Beruflich Dokumente

Kultur Dokumente

A Buyers Guide To Treasury Management Systems 2011

Hochgeladen von

sowmikchakravertyOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

A Buyers Guide To Treasury Management Systems 2011

Hochgeladen von

sowmikchakravertyCopyright:

Verfügbare Formate

Treasury Management Systems

2011

buyerS guide

www.gtnewsawards.com

-,,,, ,,,, ,, -, ,,,,-,-,

,, -,, , ,-,,, ,,,,,,

Sponsored by

TREASURY AWARDS 2011

GLOBAL CORPORATE

Recognising Excellence in Treasury

gtnews hosted the second annual Global Corporate

Treasury Awards in Toronto, Canada, 20 September 2011.

The Global Corporate Treasury Awards, sponsored by Bank of America

Merrill Lynch, pays tribute to treasury innovation that has contributed to

the success of a corporations business.

gtnews_awards_A4_ad_final_aug11_aw.indd 1 8/4/11 2:06 PM

a buyers guide to TreaSury ManageMenT SySTeMS 2011

3

A

ll a

rtic

le

s

2

0

1

1

C

-S

tre

a

m

L

im

ite

d

Contents

4

getting the Most Out of your TMS

The recent gtnews 2011 Treasury Management

Systems Survey found that most corporates do not

fully use all of their TMS capabilities.

7

Wheres the Cash?

At a time when having the best possible visibility

over cash is a critical issue for treasurers, how can

using a treasury management system (TMS) provide

this visibility?

10

expert Opinion

Six corporate treasurers explain why they chose the

TMS that they did and discuss additional functionality

that they would like developed in the future.

12

risk and reporting

What are some of todays considerations in

evaluating technology for measuring, managing and

reporting risk in treasury operations?

16

directory of Service

Plus a functionality matrix of 22 treasury

management systems.

Editor:

Joy Macknight

joym@gtnews.com

Deputy editor:

Lynne Peachey

lynnep@gtnews.com

Publishing manager:

Mia Leaning

mial@gtnews.com

Chief executive:

Mike Hewitt

mikeh@gtnews.com

Art and design:

Donna Jones

donna@missjonesfreelancedesign.com

Sales director:

Anne-Marie Rice

annemarier@gtnews.com

Key accounts manager:

Katharine Christian

katharinec@gtnews.com

Account manager:

TomLeitch

toml@gtnews.com

Training and events director:

Diana Henderson

dianah@gtnews.com

gtnews, an Association for Financial

Professionals company headquartered

in London, is the leading global knowledge

resource for over 50,000 treasury,

finance, payments and cash management

professionals. Online, gtnews is updated

weekly and provides subscribers access to an

archive of almost 3,000 global treasury articles

in addition to special reports, commentaries,

surveys, polls, news, ratings updates and

whitepapers. Access to gtnews.comis free of

charge to those who register, and we never sell

names or e-mail addresses, so our readers

privacy is assured.

4

7

16

For more details about how this training course can add value to your

organisation and to attend please contact Diana Henderson, Director of Training

and Events, on + 44 (0) 207 079 2808 or email dianah@gtnews.com.

I

n

c

l

u

d

e

s

a

n

a

f

t

e

r

n

o

o

n

s

e

s

s

i

o

n

o

n

S

W

I

F

T

f

o

r

c

o

r

p

o

r

a

t

e

s

Enhancing Treasury

Performance Through

Technology

Learn how to multiply the efciency of your treasury team by introducing

or upgrading a treasury management system or connecting to the SWIFT

network. Understand how to put together an RFP, choose between competitor

systems and ensure your system delivers.

Key Benets

Understand how technology can help treasury deliver business value.

Find out when and how to use a TMS.

Learn how to produce the perfect RFP.

Know what systems are available and understand the differences between them.

Be able to evaluate what is appropriate for your environment.

Understand what can go wrong and how to avoid it.

Understand how SWIFT might help your business by asking the right questions.

Know what SWIFT corporate access systems are available.

Be able to build a business case for using SWIFT.

In just one day, any treasury team can understand what technologies are available for treasury and how they

interconnect, illustrated with practical examples and case studies from the real world of corporate treasury.

A full calendar of training course can be found at www.gtnews.com

00012_Training_ad_A4_aug11_print.indd 1 8/4/11 7:18 PM

Treasury management systems (TMS) can provide

a wealth of benefts to a corporate treasury, but the

question remains: are corporates getting the most

out of their TMS? A recent gtnews survey on treasury

technology found that smaller corporates could be

missing out on the full benefts of TMS because they

do not have the appropriate internal structure to best

exploit them.

The 2011 buyers guide explores the results of the survey, looking at different

delivery methods, such as software-as-a-service (SaaS) models, and added

functionality that treasurers believe would bring the biggest improvement to

their TMS. One of these is improved cash fow forecasting, which is the most

important feature for 51% of survey respondents.

The guide also looks at some of todays considerations in evaluating technology

for measuring, managing and reporting risk in treasury operations.

Joy Macknight, editor, a buyers guide to TMS

Are You Getting the Most

Out of Your TMS?

a buyers guide to TreaSury ManageMenT SySTeMS 2011

4

a buyers guide to TreaSury ManageMenT SySTeMS 2011

5

While a majority of corporates have treasury

management systems (TMS) there is

signifcant difference in how these systems

are used, according to gtnews 2011 Treasury

Management Systems Survey. Moreover, the

survey found that smaller corporates could be

missing out on the full benefts of TMS because

they do not have the appropriate internal

structure to best exploit them.

A total of 412 corporate respondents participated

in this years survey, 50% of whom are based

in western Europe. Respondents represented

corporates of all sizes, with a third posting

between US$1bn-US$10bn in annual revenues,

28% with revenues between US$10m-US$500m

and 23% from companies that have annual

revenues of more than US$10bn.

The survey found that while corporate treasurers

at larger companies use TMS as decision

support tools, rather than merely as transaction

management applications, smaller companies

do not necessarily have the internal structure

and organisation that will enable them to fulfl

the greatest benefts of TMS.

Small companies expect TMS to improve

effciency and support downsizing of staff. Such

expectation, however, appears not fulflled by

the use of the systems, according to the survey.

This is due either to higher expectations than

what is realistically possible, as well as to a lack

of internal structure and organisation at these

small companies that is a prerequisite to reap

the greatest benefts from the application of IT

systems, such as a TMS.

TMS need the presence of trained users, says

the report. This is not always the case in small

organisations where the number of treasury

staff is kept to a minimum. While the adoption of

an automated system could provide relief from

the burden of manual operations, at the same

time the implementation of a sophisticated

IT system, such as a TMS, requires fnancial

investments that not all companies can afford,

particularly the smaller ones in a period when

credit is diffcult to access.

The surveys fnding does not surprise Jeff

Wallace, managing partner at US-based

treasury consultancy Greenwich Treasury

Advisors. What you are seeing is the very

real difference between small companies and

large companies, he says. In any company,

you must be able to handle the day-to-day

operational fow. Even small companies will

handle that, and the frst priority of any TMS is

to fulfl this function.

