Beruflich Dokumente

Kultur Dokumente

IAS 19 Guide to Employee Benefit Accounting

Hochgeladen von

Akansha KushwahaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IAS 19 Guide to Employee Benefit Accounting

Hochgeladen von

Akansha KushwahaCopyright:

Verfügbare Formate

IAS 19 EMPLOYEE BENEFITS

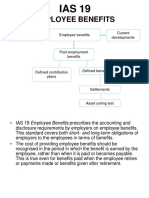

Overview IAS 19 Employee Benefits outlines the accounting requirements for employee benefits, including short-term benefits (e.g. wages and salaries, annual leave), post-employment benefits such as retirement benefits, other long-term benefits (e.g. long service leave) and termination benefits. The standard establishes the principle that the cost of providing employee benefits should be recognised in the period in which the benefit is earned by the employee, rather than when it is paid or payable, and outlines how each category of employee benefits are measured, providing detailed guidance in particular about postemployment benefits. IAS 19 was issued in February 1998 and is applicable to annual periods beginning on or after 1 January 1999, with a revised IAS 19 issued in June 2011 being applicable to annual periods beginning on or after 1 January 2013. History of IAS 19April 1980 Exposure Draft E16 Accounting for Retirement Benefits in Financial Statements of Employers January 1983 IAS 19 Accounting for Retirement Benefits in Financial Statements of Employers 1 January 1985 Effective date of IAS 19 (1983) December 1992 E47 Retirement Benefit Costs December 1993 IAS 19 Retirement Benefit Costs (revised as part of the 'Comparability of Financial Statements' project) 1 January 1995 Effective date of IAS 19 (1993) Retirement Benefit Costs October 1996 E54 Employee Benefits February 1998 IAS 19 (1998) Employee Benefits 1 January 1999 Effective date of IAS 19 (1998) Employee Benefits October 2000 Limited revisions to IAS 19 1 January 2001 Effective date of October 2000 revisions May 2002 'Asset Ceiling' amendment to IAS 19 (2000) Employee Benefits 31 May 2002 Effective date of May 2002 amendment 5 December 2002 Amendments to IAS 19.144-152 are proposed as part of the IASB's project on Share-based payment February 2004 IAS 19.144-152 on equity compensation benefits are replaced by IFRS 2 Share-based Payment 29 April 2004 Exposure Draft of Proposed Amendments to IAS 19 about recognition of actuarial gains and losses 16 December 2004 Amendments to IAS 19 adopted. Click for IASB Press Release on Amendments (PDF 56k). 22 May 2008 IAS 19 amended for 'Annual Improvements to IFRSs 2007 with regard to negative past service costs and curtailments 1 January 2009 Effective date of May 2008 amendment to IAS 19 20 August 2009 Exposure Draft of proposed amendment to IAS 19 relating to discount rate. Click for More Information

October 2009 Exposure Draft of proposed amendment to IAS 19 relating to discount rate will not be finalised. Click for More Information 29 April 2010 Exposure Draft Defined Benefit Plans published. Click for More Information 16 June 2011 Amended IAS 19 issued. Click for More Information 1 January 2013 Effective date of June 2011 amendments to IAS 19 Related Interpretations IFRIC 14 IAS 19 The Limit on a Defined Benefit Asset, Minimum Funding Requirements and their Interaction Amendments under consideration by the IASB Post-employment Benefits - Comprehensive Reconsideration of IAS 19 Post-employment Benefits Discount Rate Summary of IAS 19 Objective of IAS 19 The objective of IAS 19 is to prescribe the accounting and disclosure for employee benefits (that is, all forms of consideration given by an entity in exchange for service rendered by employees). The principle underlying all of the detailed requirements of the Standard is that the cost of providing employee benefits should be recognised in the period in which the benefit is earned by the employee, rather than when it is paid or payable. Scope IAS 19 applies to (among other kinds of employee benefits): wages and salaries compensated absences (paid vacation and sick leave) profit sharing plans bonuses medical and life insurance benefits during employment housing benefits free or subsidised goods or services given to employees pension benefits post-employment medical and life insurance benefits long-service or sabbatical leave 'jubilee' benefits deferred compensation programmes termination benefits. Basic principle of IAS 19 The cost of providing employee benefits should be recognised in the period in which the benefit is earned by the employee, rather than when it is paid or payable. Short-term employee benefits For short-term employee benefits (those payable within 12 months after service is rendered, such as wages, paid vacation and sick leave, bonuses, and non-monetary

