Beruflich Dokumente

Kultur Dokumente

Press Release - AMCHAM Philippines On ASEAN Outlook Survey

Hochgeladen von

Arangkada PhilippinesOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Press Release - AMCHAM Philippines On ASEAN Outlook Survey

Hochgeladen von

Arangkada PhilippinesCopyright:

Verfügbare Formate

Release Date: Aug 26, 2013

New Poll Finds U.S. Businesses Optimistic About Growth in ASEAN, Philippines Most Improved

(Manila Philippines) - U.S. companies remain optimistic about business prospects in the Association of Southeast Asian Nations (ASEAN), according to new survey results released today by The American Chamber of Commerce in the Philippines (AmCham Philippines) and the U.S. Chamber of Commerce. In a poll of 475 senior executives from U.S. companies operating across the region, 79% reported that their companys level of trade and investment in ASEAN increased over the past two years, and an overwhelming 91% of respondents expect it to increase over the next five years. Philippines Satisfaction in the Philippines increased across fourteen of the sixteen business factors over the last five years, led by a 50% increase in satisfaction with the stability of the government and political system. Today, 87% of respondents are satisfied with the availability of trained personnel in the Philippines, the highest percentage in ASEAN. Corruption, insufficient infrastructure, and the tax structure remain challenges in the country, but it is clear business leaders have seen significant progress in recent years. Other areas of satisfaction included sentiment toward the US (79%) - also the highest percentage in ASEAN, availability of low cost labor (74%), stable government and political system (62%), personal security (56%), housing costs (56%), office lease costs (51%), new business incentives offered by government (44%), free movement of goods within the region (41%), availability of raw materials (38%). The main concerns (shown in the table below) were corruption (59%), tax structure (56%), infrastructure (54%), laws and regulations (46%), and ease of moving products through customs (44%). With the exception of corruption, these concerns have remained quite consistent over the last five years.

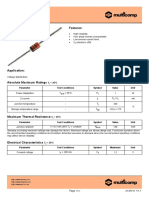

Areas of dissatisfaction, Philippines, 2003-2013 Issue Corruption Infrastructure Laws and regulations Local Protectionism Ease of moving products through customs Source: ASEAN Surveys

2003 91 69 48 40 29

2004 86 67 61 53 33

2005 2006 88 77 68 50 63 52 46 39 26 14

2007 2008 2009 2010 2011 2012 2013 Average 72 84 88 84 79 73 59 73 55 54 49 46 51 40 54 55 51 47 48 34 62 43 46 50 51 45 43 34 41 25 46 42 15 39 36 32 37 43 44 32

Areas of dissatisfaction, Philippines, 2003-2013

100%

(A)

90% Corruption (A) 80%

(B)

70% Infrastructure (B)

60%

Laws and regulations (C)

(C)

50% Local Protectionism (D) 40%

(D)

Ease of moving products through customs (E)

30%

20%

(E)

10%

0%

Source: ASEAN Surveys

The survey found substantial concerns and impediments to companies growth in the region. Corruption was the top issue across ASEAN, with the majority of respondents in all countries except Brunei and Singapore expressing dissatisfaction. Business leaders also cited burdensome laws and regulations as obstacles to greater investment, as well as the poor quality of infrastructure, and the difficulty in moving products through customs in some countries.