However, says Wallace, small companies do not

often have the additional staff with the analytical

capabilities to do anything other than just that.

While many chief fnancial offcers (CFOs) will

say they cannot afford the extra staff, it is more

likely they cannot see the value of such analysis,

he suggests. You are also seeing the Excel

phenomena: most Excel users only use 10%of

the capabilities of Excel. Most users of TMS do

not fully utilise all of the TMS capabilities.

Wallace recommends that every company

implementing a TMS should ask the TMS

vendors consulting team to come back

in 12 months after the system has been

implemented to evaluate how the company

can fully - and more effciently - use

the systems capabilities. With a years

experience under their belt, the treasury staff

will fnally have familiarity with the system to

better understand any such recommendations

- recommendations that they probably didnt

understand in the beginning because there

was just too much to learn and absorb.

The difference in use of a TMS between small

and large corporates relates to their needs, says

Rob Van Peer a partner at Nasarius, a European

treasury and cash management consultancy. A

smaller treasury with only a handful of people

or less in the treasury will typically have fewer

positions and a simpler structure. Therefore,

the treasury manager would know the position

and the risk of the position just from the daily

work. In this scenario the need for a more

advanced risk management system [RMS] is

less pressing.

Van Peer adds that the treasury manager of a

small or medium-sized treasury department

typically wont have extra staff that could be

set aside to do advanced risk analysis. When

it comes to training TMS users, the smaller

and medium-sized corporate treasuries have

limited resources. They often dont have enough

resources to be able to invest in training for

the more specialised parts of a TMS, such as

advanced risk management, he says.

TMS vendors could help smaller companies

to better exploit the capabilities of their RMS

through the added services that are possible

with a hosted solution. I envisage that in the

future vendors may support smaller corporate

treasuries in many areas where these corporates

lack expertise or time for in-depth analysis, for

example in accounting and risk analysis.

Hosted Solutions

Hosted solutions are growing in popularity,

according to the survey. The majority of TMS

are located in-house, with 44% delivered on

a software-as-a-service (SaaS) basis. SaaS

delivery is most prevalent in Asia-Pacifc where it

makes up 61% of TMS installations. The survey

suggests this is because corporations in this

region do not have the legacy systems prevalent

in Europe and North America and can implement

the most technologically advanced and fexible

solutions more easily.

SaaS solutions allow a treasurer to build

functionality for their TMS piece-by-piece,

ftting all the necessary pieces of the jigsaw

together, as required, says Paul Wheeler,

managing director at Wall Street Systems, a

US-based treasury systems developer.

In relation to the varying needs of corporate

treasurers at larger companies compared

to smaller companies, our sense is that

mid-market treasurers have no different

requirements from high-end treasurers. While

they have more modest IT support and budget,

their needs are very much the same, he says.

Wheeler says for both sets of treasurers,

the challenge is interoperability. Mid-market

treasurers are left with two options: either

invest in a new system, which can be a tough

sell to the business, or streamline their existing

TMS to allow them to do what they need to. A

SaaS solution, manages the operational issues

for the treasurer by providing a hosted solution,

and therefore allows them richer functionality

without the cost a high-end treasurer would

incur.

More than 350 of Wallstreets clients have

hosted solutions, and we are encouraging

our clients to leverage their existing systems,

managing the process via Wallstreet, rather

than beginning a lengthy, and costly, tendering

process for new TMS solutions, explains

Wheeler.

A SaaS approach to TMS is often substantially

cheaper, says Greenwichs Wallace. This is

a big selling point for corporate treasuries that

dont have much budget clout. Its OK to pay

tens of millions of dollars on ERP [enterprise

resource planning] systems, but US$500,000

for a TMS is considered to be an outrageous,

unnecessary expense.

While SaaS solutions are an obvious ft for

smaller companies, Paul Bramwell, senior

vice president (SVP), treasury solutions at

SunGard AvantGard, says they are becoming

Getting the Most

Out of Your TMS

With limited personnel and IT resources, corporate

treasuries are relying on treasury management

systems (TMS) to alleviate the strain. However,

the recent gtnews 2011 Treasury Management

Systems Survey found that most do not fully use

all of the TMS capabilities.

Words: Heather McKenzie

Cash fow forecasting will not improve

until the TMS have their hooks into the

ERP systems

a buyers guide to TreaSury ManageMenT SySTeMS

6

A

ll a

rtic

le

s

2

0

1

1

C

-S

tre

a

m

L

im

ite

d

a buyers guide to TreaSury ManageMenT SySTeMS 2011

7

A

ll a

rtic

le

s

2

0

1

1

C

-S

tre

a

m

L

im

ite

d

increasingly common for large enterprises with

extensive IT departments. There is a growing

acknowledgement in these frms that having

a solution managed by the solution architect

yields signifcant benefts over in-house

implementations. The core competency of

most large corporations IT departments tends

to be around the ERP solutions, whereas a

solution vendor is best placed to manage and

maintain the treasury solutions.

Hosted solutions are seen as a means to

outsource the operational risk associated

with commissioning and operating treasury

technology, says Tatiana Liber Soudier, marketing

director at IT2 Treasury Solutions in the UK.

Vendors can offer a spectrum of hosted

services so that the detailed solution offered

in a given case can be scaled to ft the clients

requirements. A solution can range from

a straightforward technology outsourcing

arrangement to a fully managed service solution

in which IT2, for example, is the one-stop shop

for all aspects of technology support, as well as

application support.

The key beneft of a hosted solution is that

it accommodates a broad range of client IT

policy requirements. For example, IT policy may

demand that a sensitive fnancial application

such as treasury should use a dedicated

database. IT2s opinion is that clients should frst

select the TMS that best fulfls their treasury

business objectives, and then investigate the

hosting solution that best fulfls corporate IT

policy, she says.

Nasarius Van Peer points out that new

solutions, such as Kyriba and Reval, are

available only as hosted solutions and are

proving popular. He believes vendors of the

more traditional TMS, such as Wall Street

Systems and SunGard, are now basing their

strategies on selling hosted solutions, although

they still have installed, in-house options. In

the future, he says, Saas will be the preferred

solution for the majority of treasuries.

There are three advantages to hosted solutions,

he says: technical, cost and added services. The

technical advantages include the fact you dont

have to train IT specialists in-house, as system

tuning is done by the provider, or deal with back-

up services and disaster recovery sites. Costs

are saved because there is practically no need

for upfront investments in hardware, operating

system and database software. Added services

could include automatic delivery of master data,

pre-defned interfaces to banks, integrated

dealing platforms, back offce processing, and

premium hotlines for processing issues.

At present the main reasons for choosing

a hosted solution are related to technical

advantages or cost savings, but Van Peer

says in the future, as more added services

are developed, they will prove to be key

differentiators for the different offerings.

Functionality

Additional functionality is a topic addressed

by the survey, with respondents asked what

additional functionalities would bring the

biggest improvement to their TMS. Cash fow

forecasting was the most popular at 51%, but

respondents also cited electronic bank account

management (eBAM - 48%), risk management

(40%), SWIFT connectivity (34%) and integration/

interoperability (33%).

