Beruflich Dokumente

Kultur Dokumente

Oh6 Ptbenaoe0014 Final Terms - 2012

Hochgeladen von

Paulo Jorge OliveiraOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Oh6 Ptbenaoe0014 Final Terms - 2012

Hochgeladen von

Paulo Jorge OliveiraCopyright:

Verfügbare Formate

Final Terms dated 13 December 2010

Banco Esprito Santo, S.A.

Issue of 40,000,000, Fixed Rate Covered Bonds due 26 January 2017 under the 10,000,000,000 Covered Bonds Programme

THE COVERED BONDS (AS DESCRIBED HEREIN) ARE MORTGAGE COVERED BONDS ISSUED IN ACCORDANCE WITH DECREE-LAW 59/2006, OF 20 MARCH 2006 (AS AMENDED, THE COVERED BONDS LAW). THE ISSUER HAS THE CAPACITY TO ISSUE COVERED BONDS IN ACCORDANCE WITH THE COVERED BONDS LAW. THE FINANCIAL OBLIGATIONS OF THE ISSUER UNDER THE COVERED BONDS ARE SECURED ON THE COVER POOL MAINTAINED BY THE ISSUER IN ACCORDANCE WITH THE COVERED BONDS LAW.

This document constitutes the Final Terms relating to the issue of Covered Bonds described herein.

PART A CONTRACTUAL TERMS

Terms used herein shall be deemed to be defined as such for the purposes of the terms and conditions of the Covered Bonds (the Terms and Conditions) set forth in the Base Prospectus dated 9 November 2007 and the supplemental Base Prospectus dated 29 November 2007, 17 July 2008, 12 August 2009, 30 October 2009 and 5 July 2010 which together constitutes a base prospectus for the purposes of Directive 2003/71/EC (the Prospectus Directive). This document constitutes the Final Terms of the Covered Bonds described herein for the purposes of Article 135C-4. of the Portuguese Securities Code, which implemented Article 5.4 of the Prospectus Directive and must be read in conjunction with such Base Prospectus as so supplemented. Full information on the Issuer and the offer of the Covered Bonds is only available on the basis of the combination of these Final Terms and the Base Prospectus. The Base Prospectus and the supplemental Base Prospectus are available for viewing at Banco Esprito Santo, S.A. Avenida da Liberdade, 195, 1250-142 Lisbon, and copies may be obtained from the same address.

1. Issuer: 2. (i) Series Number: (ii) Tranche Number: 3. Specified Currency or Currencies: 4. (i) Aggregate Nominal Amount of Covered Bonds: A. Series: (ii) Specify whether Covered Bonds to be admitted to trading 5. (i) Issue Price: 1

Banco Esprito Santo, S.A. 6 1 Euro () 40,000,000 40,000,000 Yes 100 per cent. of the Aggregate Nominal

Amount (ii) Net Proceeds 6. Specified Denominations: 7. Issue Date: 8. Maturity Date: 9. Extended Maturity Date: 10. Interest Basis: (i) Period to (and including) Maturity Date: (ii) Period from (but excluding) Maturity Date up to (and including) Extended Maturity Date: 11. Redemption/Payment Basis: 12. Change of Interest Redemption/Payment Basis 13. Put/Call Options: 14. (i) Status of the Covered Bonds: or 4.60 per cent. Fixed Rate (further particulars specified below) 1 month Euribor + 2.80 per cent. 40,000,000 100,000 15 December 2010 26 January 2017 26 January 2018

Redemption at par Not Applicable Not Applicable The Covered Bonds will be direct, unconditional and senior obligations of the Issuer and rank equally with all other mortgage covered bonds issued or to be issued by the Issuer. The Covered Bonds will qualify as mortgage covered bonds for the purposes of the Covered Bonds Law. 6 December 2010

(ii) Date Executive Committee approval for issuance of Covered Bonds obtained: 15. Method of distribution: 16. Listing/Admission to Regulated Market

Non-syndicated Euronext Lisbon

PROVISIONS RELATING TO INTEREST (IF ANY) PAYABLE

17. Fixed Rate Covered Bonds Provisions To Maturity Date: Applicable Not Applicable 4.60 per cent. per annum payable annually in 2

From Maturity Date up to Extended Maturity Date: (i) Rate of Interest: To Maturity Date:

From Maturity Date up to Extended Maturity Date: (ii) Interest Payment Date(s): To Maturity Date:

arrear Not Applicable

15 December in each year from and including 15 December 2011 to and including 15 December 2015 and the Maturity Date; For the avoidance of doubt, 15 December 2016 shall not be an Interest Payment Date for the purposes of the Notes and a long last coupon shall be payable on the Maturity Date

