Beruflich Dokumente

Kultur Dokumente

Annx-2-Con Audit Policy 2012-13

Hochgeladen von

as14jnOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Annx-2-Con Audit Policy 2012-13

Hochgeladen von

as14jnCopyright:

Verfügbare Formate

OBC Concurrent Audit Policy

POLICY GUIDLEINES FOR CONDUCTING CONCURRENT AUDIT

1. INTRODUCTION

The basic objectives of the concurrent audit system is to provide an additional administrative support to the branches to ensure adherence to systems and procedures and for timely detection of lapses, irregularities at the branches, so that necessary remedial measures could be taken without any loss of time. Concurrent Audit is an examination of transactions which is Contemporaneous with the occurrence of the transactions or carried out as near thereto as possible. The purpose of concurrent audit is to supplement the efforts of the Bank in carrying out simultaneous internal check of the transactions and compliance with the laid down systems and procedures of the bank. The emphasis is on substantive checking of the key areas and on spot verification of deficiencies leading to non-recurrence of the same. As of now concurrent audit is available as a tool for the management of the Bank, to have a "cool and hard look at t he way critical branches function and decisions taken and implemented. The system, if properly implemented would improve functioning of the branch, thus, upgrading its rating and also to prevent Frauds.

2.

COVERAGE OF ACTIVITIES

2.1. As the main role of the Concurrent Auditor is to supplement the efforts of the bank in carrying out simultaneous internal check of the transactions, all the daily transactions of the branch have to be checked by concurrent auditors. RBI has indicated that the scope of concurrent auditors is wide enough to cover specifically certain fraud prone areas like. 1) 2) 3) 4) 5) 6) 7) 8) 9) 10) 11) 12) Handling of cash Deposits Safe custody of securities, Investments Overdue bill Exercise of discretionary powers Sundry and suspense accounts. Inter branch reconciliation. Clearing differences Foreign exchange business including Nostro accounts Off balance sheet items like letters of credit and guarantees Treasury finance and Credit Card Business

While it has been decided to cover each and every transaction of the branch in concurrent audit, RBI has suggested some items which should be kept in view while compiling the report. 2.2. The emphasis shall be to make more in-depth study and to ensure prompt and regular reporting of the irregularities. There is an emphasis in favour of substantive checking in key areas rather than test checking. Concurrent Audit should cover all the aspects of the branch working with detailed coverage of critical areas like Credit Monitoring, Review of Loan Accounts, instances of cheque returns, compliance of KYC/AML Norms etc. 2.3. The Concurrent Auditors are also required to submit summarized Special Reports in case of any serious irregularities / instances of frauds directly to Head Office. Close monitoring of the accounts to prevent slippages to NPA category / diversion of funds assumes lot of importance in day to day working of the branch and the Concurrent Auditors have significant role to play in this regard. Similarly, instances of purchase / discount of

Page 1 of 55

OBC Concurrent Audit Policy

accommodation cheques / bills and kite flying transactions and cases of high returning of cheques also need to be detected and reported promptly. 2.4. The reports shall have to be prepared by the Concurrent Auditors meticulously and with critical / crucial observations without missing / omitting any irregularities by them so that no new irregularities shall be detected/ reported in the subsequent Regular Inspection. Similarly, the instances of revenue leakage in branches shall not be overlooked by the Concurrent Auditors, which may subsequently be detected and reported in the regular revenue audit. 2.5. The Bank has in place Know Your Customer (KYC) guidelines which are updated from time to time. It should be ensure that the same are strictly complied with by the branch. It is required that the systems & procedure and guidelines contained in the said circulars are complied with by the branches and the same needs to be checked and verified by the Concurrent Auditor on an on going basis. Monthly certificate on Annexure -11 & Annexure 11 A should form part of your reports and a copy should be sent to GM (I&C), Head Office along with a covering letter. In addition, the verification of the preparation of the Customer Profile / Risk Categorisation of existing accounts at the Branches is also to be taken up by the Concurrent Auditors. Concurrent auditors shall ensure that the branch is maintaining proper record for cash transaction (deposit as well as withdrawals) of Rs.10 lacs and above. Information to be extracted from CBS System on monthly basis & scrutinized for any unusual/ suspicious transactions which shall be reported to RO/ HO. Hard copy of the report duly singed by branch officials shall be kept at the branch for verification by Concurrent auditors/ Inspecting official. 2.6. Information relating to proper asset classification of advances be also checked on monthly basis by the Concurrent Auditors and issue Certificates to this effect on quarterly basis on Annexure -6, besides other operational aspects including Balancing of Books, MIS etc. 2.7. Obtaining balance confirmation in deposit accounts (savings and current accounts) on random basis at periodical intervals: Concurrent auditor shall randomly select 50 accounts every month and arrange to send letters (to be signed by branch manager as per Annexure -7) to the selected borrowers. The replies received in this regard at branch level shall be examined by concurrent auditors and shall refer the matter to respective regional inspectorate in the case of any discrepancy. 2.8. Concurrent audit - Forex Transactions Consequent to enactment of Foreign Exchange Management Act (FEMA) with effect from June 1, 2000, authorised dealers have been delegated more powers for undertaking current account transactions. In terms of sub section (5) of section 10 of FEMA, before undertaking any transaction in foreign exchange on behalf of any person, Authorised Dealer is required to obtain a declaration and such other information from the person on whose behalf the transaction is being undertaken that will reasonably satisfy them that the transaction is not designed to contravene or evade the provisions of the FEMA and/or rules/regulations made or notifications/ directions/orders issued under the Act. RBI has advised that while the internal auditor/inspector/concurrent auditor may continue the verifications of all the forex transactions undertaken by the branch, they may also carry out

Page 2 of 55

OBC Concurrent Audit Policy

100% checking of form A1 A2 and A3 meant for submission to Reserve Bank of India along with R Returns from the fortnight ending august 15, 2002 onwards. A summary of major deviations /irregularities observed from the above verifications may be put up to the Board of the bank on quarterly basis for necessary action. Internal auditor/ inspector/ concurrent auditors are also be advised to issue a certificate about the bonafide of the forex transactions undertaken by the branch including the correctness of forms A1 A2 and A3 also mentioning that the transactions have been carried out as per the internal guidelines/ instructions issued by the bank vis--vis FEMA provisions. They shall certify that due diligence exercise has been carried out while dealing with the forex transactions. The above certificate may be kept with the branches which should be made available to the inspection officers of Reserve Bank of India for verification. Concurrent auditors shall note the above guidelines and comply with it and certificates as per Annexure -4 should be submitted in time. 2.9 Coverage of Branches/ Business The following types of branches/offices shall be covered under concurrent audit: Normal branches 1. Exceptionally Very Large (Scale-VI), 2. Exceptionally Large (Scale-V), 3. Very Large branches (Scale IV) 4. Any other branch where concurrent audit is considered desirable by the Bank. 1. Overseas 2. SSI/ SME, Large Corporate & Mid Corporate 3. Authorized Branches handling foreign exchange business 1. Very High & 2. Exceptionally High Risk branches

Specialized branches Branches as per Risk Rating in RBIA Departments of HO/ Offices/ Cells

1. Integrated Treasury & Dealing Room 2. Fund Management department handling Investment portfolio 3. Reconciliation Deptt. 4. Depository Service Cell at Mumbai or at any other place. 5. Any other department/ office where concurrent audit is considered desirable by the Bank.

3.

