Beruflich Dokumente

Kultur Dokumente

Graham Number and Warren Buffett Portfolio

Hochgeladen von

bogatishankarOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Graham Number and Warren Buffett Portfolio

Hochgeladen von

bogatishankarCopyright:

Verfügbare Formate

Graham Number and Warren Buffett Portfolio

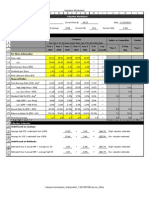

Graham Number is a concept based on Ben Grahams conservative valuation of companies. It calculates the intrinsic values of companies based on its earnings per share and tangible book value in a formula like this: Graham Number = SquareRoot of (22.5 * Tangible Book Value per Share* Earnings per Share) = SquareRoot of (22.5 * Net Income* Total Equity) / {Total Shares Outstanding This is one of the ways to estimate the intrinsic value of business based on their book value and their earnings power. Unlike valuation methods such as DCF or Discounted Earnings, the Graham number does not take growth into the valuation. Unlike the valuation methods based on book value alone, it takes into account the earnings power. Therefore, the Graham Number is a combination of asset valuation and earnings power valuation. In general, the Graham number is a very conservative way of valuing a stock. It cannot be applied to companies with negative book values. We have added a new Valuations tab to the Guru Portfolio page, which lists the companies in the portfolios of Gurus relative to their Graham Number and other valuation methods such as Peter Lynch Fair Value, Intrinsic Value (DCF Projected), value indicated by median P/S etc. Graham value is applicable only to the companies that have positive earnings and positive tangible book value. These are the companies in Warren Buffetts portfolio that Graham numbers are calculated: Ticker WPO MTB TMK LMCA WMT WFC JNJ BK UPS KO GM Company Price Graham Number Discount The Washington Post Company 370.71 93.43 -297% M&T Bank Corporation 80.8 82.05 2% Torchmark Corporation 49.59 63.19 22% Liberty Media Corp (Capital) 86.9 44.7 -94% Wal-Mart Stores, Inc. 68.3 39.26 -74% Wells Fargo & Company 32.46 38.33 15% Johnson & Johnson 66.94 34.94 -92% Bank Of Ny Mell 21.04 21.2 1% United Parcel Service, Inc. 77.13 21.1 -266% The Coca-Cola Company 76.59 13.83 -454% General Motors Company 19.8 11.92 -66%

As we can see, as indicated by Graham Number, within Warren Buffetts Portfolio, the companies that are undervalued are M&T Bank Corporation (MTB), Torchmark Corporation

(TMK), Wells Fargo & Company (WFC), and Bank Of Ny Mellon (BK). Companies such as UPS (UPS), Coca-Cola (KO), Johnson & Johnson (JNJ) and Washington Post (WPO) seems to be vastly overvalued. Is this really the case? Not necessarily. When applying any of those valuation methods, you need to be aware of their limitations. Please keep these in mind: 1. Graham Number does not take growth into account. Therefore it underestimates the values of the companies that have good earnings growth. We feel that if the earnings per share grows more than 10% a year, Graham Number underestimates the value. 2. Graham Number punishes the companies that have temporarily low earnings. Therefore, an average of earnings makes more sense in the calculation of Graham Number. 3. Graham Numbers underestimates companies that are light with book. Companies such as Moodys (MCO) and Dun & Bradstreet (DNB) has negative book values. Graham Number cannot be applied here. As indicated in our announcement of New Feature Added: Valuation Box, we also listed valuation methods such as Peter Lynch Fair Value, Median P/S Value etc. They are also listed under the new Valuations tab for gurus portfolios. To learn more on how each value is calculated, please read New Feature Added: Valuation Box and How to calculate the intrinsic value of a stock? The new Valuation Tab is just one of the features we added to the Premium features we continue to add to GuruFocus Premium Membership. If you are not a Premium Member, why not take a 7-day Free Trial? This is the link to the Valuation Tab of Warren Buffetts Portfolio. You can check out all the valuation parameters there.

