Beruflich Dokumente

Kultur Dokumente

HPCL Audited Results31Mar2013

Hochgeladen von

Pranav DesaiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

HPCL Audited Results31Mar2013

Hochgeladen von

Pranav DesaiCopyright:

Verfügbare Formate

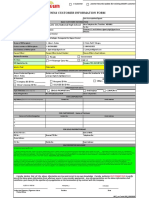

HINDUSTAN PETROLEUM CORPORATION LIMITED

(A GOVERNMENT OF INDIA ENTERPRISE)

Regd. Office : 17, Jamshedji Tata Road, Mumbai - 400 020 Website: www.hindustanpetroleum.com

AUDITED FINANCIAL RESULTS FOR THE YEAR ENDED 31ST MARCH, 2013

( ` in Crores )

Particulars

(Unaudited)

(Audited)

Quarter Ended

Year Ended

31.03.2013

PART I

A FINANCIAL PERFORMANCE

1 Income from operations

Sales/Income from Operations

Less : Excise Duty Paid

(a) Net Sales/Income from Operations

(b) Other Operating Income

Total Income from operations (net)

2 Expenditure

(a) Cost of materials consumed

(b) Purchases of stock-in-trade

(c) Changes in inventories of finished goods,

work-in-progress and stock-in-trade

(d) Employee benefits expense

(e) Depreciation and amortisation expense

(f) Other Expenditure

Total Expenses

3 Profit/(Loss) from Operations before Other Income,

Finance Cost & Exceptional Items (1-2)

4 Other Income

5 Profit/(Loss) from ordinary activities before Finance Cost &

Exceptional Items (3+4)

6 Finance Cost

7 Profit/(Loss) from ordinary activities after Finance Cost but

before Exceptional Items (5-6)

8 Exceptional Items - Expenses/(Income)

9 Profit/(Loss) from Ordinary Activities before tax (78)

10 Tax Expense

11 Net Profit/(Loss) from Ordinary Activities after tax (9-10)

12 Extraordinary Items (net of tax expenses)

13 Net Profit/(Loss) for the period (11-12)

14 Minority Interest

15 Net Profit/(Loss) for the group (14-15)

16 Paid up Equity Share Capital (Face value ` 10 each)

17 Reserves excluding Revaluation Reserves as per Balance Sheet

18 Earnings Per Share:

(i) Basic and Diluted before extraordinary item (`)

(ii) Basic and Diluted after extraordinary item (`)

19 Debt Service Coverage Ratio (DSCR) (No. of times)*

20 Interest Service Coverage Ratio (ISCR) (No. of times) **

B PHYSICAL PERFORMANCE (in MMT)

Crude Thruput

Market Sales (Including Exports)

Pipeline Thruput

31.12.2012

31.03.2012

31.03.2013

31.03.2012

Consolidated Results

Year Ended

31.03.2013 31.03.2012

63,877.08

(2,639.17)

61,237.91

(1,547.92)

59,689.99

55,164.96

(2,413.95)

52,751.01

662.88

53,413.89

54,656.97 2,15,675.49 1,88,130.95

(2,263.37)

(9,146.15) (9,991.72)

52,393.60 2,06,529.34 1,78,139.23

49.54

201.92

196.59

52,443.14 2,06,731.26 1,78,335.82

2,25,993.41

(10,043.18)

2,15,950.23

203.90

2,16,154.13

1,95,694.51

(10,607.25)

1,85,087.26

196.60

1,85,283.86

17,701.12

30,283.14

17,034.91

31,278.37

14,262.92

63,182.61 56,943.23

32,896.95 1,28,178.60 1,09,370.73

78,070.39

1,22,448.55

65,682.21

1,07,297.59

1,313.54

365.33

491.43

1,392.15

51,546.71

1,410.35

530.34

494.66

2,089.26

52,837.89

(1,259.98)

809.45

(824.29)

