Beruflich Dokumente

Kultur Dokumente

Forward Thinking

Hochgeladen von

BarbaraStewartOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Forward Thinking

Hochgeladen von

BarbaraStewartCopyright:

Verfügbare Formate

18 | Tuesday, August 20, 2013

your finance

Production halted in South Africa

South Africas auto manufacturing industry came to a near standstill on Monday when about 30,000 workers downed tools, adding to the labour woes of the continents largest economy which has been hit by violent unrest at its mines.

Too often, having no investment plan is the fallback position. Investors without plans tend to be more vulnerable, which could end up being costly.

Fotolia

Forward thinking

Any investment plan is better than no plan

Barbara Stewart Special to QMI Agency

commissioned an Angus Reid survey a couple of years ago and only 15% of Canadian women said they had an investment plan in place. It seems it is one of those things that we think we should do, but we never get around to it. What comes to mind when we think of an investment plan? I have seen some pretty extensive ones that cost in the neighbourhood of $5, 000 to 10,000. They contain many colourful graphs and pages of detailed assumptions used for inputs such as inflation rate, spending rate, etc. Some of the best plans included a Monte Carlo simulation, a computer- generated analysis of a range of investment return possibilities based on a sample of more than 2,000 possible market outcomes.

Ready to get started putting this together on a Sunday afternoon? It is easy to see why no plan is too often the fallback position. But what happens if you dont have an investment plan? I have observed that investors without plans tend to be more vulnerable either to various scams or to their own emotions. They end up trading more frequently based on gut feel because they dont have a solid investment rationale for their decisions. This behaviour gets costly and it certainly isnt a great way to feel secure about your future. How about committing to a one-page document that summarizes your personal investment objectives? Here are the key components to a focused investment policy: Return requirements What is your objective for an annual average rate of return? Do you have to take money out of your portfolio for living expenses? If so, how much? Risk tolerance How would you describe your ability to take investment risks? How have you reacted in the past to market volatility? Time horizon Do you have more than 10 years to invest? Are there any events in the future that will force

you to change your investment strategy? Tax considerations Is your portfolio made up of any registered funds (for example, RSP or RIF)? Do you have any significant embedded capital gains in any of your holdings? Liquidity needs Will you need to take out a lumpsum amount of cash in the next year or so? Maybe to buy a car or do some home renovations? Legal implications Are there any restrictions on how your funds can be invested? Is your account related to a trust or an estate? Unique preferences Would you prefer to avoid particular investment sectors for environmental or any other reasons? Answering these questions at even a very basic level will provide a solid starting point for an investment plan. From there, you will be in a position to determine which assets to put in your investment portfolio and why. Whether you are investing for yourself or using an adviser, your one-page policy will help you to focus on making investments that fit your personal objectives.

Barbara Stewart, CFA, is with Cumberland Private Wealth Management Inc. Visit her website at barbarastewart.ca

Money-saving strategies for single-income families

Linda White Special to QMI Agency

Either by choice or necessity, an increasing number of Canadian families is getting by on just one salary. For some, that may be the result of a difficult job market; others are single parents and some families choose to have one parent stay home to care for children. Whatever the reason, surviving on one salary can be challenging. But by taking advantage of income tax and estate planning strategies, its possible to keep more of those hard-earned dollars in your pocket, says Myron

Knodel, director of tax and estate planning at Investors Group.

Are you selfemployed?

In a two-parent family, the sole income earner can look for opportunities to pay the non-working spouse a reasonable salary. Thats possible if youre selfemployed and your spouse directly assists you in the business, such as keeping records and looking after correspondence. A good example is a commissioned salesperson who has a lot of paperwork and scheduling, Knodel says.

Their spouse can fulfill those duties from their home. The downside is you now have to contribute to the Canada Pension Plan. That could be an additional cost but the upside is your spouse now has a salary for that year, which will add to their pension benefits under the CPP when they eventually retire, he says.

