Beruflich Dokumente

Kultur Dokumente

DZL Unaudited Results For HY Ended 30 Jun 13

Hochgeladen von

Business Daily ZimbabweOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

DZL Unaudited Results For HY Ended 30 Jun 13

Hochgeladen von

Business Daily ZimbabweCopyright:

Verfügbare Formate

The Directors of Dairibord Holdings Limited hereby announce the Groups unaudited financial results for the six

months ended 30 June 2013

HIGHLIGHTS

UNAUDITED FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED 30 JUNE 2013

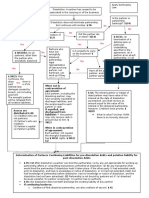

ABRIDGED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE SIX MONTHS ENDED 30 JUNE 2013 30 June 30 June Capital Retained Non - controlling Total 2013 2012 reserves earnings interests equity US$ US$ % Change US$ US$ US$ US$ Financial Revenue 49,051,741 48,643,254 1% As at 1 January 2012 25,133,085 17,519,389 921,911 43,574,385 Operating (loss)/profit (3,059,822) 4,373,269 (170)% Profit for the period - 3,135,190 9,070 3,144,260 Net cashflows from operating activities 1,923,919 1,078,946 78% Other comprehensive income (811,718) - (375,004) (1,186,722) Net assets 44,519,389 43,999,902 1% Exercise of share options 54,400 - - 54,400 Dividend paid - (1,567,812) (18,608) (1,586,420) Volume (Litres) As at 30 June 2012 24,375,767 19,086,767 537,369 43,999,903 Raw milk Intake 13,336,107 13,135,730 2% Sales 32,042,793 32,232,436 (1)% As at 1 January 2013 25,752,624 23,028,510 734,442 49,515,576 (Loss)/profit for the period - (3,355,867) 51,099 (3,304,768) Net asset value per share (US cents) 12.44 12.34 1% Other comprehensive income (54,488) - (25,173) (79,661) Dividend paid - (1,610,014) (27,244) (1,637,258) Exercise of share options 25,500 - - 25,500 ABRIDGED GROUP STATEMENT OF FINANCIAL POSITION As at 30 June 2013 25,723,636 18,062,629 733,124 44,519,389 AS AT 30 JUNE 2013 30 June 31 December 2013 2012 NOTES TO THE FINANCIAL STATEMENTS US$ US$ Assets 1. Basis of preparation Non-current assets The Groups Interim financial statements from which the abridged results were prepared, are in accordance with International Property, plant and equipment 40,216,747 40,877,522 Financial Reporting Standards (IFRS) and are based on statutory records that are maintained under the historical cost convention Intangible assets 747,824 793,882 except for property and financial instruments stated at fair value. Other non-current financial assets 925,707 1,313,021 41,890,278 42,984,425 The financial results are presented in United States dollars (US$). Current assets Inventories 17,128,142 14,791,523 2. Significant accounting policies Trade and other receivables 9,752,894 13,694,996 The accounting policies adopted are consistent with those of the previous period. Amendments to IFRS that became effective in Cash and cash equivalents 1,055,660 2,069,529 the current year did not have a significant impact on the financial results of the Group. 27,936,696 30,556,048 Assets classified as held for sale 26,045 256,305 The underlying financial statements to these results were approved by the Board on 15 August 2013. 27,962,741 30,812,353 Total assets 69,853,019 73,796,778 SUPPLEMENTARY INFORMATION Equity and liabilities 2013 2012 US$ US$ Equity Capital reserves 25,723,636 25,752,624 3. Depreciation charge 2,060,713 1,674,721 Retained earnings 18,062,629 23,028,510 Equity attributable to owners of the parent 43,786,265 48,781,134 4. Capital expenditure 2,318,547 1,538,655 Non controlling interest 733,124 734,442 Total equity 44,519,389 49,515,576 5. Capital commitments 10,066,570 7,192,064 - Authorised and contracted for 386,786 2,095,074 Non-current liabilities - Authorised but not contracted for 9,679,784 5,096,990 Interest-bearing borrowings 2,499,429 2,988,196 Deferred tax liability 4,194,813 4,381,462 6. Loss for the period is stated after the following non-recurring costs: 6,694,242 7,369,658 Current liabilities Retrenchment costs 803,000 Trade and other payables 13,244,348 12,182,051 Impairments of inventories, equipment and receivables 3,461,000 Interest-bearing borrowings 5,395,040 