Das könnte Ihnen auch gefallen

- How To Calculate Market Value of Equity?Dokument4 SeitenHow To Calculate Market Value of Equity?sakthiprimeNoch keine Bewertungen

- Easy Methods To Calculate Small Business ValuationDokument4 SeitenEasy Methods To Calculate Small Business ValuationM ShahidNoch keine Bewertungen

- Competitive Profile Matrix (CPM) - With FREE TemplateDokument7 SeitenCompetitive Profile Matrix (CPM) - With FREE TemplateRoselle MalabananNoch keine Bewertungen

- Intrinsic Valuation Model for EOG ResourcesDokument10 SeitenIntrinsic Valuation Model for EOG Resources10manbearpig01Noch keine Bewertungen

- Cost of Capital Case Study at AmeritradeDokument5 SeitenCost of Capital Case Study at Ameritradeyvasisht3100% (1)

- 4 Essential Metrics For SaaS Startups Evaluation - MetabetaDokument11 Seiten4 Essential Metrics For SaaS Startups Evaluation - MetabetaDragosnicNoch keine Bewertungen

- Yahoo & Ebay Alliance to Take on Google & MicrosoftDokument11 SeitenYahoo & Ebay Alliance to Take on Google & MicrosoftZiaul HaqueNoch keine Bewertungen

- Brand Value EstimationDokument2 SeitenBrand Value EstimationAvinash KNoch keine Bewertungen

- WaccDokument7 SeitenWacccb_mahendraNoch keine Bewertungen

- Business Mathematics SynthesisDokument3 SeitenBusiness Mathematics SynthesisZymon PasajolNoch keine Bewertungen

- SADIF-Investment AnalyticsDokument12 SeitenSADIF-Investment AnalyticsTony ZhangNoch keine Bewertungen

- Success MeasuresDokument4 SeitenSuccess MeasuresRachel YoungNoch keine Bewertungen

- Income Statement Gross Profit Operating Profit: FormulasDokument3 SeitenIncome Statement Gross Profit Operating Profit: FormulasswapnillagadNoch keine Bewertungen

- Gross MarginDokument13 SeitenGross MarginIshita Ghosh100% (1)

- (A) - How Feasibility Analysis Helps Entrepreneurs in Assessing The Viability of A New Venture. AnswerDokument5 Seiten(A) - How Feasibility Analysis Helps Entrepreneurs in Assessing The Viability of A New Venture. AnswerMuhammad Muzamil HussainNoch keine Bewertungen

- Brand Value MeasurementDokument8 SeitenBrand Value MeasurementPriyajeet SinghNoch keine Bewertungen

- The Best Metric of Success For CompaniesDokument100 SeitenThe Best Metric of Success For CompaniesKasim TatićNoch keine Bewertungen

- VALUATIONS Methods and Tools for Assessing Company WorthDokument8 SeitenVALUATIONS Methods and Tools for Assessing Company WorthVishwajeet_Pat_7360100% (1)

- Enterprise Value-to-Sales - EV/Sales Definition: Key TakeawaysDokument13 SeitenEnterprise Value-to-Sales - EV/Sales Definition: Key Takeawaysprabhubhai sapoliyaNoch keine Bewertungen

- Week 12 13 Asset Valuation Models For Merger and AcquisitionsDokument10 SeitenWeek 12 13 Asset Valuation Models For Merger and AcquisitionsAra AlivioNoch keine Bewertungen

- WMT Mature Firm's: Value CreatedDokument2 SeitenWMT Mature Firm's: Value Createdaccounts 3 lifeNoch keine Bewertungen

- multiple approachDokument9 Seitenmultiple approachkanwal preetNoch keine Bewertungen

- Brand Valuation - MercDokument11 SeitenBrand Valuation - MercLakshya ChawlaNoch keine Bewertungen

- The Complete Investment Banker ExtractDokument19 SeitenThe Complete Investment Banker ExtractJohn MathiasNoch keine Bewertungen

- Lesson 6 Business ForecastDokument26 SeitenLesson 6 Business ForecastZalamea, RyzaNoch keine Bewertungen

- Sample Sales Compensation PlanDokument12 SeitenSample Sales Compensation PlanLisa Glover-GardinNoch keine Bewertungen

- Brand Valuation MethodologyDokument4 SeitenBrand Valuation MethodologyBala MuruganNoch keine Bewertungen

- Market-Based Valuation of Family Dollar StoresDokument19 SeitenMarket-Based Valuation of Family Dollar StoresJDNoch keine Bewertungen

- Allocating Sales Effort and QuotaDokument23 SeitenAllocating Sales Effort and QuotaPrashant DubeyNoch keine Bewertungen

- Stock Valuation MethodsDokument7 SeitenStock Valuation MethodsMoti BekeleNoch keine Bewertungen

- Role of Cmas in Business Valuation: Submitted To, Prof. Ritu Wadhwa Ma'AmDokument12 SeitenRole of Cmas in Business Valuation: Submitted To, Prof. Ritu Wadhwa Ma'AmHarshita shuklaNoch keine Bewertungen

- Competitive Profile MatrixDokument5 SeitenCompetitive Profile MatrixTalha JavedNoch keine Bewertungen

