Beruflich Dokumente

Kultur Dokumente

ITD Cementation, 2Q CY 2013

Hochgeladen von

Angel BrokingCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ITD Cementation, 2Q CY 2013

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

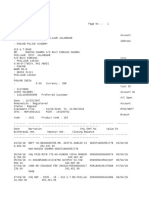

2QCY2013 Result Update | Infrastructure

August 13, 2013

ITD Cementation India

Performance highlights

Y/E December (` cr) Total operating income Operating profit OPM (%) Adj. PAT 2QCY13 334 39 11.7 5 2QCY12 332 41 12.3 6 % chg. (yoy) 0.6 (4.6) (64)bp (27.7) 1QCY12 % chg. (qoq) 355 35 9.8 6 (5.8) 11.6 182bp (17.0)

BUY

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Beta Debt 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Infrastructure 182 0.3 640 276/131 2,375 10 18,947 5,612 ITCM.BO ITCE IN

`158 `194

12 Months

For 2QCY2013, ITD Cementation reported a mixed set of numbers. The revenue of the company for the quarter was flat on a yoy basis to `334cr, 6.7% lower than our estimate of `358cr. The company's operating margin contracted by 64bp yoy to 11.7%. However, it was ahead of our estimate of 10.2%, mainly because of lower-than-expected raw material cost as a percentage of net sales. Debt for HY2013 increased substantially to `707cr, leading to a higher interest outgo of `27cr for 2QCY2013. The tax expense for the quarter was at a mere `0.04cr. Consequently, the company reported a net profit of `5cr, ahead of our estimate of `3cr.

Current year to be muted, order backlog to drive revenue in CY2014E

The company has an order backlog of ~`4000cr as on date (closing order book for CY2012 stood at `2,891cr), executable over a period of two years. In CY2013 the JV of ITD Cementation with its parent company, ITD, bagged new orders worth `1,348cr and ITD Cementation (standalone) bagged orders worth ~`215cr. The order book to sales for the company is expected to improve to ~2.4 for both CY2013E and CY2014E. However, considering the delayed execution of the projects due to slowdown in economy and various policy concerns, we expect the revenue growth to be muted this year but rebound to 10% for CY2014E. As a result we expect the company to post a revenue CAGR of 7.5% over CY201214E to `1,502cr.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 69.6 2.8 0.8 26.8

Outlook and valuation

We expect the companys revenue to post a 7.5% CAGR over CY201214E to `1,502cr. The operating margin for the company is expected to hover around 11.0% for the same period resulting in the net profit growing at a CAGR of 21.1% over CY2012-14E at `32cr. We remain positive on the companys outlook; however, delay in project execution remains a concern. We maintain our Buy recommendation on the stock with a revised target price of `194 with a target P/BV of 0.5x for CY2014E. Key financials (Standalone)

Y/E Dec. (` cr) Net sales % chg Adj. net profit % chg OPM (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x)

CY2010 1,057 8.7 9 72.0 9.2 7.9 19.9 0.5 2.6 7.5 0.6 CY2011 1,283 21.4 23 146.2 10.6 19.6 8.1 0.5 6.1 10.1 0.6 CY2012 1,300 1.3 22 (2.5) 12.1 19.1 8.3 0.5 5.6 11.8 0.6 CY2013E 1,365 5.0 21 (4.5) 10.9 18.2 8.7 0.4 5.1 10.9 0.6 5.1 CY2014E 1,502 10.0 32 53.5 11.2 28.0 5.7 0.4 7.4 12.0 0.5 4.7

Abs. (%) Sensex ITD cementation

3m (6.0)

1yr 6.8

3yr 2.7

(12.6) (25.8) (37.6)

Tejashwini Kumari

022-39357800 Ext: 6856 tejashwini.kumari@angelbroking.com

6.5 5.5 4.7 Source: Company, Angel Research; Note: CMP as of August 12, 2013

Please refer to important disclosures at the end of this report

ITD Cementation India | 2QCY2013 Result Update

Exhibit 1: 1QCY2013 performance (Standalone)

