Beruflich Dokumente

Kultur Dokumente

Garware-Wall Ropes Limited: Audited Financial Results For The Year Ended 31St March, 2009

Hochgeladen von

Jatin GuptaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Garware-Wall Ropes Limited: Audited Financial Results For The Year Ended 31St March, 2009

Hochgeladen von

Jatin GuptaCopyright:

Verfügbare Formate

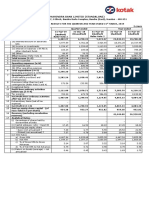

GARWARE-WALL ROPES LIMITED

Registered Office: Plot No. 11, Block D-1, MIDC, Chinchwad, Pune 411 019

AUDITED FINANCIAL RESULTS

FOR THE YEAR ENDED 31ST MARCH, 2009

Sr. Particulars

No.

1. (a) Net Sales/Income from Operations

(b) Other Operating Income

2. Expenditure

a. (Increase)/Decrease in Stock-in-trade and Work in Progress

b. Consumption of Raw Materials

c. Purchase of Traded Goods

d. Employees Cost

e. Depreciation

f. Other Expenditure

g. Total

3. Profit from Operations before Other Income, Interest and Exceptional

Items (1-2)

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

Other Income

Profit before Interest and Exceptional Items (3+4)

Interest

Profit after Interest but before Exceptional Items (5-6)

Exceptional Items

Profit (+) / Loss(-) from Ordinary Activities Before Tax (7+8)

Tax Expenses

Net Profit (+) / Loss (-) from Ordinary Activities after Tax (9-10)

Extraordinary Items (net of Tax Expense Rs. Nil)

Net Profit (+)/Loss (-) for the period (11-12)

14. Paid-up Equity Share Capital (Face value Rs. 10/- each)

15. Reserves excluding Revaluation Reserves as per Balance Sheet of

previous Accounting Year

16. Earnings Per Share (EPS)

a) Basic and diluted EPS before Extraordinary items

b) Basic and diluted EPS after Extraordinary items

17. Public shareholding

- Number of shares

- Percentage of shareholding

18. Promoters and Promoter Group

a) Pledged/Encumbered

- Number of shares

- Percentage of shares (as of total shareholding of Promoters)

- Percentage of shares (as of total share capital of the Company)

b) Non-encumbered

- Number of shares

- Percentage of shares (as of total shareholding of Promoters)

- Percentage of shares (as of total share capital of the Company)

Quarter ended

31st March (Audited)

2009

11,601.49

66.51

2008

11,715.61

50.48

649.84

3,920.24

757.49

1,317.75

292.67

3,546.38

10,484.37

1,183.63

9.12

1,192.75

243.49

949.26

44,418.56

210.05

40,725.78

132.50

(581.40)

4,859.18

795.53

1,322.20

319.66

3,824.31

10,539.48

1,226.61

775.06

17,498.84

1,886.22

5,174.71

1,230.17

14,951.24

41,516.24

3,112.37

(1,364.19)

16,582.12

1,823.88

4,651.15

1,101.92

13,784.84

36,579.72

4,278.56

5.48

1,232.09

371.65

860.44

66.22

3,178.59

1,292.84

1,885.75

10.87

4,289.43

1,431.95

2,857.48

---

---

949.26

148.79

800.47

860.44

239.13

621.31

3.38

3.38

1,26,87,259

53.51

0

0

0

1,10,21,091

100.00

46.49

621.31

2,171.24

-----

2.99 / 2.76

2.99 / 2.76

1,17,08,453

53.93

0

0

0

1,00,03,897

100.00

46.07

---

---

1,885.75

265.84

1,619.91

---

---

800.47

2,370.84

-----

(Rs. in Lacs)

Accounting year ended

31st March (Audited)

2008

2009

2,857.48

437.79

2,419.69

---

---

1,619.91

2,370.84

18,095.26

6.92 / 6.87

6.92 / 6.87

1,26,87,259

53.51

2,419.69

2,171.24

16,041.05

11.68 / 10.75

11.68 / 10.75

1,17,08,453

53.93

0

0

0

1,10,21,091

100.00

46.49

0

0

0

1,00,03,897

100.00

46.07

1. Segment Revenue

a) Synthetic cordage

8,050.81

7,908.74

33,285.76

30,374.59

b) Fibre and Industrial Products & Projects

4,215.80

4,335.01

12,884.95

11,591.41

Total

12,266.61

12,243.75

46,170.71

41,966.00

Less: Inter-Segment Revenue

(665.12)