From Maturity Date up to Extended Maturity Date: (iii) Fixed Coupon Amount [(s)]: To Maturity Date:

Not Applicable

From Maturity Date up to Extended Maturity Date: (iv) Broken Amount: To Maturity Date:

4,600 per 100,000 Specified Denomination Not Applicable

The Notes are subject to a long last coupon payable on the Maturity Date of 5,141.92 per 100,000 Specified Denomination. Not Applicable

From Maturity Date up to Extended Maturity Date: (v) Day Count Fraction To Maturity Date: From Maturity Date up to Extended Maturity Date: (vi) Determination Date(s): To Maturity Date: From Maturity Date up to Extended Maturity Date: (vii) Other terms relating to the method of calculating interest for Fixed Rate Covered Bonds: 18. Floating Rate Covered Bonds Provisions To Maturity Date: From Maturity Date up to Extended Maturity Date:

30/360 unadjusted Not Applicable

Not Applicable Not Applicable None

Not Applicable Applicable

(i) Specified Period(s)/Specified Interest Payment Dates: To Maturity Date: From Maturity Date up to Extended Maturity Date: Not Applicable 15th day in each month payable in arrear

(ii) Business Day Convention: To Maturity Date: Not Applicable Following Business Day Convention From Maturity Date up to Extended Maturity Date: (iii) Additional Business Centre(s): To Maturity Date: From Maturity Date up to Extended Maturity Date:

Not Applicable TARGET

(iv) Manner in which the Rate of Interest and Interest Amount is to be determined: To Maturity Date: Not Applicable Screen Rate Determination From Maturity Date up to Extended Maturity Date: (v) Party responsible for calculating the Rate of Interest and Interest Amount (if not the Calculation Agent): To Maturity Date:

From Maturity Date up to Extended Maturity Date: (vi) Screen Rate Determination: A. To Maturity Date: B. From Maturity Date up to Extended Maturity Date: Reference Rate: Interest Determination Date: Relevant Screen Page:

Not Applicable Banco Esprito Santo, S.A.

Not Applicable Applicable 1 month-Euribor 2 TARGET Business Days prior to the start of each Interest Period Reuters page EURIBOR01

(vii) ISDA Determination: A. To Maturity Date: Not Applicable

B. From Maturity Date up to Extended Maturity Date: (viii) Margin(s): To Maturity Date:

Not Applicable

Not Applicable + 2.80 per cent. per annum

From Maturity Date up to Extended Maturity Date: (ix) Minimum Rate of Interest: To Maturity Date: From Maturity Date up to Extended Maturity Date: (x) Maximum Rate of Interest: To Maturity Date From Maturity Date up to Extended Maturity Date: (xi) Day Count Fraction: To Maturity Date

Not Applicable Not Applicable

Not Applicable Not Applicable

Not Applicable

Actual/360 From Maturity Date up to Extended Maturity Date: (xii) Fall back provisions, rounding provisions, denominator and any other terms relating to the method of calculating interest on Floating Rate Covered Bonds, if different from those set out in the Terms and Conditions: To Maturity Date From Maturity Date up to Extended Maturity Date: Not Applicable As per the General Conditions

19. Index Linked Covered Bonds Provisions 20. Zero Coupon Covered Bonds Provisions

Not Applicable Not Applicable

PROVISIONS RELATING TO REDEMPTION

21. Call Option

Not Applicable

22. Put Option 23. Final Redemption Amount of each Covered Bond 24. Early Redemption Amount of each Covered Bond payable on an event of default and/or the method of calculating the same (if required or if different from that set out in Condition 6 (Redemption and Purchase))

Not Applicable 100,000 per 100,000 Specified Denomination Not Applicable

GENERAL PROVISIONS APPLICABLE TO THE COVERED BONDS

25. Form of Covered Bonds: 26. Additional Financial Centre(s) or other special provisions relating to Payment Dates: 27. Talons for future Coupons or Receipts to be attached to Definitive Bearer Covered Bonds (and dates on which such Talons mature): 28. Details relating to Partly Paid Covered Bonds: 29. Details relating to Installment Covered Bonds: 30. Redenomination applicable: 31.Other final terms:

DISTRIBUTION

Bearer Covered Bonds held through Interbolsa Not Applicable

No

Not Applicable

Not Applicable Not Applicable Not Applicable

32. (i) If syndicated, names of Dealers: (ii) Stabilising Manager (if any): 33. If non-syndicated, name of relevant Dealer 34. Whether TEFRA D or TEFRA C rules 35.Additional selling restrictions:

Not Applicable Not Applicable Citigroup Global Markets Limited TEFRA D Not Applicable

LISTING AND ADMISSION TO TRADING APPLICATION

These Final Terms comprise the final terms required to list and have admitted to trading the issue of the Covered Bonds described herein pursuant to the 10,000,000,000 Covered Bonds Programme of Banco Esprito Santo, S.A.

