Beruflich Dokumente

Kultur Dokumente

FORM16: Signature Not Verified

Hochgeladen von

math_mallikarjun_sapOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FORM16: Signature Not Verified

Hochgeladen von

math_mallikarjun_sapCopyright:

Verfügbare Formate

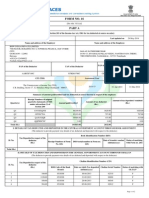

Tech Mahindra Limited

FORM16

Employee Name

Employee PAN

Employee ID

Employee Designation

Assessment Year

Financial Year

:Dilipkumar M

:ANVPM9867H

:18068

:Technical Associate

:2009-2010

:2008-2009

__________________________________________________________________________________

Note: Digitally Signed Form

This form has been signed and certified using Digital Signature Certificate as specified

under section 119 of the Income-tax Act, 1961. (Please refer Circular No.2/2007,

dated 21-5-2007).

Signature Not Verified

Digitally signed by PRADEEP ANANT NIGUDKAR

Date: 2009.04.30 00:00:00 +05:30

Reason: Form 16

Location: Pune

Number of Pages 5 (including this page)

Signed using Digital Signature of Pradeep Anant Nigudkar

__________________________________________________________________________________________

18068 Dilipkumar M

Page:1

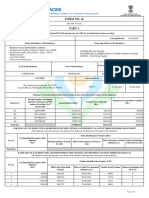

Tech Mahindra Limited

FORM NO - 16

[See rule 31 (1)(a) ]

Certificate under Section 203 of the Income - tax Act,1961 for tax deducted

at source from income Chargeable under the head "Salaries"

__________________________________________________________________________________________

Name and Address of Employer

Name and Designation of the Employee

Tech Mahindra Limited

18068 Dilipkumar M

Wing - 1,Oberoi Gardens Estate

Technical Associate

Chandivali, Andheri (East)

Mumbai--400 072

Maharashtra

__________________________________________________________________________________________

PAN/GIR No.

TAN

PAN of the Employee

AAACM3484F

MUMM15369E

ANVPM9867H

__________________________________________________________________________________________

Quarter

Acknowledgment No.

Period

Assessment Year

QI

013230100070935

From

To

QII

013230200009272

01/04/2008 31/03/2009

2009-2010

QIII

013230100084246

QIV

070570400384072

__________________________________________________________________________________________

DETAILS OF SALARY PAID AND ANY OTHER INCOME

Rs.

Rs.

Rs.

AND TAX DEDUCTED

__________________________________________________________________________________________

Pay Components :

Basic

127,696.00

Bonus/Ex-gratia

8,400.00

Conveyance Allowance

9,574.00

Misc. Earnings

67.00

House Rent Allowance

63,848.00

Personal Allowance

69,784.00

Shift Allowance

42,800.00

Variable Performance Pay

27,400.00

Perquisites (As per 12BA ) :

Accommodation perquisites (1)

Car Perquisites (2)

Other Perquisites(3-17)

1. Gross Salary

2. Less: Allowance to the extent Exempt U/S 10 :

LTA

Rent

Conveyance

Leave Encashment

Gratuity

0.00

0.00

0.00

______________________________

349,569.00

0.00

51,078.00

9,574.00

0.00

0.00

60,652.00

60,652.00

__________________________________________________________________________________________

18068 Dilipkumar M

Page:2

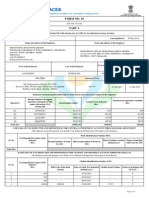

Tech Mahindra Limited

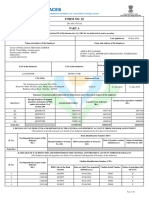

3. Balance (1-2)

4. Deduction U/S 16

(a) Entertainment Allowance

(b) Tax on Employment

5. Aggregate of 4(a) and (b)

______________________________

288,917.00

0.00

2,400.00

2,400.00

2,400.00

______________________________

286,517.00

6. Income Chargeable under

the head 'Salaries' (3 - 5)

7. Add/Less : Any other income reported by

the employee

0.00

Less : Interest on Housing Loan

8. Gross Total Income (6 + 7)

9. Deductions Under Chapter VI-A

(A) sections 80C,80CCC and 80CCD

(a) sections 80C

PF

VPF

(b) sections 80CCCC

(b) sections 80CCD

0.00

0.00

286,517.00

15,320.00

0.00

0.00

______________________________

15,320.00

(B) Other sections (for e.g 80E,80G etc.