Cash fow forecastings position at the top of

the list of requirements is not a surprise for

Van Peer, but he does question whether it is a

functionality problem. Cash fow forecasting

is not where TMS system vendors focus

their investments, and with good reason. The

majority of TMS solutions on the market are

actually very good at cash fow forecasting

already. Nasarius experience with the cash

fow forecasting at corporates isnt the lack

of functionality of the systems but is about

getting access to the right data, and getting

data with good quality. Treasury systems

cannot help with this, he adds, as the sources

of data are ERP systems, budgeting systems

or information supplied by production

planners or sales people.

Wallace agrees, saying cash fow forecasting

will not improve until the TMS have their

hooks into the ERP systems so that they can

access the payments data in the accounts

receivable (A/R) and accounts payable (A/P)

fles. I dont think many, if any, vendors, can

do that.

Wheeler says it is interesting to see a

high number of respondents in the survey

identifying eBAM as one of the most

signifcant improvements to be made

to their TMS. Our own research and

increasing experience of eBAM has shown

that while corporate treasurers see it

as a priority, banks are playing catch up

to an extent. Wallstreet is working with

banks to bring increased automation to

corporate treasurers. Its great to see

treasurers themselves driving this change

and encouraging banks to move towards

collaboration on such initiatives faster.

As cash fows around a company, it can create

large fnancial risks for the organisation.

The treasurer needs to know what cash the

company has and where it is, as well as have

visibility over accounts payables (A/P) and

accounts receivables (A/R). The topic of cash

visibility is particularly relevant today, as many

corporates are choosing to optimise their

working capital position in order to rely less

on bank funding.

Many corporate treasuries use a treasury

management system (TMS) to support their

cash management activities. The frst area

where a TMS can prove its worth is in the vital

discipline of cash fow forecasting.

Enhancing Cash Management Techniques

Cash fow forecasting is perennially one of

the top three disciplines that treasurers cite

as in most need of improvement. As Tom

Nelson, cash management specialist at Wall

Street Systems, says: Cash fow forecasting

is perhaps the most important function a

treasury provides and everything else fows

from that, for example investment, hedging

and funding decisions. But the process can

face many problems. Manual reporting is

an ineffcient process, which can lead to

errors, particularly when trying to consolidate

information from various different systems,

Nelson notes.

In this context, a TMS can be used as a

secure and stable destination to aggregate

forecasting data from remote business

units with the organisations bank positions

and treasury transactions. This enables the

treasurer to construct the cash forecast

over a defned time horizon. Jason Torgler,

vice president of strategy at Reval, says

that a TMS enables quicker analysis of a

companys historical bank transactions and

more streamlined data integration from other

fnancial software and remote operations.

Additionally, a TMS maintains an audit trail

and provides sophisticated forecast to actual

variance analysis. These are critical tools

when the treasurer is attempting to enforce

performance and accountability of the reporting

subsidiaries, explains Torgler.

A key beneft of a TMS is that the treasury

will be able to match the projected cash fow

over time against known demands, including

operating fows, dividend, interest and royalty

payments, and non-routine costs such as those

relating to new investments and acquisitions.

Paul Higdon, chief technology offcer at IT2

Treasury Solutions, says this means that as

much cash as possible can be generated

from internal sources, minimising the need for

external borrowing. This will have a further

positive effect of improving the organisations

creditworthiness. Additionally, it will enable the

organisation to plan the accurate deployment

of cash where and when it is needed, to

fnance business operations effciently and

effectively, says Higdon.

Beyond the potential for improved cash

forecasting, a TMS can also enhance the A/P

and A/R processes. Serving as a payment

factory can do this for A/P. A bank-agnostic TMS

can import A/P from a variety of systems, batch

payments and send the payment instructions

to partner banks. This method creates a single

point of payment execution and forecasting,

while outsourcing the payment format

maintenance to the TMS vendor, says Mauricio

Barberi, chief marketing offcer at Kyriba.

Barberi also points out that consolidating all

A/R in the TMS will help build an accurate

forecast and allow for aggregated days sales

outstanding (DSO) reporting by payer. This

will give the corporate the ability to identify

vendors and suppliers who pay outside of

stipulated terms and follow up with those

Wheres

the Cash?

At a time when having the best possible visibility

over cash is a critical issue for treasurers, how

can using a treasury management system (TMS)

provide this visibility, while also enhancing cash

management techniques?

Words: Ben Poole

Smaller companies do

not necessarily have the

internal structure and

organisation that will

enable them to fulfl the

greatest benefts of TMS

a buyers guide to TreaSury ManageMenT SySTeMS 2011

a buyers guide to TreaSury ManageMenT SySTeMS

8

A

ll a

rtic

le

s

2

0

1

1

C

-S

tre

a

m

L

im

ite

d

a buyers guide to TreaSury ManageMenT SySTeMS 2011

9

A

ll a

rtic

le

s

2

0

1

1

C

-S

tre

a

m

L

im

ite

d

parties, he explains. In addition, a rolling

date adjustment can be made to the cash

record upon import, which can automatically

adjust the expected receipt date by the late

pay history of that counterparty.

According to Paul Bramwell, senior vice

president (SVP) treasury solutions for SunGards

AvantGard, one recent trend has seen some

TMS vendors make acquisitions within the

A/R space to leverage the value of accurate

A/R forecasting through accurate cash

management and also short-term debt based

on securitising receivables. Key aspects of

receivables of interest to the treasurer are

quantity and quality, and both of these variables

control the amount and margin of borrowing

securitised on balances, notes Bramwell.

A Centralised Approach to Cash Visibility

Treasurers will want to take advantage of the

TMS benefts already mentioned, but does the

effectiveness of using a TMS for corporate

cash management purposes depend on the

organisational structure of that treasury

department? Fortunately, according to Bart

Parren, director of product management

at Hanse Orga, there are benefts to be

had whether your treasury structure is

largely decentralised or centralised. In a

decentralised environment, local subsidiaries

can work in the same environment, adding

their specifc business knowledge and share

the information with HQ, explains Parren.

Technically, for a decentralised TMS to be

feasible, it is necessary to have a web-based

or enterprise resource planning (ERP)-based

architecture that is able to be accessible

everywhere at the same time.

In my point of view, argues Parren, a

centralised environment only becomes

possible with a TMS. For example,

centralisation has increased administration

costs in in-house banking (i.e. when cash is

pooled and internal current accounts have

to be maintained). A TMS enables a quasi-

automatic administration, which is vital for a

centralised treasury structure.

David Soan, managing director of BELLIN

Treasury Alliance, comes to this point from a

slightly different perspective. When the right

TMS has been selected for the company, it

should not matter whether the treasury is

going to be centralised or not, says Soan.

Rather, he suggests that the following points

need to be taken in to account:

How will the users connect to the TMS?

How easy will it be to roll out the TMS if

additional subsidiaries and users need to

be added?

What support is provided by the TMS

on a local basis?

What are the additional costs involved

in the doing the above?

Finally, Soan argues, the system should ft

into the organisation, rather than forming

the organisation around the restrictions

of the system.

