Beruflich Dokumente

Kultur Dokumente

Malik Asad Pervez's Internship Report On Askari Commercial Bank Limited

Hochgeladen von

Malik Asad PervezOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Malik Asad Pervez's Internship Report On Askari Commercial Bank Limited

Hochgeladen von

Malik Asad PervezCopyright:

Verfügbare Formate

1

PREFACE

As a student of BBA (Hons), it was my desire to have a practical experience of my education and knowledge which I got in my university life. This internship program which I completed successfully has fulfilled my desire and was quite helpful in perfecting deficiencies of my bookish knowledge and concepts. The purpose of this training program is to offer an opportunity to the students for acquiring experience about the organization set up of well-organized organizations. Consequently I opted for Askari Bank Limited, Fakhr-e-Alam Road Peshawar for my internship program because Askari Bank is one of the well-established financial institution and it is playing a key role in the mobilization of national financial resources and hence developed a sense of investment in the society.

Asad Pervez

BBA (HONS)

An Internship Report

DEDICATION

This Report is dedicated to My Dear Parents My Dear Friends And My Honorable Teachers Whos Guidance; Prayers & Support is Always With Me.

An Internship Report

ACKNOWLEDGEMNTS

I offer my humblest thank to Almighty Allah and Hazrat Muhammad (PBUH) from the core of my heart that they always provided me guidance and blessings which are uncountable. This task was assigned to me as a student of BBA (Hons) and I complete this task with my full concentration and devotion.

I am thankful to Assistant Professor Mr. AhsanEjaz Edwards College Peshawar, Mr. Muhammad Ehtisahm, officer grade 1 and Mr. Esrar Ahmad Shinwari Management Trainee Officer at Askari Bank Peshawar; because they supervised my writing activity and their cooperation and guidance helped me to achieve my target.

I feel pleasure to admire all the management of Government College of Management Sciences Peshawar for their tireless efforts for the betterment of the students and provision of better educational atmosphere. I am also thankful to all staff members of Askari Bank Peshawar for their help and guidance.

I am highly indebted to my course instructors who provided not only an opportunity to learn about practical work and its implementation but also guide me through email for its completion. I am very great full to my Teachers who always helped me.

I am also thankful to my parents who always supported me to do my work efficiently and effectively in all fields of my life.

Special thanks go to my friends who have always helped me and supported me.

Asad Pervez

BBA (HONS)

An Internship Report

EXECUTIVE SUMMARY

This work projects the emphasis on the working as an internee in a bank. It is the requirement of every business graduate that he/she should get practical exposure by joining organization related to his/her specialization. My specialization was in finance so, I choose Askari Bank to get financial exposure in practical and the experience as an internee in Askari Bank Limited has given me the exposure to the financial world. My report includes the introduction of banking sector in Pakistan. It goes beyond saying that banking is one of the most sensitive businesses all over the world. Banks play very important role in the economy of a country and Pakistan is no exception. Banks are custodian to the assets of the general masses. It is the banking sector which plays a significant role in a contemporary world of money and economy. It influences and facilitates many different but integrated economic activities like resources mobilization, poverty elimination, production and distribution of public finance. Whether it is purchase of a car or building of home, bank is always there to serve you better. Whether its a playground or any educational or healthy societal activity, the money from banks nurtures them. Similarly, in case of an industrial project or agricultural development of the country the sponsorship of banks plays a pivotal role. In a nutshell, banks play a very positive and important role in the overall economic development of the country. Pakistan has a well-developed banking system, which consists of a wide variety of institutions ranging from a central bank to commercial banks and to specialized agencies to cater for special requirements of specific sectors. The country started without any worthwhile banking network in 1947 but witnessed phenomenal growth in the first two decades. By 1970, it had acquired a flourishing banking sector. State Bank of Pakistan now acts as a nucleolus in the financial system of the country. It is the linchpin of countrys banking system. Today, a central bank is the centr al arch of the monetary and fiscal framework in many countries of the world and its activities are essential for the proper functioning of the economy and critical for the fiscal operations.

