Beruflich Dokumente

Kultur Dokumente

DecisionMakingRiskUncertainty Afterposter

Hochgeladen von

totongopOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

DecisionMakingRiskUncertainty Afterposter

Hochgeladen von

totongopCopyright:

Verfügbare Formate

Basin Evaluation: A Tool to Help Assess the Petroleum Prospectivity of Australias Offshore Frontiers

Stephenson, A.E.1 (1) Geoscience Australia, Canberra, Australia Australia is vastly under-explored, with a large number of frontier basins comprising diverse geology. From an Australian Government perspective, there is a need to evaluate the petroleum prospectivity of these basins, to ensure informed and strategic decisions can be made to maintain security of energy supplies. For this reason, Geoscience Australia has evaluated the petroleum prospectivity of Australia's offshore frontiers using a new methodology. The evaluation enhances Geoscience Australia's ability to provide advice to Government, identifies the key factors of high uncertainty in each frontier that are currently impacting upon perceptions of prospectivity, and high-grades areas for future data acquisition and research. The new basin evaluation methodology is based upon standard prospect risking models, but modified to answer the question: what is the relative likelihood of an economic petroleum field being present in this frontier? rather than risking individual prospects. The basic ranking unit is the play level, which is risked for both geology and economics. Two versions of the geologic risking have been developed, involving eleven weighted risk factors, or four weighted groups of risk factors, respectively. Economic risking is mainly based upon functions of minimum economic field size versus expected field size distributions at each play level. Delphi meetings assess each risk factor, guided by a standardised indicative risk for each particular geologic or economic circumstance.

A key component of each frontier evaluation is a knowledge rating poorly known regions normally have higher risk factors for geology, and economic risking can be highly speculative. For these reasons, ranking between frontiers is only valid for regions with a similar knowledge rating. The evaluation methodology is designed to be easily modifiable, so that variations to weightings, risk factors assessed, and indicative risks can be made to reflect the preferences of the user.

Enhancing Risk Management Using AS/NZS 4360:2004 Risk Management Standard

Schwarz, Steffi1 (1) SAI Global Limited, East Perth, Australia Good outcomes in Risk Management can only happen if two key elements are present sound interdisciplinary processes and the right information. It is important to focus on comprehensive review processes that involve broad interdisciplinary participation and improve communication. The use of a Risk Management process facilitates these objectives. Risk Management is flexible in its application, and can deliver a range of benefits depending on the nature of the system and business concerned. These can include: Effective Risk management Public Confirmation Commitment to Shareholders Market Recognition Reduced Expenses Market Entry Enhanced Corporate Knowledge Improve Employee Commitment This presentation is designed to assist participants in understanding the purpose of Risk Management and applying the AS/NZS 4360:2004 Risk Management Standard. Underlying frameworks and related tools will be discussed including Risk Identification, Risk Analysis, Risk Evaluation, and Risk treatment. The Risk Management processes are illustrated using relevant examples.

Participants will be able to engage in integrated risk management activities in their organisation, outline the high level goals and framework of risk management, define roles and responsibilities for risk management and use effective tools of risk management.

Strategies and Challenges to Set the Framework to Utilize Regional Deepwater Infrastructure for Smaller Fields

Burnside, Chris1, John R. Baillie2, Sonia Dias3 (1) Chevron, Houston, TX (2) ChevronTexaco, Houston, TX (3) Sonangol, Luanda, Angola Block 14 offshore Angola has been under exploration, appraisal, development and production since being awarded in 1995 to a Contractor Group consisting of CABGOC (the operator, a Chevron company), Sonangol P&P, ENI, GALP, and Total. Over 1 billion bbls of recoverable oil have been discovered in 25 reservoirs in water depths from 300 to 1200 meters. In the exploration and appraisal period many smaller resources have been discovered and subsequently incorporated into the regional deepwater development strategies for the major hub facilities in the block. There are many issues and challenges to set the appropriate framework for to allow for the incorporation of these smaller assets to allow for economic development and maximize the utilization of the installed deepwater regional infrastructure. Strategies to deal with cross-border issues, timing and phasing of developments, consideration for tie in points and associated fluid capacity are required early in the life of a deepwater project to ensure all resources in the accessible area are developed.

