Beruflich Dokumente

Kultur Dokumente

Retail Dualisim

Hochgeladen von

tttkkktitinCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Retail Dualisim

Hochgeladen von

tttkkktitinCopyright:

Verfügbare Formate

International Journal of Development and Conflict Vol. 1, No. 1 (2011) 27 40 World Scientific Publishing Company DOI: 10.

1142/S2010269011000087

RETAIL SECTORS GROWTH UNDER DUALISM: INDIAS DEVELOPMENT DILEMMA

DILIP DUTTA

Int. J. of Dev. and Conflict 2011.01:27-40. Downloaded from www.worldscientific.com by 117.197.246.225 on 08/14/13. For personal use only.

School of Economics Faculty of Arts and Social Sciences The University of Sydney New South Wales: 2006 Australia dilip.dutta@sydney.edu.au Indias retail sector has recently been witnessing a rapid transformation in many aspects of the business by introducing scalable and profitable organized or modern retail models across different categories and, thereby, making way for new formats over the existing unorganized or traditional ones. While the organized retailing refers to trading activities undertaken by licensed retailers who are registered for sales tax, income tax, and routine regulatory checks, the unorganized retailing mostly includes low-cost neighborhood kiranas or mom-and-pop shops, kiosks, street markets, hand-cart and pavement vendors. This coexistence of two types of retailing has given rise to an organizational or institutional dualism in Indias retail sector. Because of a perceived threat that small traders will bear the brunt of the organized retail growth by losing their business, the governments current regulatory policy has been very cautious. As a result, the growth of the Indian retail sector as a whole has increasingly become inclusive. Keywords: modern (organized) and traditional (unorganized) retail sectors; dualism of Indias retail industry; growth and regulation; development dilemma; inclusive growth; multinational retailers and wholesalers; government policy.

1. Introduction During the process of economic growth and development, either sociocultural aspects or undeveloped market networks or both are the root causes of the emergence of organizational or institutional dualism within and across various economic segments/sectors in a differentiated socioeconomic system. Often, varying geographical location, sociocultural tradition, natural resource availability, and technological capability give particular organizational/institutional shapes to the segments/sectors, which could be highly contrasting in nature. The State, as a strategic actor, has an important role in making appropriate policy and regulatory design so that inter- and intra-segmental/sectoral growths and developments become increasingly inclusive and integrated within and among the components. Sector specific organizational or institutional dualism is very common in contemporary developing/emerging economies like India, at least in its early stage.

27

28 D. Dutta

Int. J. of Dev. and Conflict 2011.01:27-40. Downloaded from www.worldscientific.com by 117.197.246.225 on 08/14/13. For personal use only.

The present paper will take a close look at Indias retail sector consisting of about 12 million small unorganized stores and many more street vendors and fruit and vegetables hawkers. The low cost formats of kirana/mom-and-pop stores suffer from a number of limitations such as small size of operations, capital shortage, real estate problems, and pervasive use of tax evasion techniques. Over the past decade or so, Indias retail sector has witnessed a rapid transformation in many aspects of the business by introducing scalable and profitable modern retail models across different categories, thereby making way for new formats over the existing traditional ones. Some experts are of the opinion that the influx of major retail chains with the modern formats side by side with the traditional ones has given rise to an organizational or institutional dualism in Indias retail sector. It is feared that the small unorganized shops will be closed due to fierce competition from the modern ones, thus leading to a high rate of unemployment. The government as the executive organ of the Indian State has been actively involved in this process to balance out the interests of different stakeholders. It has been desperately trying to rectify legal, infrastructural, and educational constraints in order to achieve the kind of neo-liberal future it has planned for and also to ensure its survival within the broader status quo of sociocultural and politico-economic framework. After providing in Sec. 2 a description of Indias structural dualism at the very aggregate level of its society, recent trends in Indias retail sector are highlighted in Sec. 3. Section 4 focuses on Indias development dilemma under globalizing forces. How conflicts among stakeholders have been dealt with through cooperation, additional market exploration, and recent government initiatives is discussed in Sec. 5, which will then be followed by a concluding note in Sec. 6. 2. Nature and Extent of Indias Structural Dualism Like many developing countries, India has a structural dualism at its very aggregate societal level and this has been accentuated recently under globalizing forces.1 This means that India has two different socioeconomictechnological environments the organized segment (predominantly capitalistic and often called modern or formal) and the unorganized segment (predominantly pre-capitalistic and often called traditional or informal). The organized (or modern) segment includes all establishments in the public sector irrespective of their size, and non-agricultural establishments in the private sector employing 10 or more persons. The unorganized (or traditional) segment is usually defined to be the segment that is not recorded under any factory legislation. This segment with low capitallabor ratio is mostly comprised of self-employed households and casual

Dutta (2004), for an analysis on accentuation of dualism in India during the post-liberalization period. The process of economic liberalization can be divided into two phases: phase I of policy changes toward liberalization (198090) and phase II of comprehensive liberalization (1991 onward).