The survey also revealed that regional economic integration efforts, such as ASEANs agreements on trade in goods and services, are important to U.S. companies investment plans in the region. 54% of respondents said that their company has a strategy based on the goals of the ASEAN Economic Community, which aims to integrate the region by 2015. Moreover, nearly half of the U.S. manufacturing companies surveyed report that they utilize the provisions of ASEANs free trade agreements with major trading partners to export from ASEAN. Of the two major regional free trade agreements currently being negotiated, the Transpacific Partnership (TPP) and the Regional Comprehensive Economic Partnership (RCEP), more respondents expect the TPP to have a greater impact on their companies future investments in the region than RCEP, but many respondents are not sure about the impact of either agreement. ASEAN has the opportunity to position itself at the center of a very exciting evolving regional trade architecture, said Tami Overby, the U.S. Chambers vice president for Asia the U.S. Chamber of Commerce. This survey shows that U.S. companies are thinking regionally, and as ASEAN continues to integrate, U.S. companies will need to increasingly focus on strategies to realize ASEANs potential, she added. Singapore remains one of the most attractive countries in ASEAN to do business, with low levels of corruption, excellent infrastructure, and predictable laws and regulations, said Simon Kahn, Chairman of AmCham Singapore. Another highlight in the region is the marked improvement of the Philippines. The country has experienced high levels of growth recently and our survey shows why, as business leaders there indicate higher levels of satisfaction across almost all surveyed factors as compared to five years ago. The ASEAN Business Outlook Survey, the latest in a series of surveys conducted by AmCham Singapore and the U.S. Chamber of Commerce, polled senior business leaders from U.S. companies in all ten ASEAN countries. Highlights of findings from respondents from each country Brunei Brunei is one of two countries in ASEAN where the majority (82%) of respondents indicate satisfaction with a lack of corruption. Respondents in the country are also highly satisfied with personal security, sentiment towards the U.S., and the stability of the government and political system. Business leaders do indicate challenges in finding trained personnel in the country. Cambodia Major strengths cited by respondents in Cambodia include availability of low cost labor, positive sentiment towards the U.S., and a high level of personal security. Corruption remains a problem, as 65% of respondents expressed concern; however, this is down from 2012. Indonesia Indonesia was rated as the top destination in ASEAN for expansion, despite the many challenges companies cite in doing business there. Overwhelmingly, corruption was identified as the

greatest drawback in Indonesia. Other significant challenges include moving products through customs, insufficient infrastructure, and problematic laws and regulations. Laos Personal security and positive sentiment towards the U.S. are strengths in Laos, as they are across ASEAN. Challenges for U.S. companies in Laos include corruption, lack of trained personnel, insufficient infrastructure, and problematic laws and regulations. Malaysia 100% of respondents in Malaysia said that they do not face any significant challenges importing goods into the country. The Malaysian government has been working to implement more efficient customs procedures, and respondents seem to have noticed an improvement. The positive sentiment towards the U.S., and the quality of infrastructure, were viewed as strengths for Malaysia. Satisfaction with personal security, however, has decreased since 2012, giving Malaysia the lowest ranking in ASEAN. Myanmar 49% of respondents across the region indicate investment in or plans to invest in Myanmar. However, the U.S. business leaders currently operating in Myanmar cite ten out of the sixteen business factors in the survey as challenges. The highest levels of dissatisfaction are with infrastructure and problematic laws and regulations. Housing costs and office lease costs also have high levels of dissatisfaction, as demand for real estate in Yangon exceeds supply. Singapore Singapore-based respondents cite greater satisfaction across polled business factors than any other ASEAN country. Major strengths in Singapore include a stable government and political system, and laws and regulations, with 90% and 84% of respondents, respectively, indicating satisfaction. Challenges for businesses in Singapore, as in recent years, include lack of low cost labor, high office lease costs, and high housing costs. Thailand Respondents see personal security, positive sentiment towards the U.S., and infrastructure as major strengths in Thailand. Corruption is cited as the biggest challenge with 71% of respondents indicating dissatisfaction. Satisfaction with the tax structure in Thailand has increased by 13% since 2008. Vietnam Strengths in Vietnam are the availability of low cost labor, positive sentiment towards the U.S., and the level of personal security. Respondents indicate that corruption is one of the biggest problems in Vietnam with 70% of respondents indicating dissatisfaction. Satisfaction with new business incentives offered by the government, stability of the government and political system, and the level of personal security all have significantly decreased over the last five years. About AmCham Philippines AmCham Philippines is the oldest American Chamber outside the United States which came to life in 1902 and incorporated in 1920. For 111 years, it has maintained its long standing

commitment of serving the interests of US and Philippine businesses through civic and economic developments. About The U.S. Chamber of Commerce The U.S. Chamber of Commerce is the worlds largest business organization, and represents the interests of more than 3 million businesses of all sizes, sectors, and regions. Chamber members range in size from small enterprises and local chambers to leading industry associations and large corporations.

