Beruflich Dokumente

Kultur Dokumente

Exchange Rate of Foreign Currency For India Foreign Trade

Hochgeladen von

Jhunjhunwalas Digital Finance & Business Info LibraryOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Exchange Rate of Foreign Currency For India Foreign Trade

Hochgeladen von

Jhunjhunwalas Digital Finance & Business Info LibraryCopyright:

Verfügbare Formate

Exchange Rate of Foreign Currency Relating to Imported and Export Goods Notified For last 2 weeks of August 2013

In exercise of the powers conferred by Section 14 of the Customs Act, 1962 (52 of 1962), the Central Board of Excise & Customs (CBEC) hereby makes the following further amendments in the Notification of the Government of India, Ministry of Finance (Department of Revenue) No. 83/2013-CUSTOMS (N.T.) dated the 14th August, 2013 published in the Gazette Of India, Part-II, Section 3, Sub-Section (ii), Extraordinary vide number S.O. 2467(E) dated, the 14th August, 2013, namely:In SCHEDULE-I of the said Notification, for Serial No.2,4,5,6,7,8,14, 16,17,18 and the entries relating thereto, the following shall be substituted, namely:-

SCHEDULE-I S.No . (1) Foreign Currency (2) Rate of exchange of one unit of foreign currency equivalent to Indian rupees (3) (a ) (For Imported Goods) 176.85 11.75 87.40 8.45 76.30 234.55 17.80 ) (For Export Goods) 167.20 11.40 85.50 8.30 72.00 221.60 16.80 (b

2. 4. 5. 6. 7. 8. 14.

BahrainDina r DanishKron er Euro Hong Kong Dollar Kenya Shilling KuwaitDinar Saudi

16. 17. 18.

Arabian Riyal Swiss Franc UAE Dirham U.S. Dollar

71.00 18.15 65.35

69.35 17.15 64.30

In Schedule-II for Serial No.1 and the entry relating thereto, the following shall be substituted, namely:SCHEDULE-II S.No. Foreign Currency (2) Rate of exchange of 100 units of foreign currency equivalent to Indian rupees (3) (a) (b) (For (For Imported Export Goods) Goods) 66.85 65.25

(1)

1.

Japanese Yen

These rates will be effective from 23rd August, 2013.

Exchange Rate of Foreign Currency Relating to Imported and Export Goods Notified

In exercise of the powers conferred by section 14 of the Customs Act, 1962 (52 of 1962), and in super session of the notification of the Government of India in the Ministry of Finance (Department of Revenue) No.81/2013-CUSTOMS (N.T.), dated the 1st August, 2013 vide number S.O.2329 (E), dated the 1st August, 2013, except as respects things done or omitted to be done before such super session, the Central Board of Excise and Customs hereby determines that the rate of exchange of conversion of each of the foreign currency specified in column (2) of each of Schedule I and Schedule II annexed hereto into Indian currency or vice th versa shall, with effect from 15 August, 2013 be the rate mentioned against it in the corresponding entry in column (3) thereof, for the purpose of the said section, relating to imported and export goods.

SCHEDULE-I S.No. Foreign Currency (2) Rate of exchange of one unit of foreign currency equivalent to Indian rupees (3) (a) (b) (For Imported (For Export Goods) Goods) 56.65 55.10 167.60 60.10 11.10 82.35 8.00 72.05 222.35 49.70 10.60 95.95 158.40 58.55 10.75 80.40 7.85 68.05 209.40 48.40 10.25 93.80

(1)

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11.

Australian Dollar Bahrain Dinar Canadian Dollar Danish Kroner EURO Hong Kong Dollar Kenya Shilling Kuwait Dinar New Zealand Dollar Norwegian Kroner Pound Sterling

12. 13. 14. 15. 16. 17. 18.

Singapore Dollar South African Rand Saudi Arabian Riyal Swedish Kroner Swiss Franc UAE Dirham US Dollar

48.95 6.35 16.85 9.55 66.55 17.20 61.90

47.85 5.95 15.90 9.25 64.95 16.25 60.90

SCHEDULE-II S.No. Foreign Currency (2) (For Goods) 1. Japanese Yen Rate of exchange of 100 units of foreign currency equivalent to Indian rupees (3) (a) (b) Imported (For Export Goods) 63.45 61.95

(1)

Das könnte Ihnen auch gefallen

- India's Import and Export Update For September and December 2014Dokument16 SeitenIndia's Import and Export Update For September and December 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India Tax Collection From April To November 2014Dokument11 SeitenIndia Tax Collection From April To November 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- Indian Currency Rupee Exchange Rate of 19 Foreign Currencies Relating To Import and Export Goods From July To September 2014Dokument5 SeitenIndian Currency Rupee Exchange Rate of 19 Foreign Currencies Relating To Import and Export Goods From July To September 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- India's Index of 8 Core Industry Performance For May 2014Dokument5 SeitenIndia's Index of 8 Core Industry Performance For May 2014Jhunjhunwalas Digital Finance & Business Info LibraryNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- History of Philippine MoneyDokument5 SeitenHistory of Philippine MoneyMarius Villanueva100% (2)