RESPONSIBILITY

The Issuer accepts responsibility for the information contained in these Final Terms. Signed on behalf of the Issuer: By: ............................. Duly authorised By: .................................. Duly authorised

PART B OTHER INFORMATION 1 Listing

(i) Listing: (ii) Admission to trading:

Euronext Lisbon Application has been made for the Covered Bonds to be admitted to trading on the regulated market Eurolist by Euronext Lisbon with effect from 15 December 2010 4.600

Estimate of total expenses related to admission to trading

2 Ratings

Ratings:

The Covered Bonds to be issued have been rated: Moodys: Aa2

Notification

Not applicable

4 Interests of Natural and Legal Persons Involved in the Issue

Save as discussed in Subscription and Sale, so far as the Issuer is aware, no person involved in the offer of the Covered Bonds has an interest material to the offer.

5. Reasons for the Offer, Estimated Net Proceeds and Total Expenses

(i)

Reasons for the offer

See USE OF PROCEEDS wording in Base Prospectus

6.

YIELD - Fixed Rate Covered Bonds only

Indication of yield:

4.60 per cent. per annum The yield is calculated at the Issue Date on the basis of the Issue Price. It is not an indication of future yield.

7. Performance of index/formula, explanation of effect on value of investment and associated risks and other information concerning the underlying Index Linked Covered Bonds only

Not applicable 8. Operational Information

ISIN Code: Common Code: Any clearing system(s) other than Interbolsa - Sociedade Gestora de Sistemas de Liquidao e de Sistemas Centralizados de Valores Mobilirios, S.A. as operator of the Central de Valores Mobilirios, Euroclear Bank S.A./N.V. as operator of the Euroclear System and Clearstream Banking. socit anonyme and the relevant identification number(s): Delivery: Names and addresses of additional Paying Agent(s) (if any): Intended to be held in a manner which would allow Eurosystem eligibility:

PTBENAOE0014 056862650 Not Applicable

Delivery against payment Not applicable Yes Note that the designation yes simply means that the Covered Bonds are intended upon issue to be deposited with one of Euroclear and/or Clearstream Luxembourg as common safekeeper, and/or are intended upon issue to be registered with Interbolsa Sociedade Gestora de Sistemas de Liquidao e de Sistemas Centralizados de Valores Mobilirios, S.A. in its capacity as a securities settlement system, and does not necessarily mean that the Covered Bonds will be recognised as eligible collateral for Eurosystem monetary policy and intra-day credit operations by the Eurosystem either upon issue or at any or all times during their life. Such recognition will depend upon satisfaction of the Eurosystem eligibility criteria.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Quarterly Report Aggregate Cover Pool OH Programme - 30 12 2011Dokument2 SeitenQuarterly Report Aggregate Cover Pool OH Programme - 30 12 2011Paulo Jorge OliveiraNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Pdf-Test 3 PDFDokument1 SeitePdf-Test 3 PDFPaulo Jorge OliveiraNoch keine Bewertungen

- Quarterly Report Aggregate Cover Pool OH Programme - 30 12 2011Dokument2 SeitenQuarterly Report Aggregate Cover Pool OH Programme - 30 12 2011Paulo Jorge OliveiraNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- PDF Test PDFDokument1 SeitePDF Test PDFPaulo Jorge OliveiraNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Quarterly Report Aggregate Cover Pool 30-03-2012Dokument2 SeitenQuarterly Report Aggregate Cover Pool 30-03-2012Paulo Jorge OliveiraNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Monthly Report Aggregate Cover Pool 28-03-2013 QuarterlyDokument3 SeitenMonthly Report Aggregate Cover Pool 28-03-2013 QuarterlyPaulo Jorge OliveiraNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Oh4 Ptber9oe0012 FT Clean 2012Dokument8 SeitenOh4 Ptber9oe0012 FT Clean 2012Paulo Jorge OliveiraNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Quarterly Report Aggregate Cover Pool 28-09-2012Dokument3 SeitenQuarterly Report Aggregate Cover Pool 28-09-2012Paulo Jorge OliveiraNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Quarterly Report Aggregate Cover Pool 30-03-2012Dokument2 SeitenQuarterly Report Aggregate Cover Pool 30-03-2012Paulo Jorge OliveiraNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Quarterly Report Aggregate Cover Pool 28-09-2012Dokument3 SeitenQuarterly Report Aggregate Cover Pool 28-09-2012Paulo Jorge OliveiraNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Oh5 Ptblmioe0018 Final Terms - 2012Dokument8 SeitenOh5 Ptblmioe0018 Final Terms - 2012Paulo Jorge OliveiraNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Maximum Median Average Minimum 2 Quarter 2011 E&P: Consensus EstimatesDokument1 SeiteMaximum Median Average Minimum 2 Quarter 2011 E&P: Consensus EstimatesPaulo Jorge OliveiraNoch keine Bewertungen