4,033,759 4,264,000 Income tax payable - 695,734 18,639,388 16,911,544 CHAIRMANS STATEMENT FOR THE UNAUDITED RESULTS FOR THE Total liabilities 25,333,630 24,281,202 SIX MONTHS ENDED 30 JUNE 2013 Total equity and liabilities 69,853,019 73,796,778 ECONOMIC OVERVIEW Zimbabwe The first half of the year witnessed a slow-down in economic activity mainly due to liquidity challenges and increased uncertainty around the holding of elections in 2013. Key input costs continued to increase against fixed consumer prices, adding unrelenting ABRIDGED GROUP STATEMENT OF COMPREHENSIVE INCOME pressure on margins. FOR THE SIX MONTHS ENDED 30 JUNE 2013 30 June 30 June Malawi 2013 2012 There was an improvement in the operating environment in Malawi, measured by the stability of the Kwacha (K) and slow-down in US$ US$ inflation. The Kwacha closed the month of June 2013 at K346, to the US dollar, from K342:1 US$ at end of 2012. Year on year inflation eased to 27.9% at the end of June, from 35% at the beginning of the year. Revenue 49,051,741 48,643,254 OVERALL PERFORMANCE Operating (loss)/profit (3,059,822) 4,373,269 The results for the first half of the year, to June 30 2013 reflect the impact of the costs of the rationalisation of plant and staff complement Finance income 161,494 88,210 as well as certain provisions made for impairment on a conservative basis. These expenses relate to retrenchment packages, reFinance cost (369,645) (248,565) location of plant and equipment and impairment of equipment, spares, materials and receivables. The total of these once off expenses was US$4.3 million. Consequently, an operating loss of US$3.1 million was recorded, against a 2012 operating profit of US$4.4 million. (Loss)/profit before tax (3,267,973) 4,212,914 Income tax expense (36,795) (1,068,654) The rationalisation objective was to consolidate operations and reduce overhead costs. Savings are expected in the second half of the (Loss)/profit for the period (3,304,768) 3,144,260 year. Plant and equipment from Bulawayo and Mutare was re-deployed to functional factories in Harare and Chitungwiza. The affected Other comprehensive income: centers will retain their sales and distribution operations. Other comprehensive loss for the period, net of tax (79,661) (1,186,722) Total comprehensive (loss)/income for the period (3,384,429) 1,957,538 Turnover for the six months ended 30 June 2013 increased by 1%, to US$49.1 million. Sales volumes decreased by 0.6% from 32.22 million litres in 2012, to 32.04 million litres. Volume growth across the Groups product portfolio was as follows: 8% for liquid milks, 13% (Loss)/profit attributable to: for foods and a 12% decrease for beverages. Product supply in the first quarter was affected by the relocation of plant and equipment. Owners of the parent (3,355,867) 3,135,190 Non-controlling interest 51,099 9,070 Liquid milks benefited from increased raw milk intake in Malawi, and importation of processed UHT milk from South Africa. Foods (3,304,768) 3,144,260 continue to benefit from investments made in yoghurt, tomato sauce, salad cream and ice cream. Increased capacity and brand building will continue to enhance competitiveness. The beverages category was, however affected by stiff competition and limited Total comprehensive (loss)/income attributable to: product availability, particularly the Dairibord Aqualite brand. Owners of the parent (3,410,355) 2,323,472 Non-controlling interests 25,926 (365,934) Total operating costs excluding the once off expenses of $4.3 million, increased by 8% over the same period in 2012, mainly on (3,384,429) 1,957,538 account of increases in costs of key materials and wages. As a result of this and pressure on margins, the operating profit for the period, (Loss)/earnings per share (cents) (before the once off expenses), at $1.2 million was 72% below that achieved in the comparable period in 2012. Basic (0.95) 0.88 Diluted (0.95) 0.88 Borrowings increased, by US$0.9 million, to US$7.9 million, to reflect a gearing ratio, (interest bearing debt to equity ratio) of 15%. Shares in issue 