TERMS & CONDITIONS FOR APPOINTMENT AS CONCURRENT AUDITOR Eligibility of CA Firms The eligibility criteria of CA firms as provided in existing policy is as under and no change is proposed: Constitution of Partnership Firm Firm No. of Partners Minimum Three partners (All F.C.A.) However, at centers where suitable firms are not available, Audit Firms with lesser number of partners FCA/ ACA may also be considered for appointment. Establishment At least 5 years old Bank Audit At least three years Bank Experience (Inspection/ Concurrent Audit/ Experience Statutory Audit/ Revenue Audit) Audit Team One representative and/or partner of the CA firm should come to the branch daily and mark his attendance in the Attendance Register at the branch. However, the partner of the firm must attend the branch atleast for 10 working days in a month and should also mark his attendance in

Page 3 of 55

OBC Concurrent Audit Policy

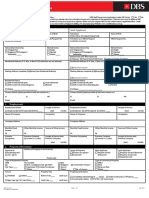

Attendance Register. The office/ branch of the firm should preferably be locally situated. However, in case of nonavailability of suitable firm at the local center, the audit firm from nearby city may be identified. The Executive Director will be the competent authority to include/ exclude any branch from eligible branches or to relax eligibility norms of CA firms where compliance of eligibility norms is not possible. Fee Structure The fee structure is given hereunder: Category of Branch & Fee Structure Total Business (Deposit + Advances) at branch Up to Rs. 200.00 crore Over Rs. 200.00 crore and up to Rs. 500 crore Over Rs. 500.00 crore & up to Rs. 1000 crores Over Rs 1000 crores & above For Investment Portfolio at CAO (Domestic Treasury) For Service Branch Full Time For Forex Treasury & Dealing Room Full Time For Reconciliation & Draft Accounts Cell Full Time Mumbai Depository Service Deptt. COPEC Secunderabad

# 1 2 3 4 5 6 7 8 9 10

Monthly Fee (Rs) 14,000 16,000 20,000 25,000 12,000 10,000 12,500 8,000 25,000 25,000

The bank shall pay the service tax, as applicable in addition to the fee. This consolidated fee is for audit, certification, etc. as per policy & guidelines of the Bank. Allotment of Audit Works An audit firm will be allotted only one branch for concurrent audit and the same firm will not be assigned any other work like stock audit/ revenue audit/ IS audit etc. during the term of concurrent audit as before. The firm of Concurrent Auditors, which are having one or more common partners, in the panel of the firms with the bank, shall not be allotted more than one branch, at a time and the same term shall also apply during the cooling period. Term of Allotment & Performance Review The allotment of concurrent audit of a branch shall normally be initially for one year. The term allotment may be extended for a further period of one year subject to satisfactory performance of the auditors. The performance may be reviewed after one year. The assessment will be made at Regional Inspectorate levels, on the basis of quality of report submitted to them. They shall submit the performance appraisal of the concurrent auditor to the General Manager (I&C), H.O. on the format prescribed by the Head office for the purpose. The bank shall always have the right to cancel the allotment, at any time, during the currency of concurrent audit. The review of the concurrent auditor may be taken up earlier than one year, if any major irregularities have been observed during RBIA, visits by RO/HO officials or because of any other reason, which bank may deem fit, covering the following parameters:1. Exercise of Discretionary Powers by the Branch Manager. 2. Reporting of Revenue leakage detected by Revenue Auditors and Inspecting Officials of Rs. 1.00 lac and above but not reported by concurrent auditor. 3. Irregularities pointed out in the Regular Inspection but not reported by the Concurrent Auditors. 4. Checking of Securities charged to the bank and Security Papers.

Page 4 of 55

OBC Concurrent Audit Policy

5. Implementation of KYC norms / Anti Money Laundering. 6. Daily attendance of CA / Assistant in the branch. 7. Inter branch reconciliation. 8. Account with comments on Pre / Post sanction of advances. 9. Whether expenses incurred at the branch carry proper authority. 10. Timely submission of Concurrent Audit report and other requisite Certificates relating to Foreign Exchange, NPA etc. 11. Contribution of Concurrent Auditors in rectification of irregularities pointed out in the Regular Audit/ Inspection, Statutory Audit and Monitoring Officer report. 12. Comments on Customer Service and redressal of Customer Grievances. 13. Any adverse features / lapses / irregularities at the branch indicated by the other Inspecting authorities which were not detected & reported by the Concurrent Auditor. Competent Authority The Executive Director will continue to be the competent authority to add/ delete branches for concurrent audit and for appointment/ cancellation of a firm as concurrent auditor and for reporting to RBI and ICAI, if any serious act of omission or commissions is noticed in the working of the CA firms. Cooling Period The firm after completion of two years shall be placed under cooling period for at least one year, the bank may consider allotment of other audits/ assignments, during the cooling period. However, during the term of concurrent audit, the Bank shall not allot the firm any other assignment. Accountability of Concurrent Auditors If during the concurrent audit any serious acts of omissions or commissions are noticed in their working their appointments may be cancelled and the fact may be reported to RBI and ICAI by the competent authority. Attendance Register One representative and/or partner of the CA firm should come to the branch daily and mark his attendance. However, the partner of the firm must attend the branch atleast for 10 working days in a month and mark his attendance in Attendance Register. For monitoring the attendance, the concerned branch shall maintain a daily Attendance Register exclusively for the Concurrent Auditors and representatives of the audit firm must sign the attendance register daily in token of their attending the branch and the attendance register would be taken by the branch incumbent during RIAC meeting. Providing of Proper Infrastructure to Concurrent Auditors For updating the concurrent auditors about the Banks policies, systems and procedures, following action may be taken: 1. Initial and periodical familiarization process for concurrent auditors wherever requested by CA firms 2. All relevant internal guidelines for Concurrent Audit would be provided. 3. Further, concurrent auditors may be given training on CBS relating to generation of reports and other related audit functions if so requested by CA firms. Monitoring of Concurrent Audit Reports /RIAC Meetings The Heads of Regional Inspectorates in consultation with the Regional Heads will call the quarterly meetings of concurrent auditors to discuss their quarterly reports and also to review the progress made in closure of previous reports. It shall be ensured by the RO/ RI Head that RIAC meeting is attending by a partner of the CA firm and the partner may be assisted by his representative attending to branch audit.

Page 5 of 55

OBC Concurrent Audit Policy

Reimbursement of TA/ DA to Concurrent Auditors for RIAC meeting As provided in the existing policy, "To and Fro" fare from the center/ city of branch to place of meeting (place, other than center/city of branch) equivalent to First Class/ 2 nd AC Train/ Taxi charges, whichever is less, will be permitted for one partner attending the meeting, on production of necessary proof of expenses. The return fare would also be payable to outstation concurrent auditors attending meeting whenever called. The Regional Head is the competent authority to pass the TA bill. Competent Authority for Passing the Auditors Bills The Regional Head would continue to be competent authority for permitting branch to make payment of the monthly fee bills submitted by the concurrent auditors through concerned branch. However, before permitting payment of monthly fee, it should be ensured that the report has been received and the same is in accordance with the Banks policy/ guidelines on concurrent audit. In case the same is not in conformity with the laid down guidelines, a letter be sent to the concerned concurrent auditor, seeking reply, on the lapses within a period of 15 days. The copies of the letters sent to the auditor and the reply, so received from them, shall be sent to the Incharge of Regional Inspectorate and to The General Manager (I&C) Head office New Delhi. Submission of Concurrent Audit Report & its Compliance As per the Banks guidelines to the concurrent audit, auditors will record the irregularities/ shortcomings noticed during the day in a register on daily basis. The carbon may be kept for making two duplicate copies, one copy to be handed over to Branch Manager/ Hall Incharge against signature to ensure timely rectifications and auditor will mark off these entries jointly with BM. The irregularities rectified will not find place in subsequent reports. PERFORMA OF REGISTER # Irregularities Signature Observed Auditor

Of How Rectified

Date Of Signature Of Rectification CA BM

Monthly Reporting The monthly report shall be cumulative un-rectified irregularities as at the end of the month. Concurrent auditor shall submit the report within 7 days of succeeding month on the prescribed reporting formats & Annexures. One copy will be submitted to branch and 2 nd copy to Regional Office for follow up. Quarterly Reporting List of aggregate un-rectified irregularities and other details on prescribed formats/ annexures of the quarter will be submitted within 7 days of succeeding month of end of quarter. One copy each shall be submitted to Branch, Regional Office and Regional Inspectorate. Dropping of Irregularities The power to drop the irregularities after rectification will be with the Concurrent Auditor till the quarterly report is sent to the Regional Office/ Regional Inspectorate. Once the Quarterly report reached the Regional Office, the powers of dropping irregularities, on rectification will be with the Regional Head. Fraudulent Acts Whenever fraudulent transaction is detected the concurrent auditor shall immediately report the matter to Regional Office, Regional Inspectorate & Inspection & Control department at Head Office as well as to Branch Manager concerned (unless the branch manager is involved). Classification of Assets RBI vide its letter no DBS: ARS: No BC: 17/08.91.001/2002-03 dated 05.06.2003 has directed that all branches under concurrent audit w.e.f June 2003 should get all borrowal accounts