- Quarterly Report Aggregate Cover Pool 28-09-2012Dokument3 SeitenQuarterly Report Aggregate Cover Pool 28-09-2012Paulo Jorge OliveiraNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Oh4 Ptber9oe0012 FT Clean 2012Dokument8 SeitenOh4 Ptber9oe0012 FT Clean 2012Paulo Jorge OliveiraNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- DecoDokument28 SeitenDecoPaulo Jorge OliveiraNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Monthly Report Aggregate Cover Pool 28-03-2013 QuarterlyDokument3 SeitenMonthly Report Aggregate Cover Pool 28-03-2013 QuarterlyPaulo Jorge OliveiraNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Monthly Report Aggregate Cover Pool 28-03-2013 QuarterlyDokument3 SeitenMonthly Report Aggregate Cover Pool 28-03-2013 QuarterlyPaulo Jorge OliveiraNoch keine Bewertungen

- Circuitos Freno - KNORRDokument352 SeitenCircuitos Freno - KNORRPaulo Jorge Oliveira100% (6)

- MEO Canais RFDokument3 SeitenMEO Canais RFPaulo Jorge OliveiraNoch keine Bewertungen

- Meo Achieves Leadership in The Triple-Play Market: WWW - Telecom.ptDokument1 SeiteMeo Achieves Leadership in The Triple-Play Market: WWW - Telecom.ptPaulo Jorge OliveiraNoch keine Bewertungen

- Maximum Median Average Minimum 2 Quarter 2011 E&P: Consensus EstimatesDokument1 SeiteMaximum Median Average Minimum 2 Quarter 2011 E&P: Consensus EstimatesPaulo Jorge OliveiraNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Maximum Median Average Minimum 2 Quarter 2011 E&P: Consensus EstimatesDokument1 SeiteMaximum Median Average Minimum 2 Quarter 2011 E&P: Consensus EstimatesPaulo Jorge OliveiraNoch keine Bewertungen

- R IntroDokument109 SeitenR IntroHartman József JociNoch keine Bewertungen

- Art Deco: The Style Ofthe 1920s and 1930s (Gebhard, 1996: 2) - One Theory Is Hillier UsedDokument49 SeitenArt Deco: The Style Ofthe 1920s and 1930s (Gebhard, 1996: 2) - One Theory Is Hillier UsedPaulo Jorge OliveiraNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Nps 223Dokument20 SeitenNps 223whateveraosdNoch keine Bewertungen

- Auditing Theory Notes RA 9298Dokument5 SeitenAuditing Theory Notes RA 9298Honeylyne PlazaNoch keine Bewertungen

- Mobile Services: Your Account Summary This Month'S ChargesDokument4 SeitenMobile Services: Your Account Summary This Month'S Chargeskumar JNoch keine Bewertungen

- 1394308827-Impressora de Etiquetas LB-1000 Manual 03 Manual Software BartenderDokument55 Seiten1394308827-Impressora de Etiquetas LB-1000 Manual 03 Manual Software BartenderMILTON LOPESNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Wedgeworth Sentencing MemorandumDokument218 SeitenWedgeworth Sentencing MemorandumActionNewsJaxNoch keine Bewertungen

- Cases NOvember 21Dokument31 SeitenCases NOvember 21Wilfredo Guerrero IIINoch keine Bewertungen

- Security Administration GuideDokument416 SeitenSecurity Administration GuideCauã VinhasNoch keine Bewertungen

- This Succession-Reviewer JethDokument184 SeitenThis Succession-Reviewer JethMary Robelyn de Castro100% (1)

- UCO Amended ComplaintDokument56 SeitenUCO Amended ComplaintKFOR100% (1)