benefits such as medical care and housing), the undiscounted amount of the benefits expected to be paid in respect of service rendered by employees in a period should be recognised in that period. [IAS 19.10] The expected cost of short-term compensated absences should be recognised as the employees render service that increases their entitlement or, in the case of non-accumulating absences, when the absences occur. [IAS 19.11] Profit-sharing and bonus payments The entity should recognise the expected cost of profit-sharing and bonus payments when, and only when, it has a legal or constructive obligation to make such payments as a result of past events and a reliable estimate of the expected cost can be made. [IAS 19.17] Types of post-employment benefit plans The accounting treatment for a post-employment benefit plan will be determined according to whether the plan is a defined contribution or a defined benefit plan: Under a defined contribution plan, the entity pays fixed contributions into a fund but has no legal or constructive obligation to make further payments if the fund does not have sufficient assets to pay all of the employees' entitlements to post-employment benefits. A defined benefit plan is a post-employment benefit plan other than a defined contribution plan. These would include both formal plans and those informal practices that create a constructive obligation to the entity's employees. Defined contribution plans For defined contribution plans, the cost to be recognised in the period is the contribution payable in exchange for service rendered by employees during the period. [IAS 19.44] If contributions to a defined contribution plan do not fall due within 12 months after the end of the period in which the employee renders the service, they should be discounted to their present value. [IAS 19.45] Defined benefit plans For defined benefit plans, the amount recognised in the balance sheet should be the present value of the defined benefit obligation (that is, the present value of expected future payments required to settle the obligation resulting from employee service in the current and prior periods), as adjusted for unrecognised actuarial gains and losses and unrecognised past service cost, and reduced by the fair value of plan assets at the balance sheet date. [IAS 19.54] The present value of the defined benefit obligation should be determined using the Projected Unit Credit Method. [IAS 19.64] Valuations should be carried out with sufficient regularity such that the amounts recognised in the financial statements do not differ materially from those that would be determined at the balance sheet date. [IAS 19.56] The assumptions used for the purposes of such valuations should be unbiased and mutually compatible. [IAS 19.72] The rate used to discount estimated cash flows should be determined by reference to market yields at the balance sheet date on high quality corporate bonds. [IAS 19.78]

