal GargNoch keine Bewertungen

- Cash Budget Model Cash Budget Model - Case Study: InflowsDokument1 SeiteCash Budget Model Cash Budget Model - Case Study: Inflowsayu nailil kiromahNoch keine Bewertungen

- TFG Manuel Feito Dominguez 2015Dokument117 SeitenTFG Manuel Feito Dominguez 2015Yenisel AguilarNoch keine Bewertungen