- How To Value A CompanyDokument120 SeitenHow To Value A CompanyAbhishek kushawahaNoch keine Bewertungen

- Questions DuresDokument25 SeitenQuestions DuresAnna-Maria Müller-SchmidtNoch keine Bewertungen

- Sales Quotas, Budgeting & ControlDokument12 SeitenSales Quotas, Budgeting & ControlAbhishek SisodiaNoch keine Bewertungen

- Qlutch Plan Use ROI To Calculate A Marketing BudgetDokument8 SeitenQlutch Plan Use ROI To Calculate A Marketing BudgetIvy SamsonNoch keine Bewertungen

- G. Assignment - Developing A CPM For Adidas AgDokument16 SeitenG. Assignment - Developing A CPM For Adidas AgMarriaNoch keine Bewertungen

- Marketing: The Strategic 3Cs Concept: Exhibit 1-2: Two Interacting Components of MarketingDokument6 SeitenMarketing: The Strategic 3Cs Concept: Exhibit 1-2: Two Interacting Components of MarketingwilkhienNoch keine Bewertungen

- Rosembaum Book SummaryDokument2 SeitenRosembaum Book SummaryLeonardo MercuriNoch keine Bewertungen

- Rothaermel Ch. 5 SummaryDokument5 SeitenRothaermel Ch. 5 SummaryMichaelNoch keine Bewertungen

- Final Relative ValuationDokument5 SeitenFinal Relative ValuationKostia RiabkovNoch keine Bewertungen

- Fundamentals of SAP SD PricingDokument13 SeitenFundamentals of SAP SD Pricingrajendrakumarsahu100% (3)

- Valmeth AssDokument20 SeitenValmeth AssMark Andrei TalastasNoch keine Bewertungen

- Financial Ratio Analysis Guide for Fundamental Stock AnalysisDokument87 SeitenFinancial Ratio Analysis Guide for Fundamental Stock Analysisrajeshksm100% (2)

- The Competitive Profile Matrix: Chapter 7: The External Audit By: Nur Syuhada Binti ZaidiDokument26 SeitenThe Competitive Profile Matrix: Chapter 7: The External Audit By: Nur Syuhada Binti ZaidiMsFruitsJokes0% (1)

- AnswersDokument3 SeitenAnswersHarshit AroraNoch keine Bewertungen

- Finance AssessmentDokument5 SeitenFinance AssessmentAmmar AhmadNoch keine Bewertungen

- CPM Analysis Compares Firms' Strengths & WeaknessesDokument6 SeitenCPM Analysis Compares Firms' Strengths & WeaknessesjwreedjrNoch keine Bewertungen

- Price-Earnings Ratio (P/E Ratio)Dokument6 SeitenPrice-Earnings Ratio (P/E Ratio)Asif AminNoch keine Bewertungen

- Strategic Management - Competitive Profile MatrixDokument2 SeitenStrategic Management - Competitive Profile MatrixJj RegenciaNoch keine Bewertungen

- UNIT 5 StategiesDokument6 SeitenUNIT 5 StategiesNari RaoNoch keine Bewertungen

- Comprehensive ExaminationDokument15 SeitenComprehensive Examinationace rogerNoch keine Bewertungen

- Balanced Scorecard SCMDokument5 SeitenBalanced Scorecard SCMudelkingkongNoch keine Bewertungen

- Sample Sales Manager Sales Comp PlanDokument13 SeitenSample Sales Manager Sales Comp PlanKerena Precious Soontobe-HopeNoch keine Bewertungen

- FIN 310 - Chapter 3 Questions With AnswersDokument8 SeitenFIN 310 - Chapter 3 Questions With AnswersKelby BahrNoch keine Bewertungen

- SAP SD Pricing FundamentalsDokument14 SeitenSAP SD Pricing FundamentalsThiagoHanuschNoch keine Bewertungen

- Micro Saas ValuationDokument6 SeitenMicro Saas ValuationaddyNoch keine Bewertungen

- How To Value StocksDokument19 SeitenHow To Value StocksGabriel RivasNoch keine Bewertungen

- Unit 4 - 230713 - 003454Dokument4 SeitenUnit 4 - 230713 - 003454SreeNoch keine Bewertungen

- Tilson Behavioral FinanceDokument19 SeitenTilson Behavioral Financeapi-3709940100% (1)

- Safal NiveshakDokument4 SeitenSafal NiveshakbogatishankarNoch keine Bewertungen

- What Has Worked in InvestingDokument60 SeitenWhat Has Worked in InvestinggsakkNoch keine Bewertungen

