Beruflich Dokumente

Kultur Dokumente

4 MS811 Pp34to45

Hochgeladen von

Bella NovitasariOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

4 MS811 Pp34to45

Hochgeladen von

Bella NovitasariCopyright:

Verfügbare Formate

34 JOURNAL FOR ECONOMIC EDUCATORS, 11(2), FALL 2011

A PRIMER ON PROFIT MAXIMIZATION

Robert Carbaugh1 and Tyler Prante2 Abstract Although textbooks in intermediate microeconomics and managerial economics discuss the firstorder condition for profit maximization (marginal revenue equals marginal cost) for pure competition and monopoly, they tend to ignore the second-order condition (marginal cost cuts marginal revenue from below). Mathematical economics textbooks also tend to provide only tangential treatment of the necessary and sufficient conditions for profit maximization. This paper fills the void in the textbook literature by combining mathematical and graphical analysis to more fully explain the profit maximizing hypothesis under a variety of market structures and cost conditions. It is intended to be a useful primer for all students taking intermediate level courses in microeconomics, managerial economics, and mathematical economics. It also will be helpful for students in Masters and Ph.D. programs in economics and in MBA programs. Moreover, the paper provides instructors with an effective supplement when explaining the profit-maximization concept to students.3 Key Words: profit maximization, microeconomics JEL Classification: A2, D2 Introduction For about a century, the assumption that a firm maximizes profit (total revenue minus total cost) has been at the forefront of neoclassical economic theory. This assumption is the guiding principle underlying every firms production. An important aspect of this assumption is that firms maximize profit by setting output where marginal cost (MC) equals marginal revenue (MR). This equality holds regardless of the market structure under studythat is, perfect competition, monopoly, monopolistic competition, or oligopoly. While the implications of profit maximization are different for different market structures, the process of maximizing profit is essentially the same. The problem for the firm is to determine where to locate output, given costs and the demand for the product to be sold. In the simplest version of the theory of the firm, it is assumed that a firms ownermanager attempts to maximize the firms short-run profits (current profits and profits in the near future). More sophisticated models of profit maximization replace the goal of maximizing short-run profits with the goal of maximizing long-run profits, which reflect the

Professor and Co-Chair, Department of Economics, Central Washington University Assistant Professor, Department of Economics, Los Angeles Valley College

2 3

We wish to thank Professors John Olienyk, Darwin Wassink, Gerald Gunn, Tim Dittmer, Koushik Ghosh and an anonymous reviewer for comments and suggestions.

