Beruflich Dokumente

Kultur Dokumente

DSFDSFDSFDSF

Hochgeladen von

Naveen KumarOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

DSFDSFDSFDSF

Hochgeladen von

Naveen KumarCopyright:

Verfügbare Formate

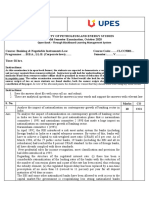

INDIAN BANKING INDUSTRY INTEREST RATE CUT Further to the instructions from the Finance minister P.

Chidambaram, state-run banks have reduced their bank rates by 25 basis points. The banks which have reduced their rates include the Union Bank, Oriental Bank of Commerce, Canara bank. The rational for the reduction in the rate cuts is to boost the growth in the country. Advantages of rate cuts: Reduction in interest rate will help in credit picking up in the retail and small businesses segment. Reduction in the rate cuts will help the students who wish to study abroad. The interest burden on students taking loan will reduce as the interest rate on loans is dependable on the bank rates. The rate reduction is applicable to both new applicants and existing borrowers of education loans.

The fear of reduction in the net interest margins of banks are allayed by the expectations of reduction in the costs of funds and increase in the credits as the economy improves. BANKING REGULATIONS Violation of anti-money laundering norms by banks has invited the wrath of the RBI. RBI on 12th of June has warned banks to meticulously follow its instructions with regard to walk-in customers while selling insurance, mutual fund, gold and other products above Rs 50,000 or face action. The Cobra-post operation exposing the violation of norms by banks has made a serious impact and thereby RBI has instructed the banks to follow the instructions in letter and spirit and ensure that violations of (KYC and anti-money laundering norms) do not recur. The existing guidelines include:

Banks should verify the identity and address of walk-in-customers while selling third

party products, like insurance, mutual funds, gold coins. PAN is mandatory for transactions exceeding Rs 50,000 The instructions in respect of third party products would also apply to sale of banks' own products, payment of dues of credit cards/sale and reloading of prepaid/travel cards and any other product above the threshold of Rs 50,000.

CLASSIFICATION OF FLOATING PROVISIONS RBI is expected to issue an order asking banks to classify floating provisions as net demand and time liability. Floating provisions are provisions made in excess of what banks are required to make. However, banks can dip into floating provision only after taking approval from RBI. RBI is likely to ask banks to treat floating provisions as a part of net demand and time liability on which banks are mandated to maintain cash reserve ratio and statutory liquidity ratio. This move will hurt HDFC Bank and IndusInd banks more. HDFC Bank has floating provisions of Rs 1800 crore while IndusInd bank has floating provisions of Rs 50 crore. Currently banks have to park 4% of the NDTL with RBI as CRR and invest 23% of their deposits in government securities known as SLR. If floating provisions are added to banks deposits, they will have to park more money with RBI in form of CRR where they do not earn any interest.

Das könnte Ihnen auch gefallen

- Further To The Above Developments, in July 2008, RBI Took Strict Measures To The Unsolicited Cards IssueDokument21 SeitenFurther To The Above Developments, in July 2008, RBI Took Strict Measures To The Unsolicited Cards IssueGourav Kumar SwainNoch keine Bewertungen

- Monthly News Letter 01.12.10 To 31.12.10Dokument6 SeitenMonthly News Letter 01.12.10 To 31.12.10poojaapandeyNoch keine Bewertungen

- Module 4 Eco Sem 3Dokument18 SeitenModule 4 Eco Sem 3sruthikadug22Noch keine Bewertungen

- RBI Guidelines For Banks Regarding Customer Complaints On Home LoansDokument2 SeitenRBI Guidelines For Banks Regarding Customer Complaints On Home Loanssamy7541Noch keine Bewertungen

- Gaurav Choudhari Project ReportDokument59 SeitenGaurav Choudhari Project ReportSoluion RajNoch keine Bewertungen

- Latest in BankingDokument11 SeitenLatest in Bankingbrightlight1989Noch keine Bewertungen

- November 2017 Banking Current AffairsDokument2 SeitenNovember 2017 Banking Current Affairsnaveen0037Noch keine Bewertungen

- Synopsis On Differentiated Banking: Name: Pragti Bhargava Roll No: 2 Branch: PGDM-RuralDokument3 SeitenSynopsis On Differentiated Banking: Name: Pragti Bhargava Roll No: 2 Branch: PGDM-RuralPardeep Singh SainiNoch keine Bewertungen

- Institute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementDokument4 SeitenInstitute of Management Studies Davv Indore Mba (Financial Administration) Iiird Semester - Fa 303C Insurance and Bank ManagementjaiNoch keine Bewertungen

- Retail Banking: NtroductionDokument13 SeitenRetail Banking: NtroductionAmit PandeyNoch keine Bewertungen