Y/E Dec. (` cr) Total operating income Net raw material (% of Sales) Employee cost (% of Sales) Other Expenses (% of Sales) Total expenditure Operating profit OPM (%) Interest Depreciation Other income PBT (% of Sales) Tax (% of PBT) Reported PAT PATM (%)

Source: Company, Angel Research

2QCY13 334 106 31.6 40 12.0 149 44.7 295 39 11.7 27 8 1 5 1.4 0 0.9 5 1.4

2QCY12 332 124 37.3 35 10.4 133 40.0 291 41 12.3 25 9 5 12 3.6 6 46.3 6 1.9

% chg. (yoy) 0.6 (14.8) 15.9 12.6 1.3 (4.6) (64) 7.0 (3.4) (86.3) (60.9) (99.3) (27.7)

1QCY12 355 128 36.0 41 11.6 151 42.5 320 35 9.8 26 8 7 8 2.2 2 28.2 6 1.6

% chg. (qoq) (5.8) (17.3) (2.9) (0.9) (7.7) 11.6 182 3.0 5.9 (90.5) (39.9) (98.2) (17.0)

HY2013 689 233 33.9 81 11.8 300 43.6 615 74 10.7 52 16 7 12 1.8 2 17.9 10 1.5

HY2012 716 272 38.0 68 9.5 286 39.9 626 90 12.6 51 17 6 28 3.9 9 33.5 18 2.6

% chg (3.8) (14.3) 19.8 5.0 (1.8) (18) (184) 1.7 (5.1) 15.6 (55.0) (75.9) (44.2)

Exhibit 2: Actual vs. Angel estimate (2QCY2013)

Actual (` cr) Total operating income Operating profit OPM (%) Adj. PAT

Source: Company, Angel Research

Estimate (` cr) 358 37 10.2 3

% variation (6.7) 6.2 142bp 66.8

334 39 11.7 5

Revenue disappointed, operating margin ahead of estimates

The revenue for the quarter came in at `334cr, 6.7% lower than our expectation of `358cr. It was flat on a yoy basis and declined by 5.8% on a qoq basis. On a yoy basis, the operating margin contracted marginally by 64bp. However, it came ahead of our estimate of 10.2% on account of lower than expected raw material cost as a percent of net sales. The tax outgo for the quarter was at a mere `0.04cr, against our estimate of `2cr, as the revenue from the orders executed with JVs were net of tax. The debt level as on June 30, 2013 for the company is `707cr leading to an interest cost of `27cr. Consequently, the bottom-line stood at `5cr against our estimate of `3cr.

August 13, 2013

ITD Cementation India | 2QCY2013 Result Update

Exhibit 3: Revenue flat on yoy basis

500 400

334 313 ( ` cr)

Exhibit 4: Operating margin ahead of estimates

40 30

355

31.4 18.0 7.3 11.5 (0.7)

335 292 327 384 332 271

60 50 40

( ` cr) (%)

13.5 11.4 9.4

12.8

12.3

12.7 10.5 9.8

11.7

15 12 9 6

(%)

300 200 100 0

2QCY11

20 10 0 (10)

30 20

32 33 44 49 41 34 33 35 39 2QCY13

0.6 (7.3) (4.0) (7.6)

4QCY12 1QCY13 2QCY13

10 0

3 0

2QCY11

3QCY11

4QCY11

1QCY12

2QCY12

3QCY12

4QCY12

3QCY11

4QCY11

1QCY12

2QCY12

3QCY12

Revenue (LHS)

yoy growth (RHS)

EBITDA (LHS)

EBITDA Margin (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

August 13, 2013

1QCY13

ITD Cementation India | 2QCY2013 Result Update

Investment arguments Strong order book to drive revenue in CY2014E

The company has an order backlog of ~`4000cr as on date (closing order book for CY2012 stood at `2,891cr), executable over a period of two years. Till now in CY2013, the JV of ITD Cementation with its parent company, ITD, has bagged new orders of `546cr and `752cr from Delhi Metro Rail Corporation (DMRC). It also has an order worth ~`50cr for water supply in Agartala. Also, ITD Cementation (standalone) bagged order worth ~`115cr in Ghaziabad for the construction of flyovers and projects worth ~`100cr on specialist engineering works of piling, civil works for power plant, water treatment plant etc.

