Beruflich Dokumente

Kultur Dokumente

Department of Labor: UC-20

Hochgeladen von

USA_DepartmentOfLaborCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Department of Labor: UC-20

Hochgeladen von

USA_DepartmentOfLaborCopyright:

Verfügbare Formate

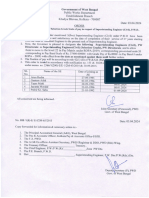

HAVE A QUESTION?

WHO TO CALL

State of Connecticut – Department of Labor

Unemployment Compensation Tax Division

www.ctdol.state.ct.us/uitax/txmenu.htm

Topic Write Call Fax

. Registration of employer for unemployment tax reporting

. Determination of liability of employers

. Status of employers (new employer, successor)

. Change of address, status Department of Labor

. Discontinue/release of liability for registered employers Employer Status Unit (860) 263-6550 (860) 263-6567

. Changes in payment options (Tax or Benefit Reimbursing) 200 Folly Brook Blvd.

. Interpretation of Unemployment laws and regulations Wethersfield, CT 06109

. Joint and Unit accounts of commonly controlled entities

. Requests for partial transfers of Merit Rating experience

. Clearance Statements for corporations concerning status

with the Secretary of the State

. Employer contribution rates – Form UC-54A

. Employer charges (taxable) – Form UC-54Q Department of Labor

. Employer protests – Form UC-280 Merit Rating Unit (860) 263-6705 (860) 263-6723

. Employer appeals – Form UC 56-KC 200 Folly Brook Blvd.

Wethersfield, CT 06109

. 940 re-certifications for the IRS

. Credit Statements and Refunds – Form UC116 Department of Labor

. Employer Contribution Return during the next Cashiers Unit (860) 263-6470 (860) 263-6398

4 calendar quarters 200 Folly Brook Blvd.

. Correction returns – Forms UC-2 (Corr); Conn. UC5A (Corr.) Wethersfield, CT 06109

. Bankruptcies

. Liens: Personal Property; Real Estate; Garnishment;

Release of Liens

. Missing quarterly tax returns

. Collection issues: Balance due, Plans of Payment; Department of Labor

Waiver of Penalty Delinquent Accounts Unit (860) 263-6185 (860) 263-6379

. Tax Warrants 200 Folly Brook Blvd.

. Estimated Assessments Wethersfield, CT 06109

. Notice to File (UC-14)

. Statement of Account (UC-11)

. Billing statement (UC-116)

Telephone Area Offices

. General questions of UC Tax law Department of Labor Bridgeport (203) 455-2725

. Definition of wages Field Audit Unit Danbury (203) 797-4148

. Definition of an employee 200 Folly Brook Blvd. Enfield (860) 741-4285

. Special bond assessment Wethersfield, CT 06109 Hamden (203) 859-3325

Hartford (860) 256-3725

Middletown (860) 754-5130

New Britain (860) 827-7063

New London (860) 439-7550

Norwich (860) 859-5700

Torrington (860) 626-6221

Waterbury (203) 437-3400

Willimantic (860) 423-2689

. Quarterly Filing of Wage & Tax Information

via the Internet (UC-5A/UC-2) Internet, Magnetic & Paper Filing

(860) 263-6375

. Magnetic Filing of Wage & Tax Information Department of Labor

Who must file magneticially? Tax Automation & Wage

Registering to file magnetically Processing Unit (860) 263-6379

Specifications for filing magnetically 200 Folly Brook Blvd. (Fax)

Mailing address for magnetic media submissions Wethersfield, CT 06109

. Paper Filing of Wage Information (UC-5A)

Specifications & format requirements

Correction of Social Security Numbers

Correction of quarterly returns

UC-20 (Rev 8/07)

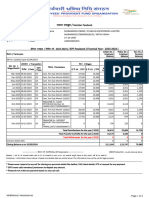

Taxable Employer’s Mailings Calendar

When What Why

March

First Friday Statement of Experience Account and Provides taxable employers a transcript of

New Contribution Rate (Form UC-54A) experience account data used to compute

current year contribution rate

Last Week Employee Quarterly Earnings Report/

Employer Contribution Return To report quarterly employee wages and

Form UC-5A/UC-2 Pay UC taxes

June Employee Quarterly Earnings Report/ To report quarterly employee wages and

Last Week Employer Contribution Return Pay UC taxes

Form UC-5A/UC-2

September Employee Quarterly Earnings Report/ To report quarterly employee wages and

Last Week Employer Contribution Return Pay UC taxes

Form UC-5A/UC-2

December Employee Quarterly Earnings Report/ To report quarterly employee wages and

Last Week Employer Contribution Return Pay UC taxes

Form UC-5A/UC-2

Informs base period employers of an award

of benefits and potential charges to their

Notice of Potential Liability Form UC-280 experience accounts. Affords employer

the opportunity to protest the charging of

benefits to their account.

