Beruflich Dokumente

Kultur Dokumente

Queuing Kiosk RFP

Hochgeladen von

raven_3023Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

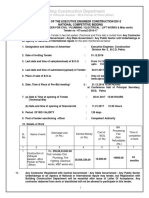

Queuing Kiosk RFP

Hochgeladen von

raven_3023Copyright:

Verfügbare Formate

Visitor Management/Customer Queuing System Interactive queuing kiosk solution and customer flow management This refers in general

to an interactive customer queuing process integrated with a signage system to efficiently handle, monitor and enhance customers on-site banking experience. Benefits: First in first out customer service excluding priority lane customers Alternative advertising and branding solution Reduce customer perceived wait-time with entertaining and informative targeted communications at the kiosks and displays. Experience to remember ease of transaction on the part of the client Better means to attract attention of next customer Increase work efficiency, reduce workload Utilize and leverage front-liner experience in customer service Serve as a channel to manage standard questions about a service (ex. required documents), reducing customer flow to counters to ask for pre-service information, and improving communication efficiency between the Bank and the customer. Printing of complete transaction details in ticket can serve as additional measure to decrease percentage of mistake made by a user when selecting the service.

KIOSK with TOUCHSCREEN Kiosk totem design shall be based on PBCom standards (standee, screen colors, etc.) SYSTEM COMPONENTS: Touchscreen totem to select service & print ticket o Touchscreen kiosk service selection unit o Thermal printer printed ticket dispensing unit Wall/Ceiling queuing display units flat panel (plasma/LCD/LED) monitor, with split screen/visualization displaying queue number progression (easily viewable by customers in waiting area), active counters servicing (with tickets being served by the counter/service data) and infotainment contents like advertisements, rates, RSS feeds, greetings. Server for queuing software, media, network management, monitoring & reporting modules. o This can be onsite or remotely accessed by the branch. o If possible, existing branch units may be utilized. Counter console browser based access, no workstation installation required. Queuing software system software to manage service queues. See KIOSK SPECS document for details on services and screen progression for queuing management. QUEUING MANAGEMENT SOFTWARE should offer: Good quality graphic interface. Ease of use. Remote voicecall system between counter and customer (if available) software triggering sound announcement for ticket number being called and which counter should client go to. Can run for long periods of time without crashing or rebooting. Integrated with content delivery and management system for additional content displays in the kiosk and signage system, with remote access/update feature. Web terminals for internal users servicing the client: Browser-based interface to server software. No hardware/software installation in branch workstations.

COMPONENTS: Back office system for administrator, content management, monitoring and reportorial functions. o Used primarily to generate the services displayed on the kiosks, counter assignments, and data gathering for statistics/reportorial requirements. o Branch kiosk management Allow remote control of kiosks and displays or centralized management of multi-branch multi-kiosks and displays, including monitoring, reporting management and control of terminals. Remote update, monitoring and management with upload features With end-of-day/backup/restore/initialization facilities. o Allow editing of details that will be printed in the ticket such as required documents for the service, reminders or announcements. THERMAL PRINTER - Print ticket with the ff. primary details: Logo and bank name Date and time Queue number (prominently printed) Accountholders signature portion (for Withdrawals/Encashments & Fund Transfers) Facility to add print details, should the Bank require the ff. in the future: Service/s selected o Service listing only OR o Service, amount, no. of checks (Once available) Average waiting time Customized message at bottom Required forms/documents for the transaction/s o Allow display of cut-offs and prioritization for queued transactions with cutoff periods (display in queuing kiosk, queue announcement screen/display unit, and bank user terminals). o Allow display of teller counters and queue numbers being serviced (max. up to 5). o Allow editing and publishing in branch display unit. Video or static advertisement displays Specialized greetings/announcements News ticker News via RSS feeds TV channel via streaming In case of simultaneous pick-up in queue sequence, display queue number for 7 seconds before displaying next queue number. If idle, keep last number serviced on display. o Services management customizable Allow creation & editing of services displayed in the kiosk, including optimization of sorting for a required service/transaction. Allow display of cut-off period for transactions with scheduled cutoffs (display in queuing kiosk, queue announcement screen/display unit, and bank user terminals). Categorized services (see Excel worksheet) Supports multiple networked ticketers. Allow display of additional requirements for selected service, ex. check deposit: customer should ensure check details (bank, check no., amount) are listed in the deposit slip. Allow queue system to copy/integrate account number and amount details encoded in the kiosk, to front-end tellering systems transaction screen. Possibility to upgrade system to integrate check reader/scanner, card reader (magnetic stripe or chip-based cards), barcode reader utilities.