95.64

2,525.56

1,583.10

472.64

1,934.42

1,712.93

841.31

7,709.09

7,132.20

47,309.47 2,04,339.73 1,75,917.89

(165.17)

2,620.17

2,315.56

9,007.59

2,14,297.09

(1,365.19)

1,643.40

1,911.44

7,786.35

1,82,955.80

8,143.28

391.04

576.00

204.63

5,133.66

330.57

2,391.53

1,102.36

2,417.92

1,025.59

1,857.04

1,064.52

2,328.06

1,020.45

8,534.32

285.16

780.63

633.52

5,464.23

525.43

3,493.89

2,019.33

3,443.51

2,224.27

2,921.56

2,314.98

3,348.51

2,481.60

8,249.16

8,249.16

569.85

7,679.31

7,679.31

7,679.31

338.63

147.11

147.11

147.11

147.11

147.11

338.63

4,938.80

4,938.80

307.81

4,630.99

4,630.99

4,630.99

338.63

1,474.56

1,474.56

569.85

904.71

904.71

904.71

338.63

13,387.39

1,219.24

1,219.24

307.81

911.43

911.43

911.43

338.63

12,783.51

606.58

(275.14)

881.72

381.23

500.49

500.49

(0.81)

501.30

338.63

13,019.57

866.91

866.91

690.95

175.96

175.96

1.31

174.65

338.63

12,769.18

26.72

26.72

1.38

2.69

26.92

26.92

1.32

2.20

14.80

14.80

5.16

5.16

15.78

30.32

14.04

16.19

29.48

13.62

4.32

7.75

3.70

4.22

7.73

3.65

3.96

7.73

3.42

SELECTED INFORMATION FOR THE YEAR ENDED 31ST MARCH, 2013

16,55,50,500 16,55,50,500 16,55,50,500 16,55,50,500 16,55,50,500 16,55,50,500 16,55,50,500

48.89

48.89

48.89

48.89

48.89

48.89

48.89

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

NIL

17,30,76,750 17,30,76,750 17,30,76,750 17,30,76,750 17,30,76,750 17,30,76,750 17,30,76,750

100

51.11

31.03.2013

100

51.11

100

51.11

100

51.11

100

51.11

100

51.11

100

51.11

Nil

11

11

Nil

Notes :

1. The Board has recommended a final dividend of ` 8.50 per share. 2. The Audited Accounts are subject to review by the Comptroller & Auditor General of India under section 619(4) of the Companies Act, 1956.

3. Average Gross Refining Margins during the year ended March 2013, were US $ 2.08 per BBL as against US $ 2.39 per BBL during the corresponding previous year. 4. The prices of PDS Kerosene and Domestic

LPG are subsidized as per the scheme approved by the Government of India. During the current year ended March 2013, Subsidy amounting to ` 666.41 crores (April - March 2012: ` 672.83 crores) has been

accounted at 1/3rd of the subsidy rates for 2002-03 as approved by the Government. 5. Based on the approval received from Government of India, the Company has accounted for Budgetary Support amounting to

` 24,825.28 crores for the period April-March 2013 (April-March 2012: `18,342.77 crores) against under-recoveries on sale of sensitive petroleum products for the period April-March 2013. 6. During the year

ended March 2013, discount from upstream oil companies, viz., ONGC and GAIL, amounting to ` 11,188.53 crores (April-March 2012: ` 12,079.75 crores) in respect of Crude Oil, PDS Kerosene & Domestic LPG

purchased from them has been accounted. 7. The Employee cost for the year 2012-13 includes ` 813 crores towards implementation of Long Term Settlement of Non-management employees and

Superannuation Benefits for all the employees finalized during the year, including for the past periods. 8. The figures for the quarter ended 31st March 2013 are the balancing figures between the audied financial

results for the year ended 31st March, 2013 and the published unaudited financial results for the nine months ended 31st December 2012.