Under Chapter VI- A

0.00

______________________________

0.00

10. Aggregate of deductible amounts

under Chapter VI- A

11. Total Income (8 - 10)(Round to higher 10)

12. Tax on Total Income

13. Surcharge

14. Education Cess 3%

15.

16.

17.

18.

15,320.00

271,200.00

_______________

12,120.00

0.00

364.00

_______________

12,484.00

0.00

12,484.00

12,484.00

Tax Payable (12 + 13 + 14 )

Relief under section 89

Tax Payable (15 -16)

Less: Tax Deducted at Source u/s

192(1) & 192 (IA) on

perquisites u/s 17 (2)

__________________________________________________________________________________________

19. Tax Payable / Refundable (17 -18)

0.00

__________________________________________________________________________________________

18068 Dilipkumar M

Page:3

Tech Mahindra Limited

__________________________________________________________________________________________

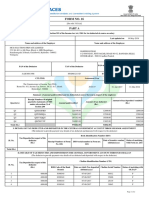

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT

__________________________________________________________________________________________

Sr.

TOTAL TAX

CHEQUE/DD NO BSR CODE

DATE ON WHICH

CHALLAN NO

No.

OF BANK

TAX DEPOSITED

__________________________________________________________________________________________

1

267.00

276894 6910214

07/05/2008

00048

2

303.00

1117728 6910239

06/06/2008

50969

3

638.00

1174384 6910239

04/07/2008

50575

4

1,440.00

1256779 6910333

07/08/2008

51726

5

1,495.00

1324900 6910333

05/09/2008

51401

6

1,557.00

1421035 6910333

07/10/2008

50574

7

2,004.00

1511042 6910333

07/11/2008

51469

8

2,004.00

1586874 6910333

05/12/2008

52013

9

2,396.00

1683321 6910333

07/01/2009

55726

10

141.00

1770598 6910333

06/02/2009

51980

11

142.00

1864513 6910333

06/03/2009

52403

12

97.00

1988173 6910333

07/04/2009

53808

__________________________________________________________________________________________

12,484.00

__________________________________________________________________________________________

I, Pradeep Anant Nigudkar Son of : Anant V. Nigudkar working in the capacity of Sr. Manager

do hereby certify that a sum of

Rs. 12,484.00 ( Twelve Thousand Four Hundred Eighty Four )

has been deducted at source and paid to the credit of the Central Government. I further

certify that the information given above is true and correct based on the book of account,

documents and other available records.

For Tech Mahindra Ltd.

This form is digitally signed.

Place :Pune

Full Name

: Pradeep Anant Nigudkar

Date :30/04/2009

Designation : Sr. Manager

__________________________________________________________________________________________

__________________________________________________________________________________________

18068 Dilipkumar M

Page:4

Tech Mahindra Limited

FORM NO 12BA

[See rule 26A(2)(b)]

Statement showing particulars of perquisites, other fringe benefits of amenities and

profits in lieu of salary with value thereof

__________________________________________________________________________________________

1. Name and Address of the Employer:

Tech Mahindra Limited

Wing - 1,Oberoi Gardens Estate

Mumbai

Maharashtra

2. TAN:

MUMM15369E

3. Name and Designation of the Employee:18068 Dilipkumar M

Technical Associate

4. PAN:

ANVPM9867H

5. Assessment Year:

2009-2010

__________________________________________________________________________________________

Sr. Name of Perquisite

Value of per- Amount, If any

Amount of

No. (See rule 3)

