Beruflich Dokumente

Kultur Dokumente

Agricultural Project Planning and Analysis Sourcebook

Hochgeladen von

sagugu20004394Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Agricultural Project Planning and Analysis Sourcebook

Hochgeladen von

sagugu20004394Copyright:

Verfügbare Formate

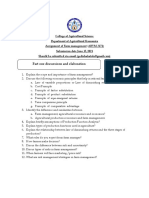

Agricultural Project Planning and Analysis:

A Sourcebook

Second edition

Edited by

P Anandajayasekeram

CJ Van Rooyen

F Liebenberg

Emblems in the following order:

UP University of Ghent FARMESA IFPRI

April 2004

Spine of the Book

Anandajayasekeram

Van Rooyen

Liebenberg

Agricultural Project Planning and

Analysis:

A Sourcebook

Second Edition

April 2004

i

Agricultural Project Planning and Analysis: A Sourcebook

Second edition

Contributors

1

1

Listed alphabetically

:

P. Anandajayasekeram, International Food Policy Research Institute (Co-Project Leader)

M. DHaese, University of Ghent, Belgium

L. DHaese, University of Ghent and Antwerp, Belgium

F. Liebenberg, Agricultural Research Council of South Africa

C. Marasas, Agricultural Research Council of South Africa

M. Rukuni, WK Kellogg Foundation

CJ. Van Rooyen, University of Pretoria (Project Leader)

ACKNOWLEDGEMENT

This Sourcebook is the product of a Network Activity Program, coordinated by the University of Pretoria, that

forms part of the Institutional University Cooperation (IUC) between the Flemish Universities of Belgium and

several universities in Africa. The Network Activity Program was initiated with a workshop in Pretoria where a

course outline for a post-graduate course in agricultural project planning, management, evaluation and impact

analysis, was elaborated. This workshop was attended by academics from the African Universities of Pretoia,

Natal, The North, Fort Hare, Zambia, Zimbabwe, Burundi, and Sokoine University of Agriculture in Tanzania,

as well as respresentatives of FAO-FARMESA in Zimbabwe, the Agricultural Research Council of SA, and

LIMA (an NGO involved in rural development). The Course outline was further refined by a task team before

being circulated and proposals for writing envited.

The Network Activity is funded by the Belgian Government via the Flemish Inter-University Council.

African Coordinator: Johann Kirsten, University of Pretoria

Flemish Coordinator: Luc DHaese, Universities of Ghent and Antwerp

ii

PREFACE TO SECOND EDITION:

This is the second edition of a book originally published in 2003. The sourcebook was a product of the

Institutional University Co-operation (IUC) between the Flemish university of Belgium and several universities

in Eastern, Central and Southern Africa. The sourcebook was developed to address the felt needs of the

agricultural higher learning institutions. It is written for undergraduate and graduate students, and for

development practitioners who are concerned with project planning, implementation and evaluation including

impact assessment. The sourcebook is based on the notion of project cycle, with heavy emphasis on planning

and evaluation. A unique feature of this sourcebook is that it addresses both the research projects and

development projects geared towards broad based agricultural and rural development.

Currently the book is being used by a number of universities as a textbook, and in some international workshops

on Monitoring, Evaluation and Impact Assessment as a sourcebook for reading. The feedback and comments

from the users are very positive and encouraging. As we ran out of copies, it was decided to revise the first

edition before printing additional copies. The revision has also provided an opportunity to incorporate some

additional materials based on the recent developments. As a result while maintaining the initial structure,

number of new sections were added in order to make the book ever green.

In a fast moving world the business environment is rapidly changing and becoming increasingly complex and

unpredictable. The new generation of managers is facing the task of creating a balance between stability

necessary to allow development of strategic planning and decision process and instability that allows continuous

change and adaptation to dynamic environment. Scenario planning is a tool which has been successfully used to

handle the rapidly changing environment for anticipating and managing change especially the notion of

uncertainty. This technique is applicable to virtually any situation in which a decision maker would like to

imagine how the future might unfold. Therefore an additional chapter was included to describe the various steps

involved in scenario planning; which should be considered as part of or extension of conventional strategic

planning.

When dealing with Monitoring and Evaluation, in the first edition of the book much attention was paid to

progress monitoring. Because of the emergence of the participatory approaches and processes, in the recent past

a distinction has been made between process monitoring and progress monitoring. Conventional progress

monitoring focuses on physical, financial and logistical aspects of projects whereas process monitoring deals

with critical processes which are directly related to project objectives. An ideal M&E system should contain

elements of both process and progress monitoring. Therefore an additional section on process monitoring is

included in chapter 12 to take care of this deficiency

The three basic issues that need to be taken care of, in any empirical impact study of R&D investment are

causality, attribution and incrementality. The attribution problem is a difficult one to deal with, and it arises

when one believes, or tries to claim that program has resulted in certain outcomes and alternative plausible

explanation exist. A number of strategies can be used to address the attribution issue which are collectively

called contribution analysis. Therefore, a section covering contribution analysis is included in chapter 21,

Strategies for Impact Assessment.

In the first edition of the sourcebook much emphasis was placed on projects an program planning and

evaluation; where no attention was paid to the evaluation of organizations. In the recent past, organizations

have become more and more complex and especially the R&D organizations are undergoing rapid and frequent

changes especially in Sub-Saharan Africa. This has lead to the need for organizational performance assessment.

Organizations provide the context in which virtually all work behaviour occurs, as such can be viewed as a

major element of the environment affecting work behaviour, individual performance as well as goal attainment.

Evaluators are often asked to assess the organizations as part of the overall evaluation process. This field is fast

developing. Therefore a new chapter is included to over the methods and approaches used in organizational

performance assessment.

In the revised edition we still tried to maintain the original structure of the sourcebook. Part I deals with

methods and approaches for the planning and analysis of agricultural projects. The three important aspects of

project management namely the management of money flows, procurements and managing of materials, and

human resources management are also discussed in this section. Cost-benefit analysis methodology is discussed

as an approach to appraise and evaluate projects.