Childrens education, tax deductions, credits

Take maximum advantage of the Registered Education Savings Plan and receive a 20% Canada Education

Savings Grant. Contributing the annual maximum of $2,500 per child will generate a $500 grant and if your family income is low, you may also be eligible for additional grants and a learning bond. No matter your family situation, be sure to take advantage of deductions and credits for things such as child care expenses and fitness costs. The Universal Child Care Benefit program issues a taxable $100 monthly payment to families for each child under the age of six. In a two-income family, its automatically taxable

in the hands of the lowerincome spouse but in a single-income family you can have that benefit taxed in the hands of the child, which can provide tax savings, Knodel says.

Estate planning

Consider the creation or updating of a testamentary trust to ensure you have control over how your estate is passed on to your children. Likewise, there are benefits to having any inheritance you expect to receive left within a testamentary trust to you and your children because the income earned by the trust can be allocated

and taxed in the hands of the kids, Knodel explains. Contributing to a Registered Retirement Savings Plan requires a plan to pass on this major asset in the event of death and there can be substantial benefits to having a minor dependent child designated as beneficiary. As part of any estate plan, life and disability insurance needs to be considered, even where you have a spouse not working outside the home because their absence could result in additional costs to you and your family in the event of their death or disability, Knodel says.

Das könnte Ihnen auch gefallen

- World Financial Group PresentationDokument8 SeitenWorld Financial Group PresentationThe Rostie Group50% (2)

- Tax Strategies for High Net-Worth Individuals: Save Money. Invest. Reduce Taxes.Von EverandTax Strategies for High Net-Worth Individuals: Save Money. Invest. Reduce Taxes.Bewertung: 5 von 5 Sternen5/5 (1)

- Ten Money Mistakes That Are Keeping You PoorDokument5 SeitenTen Money Mistakes That Are Keeping You PoorMistellahNoch keine Bewertungen

- The Financial Planning Pyramid: Securing Your Financial FutureDokument6 SeitenThe Financial Planning Pyramid: Securing Your Financial FutureDaniel BothaNoch keine Bewertungen

- AP9 PRCDokument252 SeitenAP9 PRCDRAVIDA SANKSHEMA SANGHAM100% (1)

- Project On BancassuranceDokument83 SeitenProject On Bancassurancepriya_1234563236996% (26)

- Account Closure/ Fixed Deposit Premature Withdrawal FormDokument1 SeiteAccount Closure/ Fixed Deposit Premature Withdrawal Formrony1346100% (1)

- Finals Quiz 1 Dealings in Properties Answer KeyDokument6 SeitenFinals Quiz 1 Dealings in Properties Answer KeyMjhaye100% (1)

- Case 10 - Timing Is EverythingDokument6 SeitenCase 10 - Timing Is EverythingMariaAngelicaMargenApe100% (1)

- MMPE08Dokument21 SeitenMMPE08Joshua CornitoNoch keine Bewertungen

- First Steps in Financial PlanningDokument4 SeitenFirst Steps in Financial PlanningMoraesCassidyGroupNoch keine Bewertungen

- Personal Finance Is The Application of The Principles ofDokument14 SeitenPersonal Finance Is The Application of The Principles ofsharmila09byteNoch keine Bewertungen

- 7 Smart Financial Steps To Take in 2016Dokument14 Seiten7 Smart Financial Steps To Take in 2016efsdfsdafsdNoch keine Bewertungen

- What Is Personal FinanceDokument16 SeitenWhat Is Personal Financesirjagz0611Noch keine Bewertungen

- Calculating Your Financial Ratios: U C C E S SDokument4 SeitenCalculating Your Financial Ratios: U C C E S SPhil_OrwigNoch keine Bewertungen

- Tax Planning 0611Dokument2 SeitenTax Planning 0611GLSTaxAdviceUKNoch keine Bewertungen

- Financially Fit PersonDokument8 SeitenFinancially Fit PersonMoises Von Rosauro De Gracia100% (1)

- Esmart Money April 2013Dokument15 SeitenEsmart Money April 2013Company CheckNoch keine Bewertungen

