Beruflich Dokumente

Kultur Dokumente

Acct557 w6 HW JM

Hochgeladen von

Coco M.Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Acct557 w6 HW JM

Hochgeladen von

Coco M.Copyright:

Verfügbare Formate

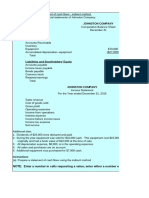

Required: A) Prepare a statement of cash flows using the indirect method

FANCY FOOTWORK COMPANY STATEMENT OF CASH FLOW As of December 31 Indirect Method

CASH FLOW FROM OPERATING ACTIVITIES Net Income Depreciation on Assets Gain on sale of investments Increase in account receivable Decrease in merchandise inventory Increase in account payable Decrease in accrued payable Net Cash Flow from Operating Activities CASH FLOW FROM INVESTING ACTIVITIES Sale of investments Purchase of assets Net Cash Flow from Investing Activities CASH FLOW FROM FINANCING ACTIVITIES Dividends Paid Issue of Common Stock Repaid Bond Payable Net Cash Flow from Financing Activities Net Cash Flows Add Beginning cash balance Ending Cash balance

$ 72,600 $ 4,000 $ (7,000) $ (36,000) $ 40,000 $ 13,000 $ (3,100) $ 83,500

$ 20,000 $ (16,000) $ 4,000

$ (32,500) $ 6,000 $ (31,000) $ (57,500) $ 30,000 $ 230,000 $ 260,000

B) Prepare a statement of cash flows using the direct method. (Do not prepare a reconciliation schedule.)

FANCY FOOTWORK COMPANY STATEMENT OF CASH FLOW AS OF December 31 Direct Method

CASH FLOW FROM OPERATING ACTIVITIES Cash received from customers Cash paid to suppliers Operating expenses Income tax paid Net Cash Flow from Operating Activities CASH FLOW FROM INVESTING ACTIVITIES Sale of investments Purchase of assets Net Cash Flow from Investing Activities CASH FLOW FROM FINANCING ACTIVITIES Dividends Paid Issue of Common Stock Repaid Bond Payable Net Cash Flow from Financing Activities Net Cash Flows Add Beginning balance Ending Cash Balance

$ $ $ $ $

714,000 (477,000) (105,100) (48,400) 83,500

$ 20,000 $ (16,000) $ 4,000

$ (32,500) $ 6,000 $ (31,000) $ (57,500) $ 30,000 $ 230,000 $ 260,000

tion schedule.)

Das könnte Ihnen auch gefallen

- Accounting-8264829Dokument6 SeitenAccounting-8264829nathardeen2000100% (3)

- Exercises On Cash Flow StatementsDokument3 SeitenExercises On Cash Flow StatementsSam ChinthaNoch keine Bewertungen

- ACCT 101 QUIZ 11 Section ReviewDokument5 SeitenACCT 101 QUIZ 11 Section ReviewhappystoneNoch keine Bewertungen

- CH 16 Practice SolutionsDokument9 SeitenCH 16 Practice SolutionsaaaNoch keine Bewertungen

- A 201 Chapter 12Dokument14 SeitenA 201 Chapter 12blackprNoch keine Bewertungen

- Cash Flow Activities of 5 CompaniesDokument6 SeitenCash Flow Activities of 5 CompaniesFariha tamannaNoch keine Bewertungen

- Lindsay, Inc. Statement of Cash Flows For Year Ended December 31, Year 4 OperationsDokument1 SeiteLindsay, Inc. Statement of Cash Flows For Year Ended December 31, Year 4 OperationsYu BabylanNoch keine Bewertungen

- Solutions Chapter 23Dokument11 SeitenSolutions Chapter 23Avi SeligNoch keine Bewertungen

- Statement of Cash FolwDokument57 SeitenStatement of Cash FolwmibshNoch keine Bewertungen

- Enter The Appropriate Amounts in The Shaded Cells Below. A Red Asterisk ( ) Will Appear To The Right of An Incorrect Amount in The Outlined CellsDokument4 SeitenEnter The Appropriate Amounts in The Shaded Cells Below. A Red Asterisk ( ) Will Appear To The Right of An Incorrect Amount in The Outlined CellsAbba Consultores Servicios RaffahNoch keine Bewertungen