- Central Bank To Simplify KYC NormsDokument9 SeitenCentral Bank To Simplify KYC NormsAnsariMohdIrfanNoch keine Bewertungen

- Payments Bank and Small Finance BanksDokument4 SeitenPayments Bank and Small Finance BanksRahulNoch keine Bewertungen

- Monthly Beepedia May 2022Dokument122 SeitenMonthly Beepedia May 2022Atul sharmaNoch keine Bewertungen

- Danish Muzzafar Amjadkhan Ali Ammar Maitla Inam-Ul Haque RanaDokument21 SeitenDanish Muzzafar Amjadkhan Ali Ammar Maitla Inam-Ul Haque RanaChiken BurgerNoch keine Bewertungen

- Changes in Norms Under Shakti Kantha DasDokument2 SeitenChanges in Norms Under Shakti Kantha DasSai Dinesh BilleNoch keine Bewertungen

- Banking, Financial & Economic Current Affairs August 2021: Recommended Speed 1.25xDokument54 SeitenBanking, Financial & Economic Current Affairs August 2021: Recommended Speed 1.25xunknown surprisesNoch keine Bewertungen

- Current Affairs 2017Dokument43 SeitenCurrent Affairs 2017BaskarBossYuvanRomeo'zNoch keine Bewertungen

- Banking LicenceDokument8 SeitenBanking LicenceSahil JoshiNoch keine Bewertungen

- Foreign Banks and GuidelinesDokument7 SeitenForeign Banks and GuidelinesprasannarbNoch keine Bewertungen

- Principles of Bank Lending & Priority Sector LendingDokument22 SeitenPrinciples of Bank Lending & Priority Sector LendingSheejaVarghese100% (8)

- CBS NewDokument92 SeitenCBS NewBen MathewsNoch keine Bewertungen

- IIBF Vision May 2011Dokument8 SeitenIIBF Vision May 2011luvnuts4u luvnutsNoch keine Bewertungen

- PreambleDokument7 SeitenPreambleSudhir Kumar SinghNoch keine Bewertungen

- Project Report "Banking System" in India Introduction of BankingDokument9 SeitenProject Report "Banking System" in India Introduction of BankingmanishteensNoch keine Bewertungen

- Minutes of Meeting On Response of Meeting Held On (22-4-17)Dokument4 SeitenMinutes of Meeting On Response of Meeting Held On (22-4-17)Shivam KumarNoch keine Bewertungen

- L1 BankingDokument38 SeitenL1 BankingdjroytatanNoch keine Bewertungen

- GK Tornado Lic Assistant Main Exams 2019 Eng 18Dokument203 SeitenGK Tornado Lic Assistant Main Exams 2019 Eng 18Sakshi GuptaNoch keine Bewertungen

- General Knowledge Today - 88Dokument2 SeitenGeneral Knowledge Today - 88niranjan_meharNoch keine Bewertungen

- GK-Capcule 2015 in EnglishDokument54 SeitenGK-Capcule 2015 in EnglishJyothi SmilyNoch keine Bewertungen

- Exclusive Current Affairs Tonic For NABARD & HARYANA Co-Operative Bank (Part I)Dokument64 SeitenExclusive Current Affairs Tonic For NABARD & HARYANA Co-Operative Bank (Part I)Manu Mallikarjun NelagaliNoch keine Bewertungen

- General Knowledge Today - 56Dokument3 SeitenGeneral Knowledge Today - 56niranjan_meharNoch keine Bewertungen

- Finance Project On Various Credit Schemes of SBIDokument46 SeitenFinance Project On Various Credit Schemes of SBItaanvi00783% (6)

- Project On Various Credit Schemes of SBI Back PDFDokument46 SeitenProject On Various Credit Schemes of SBI Back PDFAbhinaw KumarNoch keine Bewertungen

- Finance Project On Various Credit Schemes of SBI PDFDokument46 SeitenFinance Project On Various Credit Schemes of SBI PDFAbhinaw KumarNoch keine Bewertungen

- Mrutyunjaya Sangresakoppa - MB207683Dokument21 SeitenMrutyunjaya Sangresakoppa - MB207683Prashanth Y GNoch keine Bewertungen

- An Overview of Kyc NormsDokument5 SeitenAn Overview of Kyc NormsArsh AhmedNoch keine Bewertungen

- Banking Notes Functions of BanksDokument17 SeitenBanking Notes Functions of Banksbestread67Noch keine Bewertungen

- Beepedia Monthly Current Affairs (Beepedia) December 2022Dokument116 SeitenBeepedia Monthly Current Affairs (Beepedia) December 2022Sovan KumarNoch keine Bewertungen

- What Is Differential BankingDokument8 SeitenWhat Is Differential BankingSakshiNoch keine Bewertungen