The present structure, operation and authority of the SBP originate from the SBP Act 1956. State Bank of Pakistan is entrusted with the prosperity, stability, and growth of the domestic economy.

An Internship Report

It is sole bank of issue, holder of gold and currency reserves, banker to the government, lender of the last resort to commercial banks and supervisor of the others banks. It is also responsible for National Credit Policy. In October 1993, complete autonomy was granted to SBP. It was the milestone in the history of SBP. Main reason of its full autonomy is to assume increased independent inputs in macroeconomic policy making of the country. Autonomy granted to the SBP has strengthened its supervisory and regulatory powers now all the financial institutions have also been under the supervision of SBP. Improvements to better understand the need of the customers. The threats always remain there for every business, and the business which fails to address its threats goes down by the time. So identifying those threats was also the part of this report. Lastly in this report I have presented some of my suggestions and made recommendations for improvement. On the whole, this report is a sincere effort of understanding the financial markets with the aspect of marketing. I have done a sincere effort to project my work truly with the facts, knowledge and the skill gained through the practical experience of internship in Askari Bank Limited.

An Internship Report

CHAPTER 1: INTRODUCTION OF THE REPORT

1.1 Background of Study: Banking sector is one of the examples of financial institutions which can play a very vital role in development of the overall economy of a country. Banking sector has now become a very challenging field with the advent of modern technology and increased competition.

The banking sector has witnessed a dramatic change during the last ten years with the development of Askari Bank, which is not only redefining priorities and focus of the banks, but also threatening the domination of traditional players. Nationalization of Banks was not done since 1st January 1974 under the Nationalization Act 1974 due to certain objectives. But it had negative effects on the efficiency of the banking sector. Afterwards, a Privatization Commission was set up on January 22, 1991. The commission transferred many banks to the private sector, i.e., MCB and ABL. The government approved and permitted the establishment of 10 new private banks in August 1991. Hence many new private banks have incorporated since then. Askari Commercial Banks is one of the namely established private scheduled banks. It is a branch of Army Welfare Trust (AWT). Army Welfare Trust (AWT): Army welfare trust was established mainly for the welfare of army officials. The office of army welfare trust is situated at AWT Plaza, The Mall Rawalpindi. AWT offers the AWT Saving Scheme to the army officials only. AWT has following units: Askari Associates Askari Leasing Askari General Insurance Private Businesses Textile Mill Cement Industry

An Internship Report

Petroleum

Askari Association deals with the shareholding. Askari General Insurance &Askari Leasing are registered at stock exchange. Cement Industry, Firstly produced Nizam Cement. Recently AWT invested their capital with Mobil named as Askari Mobil. The organ gram below depicts the overall activities of AWT:

1.2 Purpose of Study: The main purpose of the study was to fulfill the requirement for the award of degree of Bachelors of Business Administration (Hons). Other purpose includes:

Studying the overall operations carried out at the Askari bank Peshawar Cantt Branch. To apply Business and Administrative knowledge Acquired, in practice. To summarize my weekly observations. To suggest and recommend feasible steps needed to improve its performance. To fulfill the requirement of my degree; BBA(Hons) by acquiring practical experience of a work environment of any financial institution by working in it as an internee and prepare and submit report regarding it to the controller of examination of UOP ,

1.3 Scope of Study: The scope of my work is based on the complete observation of Askari bank. In which I have identified problems and remedies have been too suggested to overcome these problems. 1.4 Methodology of Study: I used a number of techniques to collect the required material and conduct the report. The methodology, which I adopted for this study, is based on both the primary data and secondary data.

An Internship Report

1.4.1 Sources of Primary Data Interviews of the banks staff members. Personal observation. Help from the relative bankers.

1.4.2 Sources of Secondary Data Askari Bank Annual Reports. Bank Manuals. Bank Magazines. Bank Brochures. Banking concept Books. Internet.