1See

Retail Sectors Growth under Dualism 29

Int. J. of Dev. and Conflict 2011.01:27-40. Downloaded from www.worldscientific.com by 117.197.246.225 on 08/14/13. For personal use only.

laborers with no steady employment and, therefore, no secure or sustainable incomes, and above all with no access to the usual set of social security benefits. Although the share of Indias organized segment in its net domestic product (NDP) (at factor cost) has increased from 30% during 198081 to 42.9% during 200708, its share in employment has declined from 8.7% of total labor force in 1981 to only 6.1% in 2007. As a result, the unorganized segment continues to contain over 93% of Indias total workers, in spite of the decline in its share in NDP from 70% in 198081 to 57.1% in 200708.2 The unorganized segments share of NDP in agriculture has remained virtually unchanged since the early 1980s. However, during the recent period, the overall declining trend in Indias share of NDP attributed to the unorganized segment is mainly due to its reduction in the manufacturing sector and in a few categories of the services sector such as construction, trade (retail plus wholesale), finance, insurance, real estate, and business (see Table 1). It is noteworthy that Indias retail sector caters to consumer needs across India through about 15 million predominantly tiny outlets, belonging mostly to its unorganized segment. As Guruswamy et al. (2005, p. 620) note: One of the principal reasons behind the explosion of retail outlets and its fragmented nature in the country is the fact that retailing is probably the primary form of disguised unemployment/underemployment []. Given the already overcrowded agriculture sector, and the stagnating manufacturing sector, [] it becomes almost a natural decision for an individual to set up a small shop or

Table 1. Percentage share of unorganized segment in Indias net domestic product by selected economic activities (at current prices).

Sectors Agriculture Manufacturing Construction Trade (retail + wholesale) Transport Communication Financing, insurance, real estate and business services 199900 200304 2004 05 200506 200607 2007 08 91.0 37.5 59.0 85.8 76.5 18.0 48.4 91.9 33.8 58.8 81.6 78.1 30.5 44.3 90.7 32.7 63.6 81.3 78.5 41.7 44.1 90.8 32.2 56.5 79.4 78.4 51.3 43.1 90.1 32.2 57.2 79.0 80.2 65.2 40.0 91.2 32.6 57.0 78.6 81.4 74.5 39.1

Source : National Accounts Statistics, Government of India, 2009 (p. 184).

2 The figures on NDP are from different issues of National Accounts Statistics (Government of India), while figures on employment are from Economic Survey (Government of India) (different issues including 20092010) and World Development Indicators 2010 (online).

30 D. Dutta

store, depending on his or her means and capital. And thus, a retailer is born, seemingly out of circumstance rather than choice. In fact, Indias retail sector is the second largest employer of people after agriculture. These retail outlets appear in the form of mostly low-cost neighborhood kiranas or mom-and-pop shops, kiosks, street markets, handcart and pavement vendors, owner-operated general stores and a few exclusive/multi-brand departmental stores. 3. Emergence of Modern Retail Outlets

Int. J. of Dev. and Conflict 2011.01:27-40. Downloaded from www.worldscientific.com by 117.197.246.225 on 08/14/13. For personal use only.

Before the emergence of modern organized retail outlets, there were a number of traditional organized retail outlets. These are basically of two types: (i) private manufacturer-dominated outlets such as Bata Shoe, Bombay Dyeing, the S. Kumars Group, and the Raymond Group to name a few; and (ii) government initiated/supported outlets such as public distribution system (PDS),3 khadi stores and cooperatives, Mother Dairy, Kendriya Bhander, Super Bazar, etc. The modern organized retailing in consumer goods4 gathered momentum around the late 1990s when growth of shopping malls began to take some foothold across different parts of the country. Organized retailing refers to trading activities undertaken by licensed retailers who are registered for sales tax, income tax, and routine regulatory checks. These modern outlets include privately owned large retail businesses and corporatebacked super- as well as hyper-markets,5 and retail chains. It is often argued that the DNA of a retail business is very different from that of manufacturing sector firms and even from services providers as well: retail scales up one store at a time, and unlike telecom and banking which just move information, retail is physical.6 An earlier report prepared by the credit rating agency Crisil Ltd. notes that the Indian retail market is the most fragmented in the world and that only 2% of the entire retailing business is in the organized sector. This suggests that the potential for its growth is immense. The modern (organized) component of Indias retail sector has been booming in recent years, although its percentage share compared to the traditional (unorganized) component is at the bottom (see Table 2) among the countries with large populations particularly in the Asia-Pacific region. Different surveys and reports suggest that the modern retailing component of Indias retail sector is on the threshold of the next big revolution after that of the

3Arvind Singhal, Chairman of Technopak Advisors Pvt Ltd., remarks that there is no comparably large and diverse economy anywhere in the world that has such an antediluvian distribution system for basic commodities and day-to-day-needed consumer products as we have in India (Singhal, 2007). 4 Consumer goods consist of durables (refrigerators, washing machines, automobiles, etc.), semidurables (clothing, furnishing, home textiles, etc.) and nondurables (food products, fast moving consumer goods (FMCG) or consumer packaged goods (CPG) that are sold quickly at relatively low cost). 5 Hypermarkets sell all varieties of a particular product, while supermarkets sell all products, but not all varieties of any product. 6 Dobhal et al. (2007) quote Damodar Mall, CEO (Innovation & Incubation) at Future Group.