Over the past decade, the Contractor Group in Block 14 in conjunction with the Concessionaire has formulated workable development plans and strategies to incorporate the potential of the complete discovered resource base. This has required the early consideration of full cycle depletion plans, work plans and phasing

considerations to optimize the development strategy and work efforts. Lessons learned from implementing these strategies are relevant to future developments in the deepwater along with incorporating exploitation discoveries.

Decisions and Optimal Appraisal Planning for LNG Gas Supply: A Case Study

Haskett, William J.1 (1) Decision Strategies Inc, Houston, TX A 5 MMtpa LNG plant is going to be built in West Africa. This multi-billion dollar project will receive associated gas from existing oil fields, oil fields which have been discovered but are as yet undeveloped, and future discoveries. The LNG facility is sized to take near-term associated gas at rates that will not impede oil production, but not too large so as to retain a reasonable probability of continued full capacity for as long as possible. Unfortunately, as the current associated gas fields decline the plant will fail to maintain liquefaction at full capacity without sources of additional gas. Four nonassociated gas sources of uncertain size are known to exist within the gas supply area for the LNG plant. An appraisal and development plan was required that maximized throughput of the LNG facility while providing sustained domestic gas supply and a foundation for infrastructure development. Questions remained as to the order, number, and extent of appraisal required to ensure adequate production capability. Each non-associated gas field requires appraisal, development, facility design, and tie-in prior to being able to contribute to gas supply. Factors taken into consideration for the decision on the appraisal order and specific appraisal location included specific field learnings and risk reduction, contribution to gas supply uncertainty reduction, ease of tie-in, ability to delay significant capital investment, and most significant of all, the extent of demand from the LNG plant. Qualitative and quantitative decision methods were used. An integrated multi-disciplinary decision-based approach allowed a plan that will maximize value to the project and provides a certainty of supply sufficiency.

Risk Assessment, Decision Making and Play Fairway Analysis in a Fluvial Setup: Risk and Uncertainity

Elamahi, Ranya1, K.B. Trivedi2 (1) Greater Nile Petroleum Operating Company Ltd, Khartoum, Sudan (2) Greater nile Petroleum Operating Company, Khartoum, Sudan

Play risk consist of regional risk element, constrained by regional depositional model, which is further enhanced by poor or lack of quality data. Risk and uncertainty are inherent aspect of investing in exploration venture, and a successful and economically viable exploration programme requires a consistent consideration of risk aversion and accurate perception of uncertainty. The major attributes to define risk are (1) Quality of the seismic dataset (2) Presence of source, reservoir and trap (3) Play dynamics. In Muglad basin of Sudan the Mega elements of petroleum system are fluvial in nature, since this adds to uncertainty in predicting lateral facies variation in short distances. As the reservoirs are mainly thin fluvial sandstone they are not quite decipherable in conventional 2D seismic. Authors have made a case study by analyzing role of 3D data in reducing the uncertainty and pre and post 3D data acquisition scenario is being analyzed and it is deciphered that more the Geological uncertainty, as in fluvial system, the level of uncertainty and risk factor increases exponentially if the data is not of high resolution to track the sand geometry. With the maturity of data base the risk factor decreases and confidence level for decision making and investment increases. The authors have shown by case history, the risk, both pre and post drilling, viz a viz success ratio and prospect identification, pre and post 3D data acquisition.

Human Bias in Geological Interpretation How Much Uncertainty Does It Introduce?

Bond, Clare E.1, Alan Gibbs2, Zoe K. Shipton1, Serena Jones2 (1) Glasgow University, Glasgow, United Kingdom (2) Midland Valley Exploration Ltd, Glasgow, United Kingdom To quantify the range in interpretations of geological data by professionals, we have asked over 200 geoscientists to interpret a seismic section. Our aim was to assess the impact of interpretation on structural models and, ultimately, on prospectivety. A crucial element of the project was to create a known geological scenario, to compare interpretations against, a 'catch 22' situation if using real' seismic. We have created our data-set in the structural modelling and restoration program 2DMove in which we determined the input parameters for the model. Synthetic seismic was shot' across the model to create an image for interpretation. Individuals were asked to interpret the image and provide information on their level of experience in: years, tectonic regimes, industry, academia etc.