Page 6 of 55

OBC Concurrent Audit Policy

reviewed from the concurrent auditors, who will also submit certificate as per format given below on quarterly basis: We certify that branch Office _________________ 1. Has complied with income Recognition and Assets classification norms laid down by the Reserve Bank of India, Classification of NPA of the branch are as under: Account As on last date of present QTR As on Last date of previous DD /MM/ YYYY QTR DD /MM/ YYYY Sub Standard Doubtful Loss Total NPA 2. All necessary Income and Expenditure vouchers have been passed for the Quarter Ended Mar / June/ Sept. / December ---- (Year) The above certificates are to be sent to: 1. 2. 3. Recovery & Law Dept. Head Office New Delhi Concerned Regional Office Concerned Regional Inspectorate

3. Certificate of (a) 100% verification of Exchange Control copies of Bills of Entry etc., (b) 100% verification of Export Credits (Pre/ Post shipment against orders), (c) 100% checking of Forms A1, A-2 & A-3 and compliance of FEMA guidelines & (d) any other certification required by the Bank from time to time. (Detailed terms and conditions for appointment as concurrent auditors is given in the Annexure. Acceptance to be furnished on the letter head of the firm duly signed to I&C dept. HO) 1. The audit team shall visit the branch ON DAILY BASIS. The Audit Team shall at least consist of one or qualified Chartered Accountant/Article associate of the firm. However the partner of the firm dealing with bank audit must attend the branch at least for 15 days in a month. 2. The entire working of the branch shall be covered under audit. The shortcomings observed in the working of the branch shall be reported to the Branch Manager in the form of short notes on daily basis as per prescribed guidelines for necessary rectification. Concurrent auditors emphasis should be on the rectification of the irregularities and not on reporting the same in the monthly reports. Only the unrectified irregularities are to be reported in the monthly/ quarterly reports as per procedure given in the Operating Guidelines. 3. The entire loaning documents for the advances sanctioned after the Base Date of the Last Regular inspection of the Branch and thereafter all fresh advances sanctioned during the month shall be examined by concurrent auditors and any irregularity / discrepancy observed in the same should be got rectified by following up with the branch officials. The unrectified discrepancies are to be reported in the first report submitted by concurrent auditors. 4. A report on Computer Audit shall also be submitted along with the Quarterly reports. 5. The report shall be discussed with the Branch Incumbent or other officer as nominated & certificate in this regard from the Branch Incumbent shall be submitted along with the report.

Page 7 of 55

OBC Concurrent Audit Policy

6. The procedure for submission of the reports on monthly/ quarterly basis is given. However, it is clarified that 4 copies of the quarterly report are to be prepared and the same are to be sent as under: One copy to the branch. Second copy to the concerned Regional Office. Third copy to the concerned Regional Inspectorate. Forth Copy for concurrent auditors records.

7. The Revenue Leakage detected & recovered during the quarter shall also be compiled in Quadruplicate (4 copies) & sent to Inspection & Control Deptt. H.O. along with a copy to respective Regional Office & Regional Inspectorate, as per format enclosed. 8. If any matter susceptible to be fraud or fraudulent activity or any foul play is detected during course of audit in any transaction, the same shall be reported directly to the General Manager (Insp. & Control) of our bank who is the principal officer to report the same to the Reserve Bank of India as per guidelines. 9. Any deliberate failure on your part shall render yourselves liable for action. Further in case the fraudulent activities are not detected and reported by concurrent auditor which should have been detected during the course of audit the same shall be viewed seriously and the assignment can be terminated by the bank besides taking other punitive action against the concurrent auditor. 10. Serious irregularities warranting immediate attention shall be reported in the form of a summarized SPECIAL REPORT to General Manager (I&C), Head Office with a copy to Regional Head & respective Regional Inspectorate immediately after detection of such irregularities. 11. concurrent auditors Shall Closely monitor the bills portfolio & instances of purchase / discount of accommodation cheques / bills, if any, and kite flying transactions & cases of high returning of cheques shall be detected & reported promptly. A certificate to the effect that branch is not indulging in any kite flying operations shall be submitted in terms of RBI guidelines monthly basis. 12. Concurrent Auditors shall conduct cent-percent verification of Exchange Control Copies of Customs Bills of Entry/Postal wrappers under FEMA guidelines, if the branch is authorized to deal in Foreign Exchange Business, at the end of each half-year viz. June & December. A certificate to this effect indicating the period for which cent-percent verification has been carried out shall be submitted to Deputy Gen. Manager, International Banking Division, within 7 days of completion of the half year to which it relates. Copy of the said certificate shall also be submitted to REGIONAL OFFICE alongwith the details of the irregularities/ discrepancies observed, if any. 13. Concurrent Auditors shall conduct cent percent verification of Export Credit (Preshipment/ Post-shipment against orders) to ensure that E.C.G.C. coverage has been obtained in respect of each account. A certificate in this regard shall be submitted to General Manager (IBD), on quarterly basis (for the quarters ending Dec/ Mar/ June/ Sep), under copy to the Regional Inspectorate & Regional Office on the following format:

Month

Amount of Premium paid to ECGC

Date of Remittance to ECGC

Page 8 of 55

OBC Concurrent Audit Policy

14. Where E.C.G.C. coverage has not been obtained, a separate list of such accounts alongwith details of credit facilities sanctioned and outstanding at the end of the quarter shall be intimated. 15. Concurrent Auditors shall physically verify the various Govt. & other securities kept in the safe custody of the branch (wherever kept) on quarterly basis (for quarters ending Dec /Mar /June /Sep) and certificate to this effect shall be submitted to General Manager (Accounts), within 7 days of close of relevant quarter. 16. Concurrent Auditors shall verify the correctness of the Quarterly NPA Statement prepared by the Branch and send a certificate as per format enclosed to Regional Office, Recovery & Law Department-HO and Accounts Department-HO 17. Concurrent Auditors shall certify the following quarterly statements for the quarters ending Mar/Jun/Sep/Dec at the Branch: Profit & Loss Statement. Statement showing details of Advances for Capital Adequacy (formatREC/OSS/RBI/DSB/2-B/118 ) Statement of Contingent Liabilities (Format REC/OSS/RBI/DSB/2-A/117 ) Provision Sheet for Doubtful debts/Sub-standard debts/Loss Debts. 18. As per H.O. Guidelines monthly report of all Cash Transactions of Rs. 10.00 Lacs & Above in aggregate (deposits & withdrawals) is to be submitted to FIU-IND by the head office of the bank. This statement is drawn from the CBS system now and submitted by head office. However it is the responsibility of branch and concurrent auditor to scrutinize these transactions for identifying doubtful transactions and report them as suspicious transactions to the regional office for onward submission to GM (I&C), Head Office. This information is now available for branches on Netcast and branches are advised to take printouts on monthly basis and scrutinize the same and keep it on record. Concurrent auditor shall ensure that the scrutiny is being done on regular basis and identified suspicious transactions are reported to regional office and report compliance of the same in the monthly audit report. 19. Concurrent Auditors have to conduct 100% verification of all the Forms A1,A2 and A3 and submit the quarterly certificate to the respective Regional Inspectorate as per annexure-1 to 4. 20. The appointment is for one year which may be extended by one more year subject to satisfactory performance of the auditor. The performance may be first reviewed after completion of first quarter of audit. The assessment shall be made at Regional Inspectorate, on the basis of quality of report submitted by the auditor. Performance appraisal on concurrent auditors performance will be submitted to I&C, HO as per the prescribed format. The bank shall always have the right to cancel the allotment, at any time during the currency of concurrent audit. Banks decision in the matter shall be final. 21. The allotment is also liable to be cancelled if any major irregularities have been observed during regular inspection or because of any other reason, which bank may deem fit, covering the following parameters: (a) (b) (c) Exercise discretionary power by the branch manager Reporting of revenue leakage detected by revenue auditor and inspecting officials of Rs. 1.00 lac and above but not reported by concurrent auditor Irregularities pointed out in the risk based internal audit but not reported by concurrent auditor