Retail Sectors Growth under Dualism 31

Table 2. Percentage of unorganized and organized retail in selected countries.

Unorganized India China Indonesia Thailand Malaysia Taiwan USA 95 80 70 60 45 19 15 Organized 5 20 30 40 55 81 85

Int. J. of Dev. and Conflict 2011.01:27-40. Downloaded from www.worldscientific.com by 117.197.246.225 on 08/14/13. For personal use only.

Source : Jha (2007) quoting from EY Research.

information and communication technology (ICT) sector. A survey was jointly undertaken by the Confederation of Indian Industry (CII) and Pricewaterhouse Coopers (PwC) in late 2005. The survey titled The Rising Elephant Benefits of Modern Trade to Indian Economy added that the Indian retail sector (both organized and unorganized) was a US$210 billion pie witnessing a healthy growth rate of 5% per annum. As India Retail Report 2007 (p. 22) shows, the Indian retail market was estimated to be worth Rs. 1,200,000 crore (US$270 billion) in 2006 at 2007 prices. Organized retailing had increased its share from 3% in 2004 to 4.6% and was valued at Rs. 55,000 crore (US$12.4 billion) in 2006. In the overall retail pie, food and grocery claimed a 63% share, followed by clothing and accessories (9%), jewellery and catering with 5% share each. But in the organized retail pie, the largest 39% share was with the clothing, textiles, and fashion accessories segment, while the food and grocery segment had the second largest share of 11%, and then each of the consumer electronics and footwear segments had a third largest share of 9%. According to Technopak Analysis and Industry Estimates as published in Business Standard (2008b), the share of organized players in overall retail trade was expected to move at a record pace (see Table 3). Although impact of the recent global slowdown on Indias gross domestic product (GDP) was limited, private consumption growth took a significant dip due to low consumer confidence. In the first few quarters of 200809, growth in GDP came down from 9.1% to 6.1%, but growth in private consumption decreased drastically from 8.5% to 2.9%. This dip significantly impacted the retail sectors growth. Organized retail, which was growing at over 30% in 200506 and 2006 07, slowed down to around 16% in 200809. With the revival of economic growth from the second quarter of 200910, growth in organized retail has returned to an estimated level of 21%.7 As to the entry of multinational retailers and wholesalers in Indian market, Indias Foreign Direct Investment (FDI) Policy allows 100% foreign investment in

7 Gupta

et al. (2010, p. 27).

32 D. Dutta

Table 3. New organized retail stores projected to be added during 200712.

Types of retail stores New retail space (million sq. ft.) 218 86 76 32 75 Average store size (sq. ft.) Number of stores

Hypermarket Supermarket Cash and carry Department stores Speciality store

80,000 4,000 150,000 40,000 4,000

2,725 21,500 507 803 18,725

Int. J. of Dev. and Conflict 2011.01:27-40. Downloaded from www.worldscientific.com by 117.197.246.225 on 08/14/13. For personal use only.

organized wholesale (cash and carry) formats and up to 51% foreign investment in single-brand retail formats in a joint venture with a local firm and with prior government permission.8 It is noteworthy that foreign-owned wholesale traders can sell to shops and restaurants or other retailers but not to individual buyers. 4. Indias Development Dilemma vis-a-vis Interests of Different Stakeholders The strong opposition to organized retailing has surfaced mainly due to two reasons. First, livelihoods of a multitude of the so-called self-employed, small neighborhood shopkeepers and their dependents were feared to be severely affected by income/job losses from fierce competition from the large retail shops lower priced and superior quality products. Second, some of the vested interest groups opposed organized retailing in agricultural commodities particularly in states with some of the most marginalized farmers.9 While the government allowed 51% FDI in single-brand retail in 2005, FDI in multi-product retail is still not allowed due to political opposition. Although the domestic companies, meanwhile, had managed to gradually strengthen their foothold in the sensitive industry of retailing, opposition by the Left parties the main opposition being from the Bharatiya Janata Party (BJP) and even by some vested interests including sections of the ruling Congress party, whose political support base includes traders and wholesalers, remained strong. Opposition by several groups had occasionally escalated into violence, with even a few stores of big retailers thrashed by angry mobs. As a result, some states had decided to curtail or suspend

8 There has been entry of several premium brands (Giorgio Armani, Versace, Gucci, etc.) mostly through joint ventures (Pande, 2010). 9 In spite of the fact that organized retailing of agricultural commodities offers farmers a glimmer of hope to realize market-linked competitive prices, it also enters an arena controlled by local mafia and politicians in many states. As Pandey (2007) elaborates, marketing and access to agricultural markets or mandis are virtually out of reach for a sizable section of farmers; most farmers are at the mercy of local commodity traders. In mandis most transactions are done by commission agents, who usually keep farmers in the dark about how their produce is evaluated and priced, and ensure that there is no fair competition.