(528.14)

(1,752.15)

(1,240.22)

Net Sales/Income from Operations

11,601.49

11,715.61

44,418.56

40,725.78

2. Segment Results (Profit (+)/Loss(-) before tax and interest from

each segment)

a) Synthetic cordage

1,424.24

1,145.74

4,406.57

4,393.29

b) Fibre and Industrial Products & Projects

458.25

585.88

863.45

1,320.95

Total

1,882.49

1,731.62

5,270.02

5,714.24

Less:

(243.49)

(371.65)

i) Interest

(1,292.84)

(1,431.95)

(689.74)

(499.53)

ii) Other unallocable expenditure net off Unallocable Income

(2,091.43)

(1,424.81)

Total Profit Before Tax

949.26

860.44

1,885.75

2,857.48

3. Capital Employed (Segment Assets - Segment Liabilities)

21,973.90

21,841.39

a) Synthetic cordage

21,973.90

21,841.39

b) Fibre and Industrial Products & Projects

9,797.49

9,642.60

9,797.49

9,642.60

Total

31,771.39

31,483.99

31,771.39

31,483.99

(The figures of previous periods have been regrouped wherever necessary.)

Notes:

1. Provision for Taxation for the year ended on 31st March, 2009 includes Fringe Benefit Tax of Rs.51.50 Lacs, (Previous year Rs.

50.11 Lacs) and Rs. 8.59 Lacs of deferred tax liability (Previous year Rs. 61.88 Lacs) and wealth Tax Rs. 2.25 Lacs (Previous year

Rs.2.25 Lacs) and Income Tax Rs. 203.50 Lacs (Previous year Rs. 323.55 Lacs).

2. Garware Environmental Services Private Limited ("GESPL"), which has ceased to be wholly owned subsidiary of the Company on

26th March, 2009, had not undertaken any activity since its inception.

3. Balance Amount out of Rs.11.95 Crores raised, out of allotment of 9,98,000 Equity Shares of Rs. 10/- each to Promoters and

9,98,000 Equity Shares of Rs. 10/- each to GWRL-Managerial Staff Welfare Trust, on 24th May, 2008, on conversion of Convertible

Warrants issued on preferential basis, was used entirely for on going capital expenditure.

4. The above results were reviewed by the Audit Committee and have been taken on record and approved by the Board of Directors at

its meeting held on Wednesday, 27th May, 2009.

5. The Board has recommended a Dividend of Rs. 2.50/- per share of Rs. 10/- each.

6. During the quarter, two investor complaints were received & resolved. There were no investor complaints pending for redressal as

on 1st January, 2009.

Mumbai

27th May, 2009

For Garware-Wall Ropes Limited

Sd/R.B. GARWARE

Chairman & Managing Director

Das könnte Ihnen auch gefallen

- Year Ended (Audited) Quarter Ended (Unaudited) Nine Months Ended (Unaudited)Dokument1 SeiteYear Ended (Audited) Quarter Ended (Unaudited) Nine Months Ended (Unaudited)Jatin GuptaNoch keine Bewertungen

- Balance SheetDokument2 SeitenBalance Sheetgagandeepdb2Noch keine Bewertungen

- 2008 2009 - 31 Mar 2009Dokument3 Seiten2008 2009 - 31 Mar 2009Nishit PatelNoch keine Bewertungen

- Unaudited Financial Results For The Quarter Ended 30Th June, 2011Dokument1 SeiteUnaudited Financial Results For The Quarter Ended 30Th June, 2011Ayush JainNoch keine Bewertungen

- Registered Office: Plot No. 11, Block D-1, MIDC, Chinchwad, Pune 411 019 Unaudited Financial Results (Provisional) For The Quarter Ended 30th June, 2007Dokument1 SeiteRegistered Office: Plot No. 11, Block D-1, MIDC, Chinchwad, Pune 411 019 Unaudited Financial Results (Provisional) For The Quarter Ended 30th June, 2007Jatin GuptaNoch keine Bewertungen