- MBA Finance Project On Credit Schemes of State Bank of India (SBI) and Other Banks in IndiaDokument13 SeitenMBA Finance Project On Credit Schemes of State Bank of India (SBI) and Other Banks in IndiaDiwakar BandarlaNoch keine Bewertungen

- Roll No.-103 SAP ID - 500071323: Open Book - Through Blackboard Learning Management SystemDokument4 SeitenRoll No.-103 SAP ID - 500071323: Open Book - Through Blackboard Learning Management SystemAryan DevNoch keine Bewertungen

- Eco Final 3RD SemDokument10 SeitenEco Final 3RD Semnagendra yanamalaNoch keine Bewertungen

- News of The Week 2Dokument17 SeitenNews of The Week 2mehtarahul999Noch keine Bewertungen

- Payment Bank LicenseDokument5 SeitenPayment Bank LicenseDr. Prafulla RanjanNoch keine Bewertungen

- Presentation On The Articles "Priority Sector Lending and Statement of Intent "Dokument17 SeitenPresentation On The Articles "Priority Sector Lending and Statement of Intent "Gaurav SawlaniNoch keine Bewertungen

- IIBF Vision February 2016 For WebDokument8 SeitenIIBF Vision February 2016 For WebparulvrmNoch keine Bewertungen

- Project Report "Banking System" in India Introduction of BankingDokument15 SeitenProject Report "Banking System" in India Introduction of BankingshabnammerajNoch keine Bewertungen

- The Casa Courtship: FeatureDokument5 SeitenThe Casa Courtship: FeatureRajat BarveNoch keine Bewertungen

- Project Report On Banking SystemDokument16 SeitenProject Report On Banking SystemArun Kumar0% (1)

- 33-Top 60 Bank Interview QuestionsDokument10 Seiten33-Top 60 Bank Interview Questionsshubh9190Noch keine Bewertungen

- L-3 Regulatory Framework For Banks - RBIDokument46 SeitenL-3 Regulatory Framework For Banks - RBIVinay SudaniNoch keine Bewertungen

- How Cash Reserve Ratio Affects Loan Rates?: Know Your CustomerDokument21 SeitenHow Cash Reserve Ratio Affects Loan Rates?: Know Your CustomerDevendra Singh JodhaNoch keine Bewertungen

- Presented By:: Madhuri Koul Narayan Ambulgekar Vrushali Hadawale Anupam Sinha Prajakta KambleDokument14 SeitenPresented By:: Madhuri Koul Narayan Ambulgekar Vrushali Hadawale Anupam Sinha Prajakta Kamblepratheesh_tulsiNoch keine Bewertungen

- Banking Today Nov 15Dokument22 SeitenBanking Today Nov 15Apurva JhaNoch keine Bewertungen

- Banking NotesDokument28 SeitenBanking NotesnitiNoch keine Bewertungen

- Commercial Banking in IndiaDokument32 SeitenCommercial Banking in IndiaShaifali ChauhanNoch keine Bewertungen

- Beepedia Monthly Current Affairs (Beepedia) December 2023Dokument99 SeitenBeepedia Monthly Current Affairs (Beepedia) December 2023Amit KanojiaNoch keine Bewertungen

- Islamic Banking And Finance for Beginners!Von EverandIslamic Banking And Finance for Beginners!Bewertung: 2 von 5 Sternen2/5 (1)

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsVon EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNoch keine Bewertungen

- LJLKLK OpppDokument18 SeitenLJLKLK OpppNaveen KumarNoch keine Bewertungen

- CH How Inefficient Is Investment 121112Dokument15 SeitenCH How Inefficient Is Investment 121112Naveen KumarNoch keine Bewertungen

- Water Heaters: Based On Research Conducted by TVJ in December 2011Dokument1 SeiteWater Heaters: Based On Research Conducted by TVJ in December 2011Naveen KumarNoch keine Bewertungen

- Strategic Management Mini Project: Bajaj Electricals LTDDokument36 SeitenStrategic Management Mini Project: Bajaj Electricals LTDNaveen KumarNoch keine Bewertungen

- Examples of Borrowing Constraints Royal Bank of Scotland LoanDokument2 SeitenExamples of Borrowing Constraints Royal Bank of Scotland LoanNaveen KumarNoch keine Bewertungen

- ECB Holds Rates, Says No Move For Extended Period'Dokument3 SeitenECB Holds Rates, Says No Move For Extended Period'Naveen KumarNoch keine Bewertungen

- BDFBFBDFDokument2 SeitenBDFBFBDFNaveen KumarNoch keine Bewertungen

- RklregDokument18 SeitenRklregNaveen Kumar100% (1)

- BJHBHBJDokument30 SeitenBJHBHBJNaveen KumarNoch keine Bewertungen

- Activity 1 - Pajanustan (Assignment)Dokument2 SeitenActivity 1 - Pajanustan (Assignment)Trisha Mae Lyrica CastroNoch keine Bewertungen