Retail Sectors Growth under Dualism 33

all organized retailing domestic and foreign. For example, the Uttar Pradesh government had banned in mid-2007 the opening of new stores by retail chains like Reliance Retail, which was also forced to shut down several of its grocery stores (Reliance Fresh) in Kolkata and Jharkhand due to political agitation against large organized retailers. The perceived threat was that small traders would bear the brunt of the organized retail onslaught.10 The issue goes, as Leahy (2008) comments, to the heart of Indias development dilemma: how far can it pursue market reforms without alienating the vested interests of the left? Due to wider political pressure on the UPA government,11 particularly by the Left parties which were supporting the UPA coalition externally, the commerce and industry ministry, following directions from the Prime Ministers Office, toward the end of February 2007, had mandated the New Delhi-based think tank, Indian Council for Research on International Economic Relations (ICRIER) to prepare a study of various aspects of the domestic retail industry. More specific instruction was given to investigate the impact of big retailing chain stores in the mould of the multinational retailers like the USAs Wal-Mart, the UKs Tesco, Frances Carrefour, or Germanys Metro on small neighborhood shops or kiranas, kiosks, and street vendors. The industry ministrys terms of reference for the study were to examine impact of the growth of organized retail (a) on the growth and employment of the unorganized retailers and vendors, as well as (b) on farmers, consumers, manufacturers, prices, and overall economic growth. The much-awaited ICRIER report was released on May 26, 2008, some 15 months after it was commissioned. The field research that was conducted across 10 major (mega- and mini-metro) cities12 had surveyed 2,020 unorganized small retailers, 1,318 consumers shopping at both organized and unorganized retail outlets, 100 intermediaries, and 197 farmers. Of the 2,020 stores surveyed, 805 were in the control group or in neighborhoods in New Delhi, Kolkata, Hyderabad, and Ahmedabad, where branded outlets had not opened for business at the time of survey. Overall, across both the treatment sample (of unorganized stores in areas where there was head-to-head competition with new organized retail outlets within a 25 km radius) and the control sample, sales and profits of small stores were down by 8% and 9%, respectively. In safe neighborhoods (the control group), sales of small stores were up by at least 2% and profits up by 5.2%, while in neighborhoods with head-to-head competition between the so-called unorganized and organized stores (treatment group), both sales and profits were down by around 16% (or 10% on an annualized basis).13

(2008) and ET Bureau (2011). Prime Minister Manmohan Singh-led United Progressive Alliance (UPA) Government came to power in May 2004. 12 These cities include New Delhi and Jaipur in the north; Kolkata in the east; Chennai, Bangalore, Hyderabad, and Kochi in the south; and Mumbai, Ahmedabad, and Indore in the west. 13 These figures have been taken mostly from Bailay (2008) and Business Standard (2008a).

11 The 10 Rediff.com.

Int. J. of Dev. and Conflict 2011.01:27-40. Downloaded from www.worldscientific.com by 117.197.246.225 on 08/14/13. For personal use only.

34 D. Dutta

More importantly, the study reports that only 1.7% of small shopkeepers closed as a result of the direct competition from the organized retailers. In fact, this figure is even less than half the 4.2% small stores that close down every year for all sorts of reasons.14 The studys other findings include: (i) a 25% likely increase in farmers income if the cauliflower case study is taken as a benchmark when they sell their produce directly to large retailers and not to agricultural markets or mandis; (ii) consumers are the winners from lower prices as a result of sharp pruning of the distribution chain by the organized retailers, with low-income groups saving as much as 10%15; (iii) some decline in turnover and employment region-wise in the north and west regions, although net effect weakens over time; (iv) in terms of product categories, adverse impact is greater in textiles and clothing shops (46%) and least for fruit and vegetable hawkers (34%); (v) surprisingly, the intermediaries have not been adversely affected by the organized retail, but large manufacturers have started feeling the retail sectors competitive impact through price and payment pressures; and (vi) the more serious problem for small stores is the unavailability of credit with only 12% of unorganized retailers having access to institutional credit. For the country as a whole, unorganized retail is growing at a reasonable rate and will continue to do so for many years to come. Yet, it is clear that demand growth for retail is likely to substantially exceed any possible supply response from unorganized retailers, the report adds.16 It is worthwhile to point out that some activist groups like India FDI Watch17 were critical of the ICRIER findings especially because the survey did not cover Indias street vendors and hawkers, such as fruit and vegetables sellers.18 These groups, however, welcomed ICRIERs policy recommendations that the government (i) encourage cooperatives and associations of traditional retailers for direct procurement, (ii) improve credit facilities and create cash and carry stores for small retailers which would create a level playing field for small retailers.19 Other policy measures suggested by the ICRIER report include the following: Government should encourage private codes of conduct by organized retail especially with small supplies; move toward a nationwide uniform licensing regime for the organized retail sector, and simplify the existing licensing/permit

Int. J. of Dev. and Conflict 2011.01:27-40. Downloaded from www.worldscientific.com by 117.197.246.225 on 08/14/13. For personal use only.