Reporting suite

Provide service & (customer) wait statistics. Alert system in case branch level of service quality falls below minimum standards (statistical analysis) i.e. turnaround time, queue waits. Kiosk usage statistics: Generate daily or on-demand activity report per individual/branch/bankwide or per transaction type, over a single day or period of time. This can also be used to identify which content works or not. Statistics: Offer capability to use statistical forms to analyze customer flow and branch personnel performance. Duplications: Offer capability to generate reports of duplicate transactions (same acct no., amount, & other details on a given day). Allow remote bankwide consolidation/batch sending of statistics. Provide real time monitoring of system & hardware status. Hardware monitoring system including alerts for low supplies (thermal paper, ink) or hardware problems (counters/queue series & display out of sync, disconnection from display feed, etc.). Send/generate error reports for system problem management. Should have system and hardware health monitoring tools.

Back office system for counter service management: o User authentication and authorization username, password and counter assignment. Access rights may be set up in a complex system. Functions: Login, profile management (admin function), change password, change counter, service selection, session management, customer queue. o

Counter service management

Allow sorting and management of transaction flow queue assignment, detail qualification, opening and closing of tickets. This would enable flexibility in queue selection for transactions with cutoff schedules. Allow sorting of queue per transaction type (for cut-off process management). Possibility for real-time checking of queue status at counter/s from any web console. Capability to transfer all/some transaction to another counter (queued to that counter, as next for processing). Allow assigning of service tickets to counter users. Counter user can identify queue as completed but still displayed as being serviced, in case other transactions w/o queue numbers (special transactions) are being serviced. A counter user/ teller can add non-queued transactions in this system in order to process priority transactions and update productivity measures (special transactions). Non-queued transactions need not be included in queue display monitor (client display). Features: Display queue Call or recall a number Prioritize a number Cancel a number

Transfer service Suspend counter service Show total number of queue/customers waiting in line, including transaction subtype (or type, if no subtype defined) Add non-queued transactions (special/priority)

Queue Management

Queue data can either be immediately copied and pasted from queue terminal to core banking system, allowing simple interface/integration with the core banking system, immediately displaying in the front-end tellering transaction screen, the customerentered details (primarily the account number and amount), upon pick-up of queue number. In case of simultaneous pick-up in queue sequence, display queue number for 7-10 seconds before displaying next queue number. If idle, keep last number serviced on display. Allow counter user to display/call queue number again in case client has not proceeded to the counter, after which display latest queue number picked up by counter users.

Front-office customer/user interface: Touchscreen interface for user selections, with provision of virtual keyboard when needed. Consider inclusion of option for customer to cancel a service or whole ticket number. Security o Front-end/non-admin locked to specific user interface. No other features of the software should be accessible for non-admin profiles/set-up. o Disallow front-end user from accessing desktop, program or file system. o Virtual/actual keyboard disable special keys/keystroke sequences. o Browser-based interface: menus must be disabled do not allow manual access to URLs except for kiosk system (i.e. hide address bar) Block non-kiosk domains/pages or initiate browser lockdown when accessing the kiosk

PROCESS FLOW 1. Customer selects service item/s, enters details. 2. Customer gets number from ticketer. Number is included in queue. 3. Teller selects transaction queue number for processing. a. Queue number being serviced displayed in wall unit together with counter number of servicing teller. b. Number being serviced will also be displayed in counter displays. 4. Teller opens transaction screen in BDS, clicks on selected queue, with details being automatically copied to the tellering transaction screen, then performs standard validation for withdrawals, check deposits, etc. 5. If transaction cannot be processed by teller, teller can transfer queue sequence to another teller for fulfillment via queuing system. 6. A queue number can be cancelled/suspended if client is not around. 7. Counter service can be suspended by a teller during break or while servicing non-queued transactions.

Complex kiosk variation

Financial services kiosk multi-function financial self-service kiosks for stand-alone customer servicing. Services offered may require integration with core banking system: Passbook Updating requires passbook printing function Checkbook Reorder Account snapshot/mini-statement Envelope deposits o Cash * May utilize check scanners/readers and check imaging systems to capture check details and deposit totals o On-us checks o Checks o Late checks o Post-dated checks Bills payment requires PIN security/authentication for debit account funding. May be interfaced with ATM system or not. ATM Cash withdrawal Requires card swipe terminals to read ATM data and retrieve account details. May be interfaced with ATM system or not. Integration of a check reader/scanner, card reader (magnetic stripe or chip-based cards), barcode reader for automatic display/selection of accounts/check details for transactions.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- SMMA Contract ExampleDokument4 SeitenSMMA Contract ExampleFranco Lopez100% (5)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Printer Test v3.1cDokument8 SeitenPrinter Test v3.1cIsis Diaz75% (4)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- AJSPR 10.a-R LGD PDFDokument304 SeitenAJSPR 10.a-R LGD PDFAdaNoch keine Bewertungen