358,000,858 356,620,858 Cashflows generated from operations amounted to US$1.9 million compared to US$1.1 million generated during the same period in 2012. Weighted average shares 357,817,525 356,333,822 RAW MILK SUPPLY Weighted average shares adjusted for the effect of dilution 358,135,733 357,284,113 Raw milk intake grew by 2%, to 13.3 million litres, from 13.1 million litres received in the same period last year. Zimbabwe recorded a 1% decline while supplies in Malawi increased by 9%. Efforts of the Milk Supply Development Unit in Malawi are beginning to yield the desired results. Heifers imported under the Heifer Importation Scheme in Zimbabwe are currently providing an additional 4% of raw ABRIDGED GROUP STATEMENT OF CASH FLOWS milk per month which is in line with target. FOR THE SIX MONTHS ENDED 30 JUNE 2013 30 June 30 June INVESTMENTS 2013 2012 Capital investments for the period under review were US$2.3 million. Significant investments were in cold chain facilities, distribution US$ US$ vehicles and commissioning of the salad cream and tomato sauce processing and filling lines. The increased capacity is expected to OPERATING ACTIVITIES: support revenue growth and enhance efficiencies going forward. (Loss)/profit before tax (3,267,973) 4,212,915 Non-cash items 3,147,281 1,850,258 The Directors continue to monitor the performance of the subsidiary in Malawi. The improved operating conditions in Malawi helped Working capital adjustments 3,318,164 (2,965,041) enhance the contribution of DML to the Group. For the period under review, Dairibord Malawi contributed US$0.2 million operating Finance cost (369,645) (248,565) profit to the Group, compared to the 2012 first half contribution of $0.1 million. Focus on exports, to sustain the business, will continue. Income tax paid (903,908) (1,770,621) Net cashflows from operating activities 1,923,919 1,078,946 HUMAN CAPITAL The Group enjoyed cordial industrial relations during the first half of the year particularly during the rationalisation process during which Investing activities: significant co-operation was received from the employees. The Group continues to look at strategies to improve the livelihoods of its employees in a manner which can be sustained. Acquisition of property, plant and equipment (2,318,547) (1,486,476) Acquisition of intangibles - (52,179) OUTLOOK Proceeds from sale of property, plant and equipment 6,331 42,985 The first half of the year presented the Group with major challenges since the adoption of the multiple currencies. However rationalization Proceeds from sale of investments - 100,000 of the operations and other cost reduction measures implemented by management, have put the Group in a stronger position. We Finance income 161,494 88,210 expect the Group to return to profitability in the second half of the year. (2,150,722) (1,307,460) Financing activities: The future of the business is in its brands and research will continue in order to develop brands that meet consumer expectations. The Net increase in borrowings 878,520 580,065 Dairibord Novelty vegetable oil based range of ice-creams were launched in the first half of the year to increase the choice of nutritious Proceeds from exercise of share options 25,500 54,400 offerings to consumers. Dividend paid (1,637,258) (1,579,158) Net cashflows from financing activities (733,238) (944,693) The Group will continue to scout for investment opportunities in milk development as well as acquisitions with a strategic fit. Net decrease in cash and cash equivalents (960,041) (1,173,207) DIVIDEND DECLARATION Effects of exchange rate changes (53,828) (449,480) In view of the subdued Group performance, the Directors resolved not to declare a dividend for the six months ended 30 June 2013. Cash and cash equivalents at beginning of period 2,069,529 2,256,023 Cash and cash equivalents at the end of period 1,055,660 633,336 APPRECIATION I express my unreserved gratitude to our various stakeholders, my fellow directors and staff for the support they continue to give to the Dairibord Group of Companies.