Demonstrating Visibility - Reporting to

Senior Management

While cash visibility is critical for an

organisation to maximise its working capital

position and in turn reduce its dependency

on bank funding, treasurers are also under

increased pressure to demonstrate their cash

visibility competency to senior management.

This is a legacy from the credit crisis and

it is here to stay. Many modern TMS are

equipped to help the treasurer generate either

summary-level or detailed cash management

reports for senior management.

The key to providing complete and up-to-

date information needed by management is

the automatic updating of the TMS database

with all relevant information in real time, as

the data is inputted, uploaded or detected,

says IT2s Higdon. With such a solution in

place, senior management can depend on

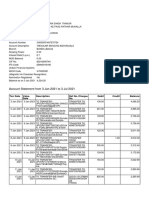

Figure 1: An Example of a TMS Dashboard Reporting Cash Management KPIs

Source: Hanse Orga

the accuracy and completeness of their

on-demand cash management reporting,

including summaries of cash positioning and

cash fow forecast.

Additionally, the database can support the

derivation and reporting of key performance

indicators [KPIs] for management

benchmarking of the accuracy and timeliness

of quantities and events, such as forecast

accuracy, bank account reconciliation

performance and payment execution,

to support proactive, best practice cash

management operations, says Higdon.

TMS Versus Bank Cash Management Portals

There are a variety of options for treasurers

to consider when it comes to choosing

support for their cash management practices.

For example, some choose to use the cash

management portal offered by a bank,

sometimes at the expense of a TMS. Bank

portals are central sites where users can view

balance and transaction information and make

payments, primary for that specifc bank.

For organisations with one cash

management bank and limited need for

integration of other activities, bank portals are

useful, says Revals Torgler. However, he adds

that a TMS is adopted when requirements

exist across global, multi-bank environments

and include cash positioning, reconciliation,

cash fow forecasting, accounting integration,

portfolio management, cash pooling and

intercompany lending and fnancial risk

management - requirements that many

treasurers of multinational corporations will

have. The additional advantage here is that a

bank-agnostic TMS gives treasurers freedom

over which banks they give their cash

management business to, rather than being

tied to a particular bank via their portal.

Barberi from Kyriba makes the point that

bank portals provide very basic cash position

worksheet functionality and do not

support the level of data accumulation

of a TMS. This means that data is re-

keyed extensively, similar to working on a

spreadsheet, he says.

Future Developments

The potential for TMS to provide greater

support for corporate cash management in

the future comes from technical innovation

that vendors can make in this area. A large

part of this will be seen in the delivery channel

of the TMS itself. SunGard AvantGards

Bramwell suggests that cloud-based TMS

offerings are starting to become more

accepted and will be the big growth area for

cash management solutions. Coupled with

mobile device technology - where reports,

metrics, payments and approvals are done on

a wireless device - companies will be able to

operate without being tied to a single location

or bank, Bramwell says.

Revals Torgler believes that software-as-

a-service (SaaS) will continue to dominate

the TMS adoption landscape. Organisations

will demand rapid deployment from a

single solution, without the headaches of

internal IT resourcing and scheduling, he

says, while also making the point that the

TMS marketplace will no longer tolerate the

frustrations of costly upgrades, post-purchase.

Too many treasury departments have been

left high and dry and unsupported due to older

TMS software versions, Torgler notes.

In addition to developments in

technology, Hanse Orgas

Parren believes that

treasurers should

be looking out for

integration and

effciency as a trend

over the next 18

months, citing the

integration of cash and liquidity management

with the front offce as an example. The same

liquidity position that is used to assess how

much cash the business makes in the medium-

term can be used as the basis for an evaluation

of credit lines and loans, as well as for foreign

exchange [FX] positions, says Parren.

Wall Street Systems Nelson suggests that

regulation will continue to play a part in

the role of the treasurer, placing increasing

pressure on issues of reporting, risk

assessment and visibility of accounts. There

will be a continued demand for stronger global

systems, as well as a desire for reducing the

number of systems in use, he says.

Conclusion

Corporate cash management is a complex feld

that requires tools capable of managing the

workfow and reporting needs across the entire

organisation. SunGard AvantGards Bramwell

notes that, while ERP extensions and bank

portals can offer some of the functionality,

a TMS can provide comprehensive tools to

manage an entire organisations cash, risk,

bank account structure and consolidated

reporting. With the prolonged elevated

importance of cash, this breadth of functionality

is vital for treasury effciency.

a buyers guide to Treasury ManageMenT sysTeMs

10

A

ll a

rtic

le

s

2

0

1

1

C

-S

tre

a

m

L

im

ite

d

a buyers guide to Treasury ManageMenT sysTeMs 2011

11

A

ll a

rtic

le

s

2

0

1

1

C

-S

tre

a

m

L

im

ite

d

What treasury

management

system (TMS) do

you use and why

did you choose it?

1. Steinhof Group chose to use tm5 by BELLIN

due to reasons of user-friendliness and the clear

structure of the application. Considering the

expansion plans of the group, the ASP service

was also an important factor for us to decide in

favour of tm5, as it is easy to integrate acquired

companies without much technical efort.

Another bonus was the option to integrate

the payment transaction management, by

which we can make all process steps in one

application frombeginning to end.

1. We are using IT2 and are just going live

with the system now. Prior to this, CLS

was using a custom-built Access-based

application to manage its third-party debt.

A fully integrated solution was needed to

optimise the management of the groups

treasury operations (cash management, debt,

interest rate and FX hedging), both external

and internal, and interfaces with other used

systems (internet banking, information

systems, internal accounting and forecasting).

In addition, we were looking for a solution

that would improve our reporting capabilities

in terms of consistency, quality and fexibility.

IT2 was chosen as it ofered the right mix of

functionalities, adaptability and ease of use/

self-intuitiveness.

What advice

can you give

for others looking

to implement a

new system?

2. Our process began by determining the report

requirements we have and which processes

we wanted, and specifed diferent business

transactions one-by-one. Then the diferent

providers showus presentations of their solution

for performance. An important requirement was

to be able to complete all business transactions

in theTMS. Due to our expansion plans it was

important to make the implementation with our

own resources to build up internal know-how.

The treasury department was responsible for

realisation. This approach provided us with an

excellent understanding of the function of tm5.

We were able to establish our reputation as

an internal service provider in the Steinhof

Group successfully.

2. Do not underestimate the work involved

during implementation. We elected to carry

out the implementation using internal

resources only. I strongly believe that getting

involved in all the aspects of setting up

the system will beneft us and will make us

better users of the system. This approach

will inevitably increase the workload of

the department and also result in delays

in the implementation plan. It is important

to manage the expectations of senior

management in that respect.

How easy is your

organisations TMS

to use on a day-to-

day basis?

3. We process the entire daily business with

tm5. In the morning we pick up the electronic

bank account statements fromthe banks

and balance the revenues with the planned

revenues. Next we defne the fnancial status

and schedule payments. The bulk payments

are imported fromthe ERP systems. Payment

releases and dispatch of payments to the

banks all happen inside tm5. This provides

transparent and revision-safe handling of all

payment transactions. In foreign exchange (FX)

management, the IC-trading platforminforms

us about the currency requirements of the

diferent business units. Our currency trader will

trade themas required. The back ofce reviews

the bank confrmations against the trading

items.

