Beruflich Dokumente

Kultur Dokumente

Banco Filipino Vs Monetary

Hochgeladen von

Dayday AbleOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Banco Filipino Vs Monetary

Hochgeladen von

Dayday AbleCopyright:

Verfügbare Formate

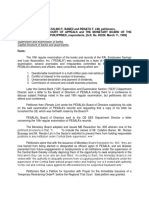

De La Salle University - Graduate School of Business A Case Analysis on Banco Filipino vs Monetary Board, Central Bank, Fernandez et al.

Gr. No. 68878 Submitted by: Vidar Halvorsen

Submitted to: Dean Atty. Joe-Santos B. Bisquera

Table of Contents 1.0 Background of the Case ................................................................................................................................. 3 2.0 Statement of the Problem ............................................................................................................................... 6 3.0 Objectives ..6 4.0 Areas of Consideration ................................................................................................................................... 7 5.0 Alternative Courses of Action . 7 6.0 Conclusion ...................................................................................................................................................... 13

1|Page

1.0 BACKGROUND The case refers to 9 consolidated casesconcerning the legality of the closure of Banko Filipino Savings and mortgage bank ( Banko Filipino) by the order of the Monetary Board in 1985. The bank was put under conservatorship, which consequently applied for extrajudicial forclosure for the other 8 petitioners in this case. Briefly the bank had its major loans with development organization directly or indirectly linked to itself of its officers, who dealt in the realestate development areas. when these organizations defaulted on their mortgages the conservators of Banko Filipino immediately sought to forclose these. The Monetary Board received several reports on the state of Banko Filipino during the time it was under administration by its conservators, and was in the end liquidated. The bank appealed the closure/ liquidation to the courts, which all affirmed the former. Hence the case ended in the Supreme Courts.

2.0 STATEMENT OF THE PROBLEM. The major issue here is whether the Monetary board had the legal rights to liquidate Banko Filipino in relations to the rules and regulations of the banking act.

3.0 OBJECTIVES The object of this report is to look at the laws and provisions involved in this case, then to find reasons to agree or disagree with the findings and rulings of the Supreme Courts. 4.0 AREAS OF CONSIDERATIONS

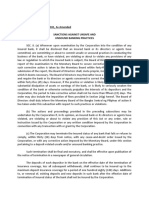

Section 29 of the Republic Act No. 265, as amended known as the Central Bank Act, provides that when a bank is forbidden to do business in the Philippines and placed under receivership, the person designated as receiver shall immediately take charge of the bank's assets and liabilities, as expeditiously as possible, collect and gather all the assets and administer the same for the benefit of its creditors, and represent the bank personally or through counsel as he may retain in all actions or proceedings for or against the institution, exercising all the powers necessary for these purposes including, but not limited to, bringing and foreclosing mortgages in the name of the bank. If the Monetary Board shall later determine and confirm that banking institution is insolvent or cannot resume business safety to depositors, creditors and the general public, it shall, public interest requires, order its liquidation and appoint a liquidator who shall take over and continue the functions of receiver previously appointed by Monetary Board. The liquid for may, in the name of the bank and with the assistance counsel as he may retain, institute such actions as may necessary in the appropriate court to collect and recover a counts and assets of such institution or defend any action ft against the institution.chanroblesvirtuallawlibrary chanrobles virtual law library