On an ongoing basis, actuarial gains and losses arise that comprise experience adjustments (the effects of differences between the previous actuarial assumptions and what has actually occurred) and the effects of changes in actuarial assumptions. In the long-term, actuarial gains and losses may offset one another and, as a result, the entity is not required to recognise all such gains and losses in profit or loss immediately. IAS 19 specifies that if the accumulated unrecognised actuarial gains and losses exceed 10% of the greater of the defined benefit obligation or the fair value of plan assets, a portion of that net gain or loss is required to be recognised immediately as income or expense. The portion recognised is the excess divided by the expected average remaining working lives of the participating employees. Actuarial gains and losses that do not breach the 10% limits described above (the 'corridor') need not be recognised - although the entity may choose to do so. [IAS 19.92-93] In December 2004, the IASB issued amendments to IAS 19 to allow the option of recognising actuarial gains and losses in full in the period in which they occur, outside profit or loss, in a statement of comprehensive income. This option is similar to the requirements of the UK standard, FRS 17 Retirement Benefits. The Board concluded that, pending further work on post-employment benefits and on reporting comprehensive income, the approach in FRS 17 should be available as an option to preparers of financial statements using IFRSs. [IAS 19.93A] Over the life of the plan, changes in benefits under the plan will result in increases or decreases in the entity's obligation. Past service cost is the term used to describe the change in the obligation for employee service in prior periods, arising as a result of changes to plan arrangements in the current period. Past service cost may be either positive (where benefits are introduced or improved) or negative (where existing benefits are reduced). Past service cost should be recognised immediately to the extent that it relates to former employees or to active employees already vested. Otherwise, it should be amortised on a straight-line basis over the average period until the amended benefits become vested. [IAS 19.96] Plan curtailments or settlements: Gains or losses resulting from curtailments or settlements of a plan are recognised when the curtailment or settlement occurs. Curtailments are reductions in scope of employees covered or in benefits. If the calculation of the balance sheet amount as set out above results in an asset, the amount recognised should be limited to the net total of unrecognised actuarial losses and past service cost, plus the present value of available refunds and reductions in future contributions to the plan. [IAS 19.58] The IASB issued the final 'asset ceiling' amendment to IAS 19 in May 2002. The amendment prevents the recognition of gains solely as a result of deferral of actuarial losses or past service cost, and prohibits the recognition of losses solely as a result of deferral of actuarial gains. [IAS 19.58A]

The charge to income recognised in a period in respect of a defined benefit plan will be made up of the following components: [IAS 19.61] current service cost (the actuarial estimate of benefits earned by employee service in the period) interest cost (the increase in the present value of the obligation as a result of moving one period closer to settlement) expected return on plan assets* actuarial gains and losses, to the extent recognised past service cost, to the extent recognised the effect of any plan curtailments or settlements *The return on plan assets is interest, dividends and other revenue derived from the plan assets, together with realised and unrealised gains or losses on the plan assets, less any costs of administering the plan (other than those included in the actuarial assumptions used to measure the defined benefit obligation) and less any tax payable by the plan itself. [IAS 19.7] IAS 19 contains detailed disclosure requirements for defined benefit plans. [IAS 19.120125] IAS 19 also provides guidance on allocating the cost in: a multi-employer plan to the individual entities-employers [IAS 19.29-33] a group defined benefit plan to the entities in the group [IAS 19.34-34B] a state plan to participating entities [IAS 19.36-38]. Other long-term benefits IAS 19 requires a simplified application of the model described above for other long-term employee benefits. This method differs from the accounting required for postemployment benefits in that: [IAS 19.128-129] actuarial gains and losses are recognised immediately and no 'corridor' (as discussed above for post-employment benefits) is applied; and all past service costs are recognised immediately. Termination benefits For termination benefits, IAS 19 specifies that amounts payable should be recognised when, and only when, the entity is demonstrably committed to either: [IAS 19.133] terminate the employment of an employee or group of employees before the normal retirement date; or provide termination benefits as a result of an offer made in order to encourage voluntary redundancy. The entity will be demonstrably committed to a termination when, and only when, it has a detailed formal plan for the termination and is without realistic possibility of withdrawal. [IAS 19.134] Where termination benefits fall due after more than 12 months after the balance sheet date, they should be discounted. [IAS 19.139]