- Tugas Pertemuan Ke-7: Nama: Vicky Fadilla Ahmad DaffaDokument6 SeitenTugas Pertemuan Ke-7: Nama: Vicky Fadilla Ahmad DaffaVicky fadillaNoch keine Bewertungen

- Company A 2010 Cash Flow StatementDokument1 SeiteCompany A 2010 Cash Flow StatementAbdul NaveedNoch keine Bewertungen

- Company A, Inc. Cash Flow Statement For The Year Ended Dec 31, 2010Dokument1 SeiteCompany A, Inc. Cash Flow Statement For The Year Ended Dec 31, 2010Abdul NaveedNoch keine Bewertungen

- ACC 401 Homework CH 4Dokument4 SeitenACC 401 Homework CH 4leelee03020% (1)

- Cash Flow STMTDokument2 SeitenCash Flow STMTSanthosh ShettyNoch keine Bewertungen

- Statement of Cash FlowsDokument38 SeitenStatement of Cash FlowsspringzingNoch keine Bewertungen

- Contemporary Financial Management 10th Edition Moyer Solutions Manual 1Dokument15 SeitenContemporary Financial Management 10th Edition Moyer Solutions Manual 1carlo100% (39)

- Mileni 5459 Tarea Sem 6.2 ACCO 2100Dokument5 SeitenMileni 5459 Tarea Sem 6.2 ACCO 2100Mileni ColonNoch keine Bewertungen

- Finance Report2Dokument8 SeitenFinance Report2Sadman Sharar 1931037030Noch keine Bewertungen

- ABC Company comparative balance sheet and income statement analysisDokument6 SeitenABC Company comparative balance sheet and income statement analysisruruNoch keine Bewertungen

- Financial Accounting ProjectDokument9 SeitenFinancial Accounting ProjectL.a. LadoresNoch keine Bewertungen

- Cashflow PracticeDokument17 SeitenCashflow PracticeAhmar ChNoch keine Bewertungen

- Boswell Manufacturing Cash Flow Statement 2002Dokument1 SeiteBoswell Manufacturing Cash Flow Statement 2002Elsa MendozaNoch keine Bewertungen

- Chapter 13Dokument9 SeitenChapter 13RBNoch keine Bewertungen

- Parent, Inc Actual Financial Statements For 2012 and OlsenDokument23 SeitenParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyNoch keine Bewertungen

- CH 01Dokument5 SeitenCH 01deelol99Noch keine Bewertungen

- Assignment EMB660Dokument11 SeitenAssignment EMB660Ashekin MahadiNoch keine Bewertungen

- Garing, Aireen - Sa No.13 Statement of CashflowsDokument3 SeitenGaring, Aireen - Sa No.13 Statement of CashflowsAireen GaringNoch keine Bewertungen

- Intercompany Gain Transactions - Plant AssetsDokument51 SeitenIntercompany Gain Transactions - Plant AssetsBoyd Banal100% (2)

- Final Exam - AccountingDokument5 SeitenFinal Exam - Accountingtanvi virmaniNoch keine Bewertungen

- 2208 ch22Dokument7 Seiten2208 ch22Clyde Ian Brett PeñaNoch keine Bewertungen

- Latihan Soal Sebelum UAS 29 April 2023Dokument14 SeitenLatihan Soal Sebelum UAS 29 April 2023Ritsu SenkaNoch keine Bewertungen

- Ashley Cleveland CompanyDokument4 SeitenAshley Cleveland CompanySabah Barek PurnimaNoch keine Bewertungen

- Cash Flow Statement ReviewDokument3 SeitenCash Flow Statement ReviewSarah WinzenriedNoch keine Bewertungen

- L11-Statement of Cash FlowsDokument33 SeitenL11-Statement of Cash FlowsSYAMIMI ANUARNoch keine Bewertungen

- Accy 517 HW PB Set 1Dokument30 SeitenAccy 517 HW PB Set 1YonghoChoNoch keine Bewertungen