We expect the company to post a slow revenue CAGR of 7.5% over CY2012-14E due to delayed execution of projects and various regulatory concerns. The order book to sales for the company is expected to improve to ~2.4 for both CY2013E and CY2014E.

Exhibit 5: Order Book break-up

Transportation 12% Specialist works 12% Hydro, Dams, Tunnels and irrigation projects 30%

Exhibit 6: Order book to sales to improve in CY2014E

4,000 3,500 3,000 2.09 2.75 Order book 2.15 2.22 OB/sales 2.38 2.42 3.00 2.50 2.00 1.50 1.00

(Order Book)

2,000 1,500

3,246

2030

2905

2754

MRTS 26%

500 0

2889

Marine works 20%

3,639

1,000

0.50 0.00

CY2009

CY2010

CY2011

CY2012 CY2013E CY2014E

Source: Company, Angel Research

Source: Company, Angel Research

Softening of interest rate to improve bottom-line

We expect the interest outgo to be flat for CY2013E. However, in CY2014E, we expect the Reserve Bank of India (RBI) to cut interest rates to boost economic growth. Hence, we expect interest outgo for the company to reduce to `99cr in CY2014E, adding directly to the bottom-line, which is expected to be `32cr.

Foray into the industrial segment long-term growth driver

The company had forayed into the industrial and power segments in 1HCY2012. It is currently very cautious in taking orders in the power segment due to the regulatory and financial issues involved. However, the company sees a huge potential in the industrial segment. The company currently has 3 small orders, totaling ~30-40cr in this segment, but it expects revenue inflow of ~400-500cr in the coming 3-4years. The segment being a high-margin segment is expected to help the company in expanding its operating margin going forward.

August 13, 2013

(OB/sales)

2,500

ITD Cementation India | 2QCY2013 Result Update

Financials

Revenue visibility to improve in CY2014E

Considering the delayed execution of the projects due to slowdown in economy and various regulatory concerns, we expect the revenue growth to be muted this year but rebound to 10% for CY2014E. As a result we expect the company to post a revenue CAGR of 7.5% over CY201214E to `1,502cr.

Exhibit 7: Strong order book to drive revenue

1,800 1,500 21.4 25 20

1,300

1,365

1,200

(` Cr)

15 10.0 10

973

8.7 5.0

600

1,283

300 0

1.5 CY2009

1,057

1.3 CY2012

1,502

5 0

CY2010

CY2011

CY2013E CY2014E

Revenue (LHS)

Source: Company, Angel Research

Revenue growth (RHS)

On the operating expenses front, we expect the raw material cost to remain at same levels as a percent of net sales. However, we expect the employee cost to increase to 11.8% as a percentage of net sales. Consequently, the operating margin is expected to be range bound for CY2013E (10.9%) and CY2014E (11.2%). Going forward we expect the interest rate to come down to 15.0% for CY2014E. The tax rate for the current year is expected to be on the lower side at ~17% of PBT; however, we expect the tax rate to normalize at ~30% going forward. Consequently we expect the company to post a profit CAGR of 21.1% at `32cr for CY2014E.