Highlights of developments August 2009: ED on employee benefits discount rate On 20 August 2009, the IASB published for public comment proposals to amend the discount rate for measuring employee benefits. IAS 19 requires an entity to determine the rate used to discount employee benefits with reference to market yields on high quality corporate bonds. However, when there is no deep market in corporate bonds, an entity is required to use market yields on government bonds instead. The global financial crisis has led to a widening of the spread between yields on corporate bonds and yields on government bonds. As a result, entities with similar employee benefit obligations may report them at very different amounts. To address the issue expeditiously, the IASB proposes to eliminate the requirement to use yields on government bonds. Instead, entities would estimate the yield on high quality corporate bonds. If adopted, the amendments would ensure that the comparability of financial statements is maintained across jurisdictions, regardless of whether there is a deep market for high quality corporate bonds. In view of the urgency of the issue and the limited scope of the proposals the IASB has set a shortened period for comments on the exposure draft comments are due by 30 September 2009. The IASB intends to permit entities to adopt the amendments that arise from this exposure draft in their December 2009 financial statements. Click for Press Release (PDF 99k). October 2009: Board decides not to finalise ED on employee benefits discount rate At its October 2009 meeting, the Board received a staff analysis of comments received on its proposed amendment of IAS 19 Discount Rate for Employee Benefits (ED/2009/10). It also redeliberated its conclusions in that exposure draft (ED see immediately above). The staff noted that 100 comment letters were received; in addition, there had been correspondence with constituents since the staff papers for this meeting had been released. The staff said that the comments were polarised: those who were in favour of the change were strongly so; those against were equally strong in their opposition. In addition, it was apparent that the exposure process had highlighted a number of areas in which the proposal would create problems of which the staff were previously unaware. The Board's proposals could lead to greater diversity in practice rather than less. As a result, the staff presented three alternatives: Require government bond rates to be used when it is difficult to estimate a high quality corporate bond rate, rather than when there is no deep market in high quality corporate bonds. The staff would consider further what is meant by 'difficult' if the Board decides to proceed on this option; Continue with the ED proposal to eliminate the requirement to use a government bond rate; or Keep the existing requirement to refer to a government bond rate when there is no deep market in high quality corporate bonds in other words, stop the project.

Board members engaged in a vigorous debate. Some challenged that staff analysis as simplistic and disingenuous. Others noted that the proposed amendment illustrated the danger of forcing an entity to use a measurement input that matched neither the currency nor duration of its defined benefit obligation. Board members expressed dissatisfaction with all three alternatives. However, ultimately there was not sufficient support among Board members to ratify the amendments. Consequently, the requirement in IAS 19 paragraph 78 to use the government bond rate in the absence of a high-quality corporate bond rate would remain in force. April 2010: IASB proposes to amend IAS 19 for defined benefit plans On 29 April 2010, the IASB published for public comment an exposure draft (ED) of proposed amendments to IAS 19 Employee Benefits. The proposals would amend the accounting for defined benefit plans through which some employers provide long-term employee benefits, such as pensions and post-employment medical care. In defined benefit plans, employers bear the risk of increases in costs and of possible poor investment performance. The ED proposes improvements to the recognition, presentation, and disclosure of defined benefit plans. The ED does not address measurement of defined benefit plans or the accounting for contribution-based benefit promises. Among the amendments proposed to IAS 19 are: Immediate recognition of all estimated changes in the cost of providing defined benefits and all changes in the value of plan assets. This would eliminate the various methods currently in IAS 19, including the 'corridor' method, that allow deferral of some of those gains or losses. A new presentation approach that would clearly distinguish between different types of gains and losses arising from defined benefit plans. Specifically, the ED proposes that the following changes in benefit costs should be presented separately: service cost in profit or loss finance cost (ie, net interest on the net defined benefit liability) as part of finance costs in profit or loss remeasurement in other comprehensive income The effect of presenting these items separately is to remove from IAS 19 the option for entities to recognise in profit or loss all changes in defined benefit obligations and in the fair value of plan assets. Improved disclosures about matters such as: the characteristics of the company's defined benefit plans. the amounts recognised in the financial statements. risks arising from defined benefit plans. participation in multi-employer plans. Comment deadline on the ED Defined Benefit Plans is 6 September 2010. Click for IASB Press Release (PDF 100k). June 2011: IASB issues amended IAS 19