35 JOURNAL FOR ECONOMIC EDUCATORS, 11(2), FALL 2011

present value of the firms expected profits. In these models, the MR = MC concept plays an important role in analyzing the behavior of firms. Nevertheless, the profit-maximization assumption has been criticized on the grounds that managers often aim to attain merely satisfactory profits for the stockholders of the firm rather than maximum profits. Moreover, managers may pursue goals other than profit maximization, including sales maximization, personal welfare, and social welfare, all of which tend to reduce profit. In spite of these challenges, the MR = MC model of profit maximization is the dominant model used by the economics profession to explain firm behavior. Profit maximization is emphasized in all microeconomics courses, from principles classes to graduate courses. Principles textbooks (e.g., Mankiw, 2009; Krugman and Wells, 2009; Hubbard and OBrien, 2007) provide an introduction to the topic by using graphical analysis showing that a firms total profit is maximized at the output where MR is equal to MC. Because principles texts are intended to fulfill the needs of beginning students (as they should), they address this topic only by considering the first-order condition for profit maximization, MR = MC. This leaves the second-order condition for profit maximization to be explained by more advanced texts; that is, when MR = MC, profit is maximized if MC cuts MR from below. When surveying intermediate microeconomics texts, however, we found that they generally do not shed much light on the second-order condition. Of the eight leading intermediate microeconomics texts that we surveyed, all use graphical analysis to illustrate the first-order condition for profit maximization for the market models of perfect competition and monopoly, as seen in Tables 1 and 2. One text (Besanko and Braeutigam, 2005) uses graphical analysis to portray the second-order condition for perfect competition, but not for monopoly. Another text (Eaton, Eaton and Allen, 2009) uses graphical analysis to tangentially discuss the second-order condition for perfect competition and monopoly; in a footnote, it also uses calculus to identify the second-order condition for monopoly. Its treatment of this topic is limited to the case where marginal cost is rising at the profit-maximizing output. But what if MC is decreasing? A possible example of decreasing MC arises in the current weak economies of the United States and other countries. Given excess capacity, as firms such as Ford Motor Co. expand production, the benefits of mass production kick in and MC may decline. As output increases, MC may fall below MR, but the firm will maximize profit by increasing output until rising MC eventually meets MR. We also surveyed leading undergraduate mathematical economics texts to determine the extent to which they discuss the necessary and sufficient conditions for profit maximization. Initially we thought that these texts would present these conditions in a comprehensive manner so as to make the topic obvious to students; therefore, why should we write this paper? However, we found coverage of this topic to be tangential. All of the texts that we reviewed (Dadkhah 2007, Sydsaeter and Hammond 2006, Dowling 2001, Silberberg and Suen 2001, and Simon and Blume 1994) use calculus to illustrate the general nature of first- and second-order conditions, which can be applied to a variety of topics. But these texts do not apply in a student friendly manner these conditions to profit maximization for pure competition and monopoly. Moreover, not all students taking economics courses will take a course in mathematical economics dealing with first- and second-order conditions. Simply put, there is a void in the treatment of the necessary and sufficient conditions for profit maximization that exists not only in intermediate microeconomics textbooks, but also in those for mathematical economics and managerial economics.

36 JOURNAL FOR ECONOMIC EDUCATORS, 11(2), FALL 2011

Table 1: Illustrating the Necessary and Sufficient Conditions for Profit Maximization for Perfect Competition in Intermediate Microeconomics Textbooks ________________________________________________________________________ Method of Illustration First-Order Condition Second-Order Condition Graph Calculus Graph Calculus Yes Yes Yes Yes Yes Yes Yes Yes No No No No No No No No No Yes No Yes No No No No No No No Yes No No No No

Textbook 1) Bernheim & Whinston 2) Besanko & Braeutigam 3) Browning & Zupan 4) Eaton, Eaton & Allen 5) Nicholson & Snyder 6) Perloff 7) Pindyck & Rubinfield 8) Varian

________________________________________________________________________ We maintain that additional coverage devoted to profit maximization is useful for economics students. Why? Profit maximization provides the simplest and most straight forward application of first- and second-order conditions. Students can easily relate to a firm that produces one product and how the firm goes about finding the output level that maximizes total profit. Other applications of necessary and sufficient conditions are even more complex, such as utility maximization, which involves two goods, and cost minimization involving two inputs, labor and capital. These topics are covered in advanced undergraduate courses and graduate courses in microeconomics. Given the inadequate pedagogical treatment of profit maximization in current intermediate microeconomics texts and mathematical economics texts, we feel that a more comprehensive approach to the topic is warranted. If students grasp the implications of the simplest case of first- and second-order conditions found in profit maximization, they will have a greater ability to grasp these conditions found in more complex cases at the graduate level. Our many years of teaching experience have led us to conclude that students tend to understand concepts better when they are presented in verbal, graphical (visual), and mathematical terms. This also applies to profit maximization. The purpose of our paper is to provide students and instructors a primer on profit maximization. Our analysis begins by using calculus to derive the first- and second-order conditions. We then use graphs to illustrate these concepts visually, as applied to perfect competition and monopoly.