- List of Circulating Currencies by CountryDokument9 SeitenList of Circulating Currencies by CountrydlreddyNoch keine Bewertungen

- Dashboard 5Dokument154 SeitenDashboard 5Paulo HenriqueNoch keine Bewertungen

- List of Countries, Territories and Currencies: (Situation at 30.3.2007)Dokument27 SeitenList of Countries, Territories and Currencies: (Situation at 30.3.2007)mitocayoNoch keine Bewertungen

- Tricks To Remember The Name of Currencies of The World: Trick To Remember Countries With Rupee As CurrencyDokument4 SeitenTricks To Remember The Name of Currencies of The World: Trick To Remember Countries With Rupee As CurrencyabiNoch keine Bewertungen

- The Mint Par Parity TheoryDokument2 SeitenThe Mint Par Parity TheoryNeha AgarwalNoch keine Bewertungen

- List of Currencies Alphabetical: Currency State TerritoryDokument11 SeitenList of Currencies Alphabetical: Currency State TerritoryMuhammad FahadNoch keine Bewertungen

- Dashboard 49Dokument330 SeitenDashboard 49Elder Angelo Ginú da SilvaNoch keine Bewertungen

- Currencies of The World PDFDokument4 SeitenCurrencies of The World PDFRupss Adam JensenNoch keine Bewertungen

- C2 W3 Assessment WorkbookDokument4 SeitenC2 W3 Assessment WorkbookArit Ra0% (1)

- 1st Periodical in Math 3Dokument5 Seiten1st Periodical in Math 3John TankNoch keine Bewertungen

- Russian RubleDokument13 SeitenRussian RubleArjunNoch keine Bewertungen

- Coins and Canada - 5 Cents 1858 To 1901 - Canadian Coins Price Guide and ValuesDokument5 SeitenCoins and Canada - 5 Cents 1858 To 1901 - Canadian Coins Price Guide and ValuesAmado KhammashNoch keine Bewertungen

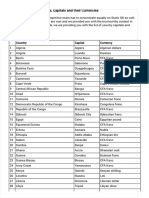

- Important List of Countries, Capitals and Their CurrenciesDokument7 SeitenImportant List of Countries, Capitals and Their CurrenciesShiva KumarNoch keine Bewertungen

- Mint Marks On Regular-Issue U.S. Coins: Littleton's Illustrated Guide ToDokument2 SeitenMint Marks On Regular-Issue U.S. Coins: Littleton's Illustrated Guide To777brendaNoch keine Bewertungen

- 21 Money in The Land of The Rising Sun I The Copper Coins of Ancient JapanDokument11 Seiten21 Money in The Land of The Rising Sun I The Copper Coins of Ancient JapanKerr CachaNoch keine Bewertungen

- Week 2 - Tutorial 1 - Part IV - Currency Exchange PDFDokument3 SeitenWeek 2 - Tutorial 1 - Part IV - Currency Exchange PDFSetsuna TeruNoch keine Bewertungen

- Exchange Rate Regime in UzbekistanDokument11 SeitenExchange Rate Regime in UzbekistanравшанNoch keine Bewertungen

- FedEx Seed - KopiaDokument20 SeitenFedEx Seed - KopiaJarosław PałaszNoch keine Bewertungen

- QA-23. Valuation of An MNCDokument1 SeiteQA-23. Valuation of An MNChy_saingheng_7602609Noch keine Bewertungen

- Counting CoinsDokument1 SeiteCounting Coinsapi-438659682Noch keine Bewertungen

- Currencies Code ISO - 4217 PDFDokument23 SeitenCurrencies Code ISO - 4217 PDFSanjay JayaratneNoch keine Bewertungen

- C4 W5 Final AssessmentDokument87 SeitenC4 W5 Final AssessmentBigGmaerPC chandolaNoch keine Bewertungen

- SIPRI Milex Data 1949 2023Dokument344 SeitenSIPRI Milex Data 1949 2023Tariq MeciNoch keine Bewertungen

- 1 Currencies - The World Map of CurrenciesDokument14 Seiten1 Currencies - The World Map of CurrenciesJoddyNoch keine Bewertungen

- All Country Currency Name ListDokument13 SeitenAll Country Currency Name ListLakshmi TNoch keine Bewertungen

- 10 Dollars (Royal Visit) - The Bahamas - NumistaDokument4 Seiten10 Dollars (Royal Visit) - The Bahamas - NumistaCharme TibanuNoch keine Bewertungen

- Capital and CurrencyDokument4 SeitenCapital and CurrencySumit SinghNoch keine Bewertungen

- 25 Most Valuable US PenniesDokument4 Seiten25 Most Valuable US PenniesSpooknasty100% (7)

- Global View - Forex: Visit The - C 2010 Praxis Language LTDDokument3 SeitenGlobal View - Forex: Visit The - C 2010 Praxis Language LTDasgharNoch keine Bewertungen