On 16 June 2011, the IASB published an amended IAS 19 Employee Benefits. Accounting for employee benefits, particularly pensions and other post-retirement benefits, has long been a complex and difficult area and initial plans for a full review of pension accounting had to be deferred in light of competing priorities, ultimately leaving the IASB to proceed alone on improving specific aspects of the existing requirements of IAS 19. Prior to the amendment, IAS 19 permitted choices on how to account for actuarial gains and losses on pensions and similar items, including the so-called 'corridor approach' which resulted the deferral of gains and losses. The Exposure Draft proposed eliminating the use of the 'corridor' approach and instead mandating all remeasurement impacts be recognised in OCI (with the remainder in profit or loss) and in fact had proposed extending these requirements to all long-term employee benefits (e.g. certain long service leave schemes). The final amendments make the OCI presentation changes in respect of pensions (and similar items) only, but all other long term benefits are required to be measured in the same way even though changes in the recognised amount are fully reflected in profit or loss. Also changed in IAS 19 is the treatment for termination benefits, specifically the point in time when an entity would recognise a liability for termination benefits. The final amendments do not adopt the equivalent US-GAAP requirements verbatim (which requires individual employees to be notified), but the recognition timeframe may be extended in some cases. Finally, various other amendments to IAS 19 may have impacts in particular areas. For instance, employee benefits not settled wholly before twelve months after the end of the annual reporting period would be captured as an 'other long term benefit' rather than a 'short term benefit', and whilst presented as a current item in the statement of financial position, would be measured differently under the amendments. Overview of changes introduced by IAS 19 Employee Benefits (as amended in 2011) Require recognition of changes in the net defined benefit liability (asset) including immediate recognition of defined benefit cost, disaggregation of defined benefit cost into components, recognition of remeasurements in other comprehensive income, plan amendments, curtailments and settlements Introduce enhanced disclosures about defined benefit plans Modify accounting for termination benefits, including distinguishing benefits provided in exchange for service and benefits provided in exchange for the termination of employment and affect the recognition and measurement of termination benefits Clarification of miscellaneous issues, including the classification of employee benefits, current estimates of mortality rates, tax and administration costs and risk-sharing and conditional indexation features Incorporate other matters submitted to the IFRS Interpretations Committee Applicable on a modified retrospective basis to annual periods beginning on or after 1 January 2013, with early adoption permitted.

Das könnte Ihnen auch gefallen

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionVon EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNoch keine Bewertungen

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsVon EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNoch keine Bewertungen

- IAS 19 Employee Benefits History and Key RequirementsDokument5 SeitenIAS 19 Employee Benefits History and Key RequirementsCA Rekha Ashok PillaiNoch keine Bewertungen

- IAS19 (Employee Benefits) SummaryDokument5 SeitenIAS19 (Employee Benefits) Summaryfebzz88Noch keine Bewertungen

- Employee BenefitsDokument8 SeitenEmployee Benefitssimply PrettyNoch keine Bewertungen

- IAS 19 Employee BenefitsDokument110 SeitenIAS 19 Employee BenefitsFritz MainarNoch keine Bewertungen

- Ias 19-Employee BenefitsDokument3 SeitenIas 19-Employee Benefitsbeth alviolaNoch keine Bewertungen

- Ias 19 Employee BenefitsDokument43 SeitenIas 19 Employee BenefitsHasan Ali BokhariNoch keine Bewertungen

- IAS 19 DataDokument3 SeitenIAS 19 DataShafaq QureshiNoch keine Bewertungen

- Employee Benefits IAS 19Dokument17 SeitenEmployee Benefits IAS 19Sbonga Gift Blessedbeyondmeasure MbathaNoch keine Bewertungen

- Revised PAS 19R Employee Benefits Technical SummaryDokument4 SeitenRevised PAS 19R Employee Benefits Technical SummaryJBNoch keine Bewertungen

- Subject: Audit & Assurance Service: Assignment # 2Dokument4 SeitenSubject: Audit & Assurance Service: Assignment # 2Abdul Moeez KhanNoch keine Bewertungen