37 JOURNAL FOR ECONOMIC EDUCATORS, 11(2), FALL 2011

Table 2: Illustrating the Necessary and Sufficient Conditions for Profit Maximization for Monopoly in Intermediate Microeconomics Textbooks ________________________________________________________________________

Method of Illustration First-Order Condition Second-Order Condition Graph Calculus Graph Calculus Yes Yes Yes Yes Yes Yes Yes Yes No No No No No No No No Yes No No Yes No No No No No No No Yes No No No No

Textbook 1) Bernheim & Whinston 2) Besanko & Braeutigam 3) Browning & Zupan 4) Eaton, Eaton & Allen 5) Nicholson & Snyder 6) Perloff 7) Pindyck & Rubinfield 8) Varian

________________________________________________________________________ It is hoped that the pedagogical presentation of this paper will lead to a more complete understanding of the profit-maximization hypothesis by student readers of all backgrounds and abilities. Simply put, any economic model that simplifies from the real world should be as tight and complete as possible. Our paper meets this objective by addressing profit maximization for a variety of market structures and under conditions of increasing MC and decreasing MC. Our paper is intended to serve as a supplement for a course in intermediate microeconomics, managerial economics, or mathematical economics. It will be useful for those students who realize that profit is not necessarily maximized when MR = MC, and who could benefit from an article that systematically lays out the implications of this theory for alternative market structures. It also will be useful for students who are in Masters and Ph.D. programs in economics as well as in MBA programs. Finally, it will serve as a helpful supplement for faculty who wish to elaborate on the profit-maximization concept in their classrooms. Profit Maximization: Mathematical Exposition Consider the derivation of a firms profit maximizing conditions. The maximization of net revenue (total revenue minus total cost) requires that the first-and second-order conditions be fulfilled. To show this mathematically, first write the net revenue function as: (1) (q) R(q) C (q), where q is quantity, R(q) is the total revenue function, and C (q) is the total cost function. For an extremum of this function, the first derivative of the function is set equal to zero. This

38 JOURNAL FOR ECONOMIC EDUCATORS, 11(2), FALL 2011

suggests that the first-order condition is met--that marginal revenue equals marginal cost. This is shown below as: R( q ) C (q ) (2) 0, q q q which implies, (3) MR(q) MC (q) . That is, when marginal revenue and marginal cost are equal, the firm has either maximized or minimized total profit. Using this reasoning, microeconomic texts suggest that profit is maximized when marginal revenue equals marginal cost. Of course, for the extremum in (2) to be a maximum (that is, profit maximization or loss minimization), the second-order condition requires that the second derivative of the net revenue function have a negative value. This is shown as: MR(q) MC(q) (4) 0, q q MC(q) or, adding to both sides of the inequality, q MR(q) MC(q) (5) . q q The net revenue function is at a maximum when the slope of the marginal cost curve, MC(q) MR(q) , exceeds that of the marginal revenue curve, . q q Although calculus can be used to explain the first and second order conditions for profit maximization, students often have difficulty in visualizing this method of presentation. Their comprehension often improves when principles are illustrated in verbal and visual (graphical) terms to which the rest of this paper is devoted. Profit Maximization in Perfect Competition It can also be shown graphically that the first-order condition of marginal revenue equals marginal cost is a necessary, but not sufficient, condition for profit maximization. This is presented here for the special case of perfect competition. Because a perfectly competitive firms demand schedule is perfectly elastic, its marginal revenue function is modeled as a horizontal line. Fulfillment of the general rule that the slope of the marginal cost curve exceeds that of the marginal revenue curve necessarily requires that the marginal cost curve have a positive slope at its point of intersection with the horizontal (zero slope) marginal revenue curve. Shown in Figure 1, marginal revenue equals marginal cost at both Q1 and Q2.4 Given favorable demand conditions, a competitive firm in the short run will find its total revenue exceeding total cost at its best output level. Its profit is maximized at output level Q1, where the first-and second-order conditions are fulfilled.

4

Throughout this paper linear demand conditions are assumed for the perfect-and imperfect-competition models analyzed. An exception will be made in the last case discussed, where nonlinear demand conditions will be assumed.