Exhibit 8: Margin to remain range bound

200 12.1 150 9.5 10.6 9.2 9 10.9 11.2 15 12

Exhibit 9: Lower interest cost to improve profitability

35 30 25 20 146.2 72.0 (2.5) 5 CY2009 9 CY2010 23 CY2011 PAT (LHS) 22 CY2012 (4.5) 21 32 275.0 300 250 200 150 53.5 100 50 0 (50) CY2013E CY2014E PAT growth (RHS)

( ` Cr)

( ` Cr)

(%)

100 6 50 3

15 10

136

157

149

168

5 0

92

0 CY2009 CY2010 CY2011 CY2012 CY2013E CY2014E EBITDA (LHS) EBITDA margin (RHS)

97

Source: Company, Angel Research

Source: Company, Angel Research

August 13, 2013

(%)

(%)

900

ITD Cementation India | 2QCY2013 Result Update

The company

ITD Cementation is a subsidiary of Thailand-based Italian Thai Development Public Company Ltd. (ITD), which holds 70% stake in the company. ITD also provides its knowhow, technologies and skilled personnel to ITD Cementation. ITD Cementation provides EPC services to infrastructure projects in India. The company has a leadership position in the foundation and piling work, which contributes almost 45% to its revenue. The companys business operation areas include construction of maritime structures, mass rapid transit systems, hydro power, tunnels, dams, industrial structures, airports, highways, bridges, flyovers, tube heading and foundation and specialist engineering.

Outlook and valuation

We expect the companys revenue to post a 7.5% CAGR over CY201214E to `1,502cr. The operating margin for the company is expected to hover around 11.0% for the same period. Further, we expect the interest rate to soften by ~164bp to 15.0% for CY2014E resulting in the net profit growing at a CAGR of 21.1% over CY2012-14E to `32cr. The stock is currently trading at a P/BV of 0.4x. We remain positive on the companys outlook, however, we remain concerned on delay in project execution and hence the revenue inflow. We maintain our Buy recommendation on the stock with a revised target price of `194 with a target P/BV of 0.5x for CY2014E.

Exhibit 10: One-year forward PBV band

400 350 300 250 200 150 100 50 0

(` )

Dec-08

Dec-09

Dec-10

Dec-11

Dec-12

Apr-09

Apr-10

Apr-11

Apr-12

Aug-08

Aug-09

Aug-10

Aug-11

Aug-12

Apr-13

Price

Source: Company, Angel Research

0.2x

0.4x

0.6x

0.8x

Exhibit 11: Relative valuation

Company ITD Cementation Simplex Infra Year end CY2013E CY2014E FY2014E FY2015E

Source: Company, Angel Research

Mcap (` cr) 182 182 253 253

Sales (` cr) 1,365 1,502 6,308 7,033

OPM (%) 10.9 11.2 9.4 9.6

PAT (` cr) 21 32 59 93

EPS (`) 18.2 28.0 11.9 18.7

RoE (%) 5.1 7.4 4.5 6.7

P/E (x) 8.7 5.7 4.3 2.7

P/BV (x) 0.4 0.4 0.2 0.2

EV/Sales (x) 0.6 0.5 0.5 0.5

August 13, 2013

Aug-13

ITD Cementation India | 2QCY2013 Result Update

Concerns

Proper execution of ongoing projects is necessary for the company as any slowdown or freezing of projects either because of some approvals, clearance or investment issues may adversely affect the companys performance, as it directly affects the companys revenue. Disruption in the schedule of projects due to natural calamities is a big risk for the company. Volatility in raw-material prices in the coming years (ie, steel and cement prices) may put pressure on the companys margin. Any further slowdown in the economy may adversely affect the companys performance.