Dr. L.L Tsumba Chairman 15 August 2013

Directors:

Dr. L. L. Tsumba (Chairman), S.P. Bango, S. Chindove, T. Mabika*, H. Makuwa, C. Mahembe, A. S. Mandiwanza* (Group Chief Executive), F. Mungoni, M. Ndoro*, J. Sachikonye * Executive.

Das könnte Ihnen auch gefallen

- Omega Sibanda Linked Company Fights ChildlineDokument49 SeitenOmega Sibanda Linked Company Fights ChildlineBusiness Daily ZimbabweNoch keine Bewertungen

- Fifa Law 11 OffsideDokument37 SeitenFifa Law 11 OffsideBusiness Daily ZimbabweNoch keine Bewertungen

- CONDOLENCE SUPPLEMENT: High Profile Deaths Rise As Covid-19 Surges in ZimbabweDokument16 SeitenCONDOLENCE SUPPLEMENT: High Profile Deaths Rise As Covid-19 Surges in ZimbabweBusiness Daily ZimbabweNoch keine Bewertungen

- Fifa Law 11 OffsideDokument37 SeitenFifa Law 11 OffsideBusiness Daily ZimbabweNoch keine Bewertungen

- SA Home Affairs Department Lose 4,616 Permanent Residence ApplicationsDokument176 SeitenSA Home Affairs Department Lose 4,616 Permanent Residence ApplicationsBusiness Daily Zimbabwe67% (3)

- Results Summary - All Ballots: Party Name Ward PR DC 40%Dokument10 SeitenResults Summary - All Ballots: Party Name Ward PR DC 40%Business Daily ZimbabweNoch keine Bewertungen

- The Zimbabwe Industrial Revolution Plan: For The Church Created by Hannington MubaiwaDokument20 SeitenThe Zimbabwe Industrial Revolution Plan: For The Church Created by Hannington MubaiwaBusiness Daily ZimbabweNoch keine Bewertungen

- New African List of Most Influential Africans of 2014Dokument44 SeitenNew African List of Most Influential Africans of 2014Business Daily ZimbabweNoch keine Bewertungen

- Zimbabwe's Draft Computer Crime and Cybercrime Bill Laymans Draft July 2013Dokument28 SeitenZimbabwe's Draft Computer Crime and Cybercrime Bill Laymans Draft July 2013Business Daily ZimbabweNoch keine Bewertungen

- Simbisa BrandsDokument2 SeitenSimbisa BrandsBusiness Daily Zimbabwe100% (1)

- Zimbabwe 2015 Mid-Term Fiscal PolicyDokument274 SeitenZimbabwe 2015 Mid-Term Fiscal PolicyBusiness Daily Zimbabwe100% (1)

- Zimbabwe 2015 Mid-Term Fiscal PolicyDokument274 SeitenZimbabwe 2015 Mid-Term Fiscal PolicyBusiness Daily Zimbabwe100% (1)

- Lovemore Majaivana and The Township Music of ZimbabweDokument38 SeitenLovemore Majaivana and The Township Music of ZimbabweBusiness Daily ZimbabweNoch keine Bewertungen

- TSL - Notice of Annual General MeetingDokument2 SeitenTSL - Notice of Annual General MeetingBusiness Daily Zimbabwe100% (1)

- Nation Building in Zimbabwe and The Challenges of Ndebele ParticularismDokument29 SeitenNation Building in Zimbabwe and The Challenges of Ndebele ParticularismBusiness Daily ZimbabweNoch keine Bewertungen

- Philemon Buti SkhosanaDokument9 SeitenPhilemon Buti SkhosanaBusiness Daily ZimbabweNoch keine Bewertungen

- WILD Notice of Annual General MeetingDokument1 SeiteWILD Notice of Annual General MeetingBusiness Daily ZimbabweNoch keine Bewertungen

- CBZ Dividend AnnouncementDokument1 SeiteCBZ Dividend AnnouncementBusiness Daily ZimbabweNoch keine Bewertungen

- MMDZ Audited Results For FY Ended 31 Dec 13Dokument1 SeiteMMDZ Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNoch keine Bewertungen

- ZIMW Circular To Shareholders and Notice of Annual General MeetingDokument1 SeiteZIMW Circular To Shareholders and Notice of Annual General MeetingBusiness Daily ZimbabweNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Corp Bank Monsoon Offer PDFDokument2 SeitenCorp Bank Monsoon Offer PDFMasroorHussainNoch keine Bewertungen