- 2010-08-07 143719 ElephantbuttDokument2 Seiten2010-08-07 143719 ElephantbuttronnelNoch keine Bewertungen

- Village of Parry Print Shop Fund Statement of Cash Flows For The Year Ended April 30, 2017Dokument1 SeiteVillage of Parry Print Shop Fund Statement of Cash Flows For The Year Ended April 30, 2017deepakdohare1011Noch keine Bewertungen

- Compare Direct and Indirect Cash Flow MethodsDokument8 SeitenCompare Direct and Indirect Cash Flow MethodsKhayNoch keine Bewertungen

- Statement of Cash FlowsDokument4 SeitenStatement of Cash FlowsLara Lewis AchillesNoch keine Bewertungen

- Chaechapter 7 SolutionsDokument16 SeitenChaechapter 7 Solutionsmadddy_hydNoch keine Bewertungen

- Statement of Cash Flow - SolutionDokument8 SeitenStatement of Cash Flow - SolutionHân NabiNoch keine Bewertungen

- "How Well Am I Doing?" Statement of Cash Flows: Mcgraw-Hill/IrwinDokument23 Seiten"How Well Am I Doing?" Statement of Cash Flows: Mcgraw-Hill/Irwinrayjoshua12Noch keine Bewertungen

- Week 5Dokument3 SeitenWeek 5ZsazsaNoch keine Bewertungen

- FABM 2 - Module 5Dokument9 SeitenFABM 2 - Module 5Joshua Acosta100% (4)

- Review of Chapter 9/10 Current Liabilities, Contingent Liabilities, Bonds vs Shares, Cash Flows & RatiosDokument36 SeitenReview of Chapter 9/10 Current Liabilities, Contingent Liabilities, Bonds vs Shares, Cash Flows & RatiosDakshin SooryaNoch keine Bewertungen

- Harrison Chapter 10 Student 6 CeDokument36 SeitenHarrison Chapter 10 Student 6 CeAliyan AmjadNoch keine Bewertungen

- Net Cash Provided by Operating ActivitiesDokument6 SeitenNet Cash Provided by Operating Activitiesanna mariaNoch keine Bewertungen

- Chapter 12 Exercise E12-7 SOLUTION Fall 2018Dokument2 SeitenChapter 12 Exercise E12-7 SOLUTION Fall 2018Areeba QureshiNoch keine Bewertungen

- Chapter 5 - Cash Flows - HandoutDokument53 SeitenChapter 5 - Cash Flows - HandoutĐứcAnhLêVũ100% (1)

- Chapter 12 DrillsDokument4 SeitenChapter 12 DrillsBaderNoch keine Bewertungen

- Quiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3Dokument3 SeitenQuiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3kanroji1923Noch keine Bewertungen

- Acc101 - Chapter 14: Statement of Cash FlowsDokument12 SeitenAcc101 - Chapter 14: Statement of Cash FlowsSyed Asad Ali GardeziNoch keine Bewertungen

- Chapter 3 ProFormaDokument15 SeitenChapter 3 ProFormaNancy LuciaNoch keine Bewertungen

- Assignment 17Dokument8 SeitenAssignment 17Nicolas ErnestoNoch keine Bewertungen

- Cash Flow AnalysisDokument28 SeitenCash Flow AnalysisHONG RY100% (1)

- Facc 099 Content SheetDokument14 SeitenFacc 099 Content SheetUfuoma OkwuraiweNoch keine Bewertungen

- ACC108 - Tutorial 13-14Dokument40 SeitenACC108 - Tutorial 13-14Shivati Singh KahlonNoch keine Bewertungen

- Acct557 w7 HW JMDokument4 SeitenAcct557 w7 HW JMCoco M.Noch keine Bewertungen

- Acct557 w1 HomeworkDokument5 SeitenAcct557 w1 HomeworkCoco M.Noch keine Bewertungen

- Acct557 w4 HW JMDokument5 SeitenAcct557 w4 HW JMCoco M.Noch keine Bewertungen

- Acct557 w2 HWDokument3 SeitenAcct557 w2 HWCoco M.Noch keine Bewertungen