Initial findings suggest that people's previous experience affects both their approach and the outcome of their interpretation. Differing interpretational styles have resulted in interpretations of the single data-set ranging from salt to inversion tectonics. We have quantified the range in interpretation of the seismic data set for style and tectonic regime, and consider the impact this has on potential prospectivety. Our initial results show that those that have worked predominantly in a particular tectonic regime have in many cases brought their experience from that regime to play in their interpretation. Their prior knowledge has biased their interpretation. Can we quantify the bias of individuals in the generation of this range of interpretations and modify industry workflows to minimise the impact on prospectivety?

An Analysis and Comparison of Real Option Approaches for the Petroleum Investment

Yao, Yanhua1, Steve Begg1, John Van der Hoek1, Peter Behrenbruch1 (1) The University of Adelaide, Adelaide, Australia In many instances, oil companies struggle with decisions pertaining to petroleum investment. The difficulty partially stems

from the uncertainties in many of the inherent variables. As commonly acknowledged, traditional valuation methods are unable to properly portray investment opportunities. Due to large uncertainty in Petroleum Exploration and Production (E & P), investors are gradually turning to a more dynamic approach to investment decisions. Real Options Valuation involves a methodology for evaluating the value of an opportunity, leading to a strategic decision in an uncertain environment. Based on academic research in finance and business management, Real Options Valuation may be extended from option-pricing tools of the finance sector to that of evaluating E & P projects. However, although Real Options thinking has been widely accepted and used in some cases, the wider use of the Real Options approach is still a hot debate in the petroleum industry. A permissible definition of Real Options may lead to inconsistencies among Real Options approaches. The opportunity may involve technical aspects or may be purely commercial in nature. In all cases a quantitative approach is required. In the work by Borison (2003) and Bratvold et al (2005), the authors have listed five Real Option methodologies: the Classic approach, the Subjective approach, the Market Disclaimer approach (MAD), the Smith approach, and the Luenberger approach. A comparative analysis of these Real Option approaches is presented in this paper. In comparing the above-mentioned Real Options approaches, two petroleum cases are considered. The technical uncertainty dominated case is related to reservoir management. The market uncertainty dominated case involves a Liquid Petroleum Gas (LPG) distribution project. The case studies presented the functionality of the five Real Options approaches.

The research suggests that the petroleum industry could benefit from using Real Options Valuation in their investment strategy, thus improving petroleum business performance.

Das könnte Ihnen auch gefallen

- National Subsidies SOE Investment: Exploration, Published in 2014Dokument13 SeitenNational Subsidies SOE Investment: Exploration, Published in 2014totongopNoch keine Bewertungen

- Kieso - IFRS - ch11 - IfRS (Depreciation, Impairments, and Depletion)Dokument73 SeitenKieso - IFRS - ch11 - IfRS (Depreciation, Impairments, and Depletion)Muzi RahayuNoch keine Bewertungen

- Psia ºF T ºF P T Pressure Psia B RB/MCF Check DataDokument21 SeitenPsia ºF T ºF P T Pressure Psia B RB/MCF Check DataArun Kumar NagarNoch keine Bewertungen

- Depreciation, Impairments, and DepletionDokument83 SeitenDepreciation, Impairments, and DepletionfebrythiodorNoch keine Bewertungen

- Geophysical MethodsDokument30 SeitenGeophysical MethodsKhaled 2006Noch keine Bewertungen

- Pump Foundation DesignDokument18 SeitenPump Foundation DesignSourav92% (12)

- Annex 1 - Figure A BDokument2 SeitenAnnex 1 - Figure A BtotongopNoch keine Bewertungen

- 2012 11 LPG Chem Gas QuantityDokument4 Seiten2012 11 LPG Chem Gas QuantitytotongopNoch keine Bewertungen