- Accounting Year Ended 31st March (Audited) 2011 2011 2011 Quarter Ended 30th September (Unaudited) Six Months Ended 30th September (Unaudited)Dokument1 SeiteAccounting Year Ended 31st March (Audited) 2011 2011 2011 Quarter Ended 30th September (Unaudited) Six Months Ended 30th September (Unaudited)Jatin GuptaNoch keine Bewertungen

- 2000 5000 Corp Action 20220525Dokument62 Seiten2000 5000 Corp Action 20220525Contra Value BetsNoch keine Bewertungen

- $&C +$C CCCCCCCCCDokument4 Seiten$&C +$C CCCCCCCCCAlok SinghalNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Unitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Dokument4 SeitenUnitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Bhuvan MalikNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Cash Flow - Alpa Beta GammaDokument26 SeitenCash Flow - Alpa Beta GammaAnuj Rakheja67% (3)

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Blue Cloud Softech Solutions Limited: Bse LTDDokument3 SeitenBlue Cloud Softech Solutions Limited: Bse LTDShyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokument4 SeitenStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results of Hardwyn India Sept 2023Dokument9 SeitenFinancial Results of Hardwyn India Sept 2023prashant_natureNoch keine Bewertungen

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Dokument2 SeitenColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Yash ModiNoch keine Bewertungen

- ACC Financial ResultsDokument12 SeitenACC Financial ResultsKKVSBNoch keine Bewertungen

- Corporate Accounting AssignmentDokument15 SeitenCorporate Accounting AssignmentAfnain Amman100% (1)

- 51 - Cma Data SheetDokument18 Seiten51 - Cma Data SheetAnurag GahlawatNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results For December 31, 2016 (Result)Dokument4 SeitenStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Ger S G, Eejeeb Y We S,: Crjsi"Dokument5 SeitenGer S G, Eejeeb Y We S,: Crjsi"Suraj KediaNoch keine Bewertungen

- Standalone Financial Results For September 30, 2016 (Result)Dokument1 SeiteStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- 2016 Annual ReportDokument7 Seiten2016 Annual ReportHeadshot's GameNoch keine Bewertungen

- CIPLA Ltd. (Raj Mishra - FC23159)Dokument24 SeitenCIPLA Ltd. (Raj Mishra - FC23159)Raj MishraNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- CEAT TyreDokument3 SeitenCEAT TyreMr. Harsh Kumar Student, Jaipuria LucknowNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) NotesDokument3 SeitenNotes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) NotesSameh Ahmed HassanNoch keine Bewertungen

- Standalone Financial ResultsDokument4 SeitenStandalone Financial ResultsMD AbdulMoid MukarramNoch keine Bewertungen

- Wovensacks Projections in ExcelDokument57 SeitenWovensacks Projections in ExcelPradeep TlNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokument4 SeitenFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Tata Motors Group Q4 Annual Financial Results FY19 20Dokument10 SeitenTata Motors Group Q4 Annual Financial Results FY19 20Anil Kumar AkNoch keine Bewertungen

- Result Q-1-11 For PrintDokument1 SeiteResult Q-1-11 For PrintSagar KadamNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Wim Plast LTD.: CelloDokument5 SeitenWim Plast LTD.: CelloAbhishek RanjanNoch keine Bewertungen

- Q4FY19 Press TableDokument9 SeitenQ4FY19 Press TableSumit SharmaNoch keine Bewertungen

- 2009-10 Annual ResultsDokument1 Seite2009-10 Annual ResultsAshish KadianNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument5 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- 2022 04 Q4-2022 PR2-New-roomDokument10 Seiten2022 04 Q4-2022 PR2-New-roomTejpal SainiNoch keine Bewertungen

- Standalone Financial Results, Auditors Report For December 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Auditors Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- ICICI Financial StatementsDokument9 SeitenICICI Financial StatementsNandini JhaNoch keine Bewertungen

- NFL Results March 2010Dokument3 SeitenNFL Results March 2010Siddharth ReddyNoch keine Bewertungen