Page 9 of 55

OBC Concurrent Audit Policy

(d) (e) (f) (g) (h) (i) (j)

Checking of securities charged to the bank and security papers Implementation of KYC norms /Anti Money Laundering Daily attendance of CA/Assistant in the branch Inter-branch reconciliation Account with comment on pre/post sanction of advances Whether expenses incurred at the branch carry proper authority Timely submission of concurrent audit reports and other requisite certificates relating to foreign exchange, NPA etc (k) Contribution of concurrent auditor in rectification of irregularities pointed out in RBIA, statutory audit, annual financial inspection by RBI, M O Report. (l) Comments on customer service and redressal of customer grievances (m) Any adverse features/lapses/ irregularities at the branch indicated by the other inspecting authorities which were not detected & reported by the concurrent auditor. 22. The concurrent auditor (partner) shall attend quarterly Regional Inspectorate Audit Committee (RIAC) meeting to discuss their quarterly reports and outstanding discrepancies of previous reports if any. ATTENDANCE REGISTER Attendance Register shall be maintained by the branch for recording attendance of partner/ representative of CA firm. One representative and/or partner of the CA firm should come to the branch daily and mark his attendance. However, the partner of the firm must attend the branch atleast for 10 days a month and mark his attendance. DECLARATION OF FIDELITY & SECRECY BY C.A. FIRM A declaration as per proforma should be furnished by Concurrent Auditors immediately on appointment and before starting the audit work. This declaration duly signed shall be sent to I&C Dept., HO along with acceptance letter of terms & conditions of appointment as per proforma mentioned earlier. 5 REPORTING: 5.1. DAILY

The irregularities/shortcomings noticed during the day will be recorded in a register on daily basis as short notes (specimen provided). The carbon may be kept for making two duplicate copy and one copy of this notes will be given to the Branch Manager/Second man /hall In charge against his signatures every day, the branch will rectify these irregularities/shortcomings on daily basis and on satisfaction concurrent auditor will mark off these jointly with the branch manager. The irregularities marked off will not find place in subsequent reports PROFORMA OF REGISTER Date Irregularities Observed Auditors Signatures How irregularity Rectified Date of rectification Auditors Signatures Incumbents Signature

Recording of these irregularities may be done in the form of appendix A, B, C in sequential manner as prescribed in regular inspection. Regional Head/ Chief Manager/ Asst. Regional manager or any other officer authorized for this purpose visiting the branch will examine the register to ensure that the audit is being done on day to day basis, rectification of Irregularities is properly being attended to and all systems and procedure are being followed properly. The performance of Branch Manager/ Concurrent Auditors shall inter-alia be on the basis of on the spot rectification of irregularities. This will

Page 10 of 55

OBC Concurrent Audit Policy

develop the culture of on the Spot rectification and prevention of recurrence of irregularities 5.2. MONTHLY a) The monthly report will be cumulative un-rectified irregularities as at the end of the month including irregularities observed in computerized working of the branch wherever applicable. The Monthly Reporting will be done on the prescribed monthly report format/ annexures. The Monthly report/ annexures should be submitted to the concerned Branch, Regional Office with all the annexures within in seven days of succeeding month. b) The discrepancies pointed out in the loan documents in the previous Inspection report still not rectified along with comments of the Branch Manager will be sent by the Concurrent auditor. In case there is any gap between the last inspection and the present inspection all the transactions of this period will also be covered by the concurrent auditor and discrepancies in all the areas of the branch functioning including loans with special emphasis on documentation, compliance of terms and conditions of sanction will also be mentioned in the report. The areas like export credit and ECGC Coverage, checking of exchange control copies, of customs bill of entry /postal wrappers, checking of Govt: and other securities will also be covered. 5.3. QUARTERLY

List all un-rectified irregularities of the quarter will be reported. The quarterly report/ annexures as per format will be submitted to the concerned branch, Regional Office & Regional Inspectorate within seven days of succeeding month. Revenue Leakage The report on revenue leakage detected, recovered and un-recovered will be part of the report. Report of revenue leakage detected and recovered during the period of inspection will be given. All reports, monthly and quarterly will find a mention at the end of the report about the irregularities which have been got rectified during the course of audit. The Monthly/ Quarterly reporting formats for concurrent audit were revised and circulated vide circular No. HO/I&C/38/09/680 dated 21.3.2009 and the same were implemented w.e.f. 1.4.2009. As the circular has been hosted on Banks portal, the soft copy of the formats can be downloaded at the branch. 5.4. SPECIAL REPORT Any special report (on prescribed Proforma) on frauds gross negligence /matters involving malafide / corrupt practices, may immediately be reported to the GM (Inspection & Control Dept.) HO under copy to Regional Office / Regional Inspectorate and Branch Manager. The Branch may be informed only if branch manager is not a party to the fraudulent activity. 6 Marking Serious Irregularities in the report

The irregularities observed by the concurrent auditors should be categorized in to two segments: Others & Serious. The Serious irregularities observed by the concurrent auditors should be marked as S and numbered as S-1, S-2 and so on in the report and Branches/ ROs/RIs are required to attend to rectification of such serious irregularities on priority but within maximum period of 45 days from the date of reporting. If the rectification is delayed beyond 45 days due to valid reasons, the same should be carried over in next report till rectified. The unrectified serious irregularities should also be discussed during RIAC meetings. The list of Serious irregularities as per Risk Based Internal Audit policy guidelines is given hereunder: List of Serious Irregularities

Page 11 of 55

OBC Concurrent Audit Policy

1. On test checking leave record was found to be wrong. 2. Safeguards for remittance of Cash to Currency chest/ other branches/SBI /other banks and RBI not followed and security measures for the safety and safeguard of cash at the branch not observed. 3. Physical checking of security forms/ books is not being done as prescribed. Movement of security form is not as per prescribed procedure. 4. Long outstanding entries in remittance in transit (Suspense Remittance) for more than 15 days continue without proper follow up and all outstanding entries of Rs.50,000/- and above under various Suspense (General, Pension, Remittance, Festival and FCNR etc.), Clearing Adjustment/ Debit Notes, Main/ Local Branch clearing Heads 5. Untallied balances under any head for more than three months. The balances of ledgers/ balance reports are not being taken down and tallied. Subsidiary books/balance reports are not tallied. Subsidiary books/ balance reports are not tallied with General Ledger/ GL. Report. (The auditors have to incorporate the actual prevailing position at the branch). 6. Checking of books and transaction scrolls with vouchers is not being done as prescribed. 7. In-operative accounts are not being transferred to in-operative ledgers/ head and extent guidelines regarding operations & maintenance of such accounts not being adhered to. 8. Signatures on cheque book requisition slips/ letters of request not verified before issue of cheque books. 9. Operation in newly opened accounts particularly of heavy amount not being closely scrutinized. 10. Entries outstanding in clearing adjustment account or other local inter-branch accounts maintained for the purpose, for more than one month without valid reason, entries outstanding in Suspense account as also in inter-bank account, lying unadjusted for more than one month and no efforts being made for getting them adjusted. 11. Missing vacant locker keys/Master keys. 12. Joint registration of the vehicle/ tractor in the name of the borrower and the Bank not got done. 13. Advances granted without satisfying the eligibility criteria of the borrowers and without ensuring the end use. 14. Not getting insured/timely renewal the pledged/hypothecated securities wherever required with bank clause. 15. Valid certificate from the competent authority regarding Pollution Under Control not obtained. 16. PC is not logged out of system during the absence of authorized person. 17. Reports/ printouts as prescribed are not generated at the end of day and not checked/ signed by the concerned official. 18. Rejected transaction report, exceptional transaction report, Access log, etc. are not duly checked/ initialled by the Manager and are not kept under dual custody. 19. The prescribed mechanism of 2nd checking system is not being adhered to. 20. Debits to various income heads not being passed under the orders of the incumbent incharge/ Hall in charge (as applicable).