-quisite as

Paid by

Taxable

per rules

employee

perquisite

__________________________________________________________________________________________

1 Accommodation

0.00

0.00

0.00

2 Transfer of assets to employees

0.00

0.00

0.00

3 Cars

0.00

0.00

0.00

4 Credit card expenses

0.00

0.00

0.00

5 Club expenses

0.00

0.00

0.00

6 Education

0.00

0.00

0.00

7 Interest free or concessional loans

0.00

0.00

0.00

8 Free meals

0.00

0.00

0.00

9 Gas,electricity,water,Soft furnishings

0.00

0.00

0.00

10 Gifts, vouchers etc.

0.00

0.00

0.00

11 Holiday expenses/Own Cars

0.00

0.00

0.00

12 Use of movable assets by employees

0.00

0.00

0.00

13 Other benefits or amenities

0.00

0.00

0.00

14 Stock options (non-qualified options)

0.00

0.00

0.00

15 Sweeper,gardener,watchman or personal

0.00

0.00

0.00

attendent

16 Free or concessional travel

0.00

0.00

0.00

__________________________________________________________________________________________

Total value of perquisites

0.00

0.00

0.00

Total value of Profits

0.00

0.00

0.00

in lieu of salary

__________________________________________________________________________________________

DECLARATION BY EMPLOYER

I,Pradeep Anant Nigudkar S/o Anant V. Nigudkar

working as 'Sr. Manager' do hereby

declare on behalf of Tech Mahindara Limited that

the information given above is based on the

books of account, documents and other relevant

records or information available with us and the

details of value of each such perquisite are in

accordance with section 17 and the rules framed

thereunder and that such information is true and

correct.

Place :Pune

For

Tech Mahindra Ltd.

This form is digitally signed.

Signed By

Designation

:Pradeep Anant Nigudkar

:Sr. Manager

Date :30/04/2009

__________________________________________________________________________________________

18068 Dilipkumar M

Page:5

Das könnte Ihnen auch gefallen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNoch keine Bewertungen

- 1 1000 Form16Dokument5 Seiten1 1000 Form16Rakshit SharmaNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNoch keine Bewertungen

- Pay Slip March 2017Dokument4 SeitenPay Slip March 2017Anonymous AsVoWD04c0% (1)

- Form 16 ADokument5 SeitenForm 16 Anisha_khanNoch keine Bewertungen

- Form 16 TDS certificate for FY 2014-15Dokument2 SeitenForm 16 TDS certificate for FY 2014-15RamyaMeenakshiNoch keine Bewertungen

- Form 16 651746Dokument4 SeitenForm 16 651746Arslan1112Noch keine Bewertungen

- YourForm16 2022Dokument8 SeitenYourForm16 2022BHARATH MPNoch keine Bewertungen

- Form16 Till 14 Dec 2019Dokument11 SeitenForm16 Till 14 Dec 2019Aviral SankhyadharNoch keine Bewertungen

- Ahxxxxxxxq q4 2022-23Dokument2 SeitenAhxxxxxxxq q4 2022-23AMAN DEEP SINGHNoch keine Bewertungen

- Deve 60398Dokument7 SeitenDeve 60398Devesh Pratap ChandNoch keine Bewertungen

- Kirandeep September SalaryDokument1 SeiteKirandeep September Salaryprince.gill07Noch keine Bewertungen

- QUA05242 Form16Dokument5 SeitenQUA05242 Form16saurabhNoch keine Bewertungen

- Salary details and tax deductionsDokument3 SeitenSalary details and tax deductionsBALANoch keine Bewertungen

- Employee Details Payment & Leave Details: Arrears Current AmountDokument1 SeiteEmployee Details Payment & Leave Details: Arrears Current AmountLS QNoch keine Bewertungen