- The True Way To Use The Graham Number and Formula PDFDokument5 SeitenThe True Way To Use The Graham Number and Formula PDFbogatishankarNoch keine Bewertungen

- Maps of Bounded Rationality: A Perspective On Intuitive Judgment and ChoiceDokument41 SeitenMaps of Bounded Rationality: A Perspective On Intuitive Judgment and Choice040984100% (1)

- How NOT To Teach Your Children About MoneyDokument5 SeitenHow NOT To Teach Your Children About MoneybogatishankarNoch keine Bewertungen

- The Future of Common Stocks Benjamin GrahamDokument8 SeitenThe Future of Common Stocks Benjamin GrahambogatishankarNoch keine Bewertungen

- 5 Books That Will Make You A Wiser InvestorDokument16 Seiten5 Books That Will Make You A Wiser InvestorVishal Safal Niveshak Khandelwal100% (2)

- Asset Allocation Guide Safal NiveshakDokument38 SeitenAsset Allocation Guide Safal NiveshakdreamboiNoch keine Bewertungen

- 20 Ways I Cut Stress Out of My Investing LifeDokument3 Seiten20 Ways I Cut Stress Out of My Investing LifebogatishankarNoch keine Bewertungen

- Common Stocks and Uncommon ProfDokument317 SeitenCommon Stocks and Uncommon ProfbogatishankarNoch keine Bewertungen

- Valuing Young Growth CompaniesDokument5 SeitenValuing Young Growth CompaniesbogatishankarNoch keine Bewertungen

- Safal Niveshak Mastermind Free ChaptersDokument31 SeitenSafal Niveshak Mastermind Free Chaptersthisispraveen100% (2)

- Deep Value Investing Themes by Prof. Sanjay BakshiDokument23 SeitenDeep Value Investing Themes by Prof. Sanjay BakshiindianequityinvestorNoch keine Bewertungen

- 12 Mahatma Gandhi Quotes To Inspire You As An InvestorDokument2 Seiten12 Mahatma Gandhi Quotes To Inspire You As An InvestorbogatishankarNoch keine Bewertungen

- How To Value Stocks Using DCFDokument30 SeitenHow To Value Stocks Using DCFbogatishankarNoch keine Bewertungen

- Simple ValuationDokument1 SeiteSimple ValuationbogatishankarNoch keine Bewertungen

- Valuing Stocks The Warren Buffett WayDokument10 SeitenValuing Stocks The Warren Buffett WaybogatishankarNoch keine Bewertungen

- Steps To Take When Your StockDokument7 SeitenSteps To Take When Your StockbogatishankarNoch keine Bewertungen

- Revised Graham Enterprising Investor ScreenDokument8 SeitenRevised Graham Enterprising Investor ScreenbogatishankarNoch keine Bewertungen

- Deep Value Investing Themes by Prof. Sanjay BakshiDokument23 SeitenDeep Value Investing Themes by Prof. Sanjay BakshiindianequityinvestorNoch keine Bewertungen

- Valuation WorksheetDokument1 SeiteValuation WorksheetbogatishankarNoch keine Bewertungen

- The BEST Stock Valuation Spreadsheets Using the Piotroski F-ScoreDokument7 SeitenThe BEST Stock Valuation Spreadsheets Using the Piotroski F-ScorebogatishankarNoch keine Bewertungen

- vAJ1-Competitor Analysis FreeDokument6 SeitenvAJ1-Competitor Analysis FreebogatishankarNoch keine Bewertungen

- Understanding Behavioural Biases in Finance InvestingDokument80 SeitenUnderstanding Behavioural Biases in Finance InvestingSrinivasagopalanNoch keine Bewertungen

- 4329 Load SheddingDokument3 Seiten4329 Load SheddingIno GalNoch keine Bewertungen

- Warren Buffett's 'Professor' Teaches 12 Steps To Financial SuccessDokument4 SeitenWarren Buffett's 'Professor' Teaches 12 Steps To Financial SuccessbogatishankarNoch keine Bewertungen

- Charlie Munger - Art of Stock PickingDokument18 SeitenCharlie Munger - Art of Stock PickingsuniltmNoch keine Bewertungen

- Charlie Munger - Art of Stock PickingDokument18 SeitenCharlie Munger - Art of Stock PickingsuniltmNoch keine Bewertungen

- Oil Industry of Kazakhstan: Name: LIU XU Class: Tuesday ID No.: 014201900253Dokument2 SeitenOil Industry of Kazakhstan: Name: LIU XU Class: Tuesday ID No.: 014201900253cey liuNoch keine Bewertungen

- Rab 7x4 Sawaludin Rev OkDokument20 SeitenRab 7x4 Sawaludin Rev Ok-Anak Desa-Noch keine Bewertungen

