Beruflich Dokumente

Kultur Dokumente

Question 3 - Solution

Hochgeladen von

Karthik BhandaryCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Question 3 - Solution

Hochgeladen von

Karthik BhandaryCopyright:

Verfügbare Formate

GLIM Financial Accounting Q-3

Instructor: Dr. Manaswee K Samal

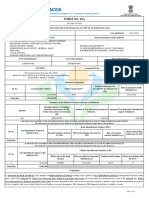

Name: Time: 30 minutes, Points: 10 The following is the balance sheet of RMC Steel Ltd. as on 30.06.11. Sources Equity share capital [Par value: Rs.100 each] 9% Preference share capital (Redeemable on 30.09.11 at par) General reserve Debenture redemption reserve Amount[Rs.] Application 4,00,000 Property, Plant & Equipment 2,00,000 Less: Provision for depreciation

Roll No

Amount[Rs.] 10,00,000 (3,00,000)

3,00,000 Net Assets 7,00,000 1,00,000 Investments ( in raw material 1,30,000 supplier) Revaluation reserve 40,000 Investments in 182 days T-bills 70,000 Debtors 70,000 Material supplier 3,10,000 Investment in land 80,000 Expense payable 50,000 Cash in hand & bank 3,00,000 Inventory 50,000 Ignore dividend payable on preference shares for 2011-12. The company has no plan to issue new shares for redemption of preference shares. Debentures of Rs.1,00,000 were redeemed on 30.06.11 at par. Calculate the following from the above Balance Sheet on 31.10.11 (except item number 3) taking substance of the items over form. 1. Free Reserve Rs.

Show the items you would consider: Upon redemption of debentures on 30.06.12, the DRR has served its purpose. So, it will be transferred to the GR. Therefore, it is in essence a free reserve. Revaluation reserve is not a free reserve. And, since for redemption of preference capital, no fresh issue will happen, a matching amount has to be transferred to CRR from GR. CRR is not a free reserve. So, FR = 2,00,000 2. Operating assets Rs.

Show the items you would consider: Except investment in T-bills, all assets are used for operating purpose of the enterprise. The investment in raw material suppliers business is for a trading benefit. So, it will be a part of assets for operating purpose. Cash balance will be less by 2 lakhs after redemption.

3. Current liability as on 30.06.11 Rs5,60,000 (Preference share redeemable just after three months, hence a part of current liability) 4. Book value per share Rs.-------------------------

BV = Equity / no. of equity shares Equity as on 31.10.11 : Equity share capital = 4,00,000 General reserve = 2,00,000 (including the transfer from DRR and after transfer of 200000 to CRR upon redemption of preference shares) CRR = 2,00,000 Revaluation reserve 40,000 840000 No. of equity shares 4000 So, BV per share is Rs.210

5. Bonus issue capacity Rs400000 (both GR and CRR ca be used) If it is an unlisted company, even RR can be utilized. But, that is a bard thing to do.

GLIM Financial Accounting Q-3

Instructor: Dr. Manaswee K Samal

Name: Time: 30 minutes, Points: 10

Roll No

The following is the balance sheet of RMC Steel Ltd. as on 30.06.11. It is a listed company. Sources Equity share capital [Par value: Rs.10 each] 9% Preference share capital (Redeemable on 30.09.11 at par) General reserve Debenture redemption reserve Revaluation reserve Dividend fluctuation reserve Material supplier Expense payable Amount[Rs.] Application 4,00,000 Property, Plant & Equipment 3,00,000 Less: Provision for depreciation 4,00,000 1,00,000 50,000 1,00,000 2,10,000 50,000 Net Assets Investments in HUL Investments in 91 days T-bills Debtors Investment in land Cash in hand & bank Inventory Amount[Rs.] 9,00,000 (3,00,000)

6,00,000 2,30,000 70,000 70,000 80,000 5,00,000 60,000 16,10,000 16,10,000 Ignore dividend payable on preference shares for 2011-12. The company issues minimum shares required for the purpose of redemption of preference shares. Debentures of Rs.1,00,000 were redeemed on 30.06.11 at par. Calculate the following from the above Balance Sheet on 31.10.11 (except item number 3) taking substance of the items over form. 1. Free Reserve Rs6,00,000 [GR+DRR+DFR]

Show the items you would consider: GR, DFR,DRR 2. Operating assets Rs12,30,000.