- Manoj Singh ITRDokument1 SeiteManoj Singh ITRPANKAJ RAUTELANoch keine Bewertungen

- FORM 16 DETAILSDokument2 SeitenFORM 16 DETAILSKushal MalhotraNoch keine Bewertungen

- Form 16Dokument2 SeitenForm 16robin0903Noch keine Bewertungen

- Atppn7354l 2020 21 PDFDokument2 SeitenAtppn7354l 2020 21 PDFPratik MeswaniyaNoch keine Bewertungen

- Offer Letter: D-278, Near Hanuman MandirDokument3 SeitenOffer Letter: D-278, Near Hanuman MandirGhanshyam SinghNoch keine Bewertungen

- Gmail - HCL Interview - 1st Aug.Dokument2 SeitenGmail - HCL Interview - 1st Aug.Kannu PriyaNoch keine Bewertungen

- Form No. 16: Part ADokument6 SeitenForm No. 16: Part Asamir royNoch keine Bewertungen

- b5047 Form16 Fy1819 PDFDokument9 Seitenb5047 Form16 Fy1819 PDFBhumika JoshiNoch keine Bewertungen

- Form No. 16: Part ADokument10 SeitenForm No. 16: Part ARAJASHEKAR KYAROLLANoch keine Bewertungen

- Abrpb4480f Partb 2020-21Dokument3 SeitenAbrpb4480f Partb 2020-21Subray N BanaulikarNoch keine Bewertungen

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADokument2 SeitenAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNoch keine Bewertungen

- Telephone Number: +91 141 267 0101, Facsimile Number: +91 141 267 0303 Amber Fort Road, Opposite Jal Mahal, Jaipur, 302002, IndiaDokument3 SeitenTelephone Number: +91 141 267 0101, Facsimile Number: +91 141 267 0303 Amber Fort Road, Opposite Jal Mahal, Jaipur, 302002, IndiaRamnish MishraNoch keine Bewertungen

- Form 16 Part - BDokument3 SeitenForm 16 Part - BdivanshuNoch keine Bewertungen

- FUPVNO1894 Arman Khan's Digital Appointment Letter - PVR PDFDokument5 SeitenFUPVNO1894 Arman Khan's Digital Appointment Letter - PVR PDFdilipkhanaman1980Noch keine Bewertungen

- Form No. 16 Part B (2020)Dokument3 SeitenForm No. 16 Part B (2020)Dharmendra ParmarNoch keine Bewertungen

- Form 16 FY 18-19 PART - ADokument2 SeitenForm 16 FY 18-19 PART - Asai venkataNoch keine Bewertungen

- Form 16Dokument4 SeitenForm 16Aruna Kadge JhaNoch keine Bewertungen

- Punjab Education Authority Salary StatementDokument1 SeitePunjab Education Authority Salary StatementMuhammad Ahmad JavedNoch keine Bewertungen

- Form No. 16: Part ADokument7 SeitenForm No. 16: Part AFuture ArtistNoch keine Bewertungen

- Form 16 20-21 PartaDokument2 SeitenForm 16 20-21 PartaTEMPORARY TEMPNoch keine Bewertungen

- Employee Details Payment & Leave Details: Arrears Current AmountDokument1 SeiteEmployee Details Payment & Leave Details: Arrears Current AmountsakthivelNoch keine Bewertungen

- D114003jul2020 PDFDokument1 SeiteD114003jul2020 PDFRajarshiRoyNoch keine Bewertungen

- Form 16 TDS Certificate SummaryDokument2 SeitenForm 16 TDS Certificate SummaryPravin HireNoch keine Bewertungen

- A-Radha@dxc - Com F16Dokument9 SeitenA-Radha@dxc - Com F16Radha PraveenNoch keine Bewertungen

- Accenture Solutions PVT LTDDokument1 SeiteAccenture Solutions PVT LTDVaraprasad ReddyNoch keine Bewertungen