Notice to Employer of Approval of Claim Notice of an award of benefits to non-base

Weekly/Daily For Benefits (Form UC-56KC) period separating employer, or to a base-

period employer involved in a hearing

resulting from a subsequent separation or

other issue not previously covered by Form

UC-280

Billing Statement – Credit Statement To notify employer of a new delinquent

Form UC-116 balance or a credit balance

Periodic statement of charges Mailed to each taxable employer IF

Form UC-54Q charges have occurred since previous

Quarterly statement. Reports the names, SS Nos.,

weeks for which benefits have been paid,

and the amount chargeable to the

employer’s experience account.

Statement of Account Form UC-11 To notify employer of any tax

delinquency.

Notice to File Employer Contribution Sent to employers who fail to file current

Return Form UC-14 quarterly tax returns.

Das könnte Ihnen auch gefallen

- Affdavit of Loss Passport SampleDokument1 SeiteAffdavit of Loss Passport Samplemorningmindset90% (10)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- July Pay Stub - STEWART SANDRA LDokument1 SeiteJuly Pay Stub - STEWART SANDRA LjamesNoch keine Bewertungen

- Accounting Clerk Exam - Answer KeyDokument5 SeitenAccounting Clerk Exam - Answer KeyErwin Dave M. DahaoNoch keine Bewertungen

- 2023 UAW LM2sDokument767 Seiten2023 UAW LM2sLaborUnionNews.comNoch keine Bewertungen

- Power of Attorney - SPA - To Process VOS of Landholding Under CARP - Long FormDokument4 SeitenPower of Attorney - SPA - To Process VOS of Landholding Under CARP - Long FormMGVMon0% (1)

- G.R. No. L-5953 February 24, 1912 ANTONIO M. PABALAN, Plaintiff-Appellant, vs. FELICIANO VELEZ, DefendantDokument3 SeitenG.R. No. L-5953 February 24, 1912 ANTONIO M. PABALAN, Plaintiff-Appellant, vs. FELICIANO VELEZ, DefendantMaceda KadatuanNoch keine Bewertungen

- Settlement Deed-Rajavel-FinalDokument6 SeitenSettlement Deed-Rajavel-FinalNaren K100% (1)

- C1304 Home Health Care Services Monthly Summary: Worker DetailsDokument1 SeiteC1304 Home Health Care Services Monthly Summary: Worker DetailsDawn CasuncadNoch keine Bewertungen

- Bills List For 8-11-10Dokument5 SeitenBills List For 8-11-10Ewing Township, NJNoch keine Bewertungen

- PopipDokument2 SeitenPopipRaj Kumar KNoch keine Bewertungen

- November 2020 DOL Letter To LoloeeDokument4 SeitenNovember 2020 DOL Letter To LoloeeKristin LamNoch keine Bewertungen

- Munna KhanDokument4 SeitenMunna Khanpocox5inNoch keine Bewertungen

- Tel No.:033-24239659/9651 FAX No.:033-24239652/53 WebDokument18 SeitenTel No.:033-24239659/9651 FAX No.:033-24239652/53 WebSanjay SatyajitNoch keine Bewertungen

- Example Company (Pty) LTD: Cashbook TransactionsDokument8 SeitenExample Company (Pty) LTD: Cashbook TransactionsShakkuNoch keine Bewertungen

- GovAcc CompreDokument15 SeitenGovAcc CompreShane ClarosNoch keine Bewertungen

- Salary Slip MainDokument1 SeiteSalary Slip MainAnujith K BabuNoch keine Bewertungen

- COI Narinder Bhatia 22-23Dokument5 SeitenCOI Narinder Bhatia 22-23Ashwani KumarNoch keine Bewertungen

- Please Pay This AmountDokument1 SeitePlease Pay This AmountAndrei CustodioNoch keine Bewertungen

- Statement of ComplianceDokument1 SeiteStatement of ComplianceAhmed IbrahimNoch keine Bewertungen

- Business Department Fee StructureDokument1 SeiteBusiness Department Fee StructureElisha MainaNoch keine Bewertungen

- TurboTax Print Preview 02-14-2013T20.10.08.460Dokument13 SeitenTurboTax Print Preview 02-14-2013T20.10.08.460glenncannon1973Noch keine Bewertungen