- Bba 101Dokument14 SeitenBba 101jithindas050% (1)

- Basis Kennis BoekhoudenDokument15 SeitenBasis Kennis BoekhoudenAgnes BeckNoch keine Bewertungen

- Inb 372Dokument3 SeitenInb 372Mushfique AhmedNoch keine Bewertungen

- Exchange Rate CurrencyDokument9 SeitenExchange Rate CurrencyAniruddha ChakrabortyNoch keine Bewertungen

- 7110 s14 Ms 21Dokument8 Seiten7110 s14 Ms 21Muhammad UmairNoch keine Bewertungen

- Efforts To Reduce The Budget DeficitDokument6 SeitenEfforts To Reduce The Budget DeficitNikkiNapalmNoch keine Bewertungen

- 6001 01 Rms 20110817Dokument19 Seiten6001 01 Rms 20110817Tamzid KhanNoch keine Bewertungen

- Winding Up of A CompanyDokument16 SeitenWinding Up of A CompanyFlipFlop Santa100% (2)

- 2009 MFI BenchmarksDokument281 Seiten2009 MFI BenchmarksRogelio CuroNoch keine Bewertungen

- High Return Investing: Passive Income and Financial FreedomDokument12 SeitenHigh Return Investing: Passive Income and Financial Freedomapi-154838839Noch keine Bewertungen

- Fundamental Analysis Sun PharmaDokument5 SeitenFundamental Analysis Sun PharmadeveshNoch keine Bewertungen

- The International Monetary System Chapter 11Dokument23 SeitenThe International Monetary System Chapter 11Ashi GargNoch keine Bewertungen

- Unit 5 - Foreign Trade & Exchange RateDokument8 SeitenUnit 5 - Foreign Trade & Exchange RateSurekha RammoorthyNoch keine Bewertungen

- Money CollocationsDokument4 SeitenMoney CollocationsTaoufik RadiNoch keine Bewertungen

- Ultratech Cement Ltd.Dokument24 SeitenUltratech Cement Ltd.Avinash GanesanNoch keine Bewertungen

- UPA DissolutionDokument1 SeiteUPA DissolutionNiraj ThakkerNoch keine Bewertungen

- Corporate Finance Practice Questions MidDokument9 SeitenCorporate Finance Practice Questions MidFrasat IqbalNoch keine Bewertungen

- Commercial Banks in India..Dokument21 SeitenCommercial Banks in India..Dakshata GadiyaNoch keine Bewertungen

- FPP1x - Slides Introduction To FPP PDFDokument10 SeitenFPP1x - Slides Introduction To FPP PDFEugenio HerreraNoch keine Bewertungen

- Specimen H1 Econs Paper 1Dokument1 SeiteSpecimen H1 Econs Paper 1tengkahsengNoch keine Bewertungen

- ch01 Introduction Acounting & BusinessDokument37 Seitench01 Introduction Acounting & Businesskuncoroooo100% (1)

- Receivables ManagementDokument4 SeitenReceivables ManagementVaibhav MoondraNoch keine Bewertungen

- Chapter 18 States and Local Govermental UnitsDokument14 SeitenChapter 18 States and Local Govermental UnitsHyewon100% (1)

- Bad Debts and Provision For Doubtful DebtsDokument13 SeitenBad Debts and Provision For Doubtful DebtsbillNoch keine Bewertungen

- HyperinflationDokument2 SeitenHyperinflationDanix Acedera50% (2)

- Business Cycles Ups and DownsDokument8 SeitenBusiness Cycles Ups and DownsmadhavithakurNoch keine Bewertungen

- Spouses Deo Agner and Maricon Agner v. Bpi Family Savings Bank Inc. GR No. 182963Dokument2 SeitenSpouses Deo Agner and Maricon Agner v. Bpi Family Savings Bank Inc. GR No. 182963Jaypee Ortiz67% (3)

- Basics of EconomicsDokument15 SeitenBasics of EconomicsAprvaNoch keine Bewertungen

- Group 4 - MANAC Report - DraftDokument11 SeitenGroup 4 - MANAC Report - DraftviewpawanNoch keine Bewertungen