Beruflich Dokumente

Kultur Dokumente

Valuation Technique by Ben Graham From Class Notes

Hochgeladen von

ceojiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Valuation Technique by Ben Graham From Class Notes

Hochgeladen von

ceojiCopyright:

Verfügbare Formate

Valuation Technique by Ben Graham (Notes on 1/17/1947 by Walter Schloss?

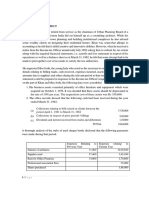

Benjamin Graham (BG) found that trends did not continue for any great length of time. When sales go up there is a tendency for the profit margin to rise at least immediately--Kroger, the other way around. Companies always seem to adjust themselves to a larger amount of business ultimately in such a way that they dont make any more profit per dollar on the larger business than they used to make on the smaller. Next question is the multiplier we would apply to expected future earnings of $1.70 on this company (Barker). Suggestion that shares of smaller companies occupying a secondary position and with a record that is not satisfactory when you study them over a period of years. Those companies should be valued on a fairly modest basis, and I would be inclined to think that a multiplier of 12 (8% Earnings Yield would be as high as you would be likely to give and on that basis you would get a valuation of this company between 20 and 21 without any allowance for the asset component or consideration. Selling at moment above this value (1/17/47). Valuation of this company is on conservative sidewhen we valued Dow Jones Average we tended to get a value higher than the market price. This shows that secondary companies do not show up as well in this method of analysis.

www.csinvesting.org

studying/teaching/investing

Page 1

Valuation Technique by Ben Graham (Notes on 1/17/1947 by Walter Schloss?

Then compared Barker Brothers to Mandel Brothers. Mandel $18.5 sales on an average before the war (profit margin very low)--$27 million during war, $30 million post war. (BG) feels profit margin should be better. Compares current earnings. Word or two on asset component on earning power valuation. Dont want to stress it too much as it is not customarily used and we have no particular reason for believing we are right. For the record, BG indicates how he feels. If the earning power value exceeds the asset value, some reduction should be made for that fact. We suggest of the difference be taken off. An arbitrary figure. If difference is great, adjustment more important. Where the assets exceed the earning power we do not value the company upward because we are not very much impressed by assets that do not have earning power. There is one rather important difference there and that relates to working capital. When the working capital exceeds the earning power value, we are impressed by experience to believe that there is some significance in that fact and in summary fashion we are inclined to add of the difference to the earning power value to allow for the excess working capital which in some way or other tends to make itself felt over the years. Sometimes you get it in a distribution; sometimes you get it in sale of the property; sometimes you get it because the company changes its policy and is able to use its working capital more effectively than otherwise. He is not inclined to stress that technique of analysis too much. (Now BG takes stock in what we are trying to do in these lectures.)

We discussed first. The market behavior in general in the years 1941-45 in relation to economic changes that affected security values. We considered new factors that were involved in the correct statement of the results that an individual company may have achieved during the war and post-war periods. An then we have just recently finished our discussion of the technique of valuing companies, based upon the capitalization of earning power and with a minor adjustment for the asset picture. Scope of the analysts activities in the securities markets and his approach to his function of analyzing securities and drawing conclusions from his analysis. Two fundamentally different approaches that the analysts may take to securities as a whole. 1. The conventional onethat is based primarily on quality and on prospects. 2. The penetrating one and that is based on value. The conventional one is divided into three separate ways of dealing with securities. A. Identification of good stocks i.e.; strong stocks, strong companies. Well-entrenched companies or high quality companies and those companies presumably can safely be bought at reasonable prices. This seems like a simple enough activity. B. The selection of companies which have better than average long-term prospects of growth and earnings. They are generally called growth stocks.

www.csinvesting.org

studying/teaching/investing

Page 2

Valuation Technique by Ben Graham (Notes on 1/17/1947 by Walter Schloss?