- Work Sheet 4A2Dokument1 SeiteWork Sheet 4A2SohailAKramNoch keine Bewertungen

- Amx001 - Statement (October 15 2019)Dokument1 SeiteAmx001 - Statement (October 15 2019)usmanNoch keine Bewertungen

- Pybom00462390000015305 2023Dokument2 SeitenPybom00462390000015305 2023lalitasabar883Noch keine Bewertungen

- COI AY 22-23 Narinder BhatiaDokument4 SeitenCOI AY 22-23 Narinder BhatiaAshwani KumarNoch keine Bewertungen

- Budget of Expenditures and Resources Financing F.Y. 2021: Barangay Samput Municipality of Paniqui Province of TarlacDokument4 SeitenBudget of Expenditures and Resources Financing F.Y. 2021: Barangay Samput Municipality of Paniqui Province of TarlacBarangay SamputNoch keine Bewertungen

- Programmed Appropriation by Ppa, Expense Class, Object of Expenditure and Expected Result, Fy 2021Dokument3 SeitenProgrammed Appropriation by Ppa, Expense Class, Object of Expenditure and Expected Result, Fy 2021Barangay SamputNoch keine Bewertungen

- Amount of Tax WithheldDokument1 SeiteAmount of Tax WithheldMelody Frac ZapateroNoch keine Bewertungen

- MTC - Fhwa - Fy09 - Funding ObligationsDokument84 SeitenMTC - Fhwa - Fy09 - Funding ObligationsprowagNoch keine Bewertungen

- COMBINED CHALLAN OF A/C NO. 01, 02, 10, 21 & 22 (With ECR) (State Bank of India) Employees' Provident Fund Organisation KolkataDokument2 SeitenCOMBINED CHALLAN OF A/C NO. 01, 02, 10, 21 & 22 (With ECR) (State Bank of India) Employees' Provident Fund Organisation KolkataMani SankarNoch keine Bewertungen

- Gjraj21313050000010234 2023Dokument3 SeitenGjraj21313050000010234 2023Pruthviraj JuniNoch keine Bewertungen

- Cpgrams: Grievance Status For Registration Number: DATOM/E/2020/00165Dokument1 SeiteCpgrams: Grievance Status For Registration Number: DATOM/E/2020/00165D S YadavNoch keine Bewertungen

- Nirmal Singh Comp2Dokument2 SeitenNirmal Singh Comp2ca.lakshaykhannaNoch keine Bewertungen

- Claimant Affidavit of Earnings: Utah Department of Workforce Services Unemployment InsuranceDokument1 SeiteClaimant Affidavit of Earnings: Utah Department of Workforce Services Unemployment InsuranceMickie FieldsNoch keine Bewertungen

- Computation 22-23 Buta SinghDokument2 SeitenComputation 22-23 Buta SinghSharn RamgarhiaNoch keine Bewertungen

- Amazon Labor Union LMs For 2023Dokument28 SeitenAmazon Labor Union LMs For 2023LaborUnionNews.comNoch keine Bewertungen

- Mhban00351780000029195 2023Dokument2 SeitenMhban00351780000029195 2023coolnitin2710_630298Noch keine Bewertungen

- Selection Grade For SeDokument1 SeiteSelection Grade For Seroychoudhuryrajkumar6Noch keine Bewertungen

- General Ledger To Trial BalanceDokument2 SeitenGeneral Ledger To Trial BalanceAudrey Christabel KwekNoch keine Bewertungen

- Tax Practice Assignmenment Edited 2 Ketty Dec 2022Dokument6 SeitenTax Practice Assignmenment Edited 2 Ketty Dec 2022ketty sambaNoch keine Bewertungen

- 06 Ex 02 Rev 0323 A11yDokument60 Seiten06 Ex 02 Rev 0323 A11yyoon tim lamNoch keine Bewertungen

- Brgy. Ubongan Dacu 2018 RecapDokument44 SeitenBrgy. Ubongan Dacu 2018 RecapReynen MendozaNoch keine Bewertungen

- Staff Nurses, Lab-Technicians& Pharmacists: WWW - Vizianagaram.nic - inDokument6 SeitenStaff Nurses, Lab-Technicians& Pharmacists: WWW - Vizianagaram.nic - inSATYAM NAIDUNoch keine Bewertungen

- KkkkjjjjhhhgfeeryjDokument2 SeitenKkkkjjjjhhhgfeeryjrajaplaysopNoch keine Bewertungen

- Bills List For 11-9-10Dokument7 SeitenBills List For 11-9-10Ewing Township, NJNoch keine Bewertungen

- Mhban01285390000015876 2023Dokument2 SeitenMhban01285390000015876 2023AIX CONNECT PVT LTDNoch keine Bewertungen