- Basha Form 16Dokument6 SeitenBasha Form 16BakiarajNoch keine Bewertungen

- QUA06702 SalarySlipwithTaxDetailsDokument1 SeiteQUA06702 SalarySlipwithTaxDetailsZubairsaeedNoch keine Bewertungen

- Payslip India August - 2023 (1) - Unlocked-1Dokument1 SeitePayslip India August - 2023 (1) - Unlocked-1Bhaskar Siva KumarNoch keine Bewertungen

- PayslipDokument1 SeitePayslipSk Samim AhamedNoch keine Bewertungen

- Form 16: Wipro LimitedDokument8 SeitenForm 16: Wipro LimitedpadduNoch keine Bewertungen

- Appointment Letter PDFDokument4 SeitenAppointment Letter PDFKhushu ParmarNoch keine Bewertungen

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokument1 SeiteIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariNoch keine Bewertungen

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDokument2 SeitenForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9Noch keine Bewertungen

- Form 16 CertificateDokument3 SeitenForm 16 CertificateGanesh LohakareNoch keine Bewertungen

- Ganpact CompanyDokument1 SeiteGanpact CompanyAsmin Sultana Ahmed100% (1)

- Jitendra Raghuwanshi - ATCS Offer Letter - 7th February 2020Dokument4 SeitenJitendra Raghuwanshi - ATCS Offer Letter - 7th February 2020Sonam BhardwajNoch keine Bewertungen

- Pay Slip For April 2019: Integrated Decisions and Systems India Private LimitedDokument1 SeitePay Slip For April 2019: Integrated Decisions and Systems India Private LimitedANANT LONENoch keine Bewertungen

- Form No. 16: Part ADokument5 SeitenForm No. 16: Part AHarish KumarNoch keine Bewertungen

- FORM 16 CERTIFICATEDokument3 SeitenFORM 16 CERTIFICATEDebesh KuanrNoch keine Bewertungen

- PDF 233526110140623Dokument1 SeitePDF 233526110140623p. r ravichandraNoch keine Bewertungen

- Form 16: Wipro LimitedDokument5 SeitenForm 16: Wipro LimitedPrantik PramanikNoch keine Bewertungen

- Joining Letter InfosysDokument11 SeitenJoining Letter InfosysAnkush Kumar SinghNoch keine Bewertungen

- 110773Dokument6 Seiten110773asheesh kumarNoch keine Bewertungen

- Environment AnalysisDokument4 SeitenEnvironment AnalysisSouravDasNoch keine Bewertungen

- S Reg PayslpDokument3 SeitenS Reg Payslpjaggu_gram0% (1)

- Jeevan Pramaaan Client Installation 3.5Dokument14 SeitenJeevan Pramaaan Client Installation 3.5math_mallikarjun_sapNoch keine Bewertungen

- RD Service Programmer Manual For Windows: You Can Download Sample Code From: 1. IntroductionDokument8 SeitenRD Service Programmer Manual For Windows: You Can Download Sample Code From: 1. Introductionmath_mallikarjun_sapNoch keine Bewertungen

- Caste in Come ApplicationDokument2 SeitenCaste in Come Applicationmath_mallikarjun_sapNoch keine Bewertungen

- DHSCH 4 Part 1Dokument25 SeitenDHSCH 4 Part 1math_mallikarjun_sapNoch keine Bewertungen

- Karnataka wind power allotment proceduresDokument3 SeitenKarnataka wind power allotment proceduresmath_mallikarjun_sapNoch keine Bewertungen

- DHSCH 9Dokument3 SeitenDHSCH 9math_mallikarjun_sapNoch keine Bewertungen

- RD Service Programmer Manual For Windows: You Can Download Sample Code From: 1. IntroductionDokument8 SeitenRD Service Programmer Manual For Windows: You Can Download Sample Code From: 1. Introductionmath_mallikarjun_sapNoch keine Bewertungen