- June 2014: Top 10 Tax Breaks You'll Miss in 2014Dokument4 SeitenJune 2014: Top 10 Tax Breaks You'll Miss in 2014Income Solutions Wealth ManagementNoch keine Bewertungen

- Moneysprite MoneyView SPR '14Dokument4 SeitenMoneysprite MoneyView SPR '14MoneyspriteNoch keine Bewertungen

- WealthCreation Financial PlanningDokument36 SeitenWealthCreation Financial PlanningcoerenciaceNoch keine Bewertungen

- Research Report Financial PlanningDokument43 SeitenResearch Report Financial PlanningManasi KalgutkarNoch keine Bewertungen

- Saving For CollegeDokument2 SeitenSaving For CollegeBeth SimsNoch keine Bewertungen

- RESP Child EducationDokument7 SeitenRESP Child Educationzamai123Noch keine Bewertungen

- Making Money Work For YouDokument20 SeitenMaking Money Work For YouAnthony Diaz GNoch keine Bewertungen

- Chapter 2 4 IntlDokument5 SeitenChapter 2 4 IntlChris FloresNoch keine Bewertungen

- Edit File 2 Reflective Report On Financial Risk ManagementDokument27 SeitenEdit File 2 Reflective Report On Financial Risk Managementmyservices 786Noch keine Bewertungen

- Overview of Financial Plan: Lesson 1: FIN101Dokument17 SeitenOverview of Financial Plan: Lesson 1: FIN101Antonette HugoNoch keine Bewertungen

- What Is Generational Wealth and How Do You Build It PDFDokument4 SeitenWhat Is Generational Wealth and How Do You Build It PDFJunior Mebude SimbaNoch keine Bewertungen

- How To Start A Hedge Fund and Why You Probably ShouldntDokument20 SeitenHow To Start A Hedge Fund and Why You Probably ShouldntJohn ReedNoch keine Bewertungen

- Financial LiteracyDokument8 SeitenFinancial LiteracyLyzette Joy CariagaNoch keine Bewertungen

- The 5-Minute 401 (K) Investment Plan - DecDokument5 SeitenThe 5-Minute 401 (K) Investment Plan - DecprodeepmNoch keine Bewertungen

- Financial Literacy and Preparedness: Claire C. Imperial Nicole I. Encinas Michael D. Paitan Angielyn A. CubillasDokument37 SeitenFinancial Literacy and Preparedness: Claire C. Imperial Nicole I. Encinas Michael D. Paitan Angielyn A. CubillasMichael Data Paitan100% (4)

- Financial Literacy: BudgetingDokument7 SeitenFinancial Literacy: BudgetingJazlyn CalilungNoch keine Bewertungen

- Wealth Management and Alternate Investments: Term Project Phase-1Dokument13 SeitenWealth Management and Alternate Investments: Term Project Phase-1priti GuptaNoch keine Bewertungen

- Personal: As Much Tax As PossibleDokument3 SeitenPersonal: As Much Tax As PossibleSathi SaranNoch keine Bewertungen

- Top 10 Ways To Prepare For RetirementDokument6 SeitenTop 10 Ways To Prepare For RetirementAniketNoch keine Bewertungen

- Are You Ready For Retirement?Dokument3 SeitenAre You Ready For Retirement?Enterprising Rural Families: Making it WorkNoch keine Bewertungen

- Series 4 5Dokument7 SeitenSeries 4 5Jessica ClareNoch keine Bewertungen

- The Flame - November 2013 EditionDokument2 SeitenThe Flame - November 2013 EditionLBSaccountingNoch keine Bewertungen

- Retirement & Estate Planning 2019Dokument12 SeitenRetirement & Estate Planning 2019Darlyn Reddy50% (2)

- Retirement Planning For Women: ING Special ReportDokument4 SeitenRetirement Planning For Women: ING Special Reportiyer_anusha81Noch keine Bewertungen