Page 12 of 55

OBC Concurrent Audit Policy

21. Non adherence to prescribed KYC/ AML guidelines. 22. Un-authorized Interest Paid on Deposits. 23. When bills are purchased/ discounted or advance made there against the documents of title of goods are not proper, such as Railway receipts with company siding, transport receipts of unapproved transport companies etc. 24. Purchase/ discounting of accommodation bills/ cheques and instances of kite flying transactions. 25. When the cheque returning is high (both inward & outward) the matter is not being effectively taken up with the borrowers. 26. Export bills purchased without applying the proceeds towards adjustment of packing credit advances. 27. Packing credit advances not correlated to the amount of outstanding confirmed orders/ LCs. Export of goods not made, though the period stipulated for shipment has expired, and not taken up with RBI/ ECGC for extension. 28. Violation of FEMA in foreign exchange business. 29. Advances made, but plant and machinery not installed or securities not supplied /not purchases/ sold out/ found missing but no effective steps are taken to safeguard banks interest. 30. Significant omissions in obtention of prescribed documents and compliance of terms and conditions of sanction and B.C.C. not sent/ not kept on record (for cases under BM powers). 31. Prescribed formalities for creation of valid equitable mortgage (which is enforceable in the court of law/ taking into account the state laws as applicable) not complied with. 32. Quick mortality of borrowal accounts within one year of sanction/significant fresh slippage of account to NPA category. 33. Non-registration of the charge with ROC, wherever applicable. 34. Sanction of credit facilities to the borrowers in the prohibited/ restricted list compiled & circulated by RBI/ IBA/ HO. 35. Non-rectification/ persistent repetition of serious irregularities in large number of borrowal accounts. 36. Accounts where limitation has expired. 37. Non-checking/ overvaluation/ shortage of securities pledged hypothecated to the Bank. 38. Frequent devolvement/ invocation of Letter of Credit/ Bank Guarantee. 7 SUBMISSION OF CONCURRENT AUDIT REPORT & ITS COMPLIANCE

As per the Banks guidelines to the concurrent audit, auditors will record the irregularities/ shortcomings noticed during the day in a register on daily basis. The carbon may be kept for making two duplicate copies, one copy to be handed over to Branch Manager/ Hall Incharge against signature to ensure timely rectifications and auditor will mark off these entries jointly with BM. The irregularities rectified will not find place in subsequent reports.

PERFORMA OF REGISTER

Page 13 of 55

OBC Concurrent Audit Policy

Irregularities Observed

Signature Of Auditor

How Rectified

Date Of Rectification

Signature Of CA BM

Monthly Reporting The monthly report shall be cumulative un-rectified irregularities as at the end of the month. Concurrent auditor shall submit the report within 7 days of succeeding month on the prescribed reporting formats & Annexures. One copy will be submitted to branch and 2 nd copy to Regional Office for follow up. Quarterly Reporting List of aggregate un-rectified irregularities and other details on prescribed formats/ annexures of the quarter will be submitted within 7 days of succeeding month of end of quarter. One copy each shall be submitted to Branch, Regional Office and Regional Inspectorate. Dropping of Irregularities The power to drop the irregularities after rectification will be the Concurrent Auditor till the quarterly report is sent to the Regional Office/ Regional Inspectorate. Once the Quarterly report reached the Regional Office, the powers of dropping irregularities, on rectification will be with the Regional Head. 8 CLOSURE OF REPORT

Monthly: The monthly report shall be submitted within 7 days by the concurrent auditor to the branch with a copy to Regional Office. The observations in the monthly report will be followed up with the branch by the Regional Office and report shall be closed within 45 days by Regional Office. Quarterly: The quarterly report shall be submitted to the Branch, Regional Office and Regional Inspectorate within 7 days. The discrepancies/ observations in the quarterly reports will also be followed up with the branch by the Regional Office, after being satisfied of the rectification of irregularity, will inform the Regional Inspectorate about the rectification of irregularities. The Regional Office will send the list of un-rectified irregularities to Regional Inspectorate on quarterly basis. The report shall be closed within 45 days by Regional Inspectorate. Fraudulent Acts Whenever fraudulent transaction is detected the concurrent auditor shall immediately report the matter to Regional Office, Regional Inspectorate & Inspection & Control department at Head Office as well as to Branch Manager concerned (unless the branch manager is involved). 9 CLASSIFICATION OF ASSETS

RBI vide its letter no DBS: ARS: No BC: 17/08.91.001/2002-03 dated 05.06.2003 has directed that all branches under concurrent audit w.e.f June 2003 should get all borrowal accounts reviewed from the concurrent auditors, who will also submit certificate as per format given below on quarterly basis: We certify that branch Office _________________ 1. Has complied with income Recognition and Assets classification norms laid down by the Reserve Bank of India, Classification of NPA of the branch are as under: Account As on last date of present QTR As on Last date of previous DD /MM/ YYYY QTR

Page 14 of 55

OBC Concurrent Audit Policy

DD /MM/ YYYY Sub Standard Doubtful Loss Total NPA 2. All necessary Income and Expenditure vouchers have been passed for the Quarter Ended Mar / June/ Sept. / December ----(Year) The above certificates are to be sent to: 1. Recovery & Law Dept. Head Office New Delhi 2. Concerned Regional Office 3. Concerned Regional Inspectorate 3. Certificate of (a) 100% verification of Exchange Control copies of Bills of Entry etc., (b) 100% verification of Export Credits (Pre/ Post shipment against orders), (c) 100% checking of Forms A1, A-2 & A-3 and compliance of FEMA guidelines & (d) any other certification required by the Bank from time to time. No additional fee would be payable for these certificates. 10 REVENUE AUDIT All the Concurrent Auditors will also be looking to the revenue audit aspect of the branch. They will report on the under charges/over charges. They will also be responsible for recovery of under charges while inspecting the branches. There will not be a separate revenue audit of such branches where concurrent audit is conducted. 11 COORDINATOR FOR CONCURRENT AUDIT All Branches/Offices where concurrent audit is conducted should designate one coordinator so as to have smooth conduct of concurrent audit and Rectification of irregularities. The Coordinator who should be of the rank of Manager /Sr. Manager should be designated out of the existing staff of the branch. He has to facilitate and ensure that concurrent audit is done smoothly. He will do this along with the other duties that are assigned to him by the Incumbent. He will be a link between the Incumbent and Concurrent Auditor. 12 EXTENSION COUNTER. In case an Extension Counter is also working with any branch the Concurrent Auditors will check the same also once in a week, in case it is not possible to do daily checking. 13 OTHERS The Concurrent Auditor should be considered as a part of the branch and there should be no mutual distrust in this regard. The concurrent auditor may however, not sit in judgment over the decisions taken by the Branch Manager or an authorized official. This is beyond the scope of concurrent audit. The auditor will necessarily have to see whether the transactions or decisions are within the policy matters laid down by the Head Office, they do not violate the instructions or policy and that they are within the delegated authority. 14 CHECK LISTS FOR CONCURRENT AUDIT A check list indicating periodicity of the items to be checked is given hereunder. The Concurrent auditors should go through this list which is elaborate but not exhaustive and implement the same. In case they come across Items other than the items listed in this list these may also be examined and the discrepancies be reported. They may also go through the audit guidelines and draw the guidance from the same