Part II includes five chapters dealing with strategic planning and priority setting. As a result of declining

funding, and emerging alternative funding mechanisms (especially competitive funding) to support agricultural

research, the issue of planning and priority setting has become much more relevant today then ever before. In

dealing with planning and priority setting due consideration is given to both agricultural research projects and

development oriented projects; supply led approaches and participatory demand driven approaches. All three

iii

aspects project planning, program planning and strategic planning are discussed in this section, and a new

chapter on scenario planning has been included.

Part III deals with the various aspects of R&D evaluation. The concepts of monitoring, evaluation and impact

assessment are defined and a framework for comprehensive impact assessment of R&D projects is developed in

Chapter 12. A distinction between process monitoring and progress monitoring was made, and the types of

evaluations were defined in relation to project cycle. In Chapter 13 an attempt was made to differentiate

evaluation research and research evaluation and the desirable attribution of a good evaluation is discussed.

Topics such as overview of evaluation activities, utilization focused evaluation, participatory evaluation,

evaluation as a research management tool, overview of R&D evaluation methods; management information

systems (MIS), and Design considerations for an M&E system are also discussed in this selection.

In Part IV of the sourcebook, a wide array of R&D impact assessment methods (especially rate of returns

estimates) are discussed, ranging from simple to complex, and from data hungry to qualitative methods. This

part of the sourcebook confines discussions to ex-post impact assessment methods. Chapter 21 sets the context

by looking at various strategies that impact on the capacity to measure and dwells on the issues of data

collection. The importance of having either cross-sectional or time-series data is discussed here. An

overview of the methods is outlined in Chapter 22.

Chapter 23 covers some of the most rigorous methods and some of the most widely used approaches for

economic impact assessment. The economic surplus approaches require a considerable amount of technical

expertise and data. Chapters 23 and 24 cover methods that are being used to a varying degree and with different

level of rigour. These include respectively the Cost saving method, the Index Number method and the

Production Function approach.

The last three Chapters in this Part discuss important issues which are often of interest to those decision makers

who sponsor research and its impact assessment. The issue of spill-overs is discussed in Chapter 25 and the

main point here is the recognition that R&Ds impact often go beyond intended physical, economic and

technological boundaries. The issue of research impacts on the environment is today such an obvious hot topic

and this is covered in Chapter 26. Once again the issue of participation is covered in Chapter 27. Increasingly

policymakers and donors are also very much concerned about organizational performance. The issues and

approaches for organization Performance Assessment are addressed in Chapter 28.

The reader is reminded that donors, financiers and beneficiary stakeholders are ultimately interested in ex-post

impact of their investments. The reader may not have all the technical expertise for each method discussed, but

the important things is to be familiar, and to remember that most of the time the application of such methods

requires a team of people and data and that it is the point at which people with requisite expertise are recruited

for the task. In addition, the importance of topical issues as the environment and participation are still

paramount whatever methods are used.

Part V of the sourcebook is a collection of other relevant topics and methods that could facilitate project

planning and analysis. One challenge is assessing agricultural development projects and programs with multiple

layers of objectives. Multi-Criteria Analysis as discussed in Chapter 29 can be appropriate for such need. The

other situation concerns impact assessment of benefits and costs of natural resources and the environment.

Chapter 34 discusses non-market valuation approaches that can be useful in this situation. The Delphi Method

in Chapter 32 is also a special purpose estimation approach for various situations.

The growing importance of participatory process in agricultural development is also shown in Chapter 30. This

Chapter is a comprehensive collection and discussion of various participatory approaches. The reader is

encouraged to treasure and periodically refer to this Chapter because it is a rare collection of what is found

generally in the literature. Chapter 31 is targeted at those scientists who would like to use their trial data for

purposes of assessing economic and social impacts. This Chapter discusses such simple methods that non-

economists can use and in this regard the reader, if a non-economist, should take advantage to familiarize

oneself with these simple but effective evaluation tools. Adoption studies are discussed in Chapter 33 and the

issue of adoption is key to the understanding of how research results lead to higher productivity of farmers and

eventually lead to progress through greater food security and income generation by scientists and managers.

Finally, the intention of the authors is to further field test this sourcebook and based on the comments and

feedback periodically revise in order to incorporate the latest developments in the field of project planning

analysis and impact assessment. In addition attempts will also be made to develop field level case studies to

complement this sourcebook. Therefore, readers are encouraged to provide feedback and constructive

comments for the continuous development of this sourcebook. Your inputs are very much appreciated.

Editors

TABLE OF CONTENTS

_____________________________________________________________

iii

TABLE OF CONTENTS

ACKNOWLEDGEMENT ......................................................................................................................... i

PREFACE ................................................................................................................................................. ii

TABLE OF CONTENTS ......................................................................................................................... iv

LIST FIGURES ...................................................................................................................................... xiv

LIST OF TABLES................................................................................................................................... xv

LIST OF BOXES ................................................................................................................................... xvii

PART I GUIDELINES FOR THE PLANNING AND ECONOMIC APPRAISAL OF

AGRICULTURAL DEVELOPMENT PROJECTS........................................................... 1

CHAPTER 1 THE PROJECT CONCEPT..................................................................................... 2

1.1 INTRODUCTION............................................................................................................................. 2

1.2 AGRICULTURAL DEVELOPMENT PROJECTS DEFINED ................................................................... 2

1.3 CLASSIFICATION OF DEVELOPMENT PROJECTS............................................................................. 3

1.3.1 Projects aimed at technological innovation ........................................................................ 3

1.3.2 Expanding the natural resource base .................................................................................. 4

1.3.3 Improvement in the living conditions of previously disadvantaged groups ......................... 4

1.3.4 Improved market infrastructure........................................................................................... 4

1.3.5 Institutional capacity development ...................................................................................... 4

1.3.6 Multifunctional investment projects .................................................................................... 4

1.3.7 Policy and institutional reforms .......................................................................................... 5