- Automatic Passive Income - How the Best Dividend Stocks Can Generate Passive Income for Wealth Building.Von EverandAutomatic Passive Income - How the Best Dividend Stocks Can Generate Passive Income for Wealth Building.Bewertung: 3.5 von 5 Sternen3.5/5 (3)

- Moral Education: Saving in Banks-Banks Typically Allow The Saver To Put Money Into The Scheme Which IsDokument2 SeitenMoral Education: Saving in Banks-Banks Typically Allow The Saver To Put Money Into The Scheme Which IsJana TaboadaNoch keine Bewertungen

- FP Group WorkDokument12 SeitenFP Group WorkStellina JoeshibaNoch keine Bewertungen

- Retirement Planning With AnnuitiesDokument11 SeitenRetirement Planning With Annuitiesapi-246909910Noch keine Bewertungen

- The Cost of WaitingDokument2 SeitenThe Cost of Waitingmirando93Noch keine Bewertungen

- The Frugal Habits of MillionairesDokument4 SeitenThe Frugal Habits of MillionairesJanet BarrNoch keine Bewertungen

- Financial Planning: I Need A Plan?Dokument6 SeitenFinancial Planning: I Need A Plan?Karim Boupalmier100% (1)

- Pivotal Planning Winter Addition NewsletterDokument7 SeitenPivotal Planning Winter Addition NewsletterAnthony WrightNoch keine Bewertungen

- Financial Literacy IntroDokument2 SeitenFinancial Literacy IntroManali TakkarNoch keine Bewertungen

- The Process and Practice of Personal Financial Planning: FocusDokument16 SeitenThe Process and Practice of Personal Financial Planning: FocusApeuDerropNoch keine Bewertungen

- 5 Critical Financial Planning TipsDokument2 Seiten5 Critical Financial Planning Tipsjojo laygoNoch keine Bewertungen

- A Fighting Chance: The High School Finance Education Everyone DeservesVon EverandA Fighting Chance: The High School Finance Education Everyone DeservesNoch keine Bewertungen

- Financial PlanningDokument3 SeitenFinancial PlanningAll AccessNoch keine Bewertungen

- Finance Your Future: 6 Things Every Newbie Investor Should DoDokument4 SeitenFinance Your Future: 6 Things Every Newbie Investor Should DoBakhshish SinghNoch keine Bewertungen

- Pivotal Planning Winter Addition NewsletterDokument7 SeitenPivotal Planning Winter Addition NewsletterAnthony WrightNoch keine Bewertungen

- Napkin Finance: Build Your Wealth in 30 Seconds or LessVon EverandNapkin Finance: Build Your Wealth in 30 Seconds or LessBewertung: 3 von 5 Sternen3/5 (3)

- Microfinance Note 1Dokument12 SeitenMicrofinance Note 1Vandi GbetuwaNoch keine Bewertungen

- Why Most Investors FailDokument2 SeitenWhy Most Investors FailINoch keine Bewertungen

- Life Experiences Can Be ValuableDokument1 SeiteLife Experiences Can Be ValuableBarbaraStewartNoch keine Bewertungen

- Dont Forget To Have Fun While You Make MoneyDokument1 SeiteDont Forget To Have Fun While You Make MoneyBarbaraStewartNoch keine Bewertungen

- Technology Changes How We Learn About FinanceDokument1 SeiteTechnology Changes How We Learn About FinanceBarbaraStewartNoch keine Bewertungen

- Fathers Financial Advice and WisdomDokument1 SeiteFathers Financial Advice and WisdomBarbaraStewartNoch keine Bewertungen

- Saving Your Family World and Soul 24TORDokument1 SeiteSaving Your Family World and Soul 24TORBarbaraStewartNoch keine Bewertungen

- Why You Should Look Inside Your RRSP 24TORDokument1 SeiteWhy You Should Look Inside Your RRSP 24TORBarbaraStewartNoch keine Bewertungen

- Foreign Investment Real Property Tax Act (FIRPTA)Dokument1 SeiteForeign Investment Real Property Tax Act (FIRPTA)book15wormNoch keine Bewertungen