C. An intermediate activity which involves the selection of companies which are expected to do better business in the near-term than the average company. All three of these activities I call conventional. The second approach should be divided into two sub-classifications of action. A. The purchases of securities generally when the market is at a low level as the market is considered by analysts. B. The purchase of special or individual securities at almost any time when the price appears to be well below the appraised or analyzed value. II. AN APPRAISAL OF THE APPRAISERS THEMSELVES (BG) A. Is the most useful of the conventional approaches as long as a conscientious effort is made to see that a good stock is not selling above the range of conservative value. Investors do not

make mistakes or bad mistakes in buying good stocks at fair prices. To see

that good companies and their prices are on the whole reasonable is their job and also of established investment counsel and it accounts for their ability to survive in spite of the fact that they are not in a very easy kind of business. Getting into type B is more interesting and difficult ground. For a long while selection of growth stocks was the best regarded type of activity of analysts. It is questionable whether you can establish a technique and transmit it to someone else. BG thinks

at bottom success of identification of growth stocks comes from being smart or shrewd and doesnt consider it a standard quality of a good security analysts to be smart or shrewd--doesnt seem to him to fit into the general pattern or canon of security

analysis to require these rare qualities. Security Analysts should be require to be wise in the sense that this he (she) is technically competent, that he is experienced, and that he is prudent. Doesnt think this type of wisdom is adapted for selection of growth stocks. Third activity of conventional sort. This is done most day by day in Wall St. operations. The trade investigation which leads one to believe that this industry or company is going to have an unusually good year in the next 12 months and therefore should be bought. He is most critical of this Wall St. activity probably because it is the most popular form of passing the time of the Security Analyst. (BG) regards it as nave in the extreme. To carry conventional lines of activity and analysis it is necessary that you impose some fairly obvious but nonetheless rigorous conditions on your own writing and recommending. If you select good stocks, determine and specify that the price is within a range of fair value. If you select growth stocks, determine and specify the round amount which the buyer at the current price is already paying for the www.csinvesting.org studying/teaching/investing Page 3

Valuation Technique by Ben Graham (Notes on 1/17/1947 by Walter Schloss?

growth factor as compared with its reasonable price if the growth prospects were only average. Then determine and state whether in the analysts judgment, the growth prospects are such as to warrant the payment of the current price by a prudent investor. See statements of that kind made in the security analysis and in circulars. In recommending a stock for its near-term prospects, determine and state whether in the analysts judgment the market price and its fairly recent market action has reflected the expectations of the analysts. (What has the market discounted?) Near term valuation, one or two years. Unconventional or penetrating type of analysis which emphasizes value. First division represents buying into the market as a whole at low levelsthat is copy book procedure. Low market in relation to the past pattern of the market and by simple valuation methods such as the type we have been discussing. A good analyst doesnt change his concept of what the earnings of the next five years are going to be because the market changes. His views of average future earnings would change only because he is convinced that there has been some change in underlying factors of a very significant sort. An example is the Yale University method. Good to buy undervalued securities. One proviso dont buy them when the general market seems very high. A cheap stock tends to decrease along with the popularity of others when the stock market falls. Lower prices stocks lose more percentage wise than the high priced ones. Field of undervalues securities is popular at all times.

END

www.csinvesting.org

studying/teaching/investing

Page 4

Das könnte Ihnen auch gefallen

- Why Stocks Are Safer Than Cash - Harris AssociatesDokument4 SeitenWhy Stocks Are Safer Than Cash - Harris AssociatesceojiNoch keine Bewertungen

- Rationality Amidst Uncertainty - Harris AssociatesDokument6 SeitenRationality Amidst Uncertainty - Harris AssociatesceojiNoch keine Bewertungen

- Elder - How To Study & LearnDokument52 SeitenElder - How To Study & LearnceojiNoch keine Bewertungen

- Unitary MethodDokument18 SeitenUnitary MethodanilNoch keine Bewertungen

- Elder - Critical Thinking Learn The Tools The Best Thinkers UseDokument368 SeitenElder - Critical Thinking Learn The Tools The Best Thinkers UseceojiNoch keine Bewertungen

- Positioning Portfolios For The Long Term - Harris AssociatesDokument6 SeitenPositioning Portfolios For The Long Term - Harris AssociatesceojiNoch keine Bewertungen

