Beruflich Dokumente

Kultur Dokumente

Accounting Prob

Hochgeladen von

Lino GumpalOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accounting Prob

Hochgeladen von

Lino GumpalCopyright:

Verfügbare Formate

Advanced Accounting, Part Three

Midterm Examination

1. On November 2, 2007, Pete Corporation acquired 100 shares of JRS Company at a cost of P120 per share. Pete classifies them as available for sale securities. On this same date, Pete decides to hedge against a possible decline in the value of the securities by purchasing at a cost of P100, a put option to sell the 100 shares at P12 per share. The option expires on March 3, 2008. The fair value of the investment and the options follow: 11/3/07 12/31/07 3/3/08 JRS Company shares: Per share P12 P11 P10.5 Put Option (100 shares) Market value P100 P140 P150 Intrinsic value -0100 150 Time value P100 P40 P-0a. How much is the net gain (loss) on hedging activity to be recognized on December 31, 2007? b. What is the journal entry to record the exercise of the put option and the sale of the securities on March 3, 2008? 2. On November 2, 2008, Michael Inc., contracted to purchase merchandise from Malaysia for 240,000 Ringgit. The merchandise were to be delivered on January 30, 2009, and payment would be due on March 1, 2009. On November 1, 2008, Michael entered into a 120-day forward contract to hedge the foreign currency commitment. the spot rates were: November 1, 2008 1 Ringgit=P12.85 December 31, 2008 1 Ringgit=P12.88 January 30, 2009 1 Ringgit=P12.83 March 1, 2009 1 Ringgit=P12.86 The forward rate on March 1, 2009 is P12.82 and on December 31, 2009 is P12.80. a. What is Michaels net exposure to changes in the exchange rate of ringgit for pesos between November 2, 2008 and March 1, 2009? b. Prepare all journal entries from November 2, 2008, through March 1, 2009 for the purchase of the merchandise, the forward exchange contract, and the foreign currency transactions. Assume Michaels fiscal year ends on December 31, 2008. 3. Mega Company believes the price of oil will increase in the coming months. Therefore, it decides to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On November 30, 2007, Mega purchase call options for 10, 000 barrels of oil at P30 per barrel at a premium of P2 per barrel, with a March 1, 2008 call date. The following is the pricing information for the term of the call: Spot Price Futures Price (for March 1, 2008 delivery) Date November 30, 2007 P30 P31 December 31, 2007 P31 P32 March 1, 2008 P33 The information for the change in the fair value of the option follows: Date November 30, 2007 December 31, 2007 March 1, 2008 Ineffective portion P20,000 P6,000 Effective portion -0P10,000 P30,000

On March 1, 2008, Mega sells the options at their value on that date and acquires 10,000 barrels of oil at the spot price. On June 1, 2008, Mega sells the oil for P34 per barrel. a. Prepare the journal entry required on November 30, 2007, to record the purchase of the call options. b. Prepare the adjusting journal entry required on December 31, 2007, to record the change in time and intrinsic value of the options.

Advanced Accounting, Part Three

Midterm Examination

c. Prepare the entries required on March 1, 2008, to record the expiration of the time value of the options, he sale of the options, and the purchase of the 10,000 barrels of oil. d. Prepare the entries required on June 1, 2008, to record the sale of the oil and any other entries required as a result of the option.

Das könnte Ihnen auch gefallen

- Cash BasisDokument4 SeitenCash BasisMark DiezNoch keine Bewertungen

- ADV2 Chapter12 QADokument4 SeitenADV2 Chapter12 QAMa Alyssa DelmiguezNoch keine Bewertungen

- Auditing JPIADokument18 SeitenAuditing JPIAAken Lieram Ats AnaNoch keine Bewertungen

- Practical Accounting 1: 2011 National Cpa Mock Board ExaminationDokument7 SeitenPractical Accounting 1: 2011 National Cpa Mock Board Examinationcacho cielo graceNoch keine Bewertungen

- Home Office Questions With AnswersDokument10 SeitenHome Office Questions With AnswersDaniel Nichole MerindoNoch keine Bewertungen

- Accounting For Special Transactions:: Corporate LiquidationDokument28 SeitenAccounting For Special Transactions:: Corporate LiquidationKim EllaNoch keine Bewertungen

- Q3 - Audit of Cash (S. Prob - KEY)Dokument7 SeitenQ3 - Audit of Cash (S. Prob - KEY)Kenneth Christian WilburNoch keine Bewertungen