Page 15 of 55

OBC Concurrent Audit Policy

CHECK LIST SL. NO 14.1 ITEMS TO BE Checked A. Routine i) Cash/Petty Cash/Postage & Telegrams/ Stamps in hand and stock ii) IBCs iii) Travellers Cheques/Foreign Currency iv) Custody of Securities held against ~advances (Indira Vikas Patras /FDRs/Gold & Jewellery etc.) v) Safe custody of articles vi) Parcels . . vii) Securities Forms i.e. blank cheque books, drafts, cash orders, FDRs, TPOs etc. viii) Govt. securities and other: securities held by. the Branch on behalf of Head Office ix) Original and duplicate keys .of. Strong room, Safes, Safe Deposit Vault etc including keys of Godown i) Account opening forms of all types of accounts (introduction, photographs, nominations, verification of address, risk profile, threshold limit, PAN, Form 60-61 etc. Special checking of newly opened accounts and where substantial and. frequent withdrawal are taking place. ii) All Vouchers High value items to be examined in detail. iii) All books checked by the branch officials (cash book day books, long book. transfer. Journals, transfer analysis register, SGL, GL, checking of books, clearing register etc. to ensure that all vouchers are accounted for) . iv) Operations in inoperative/ illiterate accounts. v) Income and expenditure .incurred. All expenses over Rs.100/- sanction to be checked, all debits to income must be checked, correctness of interest charged, other service charges, out of pocket charges; penal interests, penalties etc., expenditure' supported by bills, ensure vouchers have been signed by the competent. authority vi) Use and updating of book of authorized signatures. register of lost documents vii) Govt. business is conducted in accordance with the instructions of the Govt/ RBI/ Head Office. viii) Ensure that the drafts TPOs Cash Orders issued forRs.50000/- and above are only by debiting the individuals account and not against acceptance of cash. ix) Issue and updation of pass books and statement of accounts x) Instructions for stop payment of cheques xi) Proper recording and stitching of daily vouchers xii) Cash management - custody, control' and movement of cash, proper delivery and receipt of cash, sorting of notes, maintenance of cash balance within stipulated limits, cash balance beyond insurance limit, accumulation of nonissuable notes, proper accounting of inward & outward cash remittance xiii) Observance of guidelines in respect of security forms in use. PERIODICITY To be checked on the first day and Once in a quarter on irregular intervals

j'j'

14.2

DAILY

DAILY "

~ ' _________

Page 16 of 55

OBC Concurrent Audit Policy

xiv) xv) xvi) xvii)

Over detention of bills purchased. Timely execution, of standing instructions. Issue of cheque books - its Safeguards Daily dak, telegrams, bills etc. received and. disposed off.

xviii) Proper custody of AOF, Ledgers, Code books/check

cypher and other books/records/ documents during day and overnight' xix) Passing of all debits in suspense accounts by the incumbent xx) Immediate credit of out station/ local cheques up to Rs.15000/- as per head office guidelines xxi) Payment of interest for delayed collection of outstation cheques/remittance xxii) Any abnormal transactions in staff account. ( high amounts deposits or high frequency of operations) xxiii) Proper scrutiny of debits/credits to suspense/sundries and efforts to reverse them xxiv) Deduction and recording of service tax and TDS as per income tax rules xxv) Proper commission has been charged on draft issues/TT issued, bills purchased/discounted, RTGS/NEFT, LCs, Guarantees issued and in other transactions. xxvi) Check whether passing and signing powers in cash/transfer payments, debits relating to clearing and in interest paid accounts as under are being exercised properly Cash/transfer Debits payments relating to clearance (except income & expenditure) Rs. 1 lac Rs. 1 lac Interest paid account

Single authorized signatory Two authorized signatories Two authorized signatory one of which must be incumbent/hall in charge

Rs.10000/-

Above Rs.1 lac to Rs.5 lac Above Rs.5 lac

Above Rs.1 lac to Rs.10 lac Above Rs.10 lac

Above Rs.10000 to Rs.50000/Above Rs.50000/-

xxvii)

Check whether vouchers debiting income head are being signed by the incumbent in charge

Page 17 of 55

OBC Concurrent Audit Policy

14.3

i)

14.4

Reconciliation of clearing adjustment entries and adjustment of outstanding reconciled entries. ii) Prompt action in disposal of inward and outward bills. iii) Proper custody of parcels, bills and accompanying documents. iv) Usance bills - acceptance, stamped adequately, correctness~ of due dates etc. v) Remittance in Transit and reversal of such entries. Efforts made for reversal of entries outstanding for more than 7 days vi) Spurt in deposits/ advances. vii) Proper recording of co-acceptance of bills viii) Whether Banker Account(s) are reconciled, Follow up of unreconciled entries of more than seven days. Fund management in bankers account excess balances/overdrafts Complaints received and disposed off. Cash is checked at least once in a fortnight by the official not connected with its custody. Check that no outsider and unauthorized person is having access to Bank's books of accounts /ledgers/registers etc. i)

Once in a week

Fortnightly

14.5

14.6

Whether the books/ ledgers; have been balanced. Correctly Monthly up to the end of previous month. Also whether the concerned officers are countersigning. The balances remaining untallied be reported in Manager Month1y Certificate to RO. ii) Monthly vouchers of postage, telegrams, couriers etc. iii) Balancing of impersonal accounts. iv) Maintenance of account opened and closed, majority attainment registers. v) All sundry/suspense/clearing adjustment entries outstanding for more than one month and efforts made to adjust these. vi) Whether income and expenditure vouchers are properly recorded vii) Whether all circulars/compendiums/.manua1/books etc. are being maintained properly. viii) Recovery of locker rent, safe custody fee, inspection and other incidental charges. ix) Observance of guidelines for operation of safe deposit vault. Monthly , Of" X) submission of statutory returns xi) Timely submission of control' and other returns test checking for their correctness to cover all returns at least once in a quarter. xii) Lodging of scrolls with Link branch /SBI/ RBI in respect of pensions paid to the debit of suspense Pension Account-and 'seeking timely reimbursement thereof. xiii) Observance of security measures to be checked at irregular intervals including alarm system. xiv) Exercise of expenditure powers vested in the incumbent and seeking confirmation where powers exceeded under various heads. xv) Maintenance of deceased claims register - timely settlement. xvi) Tallying of cash orders outstanding with the Registers and G.L. xvii) Ensure that leave record of staff is being maintained properly xviii) To ensure that check cyphers and code books are kept under the safe custody and are being used by the authorized official only. i) Physical verification of various' Govt. and, other, securities -- Quarterly

Page 18 of 55

--,

OBC Concurrent Audit Policy

ii) iii) iv) v) vi) vii) viii) ix) i) ii) 14.7 iii) iv) v) vi)

vii) viii) ix) 14.8 i)

safe custody maintenance of movement register, collection of interest etc. Commission on Govt. Business whether recovered. Credit of periodic interest to FDs and PD accounts. Specimen signatures of RBI authorized officers (if supplied) under personal custody of Incumbent. Gun License - Renewal inclusion as retainer of all the guards, age of ammunition. Fire fighting arrangements. Working of customer service committee and other customer service related issues. Physical verification of security forms such as, cheque books, draft books, TPOs. Cash Orders, FD Rs with the relevant registers. All other items mentioned against (to be checked on the 1st day) Duty sheet of staff whether rotations are being done. Separate records of Non-Resident /Foreign Currency accounts including their AOF - issuing of cheque Books with prefix NRE etc. Physical checking: of SFF items with the list supplied by the Regional Office - its upkeep Destruction of old record as Per Head Office guidelines. Maintenance of Old Record Register and whether all the Half yearly books are entered therein. Incidental charges service charges in saving accounts (including inoperative) where minimum balance is .not maintained Payment of SB interest to institutions prohibited to open savings accounts. Half yearly checking of Guns /Ammunitions by test firing Verification of lease deed of premises for renewal etc. Whether the prescribed certificate of life, reemployment, re-marriage etc. obtained once in a year in October/November in all pension accounts Sample checking of pension payments - at least 30% Availability of Power of Attorney of the signing officers in the branch.

ii)

Must also comment on

i)

14.9

b, Credit i) Vouchers relating to all loan accounts. ii) Temporary overdraft allowed/ excess accommodation allowed/clean over draft whether allowed by the Competent Authority and adjusted: as per condition or Sanction letter. iii) Drawls against clearing, iv) To check all loan documents in respect of .loan releasedproper filing up of prescribed forms; properly executed. And stamped, entry in document register v) Recovery of processing fee for loans sanctioned enhanced or renewed. vi) To check whether' all the terms and conditions stipulations in the sanctions have been complied with before disbursement of loans (new and enhanced/additional facilities) and BCC stands compiled/submitted to sanctioning authority. vii) Pre-sanction appraisal in loans sanctioned, enhanced or renewed is proper, particularly realistic sales projections,

Daily

Page 19 of 55

OBC Concurrent Audit Policy

techno-economic viability etc. viii) To check whether all the loans, released have-proper: sanction and in cases where vested powers have been exceeded, confirmation of the competent Authority has been received/sought. ix) Securities encashed (FD/ NSCs/ Vikas Patras etc) the proceeds have been credited in. the respective loan accounts, unless DP 'of the remaining securities permitted release to the borrowers x) End use/diversion of funds in cash: credit, accountschecking from the names of beneficiaries of the debits allowed. . xi) To check whether documents relating to IBCs are kept under the safe custody during the day and over night; xii) Guarantees issued are on prescribed format, inclusion of clause restricting period of invocation and recorded in banks register, contra voucher passed and counter guarantee obtained.

xiii) xiv)

Release of advances covered under selective credit control as per RBI Guidelines. To ensure that- all LCs opened are entered in the LC register, margin money obtained, contra vouchers passed and. appropriate commission (including amendment charges, if any) charged To ensure that all bills received under the LC have been entered in IBC register on the same date. To ensure .that all rules, regulations and conditions laid down by the Head Office/ RBI/ FEDAI have been followed for opening of LC and FLCs. Custody of loan documents /title deeds during the day and over night.