3. Todays TMS ofer a wide array of

functionality and, as a result, navigating the

complex menus on ofer can be a frustrating

experience. An attractive feature of the IT2

system is the ability for the user to customise

specifc workfows for various tasks that need

to be carried out. Creating workfows for the

most frequent tasks makes the use of the

system much easier and also safer, as users are

guided to follow the correct processes.

If you were buying

a system today,

what additional

functionality would

you like included?

4. We are highly satisfedwithtm5andit provides

all functions we need. However, I wouldwishthat

we were able tomake payments inall European

countries throughtm5, but this is not possible

todate. Presently, we are workingwithBELLIN

tointegrate the Frenchbulk payments intotm5.

After that, we will start a pilot project withhigh

value payments inFrance inthe newXML-format.

If Frenchbanks wouldalsoaccept electronic

signatures I think we wouldbe very content, so

we are workingonthis issue too.

4. We just bought the IT2 system in 2010

and are completing the implementation

this year. The set of functionalities on ofer is

very complete, and we have bought all the

modules that we have a need for. A further

implementation phase will include the

creation of accounting entries and an interface

with the companys general ledgers. The

purchase of these extra modules was part of

the initial contract agreed with the supplier.

Expert opinion

1. EDF Energy uses Sungard AvantGard

Integrity. In 2002 we looked at a

number of TMS on the market and

chose Integrity because it was user

friendly, replicating the Microsoft

Windows layout, and had the

functionality we were looking for.

Apart fromrequirements around

cash management, we wanted a TMS

that was easily integrated with the

host accounting systemand banking

software, for a near fully automated

end-to-end process for treasury

transactions and CHAPS payments.

Integrity ftted our treasury setup, as

compared to systems with functionality

we would not use. Two years ago

we reviewed our requirements and

what was available in the market, and

decided to upgrade Integrity.

1. We had a shortlist of three systems

and performed an in-depth evaluation.

This included a one-day workshop with

each of the potential suppliers and

running identical tests and scenarios on

each systemto test its ability to meet

our requirements. The evaluation team

was made up 15 people who scored

the systems across some 200 criteria.

IT2TMS came frst - we felt that ease of

reporting and accounting confguration

were two features that set it apart from

the other systems. IT2 also had a track

record of working with our chosen

SWIFT connectivity supplier Bottomline

Technologies, which was important as

the two project elements were to be

run in parallel.

1. We selectedWallstreet City Financials

in 2003. Our previous TMS was

powerful and had value-at-risk (VaR)

functionality, but over time we realised

that it was almost too powerful for

what we needed. So we wanted to

cut costs and streamline the TMS. City

Financials appealed to us because of

its web functionality. We nowhave

40 business units using it remotely,

with around 200 users. The integrated

accounting module was of great

importance, as previously we had a

separate accounting module with fles

being manually imported and exported

- a highly inefcient process. And fnally,

it allows us to develop reports and

interfaces without having to rely on IT

support or consultants.

1. Coty treasury chose the IT2TMS, as

we needed to upgrade fromour old

technology in order to support two

treasury operations in the Netherlands

and the US. Our operations needed

a full range of cash, treasury and risk

management business processes,

including in-house banking, worldwide

hedging, borrowing and lending -

and cash fowforecasting. We chose

IT2 because of its unique workfow

management and reporting tools, user

friendliness, fexibility and complete

functionality. IT2 frees up our global

treasury teamto concentrate on

strategic issues, management functions

and local business supports, which

adds professional value.

2. The obvious advice is to spec out

your current requirement and also

have a good idea of where you want

to end up. You have to decide if you

want a standalone systemand the

level of integration. Do you require

a fully integrated systemwith your

accounting and the bank software?

Also consider the type and level of

support that is available - howmuch

support and advice is available at the

implementation stage? Cost is also

important - you should not choose an

expensiveTMS and then fnd that most

of its functionality is left unused.

2. The most important piece of advice

I could give is to use your best internal

resources to do the implementation,

as they bring detailed knowledge of

your business and treasury processes.

This is vital during the key stages of the

project. The TMS investment needs to

be successful and it is easier to bring

other resources up to speed to help

your project teamwith their day job.

After all you still have to take care of

managing day-to-day activities, but

implementing the TMS is a strategically

important project and getting it right

should take priority.

2. Outliningyour requirements at the

start is vital. For example, canyour

monthly management reporting

informationbe generatedby theTMS

withminimal editingrequired? Ensure

that the potential TMS suppliers provide

hardexamples duringthe selection

process. ATMS shouldbe fexible, so

bear inmindwhat youmight needinthe

future. Is the customer support service

robust?Try callingtheir support tosee if

a personanswers or if youare diverted

tovoicemail. Howoftenare updates

released?Visit existingusers tofndout

what theTMS are like inreality. And

fnally, assess if the cost of owningand

maintainingyour ownIT hardware

is worthwhile.

2. You should benchmark your short-

listed solutions against your current

solution. Choosing a newsystemis a

great opportunity for business process

improvement, breaking away from

the constraints of the past and bear

in mind the future growpath of your

organisation. Also, be sure to meet

the vendors management, consultant

teamand support staf- it is important

to be confdent of your suppliers

integrity and team-building qualities,

which are in many ways as important

as the technology. Last, but not least,

ensure that you take the lead in the

implementation - you need to work

with it day-to-day, therefore take the

drivers seat.

3. The TMS we use is fully integrated

and a number of interfaces have

been built. This means that it is very

easy to use and to train new staf to

use it. Administration is restricted

for control reasons and making

changes and setting up static data

is straightforward. A little more time

is required for setting up hedge

accounting. We have written our own

documentation to make this easier.

3. The IT2 system is very easy to use on

a day-to-day basis. The system has a

depth of functionality and capability,

which underlines its fexibility.

However, with this fexibility comes

greater complexity during the initial

set up of a new process as the user

screens can be customised extensively.

Therefore you need to have in-house

knowledge of the system to do this.

It was important that we developed

these skills in-house so that we could

become relatively self-sufcient. If your

best people are not involved on the

implementation, then you struggle to

develop this capability in-house.

3. Wallstreet City Financials is very easy

to use and maintain. I personally dont

have a technical background, having

spent over 18 years in the dealing

room. During this time many systems

people talked about STP - now I

can see it in action in the treasury

department. For example, our external

FX turnover last year was 90bn, with

20,000 total internal and external deals

input. Without STP, we would have

needed extra personnel to manage the

volume. The inter-site payments used

remotely makes life easier for the team

and minimises the number of input

errors. We are currently migrating

to SWIFT and can streamline TMS

processes even further.

3. We are fnding IT2 very easy to work

with on a day-to-day basis, as it is an

intuitive, confgurable system. The

IT2 process maps were impressive

in the sales process, but we are

growing to appreciate their value

beyond workfow documentation

transparency. They clearly monitor

operations in progress, helping to

ensure that the team makes the

necessary interventions to assure

timely and accurate processing. And

they are self documenting, giving

us an almost automated treasury

procedure manual, as well as easy and

transparent auditing. In the future,

they will be very helpful in efciently

training new team members.