- Gas Condensate Reservoir AnalysisDokument2 SeitenGas Condensate Reservoir AnalysistotongopNoch keine Bewertungen

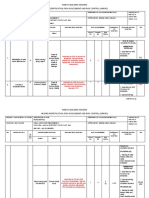

- Decision Tree Law Litigation 080601Dokument9 SeitenDecision Tree Law Litigation 080601totongopNoch keine Bewertungen

- Lab Fire Safety ChecklistDokument2 SeitenLab Fire Safety ChecklisttotongopNoch keine Bewertungen

- Pressure Relief Valve Data Sheet-Rev01Dokument1 SeitePressure Relief Valve Data Sheet-Rev01thawdarNoch keine Bewertungen

- 2012 08 ReformateDokument4 Seiten2012 08 ReformatetotongopNoch keine Bewertungen

- Solar Group Case StudyDokument3 SeitenSolar Group Case StudytotongopNoch keine Bewertungen

- RG FlowchartDokument1 SeiteRG FlowcharttotongopNoch keine Bewertungen

- Project Standards and Specifications LPG Recovery and Splitter Systems Rev01Dokument5 SeitenProject Standards and Specifications LPG Recovery and Splitter Systems Rev01hiyeonNoch keine Bewertungen

- Project Standards and Specifications Pipe Hanging and Supports Rev01Dokument5 SeitenProject Standards and Specifications Pipe Hanging and Supports Rev01hiyeonNoch keine Bewertungen

- Project Standards and Specifications Crude Desalter Systems Rev01Dokument6 SeitenProject Standards and Specifications Crude Desalter Systems Rev01muhammad_asim_10Noch keine Bewertungen

- BDokument3 SeitenBtotongopNoch keine Bewertungen

- BDokument3 SeitenBtotongopNoch keine Bewertungen

- 9697s2 - Abs Major Liquefaction Processes For Base Load LNG PlantsDokument2 Seiten9697s2 - Abs Major Liquefaction Processes For Base Load LNG PlantstotongopNoch keine Bewertungen

- RG FlowchartDokument1 SeiteRG FlowcharttotongopNoch keine Bewertungen

- 9697s2 - Abs Major Liquefaction Processes For Base Load LNG PlantsDokument2 Seiten9697s2 - Abs Major Liquefaction Processes For Base Load LNG PlantstotongopNoch keine Bewertungen

- OTC 23939 LNG Barges: The Offshore Solution For Export of US Pipeline GasDokument1 SeiteOTC 23939 LNG Barges: The Offshore Solution For Export of US Pipeline GastotongopNoch keine Bewertungen

- Heat Exchanger Datasheet SampleDokument1 SeiteHeat Exchanger Datasheet SampleMuhd Fadzlee ZNoch keine Bewertungen

- Sample Invoice Schedule FormatsDokument6 SeitenSample Invoice Schedule FormatstotongopNoch keine Bewertungen

- 9697s2 - Abs Major Liquefaction Processes For Base Load LNG PlantsDokument2 Seiten9697s2 - Abs Major Liquefaction Processes For Base Load LNG PlantstotongopNoch keine Bewertungen

- Project Standards and Specifications Pipeline Leak Detection Systems Rev01Dokument6 SeitenProject Standards and Specifications Pipeline Leak Detection Systems Rev01hiyeonNoch keine Bewertungen

- Pressure Relief Valve Data Sheet-Rev01Dokument1 SeitePressure Relief Valve Data Sheet-Rev01thawdarNoch keine Bewertungen

- 9697s2 - Abs Major Liquefaction Processes For Base Load LNG PlantsDokument2 Seiten9697s2 - Abs Major Liquefaction Processes For Base Load LNG PlantstotongopNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Bshm55 Module 1Dokument12 SeitenBshm55 Module 1Yisu HimaaNoch keine Bewertungen

- PSB - Free Mover - Study Abroad - BrochureDokument16 SeitenPSB - Free Mover - Study Abroad - BrochurezuzuzuzuoNoch keine Bewertungen