August 13, 2013

ITD Cementation India | 2QCY2013 Result Update

Profit and Loss (Standalone)

Y/E December (` cr) Total operating income % chg Net Raw Materials % chg Other Mfg costs % chg Personnel % chg Other % chg Total Expenditure EBITDA % chg (% of Net Sales) Depreciation & Amortisation EBIT % chg (% of Net Sales) Interest & other Charges (% of loan) Other Income (% of Net Sales) Recurring PBT % chg PBT (reported) Tax (% of PBT) PAT (reported) Extraordinary Expense/(Inc.) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg CY2010 1,057 8.7 418 11.9 238 (12.1) 102 22.0 201 32.5 960 97 5.0 9.2 31 66 7.3 6.3 78 14.8 24 2.3 (12) 18.3 12 3 23.3 9 0 9 72.0 0.9 7.9 7.9 72.0 CY2011 1,283 21.4 463 10.8 305 27.9 124 21.6 255 26.6 1,147 136 40.5 10.6 34 102 54.0 7.9 93 14.9 13 1.0 9 (178.9) 22 (1) (2.5) 23 0 23 146.2 1.8 19.6 19.6 146.2 CY2012 1,300 1.3 456 (1.5) 309 1.4 143 15.5 234 (8.0) 1,143 157 15.4 12.1 36 121 18.8 9.3 103 16.6 9 0.7 18 94.0 27 5 17.8 22 22 (2.5) 1.7 19.1 19.1 (2.5) CY2013E 1,365 5.0 483 6.0 326 5.4 161 12.5 246 4.8 1,216 149 (5.2) 10.9 34 115 (4.7) 8.5 101 15.8 11 0.8 14 (19.0) 25 4 17.0 21 21 (4.5) 1.5 18.2 18.2 (4.5) CY2014E 1,502 10.0 527 9.0 360 10.4 177 10.0 270 10.0 1,334 168 12.6 11.2 35 133 15.1 8.8 99 15.0 12 0.8 34 136.9 46 14 30.0 32 32 53.5 2.1 28.0 28.0 53.5

August 13, 2013

ITD Cementation India | 2QCY2013 Result Update

Balance Sheet (Standalone)

Y/E December (` cr) SOURCES OF FUNDS Equity Share Capital Reserves& Surplus Shareholders Funds Total Loans Long Term Provisions Deferred Tax (Net) Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Lease adjustment Goodwill Investments Long Term Loans and adv. Other Non-current asset Current Assets Cash Loans & Advances Inventory Debtors Other current assets Current liabilities Net Current Assets Misc. Exp. not written off Total Assets 322 165 158 12 37 1,014 35 131 357 491 335 679 886 395 197 198 3 41 93 0 1,181 23 161 680 317 514 667 1,002 426 233 193 14 47 103 0 1,234 12 116 791 315 0 575 659 1,016 447 266 181 14 47 103 0 1,258 17 137 772 332 0 550 708 1,053 465 301 164 14 47 103 0 1,376 11 150 849 365 0 603 773 1,101 12 350 361 525 886 12 370 381 624 4 (8) 1,002 12 389 400 621 5 (11) 1,016 12 407 419 640 5 (11) 1,053 12 436 447 659 5 (11) 1,101 CY2010 CY2011 CY2012 CY2013E CY2014E

August 13, 2013

ITD Cementation India | 2QCY2013 Result Update

Cash Flow (Standalone)

Y/E December (` cr) Profit before tax Depreciation Change in Working Capital Direct taxes paid Others Cash Flow from Operations (Inc.)/Dec. in Fixed Assets (Inc.)/Dec. in Investments (Incr)/Decr In LT loans & adv. Others Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances CY2010 12 31 12 (3) 59 111 (39) (14) 0 17 (36) 0 28 (2) (77) (51) 24 11 35 CY2011 22 34 0 1 (24) 33 (64) (4) 0 5 (62) 0 99 (3) (79) 17 (12) 35 23 CY2012 27 36 (3) (5) 19 74 (41) (6) 9 3 (36) 0 (3) (2) (44) (50) (11) 23 12 CY2013E 25 34 (44) (4) (11) (0) (21) 0 0 11 (10) 0 19 (2) (0) 16 5 12 17 CY2014E 46 35 (71) (14) (12) (16) (18) 0 0 12 (6) 0 19 (2) (2) 15 (6) 17 11