- Financial Results For Sept 30, 2015 (Standalone) (Result)Dokument2 SeitenFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- V-Guard Industries LTD 150513 RSTDokument4 SeitenV-Guard Industries LTD 150513 RSTSwamiNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument4 SeitenStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Audited Financial Results For The Quarter and Year Ended March 31, 2023Dokument6 SeitenAudited Financial Results For The Quarter and Year Ended March 31, 2023vikaspawar78Noch keine Bewertungen

- Devyani International Q3 ResultsDokument9 SeitenDevyani International Q3 ResultsSaurabh AggarwalNoch keine Bewertungen

- Abridged StatementDokument7 SeitenAbridged StatementAnkit BankaNoch keine Bewertungen

- HPCL Audited Results31Mar2013Dokument1 SeiteHPCL Audited Results31Mar2013Pranav DesaiNoch keine Bewertungen

- Finance Department Analysis of Dabur LimitedDokument15 SeitenFinance Department Analysis of Dabur LimitedradhikaNoch keine Bewertungen

- Schaum's Outline of Principles of Accounting I, Fifth EditionVon EverandSchaum's Outline of Principles of Accounting I, Fifth EditionBewertung: 5 von 5 Sternen5/5 (3)

- Accounting Year Ended 31st March (Audited) 2011 2011 2011 Quarter Ended 30th September (Unaudited) Six Months Ended 30th September (Unaudited)Dokument1 SeiteAccounting Year Ended 31st March (Audited) 2011 2011 2011 Quarter Ended 30th September (Unaudited) Six Months Ended 30th September (Unaudited)Jatin GuptaNoch keine Bewertungen

- Services Blueprint - Group 2Dokument13 SeitenServices Blueprint - Group 2Jatin GuptaNoch keine Bewertungen

- Industry Services: Overview of The PlanDokument2 SeitenIndustry Services: Overview of The PlanJatin GuptaNoch keine Bewertungen

- Sony CorporationDokument16 SeitenSony CorporationJatin GuptaNoch keine Bewertungen

- TEAM 702: Lessons in Marketing Excellence - Season 3Dokument155 SeitenTEAM 702: Lessons in Marketing Excellence - Season 3Jatin GuptaNoch keine Bewertungen

- 1975-1992: Information Revolution, Rise of Software and PC IndustriesDokument5 Seiten1975-1992: Information Revolution, Rise of Software and PC IndustriesRabayahramiNoch keine Bewertungen

- Mid Day MealDokument19 SeitenMid Day MealJatin GuptaNoch keine Bewertungen

- IbmDokument10 SeitenIbmJatin GuptaNoch keine Bewertungen

- Strategy DisneyDokument8 SeitenStrategy DisneyJatin Gupta100% (3)

- Evolution of TabletDokument2 SeitenEvolution of TabletJatin GuptaNoch keine Bewertungen

- Costa Rica: Case AnalysisDokument9 SeitenCosta Rica: Case AnalysisJatin GuptaNoch keine Bewertungen

- OSN 8800 6800 3800 V100R011C00 Alarms and Performance Events Reference 01Dokument1.544 SeitenOSN 8800 6800 3800 V100R011C00 Alarms and Performance Events Reference 01Oscar Behrens ZepedaNoch keine Bewertungen

- List of Newly and Migrated Programs For September 2022 - WebsiteDokument21 SeitenList of Newly and Migrated Programs For September 2022 - WebsiteRMG REPAIRNoch keine Bewertungen

- LIC Product PositioningDokument15 SeitenLIC Product PositioningRasika Pawar-HaldankarNoch keine Bewertungen

- JQuery Interview Questions and AnswersDokument5 SeitenJQuery Interview Questions and AnswersShailesh M SassNoch keine Bewertungen

- Blockchain Unit Wise Question BankDokument3 SeitenBlockchain Unit Wise Question BankMeghana50% (4)

- BW-Africa 2023 BrochureDokument12 SeitenBW-Africa 2023 BrochureDanial DarimiNoch keine Bewertungen

- Shell Omala s2 GX 320 TdsDokument2 SeitenShell Omala s2 GX 320 TdsOnie Hammamz OylNoch keine Bewertungen