- Usn LM2500 Asme Paper GT2010-22811 61410 JalDokument7 SeitenUsn LM2500 Asme Paper GT2010-22811 61410 Jalferrerick0% (1)

- Normal - DistributionDokument23 SeitenNormal - Distributionlemuel sardualNoch keine Bewertungen

- Insurance LawDokument52 SeitenInsurance LawSenelwa Anaya100% (5)

- CNHS School-ConPlanDokument26 SeitenCNHS School-ConPlanMmg Muñoz MarianNoch keine Bewertungen

- Module 10 - PROJECT EXECUTIONDokument9 SeitenModule 10 - PROJECT EXECUTIONJohncel TawatNoch keine Bewertungen

- Fiteh Kebede ProposalDokument45 SeitenFiteh Kebede ProposalFiteh KNoch keine Bewertungen

- Adarlo Demo Gloria 1Dokument11 SeitenAdarlo Demo Gloria 1Ronel AdarloNoch keine Bewertungen

- Clockwork Fatigue Management Training White Paper2Dokument15 SeitenClockwork Fatigue Management Training White Paper2Pero PericNoch keine Bewertungen

- MTM Design and Technical Review Procedure: ApprovalDokument27 SeitenMTM Design and Technical Review Procedure: ApprovalCK Tang100% (1)

- Debitum White PaperDokument88 SeitenDebitum White PaperICO ListNoch keine Bewertungen

- Case # 3 - Home Inspection Co.Dokument9 SeitenCase # 3 - Home Inspection Co.Ahmad RafiqNoch keine Bewertungen

- Project Report On A Study On Consumer Attitude Towards E-Commerce With Special Reference To RisksDokument80 SeitenProject Report On A Study On Consumer Attitude Towards E-Commerce With Special Reference To Risks141Keval JetaniNoch keine Bewertungen

- Economically DisadvantagedDokument7 SeitenEconomically DisadvantagedAhm SamNoch keine Bewertungen

- Thwin Htoo Aung (EMBF - 66)Dokument65 SeitenThwin Htoo Aung (EMBF - 66)kringNoch keine Bewertungen

- Porteo Manual PDFDokument36 SeitenPorteo Manual PDFSami YavuzNoch keine Bewertungen

- SPC HIRADC - 022 - Road WorksDokument5 SeitenSPC HIRADC - 022 - Road WorksKalai ArasanNoch keine Bewertungen

- Food Recall PlanDokument38 SeitenFood Recall Plansuhassmart100% (2)

- Baej 2014 02THesisDokument298 SeitenBaej 2014 02THesisHeidi QNoch keine Bewertungen

- Chapter 9 Professional Ethics and ResponsibilitiesDokument27 SeitenChapter 9 Professional Ethics and ResponsibilitiesDarshan M MNoch keine Bewertungen

- KPMG Fraud Survey (Ch3)Dokument38 SeitenKPMG Fraud Survey (Ch3)joyanto.roy7079Noch keine Bewertungen

- GN-04-R2 - Guidance On Medical Device RecallDokument13 SeitenGN-04-R2 - Guidance On Medical Device Recallhitham shehataNoch keine Bewertungen

- Minutes of MeetingsDokument17 SeitenMinutes of Meetingsgroup2sd1314Noch keine Bewertungen

- WHO 1033 Annex 2 - Points To Consider For HBELs in CVDokument17 SeitenWHO 1033 Annex 2 - Points To Consider For HBELs in CVDevendraNoch keine Bewertungen

- Nebosh Summary IGC1Dokument12 SeitenNebosh Summary IGC1Yousef OlabiNoch keine Bewertungen

- 4.2 - Needs and Expectation With Risk AnalysisDokument3 Seiten4.2 - Needs and Expectation With Risk AnalysisSafety Dept50% (2)

- The Collected Wisdom of Seth KlarmanDokument11 SeitenThe Collected Wisdom of Seth KlarmanSantangel's Review93% (15)

- Vanilla Risk Parity PythonDokument7 SeitenVanilla Risk Parity PythonPeter SamualNoch keine Bewertungen