- Telecentre Entrepreneur Course Login and Assessment StepsDokument11 SeitenTelecentre Entrepreneur Course Login and Assessment Stepsmath_mallikarjun_sapNoch keine Bewertungen

- UPI Wallet Top User ManualDokument13 SeitenUPI Wallet Top User Manualmath_mallikarjun_sapNoch keine Bewertungen

- RD Service Programmer Manual For Windows: You Can Download Sample Code From: 1. IntroductionDokument8 SeitenRD Service Programmer Manual For Windows: You Can Download Sample Code From: 1. Introductionmath_mallikarjun_sapNoch keine Bewertungen

- HWarden Receiptfree - HSM309954Dokument1 SeiteHWarden Receiptfree - HSM309954math_mallikarjun_sapNoch keine Bewertungen

- Notification 09-01-2013Dokument33 SeitenNotification 09-01-2013math_mallikarjun_sapNoch keine Bewertungen

- Hidden Markov Models: Ramon Van HandelDokument123 SeitenHidden Markov Models: Ramon Van Handelmath_mallikarjun_sapNoch keine Bewertungen

- DHSCH 5Dokument30 SeitenDHSCH 5math_mallikarjun_sapNoch keine Bewertungen

- An P 2 Lab 4 RespiratoryDokument7 SeitenAn P 2 Lab 4 Respiratorymath_mallikarjun_sapNoch keine Bewertungen

- Brian CarrierDokument10 SeitenBrian Carriermath_mallikarjun_sapNoch keine Bewertungen

- Lab 7 - Human Male and Female Reproductive Anatomy: System, Pp. 1036 - 1098 (Saladin 4Dokument3 SeitenLab 7 - Human Male and Female Reproductive Anatomy: System, Pp. 1036 - 1098 (Saladin 4math_mallikarjun_sapNoch keine Bewertungen

- Lindsay I Smith - A Tutorial On Principal Components AnalysisDokument27 SeitenLindsay I Smith - A Tutorial On Principal Components Analysisorestistsinalis100% (1)

- Lab 7 - Human Male and Female Reproductive Anatomy: System, Pp. 1036 - 1098 (Saladin 4Dokument3 SeitenLab 7 - Human Male and Female Reproductive Anatomy: System, Pp. 1036 - 1098 (Saladin 4math_mallikarjun_sapNoch keine Bewertungen

- Lab 5 - The Urinary System: KidneyDokument6 SeitenLab 5 - The Urinary System: Kidneymath_mallikarjun_sapNoch keine Bewertungen

- All About Gout: A Patient Guide To Managing GoutDokument8 SeitenAll About Gout: A Patient Guide To Managing Goutmath_mallikarjun_sapNoch keine Bewertungen

- Gout Diet SheetDokument2 SeitenGout Diet SheetTessa Welsh Stirk100% (1)

- Bi 70Dokument2 SeitenBi 70vinny2smileNoch keine Bewertungen

- Gout DietDokument2 SeitenGout DietsamratkadamNoch keine Bewertungen

- Salary Slip For The Month of February 2009-2010Dokument1 SeiteSalary Slip For The Month of February 2009-2010math_mallikarjun_sapNoch keine Bewertungen

- Modelling Aspects in Process Chains - TranscriptDokument35 SeitenModelling Aspects in Process Chains - TranscriptamitsapNoch keine Bewertungen

- Fiber in Your Diet What Is Fiber and Where Is It Found?Dokument2 SeitenFiber in Your Diet What Is Fiber and Where Is It Found?math_mallikarjun_sapNoch keine Bewertungen

- SAP ABAP - Advanced Business Application Programming LanguageDokument5 SeitenSAP ABAP - Advanced Business Application Programming Languagemath_mallikarjun_sapNoch keine Bewertungen