- Unit 2 IAS 19 SlidesDokument19 SeitenUnit 2 IAS 19 SlidesSiphesihleNoch keine Bewertungen

- IAS 19 Employee BenefitsDokument5 SeitenIAS 19 Employee Benefitshae1234Noch keine Bewertungen

- 2012 TTAAG IAS 19 Employee Benefits - Defined Benefit PlansDokument54 Seiten2012 TTAAG IAS 19 Employee Benefits - Defined Benefit PlansFarah DibaNoch keine Bewertungen

- Ias 19 - Employee BenefitsDokument6 SeitenIas 19 - Employee BenefitsIfyNoch keine Bewertungen

- IAS 19 Employee BenefitsDokument48 SeitenIAS 19 Employee BenefitsHuzaifa AhmedNoch keine Bewertungen

- IAS 19 Notes and Class Examples - 2019 - UpdatedDokument28 SeitenIAS 19 Notes and Class Examples - 2019 - Updatedrossvdh20Noch keine Bewertungen

- Practical Guide To IFRS: IAS 19 (Revised) Significantly Affects The Reporting of Employee BenefitsDokument13 SeitenPractical Guide To IFRS: IAS 19 (Revised) Significantly Affects The Reporting of Employee BenefitsSanath FernandoNoch keine Bewertungen

- IAS 19 Employee BenefitsDokument22 SeitenIAS 19 Employee Benefitsanon_419651076Noch keine Bewertungen

- 29 Ias 19 Employee BenefitsDokument14 Seiten29 Ias 19 Employee BenefitsSuryaNoch keine Bewertungen

- 080103Dokument7 Seiten080103Franklin JungcoNoch keine Bewertungen

- Module 6 - UfrDokument8 SeitenModule 6 - UfrAndrea Lyn Salonga CacayNoch keine Bewertungen

- EY-IFRS-FS-20 - Part 2Dokument50 SeitenEY-IFRS-FS-20 - Part 2Hung LeNoch keine Bewertungen

- IAS 19 Employee Benefits: Technical SummaryDokument3 SeitenIAS 19 Employee Benefits: Technical SummaryHassan Iqbal PenkarNoch keine Bewertungen

- Accounting for employment benefitsDokument5 SeitenAccounting for employment benefitsiamacrusaderNoch keine Bewertungen

- Actuarial Valuation of Employee Benefits Under Ifrs: 12 June 2009Dokument29 SeitenActuarial Valuation of Employee Benefits Under Ifrs: 12 June 2009Aadi BuilderNoch keine Bewertungen

- 5.12 Employee Benefits AccountingDokument5 Seiten5.12 Employee Benefits AccountingBaher MohamedNoch keine Bewertungen

- Revised PAS 19Dokument2 SeitenRevised PAS 19jjmcjjmc12345Noch keine Bewertungen

- Ias 19Dokument59 SeitenIas 19Leonardo BritoNoch keine Bewertungen

- IAS 19 Employee Benefits: Technical SummaryDokument1 SeiteIAS 19 Employee Benefits: Technical SummarydskrishnaNoch keine Bewertungen

- Lesson Six: Accounting For Employee BenefitsDokument27 SeitenLesson Six: Accounting For Employee BenefitssamclerryNoch keine Bewertungen

- Employee BenefitsDokument28 SeitenEmployee BenefitsRazel MhinNoch keine Bewertungen

- IAS 19 Employee Benefits Class NotesDokument14 SeitenIAS 19 Employee Benefits Class NotesMuhammed NaqiNoch keine Bewertungen

- Module 12 - PAS 19 Employee BenefitsDokument6 SeitenModule 12 - PAS 19 Employee BenefitsAKIO HIROKINoch keine Bewertungen

- T3 EmployeeDokument4 SeitenT3 EmployeeLe YenNoch keine Bewertungen

- IAS 19 Employee Benefits ExplainedDokument40 SeitenIAS 19 Employee Benefits ExplainedYI WEI CHANGNoch keine Bewertungen