- Digirig Mobile 1 - 9 SchematicDokument1 SeiteDigirig Mobile 1 - 9 SchematicKiki SolihinNoch keine Bewertungen

- EPM Cloud Tax Reporting Overview - EMEA Training May 2020Dokument25 SeitenEPM Cloud Tax Reporting Overview - EMEA Training May 2020zaymounNoch keine Bewertungen

- Determination of Sales Force Size - 2Dokument2 SeitenDetermination of Sales Force Size - 2Manish Kumar100% (3)

- Cat It62hDokument4 SeitenCat It62hMarceloNoch keine Bewertungen

- Crystallization of Para-Xylene in Scraped-Surface CrystallizersDokument11 SeitenCrystallization of Para-Xylene in Scraped-Surface Crystallizersanax22Noch keine Bewertungen

- Pivacare Preventive-ServiceDokument1 SeitePivacare Preventive-ServiceSadeq NeiroukhNoch keine Bewertungen

- Form DVAT 27A: Intimation of Deposit of Government DuesDokument2 SeitenForm DVAT 27A: Intimation of Deposit of Government DueshhhhhhhuuuuuyyuyyyyyNoch keine Bewertungen

- COMPLAINT - THE STAN J. CATERBONE 42 U.S.C. 14141 "POLICE MISCONDUCT PROVISION" COMPLAINT TO U.S. DEPARTMENT OF JUSTICE August 24, 2017Dokument435 SeitenCOMPLAINT - THE STAN J. CATERBONE 42 U.S.C. 14141 "POLICE MISCONDUCT PROVISION" COMPLAINT TO U.S. DEPARTMENT OF JUSTICE August 24, 2017Stan J. CaterboneNoch keine Bewertungen

- Lae ReservingDokument5 SeitenLae ReservingEsra Gunes YildizNoch keine Bewertungen

- MF 660Dokument7 SeitenMF 660Sebastian Vasquez OsorioNoch keine Bewertungen

- Google-Analytics 01Dokument28 SeitenGoogle-Analytics 01Smm Store24Noch keine Bewertungen

- 11.traders Virtual Mag OTA July 2011 WebDokument68 Seiten11.traders Virtual Mag OTA July 2011 WebAde CollinsNoch keine Bewertungen

- Pepsico IncDokument26 SeitenPepsico IncYKJ VLOGSNoch keine Bewertungen

- 9a Grundfos 50Hz Catalogue-1322Dokument48 Seiten9a Grundfos 50Hz Catalogue-1322ZainalNoch keine Bewertungen

- Review On A Protective Scheme For Wind Power Plant Using Co-Ordination of Overcurrent Relay-NOTA TECNICADokument5 SeitenReview On A Protective Scheme For Wind Power Plant Using Co-Ordination of Overcurrent Relay-NOTA TECNICAEdgardo Kat ReyesNoch keine Bewertungen

- Advanced Machining User Guide PDFDokument250 SeitenAdvanced Machining User Guide PDFDaniel González JuárezNoch keine Bewertungen

- Virtual Machine Functionalism (VMF)Dokument52 SeitenVirtual Machine Functionalism (VMF)Cássia SiqueiraNoch keine Bewertungen

- Data Sheet: Permanent Magnet GeneratorDokument2 SeitenData Sheet: Permanent Magnet Generatordiegoadjgt100% (1)

- P40Agile P541 - 2 - 3 - 4 - 5 6 Guideform SpecificationDokument15 SeitenP40Agile P541 - 2 - 3 - 4 - 5 6 Guideform SpecificationprinceNoch keine Bewertungen

- Mef Cecp TrainingDokument5 SeitenMef Cecp TrainingShambhu KhanalNoch keine Bewertungen

- Safe and Gentle Ventilation For Little Patients Easy - Light - SmartDokument4 SeitenSafe and Gentle Ventilation For Little Patients Easy - Light - SmartSteven BrownNoch keine Bewertungen

- 4 A Industrial RevolutionDokument41 Seiten4 A Industrial Revolutionabekhti2008Noch keine Bewertungen

- Filcar vs. EspinasDokument2 SeitenFilcar vs. EspinasBrian ThunderNoch keine Bewertungen