- ASOS Factory List November 2021 Final ListDokument45 SeitenASOS Factory List November 2021 Final Listishika maluNoch keine Bewertungen

- Society in Pre-British India.Dokument18 SeitenSociety in Pre-British India.PřiýÂňshüNoch keine Bewertungen

- Infosys advantages in implementing Java based eProcurement systemDokument1 SeiteInfosys advantages in implementing Java based eProcurement systemAshwini RungtaNoch keine Bewertungen

- 03 - Review of Literature PDFDokument8 Seiten03 - Review of Literature PDFDevang VaruNoch keine Bewertungen

- Types of CooperativesDokument11 SeitenTypes of CooperativesbeedeetooNoch keine Bewertungen

- Manual Book Vibro Ca 25Dokument6 SeitenManual Book Vibro Ca 25Muhammad feri HamdaniNoch keine Bewertungen

- Tax Invoice: Tommy Hilfiger Slim Men Blue JeansDokument1 SeiteTax Invoice: Tommy Hilfiger Slim Men Blue JeansSusil Kumar MisraNoch keine Bewertungen

- Shoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueDokument1 SeiteShoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueEmi SicatNoch keine Bewertungen

- China Daily - April 12 2018Dokument24 SeitenChina Daily - April 12 2018Boki VaskeNoch keine Bewertungen

- Knowledge, Attitude and Practice TowardsDokument19 SeitenKnowledge, Attitude and Practice TowardsCory Artika ManurungNoch keine Bewertungen

- India Inc's Baby Steps On Long Road To Normalcy: HE Conomic ImesDokument12 SeitenIndia Inc's Baby Steps On Long Road To Normalcy: HE Conomic ImesShobhashree PandaNoch keine Bewertungen

- Samurai Craft: Journey Into The Art of KatanaDokument30 SeitenSamurai Craft: Journey Into The Art of Katanagabriel martinezNoch keine Bewertungen

- Eco Handout Analyzes India's Demonetization and Black Money PoliciesDokument15 SeitenEco Handout Analyzes India's Demonetization and Black Money Policiessonali mishraNoch keine Bewertungen

- Understanding SpreadsDokument42 SeitenUnderstanding Spreadsluisfrod100% (8)

- Chairman, Infosys Technologies LTDDokument16 SeitenChairman, Infosys Technologies LTDShamik ShahNoch keine Bewertungen

- Project 1Dokument20 SeitenProject 1pandurang parkarNoch keine Bewertungen

- Mxkufðuð: Elðumx (UlxmkDokument8 SeitenMxkufðuð: Elðumx (UlxmkDharmesh MistryNoch keine Bewertungen

- Hotel Industry - Portfolia AnalysisDokument26 SeitenHotel Industry - Portfolia Analysisroguemba87% (15)

- Inflation Title: Price Stability Definition, Causes, EffectsDokument20 SeitenInflation Title: Price Stability Definition, Causes, EffectsSadj GHorbyNoch keine Bewertungen

- 8 Sources of Funds For Nonprofits PDFDokument2 Seiten8 Sources of Funds For Nonprofits PDFskydawnNoch keine Bewertungen

- National Board of Examinations: Sr. No. No. para No. Topic Query / Suggestion Amendments, To Be Read AsDokument3 SeitenNational Board of Examinations: Sr. No. No. para No. Topic Query / Suggestion Amendments, To Be Read AskrishnaNoch keine Bewertungen

- D01 - Scope of Work-Jenna McClendonDokument3 SeitenD01 - Scope of Work-Jenna McClendonadriana sierraNoch keine Bewertungen

- REFRIGERATORDokument2 SeitenREFRIGERATORShah BrothersNoch keine Bewertungen

- Balakrishnan MGRL Solutions Ch06Dokument64 SeitenBalakrishnan MGRL Solutions Ch06deeNoch keine Bewertungen

- Steeler Shaftwall CH StudsDokument20 SeitenSteeler Shaftwall CH Studsrodney_massieNoch keine Bewertungen

- Safari - Nov 2, 2017 at 4:13 PM PDFDokument1 SeiteSafari - Nov 2, 2017 at 4:13 PM PDFAmy HernandezNoch keine Bewertungen

- AssignmentDokument1 SeiteAssignmentdibakar dasNoch keine Bewertungen

- A4 - Productivity - City Plan 2036 Draft City of Sydney Local Strategic Planning StatementDokument31 SeitenA4 - Productivity - City Plan 2036 Draft City of Sydney Local Strategic Planning StatementDorjeNoch keine Bewertungen