1.5 Scheme of Report Chapter -1: Introduction section of Report is divided into different topics. This includes the background of study, purpose of study, scope of study, methodology of study and scheme of report. Chapter-2: Contains Organizational overview, i.e. introduction, history, products and services, departments, competitors etc. Chapter-3: Contains all work experience gained by interest in 8 weeks. Chapter-4: Contains Analysis; It includes SWOT Analysis and Askari Banks five years performance glance. Chapter-5: Contains findings and recommendations. Chapter-6: Contains references and sources of data acquired.

An Internship Report

Chapter 2: ORGANIZATIONAL INTRODUCTION OR OVERVIEW 2.1 The Introduction/Overview of Askari Bank Limited

Askari Bank Ltd (formerly Askari Commercial Bank) was incorporated in Pakistan on October 9, 1991, as a Public Limited Company. It started its operations during April 1, 1992. The bank principally deals with banking, as defined in the Banking Companies Ordinance, 1962. The Bank is listed on the Karachi, Lahore & Islamabad Stock Exchanges and its shares are currently the highest quoted from among the new private sector banks in Pakistan.

Askari Bank has since expanded into a network of 261 branches / sub-branches, including 34 dedicated Islamic banking branches, and a wholesale bank branch in Bahrain.

A shared network of 5,903 online ATMs covering all major cities in Pakistan supports the delivery channels for customer service. As at December 31, 2012, the Bank had equity of Rs. 19.7 billion and total assets of Rs. 353 billion, with 907,984 banking customers, serviced by our 5,597 employees. Askari Investment Management Limited and Askari Securities Limited are subsidiaries of Askari Bank engaged in managing mutual funds and share brokerage, respectively.

Askari Bank is the only bank with its operational head office in the twin cities of RawalpindiIslamabad, which have relatively limited opportunities as compared to Karachi and Lahore. This created its own challenges and opportunities, and forced as to evolve an outward-looking strategy in terms of Askari market emphasis. As a result, Askari developed a geographically diversified assets base instead of a concentration and heavy reliance on business in the major commercial centers of Karachi and Lahore, where most other banks have their operational Head offices. While successfully penetrating the key domestic markets through strategic expansion and business diversification they remain alive to the challenge emanating from the development in

An Internship Report

10

the global financial markets; the opportunities and threats engendered by greater deregulation and increased customer expectations. These provide them the impetus to make the best use of available resources, including modern technologies, to meet the challenges ahead. Historically, Askaris core marketing focus for its asset base has been the middle and upper middle business houses (including wholesalers and manufacturers) operating in the large urban centers of Pakistan, which are primarily oriented towards foreign trade. This segment constitutes significant revenues to the bank. The liability side remains focused on the middle and upper middle class retired and serving government and armed forces personal and mid-size business houses. With this branch network of 75 and further expected increase in future, the ATMs facility and internet Banking, Askari Banks reach is ever increasing. In recognition of this reach, they have set up a retail-banking group in July 2000, the mobile ATMs facility is first time started by Askari commercial bank in 2005 dedicated to serving the urban consumer market; Askari is committed to aggressively market this segment. The strategy is to provide their customers with a basket of innovative products to meet their varying needs. Askari's emphasis on further broadening its core foreign trade business translated into handling a higher volume of Export and Import business of Rs. 36 billion registering a growth of 42% over the previous year. This enhanced foreign trade business was secured due to excellent customer services and efficient international settlement arrangements with our correspondent banks. Askari Bank is operating throughout Pakistan. Most of the branches are connected through State of the Art, On-line Communications Network, which gives the bank a competitive edge in providing instant services to its clientele. It also offers direct access to the latest Foreign Exchange Rates through our Online Communications.