1.4 AGRICULTURAL DEVELOPMENT PROJECTS: THE CUTTING EDGE OF RURAL DEVELOPMENT? ..... 5

1.5 ANALYTICAL ASPECTS OF THE PROJECT APPROACH.................................................................... 7

1.5.1 The project cycle.................................................................................................................. 7

1.5.2 Project modules a framework of analysis......................................................................... 9

CHAPTER 2 PROJECT PLANNING METHODOLOGY ........................................................ 12

2.1 INTRODUCTION ........................................................................................................................... 12

2.2 LOGICAL FRAMEWORK ANALYSIS (LFA) ................................................................................... 12

2.2.1 The origins of LFA ............................................................................................................. 12

2.2.2 LFA - A participative tool .................................................................................................. 12

2.2.3 LFA - Its potential and its limitations ................................................................................ 13

2.2.4 LFA - Its scope ................................................................................................................... 13

2.2.5 LFA: A tool for the planning of change ............................................................................ 13

2.3 THE LFA PROCESS ..................................................................................................................... 13

2.3.1 The project context ............................................................................................................ 13

2.3.2 The analytical phase .......................................................................................................... 13

2.3.3 The planning phase: Completing the logframe matrix ...................................................... 19

2.4 THE ADVANTAGES OF LFA AS A PLANNING TOOL ..................................................................... 30

CHAPTER 3 PROJECT APPRAISAL THROUGH COST-BENEFIT ANALYSIS ............... 32

3.1 INTRODUCTION ........................................................................................................................... 32

3.1.1 Historical evolution of cost-benefit analysis methodology ................................................ 32

3.2 THE NATURE OF COST-BENEFIT ANALYSIS (CBA) .................................................................... 32

3.2.1 Private sector and public sector investment ...................................................................... 32

3.2.2 Project analysis from different viewpoints: financial, economic and social analysis ....... 33

3.3 COST-BENEFIT ANALYSIS IN THE PUBLIC SECTOR AND PROFIT DETERMINATION IN THE PRIVATE

SECTOR ................................................................................................................................................... 35

3.4 CONSIDERATIONS AND APPLICATION OF COST-BENEFIT ANALYSIS ............................................. 37

3.5 A STEP-BY-STEP APPROACH TO COST BENEFIT ANALYSIS ........................................................... 39

CHAPTER 4 THE APPLICATION OF COST-BENEFIT ANALYSIS METHODOLOGY .. 43

4.1 INTRODUCTION ........................................................................................................................... 43

4.2 IDENTIFYING AND DESCRIBING PROJECT COSTS AND BENEFITS ................................................. 43

iv

4.2.1 Objectives, costs and benefits ............................................................................................ 43

4.2.2 Costs of agricultural projects ............................................................................................ 44

4.2.3 Direct and tangible benefits of agricultural projects ........................................................ 44

4.2.4 Secondary costs and benefits ............................................................................................. 46

4.2.5 Intangible costs and benefits ............................................................................................. 46

4.3 VALUE DETERMINATION OF COSTS AND BENEFITS .................................................................... 46

4.3.1 Prices in cost-benefit analysis ........................................................................................... 46

4.3.2 Finding the correct market prices ..................................................................................... 47

4.3.3 Predicting future prices ..................................................................................................... 48

4.3.4 Pricing for internationally traded commodities ................................................................ 49

4.3.5 Economic analysis the use of shadow prices .................................................................. 50

4.3.6 Principles in the calculation of shadow prices .................................................................. 51

4.3.7 General problems with the determination of shadow prices ............................................. 52

4.4 DETERMINING THE VALUES OF INPUTS AND OUTPUTS ............................................................... 53

4.4.1 Classification of inputs ...................................................................................................... 53

4.4.2 Tradable and non-tradable goods ..................................................................................... 55

4.5 STEPS IN THE DETERMINING OF SHADOW PRICES ........................................................................ 56

4.6 COMPARING BENEFITS AND COSTS (PROJECT DECISION-MAKING CRITERIA) ............................. 59

4.6.1 Definition of terms ............................................................................................................. 59

4.6.2 Project assessment criteria ................................................................................................ 61

4.6.3 Applications of measures ................................................................................................... 62

4.6.4 Sensitivity analysis ............................................................................................................. 62

4.6.5 Switching values ................................................................................................................ 63

4.6.6 Decision Criteria Under Risk ............................................................................................ 63

4.7 EXTERNALITIES .......................................................................................................................... 63

4.8 BENEFIT-COST APPROACH AND RESEARCH INVESTMENT .......................................................... 63

4.8.1 Adoption rate/diffusion rate ............................................................................................... 64

4.8.2 Probability of success of a research effort ........................................................................ 64

4.8.3 Benefit flow period life of project ................................................................................... 64

4.8.4 Note on distortions ............................................................................................................ 64

4.9 SUMMARY: A SCHEMATIC REPRESENTATION OF THE CBA PROCESS ......................................... 65

CHAPTER 5 THE MANAGEMENT OF PROJECTS: FINANCES, MATERIALS AND

HUMAN RESOURCES .......................................................................................................................... 68

5.1 INTRODUCTION ........................................................................................................................... 68

5.2 PROJECT OBJECTIVES ................................................................................................................. 68

5.2.1 History of the project management .................................................................................... 68

5.2.2 Management by objectives (MBO) .................................................................................... 69

5.2.3 Management by exception (MBE) ..................................................................................... 69

5.2.4 The project managers job title and role in the organisation ............................................ 69

5.3 PLANNING AND SCHEDULING ..................................................................................................... 70

5.3.1 The planning and scheduling environment ........................................................................ 70

5.3.2 Distinction between planning and scheduling ................................................................... 72

5.3.3 The planning time frame .................................................................................................... 72

5.3.4 Benefits of a project planning and control system ............................................................. 73

5.4 BAR CHARTS AND GANTT CHARTS ............................................................................................ 74

5.5 NETWORK DIAGRAMS ................................................................................................................ 74

5.5.1 Activity duration ................................................................................................................ 75

5.5.2 PERT ................................................................................................................................. 75

5.5.3 Critical path method .......................................................................................................... 76

5.5.4 ADM or PDM that is the question ..................................................................................... 76