SEC. 29. Proceedings upon insolvency. - Whenever, upon examination by the head of the appropriate supervising or examining department or his examiners or agents into the condition of any bank or non-bank financial intermediary performing quasi-banking functions, it shall be disclosed that the condition of the same is one of insolvency, or that its continuance in business would involve probable loss to its depositors or creditors, it shall be the duty of the department head concerned forthwith, in writing, to inform the Monetary Board of the facts. The Board may, upon finding the statements of the department head to be true, forbid the institution to do business in the Philippines and designate an official of the Central Bank or a person of recognized competence in banking or finance, as receiver to immediately take charge of its assets and liabilities, as expeditiously as possible collect and gather all the assets and administer the same for the benefit's of its creditors, and represent the bank personally or through counsel as he may retain in all actions or proceedings for or against the institution, exercising all the powers necessary for these purposes including, but not limited to, bringing and foreclosing mortgages in the name of the bank or non-bank financial intermediary performing quasibanking functions.chanroblesvirtuallawlibrary chanrobles virtual law library The Monetary Board shall thereupon determine within sixty days whether the institution may be reorganized or otherwise placed in such a condition so that it may be permitted to resume business with safety to its depositors and creditors and the general public and shall prescribe the conditions under which such resumption of business shall take place as well as the time for fulfillment of such conditions. In such case, the expenses and fees in the collection and administration of the assets of the institution shall be determined by the Board and shall be paid to the Central Bank out of the assets of such institution.chanroblesvirtuallawlibrary chanrobles virtual law library If the Monetary Board shall determine and confirm within the said period that the bank or non-bank financial intermediary performing quasi-banking functions is insolvent or cannot resume business with safety to its depositors, creditors, and the general public, it shall, if the public interest requires, order its liquidation, indicate the manner of its liquidation and approve a liquidation plan which may, when warranted, involve disposition of any or all assets in consideration for the assumption of equivalent liabilities. The liquidator designated as hereunder provided shall, by the Solicitor General, file a petition in the regional trial court reciting the proceedings which have been taken and praying the assistance of the court in the liquidation of such institutions. The court shall have jurisdiction in the same proceedings to assist in the adjudication of the disputed claims against the bank or non-bank financial intermediary performing quasi-banking functions and in the enforcement of individual liabilities of the stockholders and do all that is necessary to preserve the assets of such institutions and to implement the liquidation plan approved by the Monetary Board. The

2|Page

Monetary Board shall designate an official of the Central bank or a person of recognized competence in banking or finance, as liquidator who shall take over and continue the functions of the receiver previously appointed by the Monetary Board under this Section. The liquidator shall, with all convenient speed, convert the assets of the banking institutions or non-bank financial intermediary performing quasi-banking function to money or sell, assign or otherwise dispose of the same to creditors and other parties for the purpose of paying the debts of such institution and he may, in the name of the bank or non-bank financial intermediary performing quasi-banking functions and with the assistance of counsel as he may retain, institute such actions as may be necessary in the appropriate court to collect and recover accounts and assets of such institution or defend any action filed against the institution: Provided, However, That after having reasonably established all claims against the institution, the liquidator may, with the approval of the court, effect partial payments of such claims for assets of the institution in accordance with their legal priority.chanroblesvirtuallawlibrary chanrobles virtual law library The assets of an institution under receivership or liquidation shall be deemed in custodia legis in the hands of the receiver or liquidator and shall from the moment of such receivership or liquidation, be exempt from any order of garnishment, levy, attachment, or executionchanroblesvirtuallawlibrary chanrobles virtual law library The provisions of any law to the contrary notwithstanding, the actions of the Monetary Board under this Section, Section 28-A, an the second paragraph of Section 34 of this Act shall be final an executory, and can be set aside by a court only if there is convince proof, after hearing, that the action is plainly arbitrary and made in bad faith: Provided, That the same is raised in an appropriate pleading filed by the stockholders of record representing the majority of th capital stock within ten (10) days from the date the receiver take charge of the assets and liabilities of the bank or non-bank financial intermediary performing quasi-banking functions or, in case of conservatorship or liquidation, within ten (10) days from receipt of notice by the said majority stockholders of said bank or non-bank financial intermediary of the order of its placement under conservatorship o liquidation. No restraining order or injunction shall be issued by an court enjoining the Central Bank from implementing its actions under this Section and the second paragraph of Section 34 of this Act in th absence of any convincing proof that the action of the Monetary Board is plainly arbitrary and made in bad faith and the petitioner or plaintiff files a bond, executed in favor of the Central Bank, in an amount be fixed by the court. The restraining order or injunction shall be refused or, if granted, shall be dissolved upon filing by the Central Bank of a bond, which shall be in the form of cash or Central Bank cashier's check, in an amount twice the amount of the bond of th petitioner or plaintiff conditioned that it will pay the damages which the petitioner or plaintiff may suffer by the refusal or the dissolution of the injunction. The provisions of Rule 58 of the New Rules of Court insofar as they are applicable and not inconsistent with the provision of this Section shall govern the issuance and dissolution of the re straining order or injunction contemplated in this Section. 5.0 ANALYSIS OF THE CASE The main problem in this case lies within the rushed liquidation of the bank. The provisions are specific in the routines needed to be performed before reaching a conclusion and to act upon this. Clearly, as the Supreme Court ruled, the Monetary Board acted hastily when they ordered Banko Filipino closed and liquidated. It is the opinion of this student that an analysis of the banks loan clients could have given a better understanding of the situation they were in. As stated in the case, the majority of its clients were corporations and companies directly or indirectly connected to its board members, officers or affiliates. This meant there were a closer personal relationship between the clients and the banks, lowering the real risks with the mortgages given. The fact that most of these clients operated in the real estate / development sector meant that there were enough monetary values available as collateral, and that the situation for these clients were more dependent on longevity than the immediate picture might portray. The Tiaoqui report stated there were still missing variables to it, and as such it was incomplete. When the Monetary board then nevertheless went on and liquidated the assets, they broke themselves the rules set by the banking act. That in itself is enough to have the supreme Court set aside the findings and judgements of the former courts. However; The Monetary Board has other variables to take into consideration. They have to look at what is best for the depositors, who might individually stand to lose much more than corporations. While corporations often have their risks spread over multiple areas or projects, the depositors can stand to lose everything. Therefore, when the Monetary Board decided to foreclose and liquidate Banko Filipino, the depositors risks were their highes t priority. Nevertheless; it is clear that due process was not followed in this case, and that Banko Filipino in that was forced to liquidate in spite of their argument against insolvency. The supreme Court also agreed to this in their findings.