( ` in Crores )

(Audited)

(Audited)

Year Ended

Consolidated Results

Year Ended

31.03.2013

31.03.2012

31.03.2013

31.03.2012

A. EQUITY AND LIABILITIES

1. Shareholder's funds

(a) Share capital

339.01

339.01

(b) Reserves and surplus

13,387.39

12,783.51

Sub-total - Shareholders' funds

13,726.40

13,122.52

2. Share application money pending allotment

3. Minority interest

4. Non-current liabilities

(a) Long-term borrowings

8,947.18

6,291.37

(b) Deferred tax liabilities (net)

3,598.35

3,085.28

(c) Other long-term liabilities

6,211.19

5,471.27

(d) Long-term provisions

498.96

436.55

Sub-total - Non-current liabilities

19,255.68

15,284.47

5. Current liabilities

(a) Short-term borrowings

23,511.09

21,187.88

(b) Trade payables

11,036.94

12,561.12

(c) Other current liabilities

6,914.08

7,406.52

(d) Short-term provisions

1,800.54

1,547.04

Sub-total - Current liabilities

43,262.65

42,702.56

TOTAL - EQUITY AND LIABILITIES

76,244.73

71,109.55

B. ASSETS

1. Non-current assets

(a) Fixed assets

27,721.57

25,294.12

(b) Goodwill on consolidation

(c) Non-current investments

8,266.07

7,483.43

(d) Long-term loans and advances

1,930.47

1,499.28

(e) Other non-current assets

95.98

67.46

Sub-total - Non-current assets

38,014.09

34,344.29

2. Current assets

(a) Current investments

2,360.86

2,887.07

16,438.70

19,454.53

(b) Inventories

(c) Trade receivables

4,935.04

3,565.16

147.13

226.38

(d) Cash and bank balances

(e) Short-term loans and advances

14,070.36

10,151.31

278.55

480.81

(f) Other current assets

Sub-total - Current assets

38,230.64

36,765.26

TOTAL - ASSETS

76,244.73

71,109.55

10. Previous period's figures have been regrouped / reclassified wherever necessary.

339.01

13,019.57

13,358.58

234.13

1.48

339.01

12,769.18

13,108.19

133.14

2.28

17,620.00

3,733.94

6,287.30

508.21

28,149.45

13,844.31

3,436.38

5,495.34

442.55

23,218.58

25,572.23

14,359.20

8,738.36

1,862.37

50,532.16

92,275.80

23,754.72

15,498.07

8,288.39

1,575.90

49,117.08

85,579.27

42,284.95

16.69

4,066.79

1,601.11

157.68

48,127.22

37,968.51

16.69

4,066.79

1,482.92

135.82

43,670.73

2,360.86

20,733.41

5,614.10

864.71

14,209.23

366.27

44,148.58

92,275.80

2,891.69

22,985.95

4,056.22

734.02

10,737.58

503.08

41,908.54

85,579.27

( ` in Crores )

SEGMENT-WISE RESULTS

(Unaudited)

Quarter Ended

31.03.2013

PART II

PARTICULARS OF SHAREHOLDING

Public Shareholding

Number of Shares

Percentage of Shareholding (%)

Promoters and Promoter Group Shareholding

(a) Pledged / Encumbered

- Number of Shares

- Percentage of Shares

(b) Non-encumbered

- Number of Shares

- Percentage of Shares (as a % of total shareholding of

Promoter and Promoter Group)

- Percentage of Shares (as a % of total share capital of the Company)

INVESTOR COMPLAINTS

Pending at the beginning of the quarter

Received during the quarter

Disposed off during the quarter

Remaining unresolved at the end of the quarter

Particulars

Particulars

* Debt Service Coverage Ratio (DSCR) = Profits after Tax but before Depreciation and Interest / (Interest + Principal Repayment of Long Term Loans).