- Keshab Kaukhik Dutta ITDokument23 SeitenKeshab Kaukhik Dutta ITAnup SahaNoch keine Bewertungen

- Test 3-11Dokument2 SeitenTest 3-11TIÊN NGUYỄN LÊ MỸNoch keine Bewertungen

- A&Nz Product Recall / Withdrawal Form Suppliers Notification Form To Retailers / Gov'T AgenciesDokument9 SeitenA&Nz Product Recall / Withdrawal Form Suppliers Notification Form To Retailers / Gov'T Agenciesahmed naveedNoch keine Bewertungen

- Please Pay This AmountDokument1 SeitePlease Pay This AmountJoshua KhoNoch keine Bewertungen

- Tnmas00496750001017568 2023Dokument2 SeitenTnmas00496750001017568 2023goldfeildestate07Noch keine Bewertungen

- Difference BillDokument6 SeitenDifference BillHaseeb Ali GillNoch keine Bewertungen

- Best Western Hotel Fed WayDokument15 SeitenBest Western Hotel Fed WayAndy HobbsNoch keine Bewertungen

- Employer-Provided Health Insurance Offer and CoverageDokument4 SeitenEmployer-Provided Health Insurance Offer and Coveragepurnaprasadghimire2020Noch keine Bewertungen

- Pupun01206130000493015 2023Dokument2 SeitenPupun01206130000493015 2023abhishekkumarasr847687Noch keine Bewertungen

- Statement of Account: Account No: Customer Name: AddressDokument3 SeitenStatement of Account: Account No: Customer Name: Addressryan fernandezNoch keine Bewertungen

- Computation Bhoopendra Ay 21-22Dokument2 SeitenComputation Bhoopendra Ay 21-22SHELESH GARGNoch keine Bewertungen

- PDF DocumentDokument6 SeitenPDF DocumentJai Sam DanielNoch keine Bewertungen

- SapDokument1 SeiteSapgite391Noch keine Bewertungen

- Tooele Savage Rail CorrectionDokument6 SeitenTooele Savage Rail CorrectionThe Salt Lake TribuneNoch keine Bewertungen

- 2023 08 28 Budget Book 2022 23 ComposedDokument28 Seiten2023 08 28 Budget Book 2022 23 ComposedMirza shaharyar baigNoch keine Bewertungen

- University of Lagos - 1000108: Payer InformationDokument1 SeiteUniversity of Lagos - 1000108: Payer InformationAfeez AbiolaNoch keine Bewertungen

- Computation Draft Shubham RefundDokument5 SeitenComputation Draft Shubham RefundShubham JainNoch keine Bewertungen

- Rjraj10143850000042492 2023Dokument2 SeitenRjraj10143850000042492 2023Dev Bhoomi Uttarakhand UniversityNoch keine Bewertungen

- Department of Labor: Yr English GuideDokument1 SeiteDepartment of Labor: Yr English GuideUSA_DepartmentOfLaborNoch keine Bewertungen

- Department of Labor: Generalprovision 6 28 07Dokument6 SeitenDepartment of Labor: Generalprovision 6 28 07USA_DepartmentOfLaborNoch keine Bewertungen

- Department of Labor: Aces CPDokument36 SeitenDepartment of Labor: Aces CPUSA_DepartmentOfLabor100% (2)

- Department of Labor: YouthworkerDokument1 SeiteDepartment of Labor: YouthworkerUSA_DepartmentOfLaborNoch keine Bewertungen

- Department of Labor: Niosh Recs To Dol 050302Dokument198 SeitenDepartment of Labor: Niosh Recs To Dol 050302USA_DepartmentOfLaborNoch keine Bewertungen

- Department of Labor: YouthRulesBrochureDokument12 SeitenDepartment of Labor: YouthRulesBrochureUSA_DepartmentOfLaborNoch keine Bewertungen

- Department of Labor: 20040422 YouthrulesDokument1 SeiteDepartment of Labor: 20040422 YouthrulesUSA_DepartmentOfLaborNoch keine Bewertungen

- Department of Labor: Niosh Letter FinalDokument3 SeitenDepartment of Labor: Niosh Letter FinalUSA_DepartmentOfLaborNoch keine Bewertungen

- Department of Labor: Final ReportDokument37 SeitenDepartment of Labor: Final ReportUSA_DepartmentOfLaborNoch keine Bewertungen

- Department of Labor: Yr English GuideDokument1 SeiteDepartment of Labor: Yr English GuideUSA_DepartmentOfLaborNoch keine Bewertungen