#### Contact: Ebb Hinchliffe, AmCham Philippines, ebb@amchamphilippines.com Lisa Burgess, US Chamber of Commerce, lburgess@uschamber.com

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Activity 7 Online Activity GERIZALDokument5 SeitenActivity 7 Online Activity GERIZALKc Kirsten Kimberly MalbunNoch keine Bewertungen

- Overseas Filipino Remittance Ilocos NorteDokument7 SeitenOverseas Filipino Remittance Ilocos NorteArangkada PhilippinesNoch keine Bewertungen

- Economic Development in The Philippines: High Potential, Big Challenges, Wide ImpactDokument31 SeitenEconomic Development in The Philippines: High Potential, Big Challenges, Wide ImpactArangkada PhilippinesNoch keine Bewertungen

- WCY Technical Note 5 18 2014 FinalDokument9 SeitenWCY Technical Note 5 18 2014 FinalArangkada PhilippinesNoch keine Bewertungen

- WCY 2014 Press Release 5 18 2014 FinalDokument2 SeitenWCY 2014 Press Release 5 18 2014 FinalArangkada PhilippinesNoch keine Bewertungen

- Tracker - May 2014Dokument21 SeitenTracker - May 2014Arangkada PhilippinesNoch keine Bewertungen

- UNDESA E-Gouvernement, Étude Complète 2014Dokument284 SeitenUNDESA E-Gouvernement, Étude Complète 2014usinemarocNoch keine Bewertungen

- AmCham Statement - Investment OmbudsmanDokument1 SeiteAmCham Statement - Investment OmbudsmanArangkada PhilippinesNoch keine Bewertungen

- TPP Updates-JuneDokument4 SeitenTPP Updates-JuneArangkada PhilippinesNoch keine Bewertungen

- Legislative Priorities - May 2014 - 16th CongressDokument5 SeitenLegislative Priorities - May 2014 - 16th CongressArangkada PhilippinesNoch keine Bewertungen

- UNDESA E-Gouvernement, Étude Complète 2014Dokument284 SeitenUNDESA E-Gouvernement, Étude Complète 2014usinemarocNoch keine Bewertungen

- Deloitte Philippines Competitiveness ReportDokument15 SeitenDeloitte Philippines Competitiveness ReportArangkada PhilippinesNoch keine Bewertungen

- Ernst & Young Trade SecretsDokument50 SeitenErnst & Young Trade SecretsArangkada PhilippinesNoch keine Bewertungen

- May Trans-Pacific Partnership UpdatesDokument4 SeitenMay Trans-Pacific Partnership UpdatesArangkada PhilippinesNoch keine Bewertungen

- Tracker - Jun 2014Dokument21 SeitenTracker - Jun 2014Arangkada PhilippinesNoch keine Bewertungen

- Legislative Priorities - June 2014 - 16th CongressDokument5 SeitenLegislative Priorities - June 2014 - 16th CongressArangkada PhilippinesNoch keine Bewertungen

- Medical Tourism Ilocos NorteDokument34 SeitenMedical Tourism Ilocos NorteArangkada PhilippinesNoch keine Bewertungen

- Joint Position Paper To Improve The Implementation of The EPIRADokument2 SeitenJoint Position Paper To Improve The Implementation of The EPIRAArangkada PhilippinesNoch keine Bewertungen

- BPO-ICT Potentials Ilocos NorteDokument20 SeitenBPO-ICT Potentials Ilocos NorteArangkada PhilippinesNoch keine Bewertungen

- FCC Presentation FinalDokument27 SeitenFCC Presentation FinalArangkada PhilippinesNoch keine Bewertungen

- Palafox Masterplan Ilocos NorteDokument33 SeitenPalafox Masterplan Ilocos NorteArangkada Philippines100% (3)

- REFMAD-V Enterprise Ilocos NorteDokument11 SeitenREFMAD-V Enterprise Ilocos NorteArangkada PhilippinesNoch keine Bewertungen

- 2013 July NewsletterDokument2 Seiten2013 July NewsletterArangkada PhilippinesNoch keine Bewertungen

- 2013 August NewsletterDokument2 Seiten2013 August NewsletterArangkada PhilippinesNoch keine Bewertungen

- 2013 September NewsletterDokument2 Seiten2013 September NewsletterArangkada PhilippinesNoch keine Bewertungen

- 2013 October NewsletterDokument2 Seiten2013 October NewsletterArangkada PhilippinesNoch keine Bewertungen

- 2013 December NewsletterDokument2 Seiten2013 December NewsletterArangkada PhilippinesNoch keine Bewertungen

- 2013 November NewsletterDokument2 Seiten2013 November NewsletterArangkada PhilippinesNoch keine Bewertungen

- 2014 January NewsletterDokument2 Seiten2014 January NewsletterArangkada PhilippinesNoch keine Bewertungen

- Corporate Finance - Ahuja - Chauhan PDFDokument177 SeitenCorporate Finance - Ahuja - Chauhan PDFSiddharth BirjeNoch keine Bewertungen