6.0 ALTERNATIVE COURSES OF ACTION Given the Supreme court found Due process not to have been observed, onw alternative course of action, albeit be that in hindsight, would have been for the Monetary Board to have given BF the time to argue their case, and to show their clients not to be in real default thereby avoiding closing of Banko Filipino itself, as well as several of their clients. This not being the case, and Due process not having been followed, this student find the Monetary board to have been negligent in their work, and as such should have been asked to compensate ( damages) to Banko Filipino. 7.0 CONCLUSION

The Supreme Court ruled correctly in their findings. Due process must be followed in all cases, as to avoid mistakes, negligence or errors that can be costly to the parts themselves as well as society. This being said, it seems to this student the Monetary Board itself has been negligent in its obligations under the Central Banking Act, and has in that been a barrier to the operations of Banko

3|Page

Filipino. That being said, this student finds the Supreme Court should have at a very least given the Monetary Board a sharp reprimand, or even found them in neglect, and awarded damages to Banko Filipino. 8.0 BIBLIOGRAPHY

All sources taken from Chan Robles Virtual Law Library. Url: http://www.chanrobles.com

4|Page

Das könnte Ihnen auch gefallen

- GBLDokument14 SeitenGBLMa Cristina Encisa-AltarejosNoch keine Bewertungen

- Chapter 4 Purpose of Examination and SupervisionDokument5 SeitenChapter 4 Purpose of Examination and SupervisionMariel Crista Celda MaravillosaNoch keine Bewertungen

- Islamic Banking And Finance for Beginners!Von EverandIslamic Banking And Finance for Beginners!Bewertung: 2 von 5 Sternen2/5 (1)

- Concepts of State and GovernmentDokument2 SeitenConcepts of State and GovernmentOnly JesusNoch keine Bewertungen

- NTC Decision On ABS-CBN FrequenciesDokument8 SeitenNTC Decision On ABS-CBN FrequenciesRapplerNoch keine Bewertungen

- New Central Bank ActDokument5 SeitenNew Central Bank ActJemNoch keine Bewertungen

- GBLDokument2 SeitenGBLBianca de GuzmanNoch keine Bewertungen

- BankingDokument43 SeitenBankingBryan MejiaNoch keine Bewertungen

- Cessation of Banking Business: Nature of A Liquidation ProceedingDokument11 SeitenCessation of Banking Business: Nature of A Liquidation ProceedingJoshua AlbisNoch keine Bewertungen