- IAS 19 Employee Benefits (2021)Dokument6 SeitenIAS 19 Employee Benefits (2021)Tawanda Tatenda Herbert100% (1)

- Overview of IAS 19Dokument9 SeitenOverview of IAS 19amitsinghslideshareNoch keine Bewertungen

- IAS 19 - Employee BenefitsDokument1 SeiteIAS 19 - Employee BenefitsClarize R. MabiogNoch keine Bewertungen

- Ias 19Dokument9 SeitenIas 19Hammad SarwarNoch keine Bewertungen

- Employee BenefitsDokument7 SeitenEmployee BenefitsJANN HANNAH FAITH CRUTANoch keine Bewertungen

- PAS 19 to PAS 34 ModuleDokument22 SeitenPAS 19 to PAS 34 ModuleRizell Mae PruebasNoch keine Bewertungen

- PAS19 RDokument1 SeitePAS19 RRarajNoch keine Bewertungen

- Actuarial Valuation of Employee Benefits Under Ifrs: 12 June 2009Dokument29 SeitenActuarial Valuation of Employee Benefits Under Ifrs: 12 June 2009Akomolafe AdetutuNoch keine Bewertungen

- 19 Employee Benefits s22 - tesFINALDokument16 Seiten19 Employee Benefits s22 - tesFINALasiphileamagiqwa25Noch keine Bewertungen

- Ias 19Dokument25 SeitenIas 19Claire RamosNoch keine Bewertungen

- LKAS 19 2021 UploadDokument31 SeitenLKAS 19 2021 Uploadpriyantha dasanayake100% (1)

- PAS 19 Practice GuideDokument4 SeitenPAS 19 Practice GuideEllaine Montojo MirandaNoch keine Bewertungen

- 2 - ifric14IAS 19-The Limit On A Defined BenefitDokument6 Seiten2 - ifric14IAS 19-The Limit On A Defined BenefitJessie de VeraNoch keine Bewertungen

- IAS 19 - Employee BenefitDokument49 SeitenIAS 19 - Employee BenefitShah Kamal100% (2)

- Employee BenefitDokument32 SeitenEmployee BenefitnatiNoch keine Bewertungen

- Employee Benefits: Financial Reporting Standard 119Dokument76 SeitenEmployee Benefits: Financial Reporting Standard 119Norhayati Abdul RahimNoch keine Bewertungen

- Factsheet IAS19 Employee BenefitsDokument15 SeitenFactsheet IAS19 Employee BenefitsHamza Fath-dinNoch keine Bewertungen

- Employee benefits accounting and bonus formulasDokument5 SeitenEmployee benefits accounting and bonus formulasem cortezNoch keine Bewertungen

- 1FU491 Employee BenefitsDokument14 Seiten1FU491 Employee BenefitsEmil DavtyanNoch keine Bewertungen

- A Look at Current Financial Reporting Issues: in BriefDokument2 SeitenA Look at Current Financial Reporting Issues: in BriefKat SarnoNoch keine Bewertungen

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideVon EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNoch keine Bewertungen

- Account Description and StructureDokument96 SeitenAccount Description and StructureNikit ShahNoch keine Bewertungen

- HRMDokument16 SeitenHRMNutan Nagpal ChopraNoch keine Bewertungen

- Compensation: Wage & Salary AdministrationDokument40 SeitenCompensation: Wage & Salary AdministrationAlokNoch keine Bewertungen

- HR Practices in The Uk (A Presentation by Group 8)Dokument36 SeitenHR Practices in The Uk (A Presentation by Group 8)faith olaNoch keine Bewertungen

- A Detailed Study of Promotion and Reward Policy of Sbi: Chapter ContentsDokument51 SeitenA Detailed Study of Promotion and Reward Policy of Sbi: Chapter ContentsSanjay SNoch keine Bewertungen