39 JOURNAL FOR ECONOMIC EDUCATORS, 11(2), FALL 2011

The minimization of net revenue (loss maximization) is not economically relevant given the assumptions of rational seller behavior. Nevertheless, it can easily be shown given the framework developed here. The two sufficient conditions for net revenue minimization are: (1) the first-order condition: marginal revenue equals marginal cost; and (2) the second-order condition: the slope of marginal revenue curve exceeds that of the marginal cost curve at their point of intersection. In perfect competition, the second-order condition necessarily implies that the marginal cost curve is decreasing (negative slope) at its point of intersection with the horizontal (zero slope) marginal revenue curve. In Figure 1, net revenue minimization occurs at Figure 1: Perfect Competition Profit Maximization, Loss Minimization

at output level Q2, where the first-and second-order conditions are met.5

5

The rationale of the second-order condition suggests the following. By increasing output beyond Q1 more is added to total cost than to total revenue, since marginal cost exceeds marginal revenue. Net revenue thus decreases. Similarly, by decreasing output below Q1 more is subtracted from total revenue.

40 JOURNAL FOR ECONOMIC EDUCATORS, 11(2), FALL 2011

Now suppose a competitive firm faces worsening short-run demand conditions. Although the firms total revenue falls short of total cost at its best output level, net revenue will be maximized at that output level at which loss is minimized - that is, where net revenue assumes its smallest negative value. In Figure 2, this occurs at output level Q1, where the first and second order conditions are met. Figure 2: Perfect Competition Loss Minimization

Profit Maximization in Imperfect Competition Concerning the conditions for net revenue maximization, the perfect competition model implies that the second-order condition requires marginal cost to be increasing when it intersects marginal revenue. This is just a special case of the general rule that the slope of the marginal cost curve must be greater than that of the marginal revenue curve at their point of intersection. The market structure of imperfect competition illustrates this general case.

41 JOURNAL FOR ECONOMIC EDUCATORS, 11(2), FALL 2011

As treated in microeconomic textbooks, the basic approach generally used to illustrate an imperfectly competitive firms net revenue maximizing behavior is illustrated in Figure 3. Profit is maximized at output level Q1. Not only is the first-order marginal revenue equals marginal cost condition met, but so also is the second condition that the slope of the marginal cost curve exceeds that of the marginal revenue curve. This is because in the neighborhood of output level Q1 marginal revenue has a negative slope, while the slope of marginal cost is positive. Figure 3: Imperfect Competition Profit Maximization, Loss Maximization

Given adverse demand conditions, an imperfectly competitive firm may find its total cost exceeding total revenue at its best output level. Provided that total revenue is sufficient to cover total variable costs, the firms best short-run output would be that level at which its loss is minimized (net revenue maximized). Figure 4 illustrates this case. At the firms best output, both the first-and second-order conditions are met: (1) marginal revenue equals marginal cost; (2) the slope of the marginal cost curve is greater than that of the marginal revenue curve. Although total revenue falls short of total cost at this output, net revenue is still maximized. This is because total loss is minimized--total revenue falls short of total cost by the least amount. Unlike the competitive firm case, profit maximization for an imperfectly competitive firm does not always require marginal cost to have positive slope when it intersects marginal revenue. Because an imperfectly competitive firms demand schedule is downward-sloping, its marginal revenue curve is negatively sloped. For imperfect competition, it is possible that the

42 JOURNAL FOR ECONOMIC EDUCATORS, 11(2), FALL 2011

Figure 4: Imperfect Competition Loss Minimization

second-order condition is fulfilled when both the marginal revenue and marginal cost curves are negatively sloped. In the neighborhood of output level Q1 in Figure 5, the total cost and total revenue curves both increase at decreasing rates: both the marginal revenue and marginal cost curves are negatively sloped. At output levels immediately below Q1, total revenue increases at a rate greater than total cost increases: marginal revenue exceeds marginal cost. A profit-maximizing firm benefits by expanding output until the differential is eliminated. At output levels immediately greater than Q1, the total revenue curve increases at a rate less than that of the total cost curve. Marginal cost now exceeds marginal revenue. The firm finds it advantageous to curtail its output until marginal revenue equals marginal cost. Net revenue is thus maximized at output Q1 where the first-and second-order conditions are met. As in the competitive firm case, the fulfillment of the first-order condition does not necessarily guarantee net revenue maximization under imperfect competition. Should the slope of the marginal revenue curve be greater than that of the marginal cost curve at their point of intersection, the net revenue function would be minimized. The firms loss would be maximized. This is illustrated in Figure 3 at output Q2. Given the assumption of net revenue maximization, however, a rational entrepreneur would not choose this extremum.