- PC 50Dokument39 SeitenPC 50math_mallikarjun_sapNoch keine Bewertungen

- Capital StructuringDokument6 SeitenCapital StructuringLourene Jauod- GuanzonNoch keine Bewertungen

- Financial Accounting: 16Th EditionDokument31 SeitenFinancial Accounting: 16Th EditionZooni FatimaNoch keine Bewertungen

- Risk Free Rate + Beta× (Expected Market Return Risk Free Rate)Dokument4 SeitenRisk Free Rate + Beta× (Expected Market Return Risk Free Rate)Sadiya Sweeto0% (1)

- Online Banking - Bank LoginDokument16 SeitenOnline Banking - Bank LoginonliebankingNoch keine Bewertungen

- Literature Review OriginalDokument7 SeitenLiterature Review OriginalJagjeet Singh82% (11)

- Infosys Vs Wipro AnalysesDokument66 SeitenInfosys Vs Wipro AnalysesNITESH100% (1)

- Nep PPT 2Dokument16 SeitenNep PPT 2chickooooNoch keine Bewertungen

- J. H. Decker Auth. Mining Latin America - Minería Latinoamericana Challenges in The Mining Industry - Desafíos para La Industria MineraDokument437 SeitenJ. H. Decker Auth. Mining Latin America - Minería Latinoamericana Challenges in The Mining Industry - Desafíos para La Industria MineraAlfaro Robles100% (1)

- Exchange Control Directive RU 28 of 2019Dokument16 SeitenExchange Control Directive RU 28 of 2019nickie2611Noch keine Bewertungen

- 5 Solar Stocks That Should Be On Your Radar: XOM CVX BP $60 A BarrelDokument3 Seiten5 Solar Stocks That Should Be On Your Radar: XOM CVX BP $60 A BarrelGautam SinghalNoch keine Bewertungen

- Fundamentals of SFP ElementsDokument33 SeitenFundamentals of SFP ElementsAbyel Nebur100% (2)

- Name: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationDokument2 SeitenName: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationLiezelNoch keine Bewertungen

- Group C PDFDokument31 SeitenGroup C PDFJoy KhetanNoch keine Bewertungen

- BBCDokument10 SeitenBBCdashanNoch keine Bewertungen

- Philippine Financial SystemDokument2 SeitenPhilippine Financial SystemKurt Lubim Alaiza-Anggoto Meltrelez-LibertadNoch keine Bewertungen

- Rich Dad, Poor DadDokument14 SeitenRich Dad, Poor DadKeah Q. LacuestaNoch keine Bewertungen

- PW,NPV,DB,FV CalculationsDokument2 SeitenPW,NPV,DB,FV CalculationsEvan Julian OdavarNoch keine Bewertungen

- Bayawan City Investment Code 2011Dokument12 SeitenBayawan City Investment Code 2011edwardtorredaNoch keine Bewertungen

- YaDokument18 SeitenYaAnnisya KaruniawatiNoch keine Bewertungen

- ENRC - Annual Report 2010Dokument164 SeitenENRC - Annual Report 2010user700700Noch keine Bewertungen

- Freeport Case AnalysisDokument2 SeitenFreeport Case AnalysisMudit AgarwalNoch keine Bewertungen

- BBCS101D-Airport Customer Service PDFDokument262 SeitenBBCS101D-Airport Customer Service PDFrajmercuryNoch keine Bewertungen

- Equity Volatility Term Structures and The Cross-Section of Option ReturnsDokument39 SeitenEquity Volatility Term Structures and The Cross-Section of Option ReturnspasaitowNoch keine Bewertungen

- The History of Lehman BrothersDokument6 SeitenThe History of Lehman BrothersL A AnchetaSalvia DappananNoch keine Bewertungen

- Income Tax Prelims.Dokument13 SeitenIncome Tax Prelims.Amber Lavarias BernabeNoch keine Bewertungen

- Factors That Affect The WaccDokument15 SeitenFactors That Affect The WaccClaire83% (6)