** Interest Service Coverage Ratio (ISCR) = Profits before Depreciation, Interest and Tax / Interest.

A

1

9. Statement of Assets and Liabilities as per clause 41 (V)(h) of the Listing Agreement.

(Audited)

1 SEGMENT REVENUE

(a) Downstream Petroleum

(b) Exploration & Production

of Hydrocarbons

Sub-Total

Less: Inter-Segment Revenue

TOTAL REVENUE

2 SEGMENT RESULTS

(a) Profit/(Loss) before Tax,

Interest Income, Interest

Expenditure and Dividend

from each Segment

(i) Downstream Petroleum

(ii) Exploration & Production

of Hydrocarbons

Sub-total of (a)

(b) Finance Cost

(c) Other Un-allocable

Expenditure

(Net of Un-allocable Income)

Profit/(Loss) before Tax (a-b-c)

3 CAPITAL EMPLOYED

(Segment Assets Segment Liabilities)

(a) Downstream Petroleum

(b) Exploration & Production

of Hydrocarbons

(c) Others (Unallocated-Corporate)

TOTAL

31.12.2012 31.03.2012

(Audited)

(Audited)

Year Ended

Consolidated Results

Year Ended

31.03.2013 31.03.2012

31.03.2013

31.03.2012

59,800.34

53,455.70

52,511.36 2,06,971.93 1,78,552.94 2,16,431.79 1,85,505.47

59,800.34

59,800.34

53,455.70

53,455.70

7.21

0.66

52,511.36 2,06,971.93 1,78,552.94 2,16,439.00 1,85,506.13

(6.21)

(0.03)

52,511.36 2,06,971.93 1,78,552.94 2,16,432.79 1,85,506.10

8,239.45

594.98

5,258.27

2,540.75

2,823.70

2,278.14

2,718.14

(14.20)

8,225.25

285.16

(12.89)

582.09

633.52

(52.65)

5,205.62

525.43

(54.81)

2,485.94

2,019.33

(96.38)

2,727.32

2,224.27

(62.80)

2,215.34

2,314.98

(99.09)

2,619.05

2,481.60

(309.07)

8,249.16

(198.54)

147.11

(258.61)

4,938.80

(1,007.95)

1,474.56

(716.19)

1,219.24

(981.36)

881.72

(729.46)

866.91

22,382.27

10,958.19

17,970.16

22,382.27

17,970.16

28,260.59

23,582.25

(625.75)

7,627.22

29,383.74

(611.55)

8,359.42

18,706.05

(570.94)

7,922.50

25,321.72

(625.75)

7,627.22

29,383.74

(570.94)

7,922.50

25,321.72

(599.46)

4,059.79

31,720.92

(546.14)

4,492.08

27,528.19

Notes: 1. The Company is engaged in the following business segments: a) Downstream i.e. Refining and Marketing of Petroleum Products b) Exploration

and Production of Hydrocarbons. Segments have been identified taking into account the nature of activities and the nature of risks and returns. 2. Segment

Revenue comprises of the following: a) Turnover (Net of Excise Duties) b) Subsidy from Government of India c) Other income (excluding interest income,

dividend income and investment income) 3. There are no geographical segments. 4. Previous period's figures have been regrouped/reclassified

wherever necessary.

The above results have been reviewed and recommended by the Audit Committee in its meeting held on 28th May, 2013 and taken on record by the Board of

Directors at its meeting held on 28th May, 2013.