5.6 CRITICAL PATH ANALYSIS USING ARROW DIAGRAMS ............................................................... 77

5.7 TIME COST TRADE-OFF .............................................................................................................. 80

5.8 EXAMPLE AND EXERCISES ......................................................................................................... 82

5.9 MANAGING MONEY ................................................................................................................... 84

5.9.1 Phasing expenditure budgets ............................................................................................. 85

5.9.2 Interpreting expenditure data ............................................................................................ 89

5.9.3 Financial records .............................................................................................................. 89

5.9.4 Budgetary methods ............................................................................................................ 90

5.10 PROCUREMENT AND MANAGING MATERIALS ............................................................................ 91

v

5.10.1 Consistency of procurement .............................................................................................. 92

5.10.2 Getting the right things ...................................................................................................... 93

5.10.3 Buying the right quantities ................................................................................................ 93

5.10.4 Ordering at the right time .................................................................................................. 94

5.10.5 Moving materials cost-effectively ...................................................................................... 96

5.10.6 The procurement cycle ....................................................................................................... 98

5.10.7 Paying for imported materials ........................................................................................... 98

5.10.8 Procurement and project scheduling ................................................................................. 99

5.11 HUMAN RESOURCES AND PERSONNEL MANAGEMENT ............................................................... 99

5.11.1 The role of personnel management .................................................................................... 99

5.11.2 Recruitment ...................................................................................................................... 100

5.11.3 Selection .......................................................................................................................... 100

5.11.4 Training and development ............................................................................................... 101

5.11.5 Evaluation of training programmes ................................................................................. 103

5.11.6 Personnel management and employment legislation ....................................................... 103

5.11.7 Summary .......................................................................................................................... 104

CHAPTER 6 POLICY ASPECTS OF PROJECT ANALYSIS ................................................ 105

6.1 INTRODUCTION ......................................................................................................................... 105

6.2 STRATEGIC CONSIDERATIONS .................................................................................................. 105

6.3 REQUIRED SUB SECTOR EXPERTISE .......................................................................................... 106

6.4 GOOD POLICIES VERSUS GOOD PROJECTS ............................................................................... 106

6.5 FIRST-BEST VERSUS SECOND-BEST SHADOW PRICES .............................................................. 107

6.6 POLICY ANALYSIS AND THE THEORY OF MARKET FAILURE ..................................................... 110

6.6.1 Scarcity of intervention capacity ..................................................................................... 111

6.6.2 Rationing of intervention capacity ................................................................................... 111

6.7 ACCOMMODATING OPERATIONAL AND POLITICAL CONSIDERATIONS ...................................... 111

PART II STRATEGIC PLANNING AND PRIORITY SETTING IN RESEARCH AND

DEVELOPMENT PROJECTS ............................................................................................................ 115

CHAPTER 7 RESEARCH PLANNING ..................................................................................... 116

7.1 INTRODUCTION ......................................................................................................................... 116

7.2 PLANNING ................................................................................................................................ 116

7.3 LEVELS OF PLANNING .............................................................................................................. 116

7.4 PROGRAM PLANNING ............................................................................................................... 117

7.4.1 Sub-sector review. ........................................................................................................... 118

7.4.2 Constraint analysis .......................................................................................................... 118

7.4.3 Evaluation of existing research results ............................................................................ 118

7.4.4 Determination of research objectives and strategy ......................................................... 118

7.4.5 Identification of research projects ................................................................................... 119

7.4.6 Priority setting ................................................................................................................. 119

7.4.7 Human resource gap analysis ......................................................................................... 119

7.4.8 Recommendation and implementation ............................................................................. 119

7.5 PROJECT PLANNING .................................................................................................................. 120

7.6 PLANNING SOCIO-ECONOMIC TYPES OF PROJECTS .................................................................. 126

7.6.1 Steps in the conduct of surveys ........................................................................................ 126

7.6.2 Sampling .......................................................................................................................... 127

7.6.3 Developing a questionnaire ............................................................................................. 130

7.6.4 Interviewing ..................................................................................................................... 131

7.6.5 Methodological and logistical issues ............................................................................... 132

7.6.6 Fieldwork design ............................................................................................................. 132

7.6.7 Special problems in the field

........................................................................................... 132

CHAPTER 8 RESEARCH PRIORITY SETTING METHODS .............................................. 134

8.1 INTRODUCTION ......................................................................................................................... 134

8.2 DIFFERENT LEVELS OF PRIORITY SETTING ............................................................................... 134

8.3 NEED FOR PRIORITY SETTING ................................................................................................... 135

vi

8.4 APPROACHES TO PRIORITY SETTING ........................................................................................ 136

8.4.1 Based on historical trend ................................................................................................. 136

8.4.2 Top-down approach ......................................................................................................... 136

8.4.3 Bottom-up approach ........................................................................................................ 136

8.5 PRIORITY SETTING METHODS .................................................................................................. 136

8.5.1 Supply oriented methods .................................................................................................. 137

8.5.2 Demand oriented methods ............................................................................................... 143

8.6 DIFFICULTIES IN APPLYING PRIORITY SETTING METHODS ....................................................... 147

CHAPTER 9 STRATEGIC PLANNING ................................................................................... 149

9.1 INTRODUCTION ......................................................................................................................... 149

9.2 DEFINITION OF STRATEGIC PLANNING ..................................................................................... 149

9.3 PURPOSE OF STRATEGIC PLANNING .......................................................................................... 149

9.4 PLANNING TO PLAN .................................................................................................................. 150

9.5 PROCESS OF STRATEGIC PLANNING ........................................................................................... 150

9.5.1 Steps in the process ......................................................................................................... 151

9.6 CONDITIONS FOR SUCCESS ....................................................................................................... 157

CHAPTER 10 COMPONENTS OF A STRATEGIC PLAN ..................................................... 159

10.1 INTRODUCTION ......................................................................................................................... 159

10.2 MISSION ................................................................................................................................... 160

10.2.1 Purpose of mission .......................................................................................................... 160