An Internship Report

11

2.2Vision Statement of AKBL

To be the leading bank in the region

2.3The Mission Statement of AKBL To be the leading private sector bank in Pakistan With an international presence, Delivering quality services Through innovative technology An effective resource management In a modern and progressive organization Culture of meritocracy, maintain High ethical and professional standards, With providing enhance value to all our stakeholders, And contributing to society. 2.4 Core Values Integrity is the most valued standard in whatever the bank does. It understands that its commitment to satisfy customers needs must be fulfilled within a professional and ethical framework. It subscribes to a culture of high ethical standards, based on the development of right attitudes. The intrinsic values, which are the corner stones of the banks corporate behavior, are: Commitment Integrity Fairness Teamwork Service

2.5 Objectives OF The AKBL As Askari Bank looks ahead to the future by moving through the decade of the 1990's its efforts are guided by a broad framework of corporate objectives, which are as follows:

An Internship Report

12

To achieve sustained growth and profitability in all areas of business. To build and sustain a high performance culture, with a continuous improvement focus. To develop a customer-service oriented culture with special emphasis on customer care and convenience. To build an enabling environment, where employees are motivated to contribute to their full potential. To effectively manage and mitigate all kinds of risks inherent in the banking business. To maximize use of technology to ensure cost-effective operations, efficient management information system, enhanced delivery capability and high service standards. To manage the Bank's portfolio of businesses to achieve strong and sustainable shareholder returns and to continuously build shareholder value. To deliver timely solutions that best meets the customers financial needs. To explore new avenues for growth and profitability.

2.6 Competitors OF AKBL

Competitors are firms or organization that provides the same product and service in the same market at same time. Askari Bank faces many of competitors that provided the same product and services. When competitions are increase other firms not only provide the same product and service but they also at the same place. I have observed most of the banking Branch side by side in different city of Pakistan due to this there are lots of chance to turn of customer to other bank branch if you are not satisfying customer at his desire .These are the followings banks that provided same product and service that provided by Askari Bank Limited. MCB (Muslim commercial Bank Limited) Faysal Bank Limited Habib bank limited Bank Alfalha Limited Meezan Bank Limited

An Internship Report

13

Bank of Punjab United bank limited Al-Habib Bank limited National Bank of Pakistan KSAB Bank limited City Bank limited Stander chartered Bank limited Barclays Bank

2.7 Products and Services OF AKBL

ABL (askari bank) has wide range of products which cater under different lines of banking, which they are operating according to the requirement of their customers. Usually products names are same but their features, facilities or terms &conditions are different, so AKBLspecializes in catering different segments of the market.

Product Line OF AKBL Askari commercial bank offer four main product Consumer banking Islamic banking Agriculture finance solution and corporate investment banking under these four product banks offer a range of product line A) Consumer banking product Askari finance loan Personal Finance Mortgage Finance Business Finance Smart Cash ASK4CAR

An Internship Report

14

Master Card

B) Investment product Mahana Bachat Account Roshan Mustaqbil Deposit Deposit Multiplier Account Value Plus Deposits Rupee Traveler Cheques ASKCARD (Askari Debit Card) Internet Banking Service Electronic Bill Payment Services Cash Management Services Investment Certificates

C) Islamic banking services Islamic Corporate Banking Islamic Investment Banking Islamic Trade Finance Islamic General Banking Islamic Consumer Banking

D) Agriculture finance solution Kissan Ever Green Finance Kissan Tractor Finance Kissan Aabpashi Finance Kissan Livestock Development Finance Kissan Farm Mechanization Finance Kissan Transport Finance

E) Corporate & Investment Banking Corporate Banking Division

An Internship Report

15

Term Loans Fund Transfers / Remittances Investment Banking Division Project Finance Islamic Finance

Several Other Facilities Provided By AKBL There are several other facilities which are offered by ABL, they are usually used to facilitate the customer. They are listed below Debit/credit Cards Travelers Cheque Remittance Virtual Banking Mobile Banking

These product & services enable ABL to be one of the leading banks of Pakistan with a deposit base of about Rs. 400 billion and total assets of around Rs.300 billion. The Bank has a customer base of approximately 4 million and a nationwide distribution network of over 1100 branches, including 8 Islamic banking branches, and over 450 ATMs.

