Beruflich Dokumente

Kultur Dokumente

Re Frence

Hochgeladen von

Sonal KadamCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Re Frence

Hochgeladen von

Sonal KadamCopyright:

Verfügbare Formate

1.

Building on the growing stream of research in the area of payment mechanisms, this paper studies the effects of the past usage of a given payment mechanism on future spending. For instance, there is compelling evidence to suggest that consumers who predominantly use credit cards overspend relative to those who dont. (Cole 1998, Lea, Webley and Levine 1993, Tokunaga 1993). However, there is little evidence of the specific role that payment mechanisms play in influencing a consumers evaluation of a pending transaction and consequently her intention to purchase or willingness-to-pay. Lea, Stephen, Paul Webley and R.Mark Levine (1993). The Economic Psychology of Consumer Debt, Journal of Economic Psychology, 14 (1993), 85-119.

2. Consumers today have the opportunity to pay for transactions with an increasingly

growing array of payment mechanisms (Marlin 1998). In addition to conventional methods like cash and checks, the past few years have seen the rapid proliferation of plastic payment mechanisms - credit cards, charge cards and debit cards (Green 1997). It is estimated that approximately 90% of Americans use credit cards while 24% use debit cards (Dean and Morris 1997, Scherer 1997).

Green, Jeffrey (1997). A Clear Line Of Demarcation, Credit Card Management, 10 (9), 14- 17.

3. Additionally, consumers are also familiar with payment mechanisms like travelers checks, credit checks and money orders. Over the coming years, a whole new generation of payment mechanisms like smart cards, memory cards and electronic payments is expected to grow and ultimately represent a significant proportion of all consumer transactions (Marlin 1998). Marlin, Steven (1998). Q&A Executive: Halt Payment Proliferation, Bank Systems & Technology, 35 (6). 42-43.

4. Recent research has also started identifying factors underlying consumer choice of payment mechanisms. Prelec and Loewenstein (1998) argue that consumers are more likely to use credit cards for durable products (e.g. a microwave oven) than for a short lived product (e.g. a vacation) in order to maximize the overall hedonic impact of the transaction. However, in addition to such strategic reasons, the choice of a payment mechanism is often accidental and driven by simpler considerations like convenience (e.g. a charge card is always in ones wallet), acceptability (e.g. certain retailers might not accept checks) and accessibility (e.g. there is no convenient ATM to withdraw and pay by cash). An interesting avenue of research, therefore, relates to the effect of the use of a particular payment mechanism on future spending. Prelec, Drazen and George Loewenstein (1998). The Red and the Black: Mental Accounting of Savings and Debt, Marketing Science, 17 (1), 4-28. 5. This proliferation of payment mechanisms has been accompanied by surprisingly little research on the effect of payment mechanisms on consumer behavior. However, some early research in this area presents intriguing findings. Hirschman (1979) and Feinberg (1986) use real consumer transactions to compare the pending of consumers who pay by credit cards with those who pay by cash or checks and find that the former spend more than the latter in similar situations. Feinberg, Richard A. (1986). Credit Cards as Spending Facilitating Stimuli : A Conditioning Interpretation, Journal of Consumer Research, 13(3), p 348-356. Hirschman, Elizabeth (1979). Differences In Consumer Purchase Behavior by Credit Card Payment System, Journal of Consumer Research, 6, 58-66.