- Bank of Boroda RajibDokument131 SeitenBank of Boroda Rajibutpalbagchi100% (5)

- Third Party Verification of Results - CabridgeDokument2 SeitenThird Party Verification of Results - CabridgeAhdgNoch keine Bewertungen

- Engineering Economy - Chapter 4Dokument37 SeitenEngineering Economy - Chapter 4Khánh Đoan Lê ĐìnhNoch keine Bewertungen

- Rtgs Format For HDFCDokument1 SeiteRtgs Format For HDFCDeepak Gupta50% (2)

- Appendix QuestionnaireDokument3 SeitenAppendix QuestionnaireDipesh KumarNoch keine Bewertungen

- Gold BeESDokument17 SeitenGold BeESNeha SureshNoch keine Bewertungen

- Commissioner of Internal Revenue vs. Goodyear Philippines, Inc.Dokument2 SeitenCommissioner of Internal Revenue vs. Goodyear Philippines, Inc.JoieNoch keine Bewertungen

- ONDK BAML TMT Conf FINAL 060315Dokument33 SeitenONDK BAML TMT Conf FINAL 060315Yves-donald MakoumbouNoch keine Bewertungen

- Nike Case AnalysisDokument9 SeitenNike Case AnalysisFami FamzNoch keine Bewertungen

- Credit Risk Analytics: Exposure at DefaultDokument10 SeitenCredit Risk Analytics: Exposure at DefaultNasim AkhtarNoch keine Bewertungen

- Chapter 1 The Securities Contract Regulation Act 1956 and The Securities Contract Regulation Rules 1957Dokument42 SeitenChapter 1 The Securities Contract Regulation Act 1956 and The Securities Contract Regulation Rules 1957Pragalbh Bhardwaj100% (1)

- 2018 SEC Form AuF 002 Renewal Auditing FirmDokument2 Seiten2018 SEC Form AuF 002 Renewal Auditing FirmLet it be100% (1)

- CBDT E-Payment Request FormDokument1 SeiteCBDT E-Payment Request FormAlicia Barnes67% (21)

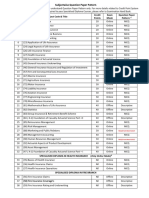

- Details of Subjectwise Question Paper PatternDokument2 SeitenDetails of Subjectwise Question Paper PatternRamalingam Chandrasekharan100% (1)

- US Bank - v-Burrage-QT Complaint 10-09-2019Dokument59 SeitenUS Bank - v-Burrage-QT Complaint 10-09-2019RussinatorNoch keine Bewertungen

- Instructions: 1. All Questions Are Compulsory 2. Calculators Are Allowed I. Answer The Following QuestionsDokument2 SeitenInstructions: 1. All Questions Are Compulsory 2. Calculators Are Allowed I. Answer The Following QuestionsanushaNoch keine Bewertungen

- Bangalore Realty: Tips For The People Who Wanna Buy Land Near International AirportDokument5 SeitenBangalore Realty: Tips For The People Who Wanna Buy Land Near International AirportAnonymous WokAmg4jNoch keine Bewertungen

- Lease Acctg ExerciseDokument12 SeitenLease Acctg ExerciseIts meh SushiNoch keine Bewertungen

- Arizona Durable Power of Attorney Form PDFDokument2 SeitenArizona Durable Power of Attorney Form PDFmax midas100% (1)

- Books and MoviesDokument4 SeitenBooks and MoviespushpabhabuaNoch keine Bewertungen

- CIR V Negros ConsolidatedDokument2 SeitenCIR V Negros ConsolidatedVerchelleNoch keine Bewertungen

- Bar Q & A (Civil Law, 2013-2015)Dokument39 SeitenBar Q & A (Civil Law, 2013-2015)Jopito Agualada100% (1)

- JL Bernardo Construction Vs CADokument2 SeitenJL Bernardo Construction Vs CAMaricar Corina CanayaNoch keine Bewertungen

- Standing Instructions FormatDokument5 SeitenStanding Instructions Formatdidi_suprayogi100% (1)