An Internship Report

16

2.9 Departments of AKBL Banking procedures are divided between various departments. Different departments do their jobs in concurrence with the bank policies. In ABL each branch is divided into various departments. Head of department manages each department & officials of the branch follow procedures. Following departments are working within Peshawar cantt branch:

GENERAL BANKING DEPARTMENT

ACCOUNTS DEPARTMENT

FOREIGN EXCHANGE DEPARTMENT

Remittances Budgeting Clearing Online banking ATM Account opening Cash

Reconciliation Daily Expenses Dealing

Foreign Currency Dealing Foreign Trade

CREDIT DEPARTMENT

Mortgage Loans Personal Loans Commercial Loans Agriculture Loans

An Internship Report

17

2.9) General Banking Department of AKBL Mr. Shokat Ali Meer is the head of General Banking department; he is operation manager at this branch of Askari bank. He is held responsible to carry out all the operations of the bank, making decisions and to solve the problems faced by the collogue Bankers. The following departments come in the General banking department.

A. Remittance Department. B. Clearing department. C. ATM Department. D. Online banking. E. Account opening Department. F. Foreign Exchange Department.

A) REMMITTANCE DEPARTMENT The need of remittance is commonly felt in commercial life particularly and in everyday life generally. The main function of the remittance department is to transmit money from one place to another. By providing this service to the customers bank earns a lot of income. Also, the customers are able to meet their day-to-day financial requirements.

The functions of remittance department are to handle with the following instruments:

Functions of remittances department Pay Order Demand Draft Pay slip Telegraphic Transfer Payment of Remittances Cancellation of pay order & demand draft

The remittance department deals with the transfer of money from one place to another.

An Internship Report

18

This department deals with the local currency transfer only. AKBL provides these services to both customers & non-customers

Remittance can be made through: Instrument transfer Electronic transfer Mail transfer

Instruments of the Remittances Departments:

1) PAY ORDER

Pay order issued from one branch only be payable from the same branch. It is normally issued for payment in the same city. It is normally referred as banker's cheque

Get the application form. Issue pay order after recovering cheques. Do necessary vouchering. Make entry in PO issue register. All pay order shall be crossed" payees account only".

2) DEMAND DRAFT A demand draft is an instrument, which is drawn by one bank upon another bank for a specific sum of money payable on demand. It is made by the bank and given to the purchaser against cash or cheque. If two banks are involved, then one bank sends a DD to anther bank. But in customer Bank case the customer sends his DD to the receiver.

It is an instrument on demand for which value has been received, issued by the branch of the bank drawn i.e. payable at some other place (branch) of the same bank. In case of agency

An Internship Report

19

arrangement- demand draft can also be issued by one branch of the bank payable to other branch of the other bank e.g. DD issued by ACBL payable by MCB. 3) TRAVELERS CHEQUE The range of AKBL products and value added services enhances with introduction of Rupee Travelers Cheques (RTCs) launched in March 2002. In spite of Askaris constraint on issuing higher denomination of RTCs against restrictions imposed by the Central Bank of Pakistan they have been striving to attain shares with sizeable portfolio. Total volume handled by the department during the year 2012 was around Rs. 976 Million.

B) CLEARING DEPARTMENT 1) MEANING OF CLEARING The word clearing has been derived from the word Clear and is defined as a system by which banks exchange cheques and other negotiable instruments drawn on each other within a specific area and thereby secure payment for their clients through the Clearing House At specified time in an efficient way. Since clearing does not involve any cash etc. and all the transaction take place through book entries, the number of transaction can be unlimited. No cash is needed as such the risk of robbery, embezzlements and pilferage is totally eliminated. As major payments are made through clearing, the banks came manage cash payments at the counters with a minimum amount of cash in vaults. A lot of time, cost and labor are saved. Since it provides an extra service to the customer of banks without any service charges or costs, more and more people are inclined and attracted towards banking.