- Department of Labor: ln61003Dokument2 SeitenDepartment of Labor: ln61003USA_DepartmentOfLaborNoch keine Bewertungen

- Department of Labor: JYMP 11x17 3Dokument1 SeiteDepartment of Labor: JYMP 11x17 3USA_DepartmentOfLaborNoch keine Bewertungen

- Question and Answer SessionDokument2 SeitenQuestion and Answer SessionANAND CHATURVEDINoch keine Bewertungen

- Lladoc vs. Commissioner of Internal Revenue, 14 SCRA 292, No. L-19201 June 16, 1965Dokument3 SeitenLladoc vs. Commissioner of Internal Revenue, 14 SCRA 292, No. L-19201 June 16, 1965PNP MayoyaoNoch keine Bewertungen

- Second Congo WarDokument10 SeitenSecond Congo WarmoschubNoch keine Bewertungen

- FAQ CivilDokument34 SeitenFAQ CivilsheglinalNoch keine Bewertungen

- Dudmoor Caravan Problem 1968Dokument2 SeitenDudmoor Caravan Problem 1968droshkyNoch keine Bewertungen

- Kotak Securities Nomination Update FormDokument1 SeiteKotak Securities Nomination Update FormPankaj BatraNoch keine Bewertungen

- Salle DigestDokument2 SeitenSalle DigestCarlota Nicolas VillaromanNoch keine Bewertungen

- Disloyalty of A DirectorDokument2 SeitenDisloyalty of A DirectorDailyn Jaectin0% (1)

- Milestone Farm vs. OPDokument1 SeiteMilestone Farm vs. OPSusie SotoNoch keine Bewertungen

- Rule 131 - DigestsDokument33 SeitenRule 131 - DigestsNoreen AquinoNoch keine Bewertungen

- RCPI vs. CA GR No. 44748Dokument1 SeiteRCPI vs. CA GR No. 44748Evander Arcenal100% (1)

- de Braganza Vs Villa Abrille 105 Phil 456 DigestDokument2 Seitende Braganza Vs Villa Abrille 105 Phil 456 DigestJERROM ABAINZA100% (1)

- Constitution of India: 18LEM101TDokument28 SeitenConstitution of India: 18LEM101TLucifer MorngstarNoch keine Bewertungen

- Land Bank of The Philippines V Belle CorpDokument2 SeitenLand Bank of The Philippines V Belle CorpDan Marco GriarteNoch keine Bewertungen

- P L D 1991 KARACHI (Different Cases)Dokument11 SeitenP L D 1991 KARACHI (Different Cases)Anonymous 16w0dovNoch keine Bewertungen

- 004 Voters List 2013, Laguna, Binan, Poblacion - Precinct 0012BDokument5 Seiten004 Voters List 2013, Laguna, Binan, Poblacion - Precinct 0012BIwai MotoNoch keine Bewertungen

- Tax Vs TollDokument4 SeitenTax Vs TollKris Joseph LasayNoch keine Bewertungen

- Ultra Villa Food Haus v. GenistonDokument6 SeitenUltra Villa Food Haus v. GenistonThoughts and More ThoughtsNoch keine Bewertungen

- Denr Application For Agricultural Free PatentDokument3 SeitenDenr Application For Agricultural Free PatentAngelica DulceNoch keine Bewertungen

- Legal Effects of IncorporationDokument4 SeitenLegal Effects of Incorporationsharifah izzatiNoch keine Bewertungen

- Cable Television Networks (Regulation) Act, 1995Dokument5 SeitenCable Television Networks (Regulation) Act, 1995m tvlNoch keine Bewertungen

- Article 82. Coverage. The Provisions of This Title Shall Apply To Employees in All Establishments andDokument18 SeitenArticle 82. Coverage. The Provisions of This Title Shall Apply To Employees in All Establishments andJerahmeel CuevasNoch keine Bewertungen

- Evidence Legal and Trial Technique Syllabus 2017-2018Dokument17 SeitenEvidence Legal and Trial Technique Syllabus 2017-2018Chey DumlaoNoch keine Bewertungen

- 1ac v. FirewaterDokument13 Seiten1ac v. FirewateralkdjsdjaklfdkljNoch keine Bewertungen

- PFR-CASES OdtDokument50 SeitenPFR-CASES OdtJims DadulaNoch keine Bewertungen

- Tavaana Exclusive Case Study: The Velvet Revolution - A Peaceful End To Communism in CzechoslovakiaDokument9 SeitenTavaana Exclusive Case Study: The Velvet Revolution - A Peaceful End To Communism in CzechoslovakiaTavaana E-InstituteNoch keine Bewertungen