Daily

xv) xvi) xvii)

14.10 i)

Daily

Scrutiny of bills purchased/discounted/under AOBC limitMTR of approved transporters, no bills on allied concernstheir entry in party wise registers and tallying the same. ii) Whether documents of loans of and above Rs. 5 crore have been got vetted from the legal retainer prior to disbursement of loan and post-facto in loans below Rs. 5 crores or otherwise stipulated in sanction. iii) Whether any adhoc/temporary limits have been allowed to customers in whose case BCC has not been submitted/ or the terms and conditions of sanction have not been fulfilled. In case such facilities are extended whether sanctioning authority has allowed this. 1% penal interest is charged on adhoc facilities. iv) Overdue DD/BD proper follow up and reporting v) To check whether bills purchased are sent to the drawee/ drawee bank on the same day and whether follow up is proper. vi) To ensure that the guarantee commission is charged at the stipulated rates for the full period of guarantee including the claim period. i) To check whether the charge with the ROC has been got registered within the stipulated' period of 30 days and the

Weekly

Weekly

14.11

Fortnightly

Page 20 of 55

OBC Concurrent Audit Policy

relevant fee receipt for submitting the application is held on record.(in case of limited companies) ii) To check whether equitable mortgage of immovable property~ have been validly created for original and enhanced limits. iii) To check proper maintenance of important registers, such as, a) Discretionary Power. b) Limitation c) Complaints, d) Securities verification register. e) Insurance iv) To check whether proper follow up i.e. notices, diary, advocate fee, court attendance etc. is being done in sick accounts/protested advances/suit filed/decreed accounts. v) To check frequent returning of cheques/bills purchased/discounted/accommodation bills. vi) Refinance, from NABARD/IDBI etc., if applicable, timely lodgement of applications and proper follow up. vii) To ensure that bills received for collection are not over detained and drawer instructions are followed for realization, the follow up is effective. 14.12

Fortnightly

i)

Loan proposal received and disposal register - its proper maintenance and entry in Proposal Tracking System (PTS). How proposals are handled etc. ii) Checking of regular submission of inventory/stock statement/book debt: statement- No operations allowed in loan account where inventory has not been submitted and DP worked out for over 3 months iii) Physical verification of securities pledged/hypothecated along with the branch manager or any other officer authorized for the purpose (plan all the securities verification with the branch manager and tentative plan (quarter wise) be submitted along with the first report. Also securities are insured for fire, theft and burglary. iv) Checking of other securities, such as FDRs/NSCs/Vikas Patras/ LIC policies/Shares. etc, Similarly checking of joint" registration: joint insurance and physical Verification' of transport /tractor/vehicle loans. v) Checking of DP register - its maintenance, proper calculation of drawing powers (even for sub limits) signatures of the Branch Manager Etc. vi) To check that all limits are reviewed/ renewed every year and ~the operation is not allowed; under lapsed" sanction. vii) To allow ad-hoc facilities only to such borrowal accounts whose asset classification is standard regular and such limit is maximum for three months, and records proper justification of its sanction. viii)To check that the stock pledged to the Bank is valued as per invoice/market value/cost prices which ever is less. The stock statement tallies with book of accounts. ix) Submission of control returns in time and their correctness (in respect of loans and foreign exchange) x) To verify that at the time of change in interest rates on advances, the amended rate of interest is noted on borrowal account ledgers. Penal interest, wherever applicable is charged

Monthly

Monthly

Page 21 of 55

OBC Concurrent Audit Policy

xi) To verify that up to date interest is levied on Bills

purchased/discounted, penal interest for overdue period and penal interest for full period in case of dishonouring/returning of Bills/cheques.

xii) To verify that inward bills for collection should not be

outstanding for more than three months in case of Demand Bills and one month after the due date for usance bills xiii) To ensure that all advances including priority sector, consumer loans, housing loans and loans in other thrust areas have been made strictly in accordance with the Head Office guidelines and payments are made to the suppliers under authority of the borrowers and receipts are held in record. xiv) To ensure that the Branch Manager is taking up the matter with the party in case of high returning of bills and is also referring to the sanctioning authority. xv) Recovery of NPA, irregular/sticky and protested accounts - personal follow up and correspondence. xvi) Recovery efforts made under Agriculture Recovery act, State Recovery Act and other summary enactments. xvii) Insurance of outstanding import bills.

Monthly

xviii) Monthly declaration under whole

turn over pre/post shipment credit, guarantee and payment of premium xix) To ensure that after the expiry period of the guarantee registered notice is sent to the beneficiary that the liability of bank has ceased and the liability vouchers are reversed. 14.13 i) In cash credits and book debts- whether the account has been Quarterly categorized as NPA where stock/book debt statements are not received and checked for continuously 90 days (even when the unit is working). In case where regular/ad-hoc credit limits could not be reviewed /renewed with in 90 days from the due date/date of ad-hoc limit - whether the account has been treated as NPA. \Whether quarterly/monthly reports of monitoring officers, complete in all respects, are being received - and their follow up. Receipt and scrutiny of QIS Statements received 'from the borrowers and fixing operative limits. While reporting comments of the following be specifically made . a.) Whether there is any deviation in actual and budgeted figures of Production/Sale/Profit/Bank borrowing etc.? 10% deviation in budgeted figures is accepted. In case deviation is more reasons may be enquired nom the borrower and Branch Manager b.) If the budgeted production/sales etc. have not been achieved, then how the Bank credit has been utilized. Diversion of funds may also be ascertained from the borrower. c.) Whether the holding of inventory and receivables are as per norms / past trend? If there is increase, the reasons be given d.) If the net working Capital (Total CA-Total CL).has decreased and or the current ratio (total CA divided by total CL) has improved or otherwise the reasons be found

Page 22 of 55

ii)

iii)

iv)

OBC Concurrent Audit Policy

and given. v) To ensure that the processing fee is recovered on all eligible borrowal accounts. vi) To ensure that guidelines on income recognition norms, asset Classification and provisioning have been followed strictly as per HO/RBI guidelines. vii) Claiming of interest subsidy. viii) Review of all loan accounts with fund based limits of Rs. l 0.00 lacs and above. ix) Personal Monitoring by the incumbent In charge of all accounts with fund based credit limits of Rs. 50 lacs and above. x) Test checking of RCC submitted by the branch for its accuracy 14.14 i)

Quarterly

14.15

Interest rate on working capital advances of borrowers with fund based limits of Rs. I.OO crore and above determined' on the basis of score/ratings as' prescribed by the Head Office ii) Review of rescheduling of repayment programme wherever required. iii) Obtaining of balance confirmation letters by the branches. iv) Comments~ on increase/decrease of NPAs irregular account - comparative position: their follow up action Half yearly initiated for recovery up gradation of quality of assets from Sub-standard to Standard etc. v) Inspection of securities at least once in six months (in case of ELBs having Chief Managers also) by the AGM/CM alternatively. vi) Whether fresh valuation of property mortgaged with the bank in certain loan accounts needs to be got done (indicate accounts and properties) ATMs: Check ATM operations as per DIT-HO guidelines. (HO Circular No.DIT/04/2006-07 Dated 27.05.2006) Comment whether Security arrangement ,ambience etc. in ATM are satisfactory. Checking of ATM cash with CBS balance. Monthly

6.