43 JOURNAL FOR ECONOMIC EDUCATORS, 11(2), FALL 2011

Figure 5: Imperfect Competition Profit Maximization

Profit Maximization: No-Solution Case The previous analysis involving net revenue maximization or minimization has been based on linear demand conditions facing a firm. This necessarily occurs under perfect competition and has been assumed to be the case under imperfect competition. However, under imperfect competition a linear demand schedule need not be assumed. And given this possibility, the first-order condition may not be achieved. A no-solution is therefore possible. Consider the case of a demand schedule taking the form of a rectangular hyperbola. The nature of a rectangular hyperbola demand curve suggests that all of the rectangular areas associated with corresponding price and quantity levels are equal. The total revenue schedule is thus constant and is horizontal with respect to the quantity axis. The marginal revenue curve therefore coincides with the quantity axis since the slope of the total revenue schedule is zero at all output levels. Figure 6 illustrates this point. Facing a rectangular hyperbola demand schedule, a rational entrepreneur attempting to maximize net revenue would try to produce at that output level at which the first- and secondorder conditions are met. In this case there is no unique net revenue-maximizing output level. This is because no output level exists where the first-order condition of marginal revenue equals marginal cost is met. Inspection of Figure 6 reveals that at output levels greater than Q1 the firm incurs a loss, while at output levels less than Q1 the firm makes a profit. Given a constant total revenue schedule, the firm would maximize net revenue by producing at that output where total cost is minimized. This occurs at output level zero. But at output level zero, total revenue also equals zero. Therefore, the best output is the smallest positive output possible.

44 JOURNAL FOR ECONOMIC EDUCATORS, 11(2), FALL 2011

Given continuous rather than discreet cost curves, there exists no smallest positive level of output. Thus, there exists no optimal level of output where the first-order condition is satisfied--a no-solution case occurs. Although this no-solution case may be of little empirical relevance, it is intended to demonstrate that the conditions sufficient for net revenue maximization may not always be fulfilled. Figure 6: Imperfect Competition No Solution Case

Concluding Remarks Several years ago, our intermediate economics students were asked the following question: If a firm operates at the output where MR = MC, will its total profit necessarily be maximized? Recalling what they learned in their microeconomics principles course, most of the students immediately responded with a yes. One student, however, recalled from his calculus course, that if MR = MC, profit could be maximized or minimized. Why the confusion? This article reflects the view that the profit maximization hypothesis is not sufficiently illustrated in intermediate textbooks in microeconomics, mathematical economics, and managerial economics. Therefore, we prepared a primer on profit maximization, combining verbal, graphical, and mathematical analysis to illustrate a topic that is religiously taught in college classrooms. By portraying the first- and second-order conditions for profit maximization, under conditions of increasing and decreasing marginal cost, and under perfect

45 JOURNAL FOR ECONOMIC EDUCATORS, 11(2), FALL 2011

competition and imperfect competition, this article attempts to provide a comprehensive approach that clarifies this important concept. This analysis is intended for the use of all students taking intermediate courses in microeconomics, mathematical economics, and managerial economics. For those students in graduate programs in economics and MBA programs, it serves as a helpful overview of economic optimization. For instructors who wish to elaborate on the profit maximization hypothesis beyond what is covered in textbooks, this article serves as a useful supplement. References Bernheim, Douglas and Michael Whinston, 2008. Microeconomics. McGraw-Hill/Irwin. Besanko, David and Ronald Braeutigam. 2005. Microeconomics. John Wiley and Sons, Inc. Browning, Edgar and Mark Zupan. 2009. Microeconomics: Theory and Applications. John Wiley and Sons, Inc. Case, Karl and Ray Fair. 2007. Principles of Microeconomics. Pearson/Prentice Hall. Dadkhah, Kamran.2007. Foundations of Mathematical and Computational Economics. Thomson/SouthWestern. Dowling, Edward. 2001. Introduction to Mathematical Economics. Schaums Outlines/ McGraw-Hill. Eaton, Curtis, Diane Eaton, and Douglas Allen. 2005. Microeconomics. Theory With Applications. Pearson/ Prentice Hall. Krugman, Paul and Robin Wells. 2009. Economics. Worth Publishers. Mankiw, Gregory. 2009. Principles of Microeconomics. SouthWestern/ Cengage Learning. Nicholson, Walter and Christopher Snyder. 2007. Intermediate Microeconomics and its Applications. Thomson/ South-Western. Perloff, Jeffery. 2009. Microeconomics. Pearson/Addison Wesley. Pindyck, Robert and Daniel Rubinfeld. 2009. Microeconomics. Pearson/Prentice Hall. Silberberg, Eugene and Wing Suen. 2001. The Structure of Economics: A Mathematical Analysis. McGraw-Hill/Irwin. Simon, Carl and Lawrence Blume. 1994. Mathematics for Economists. W. W. Norton & Company. Sydsaeter, Knut and Peter Hammond.2006. Essential Mathematics for Economic Analysis. Prentice Hall/Financial Times.