- Gen Banking LawDokument21 SeitenGen Banking LawolofuzyatotzNoch keine Bewertungen

- Philippine Deposit Insurance Corporation Act: By: PONCE, Enrico and VALMORES, Gay ValerieDokument7 SeitenPhilippine Deposit Insurance Corporation Act: By: PONCE, Enrico and VALMORES, Gay ValerieAngel Alejo AcobaNoch keine Bewertungen

- Philippine Deposit Insurance Corporation ActDokument7 SeitenPhilippine Deposit Insurance Corporation ActArwin HernandezNoch keine Bewertungen

- Banking LawsDokument3 SeitenBanking LawsAlbert Jerome RamosNoch keine Bewertungen

- General Banking Law (RA 8971)Dokument26 SeitenGeneral Banking Law (RA 8971)Carlito B. BancilNoch keine Bewertungen

- Banking Provisions Nov24Dokument5 SeitenBanking Provisions Nov24Raziele RanesesNoch keine Bewertungen

- The Case of in Re: Petition For Assistance in The Liquidation of The Rural As FollowsDokument3 SeitenThe Case of in Re: Petition For Assistance in The Liquidation of The Rural As FollowsCharms NbaubblesNoch keine Bewertungen

- Banking Law Winding UpDokument17 SeitenBanking Law Winding UpKumar SouravNoch keine Bewertungen

- Central Bank of The Philippines v. MorfeDokument8 SeitenCentral Bank of The Philippines v. MorfeChristine ChuaNoch keine Bewertungen

- Chapter 4 - Purpose of Examination and SupervisionDokument5 SeitenChapter 4 - Purpose of Examination and SupervisionMhaiNoch keine Bewertungen

- Regulation No. 5 2017Dokument16 SeitenRegulation No. 5 2017Santino AyokNoch keine Bewertungen

- Republic Act No. 8791Dokument54 SeitenRepublic Act No. 8791Vincent De VeraNoch keine Bewertungen

- Banco Filipino liquidator vs NLRCDokument5 SeitenBanco Filipino liquidator vs NLRCCMariaNoch keine Bewertungen

- R.A. 8791Dokument18 SeitenR.A. 8791Joyce AllenNoch keine Bewertungen

- Banking LawsDokument10 SeitenBanking LawsJulius MilaNoch keine Bewertungen

- Busuego V. Ca: Supervision and Examination of Banks. Capital Structure of Banks and Quasi-BanksDokument9 SeitenBusuego V. Ca: Supervision and Examination of Banks. Capital Structure of Banks and Quasi-BanksMasterboleroNoch keine Bewertungen

- Chapter IIDokument12 SeitenChapter IIJoel MaquintoNoch keine Bewertungen

- New Central Bank Act Highlights Key ReformsDokument32 SeitenNew Central Bank Act Highlights Key ReformsJanelle TamayoNoch keine Bewertungen

- Central Bank v. MorfeDokument8 SeitenCentral Bank v. MorfeKristineSherikaChyNoch keine Bewertungen

- BFNIADokument29 SeitenBFNIArheakhandke2001Noch keine Bewertungen

- GR L-38427 CB Vs MorfeDokument7 SeitenGR L-38427 CB Vs Morfemaria lourdes lopenaNoch keine Bewertungen

- Case Digest Banking LawsDokument422 SeitenCase Digest Banking LawsRonald LasinNoch keine Bewertungen

- Bsyusdiar Erontiapro Nrccreyu Claetrn Kabn Aeegnhcx Rtea Ialifaeft Innfaliot Adqluiioitn Regnitnuocids Rihsecerevip Cerusol CihsrotavrseonpDokument4 SeitenBsyusdiar Erontiapro Nrccreyu Claetrn Kabn Aeegnhcx Rtea Ialifaeft Innfaliot Adqluiioitn Regnitnuocids Rihsecerevip Cerusol Cihsrotavrseonplouis jansenNoch keine Bewertungen

- REPUBLIC ACT No 10846 (Sec. 26)Dokument4 SeitenREPUBLIC ACT No 10846 (Sec. 26)School FilesNoch keine Bewertungen