- Business Com Chapter 23Dokument5 SeitenBusiness Com Chapter 23Nino Joycelee TuboNoch keine Bewertungen

- DLSA AP Intangibles For DistributionDokument7 SeitenDLSA AP Intangibles For DistributionJan Renee EpinoNoch keine Bewertungen

- Audit of Inventory 2021 - ExamDokument9 SeitenAudit of Inventory 2021 - ExammoreNoch keine Bewertungen

- Audit of ReceivablesDokument29 SeitenAudit of ReceivablesJoseph SalidoNoch keine Bewertungen

- p1 QuizDokument3 Seitenp1 QuizEvita Faith LeongNoch keine Bewertungen

- Gialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingDokument12 SeitenGialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingMeidrick Rheeyonie Gialogo AlbaNoch keine Bewertungen

- Cost of Capital: By: Judy Ann G. Silva, MBADokument21 SeitenCost of Capital: By: Judy Ann G. Silva, MBAAnastasha GreyNoch keine Bewertungen

- Audit of IntangiblesDokument2 SeitenAudit of IntangiblesJaycee FabriagNoch keine Bewertungen

- Identify The Choice That Best Completes The Statement or Answers The QuestionDokument5 SeitenIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNoch keine Bewertungen

- Auditing ProblemsDokument5 SeitenAuditing ProblemsJayr BVNoch keine Bewertungen

- Problem 17-1, ContinuedDokument6 SeitenProblem 17-1, ContinuedJohn Carlo D MedallaNoch keine Bewertungen

- AFAR - Revenue Recognition, JointDokument3 SeitenAFAR - Revenue Recognition, JointJoanna Rose DeciarNoch keine Bewertungen

- DBP V ArcillaDokument137 SeitenDBP V ArcillajeysonregNoch keine Bewertungen

- Midterm Exam No. 2Dokument1 SeiteMidterm Exam No. 2Anie MartinezNoch keine Bewertungen

- Assign. 2 Module 2Dokument9 SeitenAssign. 2 Module 2Kristine VertucioNoch keine Bewertungen

- Chapter 6Dokument5 SeitenChapter 6Angelita Dela cruzNoch keine Bewertungen

- AainvtyDokument4 SeitenAainvtyRodolfo SayangNoch keine Bewertungen

- Chatto Interim Financial ReportingDokument6 SeitenChatto Interim Financial ReportingLabLab ChattoNoch keine Bewertungen

- Concept Of: The Basic NatureDokument35 SeitenConcept Of: The Basic NatureChan100% (1)

- CBS Corporation Purchased 10Dokument12 SeitenCBS Corporation Purchased 10Stella SabaoanNoch keine Bewertungen

- Recourse Obligation.: RequiredDokument55 SeitenRecourse Obligation.: RequiredJude SantosNoch keine Bewertungen

- Morales, Jonalyn M.Dokument7 SeitenMorales, Jonalyn M.Jonalyn MoralesNoch keine Bewertungen

- Activity #1Dokument5 SeitenActivity #1Lyka Nicole DoradoNoch keine Bewertungen

- Chapter 3 - Seat Work - Assignment #3 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDokument5 SeitenChapter 3 - Seat Work - Assignment #3 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDonise Ronadel SantosNoch keine Bewertungen

- Audit Liability 04 Chapter 7Dokument1 SeiteAudit Liability 04 Chapter 7Ma Teresa B. CerezoNoch keine Bewertungen

- Coursehero 12Dokument2 SeitenCoursehero 12nhbNoch keine Bewertungen

- Standard Costs and Variance Analysis Standard Costs and Variance AnalysisDokument26 SeitenStandard Costs and Variance Analysis Standard Costs and Variance Analysischiji chzzzmeowNoch keine Bewertungen

- Audit of Investments May 2028Dokument8 SeitenAudit of Investments May 2028kmarisseeNoch keine Bewertungen

- Audit of Investments - Set ADokument4 SeitenAudit of Investments - Set AZyrah Mae SaezNoch keine Bewertungen

- 1911 Investments Investment in Associate and Bond InvestmentDokument13 Seiten1911 Investments Investment in Associate and Bond InvestmentCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Chapter 12-14Dokument18 SeitenChapter 12-14Serena Van Der WoodsenNoch keine Bewertungen

- Summit Professional Review Center: Auditing Problems Shareholders' EquityDokument6 SeitenSummit Professional Review Center: Auditing Problems Shareholders' EquityKris Van HalenNoch keine Bewertungen