By order of the Board

Place: New Delhi

Date: 28th May, 2013

B. Mukherjee

Director (Finance)

Das könnte Ihnen auch gefallen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- 2009-10 Annual ResultsDokument1 Seite2009-10 Annual ResultsAshish KadianNoch keine Bewertungen

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosVon EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNoch keine Bewertungen

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Dokument4 SeitenColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Rohit NuwalNoch keine Bewertungen

- Industrial Machinery World Summary: Market Values & Financials by CountryVon EverandIndustrial Machinery World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- SEBI Results Mar13Dokument2 SeitenSEBI Results Mar13Mansukh Investment & Trading SolutionsNoch keine Bewertungen

- Balance Sheet: Titan Industries LimitedDokument4 SeitenBalance Sheet: Titan Industries LimitedShalini ShreyaNoch keine Bewertungen

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Dokument8 SeitenAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Tata Annual Report 2012Dokument6 SeitenTata Annual Report 2012Vaibhav BindrooNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- 2000 5000 Corp Action 20220525Dokument62 Seiten2000 5000 Corp Action 20220525Contra Value BetsNoch keine Bewertungen

- Suven Life Sciences Limited: I I I I I I IDokument7 SeitenSuven Life Sciences Limited: I I I I I I IVipul shahNoch keine Bewertungen

- Financial Highlights: Hinopak Motors LimitedDokument6 SeitenFinancial Highlights: Hinopak Motors LimitedAli ButtNoch keine Bewertungen

- Unitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Dokument4 SeitenUnitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Bhuvan MalikNoch keine Bewertungen

- PCC - Financial Stahtements 2013 - Final by RashidDokument56 SeitenPCC - Financial Stahtements 2013 - Final by RashidFahad ChaudryNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For December 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Auditors Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Interim Financial Result For 3rd Quarter Ended 31.01.2013Dokument23 SeitenInterim Financial Result For 3rd Quarter Ended 31.01.2013nickong53Noch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Q1FY2013Dokument1 SeiteQ1FY2013Suresh KumarNoch keine Bewertungen

- Havells Annual ReportDokument1 SeiteHavells Annual ReportSatyaki DeyNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Data Analysis and InterpretationDokument50 SeitenData Analysis and InterpretationAnonymous MhCdtwxQINoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokument4 SeitenFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument12 SeitenStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Wim Plast LTD.: CelloDokument5 SeitenWim Plast LTD.: CelloAbhishek RanjanNoch keine Bewertungen

- Standalone Financial Results For The Quarter / Year Ended On 31st March 2012Dokument9 SeitenStandalone Financial Results For The Quarter / Year Ended On 31st March 2012smartashok88Noch keine Bewertungen

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- QMar2013 Financials of Relieance WeavingDokument20 SeitenQMar2013 Financials of Relieance WeavingTauraabNoch keine Bewertungen

- Re Ratio AnalysisDokument31 SeitenRe Ratio AnalysisManish SharmaNoch keine Bewertungen

- TTR RRL: LimitedDokument5 SeitenTTR RRL: LimitedShyam SunderNoch keine Bewertungen

- Glomac Berhad: (Incorporated in Malaysia)Dokument8 SeitenGlomac Berhad: (Incorporated in Malaysia)Shungchau WongNoch keine Bewertungen

- Nigeria German Chemicals Final Results 2012Dokument4 SeitenNigeria German Chemicals Final Results 2012vatimetro2012Noch keine Bewertungen

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Unaudited Financial Results For The Quarter Ended 30Th June, 2011Dokument1 SeiteUnaudited Financial Results For The Quarter Ended 30Th June, 2011Ayush JainNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- BCG Q2FY22 ResultsDokument12 SeitenBCG Q2FY22 ResultsSandyNoch keine Bewertungen

- Financial Statements Year Ended Dec 2010Dokument24 SeitenFinancial Statements Year Ended Dec 2010Eric FongNoch keine Bewertungen

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Dokument6 SeitenFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Adlabs Results FY18Dokument16 SeitenAdlabs Results FY18sam13eerNoch keine Bewertungen

- Consolidated AFR 31mar2011Dokument1 SeiteConsolidated AFR 31mar20115vipulsNoch keine Bewertungen

- MSSL Results Quarter Ended 31st December 2011Dokument4 SeitenMSSL Results Quarter Ended 31st December 2011kpatil.kp3750Noch keine Bewertungen