Show the items you would consider: Net fixed assets, debtors, cash,inventory

3. Current liability as on 30.06.11 Rs5,60,000.. Material supplier, exp payable, pref cap reedemable

4. Book value per share

Rs.Rs.19.29 [ 70000 shares ]-

5. Bonus issue capacity

Rs.6,00,000---

Das könnte Ihnen auch gefallen

- Slicer 305 Basic: Simple SlicingDokument2 SeitenSlicer 305 Basic: Simple SlicingKarthik BhandaryNoch keine Bewertungen

- GSO-1754!1!2015-E Edible Vegetable Oils - Part 1Dokument19 SeitenGSO-1754!1!2015-E Edible Vegetable Oils - Part 1Karthik Bhandary100% (1)

- Slicer 405: Hygienic, Powerful, VersatileDokument4 SeitenSlicer 405: Hygienic, Powerful, VersatileKarthik BhandaryNoch keine Bewertungen

- 915 MH Microwave Batch Machines: DescriptionDokument2 Seiten915 MH Microwave Batch Machines: DescriptionKarthik BhandaryNoch keine Bewertungen

- DEFSEC DOCS Video Script ONE With Comment On VideoDokument5 SeitenDEFSEC DOCS Video Script ONE With Comment On VideoKarthik BhandaryNoch keine Bewertungen

- Logo Guidelines: We Proudly Serve StarbucksDokument12 SeitenLogo Guidelines: We Proudly Serve StarbucksMamphayssou N'GUESSANNoch keine Bewertungen

- Vested Advisory AgreementDokument14 SeitenVested Advisory AgreementKarthik BhandaryNoch keine Bewertungen

- The Power of Steam: CERTUSS Junior TC Steam GeneratorsDokument24 SeitenThe Power of Steam: CERTUSS Junior TC Steam GeneratorsKarthik BhandaryNoch keine Bewertungen

- Frigoscandia Spiral Freezer, Chiller & Proofer: Gyrocompact 60Dokument4 SeitenFrigoscandia Spiral Freezer, Chiller & Proofer: Gyrocompact 60Karthik BhandaryNoch keine Bewertungen

- Product sensory evaluation formDokument2 SeitenProduct sensory evaluation formKarthik Bhandary80% (5)

- Ball Control Bc237: The Smart Answer To Convenience ProductsDokument2 SeitenBall Control Bc237: The Smart Answer To Convenience ProductsKarthik BhandaryNoch keine Bewertungen

- Script Movie DefSec DoctorsDokument5 SeitenScript Movie DefSec DoctorsKarthik BhandaryNoch keine Bewertungen

- Live animal import duty ratesDokument337 SeitenLive animal import duty ratesKarthik BhandaryNoch keine Bewertungen

- Netherlands Visa Application CenterDokument3 SeitenNetherlands Visa Application Centermyfriend2meNoch keine Bewertungen

- Travel ItineraryDokument2 SeitenTravel ItineraryKarthik BhandaryNoch keine Bewertungen

- GSO-1754!2!2013-E Edible Vegetable Oils - Part 2Dokument14 SeitenGSO-1754!2!2013-E Edible Vegetable Oils - Part 2Karthik BhandaryNoch keine Bewertungen

- Ben Neuwirth - Dlight PresentationDokument31 SeitenBen Neuwirth - Dlight PresentationKarthik BhandaryNoch keine Bewertungen

- GSO-1016-2015-E Microbiological Criteria For FoodstuffsDokument33 SeitenGSO-1016-2015-E Microbiological Criteria For FoodstuffsKarthik Bhandary71% (7)

- 중형 보울컷터Dokument8 Seiten중형 보울컷터Karthik BhandaryNoch keine Bewertungen

- Maldives Airport Representative: Ms. Naajy Phone: Airport Representative: Ms. Anoosha Phone: Airport Counter Number: 32Dokument1 SeiteMaldives Airport Representative: Ms. Naajy Phone: Airport Representative: Ms. Anoosha Phone: Airport Counter Number: 32Karthik BhandaryNoch keine Bewertungen

- Global Retail Trends UAE PDFDokument10 SeitenGlobal Retail Trends UAE PDFKarthik BhandaryNoch keine Bewertungen

- Script Movie DefSec DoctorsDokument5 SeitenScript Movie DefSec DoctorsKarthik BhandaryNoch keine Bewertungen

- Steel CompaniesDokument2 SeitenSteel CompaniesKarthik BhandaryNoch keine Bewertungen

- ScopeDokument3 SeitenScopeKarthik BhandaryNoch keine Bewertungen

- Orders Dashboard for Hectare's WordPress WebsiteDokument6 SeitenOrders Dashboard for Hectare's WordPress WebsiteKarthik BhandaryNoch keine Bewertungen

- Orders Dashboard for Hectare's WordPress WebsiteDokument6 SeitenOrders Dashboard for Hectare's WordPress WebsiteKarthik BhandaryNoch keine Bewertungen

- Conference Lecture2 1217646379629881 9 PDFDokument47 SeitenConference Lecture2 1217646379629881 9 PDFKarthik BhandaryNoch keine Bewertungen

- A4 FlyerDokument1 SeiteA4 FlyerKarthik BhandaryNoch keine Bewertungen

- Seven Keys to Improved Customer ExperiencesDokument10 SeitenSeven Keys to Improved Customer ExperiencesKarthik BhandaryNoch keine Bewertungen

- A4 FlyerDokument1 SeiteA4 FlyerKarthik BhandaryNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Digital Banking W.R.T. Janakalyan Sahakari Bank Ltd.Dokument43 SeitenDigital Banking W.R.T. Janakalyan Sahakari Bank Ltd.Kareena WasanNoch keine Bewertungen