FOREIGN EXCHANGE BUSINESS FOREX BUSINESS- areas to be covered The audit must encompass the audit of entire Foreign Exchange Business at the Branch. The Audit must be viewed from the prospective of analyzing and evaluating the compliance level by branch to the Notification / Rules / Regulations / Directions issued under FEMA from time to time in the backdrop of KYC norms. Suggested checklist for submitting monthly FEMA Audit report is given in Annexure II C which is to be annexed to Monthly Concurrent Audit report. A. Inward / Outward remittances 1. Accounting / reporting and authorization of remittances. Purpose of remittance should be ascertained and wherever applicable FIRC should be issued. 2. Checking of commission and expenses. 3. All inward remittances are verified (including remittances received by religious / charitable / social institutions for which prior permission is required from the Government of India.)

Page 23 of 55

OBC Concurrent Audit Policy

4. Verify and confirm (monthly concurrent audit report) that large inward remittances of US$ 50,000 and above or its equivalent were received in well introduced accounts and wherever substantial increase in outward remittances had been noticed, that these transactions were carried out in strict compliance of FEMA guidelines. B. Forward Contracts- Purchase / Sale: 1. Verify sanction limits for booking contracts. 2. Whether documentary proof is held 3. Whether appropriate register is maintained. 4. Whether stamped agreement / deal confirmation has been obtained. 5. List out the forward contracts outstanding in the branch books beyond 15 days from the expiry of option period. C. Guarantees: 1. Guarantees issued / extended / cancelled during the month. 2. Rate at which commission charged/ calculations. 3. Proper authorization, documentation, recording etc. 4. Verification of securities accepted as margin. 5. List out the expired Foreign Bank Guarantees. D. Export Bills: i) Collection outstanding ii) Purchase outstanding iii) Negotiation outstanding iv) Overdue export bills under AAEBR a/c. E. Import Bills: i) Letter of credit outstanding ii) Bills received under L/c outstanding iii) Collection Bills outstanding iv) Loan against documents (LAD) outstanding F. Non Resident Accounts: i) NRE Accounts, all types ii) NRNR Accounts iii) FCNR Accounts iv) NRSR Accounts v) NRO Accounts vi) RFC (Domestic) vii) RFC of Non resident Indians who have come back to India.

G. Loans to Non Resident Indian against their deposits. Loans to Indian Residents against Non Resident deposits. H. I. EEFC Account Forward Contract outstanding.

Periodical Checks to be conducted with regard to: 1. 2. 3. 4. 5. 6. PCL (Pre-shipment Credit) Details of those Loans, which have been liquidated otherwise than from proceeds of export bills. Outward Remittance Register Inward Remittance Register Bills of Entry Register Export Bill register Import Bill Register

Page 24 of 55

OBC Concurrent Audit Policy

7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22.

Non Resident Accounts (all types of) Register Forward Contract Register To ascertain details of remittances towards overseas investments by resident Indians and Investments in India by Non Resident including portfolio Investment. Any cases of write off of export bills Details to be furnished. Details of cases, where reduction in invoice value of proceeds have been granted. Details of cases, where reduction in invoice value of exports has been permitted by the competent authority and in line with FEMA guidelines. Details of cases of un-drawn balances. Cases of project exports, if any in the branch. Any advance payment against imports. Any cases of travellers seeking foreign exchange beyond the prescribed limits delegated to ADs. Any accounts of foreign nationals maintained. Submission of A-1,A-2 & A-3 to RBI 100% checking of A1,A-2 & A3 forms and certificate of compliance of FEMA guidelines for all Forex transactions . Any outward remittance effected for more than USD 1,00,000 towards consultancy services Remittance for advertisement on the foreign television Remittance for maintenance of foreign currency account outside India Inward / outward remittances for USD 50,000 and above or its equivalent and ensure provisions of FEMA are strictly complied with.

15.3.

Periodicity and timely submission of following statements to be checked: 1. 2. 3. 4. 5. 6. 7. Whether calendar of returns / statements showing due date and date of submission is maintained. XOS statement to be submitted half yearly to reach RBI within 15 days from the reporting period. BEF Statement to be submitted half yearly to reach RBI within 15 days from the reporting period. R-Return statements to be submitted fortnightly to reach RBI within 15 days from the reporting period EBW Statement for export bills written off to be submitted half yearly to reach RBI within 15 days from the reporting period. ORS remittances made for establishing offices outside India - To be submitted half yearly to reach RBI within 15 days from the reporting period. Statements to be submitted by the bank as a whole to Cental Office of RBI: : Statement of operations in FCNR Accounts : Statement of Earnings from Tourism : Statement of operations in NRE Accounts : Statement of operations in NRE Accounts : Statement of operations in RFC Accounts

STAT 5 STAT 6 STAT 8 STAT 9 STAT 10 8.

100% verification of Bills of Entry to be confirmed and certificate sent every month to Head Office as per instructions with copies marked to Regional Office & Branch.

Irregularities noticed if any and not rectified must be incorporated in the Monthly Report as Usual. Serious irregularities / observations must however be reported in the SPECIAL Report addressed to the General Manager (I&C) HO.

15.4. A

CHECK LIST FOR VERIFICATION i) Packing credit allowed under proper sanction backed by L/C of approved bank or confirmed order, opening of separate

PERIODICITY DAILY

Page 25 of 55

OBC Concurrent Audit Policy

ii) iii) iv) v) vi)

vii) viii) ix) x) xi)

xii) xiii) xiv) B i) ii)

iii)

iv)

v) vi)

account, ECGC cover and compliance of other conditions. Checking of foreign documents purchased/negotiated under FLC and their prompt despatch. Payment of import bills Over detention of import bills under collection Due date diary for usance foreign bills , recovery of interest on import bills from the date of debit to our NOSTRO account Levy of correct charges on foreign inward/outward remittances, FOBC, travellers cheques, forward contracts, counter signing of import bills of exchange etc. Recovery of interest on overdue export bills Correct application of exchange rates Levy of correct charges, interest, exchange rates, overdue interest on FOBP/FOUBP/FOBNLC etc. Payment of overdue interet on FCNR-NRE fixed deposits To ensure that all rules regulations and conditions laid down by the Head Office/RBI/FEDAI have been followed for opening FLCs. Transactions in non-resident and other foreign currency account as per RBI/Head office guidelines Check all outward remittances on 100% basis. Whether the remittances are supported by forms A1 & A2 filled in all respects and are in order. To check that the branch has recovered the ECGC premium of all the PC advances as per Head Office Guidelines. To ensure that all pre-shipment and post-shipment advances are covered by the ECGC. IN CASE OF PC advance of more than Rs. 15 lacs per borrower falling under standard asset and in case FDBP/FUDBP/PSL advance of more than Rs.25 lacs falling under standard regular category, notice has been sent to the ECGC within 30 days of disbursement whereas in other cases prior approval has been obtained. In all fresh cases of PC advances of Rs.15 lacs and above and in all fresh cases of post shipment advances of Rs.25 lacs and above prior approval of ECGC is mandatory. Bank has obtained whole turnover Packing Credit & Post shipment guarantees which cover automatically PC advances up to Rs.15 lacs/post shipment advances up to Rs.25 lacs per borrower. In case the exporters also take separately pre-shipment and post-shipment policies of ECGC, the bank can get higher percentage of claims in case of invocation of guarantees. The auditors should ensure that this happens. Ensure- that-the commercial and political risks are also covered of all advances when ECGC policy is taken by the exporters. Whether GR forms / shipping Bills are randomly verified. Inward/Outward remittances of US$ 50,000/- and above or its equivalent to undergo snap audit. Inward remittances of US$ 50,000/- and above or its equivalent have been received in well introduced accounts under strict compliance of FEMA provisions.

WEEKLY

i) ii) iii)

Timely lodgement of claims from ECGC and proper follow up FORTNIGHTLY of outstanding claims against ECGC/DICGC. To verify correctness of GR forms reported in R returns Whether R returns are promptly submitted to RBI on a

Page 26 of 55

OBC Concurrent Audit Policy