- Auditing Cup - 19 Rmyc Answer Key Final Round House StarkDokument13 SeitenAuditing Cup - 19 Rmyc Answer Key Final Round House StarkCarl John PlacidoNoch keine Bewertungen

- Home Office and Branch Accounting PDFDokument3 SeitenHome Office and Branch Accounting PDFJisselle Marie Custodio0% (1)

- Afar IcpaDokument6 SeitenAfar IcpaAndrea Lyn Salonga CacayNoch keine Bewertungen

- Sorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonDokument8 SeitenSorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonTine Griego0% (1)

- Auditing ProblemsDokument26 SeitenAuditing ProblemsKingChryshAnneNoch keine Bewertungen

- HW On INVESTMENT PROPERTY - 1Dokument2 SeitenHW On INVESTMENT PROPERTY - 1Charles TuazonNoch keine Bewertungen

- Accounting For Business Combination - Practice ExamDokument6 SeitenAccounting For Business Combination - Practice ExamZYRENE HERNANDEZNoch keine Bewertungen

- CLINCHERDokument1 SeiteCLINCHERJerauld BucolNoch keine Bewertungen

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDokument5 SeitenColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezNoch keine Bewertungen

- ACELEC 332 Prelim Quiz 2Dokument9 SeitenACELEC 332 Prelim Quiz 2MontenegroNoch keine Bewertungen

- Afar 107 - Business Combination Part 2Dokument4 SeitenAfar 107 - Business Combination Part 2Maria LopezNoch keine Bewertungen

- Seatwork in Audit 2-3Dokument8 SeitenSeatwork in Audit 2-3Shr BnNoch keine Bewertungen

- Abc Stock AcquisitionDokument13 SeitenAbc Stock AcquisitionMary Joy AlbandiaNoch keine Bewertungen

- BLT 101Dokument14 SeitenBLT 101NIMOTHI LASENoch keine Bewertungen

- AE120 - Final Activity 1Dokument1 SeiteAE120 - Final Activity 1Krystal shaneNoch keine Bewertungen

- Sample Probles For Corpo Liquidation Part 2Dokument1 SeiteSample Probles For Corpo Liquidation Part 2Kezia GuevarraNoch keine Bewertungen

- LTCC QuizDokument3 SeitenLTCC QuizKiel SorrosaNoch keine Bewertungen

- Fire Insurance Claim TypeDokument5 SeitenFire Insurance Claim TypeAMIN BUHARI ABDUL KHADERNoch keine Bewertungen

- Module Assessment Answers - Effects of Changes in Foreign Currency Exchange RatesDokument4 SeitenModule Assessment Answers - Effects of Changes in Foreign Currency Exchange RatesJohn Philip L ConcepcionNoch keine Bewertungen

- Fire Insurance ClaimDokument4 SeitenFire Insurance ClaimAMIN BUHARI ABDUL KHADERNoch keine Bewertungen

- Soal Kuis Uas - AklDokument3 SeitenSoal Kuis Uas - AklBastian Nugraha SiraitNoch keine Bewertungen

- Memo98 569ADokument1 SeiteMemo98 569ALino GumpalNoch keine Bewertungen

- Math of Investment QuizDokument1 SeiteMath of Investment QuizLino GumpalNoch keine Bewertungen

- Chapter 4 Requirements Modeling Part 1Dokument1 SeiteChapter 4 Requirements Modeling Part 1Lino GumpalNoch keine Bewertungen

- It Quiz Journal EntriesDokument4 SeitenIt Quiz Journal EntriesLino Gumpal0% (1)

- Auditing in CIS EnvironmentDokument14 SeitenAuditing in CIS EnvironmentLino GumpalNoch keine Bewertungen

- BLT Quizzer (Unknown) - Law On Negotiable InstrumentsDokument7 SeitenBLT Quizzer (Unknown) - Law On Negotiable InstrumentsJasper Ivan PeraltaNoch keine Bewertungen

- DONORS TAX - Theory 1 of 5Dokument5 SeitenDONORS TAX - Theory 1 of 5Joey Acierda BumagatNoch keine Bewertungen

- 0601 IndiaDokument3 Seiten0601 IndiaLino GumpalNoch keine Bewertungen

- 2.6 Case Study Subway in China: Not So Easy: QuestionsDokument1 Seite2.6 Case Study Subway in China: Not So Easy: QuestionsRajasekaran0% (1)

- Sales Incentive PlansDokument28 SeitenSales Incentive Plansakanksha67% (3)