- BEML Limited: (A Govt. of India Mini Ratna Company Under Ministry of Defence)Dokument3 SeitenBEML Limited: (A Govt. of India Mini Ratna Company Under Ministry of Defence)Kapil SharmaNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- PEL 2009 FinancialsDokument7 SeitenPEL 2009 FinancialssaqibaliraoNoch keine Bewertungen

- JUL'Sep'12 Jul-Sep'11 Rupees RupeesDokument8 SeitenJUL'Sep'12 Jul-Sep'11 Rupees RupeesMansoor AliNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument6 SeitenStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Indian Oil Corporation Project 2Dokument30 SeitenIndian Oil Corporation Project 2Rishika GoelNoch keine Bewertungen

- Puma Energy Results Report q3 2016 v3Dokument8 SeitenPuma Energy Results Report q3 2016 v3KA-11 Єфіменко ІванNoch keine Bewertungen

- Bursa Q4 2013 (MAS)Dokument22 SeitenBursa Q4 2013 (MAS)Thaw ZinNoch keine Bewertungen

- Interim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDokument2 SeitenInterim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesMohammedBahgatNoch keine Bewertungen

- Gujarat State Petronet LTD.: (Standalone & Consolidated) Along With The Limited Review Reports Is Enclosed HerewithDokument20 SeitenGujarat State Petronet LTD.: (Standalone & Consolidated) Along With The Limited Review Reports Is Enclosed HerewithGhano GhayalNoch keine Bewertungen

- Ar 31mar09Dokument1 SeiteAr 31mar09Nikhil RanaNoch keine Bewertungen

- Superhouse Limited: Email: Share@superhouse - in Url: HTTP://WWW - Superhouse.inDokument7 SeitenSuperhouse Limited: Email: Share@superhouse - in Url: HTTP://WWW - Superhouse.inAmrut BhattNoch keine Bewertungen

- Financially Yours - Induction 2021 - Financial StatementsDokument16 SeitenFinancially Yours - Induction 2021 - Financial StatementsSumalakshya TatabhatlaNoch keine Bewertungen

- Anx 1 Unaudited Financial Results For Quarter 30th September 2023Dokument12 SeitenAnx 1 Unaudited Financial Results For Quarter 30th September 2023ranjana.verma6Noch keine Bewertungen

- Quarterly - Report - 2q2021-Segment ReportDokument2 SeitenQuarterly - Report - 2q2021-Segment ReporthannacuteNoch keine Bewertungen

- DEA Assignment QuestionsDokument4 SeitenDEA Assignment QuestionsPranav Desai0% (1)

- DEA Assignment QuestionsDokument4 SeitenDEA Assignment QuestionsPranav Desai0% (1)

- Press I All India Council For Technical EducationDokument6 SeitenPress I All India Council For Technical EducationPranav DesaiNoch keine Bewertungen

- ErrorDokument1 SeiteErrorPranav DesaiNoch keine Bewertungen

- V Mech Rev FinalDokument30 SeitenV Mech Rev FinalPranav DesaiNoch keine Bewertungen

- Protax 2.1 Functional Overview - GTZ Revenue Administration SupportDokument23 SeitenProtax 2.1 Functional Overview - GTZ Revenue Administration SupportRaj KishoreNoch keine Bewertungen

- Auditing Arens Chapter 20Dokument30 SeitenAuditing Arens Chapter 20MARLINNoch keine Bewertungen

- Tax Alert: The Transfer Pricing Guidelines, 2020Dokument5 SeitenTax Alert: The Transfer Pricing Guidelines, 2020musaNoch keine Bewertungen

- 9347 Single CustomsDokument8 Seiten9347 Single CustomsKalpesh RathodNoch keine Bewertungen

- CUSTOMS LAW MANUAL - NotesDokument10 SeitenCUSTOMS LAW MANUAL - NotesChetanya KapoorNoch keine Bewertungen