4. The newfunctionality I would look

for is a more user-friendly reporting

function and connectivity to new

mobile devices. This will allowfor better

management reporting. At a recent

demonstration of the latest version

of AvantGard Integrity, I noted some

improvements in this area that look

promising. As part of the next planned

upgrade, I look forward to using this

additional functionality.

4. That is a difcult questionto

answer, as IT2has usually beenable to

accommodate requests that we have

made for enhancements tothe system.

Inanideal world, perhaps, I wouldlike to

see a more easily confgurable approach

toimportingmarket data, as we needto

combine several diferent market data

types withinSABMiller. Better of-the-

shelf SWIFT for corporate access would

alsobe useful.

4. We are happy withthe current

functionality intheTMS, andI feel

confdent that Wallstreet City Financials

will be able toserve us well over the

current planningcycle. Usingthe cash

forecastingfunctionality is anarea we

aimtodevelopandthis may require

additional functionality.

4. Well, we selectedIT2because its

facilities fulfl our current requirements,

andalsoaddress our evolutionary

ideas for treasury over at least the

mediumterm. I shouldsay that we are

about tolauncha secondphase of the

implementation, whichwill extendthe

solutiontoonline cashforecastingand

guarantees. These extensions will helpus

tomaximise the value of our technology

investment, by optimisingcashvisibility

andutility, andby further automatingour

fnancial risk management activities.

1.

2.

3.

4.

Michael Eggers,

Head of Corporate Finance

& Treasury Europe,

Steinhoff Europe Group

Alain Millet,

Group Treasurer,

CLS Holdings

Brij M Kalia,

Head of Treasury,

EDF Energy

Guy Ingram,

Treasury Manager,

SABMiller

Keith Shapley,

Treasury Manager

- Projects and

Compliance,

Group Treasury,

BAE Systems

Rudmer Wedzinga,

International Treasurer,

Coty Inc

a buyers guide to TreaSury ManageMenT SySTeMS

12

a buyers guide to TreaSury ManageMenT SySTeMS 2011

13

Risk and Reporting

Corporates treasuries main role is to eliminate various forms of risk. What

are some of todays considerations in evaluating technology for measuring,

managing and reporting risk in treasury operations?

Words: Kelvin Walton, TreasuryWise

Barings management really thought that they

were making these enormous profts on futures

and options arbitrage trading - while taking very

little risk, answered Nick Leeson. I was their little

man in Singapore, who took care of everything.

Barings crash back in 1995 would certainly have

been avoided if the organisation had imposed

some basic controls and enforced prudent

dealing practices. In summary, the practical

risk management practices and processes that

were lacking included the effective segregation

of duties between front and back offces, the

assignment and management of appropriate

trading limits, and the availability of dependable

reporting, providing details of accurate and up-to-

date positions and proft/loss numbers.

But what is the relevance of this sad story

from the lost world of merchant banking

for a contemporary corporate treasury team

that is evaluating a signifcant investment

in technology?

One of the central roles of the overwhelming

majority of corporate treasuries is effective

risk management, seeking, as far as possible,

to eliminate various forms of risk. Corporates

risk management operations involve the

identifcation and measurement of risk,

leading to its mitigation through hedging

operations - as opposed to the naked and

uncontrolled speculation in derivatives that

destroyed Barings capital and independence.

Accordingly, an important aspect of a

treasury technology evaluation exercise is

investigating and verifying that the competing

systems include the correct mix of risk

management tools that that will avoid - or

at the very least reveal - the basic types of

risk we have identifed. In addition, some

treasury departments will require further,

more sophisticated risk management tools to

be deployed; this will apply in cases where

the necessary investment is justifed by the

relatively high levels of risk exposure that are

being managed, for example through signifcant

debt leverage or currency exposure.

Operational Risk Management

The most basic improvement that a frst time

or replacement treasury management system

(TMS) can offer relates to the reduction of

operational risk. A modern TMS provides

robust and transparent treasury operations

that would simply not be possible if treasury

were dependent on manual processes and

spreadsheets. At this elementary level, a TMS

can radically reduce the risk of errors associated

with manual processes. It is also increasingly

accepted that spreadsheet solutions lack the

necessary robustness to support complex

fnancial operations such as treasury. They also

tend to be undocumented, and, as they grow

organically, diffcult to understand or maintain.

When the original authors move on, the risk and

diffculties are compounded, particularly when

something breaks.

The introduction of the Sarbanes-Oxley Act

(SOX) in 2002 set new, demanding standards

for optimising treasury process robustness

and transparency. Today, consultants and

auditors consistently look for higher standards

of SOX and SOX-style compliance in support

of treasury. It might even be argued that if

an organisation is large and complex enough

to warrant the establishment of a discrete

treasury function, it should always be able

to justify a technology investment that at a

minimum addresses operational risk reduction.

Basic Financial Risk Management

Moving into the general feld of fnancial risk

management, I will consider the topics that I

regard as basic necessities, before moving on

to some more advanced concepts. The basic

tools to be examined are the management of the

segregation of duties, dealing limits and position

and exposure valuation. The value of properly

automating these functions is illustrated in the

true (but, of course, anonymous) account of the

treasury misadventures of a Nordic corporate, a

few years ago.

The company was in fact evaluating making a

TMS investment to replace the spreadsheets

they were using - at the same time as their

rogue options trader was discretely running

up a disastrous position. The trader was

receiving the incoming deal confrmations that

were addressed to him, and he fled them

in a bottom drawer. The telephone-based

transactions were not visible to the back offce

(or anyone else), bypassing any kind of limits

check or position valuation. The company,

in fact, relied on banks to value their option

hedge position, as they lacked the means to

do so in-house.

The dnouement came swiftly when a

concerned executive of a counterparty bank

phoned the companys fnance director, seeking

to discuss the large loss-making option position

to which he had been alerted. Soon after, the

new treasurer secured approval for licensing

and implementing a TMS.

We were lucky that the fnal loss was no more

than US$5m, he commented. If you contrast

this to the one-off and recurrent costs for

implementing and operating a decent TMS, you

can quickly see that this is equivalent to a very

reasonable insurance premium, providing a

solution that would effectively eliminate the risk

of anything like this ever happening again.

Segregation of Duties

At its basic level, segregation of duties simply

secures treasury operations so that individuals

who are authorised to initiate transactions

are not permitted to settle them. This is often

referred to as the four eyes system. It is

very easily administered by a TMS, through

the defnition of individuals access rights to

various critical system functions. Once the

system security has been accurately defned

and locked down, any attempt to by-pass the

control will not only be blocked, it will also be

logged on the audit trail, so that such events

can be effectively followed up.

TMS are well suited to manage various levels

of complexity in the segregation of duties

structure required, which will be a function

of the size, complexity and operating policy

of the treasury in question. The facility has

the added beneft that it can protect the

confdentiality of sensitive data by restricting

or partitioning access, in cases where this

represents a signifcant risk. A measure of

fexibility is needed in small operations, in

which a complete functional segregation

would severely strain individual resources;

in such cases, the chosen system should

enable the restriction to be defned so that,

for example, an individual may both initiate

and release payments - but not for the same

payment transaction.