- Responding To A Crisis - Harris AssociatesDokument4 SeitenResponding To A Crisis - Harris AssociatesceojiNoch keine Bewertungen

- People: Driven To Lead: 2006 Annual ReportDokument24 SeitenPeople: Driven To Lead: 2006 Annual ReportceojiNoch keine Bewertungen

- 2004ARDokument7 Seiten2004ARceojiNoch keine Bewertungen

- 2007ARDokument24 Seiten2007ARceojiNoch keine Bewertungen

- Keeping The Drive: AliveDokument24 SeitenKeeping The Drive: AliveceojiNoch keine Bewertungen

- Efficiency: in The WorkplaceDokument16 SeitenEfficiency: in The WorkplaceceojiNoch keine Bewertungen

- The Drive To LeadDokument9 SeitenThe Drive To LeadceojiNoch keine Bewertungen

- VF 2Q2012 Manager LetterDokument4 SeitenVF 2Q2012 Manager LetterceojiNoch keine Bewertungen

- Barc RfiDokument4 SeitenBarc RficeojiNoch keine Bewertungen

- VF 3Q2012 Manager LetterDokument5 SeitenVF 3Q2012 Manager LetterceojiNoch keine Bewertungen

- Asset Valuation Allocation Models-Deutsche Bank (2001)Dokument28 SeitenAsset Valuation Allocation Models-Deutsche Bank (2001)ceojiNoch keine Bewertungen

- ISC214 Fundamentals of E-Business PDFDokument5 SeitenISC214 Fundamentals of E-Business PDFceojiNoch keine Bewertungen

- Syllabus - Services Management - Development and Design of Service CompaniesDokument1 SeiteSyllabus - Services Management - Development and Design of Service CompaniesceojiNoch keine Bewertungen

- VF 4Q2012 Manager LetterDokument5 SeitenVF 4Q2012 Manager LetterceojiNoch keine Bewertungen

- RMD, PCDokument5 SeitenRMD, PCceojiNoch keine Bewertungen

- Fms 2009 Section 4Dokument3 SeitenFms 2009 Section 4MbatutesNoch keine Bewertungen

- Fms 2009 Section 4Dokument3 SeitenFms 2009 Section 4MbatutesNoch keine Bewertungen

- MKTG Dec Lehmann Syllabus2006Dokument13 SeitenMKTG Dec Lehmann Syllabus2006ceojiNoch keine Bewertungen

- Syllabus - Services Management - Development and Design of Service CompaniesDokument1 SeiteSyllabus - Services Management - Development and Design of Service CompaniesceojiNoch keine Bewertungen

- How To Read A Scientific Paper: Mihai PopDokument18 SeitenHow To Read A Scientific Paper: Mihai PopceojiNoch keine Bewertungen

- Fall 2012 Fin 380 Course SyllabusDokument5 SeitenFall 2012 Fin 380 Course SyllabusceojiNoch keine Bewertungen

- A Fresh Look PDFDokument8 SeitenA Fresh Look PDFceojiNoch keine Bewertungen

- What in The World Is Competitive Advantage?Dokument5 SeitenWhat in The World Is Competitive Advantage?Sibichakravarthi MeganathanNoch keine Bewertungen

- Article Review FormDokument1 SeiteArticle Review FormceojiNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Limitations of Mfrs 136Dokument3 SeitenLimitations of Mfrs 136Ros Shinie BalanNoch keine Bewertungen

- Strengths and Weakness of Airborne FedexDokument2 SeitenStrengths and Weakness of Airborne FedexSrilakshmi ShunmugarajNoch keine Bewertungen

- International Business: by Charles W.L. HillDokument31 SeitenInternational Business: by Charles W.L. HillFahad KhanNoch keine Bewertungen

- 05 Chapter 2Dokument50 Seiten05 Chapter 2abhanidharaNoch keine Bewertungen

- Tên Học Phần: Tiếng Anh Thương Mại 1 Thời gian làm bài: 45 phútDokument4 SeitenTên Học Phần: Tiếng Anh Thương Mại 1 Thời gian làm bài: 45 phútUyên HoangNoch keine Bewertungen