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- INF 370 Lab ManualDokument15 SeitenINF 370 Lab ManualDr.nagwa yaseenNoch keine Bewertungen

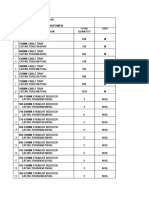

- GasLink - Development of GLIADokument24 SeitenGasLink - Development of GLIAOribuyaku DamiNoch keine Bewertungen

- Final Test 1 K 2 - KeyDokument10 SeitenFinal Test 1 K 2 - KeyDuy HưngNoch keine Bewertungen

- 193-Cable Tray QtyDokument4 Seiten193-Cable Tray QtyprkshshrNoch keine Bewertungen

- THMT 3312: Research Methods For Tourism & Hospitality ManagementDokument13 SeitenTHMT 3312: Research Methods For Tourism & Hospitality Managementmilrosebatilo2012Noch keine Bewertungen

- How Summer Students Perceive The Closed Summer Program: in The Case of Jimma UniversityDokument17 SeitenHow Summer Students Perceive The Closed Summer Program: in The Case of Jimma UniversityКонстантин НечетNoch keine Bewertungen

- CEC CategoryDokument4 SeitenCEC CategoryQ8123Noch keine Bewertungen

- Eaton Industrial Special Process List (SPL)Dokument5 SeitenEaton Industrial Special Process List (SPL)amirkhakzad498Noch keine Bewertungen

- Dist Census Book Latur PDFDokument770 SeitenDist Census Book Latur PDFMP100% (1)

- Ниязбекова АЯ19 Дипломная работа 1Dokument77 SeitenНиязбекова АЯ19 Дипломная работа 1LaikosikNoch keine Bewertungen

- Report On Industrial Visit ScribdDokument11 SeitenReport On Industrial Visit ScribdJakeer CJNoch keine Bewertungen

- 5 Ijcms-V3i2-2012-02Dokument6 Seiten5 Ijcms-V3i2-2012-02saiNoch keine Bewertungen

- E-Rpms Portfolio (Design 3) - Depedclick-1Dokument42 SeitenE-Rpms Portfolio (Design 3) - Depedclick-1angeliNoch keine Bewertungen

- Vallorbs Guide Cut Vs Rolled ThreadsDokument3 SeitenVallorbs Guide Cut Vs Rolled ThreadsOrlando AriasNoch keine Bewertungen

- Ic NotesDokument67 SeitenIc NotesVijaya Kumar VadladiNoch keine Bewertungen

- 12 Cumulative Record GunjanDokument25 Seiten12 Cumulative Record GunjanramandeepNoch keine Bewertungen

- Acer V193 Service ManualDokument46 SeitenAcer V193 Service Manualagun92Noch keine Bewertungen

- Forensic Module 2 MidtermDokument27 SeitenForensic Module 2 MidtermAdrias IvanNoch keine Bewertungen

- Quotes PsDokument10 SeitenQuotes PsSrinivasan ParthasarathyNoch keine Bewertungen

- 2021 Redding CatalogDokument44 Seiten2021 Redding CatalogRobert AugerNoch keine Bewertungen

- RESEARCH FORM and STYLEDokument8 SeitenRESEARCH FORM and STYLEKristian Karl Bautista Kiw-isNoch keine Bewertungen

- In Search of The Indo Europeans J P Mallory TextDokument289 SeitenIn Search of The Indo Europeans J P Mallory TextHISTORY OF MUSICNoch keine Bewertungen

- English 6 W10 DAYS 1-2Dokument13 SeitenEnglish 6 W10 DAYS 1-2Mary Jane CuevasNoch keine Bewertungen

- Letter B Lesson PlanDokument3 SeitenLetter B Lesson Planapi-300212612100% (1)

- LGIT CatalogueDokument11 SeitenLGIT CatalogueArjun SharmaNoch keine Bewertungen

- 1380 eDokument6 Seiten1380 ewisjaro01100% (3)

- Design MatrixDokument1 SeiteDesign MatrixThakur Kali DassNoch keine Bewertungen

- Physiological, Anthropometric, and Motor Characteristics of Elite Chinese Youth Athletes From Six Different SportsDokument12 SeitenPhysiological, Anthropometric, and Motor Characteristics of Elite Chinese Youth Athletes From Six Different SportsRafida I CNoch keine Bewertungen

- Sheena HSMDokument8 SeitenSheena HSMdesign12Noch keine Bewertungen