Limits Management

The management of limits the dealing room

of a bank that is engaged in market making

a buyers guide to TreaSury ManageMenT SySTeMS 2011

15

A

ll a

rtic

le

s

2

0

1

1

C

-S

tre

a

m

L

im

ite

d

a buyers guide to TreaSury ManageMenT SySTeMS 2011

14

Increasing numbers of treasuries

are supplementing the use of

classic credit ratings with market-

sensitive tools such as credit

default swap (CDS) spreads

A further consideration in this context

is the adoption of a hedge accounting

solution, under IAS 39 or FAS 133, and the

International Financial Reporting Standards

(IFRS) update after convergence has fnally

occurred. Hedge accounting solutions require

a combination of accounting and forward-

looking risk management techniques,

and are computationally demanding, and

hence imposing special demands on the

TMS. Companies that elect not to hedge

account will need TMS support for the

effective collection and analysis of the

relevant exposures, so that they can take the

necessary actions to avoid unwanted proft/

loss (P/L) volatility.

STP and Integration

As the effciency and accuracy benefts of

higher levels of automation become more

generally sought after, many treasuries are

looking to enhance operations by integrating

their TMS with third party systems, such as

dealing portals and confrmation management

services. Such integrations carry additional

benefts beyond cutting operational risk,

including helping to assure best price execution

with the available permitted counterparties.

Additionally, many treasuries are looking to

implement higher levels of straight-through

processing (STP) to create a more hands-free

environment, eliminating or minimising the

risks commonly caused by human error.

Advanced Risk Management

Scenario analysis is the most popular of the

more advanced techniques used by corporate

treasuries to evaluate fnancial risk, in cases

where the level of risk exposure justifes

investment in more powerful tools. I am using

the term scenario analysis here in a broad

context, covering the testing of treasurys

positions and exposures against a range of

hypothetical events, including different market

conditions (FX, interest rates and volatility),

stresses and the impact of possible deals.

Supported by the necessary technology,

scenario analysis enables treasurers to

understand the nature of the risks that might

have to tackle in different situations. It also

enables them to answer the diffcult questions

that might be urgently posed by senior

management, such as: What would be the

impact if the yen declines 5% against the US

dollar? or What would the effect on our debt

portfolio be of a 1% UK base rate hike?

Value-at-risk (VaR) is another advanced risk

management technique that requires heavy

technical support for effective deployment. In

my view, it is a useful treasury benchmarking

tool and provides objective verifcation that

treasury is managing risk according to policy

requirements. Some commentators advocate

cash-fow-at-risk (CFaR) as a more valuable

risk management tool for the corporate

environment; however, CFaR adoption naturally

requires powerful TMS support to be effective.

Reporting

The various risk management approaches

outlined above are just a part of the entire

range of treasury operations that rely on the

TMSs reporting capability to ensure that

they are effectively communicated to the

treasury department, management, auditors

and regulators, and other stakeholders. Many

would, very reasonably, hold that effective

reporting is the single most important criterion

in assessing the quality of a TMS. Arguably, the

key question to be addressed when evaluating

different reporting solutions is, how timely does

the production of the report really need to be?

In the context of risk management, I would

argue that real-time, or at least on demand,

near real-time, reporting is an essential

technical requirement. Treasurers may not feel

that the timing of database updates is really

their concern - but if they are confronted by, for

example, a sudden and violent deterioration in

a counterparty or countrys creditworthiness,

they quite reasonably demand complete

and accurate information from their TMS

- and they want it now. So there are quite

technical considerations that really need to

be understood in their practical context in a

TMS evaluation, when the underlying issue is

performance. Its not just functionality thats key

to analysing and reacting with best effect to a

sudden crisis - performance is also critical.

The Current Environment

The treasury technology marketplace has, to the

surprise of some observers, remained buoyant

in recent years, despite challenging fnancial and

economic conditions in many parts of the world.

This has, I think, been the case for a number of

reasons. Treasury has become more prominent,

probably irreversibly, since the fnancial crisis.

This is because it is clearly good corporate

governance to ensure liquidity against a range

and proprietary trading can be very complex

and demanding. The limit categories that

may be encountered include counterparty

exposure, counterparty daily settlement,

individual dealer, specifc instrument,

instrument type, instrument class, country

and geographic region. Such structures are

clearly too complex to apply to most corporate

treasuries; the obviously relevant category is

counterparty limits.

Counterparty limit assignment is closely

connected with the broader topic of

counterparty exposure management.

Increasing numbers of treasuries are

supplementing the use of classic credit ratings

with market-sensitive tools such as credit

default swap (CDS) spreads, given the lagging

performance of credit ratings when the

credit crunch frst struck (in fairness, I should

add that the ratings agencies are behaving

proactively during the sovereign debt episode

that that is unfolding at the time of writing).

Each company will determine which classes

of dealing limit are appropriate for them.

Limits management requires TMS support in

order to be fully effective, so that dealers can

deal quickly and effectively, and management

can be assured that limits are being properly

monitored, and that breaches are promptly

reported. It is also very useful to check limits

automatically on a pre-trade basis, so that the

elevated risks and potential costs of actual

breaches may be avoided. The implication

here is that strong limits management needs

real-time support from the TMS, so this is a

factor that needs to be kept in mind in during

TMS evaluation.

Position and Exposure Valuation

Position and exposure valuation require a range

of tools, ranging from the relatively simple

ones need for foreign exchange (FX) forwards

and time deposits to the more complex

requirements of some derivatives. Some TMS

include integral solutions that enable real-

time valuations of all kinds of transaction risk

position to be achieved; this powerful facility

additionally requires system integration with

up-to-date market data - FX and interest

rates, and perhaps volatilities. Others rely on

separate or third party solutions to handle more

complex instruments. The technology evaluator

will need to perform a complex analysis of the

costs and benefts of the alternatives to reach a

conclusion that best fts requirements.

of scenarios, and to measure risk exposures,

including to counterparties, sensitively and

accurately. Solutions to these issues demand

strong technology.

In addition, smaller companies are organising

discrete treasury departments, and these

are of course confronting exactly the same

risk management challenges as larger

organisations. And its not just a matter of

size; some relatively small companies, (for

example, with turnover below US$50m)

are justifying TMS investments if their

management judges that they are carrying a

suffciently high level of fnancial risk.

In addition to the steady stream of frst-

time buyers, for whom spreadsheets are

now just not good enough, there is also a

replacement market, presently focused on

those organisations that made their initial TMS

investments in the technology boom years of

the 1990s. Many treasurers are now seeking

to re-invest, to take advantage of the higher

levels of user friendliness, STP, functionality,

cost effectiveness and effciently offered by

todays TMS.

The heightened awareness of the importance

of strong corporate governance is also

increasing the complexity of the technology

procurement process; in many areas,

purchasing departments are increasingly

fexing their muscles in infuencing how

technology is acquired.