14 The report states that a total of 151 small shops have closed down over a period of 21 months. However, only 62 of these shops attributed their closure directly to competition from organized retail (Rediff.com, 2008). 15 The findings suggested that low-income consumers saved more by visiting shopping malls and supermarkets for discount schemes (Ibid.). 16 Ibid. 17 India FDI Watch opposes opening up Indias retail sector to domestic and foreign organized retailers due to fear of job losses in small retail shops and control of the entire food supply chain by a few big companies. 18 It is interesting to note that New Yorks City Council had passed a bill in February 2008 to issue 1,000 new permits for street vendors to sell fruits and vegetables in the neighborhoods of five boroughs where fresh produce was scarce, and diabetes and obesity rates skyrocketed. 19 Roy (2008).

Retail Sectors Growth under Dualism 35

Int. J. of Dev. and Conflict 2011.01:27-40. Downloaded from www.worldscientific.com by 117.197.246.225 on 08/14/13. For personal use only.

regime requiring for 2223 clearances. On the issue of supporting and strengthening the Competition Commissions role as done in the US, the UK, and France, both large and small retailers independently agreed the plan was good. However, the chief executive of industry body Retailers Association of India argued that with the Competition Act of 2003, the Monopolies and Restrictive Practices Act of 1969 and a number of other Acts, such as the Shops and Establishment Act, there is no need for the involvement of the Competition Commission. In May 2009, a premier apex body, the Associated Chambers of Commerce and Industry of India (ASSOCHAM) submitted the survey report, Indian Retailing: The Way Forward, to the two ministries (Commerce and Industry, and Consumer Affairs) and the Planning Commission. The report based on the survey of 150 retailers claims that 95% of organized retailers have opposed regulation of the retail sector jointly by the two ministries because multiple government agencies have caused confusion. The report, therefore, suggests that the government should make a comprehensive National Retail Policy under which retailing should be facilitated with only one nodal agency.20 5. Cooperation among the Stakeholders, Exploration of New Turf, and Recent Government Initiatives Indian organized retail is still in its preparatory stage and the last five years (2006 10) have been a roller coaster ride for organized retail. Not only have the countrys top corporate houses Reliance industries, Tata Group, and Aditya Vikram Birla Group to name a few entered the organized sector, smaller aspirants have also made a beeline to find a toehold in it. Global giants Wal-Mart, Metro, Tesco, and Carrefour made headlines in India as well.21 Still, the retail ride hit a pothole around 2008. As Pande (2010) describes: With the rush among the retailers to rapidly expand into newer markets to gain first mover advantage, both real estate and human resources costs were driven up. The same wasnt matched by higher footfalls. To make matter worse, the global storm affected liquidity in the market making investors and lenders wary of the existing business models. As a result, the likes of Subhiksha and Vishal Retail went down and others were forced to rethink their strategies. The organized retail sector saw 10% decline in sales in 2008. There were store closures, changes in formats and organizations made leaner.

20 Press

21 Pande

Trust of India (2009). (2010).

36 D. Dutta

Int. J. of Dev. and Conflict 2011.01:27-40. Downloaded from www.worldscientific.com by 117.197.246.225 on 08/14/13. For personal use only.

In order to fight back the downturn, vendors looked at newer ways to make their brands more relevant to both consumers and retailers. After the UPA governments return to the power in May 2009 without the Left parties in its coalition, the internal political opposition has also been avoided and it seems the wider opposition to organized retail has subsided. In the absence of a policy for contract farming across the country, farmers associations in a few states have been quickly forging relationships with a number of corporate retail groups for sourcing vegetables. Thanks to the retail boom, retailers are increasingly pushing for such cooperative arrangements, especially because the cooperatives are registered under the mutually aided Cooperative Society Act. For instance, the Federation of Farmers Association (FFA) of Andhra Pradesh has initiated a move by setting up eight cooperatives in the state for mango, about 4,000 farmers in over 140,000 acres are working across these in Chitoor for mango production. This cooperative arrangement had helped in mitigating losses to an extent of Rs. 2030 million. Coca-Cola has obtained 3,500 tonnes of mango from this source. Furthermore, FFA has signed a contract with another corporate retailer ITC in Medak district in Andhra Pradesh to be the source of vegetables grown on about 200300 acres with over 700 growers. FFA was in talks with Heritage Foods to supply over one lakh bags of Sona Masoori rice (Mahalakshmi, 2007). As the India Retail Report (2009, p. 291) notes: With several states in the country permitting retailers to purchase produce directly from farmers, the farmers too are adapting to the new opportunity to cultivate assigned crops and take special care of the same. This gets them instant credit at higher prices than what they received from the erstwhile traders/middlemen. Corporate retailers like ITC, Godrej, Reliance, AV Birla and many others have already established the farm linkages. Indian farmers are finally making good money, after centuries of social and economic exploitation. The Indian government too has chipped in with a massive loan waiver worth Rs. 60,000 crore to lighten the farmers debt burden. Realizing that the urban retail markets concentrated in metropolitan and tier-I as well as tier-II cities are fast getting saturated, retailers are increasingly paying attention to Indias rural markets22 for growth opportunities. The bottom of the pyramid consisting of tier-III cities and the rural towns has already been targeted by the retail companies who wanted to explore new turf. The rural retail hubs that have already been set up include Hariyali Kisan Bazaars (DCM), Aadhars

22 According to National Council of Applied Economic Research (NCAER) reports, rural India is home to 720 million consumers across 627,000 villages, and 17% of these villages account for 50% of the rural population as well as 60% of rural wealth. This implies that reaching out to just 100,000 plus villages will enable firms to tap most of the retail opportunity in rural markets (India Retail Report, 2009, p. 291).