- Heizer ComplaintDokument45 SeitenHeizer ComplaintDavid L HucksNoch keine Bewertungen

- HDD InvoiceDokument1 SeiteHDD Invoicearun rayakwarNoch keine Bewertungen

- PPT-on-GST Annual-ReturnDokument33 SeitenPPT-on-GST Annual-Returnshrutha p jainNoch keine Bewertungen

- Syllabus Ay 2021 2022 Ba 101 Taxation Income TaxationDokument16 SeitenSyllabus Ay 2021 2022 Ba 101 Taxation Income TaxationQuinnie CervantesNoch keine Bewertungen

- CastroDokument91 SeitenCastroAries SatriaNoch keine Bewertungen

- Text of RA9162Dokument18 SeitenText of RA9162Juan Luis LusongNoch keine Bewertungen

- Escaping The Fragility TrapDokument79 SeitenEscaping The Fragility TrapJose Luis Bernal MantillaNoch keine Bewertungen

- Issue 16 PDFDokument32 SeitenIssue 16 PDFThe Indian NewsNoch keine Bewertungen

- Prs Staff Retention Reward 2021Dokument57 SeitenPrs Staff Retention Reward 2021Hasan AyoubNoch keine Bewertungen

- GX Tracking The Trends 2022 DigitalDokument61 SeitenGX Tracking The Trends 2022 DigitalJuan Manuel PardalNoch keine Bewertungen

- Farooq Haque Classes: Exclusions From Syllabus of IDT of CA FinalDokument1 SeiteFarooq Haque Classes: Exclusions From Syllabus of IDT of CA FinalNikhilNoch keine Bewertungen

- Chapter 16Dokument13 SeitenChapter 16Andi Luo100% (1)

- Ola Cabs 197986805Dokument1 SeiteOla Cabs 197986805Lakshmi MuvvalaNoch keine Bewertungen

- Open Your Own Paint Your Own Pottery Studio!: A Start Up Guide and Daily Operations ManualDokument4 SeitenOpen Your Own Paint Your Own Pottery Studio!: A Start Up Guide and Daily Operations ManualContemporary Ceramic Studio Association25% (4)

- Sap Accounting EntriesDokument7 SeitenSap Accounting Entriesperera_kushan7365Noch keine Bewertungen

- Torcuator Vs Bernabe - G.R. No. 134219 - 20210705 - 223257Dokument9 SeitenTorcuator Vs Bernabe - G.R. No. 134219 - 20210705 - 223257Maria Fiona Duran MerquitaNoch keine Bewertungen

- 11 Handout 1Dokument4 Seiten11 Handout 1Jeffer Jay GubalaneNoch keine Bewertungen

- Iloilo Bottlers vs. City of IloiloDokument5 SeitenIloilo Bottlers vs. City of IloiloCeline GarciaNoch keine Bewertungen

- Pay The Bill Within One Week From The Date of Invoice To Ensure Continuity of The ServiceDokument1 SeitePay The Bill Within One Week From The Date of Invoice To Ensure Continuity of The ServiceMohammed50% (2)

- PPM 8Dokument110 SeitenPPM 8Nilima LudbeNoch keine Bewertungen

- "A Study On GST Implementation in FMCG Sector" Table of ContentsDokument49 Seiten"A Study On GST Implementation in FMCG Sector" Table of ContentsPravallika0% (2)

- Akash Flight BookingDokument3 SeitenAkash Flight BookingAkash GuptaNoch keine Bewertungen

- White Hats Strategic OverviewDokument4 SeitenWhite Hats Strategic OverviewTheWhiteHats100% (1)

- Trusts and Estates - Edmisten - Summer 2003 - 3Dokument6 SeitenTrusts and Estates - Edmisten - Summer 2003 - 3champion_egy325Noch keine Bewertungen

- Business Customer Information FormDokument3 SeitenBusiness Customer Information Formpretty mangayNoch keine Bewertungen