- Corporate Finance Institute - Financial-Modeling-GuidelinesDokument95 SeitenCorporate Finance Institute - Financial-Modeling-GuidelinesTan Pheng SoonNoch keine Bewertungen

- Ushtrime Studente Tema 3, TezgjidhuraDokument25 SeitenUshtrime Studente Tema 3, TezgjidhuraAndi HoxhaNoch keine Bewertungen

- Allied BankDokument3 SeitenAllied BankHamzaNoch keine Bewertungen

- Fly Ash For Cement ConcreteDokument48 SeitenFly Ash For Cement Concreterashm006ranjanNoch keine Bewertungen

- Self Evaluation QuestionsDokument4 SeitenSelf Evaluation QuestionsNeeraj KhatriNoch keine Bewertungen

- Basic Tools of FinanceDokument13 SeitenBasic Tools of FinanceGayle AbayaNoch keine Bewertungen

- Hyperion Training DetailsDokument19 SeitenHyperion Training DetailsAmit SharmaNoch keine Bewertungen

- Case Unpredictable DemandDokument3 SeitenCase Unpredictable DemandnitishghuneNoch keine Bewertungen

- Chapter 1 - The Systems Development Environment - 2Dokument23 SeitenChapter 1 - The Systems Development Environment - 2Mahdi GhulamiNoch keine Bewertungen

- Smart Investment Gujarati Issue (H)Dokument82 SeitenSmart Investment Gujarati Issue (H)Mukesh GuptaNoch keine Bewertungen

- Case Study - FM LogisticsDokument3 SeitenCase Study - FM Logisticssaurs24231Noch keine Bewertungen

- Management Leading and Collaborating in A Competitive World 12th Edition Bateman Snell Konopaske Solution ManualDokument76 SeitenManagement Leading and Collaborating in A Competitive World 12th Edition Bateman Snell Konopaske Solution Manualamanda100% (24)

- Project Planning With Gant Chart TemplateDokument1 SeiteProject Planning With Gant Chart TemplatePrashant SharmaNoch keine Bewertungen

- Stephen Dallas CV General Feb 2022 V 1.1Dokument3 SeitenStephen Dallas CV General Feb 2022 V 1.1Joe DallasNoch keine Bewertungen

- RSPO Supply Chain Certification Standards 2020-EnglishDokument60 SeitenRSPO Supply Chain Certification Standards 2020-EnglishHector Gonzalez MuñozNoch keine Bewertungen

- ISO 14001-2015 Environmental Management Systems-Requirements With Guidance For UseDokument44 SeitenISO 14001-2015 Environmental Management Systems-Requirements With Guidance For UseLeo Benzut B-fam 'istunink'100% (1)

- Techcombank PresentationDokument41 SeitenTechcombank PresentationbinhNoch keine Bewertungen

- Software Dev ContractDokument7 SeitenSoftware Dev ContractRahulPardasaniNoch keine Bewertungen

- Principle of MarketingDokument16 SeitenPrinciple of MarketingahmedbariNoch keine Bewertungen

- Kohli, A K Jaworski B J (1990) Market Orientation The Construct, Research Propositions, and Managerial Implications PDFDokument19 SeitenKohli, A K Jaworski B J (1990) Market Orientation The Construct, Research Propositions, and Managerial Implications PDF邹璇Noch keine Bewertungen

- Lectures For Basic Seminar On Cooperative Development 1203395026675748 4Dokument37 SeitenLectures For Basic Seminar On Cooperative Development 1203395026675748 4Marlon CorpuzNoch keine Bewertungen

- Cash Flow AnalysisDokument7 SeitenCash Flow AnalysisDeepalaxmi BhatNoch keine Bewertungen

- 19016620-031 MKT-434 Assignment 3&4Dokument7 Seiten19016620-031 MKT-434 Assignment 3&4HasnainNoch keine Bewertungen

- Basic Safety Procedures in High Risk Activities and IndustriesDokument2 SeitenBasic Safety Procedures in High Risk Activities and IndustriesLlanah Luz Marie Grate33% (3)

- Dividend Policy AssignDokument2 SeitenDividend Policy AssignAsad RehmanNoch keine Bewertungen

- International Business New 11Dokument66 SeitenInternational Business New 11tubenaweambroseNoch keine Bewertungen

- Global ManagerDokument15 SeitenGlobal ManagerNakita D'costaNoch keine Bewertungen

- WWW Zoho Com en Au Tech Talk Ethical Issues in Business HTMLDokument3 SeitenWWW Zoho Com en Au Tech Talk Ethical Issues in Business HTMLHamza CollectionNoch keine Bewertungen

- CBM ReportDokument11 SeitenCBM ReportBen ChongNoch keine Bewertungen