An Internship Report

20

2) CLEARING HOUSE It is a place where representatives of all banks sit together and interchange their claims against each other with the help of controlling staff of State Bank of Pakistan And where there is no branch of State Bank of Pakistan the designated branch of National Bank of Pakistan act as controlling member instead of State Bank of Pakistan

3) RULES AND REGULATIONS HAVE CLEARING HOUSE:

Timing:(Monday through Saturday) 1. 1st Clearing at 10:00 a.m. 2. 2nd Clearing at 2.30 p.m.

Each bank will send competent representative to exchange the cheques. Each bank is required to insure that all cheques and other negotiable instruments are properly stamped and suitably discharged An objection memo must accompany each and every cheque when return unpaid duly initialed. Each bank is required to maintain sufficient funds in the principal account with SBP to meet the payment obligations. The State Bank of Pakistan debit the account of each member of the clearinghouse with the proportionate working expenses incurred on the operation of clearing house. These expenses are very nominal.

C) ATM ISSUANCE DEPARTMENT Automated Teller Machine is a hi-tech invention in the field of the banking. It facilitates a depositor who can withdraw money at any time without the need of presenting cheque to banking personnel at the banks counter. Money can also be deposited with the help of this machine. But it is not so much practiced here because of some drawbacks.

An Internship Report

21

In this branch of AKBL Miss Nadia, has the authority of issuance of the ATM card to the customers while the operational manager Mr, Shokat Ali Meer has the authority to feed the number of ATM card in the computer and verify the customer signatures. Every ATM card has a PIN code that should be entered for the first time at the ATM machine to activate the card then the customer is guided to change the default PIN code with its own PIN code by the ATM machine. Issuing Procedure of ATM Cards The person first opens the account within the bank. Then he fills the ATM application form in which name of Account Holder, Fathers name Account number and C.N.I. Card number is mentioned. A copy of C.N.I.C is also attached with the application form. After completing this process, the application package is sent to head office. ABL head office takes a period of 2-3 weeks for preparing and processing of ATM cards. First, list of cardholder is issued and then after 15 days cards are sent to ABLs issuing branch. The card and list are not sent simultaneously in order to avoid any mishandling. D) Online Banking Online banking means that the customer of Askari Bank Limited can deposit or withdraw funds in or from other branches of Askari Bank Limited. Askari bank provides online facility to all of its branches. Every account at Askari Bank is online. Online banking is done through two modes as mentioned below: Over the counter. Through ATM.

An Internship Report

22

E) Account Opening Department

The account opening department performs the function of opening individual, business and corporate accounts. The account opening procedure in AKBL is very tuff because it follows the policies of SBP strictly. This department also held responsible for activating a dormant accounts of the customer, issuance of cheque books, informing customers about their account balance on their demand. The account opening department in charge is Mr. Jamshid Khan. Types of account exist in AKBL are following. Types of Accounts In AKBL Are discussed below; 1) Current Account On current account there is no interest paid by the AKBL. It is for only transaction purposes. They are paid on demand. When a banker accepts a demand deposit, he incurs the obligation of the paying all cheques drawn against him to the extent of the balance in the account. As there is no profit paid on this account it is also called Chequing Account because cheques can be drawn on it. Current Account is mostly opened for business. The minimum amount should be Rs 5000 for opening this account. 2) Saving Account The purpose of this account is to induce the habit of saving individuals in the neighborhood. The profit is PLS saving and ASDA Accounts in ABL are chequing accounts paid on the basis of profit and loss sharing at the rate of 8.5% six monthly. The minimum deposit for opening the account is Rs.1000/-. Individuals open such accounts for saving purposes, persons belonging to Armed Forces, and different military and civilian institutions open this account.