TMS evaluation projects are tending to

become more complex and demanding,

increasing the number of hoops that

treasurers need to navigate through to acquire

the management technology they really need

to maximise their departments productivity

and effectiveness,

Conclusion

I have summarised here some of todays

considerations in evaluating technology for

measuring, managing and reporting risk

in treasury operations. It seems clear that

there are some generally applicable issues;

but in fact no one quite perfectly fts the

bog standard mould when it comes to risk.

Somewhere in the most innocuous looking

operations may lurk ferociously complicated

guarantee structures, performance bonds,

leases and so forth. Finding the appropriate risk

and reporting TMS solution may be a little more

complex than it initially appears to be.

15

a buyers guide to TreaSury ManageMenT SySTeMS 2011

a buyers guide to TreaSury ManageMenT SySTeMS 2011

17

A

ll a

rtic

le

s

2

0

1

1

C

-S

tre

a

m

L

im

ite

d

BELLIn

Consultancy

Whatever it takes to set up and run the

project, even meeting tight timelines, a team

of professionals with guide, consult and help

your company achieve its objectives.

Implementation management and monitoring.

Group-wide supervision and support,

including the aspects and requirements of

the local treasury business.

Process review and optimisation, e.g. cash

pools, hedging analysis and strategies,

domestic and international payment

processing, and liquidity forecasting.

Provision of temporary staff to provide

support to your company.

Software

tm5 - LoadBalancedTreasury

The core idea behind tm5 is the concept of

LoadBalancedTreasury. Our business logic and

technical architecture support this concept. Its

all about bringing the system to the local user

for their beneft, instead of centralising tasks

in one spot.

Local teams, including the central treasury,

can operate on their own terms - replacing

spreadsheets and exchanging data with other

companies and organisations for reconciliation

purposes. This has tremendous advantages

for all companies and departments within

complex organisations.

With BELLIN, everyone operates their local

treasury from one platform, which contains

all the information. The central treasury

retrieves whatever is required to run treasury

management, effectively replacing the daily

task of data collection. tm5 not only offers daily

cash management, including multi-bank and

multinational e-banking solutions, but also

fexible mid- and long-term liquidity forecasting.

Additionally BELLIN offers solutions for clearing

internal payment fows, as well as single

invoice-based reconciliation as part of the

netting process. BELLIN clients were twice rated

as highly commended and have recently

won the Adam Smith Award in the category of

Harnessing the Power of Technology.

Small business international payment

processing is possible with BELLINs hosted

solution Payment2Go. Most companies

accept banks just like the weather. With our

multi-bank and multinational web portal,

all you need is a URL and a password. Now

the company can concentrate on its core

business and be independent of the systems

offered by banks.

Since it is a fully-hosted solution, if there is any

trouble during the operation, we fx the problem

or provide you with a consultant for further

assistance at any time. I am convinced that

this will be the future in the day-to-day banking

business - and this is even more interesting

for small and medium-sized companies, says

Martin Bellin.

Services

BELLIN provides a full range of services for

your treasury:

Consulting

Application implementation, confguration

and customisation.

Complete treasury reviews.

Optimisation of processes and strategies.

Temporary staff.

Software

m5 - a fully web-based solution for global

treasuries in any confguration.

Payment2Go - the web-based software-

as-a-service (SaaS) payment platform for

Europe.

Services

Financing options for the purchase or

rental of the end user license.

Hosting, ASP and SaaS.

Worldwide local support for all subsidiaries.

Market data.

Connectivity for payment processing to

numerous banks (Citi, Deutsche Bank,

Bank of America, Lloyds, and many more)

and organisations such as SWIFT.

Founded by a treasurer who was unable to fnd the appropriate tools for his

treasury, BELLIN provides corporate clients with a company-wide web-based

treasury platform.

Our philosophy at BELLIN is that we dont just like treasury, we love it, and

our product tm5 is custom-made to get treasuries connected.

BELLIN is a global leader in providing treasury software and services to

over 15 000 users in 120 countries. Headquartered in Germany, BELLIN has

partners in North America, the UK, the Netherlands, Sweden and France.

Our team of consultants consists of many former treasurers who can fnd

treasury solutions to suite your corporations needs.

As an all-in-one treasury product, tm5 is guaranteed to amaze you with

adaptable modules such as cash and risk management and netting.

The LoadBalancedTreasury approach that we apply allows subsidiary

companies and the central treasury access to real-time fnancial data and

processes at the click of a mouse. BELLIN also offers hosting services (ASP).

The try before you buy option gives customers a chance to discover

BELLINs treasury solutions for themselves. Join us and our hundreds of

clients, such as Flextronics, Virgin Atlantic and Red Bull, who all say: We love

treasury!

Products and Services

ContaCt information

German Headquarters:

BELLIN GmbH

Tullastrasse 19

77955 Ettenheim

Email: sales@bellin.de

Tel: +49 7822 44600

Website: www.bellin.com

M

a

r

t

in

B

e

llin

C

E

O

&

F

o

u

n

d

e

r

o

f

B

E

L

L

IN

Consulting

s o f t wa r e

s e r v i C e s

www.bellin.com

BELLIN

Benelux B.V.

Benelux

AGL

Transaction Services AB

sweden

BELLIN

Treasury Services Ltd.

Canada

BELLIN

Treasury Alliance Ltd.

uK

Cap Fi

Technology

france

The BELLIN Treasury Network Partners:

a buyers guide to TreaSury ManageMenT SySTeMS 2011

19

A

ll a

rtic

le

s

2

0

1

1

C

-S

tre

a

m

L

im

ite

d

ecofnance - a Reval Company

Integrated Treasury System (ITS)

The Integrated Treasury System (ITS) is a

comprehensive solution for the effcient handling

of all fnancial processes of international

companies. The system, with more than 20

modules, covers the areas of cash, treasury and

risk management, payments and reporting. Due

to its modular structure ITS can be combined

and extended in a fexible manner meeting the

individual needs of corporates.

ITS brings about the:

Acceleration of processes.

Increase in the quality of work.

Integration of data.

Automation of work routines.

Time and cost saving.

Global and Mobile Treasury

ITS enables local entities to access the

application at any time. Local users are

granted easy and secure access via internet,

intranet or CITRIX. In this way local entities

can assist the central group treasury by

entering planning data. Bank account

statements are imported automatically.

The integrated reporting gives local cash

managers an overview of the fnancial status

within their company. ITS supports all central

and local treasury concepts such as treasury

centre, in-house banking, netting centre and

payment factory.

The ecofnance Mobile Client (eMC), an iPhone

app, allows mobile usage of the ITS Report Inbox

and the ITS Monitor.

Cash Management

The cash management modules of ITS serve

to administer and process all cash fows in

the company. The cash fows are imported,

automatically produced in ITS or entered

manually. In line with the automatic bank

statement processing, electronic account

information is reconciled automatically with

the cash fows entered in ITS. The account

assignment and posting module then generates

posting fles for further processing in the external

general ledger. The liquidity planning module is

a fexible tool for managing future cash fows.

Planning horizons, as well as liquidity groups,