- Israeli Decision MakingDokument204 SeitenIsraeli Decision MakingAmirul Asyraf100% (1)

- Tugas BPFDokument2 SeitenTugas BPFRichard JapardiNoch keine Bewertungen

- Case Study Analysis-BusinessEthicsDilemmaDokument1 SeiteCase Study Analysis-BusinessEthicsDilemmaMeg CariñoNoch keine Bewertungen

- Read The Five Text Items 1 - 5. Then Read The Headlines A - J. Decide Which Headline A - J Goes Best With Which TextDokument9 SeitenRead The Five Text Items 1 - 5. Then Read The Headlines A - J. Decide Which Headline A - J Goes Best With Which TextVeronika HuszárNoch keine Bewertungen

- 8DIO Claire Flute Virtuoso Manual PDFDokument10 Seiten8DIO Claire Flute Virtuoso Manual PDFaaaaaaaaaaNoch keine Bewertungen

- AEC - 12 - Q1 - 0401 - SS2 Reinforcement - Investments, Interest Rate, and Rental Concerns of Filipino EntrepreneursDokument5 SeitenAEC - 12 - Q1 - 0401 - SS2 Reinforcement - Investments, Interest Rate, and Rental Concerns of Filipino EntrepreneursVanessa Fampula FaigaoNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Important SAP MM Tcodes 1Dokument2 SeitenImportant SAP MM Tcodes 1shekharNoch keine Bewertungen

- The Tipster1901, From "Wall Street Stories" by Lefevre, EdwinDokument20 SeitenThe Tipster1901, From "Wall Street Stories" by Lefevre, EdwinGutenberg.orgNoch keine Bewertungen

- Answers Chapter 4 QuizDokument2 SeitenAnswers Chapter 4 QuizZenni T XinNoch keine Bewertungen

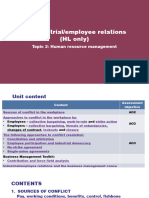

- 2.7 Industrial and Employee RelationDokument65 Seiten2.7 Industrial and Employee RelationadhityakinnoNoch keine Bewertungen

- El Presidente - Film AnalysisDokument4 SeitenEl Presidente - Film AnalysisMary AshleyNoch keine Bewertungen

- PEER PRESSURE - The Other "Made" Do ItDokument2 SeitenPEER PRESSURE - The Other "Made" Do ItMyrrh PasquinNoch keine Bewertungen

- Practice Tests Electrical Potential Energy PDFDokument9 SeitenPractice Tests Electrical Potential Energy PDFFirdausia Rahma Putri100% (2)

- University of ZimbabweDokument21 SeitenUniversity of ZimbabweMotion ChipondaNoch keine Bewertungen

- Beso v. DagumanDokument3 SeitenBeso v. DagumanMarie TitularNoch keine Bewertungen

- Approaches To CSRDokument3 SeitenApproaches To CSRBryann Nyangeri100% (7)

- Instant Download Ebook PDF A Synoptic History of Classical Rhetoric 4th Edition PDF ScribdDokument41 SeitenInstant Download Ebook PDF A Synoptic History of Classical Rhetoric 4th Edition PDF Scribdandrew.lints179100% (39)

- CFS Session 1 Choosing The Firm Financial StructureDokument41 SeitenCFS Session 1 Choosing The Firm Financial Structureaudrey gadayNoch keine Bewertungen

- A Dictionary of Idiomatic Expressions in Written Arabic - For The Reader of Classical and Modern TextsDokument290 SeitenA Dictionary of Idiomatic Expressions in Written Arabic - For The Reader of Classical and Modern TextsAbdul SalamNoch keine Bewertungen

- HHI Elite Club - Summary of Benefits 3Dokument3 SeitenHHI Elite Club - Summary of Benefits 3ghosh_prosenjitNoch keine Bewertungen

- Business School: University of Dar Es SalaamDokument5 SeitenBusiness School: University of Dar Es SalaamCosta Nehemia MunisiNoch keine Bewertungen

- First Law of ThermodynamicsDokument21 SeitenFirst Law of ThermodynamicsMariam50% (2)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successVon EverandReady, Set, Growth hack:: A beginners guide to growth hacking successBewertung: 4.5 von 5 Sternen4.5/5 (93)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNVon Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNBewertung: 4.5 von 5 Sternen4.5/5 (3)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingVon EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingBewertung: 4.5 von 5 Sternen4.5/5 (17)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 4.5 von 5 Sternen4.5/5 (18)