10.2.2 Characteristics of an effective mission ............................................................................ 161

10.3 FORMULATING OBJECTIVES ...................................................................................................... 162

10.4 OBJECTIVE SETTING ................................................................................................................. 162

10.5 CRITERIA FOR OBJECTIVE-SETTING .......................................................................................... 163

10.6 FORMULATING POLICIES ........................................................................................................... 163

10.6.1 Basic characteristics of an effective policy are: .............................................................. 163

10.6.2 Types of policies .............................................................................................................. 163

10.7 VALIDATING THE MISSION, OBJECTIVES AND POLICIES ............................................................. 164

10.8 FORMULATING STRATEGIES ..................................................................................................... 164

CHAPTER 11 SCENARIO PLANNING ..................................................................................... 167

11.1 INTRODUCTION ......................................................................................................................... 167

11.2 WHAT IS SCENARIO PLANNING ................................................................................................. 167

11.3 EVOLUTION OF SCENARIO PLANNING ....................................................................................... 170

11.4 TYPES OF SCENARIOS ............................................................................................................... 170

11.5 STEPS IN SCENARIO PLANNING ................................................................................................. 171

11.6 PRINCIPLES OF SCENARIO THINKING ........................................................................................ 179

11.7 MODELS OF CARRYING OUT SCENARIO PLANNING. ................................................................... 180

11.8 LESSONS AND EXPERIENCES: .................................................................................................... 180

PART III RESEARCH AND DEVELOPMENT EVALUATION ............................................. 182

CHAPTER 12 MONITORING, EVALUATION AND IMPACT ASSESSMENT .................. 183

12.1 INTRODUCTION ......................................................................................................................... 183

12.2 MONITORING ............................................................................................................................ 183

12.3 PROCESS MONITORING ............................................................................................................. 184

12.3.1 Key feature of Process Monitoring .................................................................................. 187

12.3.2 Key steps in Process Monitoring ..................................................................................... 187

12.3.3 Developing Process Monitoring Indicators ..................................................................... 190

12.4 EVALUATION ............................................................................................................................ 191

12.5 TYPES OF EVALUATION ............................................................................................................ 191

12.5.1 Ex-ante evaluation ........................................................................................................... 192

12.5.2 On-going evaluation ........................................................................................................ 192

12.5.3 Ex-post evaluation (immediately after the completion) ................................................... 192

12.5.4 Impact evaluation ............................................................................................................ 193

12.6 MEANING OF IMPACT ............................................................................................................... 193

12.7 PURPOSE OF IMPACT ASSESSMENT ........................................................................................... 194

vii

12.8 IMPACT CHAIN ......................................................................................................................... 194

12.8.1 Collaborative activities .................................................................................................... 194

12.8.2 Outputs ............................................................................................................................ 194

12.8.3 Immediate outcome .......................................................................................................... 194

12.8.4 Intermediate outcome ...................................................................................................... 196

12.8.5 Ultimate outcome (impact) .............................................................................................. 196

12.9 TYPES OF IMPACT ..................................................................................................................... 197

12.10 OVERVIEW OF IMPACT ASSESSMENT METHODS ................................................................... 199

12.10.1 Direct product of research - effectiveness analysis ..................................................... 199

12.10.2 Evaluating the impact of intermediate product(s) ....................................................... 200

12.10.3 People level impact ...................................................................................................... 200

12.11 MULTI-CRITERIA ANALYSIS ................................................................................................. 202

CHAPTER 13 EVALUATION RESEARCH VS RESEARCH EVALUATION ..................... 203

13.1 INTRODUCTION ......................................................................................................................... 203

13.2 EVALUATION ............................................................................................................................ 203

13.3 PURPOSE OF EVALUATION ........................................................................................................ 204

13.4 CHARACTERISTICS OF EVALUATION ......................................................................................... 204

13.5 EVALUATION PROCESSES AND CONTENT ................................................................................. 205

13.6 EVALUATION OF RESEARCH AND RESEARCH SYSTEMS ............................................................ 205

13.7 CLASSES OF EVALUATION RESEARCH ...................................................................................... 206

13.7.1 Program conceptualisation and design ........................................................................... 206

13.7.2 Monitoring and accountability of program implementation ............................................ 206

13.7.3 Assessment of program utility .......................................................................................... 207

CHAPTER 14 OVERVIEW OF EVALUATION ACTIVITIES ............................................... 209

14.1 INTRODUCTION ......................................................................................................................... 209

14.2 CATEGORIES OF PROJECT EVALUATION ................................................................................... 209

14.2.1 Evaluation of innovative projects .................................................................................... 209

14.2.2 Evaluation for fine tuning of projects .............................................................................. 209

14.2.3 Evaluation of established programs ................................................................................ 209

14.3 INNOVATIVE EVALUATION ACTIVITIES .................................................................................... 209

14.3.1 Operationalising objectives for the program ................................................................... 210

14.3.2 Defining the target population ......................................................................................... 210

14.3.3 Designing a delivery system ............................................................................................ 210

14.3.4 Assessing impact and estimating efficiency ..................................................................... 211

14.4 FINE-TUNING ESTABLISHED PROGRAMS .................................................................................. 211

14.4.1 Re-appraising objectives and outcomes .......................................................................... 211

14.4.2 Reputability assessments ................................................................................................. 211

14.4.3 Program re-planning and re-design ................................................................................ 212

14.5 EVALUATING ESTABLISHED PROGRAMS .................................................................................. 212

14.5.1 The evaluability perspective ............................................................................................ 212

14.5.2 Evaluability assessments ................................................................................................. 212

14.6 KEY DIFFERENCES ................................................................................................................... 213

CHAPTER 15 UTILIZATION FOCUSSED EVALUATION ................................................... 215

15.1 INTRODUCTION ......................................................................................................................... 215

15.2 STEPS IN UTILIZATION FOCUSSED EVALUATION ...................................................................... 215

15.3 SUMMARY OF STEPS IN A UTILIZATION FOCUSSED EVALUATION ............................................. 217

CHAPTER 16 PARTICIPATORY EVALUATION ................................................................... 218

16.1 INTRODUCTION ......................................................................................................................... 218