- Evolving Principles of Dominant Position and Predatory Pricing in the Telecommunication Sector (1)Dokument20 SeitenEvolving Principles of Dominant Position and Predatory Pricing in the Telecommunication Sector (1)Aryansh SharmaNoch keine Bewertungen

- Abhivyakti Yearbook 2019 20Dokument316 SeitenAbhivyakti Yearbook 2019 20desaisarkarrajvardhanNoch keine Bewertungen

- Judge Jackson's Roger Stone RulingDokument56 SeitenJudge Jackson's Roger Stone RulingLaw&CrimeNoch keine Bewertungen

- Manage Your Risk With ThreatModeler OWASPDokument39 SeitenManage Your Risk With ThreatModeler OWASPIvan Dario Sanchez Moreno100% (1)

- ITD GYE21 GTS 2051 2021 0026 SignedDokument6 SeitenITD GYE21 GTS 2051 2021 0026 SignedY'aa M'ichaelNoch keine Bewertungen

- LEN - Waterpolo Transfer RegulationsDokument4 SeitenLEN - Waterpolo Transfer RegulationsPólo Aquático - Vitória Sport Clube100% (1)

- Zener DiodoDokument4 SeitenZener Diodoyes-caliNoch keine Bewertungen

- Innovyze Software Maintenance Support AgreementDokument2 SeitenInnovyze Software Maintenance Support Agreementshahrukhkhalid1359Noch keine Bewertungen

- VAT Guide For VendorsDokument106 SeitenVAT Guide For VendorsUrvashi KhedooNoch keine Bewertungen

- Human Rights and the Death Penalty in the USDokument4 SeitenHuman Rights and the Death Penalty in the USGerAkylNoch keine Bewertungen

- Election of 2000 WorksheetDokument3 SeitenElection of 2000 Worksheetvasanthi sambaNoch keine Bewertungen

- PoliceLife April-2011 Issuu PDFDokument32 SeitenPoliceLife April-2011 Issuu PDFshane parrNoch keine Bewertungen

- Republic Act No. 7638: December 9, 1992Dokument13 SeitenRepublic Act No. 7638: December 9, 1992Clarisse TingchuyNoch keine Bewertungen

- Template - Proposal For F&B EventDokument3 SeitenTemplate - Proposal For F&B EventTrisna Djunaedi KurniawanNoch keine Bewertungen

- Niva Bupa Health Insurance Company LimitedDokument1 SeiteNiva Bupa Health Insurance Company LimitedSujanNoch keine Bewertungen

- Acc311-Midterm Paper: Solved by AhsanDokument46 SeitenAcc311-Midterm Paper: Solved by Ahsanamarjaved1Noch keine Bewertungen

- CHM Utopia or Reality Alexandre KissDokument20 SeitenCHM Utopia or Reality Alexandre Kissfaad badirNoch keine Bewertungen

- MUH050220 O-12 - Final PDF 061221Dokument123 SeitenMUH050220 O-12 - Final PDF 061221Ricardo OkabeNoch keine Bewertungen

- Canadian History VocabularyDokument3 SeitenCanadian History VocabularyJessica WilsonNoch keine Bewertungen

- Digital Forensic Tools - AimigosDokument12 SeitenDigital Forensic Tools - AimigosKingNoch keine Bewertungen

- BSNL Payslip February 2019Dokument1 SeiteBSNL Payslip February 2019pankajNoch keine Bewertungen

- The Medical Act of 1959Dokument56 SeitenThe Medical Act of 1959Rogelio Junior RiveraNoch keine Bewertungen

- DeclarationDokument6 SeitenDeclarationzdvdfvsdvsNoch keine Bewertungen

- LTC ApllDokument4 SeitenLTC ApllSimranNoch keine Bewertungen

- Notes Volume I and IIDokument31 SeitenNotes Volume I and IITawanda Mahere0% (1)

- Far Eastern Bank (A Rural Bank) Inc. Annex A PDFDokument2 SeitenFar Eastern Bank (A Rural Bank) Inc. Annex A PDFIris OmerNoch keine Bewertungen

- NBIMS-US V3 2.4.4.7 OmniClass Table 31 PhasesDokument8 SeitenNBIMS-US V3 2.4.4.7 OmniClass Table 31 Phasesmahmoud mokhtarNoch keine Bewertungen

- StaRo Special Steel Items and Surplus StockDokument2 SeitenStaRo Special Steel Items and Surplus StockmelainiNoch keine Bewertungen