August 13, 2013

10

ITD Cementation India | 2QCY2013 Result Update

Key Ratios (Standalone)

Y/E December Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Net sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value DuPont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset TO (Gross Block) Inventory / Net sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Int. Coverage (EBIT/ Int.) 1.3 4.7 0.9 1.5 4.1 1.1 1.4 3.6 1.2 1.4 3.9 1.1 1.3 3.6 1.3 3.3 123 156 119 225 3.3 147 115 135 183 3.1 206 89 174 181 3.1 206 89 165 179 3.2 206 89 165 177 7.5 8.2 2.6 10.1 10.8 6.1 11.8 12.7 5.6 10.9 11.7 5.1 12.0 12.8 7.4 6.3 0.8 1.3 6.3 11.4 1.3 0.0 7.9 0.7 1.4 7.4 10.1 1.5 3.3 9.3 0.8 1.4 10.4 13.7 1.4 5.9 8.5 0.8 1.4 9.7 13.1 1.4 5.1 8.8 0.7 1.4 8.9 10.5 1.3 6.9 7.9 7.9 34.6 1.5 313.7 19.6 19.6 49.3 2.0 331.0 19.1 19.1 50.4 2.0 347.8 18.2 18.2 47.3 2.0 363.8 28.0 28.0 58.2 2.0 388.3 20.1 4.6 0.5 0.9 0.6 6.6 0.7 8.2 3.2 0.5 1.2 0.6 5.5 0.7 8.4 3.2 0.5 1.2 0.6 4.7 0.7 8.8 3.4 0.4 1.2 0.6 5.1 0.7 5.7 2.7 0.4 1.2 0.5 4.7 0.7 CY2010 CY2011 CY2012 CY2013E CY2014E

August 13, 2013

11

ITD Cementation India | 2QCY2013 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

ITD Cementation No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors.

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

August 13, 2013

12

Das könnte Ihnen auch gefallen

- Technical & Derivative Analysis Weekly-14092013Dokument6 SeitenTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report November 12Dokument2 SeitenMetal and Energy Tech Report November 12Angel BrokingNoch keine Bewertungen

- Special Technical Report On NCDEX Oct SoyabeanDokument2 SeitenSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokument6 SeitenCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Commodities Weekly Tracker 16th Sept 2013Dokument23 SeitenCommodities Weekly Tracker 16th Sept 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 16 Sept 2013Dokument3 SeitenDerivatives Report 16 Sept 2013Angel BrokingNoch keine Bewertungen

- Sugar Update Sepetmber 2013Dokument7 SeitenSugar Update Sepetmber 2013Angel BrokingNoch keine Bewertungen

- TechMahindra CompanyUpdateDokument4 SeitenTechMahindra CompanyUpdateAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Technical Report 13.09.2013Dokument4 SeitenTechnical Report 13.09.2013Angel BrokingNoch keine Bewertungen

- IIP CPIDataReleaseDokument5 SeitenIIP CPIDataReleaseAngel BrokingNoch keine Bewertungen

- Market Outlook 13-09-2013Dokument12 SeitenMarket Outlook 13-09-2013Angel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- MarketStrategy September2013Dokument4 SeitenMarketStrategy September2013Angel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- MetalSectorUpdate September2013Dokument10 SeitenMetalSectorUpdate September2013Angel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 06 2013Dokument2 SeitenDaily Agri Tech Report September 06 2013Angel BrokingNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Icici Brochure - PENSION PLAN ULIPDokument10 SeitenIcici Brochure - PENSION PLAN ULIPAbhishek PrabhakarNoch keine Bewertungen

- Why Public Policies Fail in PakistanDokument5 SeitenWhy Public Policies Fail in PakistanbenishNoch keine Bewertungen

- EduHubSpot ITTOs CheatSheetDokument29 SeitenEduHubSpot ITTOs CheatSheetVamshisirNoch keine Bewertungen

- Working Capital Management at BEMLDokument20 SeitenWorking Capital Management at BEMLadharav malikNoch keine Bewertungen