Retail Sectors Growth under Dualism 37

Int. J. of Dev. and Conflict 2011.01:27-40. Downloaded from www.worldscientific.com by 117.197.246.225 on 08/14/13. For personal use only.

(PantaloonGodrej joint venture), Choupal Sagar (ITC), Kisan Sansars (Tata), Reliance Fresh, and others such as the Naya Yug Bazaar. On the part of the government, the industry ministry has for the first time released the consolidated policy framework for FDI in India contained in Circular No. 1 of 2010, effective from April 1, 2010. The underlying rationale of the Circular is both to promote FDI through a transparent, predictable, simple and clear policy framework, which reduces regulatory burden, and to make sure no retail trade happens in the garb of cash and carry. The Circular clarifies the new FDI rules in wholesale trading currently carried out by Bharti Wal-Mart and Metro Cash and Carry, apart from the wholly Indian firms. As KPMG India (2010) summarizes, the key features of the cash and carry wholesale trading/wholesale trading are as follows:

. . .

. . .

Wholesale trading implies sales for trade, business, and profession as opposed to sales for personal consumption. Wholesale trading would include resale, sale after processing, bulk imports with export and B2B e-commerce. Wholesale trading of goods is permitted among group companies subject to a ceiling of 25% of the total turnover of the wholesale venture. The wholesale trade made to the group companies should be for their internal use only. Wholesale trading can be undertaken as per normal business practice, including on credit, subject to applicable regulations. A wholesale/cash and carry trader cannot open retail shops to sell to the consumer directly. To constitute wholesale trade, the entity to whom the sale is made should fulfil any one of the following four conditions: (a) The entity should hold sales tax/VAT registration/service tax/excise duty registration; or (b) The entity should hold trade licenses, i.e., a license/registration certificate/ membership certificate/registration under Shops and Establishment Act, issued by a government authority/government body/local self-government authority, reflecting that the entity/person holding the license/registration certificate/membership certificate, as the case may be, is itself/himself/herself engaged in a business involving commercial activity; or (c) The entity should hold permits/license etc. for undertaking retail trade (like tehbazari and similar license for hawkers) from government authorities/ local self government bodies; or (d) The entity should be an institution having certificate of incorporation or registration as a society or registration as public trust for their self consumption.

The Indian company is obliged to maintain day-to-day records with respect to the satisfaction of the above conditions.

38 D. Dutta

The government has also proposed that, as an investor friendly measure, a new Circular will be issued every six months to update the Consolidated FDI Policy Framework. It is interesting to note that Wal-Mart had made its latest pitch for further opening of Indias multibrand retail just weeks before the US President Barack Obamas visit to India during November 68, 2010. The Wal-Mart CEO Mike Duke even trumpeted the recent policy initiatives by calling them very positive signals from the government.

Int. J. of Dev. and Conflict 2011.01:27-40. Downloaded from www.worldscientific.com by 117.197.246.225 on 08/14/13. For personal use only.

6. A Look Ahead and Conclusion As we have noted in Sec. 3, with the revival of economic growth from the second quarter of 200910, growth in private consumption tracking GDP growth has returned. Private consumption in India currently adds up to about Rs. 34 lakh crore (or trillion) (approximately US$767 billion) and accounts for 60% of GDP. The total (organized and unorganized) retail industry in India is currently estimated to be Rs. 20 lakh crore (or trillion) (approximately US$451 billion) and projected to reach Rs. 27 lakh crore (approximately US$609 billion) by 2015. Organized retail, which is currently estimated to be Rs. 1 lakh crore (5% share), is expected to reach Rs. 3 lakh crore (11%) by 2015.23 Although organized retail is expected to grow at a faster pace than unorganized retail, the latter will constitute a larger part (in absolute terms) of the additional Rs. 7 lakh crore in total retail by 2015, which suggests its continued potential strong footing. Given the fact that consumption habits of a section of Indian consumers, particularly the economically stronger ones, are changing, composition of the Indian consumption basket is also transforming from need-based consumption categories (like food and groceries, footwear, textiles, and apparel) to aspiration/ lifestyle-based consumption categories (such as education, personal transport, health and beauty services, jewellery, and watches). Because of the very large consumer base of India, both organized and unorganized retail will continue to grow. How Indias traditional retail sector has been able to successfully compete with its modern counterpart using its certain inherent features has been succinctly summarized by Gupta et al. (2010, p. 28): Inherent strengths of traditional retail (entrepreneurial drive, relationship management with catchment, real estate and labor costs not fully accounted for in P&Ls, flexibility to deliver very small quantities home, and the MRP regime) coupled with the fact that many mom & pop stores have geared up for competition from

23All

the figures (in lakh crore unit) have been taken from Gupta et al. (2010) and converted into US$ (using exchange rate of 1 US$ = Indian Rs. 44.35).