Das könnte Ihnen auch gefallen

- Lembaran Soal PostestDokument4 SeitenLembaran Soal PostestBella NovitasariNoch keine Bewertungen

- Ps 3 ADokument9 SeitenPs 3 ABella NovitasariNoch keine Bewertungen

- Solowmodel (BAGUS NIH)Dokument19 SeitenSolowmodel (BAGUS NIH)Bella NovitasariNoch keine Bewertungen

- The Solow Growth ModelDokument2 SeitenThe Solow Growth ModelBella NovitasariNoch keine Bewertungen

- Analisis Faktor-Faktor Yang Mempengaruhi Produksi Padi Sawah Pada Daerah Tengah Dan Hilir Aliran Sungai AyungDokument10 SeitenAnalisis Faktor-Faktor Yang Mempengaruhi Produksi Padi Sawah Pada Daerah Tengah Dan Hilir Aliran Sungai AyungBella NovitasariNoch keine Bewertungen

- ch05 Mark HirscheyDokument11 Seitench05 Mark HirscheyBella NovitasariNoch keine Bewertungen

- Managerial Economics & Business Strategy: Market Forces: Demand and SupplyDokument41 SeitenManagerial Economics & Business Strategy: Market Forces: Demand and SupplyBella NovitasariNoch keine Bewertungen

- ARTIKEL - Hubungan Faktor Sosial Ekonomi Dan Ketahanan Pangan Terhadap KEJADIAN STUNTINGDokument9 SeitenARTIKEL - Hubungan Faktor Sosial Ekonomi Dan Ketahanan Pangan Terhadap KEJADIAN STUNTINGBella NovitasariNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Emerson Mentor MP ManualDokument182 SeitenEmerson Mentor MP ManualiampedrooNoch keine Bewertungen

- 19 71 Hydrologic Engineering Methods For Water Resources DevelopmentDokument654 Seiten19 71 Hydrologic Engineering Methods For Water Resources DevelopmentMartha LetchingerNoch keine Bewertungen

- Norberto Elias: Graduation of Teach Portuguese Language With Ability in EnglishDokument14 SeitenNorberto Elias: Graduation of Teach Portuguese Language With Ability in EnglishGildo Joaquim FranciscoNoch keine Bewertungen

- DTS 600 GDO Installation ManualDokument12 SeitenDTS 600 GDO Installation Manualpiesang007Noch keine Bewertungen

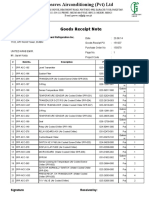

- Goods Receipt Note: Johnson Controls Air Conditioning and Refrigeration Inc. (YORK) DateDokument4 SeitenGoods Receipt Note: Johnson Controls Air Conditioning and Refrigeration Inc. (YORK) DateSaad PathanNoch keine Bewertungen

- Performance Comparison of VxWorks Linux RTAI and Xenomai in A Hard Real-Time ApplicationDokument5 SeitenPerformance Comparison of VxWorks Linux RTAI and Xenomai in A Hard Real-Time ApplicationsatyanaryanakNoch keine Bewertungen