- Introduction - IAPH - Patrick VerhoevenDokument13 SeitenIntroduction - IAPH - Patrick VerhoevenThrillage BlackNoch keine Bewertungen

- Conceptual Framework: Amendments To IFRS 3 - Reference To TheDokument3 SeitenConceptual Framework: Amendments To IFRS 3 - Reference To TheteguhsunyotoNoch keine Bewertungen

- Best Practice Solutions: Managing Stakeholder ExpectationsDokument18 SeitenBest Practice Solutions: Managing Stakeholder ExpectationsabdelmutalabNoch keine Bewertungen

- Case StudyDokument17 SeitenCase Studysubakarthi0% (1)

- Compensation Survey 2021Dokument14 SeitenCompensation Survey 2021Oussama NasriNoch keine Bewertungen

- SIEMENS Analysis of Financial StatementDokument16 SeitenSIEMENS Analysis of Financial StatementNeelofar Saeed100% (1)

- CPG SampleDokument43 SeitenCPG SampleRabindra Rajbhandari100% (2)

- K. Marx, F. Engels - The Communist Manifesto PDFDokument77 SeitenK. Marx, F. Engels - The Communist Manifesto PDFraghav vaid0% (1)

- Ac3143 ch1-4 PDFDokument62 SeitenAc3143 ch1-4 PDFNero PereraNoch keine Bewertungen

- CommunismDokument2 SeitenCommunismhezekiahNoch keine Bewertungen

- Analisis Kependudukan - Proyeksi IndonesiaDokument43 SeitenAnalisis Kependudukan - Proyeksi Indonesiaratna murtiNoch keine Bewertungen

- 1538139921616Dokument6 Seiten1538139921616Hena SharmaNoch keine Bewertungen

- Constantinides 2006Dokument33 SeitenConstantinides 2006Cristian ReyesNoch keine Bewertungen

- Social Security CalculatorDokument20 SeitenSocial Security CalculatorHamood HabibiNoch keine Bewertungen

- IT Security Specialist Home Credit: About PositionDokument2 SeitenIT Security Specialist Home Credit: About PositionPatrikNoch keine Bewertungen

- Ipo Note Oimex Electrode LimitedDokument7 SeitenIpo Note Oimex Electrode LimitedSajjadul MawlaNoch keine Bewertungen

- Industry and Competitive Analysis: A. Tony Prasetiantono Week 2Dokument22 SeitenIndustry and Competitive Analysis: A. Tony Prasetiantono Week 2farahamaliay8877Noch keine Bewertungen

- Banking in Indo Pak SubcontinentDokument3 SeitenBanking in Indo Pak Subcontinentimran khan100% (2)

- Pija Doc 1581907800Dokument8 SeitenPija Doc 1581907800lamp vicNoch keine Bewertungen

- ACC 307 Final Project Part IIDokument4 SeitenACC 307 Final Project Part IISalman Khalid100% (4)

- HydrogenPro Integrated Report 2021Dokument114 SeitenHydrogenPro Integrated Report 2021Maria PolyuhanychNoch keine Bewertungen

- Dealing With Competition: Competitive ForcesDokument9 SeitenDealing With Competition: Competitive Forcesasif tajNoch keine Bewertungen

- Global CFO VP Director Finance in Los Angeles CA Resume Lance GatewoodDokument2 SeitenGlobal CFO VP Director Finance in Los Angeles CA Resume Lance GatewoodLanceGatewoodNoch keine Bewertungen

- CH 01Dokument14 SeitenCH 01Madalina RaceaNoch keine Bewertungen

- Islamic Modes of Financing: Diminishing MusharakahDokument40 SeitenIslamic Modes of Financing: Diminishing MusharakahFaizan Ch0% (1)

- Business English Stock MarketDokument2 SeitenBusiness English Stock MarketMara CaiboNoch keine Bewertungen