- Building Construction Department: Construction of Vidhayak Awasan - MLA Parisar at Patna (Bihar)Dokument3 SeitenBuilding Construction Department: Construction of Vidhayak Awasan - MLA Parisar at Patna (Bihar)PERVEZ AHMAD KHANNoch keine Bewertungen

- SpeedTouch™ ST 585 CLI GuideDokument682 SeitenSpeedTouch™ ST 585 CLI GuidesertuxNoch keine Bewertungen

- UNIXXDokument2 SeitenUNIXXAngelino Gutierrez JhonnyNoch keine Bewertungen

- Node With MysqlDokument26 SeitenNode With MysqlmahiNoch keine Bewertungen

- Emp Cli User GuideDokument162 SeitenEmp Cli User GuideJaime ColvatelNoch keine Bewertungen

- Msa 4th Edition PDFDokument2 SeitenMsa 4th Edition PDFSenthil KumarNoch keine Bewertungen

- Wonderware Factorysuite SQL Access Manager: User'S GuideDokument63 SeitenWonderware Factorysuite SQL Access Manager: User'S GuideHoang ManhNoch keine Bewertungen

- Le Protocole MGCPDokument40 SeitenLe Protocole MGCPikhlasNoch keine Bewertungen

- Ijrar 37Dokument84 SeitenIjrar 37Aryan MauryaNoch keine Bewertungen

- SSS Member Loan Application FormDokument41 SeitenSSS Member Loan Application FormRosie Marfe100% (1)

- V Virtua L Con Nect F Flexfabbric C Cookboook: P F Part Number C02 First Edition Nov 2616817 Vember 2010Dokument147 SeitenV Virtua L Con Nect F Flexfabbric C Cookboook: P F Part Number C02 First Edition Nov 2616817 Vember 2010Михаил РутковскийNoch keine Bewertungen

- Understanding Crowdsourcing Effects of Motivation and Rewards On Participation and Performance in Voluntary Online ActivitiesDokument226 SeitenUnderstanding Crowdsourcing Effects of Motivation and Rewards On Participation and Performance in Voluntary Online Activities"150" - Rete socialeNoch keine Bewertungen

- Cellphone Ban During School TimeDokument4 SeitenCellphone Ban During School TimeDmytro KarlashNoch keine Bewertungen

- New Text DocumentDokument236 SeitenNew Text DocumentAlexandru Daniel SimionNoch keine Bewertungen

- #ThisIsNotArt BlurbDokument7 Seiten#ThisIsNotArt BlurbcarolinaNoch keine Bewertungen

- CF Lecture 10 - Email ForensicsDokument55 SeitenCF Lecture 10 - Email ForensicsFaisal ShahzadNoch keine Bewertungen

- Seco Products GuideDokument68 SeitenSeco Products GuidebabichemNoch keine Bewertungen

- RS-232/485/422 Communication ControllerDokument13 SeitenRS-232/485/422 Communication ControllerLuckyboybk FCNoch keine Bewertungen

- IVI 2032 Asd Essential 8 WP - A4Dokument13 SeitenIVI 2032 Asd Essential 8 WP - A4Andrew HNoch keine Bewertungen

- HMS Anybus X Fieldbus Gateway CC Link Slave Profibus DP Master AB7810Dokument1 SeiteHMS Anybus X Fieldbus Gateway CC Link Slave Profibus DP Master AB7810avinash14 neereNoch keine Bewertungen

- 5tzr6h HR h555Dokument11 Seiten5tzr6h HR h555jackkerouacZagrebNoch keine Bewertungen

- Ivideon Web SDKDokument24 SeitenIvideon Web SDKintegrationtestresideo01Noch keine Bewertungen

- Sitecore Developers CookbookDokument52 SeitenSitecore Developers CookbookKiran Kumar PNoch keine Bewertungen

- Q1:Fill in The Blanks: (4) : Dare-R-Arqam School, Model Town Extension Final Exam, 2018 Computer Paper of Class 4Dokument2 SeitenQ1:Fill in The Blanks: (4) : Dare-R-Arqam School, Model Town Extension Final Exam, 2018 Computer Paper of Class 4Huma JabeenNoch keine Bewertungen

- The Role of Kpis and Metrics in Digital Marketing: January 2019Dokument7 SeitenThe Role of Kpis and Metrics in Digital Marketing: January 2019Nora MedalyNoch keine Bewertungen

- DefCon 22 WCTF Helpful HintsDokument46 SeitenDefCon 22 WCTF Helpful Hintsscribdart2100% (2)

- Amazon Case StudyDokument19 SeitenAmazon Case StudyAdnan KhanNoch keine Bewertungen