3) Askari Special Deposit Account (ASDA) ASDA account is an interest bearing current account interest is paid. The payment of return is monthly, whereas the rate of return with aspect to the amount of minimum deposit clear from

An Internship Report

23

deposit schedules in following table). It is also checking account because cheques can be drawn on it. It is necessary for this account that the client must maintain a minimum balance of Rs. 50,000 at the end of the month. Thats why it is similar to current account. It is mostly opened by Business but individuals to open this account. 4) Askari Bachat Account ABCs are long term fixed deposit for 3 and 5 years. These are not term deposits because payment of return is on monthly basis rather than on maturity of deposits. The minimum balance requirement is Rs. 25000/- and maximum balance requirement is Rs. 1.0 Million. If ABC is for 3-years, the rate of return for 3-years is 12% if ABCs is for 5-years the rate of return is 13%. Because in such account the balance is kept for either '3' or '5' years within the bank no cheque is drawn on it. That is why it is not a checking account. Return is made monthly. . F) ACCOUNTS DEPARTMENT: Accounts department is a department, which deals and checks all the activity of the entire department. It also deals in expression of finance of the bank. Salary payment is also one function of the bank. Mr. Iqbal and Miss. Samina deal this department. Checking Banks Daily Activities Accounts department deals and checks the entire working of the Branch; all the vouchers that have been posted at the computer are scrutinized in accounts department. The End of Day i.e. computer print is also received from the computer. The next day the activity is separated some statements from the End of Day. Then next day activity separated some statements from the End of Day. The vouchers are sorted out head wise. The vouchers are matched with the entries in the statements.

Any abnormality if occurs, is immediately dealt with. All the vouchers and instruction are checked individually are checked individually against the computer printouts. After checking they are signed by Mr. Iqbal and the internal auditor Miss. Samina.

An Internship Report

24

Other Activities Preparation of daily bank positions statement Payment of salaries Preparation of the statements Depreciation calculation

G) FOREIGN EXCHANGE DEPARTMENT Every country is blessed with different things and blessings by Allah. This is the point where different countries come together to exchange their competencies and efficiencies. The countries, which lack in any of the resource, start importing those resources from the country that is having excess of it. In this way the trade starts between different countries. There are two functions performed by the foreign exchange department, which are as under; 1) Foreign Currency Accounts A depositor can open account in US Dollar, Pond, Japanese Yen and Euro with nominated branches. For opening of account a Form is provided to the person/party, introduction of the new account holder or by the Officer of the Bank. Procedure of opening foreign currency accounts is same as other accounts. No Zakat is deducted on these accounts, no income tax deductions, no wealth tax deduction will be there, and these incentives reinforce and motivate the people to invest in foreign currency accounts rather to keep foreign currency idle. 2) Imports and Exports The foreign exchange department of AKBL also facilitates imports and exports on behalf of its customers. Imports means when a person wants to bring something in Pakistan and exports means when a person sends something outside the Pakistan.

An Internship Report

25

CHAPTER 3: WEEK WISE WORK DISTRIBUTION LEARNINGS AS AN INTERNEE IN ASKARI BANK Ltd.

There were following learning points for me that I have learned in AKBL. 3.1) First & Second Week In Account Opening Department In my first week in Askari Bank, they assigned me work in Account Opening Department. The Officer Mr. Jamshid Khan trained me very nicely and I learned lot of things in this department. He told me different accounts names and their codes and the requirements to how t o open the account for individual or business, Conditions are as follows: New Computerized national identity card is must for opening of new account. For salary person documents like; NIC copy, recent salary slip Copy and written application from the firm where that person works is required for account opening. These documents must originally present at the time of account opening otherwise the account will not be opened. For Business man documents like; NIC Copy ,national tax number copy, Federal board of Revenue and chamber of commerce membership certificate, application and undertaking on the business letter head is required for account opening and all of these documents must be originally seen by the attender. Signatures must be taken on account opening form from the person in his presence only otherwise his/her account cannot be opened How to fill-up Customer Identity Form (CIF), where signature of the person should be taken and where the required stamp is pasted. How to fill the deposit Slip if anyone wants to transfer cash in the account or online transfer How to fill the different accounts Forms such as filling of individual and Business man account opening form. The procedures for the issuance of ATM cards and to fill up form for the

Customer for the ATM card

An Internship Report

26

The stamp pasted on CIF for specimen signatures of the customer is Signature admitted, the signatures that need to be verified the signature verified stamp is pasted and the documents that are originally seen the original seen stamp is pasted.