- Reasoning Question Paper With AnswerDokument128 SeitenReasoning Question Paper With AnswerEduZone ClassesNoch keine Bewertungen

- Egyptian Processed Food Sector Development Strategy - ENDokument442 SeitenEgyptian Processed Food Sector Development Strategy - ENReyes Maria Kristina Victoria100% (1)

- 2018 - GAR Annual ReportDokument211 Seiten2018 - GAR Annual ReportKirstie ImeldaNoch keine Bewertungen

- Jawaban Review Uts Inter 2 - FixDokument8 SeitenJawaban Review Uts Inter 2 - FixCaratmelonaNoch keine Bewertungen

- 2-Year Treasury Yield Tops 10-Year Rate, A 'Yield Curve' Inversion That Could Signal A RecessionDokument1 Seite2-Year Treasury Yield Tops 10-Year Rate, A 'Yield Curve' Inversion That Could Signal A Recessionpan0Noch keine Bewertungen

- New Issue MarketDokument15 SeitenNew Issue Marketshivakumar NNoch keine Bewertungen

- Tejas UCLEntrepreneurshipDokument4 SeitenTejas UCLEntrepreneurshiprahul jainNoch keine Bewertungen

- Case: Mired in Corruption - Kellogg Brown & Root in NigeriaDokument9 SeitenCase: Mired in Corruption - Kellogg Brown & Root in NigeriakenkenNoch keine Bewertungen

- Comparative Study of Investment Vs RISK SYNDokument12 SeitenComparative Study of Investment Vs RISK SYNAnonymous F6fyRYGOqGNoch keine Bewertungen

- Latif Khan PDFDokument2 SeitenLatif Khan PDFGaurav AroraNoch keine Bewertungen

- MBA 610 Group 2 ITC Case 2 FINALDokument12 SeitenMBA 610 Group 2 ITC Case 2 FINALayush singlaNoch keine Bewertungen

- CBU2202200910 Customer Relationship ManangementDokument2 SeitenCBU2202200910 Customer Relationship ManangementSimbarashe MaringosiNoch keine Bewertungen

- TCS-Recruitment and SelectionDokument17 SeitenTCS-Recruitment and SelectionChirag PatelNoch keine Bewertungen

- Musembi 2017 Commercial BanksDokument82 SeitenMusembi 2017 Commercial Banksvenice paula navarroNoch keine Bewertungen

- Investment Analyst CV TemplateDokument3 SeitenInvestment Analyst CV TemplatenisteelroyNoch keine Bewertungen

- Dr. Reddy CaseDokument1 SeiteDr. Reddy Caseyogesh jangaliNoch keine Bewertungen

- Professional Photographer Bank StatementDokument6 SeitenProfessional Photographer Bank StatementDhiraj Kumar PradhanNoch keine Bewertungen

- Marketing StrategyDokument3 SeitenMarketing Strategyakakaka2402Noch keine Bewertungen

- MCQs Unit 1 An Introduction To Labour Laws in IndiaDokument9 SeitenMCQs Unit 1 An Introduction To Labour Laws in IndiaRia Deshpande100% (1)

- A Glass Half Full - Rhb-Report-My - Budget-2022-Equity-Impact - 20211030Dokument19 SeitenA Glass Half Full - Rhb-Report-My - Budget-2022-Equity-Impact - 20211030Shaun WooNoch keine Bewertungen

- Development AdministrationDokument3 SeitenDevelopment AdministrationJean Aspiras WongNoch keine Bewertungen

- How To Turn Your HR StrategyDokument99 SeitenHow To Turn Your HR StrategyKhinphone OoNoch keine Bewertungen

- Intermediate Examination Syllabus 2016 Paper 7: Direct Taxation (DTX)Dokument18 SeitenIntermediate Examination Syllabus 2016 Paper 7: Direct Taxation (DTX)GopalNoch keine Bewertungen

- Deepa Project FinalDokument94 SeitenDeepa Project Finalsumi akterNoch keine Bewertungen

- 9-28-21 Mexico Market UpdateDokument14 Seiten9-28-21 Mexico Market UpdateSchneiderNoch keine Bewertungen