Retail Sectors Growth under Dualism 39

new age stores (through improved store ambience, better product mix and support from brands/manufacturers in training, retail operations, etc.) puts them on a strong footing. Thus, the Indian retail sectors growth under organizational/institutional dualism between its organized and unorganized components that had emerged over the past decade or so seems to be increasingly becoming inclusive with the help of the current policy regime. It remains to be seen if replication of this type of piecemeal policy regime in the context of other major socioeconomic sectors (such as agriculture, industry, education, and health) can help to make any lasting dent on Indias structural dualism that prevails at its overall societal level. References

Bailay, Rasul. 2008. ICRIER to Finally Make Its Study Public on 26th. Livemint, May 22. http://www.livemint.com/Articles (accessed 28 May, 2008). Business Standard. 2008a. Report on Impact of Organised Retail Released. May 26. http://www.business-standard.com/general (accessed 28 May, 2008). Business Standard. 2008b. Revenue Gains Can Refurbish Small Stores. May 27. http:// www.business-standard.com/general (accessed 28 May, 2008). Dobhal, S., K. Vijayraghvan, and C. Chakravarty. 2007. Mall-a-Mall Weekly or Buy Bye Love. The Economic Times Kolkata. December 31. Dutta, Dilip. 2004.Effects of Globalisation on Employment and Poverty in Dualistic Economies: The Case of India. In Economic Globalisation: Social Conflicts, Labour and Environmental Issues, eds. Clem Tisdell and Raj Sen, pp. 16785, UK: Edward Elgar. ET Bureau. 2011. Reliance Retail to Expand Operations in UP Again. The Economic Times. January 8. Gupta, Raghav, Rohit Bhatiani and Pranay Gupta. 2010. An Overview of Indias Consumer and Retail Sectors. Technopak Perspective, 4: 2732. Guruswamy, M., K. Sharma, J. P. Mohanty, and T. J. Korah. 2005. FDI in Indias Retail Sector: More Bad than Good. Economic and Political Weekly, 40(7): 61923. India Retail Report. 2007. An Image. Delhi, Mumbai, Kolkata and Bangalore: F&R Research Publication. India Retail Report. 2009. An Image. Delhi, Mumbai, Kolkata and Bangalore: F&R Research Publication. Jha, Mayur Sekhar. 2007. Whats Needed is Some Real Support. The Economic Times Kolkata. December 31. KPMG India. 2010. Consolidated FDI Policy Framework effective 1 April 2010. Leahy, Joe. 2008. Delhi Dithers as Big Retail Rattles the Gates. Financial Times. May 28. Mahalakshmi, B. V. 2007. Retailers Turn to Co-op Movement for Better Supply Chain Management. The Financial Express. October 9. Pande, Bhanu. 2010. The Great Indian Tale Called Retail. The Economic Times. December 31. Pandey, Arvind. 2007. Organised Retail: Facing Political Head Winds-(I)? The Economic Times. October 9.

Int. J. of Dev. and Conflict 2011.01:27-40. Downloaded from www.worldscientific.com by 117.197.246.225 on 08/14/13. For personal use only.

40 D. Dutta

Press Trust of India. 2009. Single Authority Should Regulate Retail Sector: Assocham. The Economic Times. May 3. Rediff.com. 2008. Big Retail has Small Impact on Mom-n-Pop Stores. May 27. http:// www.rediff.com///money/2008/may/27retail.htm (accessed 27 May, 2008). Roy, Saumya. 2008. Icriers Retail Policy Suggestions Find Supporters on both Sides. Livemint, 29 April. http://www.livemint,com/Articles (accessed 28 May, 2008). Singhal, Arvind. 2007. Organised Retail: Facing Political Head Winds-(III)? The Economic Times. October 9.

Int. J. of Dev. and Conflict 2011.01:27-40. Downloaded from www.worldscientific.com by 117.197.246.225 on 08/14/13. For personal use only.

Das könnte Ihnen auch gefallen

- Full Marks: 20 TIME: 20 Mins (All of The Following Are Compulsory)Dokument2 SeitenFull Marks: 20 TIME: 20 Mins (All of The Following Are Compulsory)tttkkktitinNoch keine Bewertungen

- IiflDokument2 SeitenIifltttkkktitinNoch keine Bewertungen

- Window Display and Its Effect On Buying BehaviourDokument3 SeitenWindow Display and Its Effect On Buying BehaviourtttkkktitinNoch keine Bewertungen

- A Report On Management Education and Inclusive Growth in India Perspectives and ChallengeDokument7 SeitenA Report On Management Education and Inclusive Growth in India Perspectives and ChallengetttkkktitinNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Decolonization DBQDokument3 SeitenDecolonization DBQapi-493862773Noch keine Bewertungen