- Banking LawsDokument72 SeitenBanking LawsMariel MontonNoch keine Bewertungen

- RA 3591 Banking Practices Sanctions Unsafe UnsoundDokument15 SeitenRA 3591 Banking Practices Sanctions Unsafe UnsoundKrystal MaciasNoch keine Bewertungen

- Republic Act No. 8791Dokument15 SeitenRepublic Act No. 8791nn tyIINoch keine Bewertungen

- Republic Act No. 8791 - Chap 1-3Dokument5 SeitenRepublic Act No. 8791 - Chap 1-3Joel Guasis AyonNoch keine Bewertungen

- Banking Laws A. The New Central Bank Act (R.A. 7653) 1. State PoliciesDokument12 SeitenBanking Laws A. The New Central Bank Act (R.A. 7653) 1. State PoliciesPaoloTrinidadNoch keine Bewertungen

- RA 7653, As Amended by RA 11211Dokument13 SeitenRA 7653, As Amended by RA 11211Jay TabuzoNoch keine Bewertungen

- Banking Laws Week 1Dokument7 SeitenBanking Laws Week 1Keshlyn KellyNoch keine Bewertungen

- SANCTIONS AGAINST UNSAFE BANKINGDokument3 SeitenSANCTIONS AGAINST UNSAFE BANKINGAnonymous 4IOzjRIB1Noch keine Bewertungen

- Gpa For Book DebtsDokument2 SeitenGpa For Book DebtsDeepak Govindan0% (1)

- Republic Act No.: 8791 An Act Providing For TheDokument77 SeitenRepublic Act No.: 8791 An Act Providing For TheRuel GuiangNoch keine Bewertungen

- 63603Dokument4 Seiten63603Ankur PrajapatiNoch keine Bewertungen

- RA 3591 Philippine Deposit Insurance Corporation ActDokument14 SeitenRA 3591 Philippine Deposit Insurance Corporation ActKristine Kyle AgneNoch keine Bewertungen

- Philippine General Banking Act Ra 8791Dokument34 SeitenPhilippine General Banking Act Ra 8791stylistahNoch keine Bewertungen

- Ra 8791 - GBLDokument16 SeitenRa 8791 - GBLJen AnchetaNoch keine Bewertungen

- Be It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledDokument32 SeitenBe It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledIrish MartinezNoch keine Bewertungen

- Banking Notes (With Digests From Kriz P) - Cha MendozaDokument570 SeitenBanking Notes (With Digests From Kriz P) - Cha Mendozacmv mendozaNoch keine Bewertungen

- Philippine Deposit Insurance Corporation Act (RA 3591)Dokument35 SeitenPhilippine Deposit Insurance Corporation Act (RA 3591)NHASSER PASANDALANNoch keine Bewertungen

- Special Laws ProvisionsDokument103 SeitenSpecial Laws ProvisionsGian Joshua DayritNoch keine Bewertungen

- Banking LawsDokument31 SeitenBanking LawsJanMarkMontedeRamosWongNoch keine Bewertungen

- Republic Act NoDokument49 SeitenRepublic Act NoJo AngeliNoch keine Bewertungen

- Vivas vs Monetary Board rulingDokument5 SeitenVivas vs Monetary Board rulingmimisabayton100% (1)

- Vivas V Monetary BoardDokument3 SeitenVivas V Monetary BoardJincy Biason MonasterialNoch keine Bewertungen

- Indian Banking Facing Hurdles in NPA ManagementDokument9 SeitenIndian Banking Facing Hurdles in NPA ManagementAkshay AgarwalNoch keine Bewertungen

- Trading Mastery: Unleashing Financial Potential in the Modern Markets Innovative Strategies, Prudent Approaches, and Insider insights for Mastering the Art of TradingVon EverandTrading Mastery: Unleashing Financial Potential in the Modern Markets Innovative Strategies, Prudent Approaches, and Insider insights for Mastering the Art of TradingNoch keine Bewertungen

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- Decentralization and Governance in the Ghana Health SectorVon EverandDecentralization and Governance in the Ghana Health SectorNoch keine Bewertungen