- Ebook - Ryan Litchfield - Fun Filled GapsDokument43 SeitenEbook - Ryan Litchfield - Fun Filled GapspankajparimalNoch keine Bewertungen

- Details of New Credit Ratings Assigned During Last Six Months 2011Dokument43 SeitenDetails of New Credit Ratings Assigned During Last Six Months 2011SK Business groupNoch keine Bewertungen

- Letter requests bank honor chequeDokument2 SeitenLetter requests bank honor chequeANNAPRASADNoch keine Bewertungen

- Success Story of Prince Bansal - AIR1 RBI Grade B 2017 & SBI PO 2016Dokument6 SeitenSuccess Story of Prince Bansal - AIR1 RBI Grade B 2017 & SBI PO 2016Chinmoy DasNoch keine Bewertungen

- FM 133 Capital-Wps OfficeDokument10 SeitenFM 133 Capital-Wps OfficeJade Del MundoNoch keine Bewertungen

- Managerial Finance SyllabusDokument5 SeitenManagerial Finance SyllabusNerissaNoch keine Bewertungen

- Module 2 Cash, Accrual and Single EntryDokument10 SeitenModule 2 Cash, Accrual and Single EntryFernando III PerezNoch keine Bewertungen

- Logical Reasoning 2Dokument2 SeitenLogical Reasoning 2luigimanzanaresNoch keine Bewertungen

- Cenizabusinessplan 2Dokument68 SeitenCenizabusinessplan 2Dexterr DivinooNoch keine Bewertungen

- GDP LQDokument5 SeitenGDP LQjoeylamch126Noch keine Bewertungen

- Foreclosure Cleaning/Cleanup Contract Form and TemplateDokument3 SeitenForeclosure Cleaning/Cleanup Contract Form and Templatedreamstinvestments80% (10)

- CFA Level II: DerivativesDokument48 SeitenCFA Level II: DerivativesCrayonNoch keine Bewertungen

- Earnings Statement: Pay Period Hours and EarningsDokument1 SeiteEarnings Statement: Pay Period Hours and EarningsAileen StuerNoch keine Bewertungen

- Mechanics of Currency Dealing and Exchange Rate QuotationsDokument6 SeitenMechanics of Currency Dealing and Exchange Rate Quotationsvijayadarshini vNoch keine Bewertungen

- Scale TradingDokument2 SeitenScale TradingLuis ArcondoNoch keine Bewertungen

- OpTransactionHistory13 06 2020Dokument2 SeitenOpTransactionHistory13 06 2020MssNoch keine Bewertungen

- Chapter 04: Exchange Rate Determination: Page 1Dokument20 SeitenChapter 04: Exchange Rate Determination: Page 1Lê ChíNoch keine Bewertungen

- Chapter 3 Entrepreneurship, New Ventures, and Business OwnershipDokument47 SeitenChapter 3 Entrepreneurship, New Ventures, and Business OwnershipAnas Khalid shaikhNoch keine Bewertungen

- Cash and Cash Equivalents Multiple Choice QuestionsDokument11 SeitenCash and Cash Equivalents Multiple Choice Questionsjhela18Noch keine Bewertungen

- 1908GMPb PDFDokument41 Seiten1908GMPb PDFKirillNoch keine Bewertungen

- The Federal Reserve System - An EncyclopediaDokument486 SeitenThe Federal Reserve System - An EncyclopediaBenjamin SpahićNoch keine Bewertungen

- CPEM 2014 - TOC - PracticeAids Audit File DocumentationDokument6 SeitenCPEM 2014 - TOC - PracticeAids Audit File DocumentationranibarNoch keine Bewertungen

- Magpantay-Payroll LocalDokument17 SeitenMagpantay-Payroll LocalKate Catherine MatiraNoch keine Bewertungen

- Oracle Applications 11i Oracle Applications 11i: Using GLDokument95 SeitenOracle Applications 11i Oracle Applications 11i: Using GLappsloaderNoch keine Bewertungen

- 2021-11-09-SWIR - OQ-RBC Capital Markets-Normalizing Following Manufacturing Disruptions-94496714Dokument14 Seiten2021-11-09-SWIR - OQ-RBC Capital Markets-Normalizing Following Manufacturing Disruptions-94496714andrewNoch keine Bewertungen

- Form 16A TDS CertificateDokument2 SeitenForm 16A TDS CertificateRichardNoelFernandesNoch keine Bewertungen

- Context Diagram: Loan Request Approv Al Rejecti On 0Dokument4 SeitenContext Diagram: Loan Request Approv Al Rejecti On 0rahulNoch keine Bewertungen

- Câu Hỏi Ôn Tập - PolicyDokument13 SeitenCâu Hỏi Ôn Tập - Policythịnh huỳnhNoch keine Bewertungen

- Capital Budgeting: Questions & Answers Q18.1Dokument38 SeitenCapital Budgeting: Questions & Answers Q18.1Japhary Shaibu67% (3)