- Kotak Fund Merger NoticeDokument1 SeiteKotak Fund Merger NoticePriyanka PatelNoch keine Bewertungen

- Investor Agreement ContractDokument4 SeitenInvestor Agreement ContractGian Joaquin0% (1)

- Rmyc SGV Cup Final Round QM Copy v1Dokument15 SeitenRmyc SGV Cup Final Round QM Copy v1Darelle Hannah MarquezNoch keine Bewertungen

- Etf PresentationDokument111 SeitenEtf PresentationMarkus MilliganNoch keine Bewertungen

- You Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherVon EverandYou Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherNoch keine Bewertungen

- Other People's Dirt: A Housecleaner's Curious AdventuresVon EverandOther People's Dirt: A Housecleaner's Curious AdventuresBewertung: 3.5 von 5 Sternen3.5/5 (104)

- The Importance of Being Earnest: Classic Tales EditionVon EverandThe Importance of Being Earnest: Classic Tales EditionBewertung: 4.5 von 5 Sternen4.5/5 (43)

- The House at Pooh Corner - Winnie-the-Pooh Book #4 - UnabridgedVon EverandThe House at Pooh Corner - Winnie-the-Pooh Book #4 - UnabridgedBewertung: 4.5 von 5 Sternen4.5/5 (5)

- The Asshole Survival Guide: How to Deal with People Who Treat You Like DirtVon EverandThe Asshole Survival Guide: How to Deal with People Who Treat You Like DirtBewertung: 4 von 5 Sternen4/5 (60)

- Welcome to the United States of Anxiety: Observations from a Reforming NeuroticVon EverandWelcome to the United States of Anxiety: Observations from a Reforming NeuroticBewertung: 3.5 von 5 Sternen3.5/5 (10)

- The Inimitable Jeeves [Classic Tales Edition]Von EverandThe Inimitable Jeeves [Classic Tales Edition]Bewertung: 5 von 5 Sternen5/5 (3)

- The Best Joke Book (Period): Hundreds of the Funniest, Silliest, Most Ridiculous Jokes EverVon EverandThe Best Joke Book (Period): Hundreds of the Funniest, Silliest, Most Ridiculous Jokes EverBewertung: 3.5 von 5 Sternen3.5/5 (4)

- Sexual Bloopers: An Outrageous, Uncensored Collection of People's Most Embarrassing X-Rated FumblesVon EverandSexual Bloopers: An Outrageous, Uncensored Collection of People's Most Embarrassing X-Rated FumblesBewertung: 3.5 von 5 Sternen3.5/5 (7)

- The Smartest Book in the World: A Lexicon of Literacy, A Rancorous Reportage, A Concise Curriculum of CoolVon EverandThe Smartest Book in the World: A Lexicon of Literacy, A Rancorous Reportage, A Concise Curriculum of CoolBewertung: 4 von 5 Sternen4/5 (14)

- Humorous American Short Stories: Selections from Mark Twain, O. Henry, James Thurber, Kurt Vonnegut, Jr. and moreVon EverandHumorous American Short Stories: Selections from Mark Twain, O. Henry, James Thurber, Kurt Vonnegut, Jr. and moreNoch keine Bewertungen

- Lessons from Tara: Life Advice from the World's Most Brilliant DogVon EverandLessons from Tara: Life Advice from the World's Most Brilliant DogBewertung: 4.5 von 5 Sternen4.5/5 (42)

- Spoiler Alert: You're Gonna Die: Unveiling Death One Question at a TimeVon EverandSpoiler Alert: You're Gonna Die: Unveiling Death One Question at a TimeBewertung: 4 von 5 Sternen4/5 (57)

![The Inimitable Jeeves [Classic Tales Edition]](https://imgv2-2-f.scribdassets.com/img/audiobook_square_badge/711420909/198x198/ba98be6b93/1712018618?v=1)