- Income From Salary Final SEM 3Dokument49 SeitenIncome From Salary Final SEM 3Baleshwar ChauhanNoch keine Bewertungen

- BIR Ruling 2002Dokument113 SeitenBIR Ruling 2002Bobby Olavides SebastianNoch keine Bewertungen

- Annual Report 2019-2020Dokument118 SeitenAnnual Report 2019-2020Positive ThinkerNoch keine Bewertungen

- Hdfcslic: Preferred Partner in Your Financial PlanningDokument17 SeitenHdfcslic: Preferred Partner in Your Financial PlanningSandeep BorseNoch keine Bewertungen

- Agreement Between Communications Workers of America and Verizon New Jersey Inc. and Verizon Services Corp. - September 19, 2012Dokument382 SeitenAgreement Between Communications Workers of America and Verizon New Jersey Inc. and Verizon Services Corp. - September 19, 2012CWALocal1022Noch keine Bewertungen

- Presentation 7Dokument9 SeitenPresentation 7Abhiya E TNoch keine Bewertungen

- List of Benefits Available To Salaried PersonsDokument11 SeitenList of Benefits Available To Salaried PersonsHemant Kumar VermaNoch keine Bewertungen

- Tds Rate ChartDokument15 SeitenTds Rate ChartJain MjNoch keine Bewertungen

- Induction & Orientation FinalDokument32 SeitenInduction & Orientation FinalSwapnali RajputNoch keine Bewertungen

- Executive CompensationDokument2 SeitenExecutive Compensationricha928Noch keine Bewertungen

- Answer Key Tax 501 by AmponganDokument41 SeitenAnswer Key Tax 501 by AmponganHarriet Caryn Albaño57% (21)

- Human Resource Project NGODokument37 SeitenHuman Resource Project NGOKrishna100% (2)

- Virgin Atlantic Marketing TriangleDokument44 SeitenVirgin Atlantic Marketing Triangleavneeshbansal1993Noch keine Bewertungen

- HRM Report Bank AlfalahDokument31 SeitenHRM Report Bank AlfalahMirza MunirNoch keine Bewertungen

- DT Shrey RathiDokument33 SeitenDT Shrey RathiranveerNoch keine Bewertungen

- APPLICATION FOR EMPLOYMENTDokument4 SeitenAPPLICATION FOR EMPLOYMENTPullaReddy Singam0% (1)

- E-HRM Implementation and TypesDokument22 SeitenE-HRM Implementation and Typesaashi100% (1)

- Taxation Law Codes Presents Cs Executive Tax Laws - 59cd7a9a1723dda4f28dee1e PDFDokument84 SeitenTaxation Law Codes Presents Cs Executive Tax Laws - 59cd7a9a1723dda4f28dee1e PDFRaj SinghNoch keine Bewertungen

- Employee HandbookDokument29 SeitenEmployee HandbookReccieNoch keine Bewertungen

- IT-AE-36-G01 - Quick Guide On How To Complete The IT12EI Return For Exempt Organisations - External GuideDokument13 SeitenIT-AE-36-G01 - Quick Guide On How To Complete The IT12EI Return For Exempt Organisations - External GuideThapeloNoch keine Bewertungen

- International HRMDokument80 SeitenInternational HRMDolly PatelNoch keine Bewertungen

- Income TaxDokument74 SeitenIncome Taxhemanshi07soniNoch keine Bewertungen

- Taxability of Employer's Contribution To An Approved Superannuation Fund Vs NPSDokument7 SeitenTaxability of Employer's Contribution To An Approved Superannuation Fund Vs NPSRaviteja GNoch keine Bewertungen

- 2018 Cost Report Training GuideDokument155 Seiten2018 Cost Report Training GuideHost MomNoch keine Bewertungen

- Fit Chap012Dokument56 SeitenFit Chap012djkfhadskjfhksd100% (2)