16.2 FUNCTIONS OF PARTICIPATORY EVALUATION .......................................................................... 218

16.3 KEY CHARACTERISTICS OF A PARTICIPATORY EVALUATION ..................................................... 219

16.4 PARTICIPATORY EVALUATION AND CONVENTIONAL EVALUATION ........................................... 220

16.5 COLLABORATIVE EVALUATION APPROACH ............................................................................. 221

16.6 STEPS IN PARTICIPATORY EVALUATION .................................................................................... 222

16.6.1 Pre-planning and preparation ......................................................................................... 222

16.6.2 Generating evaluation questions ..................................................................................... 222

viii

16.6.3 Data gathering and analysis ............................................................................................ 223

16.6.4 Reflection and action ....................................................................................................... 223

16.7 CHARACTERISTICS OF AN EVALUATOR/FACILITATOR ............................................................... 224

16.8 GROUP DYNAMICS ................................................................................................................... 224

16.9 MEASUREMENT AND ASSESSMENT OF PM&E INDICATORS ..................................................... 225

16.9.1 Quantitative indicators .................................................................................................... 225

16.9.2 Qualitative indicators ...................................................................................................... 225

16.9.3 Time dimension indicators ............................................................................................... 226

16.10 CHALLENGES FOR PM&E ..................................................................................................... 227

CHAPTER 17 EVALUATION AS A RESEARCH MANAGEMENT TOOL ......................... 228

17.1 INTRODUCTION ......................................................................................................................... 228

17.2 PURPOSE OF RESEARCH EVALUATION ...................................................................................... 228

17.3 RESEARCH MANAGEMENT AND RESEARCH ADMINISTRATION ................................................. 228

17.4 GROUPS INTERESTED IN R&D EVALUATION ............................................................................ 229

17.4.1 Policy makers and donors ............................................................................................... 229

17.4.2 Research managers, administrators and program leaders .............................................. 229

17.4.3 Individual researchers ..................................................................................................... 230

17.5 INTERNAL, EXTERNAL AND COLLABORATIVE EVALUATION .................................................... 230

CHAPTER 18 OVERVIEW OF R&D EVALUATION METHODS ........................................ 232

18.1 INTRODUCTION ......................................................................................................................... 232

18.2 INFORMAL METHODS ............................................................................................................... 232

18.3 FORMAL METHODS - SIMPLE .................................................................................................... 232

18.3.1 Sorting models ................................................................................................................. 232

18.3.2 Scoring models ................................................................................................................ 232

18.4 FORMAL METHODS - ELABORATE ............................................................................................ 233

18.4.1 Ex-post evaluation techniques ......................................................................................... 233

18.4.2 Ex-ante evaluation techniques ......................................................................................... 233

18.5 SIMULATION APPROACH .......................................................................................................... 234

18.5.1 Steps in the simulation approach ..................................................................................... 234

18.5.2 Disadvantages of the simulation approach ..................................................................... 235

18.5.3 Advantages of the Simulation Approach .......................................................................... 235

18.6 THE INPUT-SAVED APPROACH (AVERAGE RETURNS) .............................................................. 235

18.7 MATHEMATICAL PROGRAMMING ............................................................................................. 235

18.7.1 Advantages of the Mathematical Programming Method ................................................. 235

18.7.2 Disadvantages of the Mathematical Programming Method ............................................ 235

18.8 OTHER METHODS ..................................................................................................................... 235

18.8.1 Peer Review ..................................................................................................................... 236

18.8.2 Bibliometric method ........................................................................................................ 236

18.8.3 Problems with bibliometrics ............................................................................................ 237

18.9 SELECTION OF METHODS FOR EVALUATION ............................................................................. 237

CHAPTER 19 MANAGEMENT INFORMATION SYSTEMS ................................................ 238

19.1 INTRODUCTION ......................................................................................................................... 238

19.2 DEFINITION .............................................................................................................................. 238

19.3 MANAGEMENT INFORMATION MATRIX .................................................................................... 238

19.4 NEED FOR MIS ......................................................................................................................... 239

19.5 CHARACTERISTICS OF MIS STRATEGY ..................................................................................... 239

CHAPTER 20 DESIGNING MONITORING AND EVALUATION SYSTEM ...................... 241

20.1 INTRODUCTION ......................................................................................................................... 241

20.2 MONITORING AND EVALUATION .............................................................................................. 241

20.3 M&E AND PROJECT MANAGEMENT ......................................................................................... 242

20.4 MONITORING AND TYPE OF INFORMATION ............................................................................... 242

20.5 ACTIVITIES OF THE MONITORING UNIT .................................................................................... 243

20.6 BENEFICIARY CONTACT MONITORING ..................................................................................... 243

20.7 DESIGNING AND SETTING UP A MONITORING UNIT ................................................................. 243

20.7.1 Choosing the type of evaluation system ........................................................................... 243

ix

20.7.2 Defining the program elements to be measured .............................................................. 244

20.7.3 Monitoring and evaluation designs ................................................................................. 244

20.8 FOLLOW-UP DIAGNOSTIC STUDIES FOR MONITORING ............................................................. 247

20.8.1 Diagnosing and solving problems ................................................................................... 247

20.9 DATA COLLECTION, PROCESSING AND PRESENTATION ............................................................ 248

20.10 COMMUNICATING INFORMATION ......................................................................................... 248

20.11 SETTING UP A M&E SYSTEM FOR A SPECIFIC PROGRAM OR PROJECT ................................. 249

20.12 KEY POINTS TO CONSIDER IN ESTABLISHING AN M&E SYSTEM FOR RESEARCH ................. 249

PART IV IMPACT ASSESSMENT METHODS ........................................................................ 253

CHAPTER 21 STRATEGIES FOR IMPACT ASSESSMENT ................................................. 255

21.1 INTRODUCTION ......................................................................................................................... 255