- Updated WorksheetDokument5 SeitenUpdated WorksheetJohn Ramer Lazarte InocencioNoch keine Bewertungen

- Lecture 5Dokument20 SeitenLecture 5Paylaşım KanalıNoch keine Bewertungen

- IES OBJ Civil Engineering 2000 Paper IDokument17 SeitenIES OBJ Civil Engineering 2000 Paper Itom stuartNoch keine Bewertungen

- Be and Words From The List.: 6B Judging by Appearance Listening and ReadingDokument3 SeitenBe and Words From The List.: 6B Judging by Appearance Listening and ReadingVale MontoyaNoch keine Bewertungen

- Aristotle Metaphysics Lambda Accessed 201111 Classicalk LibraryDokument19 SeitenAristotle Metaphysics Lambda Accessed 201111 Classicalk Librarygijsbo2000Noch keine Bewertungen

- Analyst - Finance, John Lewis John Lewis PartnershipDokument2 SeitenAnalyst - Finance, John Lewis John Lewis Partnershipsecret_1992Noch keine Bewertungen

- En DAY4 David Chen Building The AI Computing Platform For Pervasive Intelligence enDokument8 SeitenEn DAY4 David Chen Building The AI Computing Platform For Pervasive Intelligence endieuwrignNoch keine Bewertungen

- Diltoids Numberletter Puzzles Activities Promoting Classroom Dynamics Group Form - 38486Dokument5 SeitenDiltoids Numberletter Puzzles Activities Promoting Classroom Dynamics Group Form - 38486sinirsistemiNoch keine Bewertungen

- Customer Service Metrics CalculatorDokument28 SeitenCustomer Service Metrics CalculatorSelma Regita MahardiniNoch keine Bewertungen

- Scan WV1DB12H4B8018760 20210927 1800Dokument6 SeitenScan WV1DB12H4B8018760 20210927 1800Sergio AlvarezNoch keine Bewertungen

- Ib Psychology - Perfect Saq Examination Answers PDFDokument2 SeitenIb Psychology - Perfect Saq Examination Answers PDFzeelaf siraj0% (2)

- Powerplant QuestionsDokument19 SeitenPowerplant QuestionsAshok KumarNoch keine Bewertungen

- NCRA Membership InformationDokument1 SeiteNCRA Membership Informationbkharkreader1301Noch keine Bewertungen

- Kowalkowskietal 2023 Digital Service Innovationin B2 BDokument48 SeitenKowalkowskietal 2023 Digital Service Innovationin B2 BAdolf DasslerNoch keine Bewertungen

- I. Objectives Ii. Content Iii. Learning ResourcesDokument13 SeitenI. Objectives Ii. Content Iii. Learning ResourcesZenia CapalacNoch keine Bewertungen

- TOEFL-Reading Question Type Definitions and ExplanationDokument5 SeitenTOEFL-Reading Question Type Definitions and ExplanationSamara SampaioNoch keine Bewertungen

- Practice Test - Math As A Language - MATHEMATICS IN THE MODERN WORLDDokument8 SeitenPractice Test - Math As A Language - MATHEMATICS IN THE MODERN WORLDMarc Stanley YaoNoch keine Bewertungen

- JVC tm1010pnDokument4 SeitenJVC tm1010pnPer VigiloNoch keine Bewertungen

- Emcee Script For Recognition DayDokument3 SeitenEmcee Script For Recognition DayRomeo Jr. LaguardiaNoch keine Bewertungen

- Manitou 1350RDokument4 SeitenManitou 1350RcandlaganNoch keine Bewertungen

- Void Engineers (Convention: Mage The Ascension)Dokument6 SeitenVoid Engineers (Convention: Mage The Ascension)Beth0% (1)

- Paper Ed Mid TermDokument2 SeitenPaper Ed Mid Termarun7sharma78Noch keine Bewertungen

- Drsent PT Practice Sba OspfDokument10 SeitenDrsent PT Practice Sba OspfEnergyfellowNoch keine Bewertungen

- Hemax-530 PDFDokument2 SeitenHemax-530 PDFNice BennyNoch keine Bewertungen