- Azurro Di Boracay Marketing CaseDokument13 SeitenAzurro Di Boracay Marketing CaseVidar HalvorsenNoch keine Bewertungen

- Report On Aquintey Vs TibongDokument10 SeitenReport On Aquintey Vs TibongVidar HalvorsenNoch keine Bewertungen

- Philippines Demographics Profile 2011Dokument13 SeitenPhilippines Demographics Profile 2011Vidar HalvorsenNoch keine Bewertungen

- Death of A Salesman - An Eve Online Fan FictionDokument2 SeitenDeath of A Salesman - An Eve Online Fan FictionVidar HalvorsenNoch keine Bewertungen

- Case 6-Pamplona Plantation vs. AcostaDokument11 SeitenCase 6-Pamplona Plantation vs. AcostaVidar HalvorsenNoch keine Bewertungen

- Pacheco Vs CA & People of The PhilippinesDokument17 SeitenPacheco Vs CA & People of The PhilippinesVidar Halvorsen100% (1)

- Case Report On Tangco Vs Safeguard Security AgencyDokument6 SeitenCase Report On Tangco Vs Safeguard Security AgencyVidar HalvorsenNoch keine Bewertungen

- Reason For LifeDokument3 SeitenReason For LifeVidar HalvorsenNoch keine Bewertungen

- Aquintey vs. TibongDokument5 SeitenAquintey vs. TibongVidar HalvorsenNoch keine Bewertungen

- Zepeda Vs China BankingDokument7 SeitenZepeda Vs China BankingVidar HalvorsenNoch keine Bewertungen

- Tan vs. TimbalDokument9 SeitenTan vs. TimbalVidar HalvorsenNoch keine Bewertungen

- Al Bachio, Consumer BehaviorDokument15 SeitenAl Bachio, Consumer BehaviorVidar HalvorsenNoch keine Bewertungen

- Gozun Vs MercadoDokument7 SeitenGozun Vs MercadoVidar HalvorsenNoch keine Bewertungen

- Traders Royal Bank, Vs Radio Philip Pi NoDokument9 SeitenTraders Royal Bank, Vs Radio Philip Pi NoVidar HalvorsenNoch keine Bewertungen

- Report On Aquintey Vs TibongDokument10 SeitenReport On Aquintey Vs TibongVidar HalvorsenNoch keine Bewertungen

- Dlsu M P .: The Filipino Entrepreneur - Vidar HalvorsenDokument4 SeitenDlsu M P .: The Filipino Entrepreneur - Vidar HalvorsenVidar HalvorsenNoch keine Bewertungen

- Gilette Case - V3Dokument23 SeitenGilette Case - V3Vidar Halvorsen100% (3)

- The Puma Case - Vidar Halvorsen & Mike Maquilan: HE UMA ASEDokument9 SeitenThe Puma Case - Vidar Halvorsen & Mike Maquilan: HE UMA ASEVidar HalvorsenNoch keine Bewertungen

- Are We Still Going Nuts Over Donuts? - The Gonuts Donuts CaseDokument30 SeitenAre We Still Going Nuts Over Donuts? - The Gonuts Donuts CaseVidar Halvorsen100% (1)

- Happy Cone Ȃ Growing PainsDokument23 SeitenHappy Cone Ȃ Growing PainsVidar HalvorsenNoch keine Bewertungen

- Wedding CantataDokument39 SeitenWedding CantataSkyLarkNoch keine Bewertungen

- SC Rules Grace Poe Qualified for PresidencyDokument3 SeitenSC Rules Grace Poe Qualified for PresidencyJae LeeNoch keine Bewertungen

- Law On SuccessionDokument46 SeitenLaw On SuccessionIris FenelleNoch keine Bewertungen

- Us BankDokument16 SeitenUs BankFelix SalmonNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Rahul ChandrawarNoch keine Bewertungen

- Entry No. Date Time Incidents / Events Disposition in Relation To Blotter Entry # 0026Dokument2 SeitenEntry No. Date Time Incidents / Events Disposition in Relation To Blotter Entry # 0026Ryan Ed RoaNoch keine Bewertungen