21.2 PRE-REQUISITES FOR ASSESSING THE IMPACT (EX-POST) OF AN INTERVENTION ...................... 255

21.3 GROSS OUTCOME AND NET CHANGE ....................................................................................... 255

21.4 CONFOUNDING FACTORS .......................................................................................................... 255

21.4.1 Endogenous changes ....................................................................................................... 255

21.4.2 Secular drift ..................................................................................................................... 255

21.4.3 Interfering events ............................................................................................................. 255

21.4.4 Self selection .................................................................................................................... 256

21.5 MEASUREMENT ERROR ............................................................................................................ 256

21.5.1 Stochastic effects ............................................................................................................. 256

21.5.2 Unreliability .................................................................................................................... 256

21.6 A FORMULA FOR IMPACT ASSESSMENT .................................................................................... 256

21.7 DESIGN OPTIONS FOR IMPACT ASSESSMENT ............................................................................ 257

21.8 DATA COLLECTION POINTS ...................................................................................................... 257

21.9 CROSS SECTIONAL SURVEYS .................................................................................................... 258

21.10 TIME SERIES ANALYSIS ........................................................................................................ 258

21.11 BEFORE AND AFTER STUDIES OF FULL COVERAGE .............................................................. 258

21.12 GENERIC AND SHADOW CONTROLS ...................................................................................... 258

21.12.1 Generic control ............................................................................................................ 258

21.12.2 Shadow control ............................................................................................................ 259

21.13 DATA FOR IMPACT ASSESSMENT .......................................................................................... 259

21.14 MAJOR ISSUES IN ASSESSING IMPACT OF R&D ACTIVITIES ................................................. 260

21.14.1 Causality: .................................................................................................................... 260

21.14.2 Incrementality: ............................................................................................................ 260

21.14.3 Attribution .................................................................................................................... 261

CHAPTER 22 OVERVIEW OF IMPACT ASSESSMENT METHODS .................................. 267

22.1 INTRODUCTION ......................................................................................................................... 267

22.2 MODIFIED PEER REVIEW .......................................................................................................... 267

22.3 USER SURVEYS ........................................................................................................................ 267

22.4 BENEFIT - COST METHODS ....................................................................................................... 268

22.5 COST-EFFECTIVENESS ANALYSIS ............................................................................................. 270

22.6 CASE STUDIES .......................................................................................................................... 270

22.7 PARTIAL INDICATORS OF IMPACT ............................................................................................. 270

22.8 INTEGRATED PARTIAL INDICATORS/WEIGHTED MULTIPLE CRITERIA ANALYSIS/SCORING

ANALYSIS ............................................................................................................................................ 271

22.9 PATENT ANALYSIS ................................................................................................................... 272

22.10 MATHEMATICAL PROGRAMMING ......................................................................................... 272

22.11 ECONOMETRIC METHODS ..................................................................................................... 272

22.12 APPLICABILITY AND CHARACTERISTICS OF DIFFERENT METHODS ....................................... 272

22.13 QUANTITATIVE AND QUALITATIVE DEBATE ........................................................................ 272

22.14 GENERAL REMARKS ON IMPACT ASSESSMENT METHODS .................................................... 273

CHAPTER 23 ECONOMIC SURPLUS APPROACHES TO ROR ESTIMATES ................. 276

23.1 INTRODUCTION ......................................................................................................................... 276

23.2 CONSUMER AND PRODUCER SURPLUS ...................................................................................... 276

23.2.1 Consumer Surplus ........................................................................................................... 276

23.2.2 Producer Surplus ............................................................................................................. 276

x

23.2.3 Economic Surplus Changes Due to Technological Changes in a Closed Economy ........ 277

23.3 SURPLUS APPROACH ................................................................................................................ 279

23.3.1 Advantages of the Surplus Approach ............................................................................... 279

23.4 INDEX NUMBER METHODS ....................................................................................................... 279

23.5 THE BENEFIT - COST ANALYSIS APPROACH ............................................................................. 280

23.5.1 With and Without scenario ..................................................................................... 281

23.5.2 Benefits ............................................................................................................................ 282

23.5.3 Costs ................................................................................................................................ 282

23.5.4 Commodity Research and Transfer Costs ....................................................................... 282

23.5.5 Calculating internal rate of return .................................................................................. 283

23.6 INDEX NUMBER APPROACH ..................................................................................................... 284

23.6.1 Case 1: Linear Supply and Demand Curves with a Parallel Supply Shift ....................... 284

23.6.2 Estimating the Social Gains from Research .................................................................... 285

23.6.3 Case II: Akino - Hayami Method ..................................................................................... 286

23.6.4 Algebraic Model .............................................................................................................. 288

23.7 COSTS OF R&D AND EXTENSION ............................................................................................. 289

23.7.1 Research and Development Costs ................................................................................... 290

23.7.2 Adoption costs ................................................................................................................. 290

23.7.3 Research maintenance costs ............................................................................................ 290

23.8 APPLICATION OF AKINO-HAYAMI MODEL TO ESTIMATE RATES OF RETURN ............................. 290

23.9 COST SAVING METHOD ............................................................................................................ 291

23.9.1 Rationale for the cost-saving method .............................................................................. 291

23.9.2 Theoretical Background .................................................................................................. 291

23.9.3 Savings in Fixed Cost ...................................................................................................... 293

23.9.4 Methods for Estimating Cost-Savings ............................................................................. 293

23.9.5 Assumptions in the Cost-Savings Method ........................................................................ 294

CHAPTER 24 PRODUCTION FUNCTION APPROACH ....................................................... 295

24.1 INTRODUCTION ......................................................................................................................... 295

24.2 DEFINITION OF THE PRODUCTION FUNCTION APPROACH ......................................................... 295

24.2.1 Prediction of the impact of a variable ............................................................................. 296

24.3 COMPUTATION OF THE RATE OF RETURNS TO RESEARCH ........................................................ 296

24.4 CONSIDERATIONS IN PRODUCTION FUNCTION APPROACH ....................................................... 297

24.4.1 Choice of explanatory variables (predictors) .................................................................. 297

24.4.2 Choice of an algebraic form ............................................................................................ 298