- LUNG ARTIFACTSreviewDokument13 SeitenLUNG ARTIFACTSreviewMayra ValderramaNoch keine Bewertungen

- Competent Testing Requirements As Per Factory ActDokument3 SeitenCompetent Testing Requirements As Per Factory Actamit_lunia100% (1)

- NRNP PRAC 6665 and 6675 Focused SOAP Note ExemplarDokument6 SeitenNRNP PRAC 6665 and 6675 Focused SOAP Note ExemplarLogan ZaraNoch keine Bewertungen

- Code of Conduct For Public OfficialDokument17 SeitenCode of Conduct For Public OfficialHaNoch keine Bewertungen

- Syllabus: Cambridge IGCSE (9-1) Art & Design 0989Dokument27 SeitenSyllabus: Cambridge IGCSE (9-1) Art & Design 0989Jashan LoombaNoch keine Bewertungen

- ActivityDokument2 SeitenActivityShaira May SalvadorNoch keine Bewertungen

- Heart Attack Detection ReportDokument67 SeitenHeart Attack Detection ReportAkhil TejaNoch keine Bewertungen

- Exploring Nurses' Knowledge of The Glasgow Coma Scale in Intensive Care and Emergency Departments at A Tertiary Hospital in Riyadh City, Saudi ArabiaDokument9 SeitenExploring Nurses' Knowledge of The Glasgow Coma Scale in Intensive Care and Emergency Departments at A Tertiary Hospital in Riyadh City, Saudi Arabianishu thapaNoch keine Bewertungen

- Cambridge IGCSE: PHYSICS 0625/62Dokument12 SeitenCambridge IGCSE: PHYSICS 0625/62EffNoch keine Bewertungen

- Synopsis SsDokument14 SeitenSynopsis SsJYOTI KATIYAR SVUNoch keine Bewertungen

- The Path Vol 9 - William JudgeDokument472 SeitenThe Path Vol 9 - William JudgeMark R. JaquaNoch keine Bewertungen

- Paper 11-ICOSubmittedDokument10 SeitenPaper 11-ICOSubmittedNhat Tan MaiNoch keine Bewertungen

- ARRANGING For Marchong or Concert BandDokument13 SeitenARRANGING For Marchong or Concert BandCheGus AtilanoNoch keine Bewertungen

- Forlong - Rivers of LifeDokument618 SeitenForlong - Rivers of LifeCelephaïs Press / Unspeakable Press (Leng)100% (15)

- Industrial Automation Using PLCDokument29 SeitenIndustrial Automation Using PLCAditya JagannathanNoch keine Bewertungen

- EVS (Yuva)Dokument88 SeitenEVS (Yuva)dasbaldev73Noch keine Bewertungen

- P&CDokument18 SeitenP&Cmailrgn2176Noch keine Bewertungen

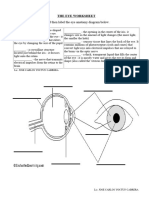

- The Eye WorksheetDokument3 SeitenThe Eye WorksheetCally ChewNoch keine Bewertungen

- Mge - Ex11rt - Installation and User Manual PDFDokument38 SeitenMge - Ex11rt - Installation and User Manual PDFRafa TejedaNoch keine Bewertungen

- Training Structure - Thinkific Plus TemplateDokument7 SeitenTraining Structure - Thinkific Plus TemplateQIONG WUNoch keine Bewertungen

- 06.21.2010 - Historic Treasure of Jewish Life and Culture Gifted To UC BerkeleyDokument2 Seiten06.21.2010 - Historic Treasure of Jewish Life and Culture Gifted To UC BerkeleymagnesmuseumNoch keine Bewertungen

- 1980 - William Golding - Rites of PassageDokument161 Seiten1980 - William Golding - Rites of PassageZi Knight100% (1)

- Anglo Afghan WarsDokument79 SeitenAnglo Afghan WarsNisar AhmadNoch keine Bewertungen

- The Meanings of Goddess PT IIIDokument14 SeitenThe Meanings of Goddess PT IIILevonce68Noch keine Bewertungen

- MATLAB For Data VisualizationDokument63 SeitenMATLAB For Data Visualizationfahmi fawjiNoch keine Bewertungen

- TDS-11SH Top Drive D392004689-MKT-001 Rev. 01Dokument2 SeitenTDS-11SH Top Drive D392004689-MKT-001 Rev. 01Israel Medina100% (2)

- Hydraulic Excavator: Engine WeightsDokument28 SeitenHydraulic Excavator: Engine WeightsFelipe Pisklevits LaubeNoch keine Bewertungen

- Development and Growth of Teeth: Dr. Madhusudhan ReddyDokument48 SeitenDevelopment and Growth of Teeth: Dr. Madhusudhan ReddysiyaNoch keine Bewertungen

- Opentext Documentum Archive Services For Sap: Configuration GuideDokument38 SeitenOpentext Documentum Archive Services For Sap: Configuration GuideDoond adminNoch keine Bewertungen