- History Research Project: The Life of A Democratic Leader Nelson Mandela's Long Walk To Freedom Composed by Tristan Chetty Grade 6SDokument7 SeitenHistory Research Project: The Life of A Democratic Leader Nelson Mandela's Long Walk To Freedom Composed by Tristan Chetty Grade 6SDanielle Chetty100% (2)

- Invoice: Bill To X Works Solutions Corporation Attn: Accounts Payable DepartmentDokument2 SeitenInvoice: Bill To X Works Solutions Corporation Attn: Accounts Payable DepartmentRuodNoch keine Bewertungen

- Treason Crime CommittedDokument2 SeitenTreason Crime CommittedSu Kings AbetoNoch keine Bewertungen

- PDF Persons and Family Relations Case DigestspdfDokument101 SeitenPDF Persons and Family Relations Case DigestspdfBella CrosatNoch keine Bewertungen

- Norse Management Co. (PTE) vs. National Seamen BoardDokument8 SeitenNorse Management Co. (PTE) vs. National Seamen BoardFbarrsNoch keine Bewertungen

- Public Information ActDokument1 SeitePublic Information ActKenneth GarrisonNoch keine Bewertungen

- Government: Quarrels and Wars Between Barangays Were From The Following CausesDokument31 SeitenGovernment: Quarrels and Wars Between Barangays Were From The Following CausesBheiatriz de Vera75% (4)

- CIR vs. San Roque Power CorporationDokument7 SeitenCIR vs. San Roque Power CorporationMIKKONoch keine Bewertungen

- Intangibles Formative AssessmentDokument2 SeitenIntangibles Formative AssessmentStephanie gasparNoch keine Bewertungen

- Municipal Trial Courts in Cities: Master List of Incumbent JudgesDokument8 SeitenMunicipal Trial Courts in Cities: Master List of Incumbent JudgesShaneBeriñaImperialNoch keine Bewertungen

- PPG Q2 Week 1 Module 6 The ExecutiveDokument3 SeitenPPG Q2 Week 1 Module 6 The ExecutiveRoi S. ReconNoch keine Bewertungen

- Application Format: Application For BPCL Retail Outlet (Petrol Pump) DealershipDokument6 SeitenApplication Format: Application For BPCL Retail Outlet (Petrol Pump) DealershipDevendrra ShejavNoch keine Bewertungen

- CT Apr2023Dokument4 SeitenCT Apr2023NUR ATHIRAH ZAINONNoch keine Bewertungen

- Be It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledDokument9 SeitenBe It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledKarlvindeCardoNoch keine Bewertungen

- What Is The Doctrine of Prospective Overruling - Jurisprudence - Legal Articles - Free LawDokument5 SeitenWhat Is The Doctrine of Prospective Overruling - Jurisprudence - Legal Articles - Free LawM KNoch keine Bewertungen

- 00 - Mapua University Senior High School Parent's Consent - January 2021 - For Own ImmersionDokument2 Seiten00 - Mapua University Senior High School Parent's Consent - January 2021 - For Own ImmersionReysel LizardoNoch keine Bewertungen

- Grop PaperDokument14 SeitenGrop PaperSri Harsha Xerox and Job WorksNoch keine Bewertungen

- 9 SikatanaDokument3 Seiten9 SikatanaMatt EvansNoch keine Bewertungen

- Miserere: "Baldwin Commonplace Book"Dokument10 SeitenMiserere: "Baldwin Commonplace Book"Jorge Alfredo Moros ContrerasNoch keine Bewertungen

- 3.4 E6.4-Tavre 22 Foz: W. Z. W. ChapmanDokument2 Seiten3.4 E6.4-Tavre 22 Foz: W. Z. W. ChapmanJagannathan ArumugamNoch keine Bewertungen

- Marci A. Hamilton - Justice Denied - What America Must Do To Protect Its Children-Cambridge University Press (2008)Dokument169 SeitenMarci A. Hamilton - Justice Denied - What America Must Do To Protect Its Children-Cambridge University Press (2008)DaveMoebiusNoch keine Bewertungen

- 2020.05.19 DFEH Original Complaint (ABC) FINALDokument23 Seiten2020.05.19 DFEH Original Complaint (ABC) FINALeriq_gardner6833100% (2)