- Tongson Vs Emergency PawnshopDokument8 SeitenTongson Vs Emergency PawnshopWonder WomanNoch keine Bewertungen

- Brand Revitalisation '" Focusing On Renovating OfferingsDokument5 SeitenBrand Revitalisation '" Focusing On Renovating OfferingsEditor IJTSRDNoch keine Bewertungen

- Product PortfolioDokument83 SeitenProduct PortfoliosteveNoch keine Bewertungen

- Sell More Faster Schwartzfarb en 37899Dokument6 SeitenSell More Faster Schwartzfarb en 37899rdeepak99Noch keine Bewertungen

- Blade2017 2 PDFDokument84 SeitenBlade2017 2 PDFgordonsanweyNoch keine Bewertungen

- BudgetDokument24 SeitenBudgetYoussef MohammedNoch keine Bewertungen

- Unit 4 Sale of Goods Lecture and Tutorial Notes 20081Dokument9 SeitenUnit 4 Sale of Goods Lecture and Tutorial Notes 20081twanda bryanNoch keine Bewertungen

- Case Analysis AvonDokument4 SeitenCase Analysis AvonRaj Paroha83% (6)

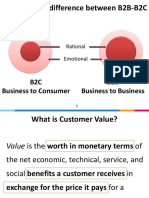

- Fundamental Difference Between B2B-B2C: B2C Business To Consumer B2B Business To BusinessDokument24 SeitenFundamental Difference Between B2B-B2C: B2C Business To Consumer B2B Business To BusinessALOK PRADHANNoch keine Bewertungen

- Chapter 9Dokument58 SeitenChapter 9meghan100% (1)

- Summer TrainingDokument20 SeitenSummer TrainingBharti VermaNoch keine Bewertungen

- T3int 2010 Jun QDokument9 SeitenT3int 2010 Jun QlowchangsongNoch keine Bewertungen

- 100 Sales Qualification Questions PDFDokument16 Seiten100 Sales Qualification Questions PDFNamtien UsNoch keine Bewertungen

- Customer Satisfaction-JCB 1Dokument70 SeitenCustomer Satisfaction-JCB 1Ankita_Rules_867067% (3)

- Unit 6 of MPBCDokument3 SeitenUnit 6 of MPBCYellow CarterNoch keine Bewertungen

- Reg 343Dokument2 SeitenReg 343aloknsinghNoch keine Bewertungen

- Chapter15 - Electronic Marketing ChannelsDokument21 SeitenChapter15 - Electronic Marketing ChannelsNaveen HanagandiNoch keine Bewertungen

- FSDokument44 SeitenFSMaria Beatriz Aban Munda100% (2)

- Ac102 ch7Dokument22 SeitenAc102 ch7Mohammed OsmanNoch keine Bewertungen

- F.A. (Sir Farhan) - Evening Paper (2013)Dokument3 SeitenF.A. (Sir Farhan) - Evening Paper (2013)Daniyal RahatNoch keine Bewertungen

- Cisg Through The Willem C Vis Moot CasebookDokument160 SeitenCisg Through The Willem C Vis Moot CasebookeucaleaNoch keine Bewertungen

- EMCORDokument13 SeitenEMCORDy Ju Arug AL100% (1)

- Beer Distribution Game InstructionDokument12 SeitenBeer Distribution Game InstructionCristian BenavidesNoch keine Bewertungen

- 41Dokument20 Seiten41Rinku PatelNoch keine Bewertungen

- A Tale of Two MoralitiesDokument5 SeitenA Tale of Two MoralitiesrebaalNoch keine Bewertungen

- Abhishek Singh (PGP/16/003) Anshuman Tigga (PGP/16/005) Sudhanshu Shukla (PGP/16/052) Babita Pegu (PGP/16/136) Harsh Bajpai (PGP/16/197)Dokument18 SeitenAbhishek Singh (PGP/16/003) Anshuman Tigga (PGP/16/005) Sudhanshu Shukla (PGP/16/052) Babita Pegu (PGP/16/136) Harsh Bajpai (PGP/16/197)Abhishek SinghNoch keine Bewertungen

- Republic Vs Umali: Torrens System of Land RegistrationDokument1 SeiteRepublic Vs Umali: Torrens System of Land RegistrationReyna RemultaNoch keine Bewertungen

- How Mahindra & Mahindra Came To Dominate The Indian Automotive IndustryDokument10 SeitenHow Mahindra & Mahindra Came To Dominate The Indian Automotive IndustryKunwar AdityaNoch keine Bewertungen