24.5 DISADVANTAGES IN THE PRODUCTION FUNCTION APPROACH ................................................. 298

24.6 ADVANTAGES OF THE PRODUCTION FUNCTION APPROACH ..................................................... 299

CHAPTER 25 SPILL-OVERS AND IMPACT ASSESSMENT ................................................ 301

25.1 INTRODUCTION ......................................................................................................................... 301

25.2 TYPES OF SPILL-OVERS ............................................................................................................ 301

25.2.1 Inter-locational spill-over ................................................................................................ 301

25.2.2 Inter-foci spill-over .......................................................................................................... 301

25.2.3 Inter-commodity spill-over .............................................................................................. 302

25.2.4 Inter-sectoral spill-over ................................................................................................... 302

25.3 SPILL-OVERS CONSIDERED IN IMPACT ASSESSMENT ............................................................... 302

25.3.1 Economic spill-overs ....................................................................................................... 302

25.3.2 Technological spill-overs ................................................................................................ 304

25.3.3 Knowledge spill-overs ..................................................................................................... 305

25.4 SPILL-OVER EFFECTS AND REGIONAL NETWORKS ................................................................... 305

25.5 APPROACHES TO ESTIMATE ROR INCORPORATING SPILL-OVER EFFECTS ............................... 306

COUNTRY

.......................................................................................................................................... 307

CHAPTER 26 ENVIRONMENTAL IMPACT ASSESSMENT ................................................ 309

26.1 INTRODUCTION ......................................................................................................................... 309

26.2 DEFINITION OF ENVIRONMENTAL AND SOCIAL IMPACT ASSESSMENT ...................................... 309

26.3 IMPORTANCE OF ENVIRONMENTAL IMPACT ASSESSMENT ........................................................ 309

26.4 TYPES OF ENVIRONMENTAL IMPACTS ...................................................................................... 309

xi

26.4.1 On-site market impacts .................................................................................................... 309

26.4.2 On-site non-market impacts ............................................................................................. 309

26.4.3 Off-Site market impacts ................................................................................................... 309

26.4.4 Off-Site non-market impacts ............................................................................................ 310

26.5 ENVIRONMENTAL IMPACT ASSESSMENT COMPONENTS ........................................................... 310

26.5.1 Predicting the future state in the absence of action ......................................................... 311

26.5.2 Predicting the future state in the presence of action ....................................................... 311

26.6 AN IMPACT INDICATOR ............................................................................................................ 311

26.6.1 Ranking alternatives within impact categories ................................................................ 312

26.7 WEIGHTING .............................................................................................................................. 312

26.8 UNCERTAINTY IN ENVIRONMENTAL IMPACT ANALYSIS ........................................................... 312

26.9 GUIDELINES FOR ENVIRONMENTAL IMPACT ASSESSMENT ....................................................... 312

26.10 DEFINITION OF SOCIAL IMPACT ASSESSMENT ...................................................................... 313

26.11 IMPORTANCE OF SOCIAL IMPACT ASSESSMENT .................................................................... 313

26.12 GUIDELINES FOR SOCIAL IMPACT ASSESSMENT ................................................................... 313

CHAPTER 27 PARTICIPATORY IMPACT MONITORING (PIM) ................................... 316

27.1 INTRODUCTION ......................................................................................................................... 316

27.2 DEFINITION AND OBJECTIVES OF PIM ...................................................................................... 316

27.3 KEY ELEMENTS IN PIM ............................................................................................................ 317

27.4 THE SPECIAL FEATURES OF PIM .............................................................................................. 317

27.5 STEPS IN PIM ........................................................................................................................... 318

27.5.1 What should be monitored? ............................................................................................. 318

27.5.2 How can it be monitored? ............................................................................................... 318

27.5.3 Who should monitor? ....................................................................................................... 318

27.5.4 How can results be documented? .................................................................................... 319

27.5.5 Analysis - why these results? ........................................................................................... 319

27.5.6 What action should be taken? .......................................................................................... 319

27.6 LIMITATIONS OF PIM ............................................................................................................... 320

CHAPTER 28 ORGANISATIONAL PERFORMANCE ASSESSMENT ................................ 321

28.1 ASSESSING AND IMPROVING ORGANISATIONAL PERFORMANCE .............................................. 321

28.1.1 What is organisational performance? ............................................................................. 321

28.1.2 Why assess performance? ................................................................................................ 321

28.1.3 Performance management ............................................................................................... 322

28.1.4 Approaches to performance assessment .......................................................................... 323

28.1.5 OPAS: Performance assessment for agricultural research ............................................. 323

28.2 OPAS: A STEP-BY-STEP APPROACH TO PERFORMANCE ASSESSMENT ..................................... 325

28.2.1 Output assessment methods ............................................................................................. 325

28.2.2 Management assessment methods ................................................................................... 334

28.3 PLANNING, IMPLEMENTING, AND USING THE OPAS ................................................................ 340

28.3.1 Planning and implementing the assessment .................................................................... 340

28.3.2 Using the OPAS results ................................................................................................... 344

28.3.3 Final observations ........................................................................................................... 346

PART V OTHER RELEVANT TOPICS .................................................................................... 349

CHAPTER 29 MULTI-CRITERIA ANALYSIS ........................................................................ 350

29.1 INTRODUCTION ......................................................................................................................... 350

29.2 THE ROLE OF MULTI-CRITERIA ANALYSIS ............................................................................... 350

29.3 MULTI-CRITERIA ANALYSIS AND DECISION MAKING .............................................................. 351

29.4 STEPS IN ANALYSIS .................................................................................................................. 351

29.4.1 Specifying the alternatives or potential actions ............................................................... 351

29.4.2 Specifying criteria ........................................................................................................... 352

29.4.3 Scoring alternatives in relation to each criterion ............................................................ 353

29.5 ASSIGNING WEIGHTS TO THE CRITERIA ................................................................................... 354

29.6 EVALUATING THE ALTERNATIVES ............................................................................................ 354

29.7 SENSITIVITY ANALYSIS ............................................................................................................ 354