The documents of the salary person and business man must be attested from a gusseted officer. Dormant account is an account which becomes partially freeze means that the money can be deposited by the customer but he cannot withdraw the amount from it .the account become dormant after six months. When there is no transaction made by the account holder during six months from his account the account become dormant.

The accounts such as current and saving become inactive within 1 year and 2 year respectively.

3.2) Third & Fourth Week In Clearing Department In the Third Week they assigned me to work in Clearing Department. Mr. Khurshid trained me very well regarding the function of clearing department. Clearing means bank to bank transfer of funds where the NIFT Facilities are available and from one place to another.in clearing function the bank work as an agent between the drawer of the cheque means maker of the cheque and the payee of the cheque, payee means to whom to pay. there are two types of clearing one is inward clearing and second is outward clearing in inward clearing the same bank cheques drawn on it which means the fund will goes from bank and in outward clearing the other banks cheques drawn on the AKBL which means the fund will be received by the bank and these both types of clearing include clearing like intercity clearing which refers to the transfer of funds from one city to another where the NIFT provided facilities are available and intra city clearing which refers to the transfer of funds with in one city and these both can be for same day as well as normal clearing. In these weeks I entered the cheques lodged for inward clearing in clearing register as their cheque number account holder name cheque amount and bank name amount to be paid.

An Internship Report

27

Secondly, I entered the cheque lodged for outward clearing for next day. Same as inward clearing just entering cheque number account holder name amount and Bank name

In these weeks I also entered the amount; drawer name and cheque number of cheques returned in cheque return register with the reason for what it has been returned and attached cheque return reason memo or slip with cheque.

The cheque that are to be cleared with in the same day some extra charges are deducted while for normal clearing the charges are Rs.300. The cheques that are crossed need to be cleared so the amount is to be transferred to another person account. The clearing is done through State Bank appointed institution NIFT which is an abbreviation of NATIONAL INSTITUTIONAL FACILITATION

TECHNOLOGIES. And where the facilities of NIFT are not available then there the clearing is done through BOC (Outward Bills for Collection). The cheques that are in bank favor, Payment Received stamp is pasted on back of them while those that are not in favor of bank, Payees Account Credited on Realization Stamp is pasted on back of the cheque. These stamps decrease the liability of the bank. The cheques that are to be cleared in a working day should not be stale dated as well as postdated, they should be for the same branch where they presented, amount in words and figures should be same, clearing stamp of the bank should be clear and signature should not be differed otherwise cheque will be returned. The bank which pastes the clearing stamp on the front of the cheque must pat the discharge stamp on the back of the cheque. Every cheque presented to be clear in AKBL has a summary from NIFT. In inward clearing; inter branch credit advice is given to the head branch situated in Karachi and the other branches give advices to Cantt branch of AKBL which is the main branch. In outward clearing the cantt branch of AKBL receive advices from other banks. At last NIFT provides summary of inward and outward clearing to the AKBL.

An Internship Report

28

3.3) Fifth Week In Remittances Department In Fourth week they assigned me to work for Remittances. Remittances also mean transfer of funds through Demand draft and Pay order instruments from one place to another on behalf of banks customers. In this week I learned that pay order is an instrument that is for local or intra city fund transfer while demand draft instrument is for inter-city fund transfer. In Pay order three parties are involved the first is the maker of instrument (Drawer) the second is the bank which is drawee and third is the beneficiary means payee; to whom the payment is to be made. In Demand Draft there are four parties are involved the first is the customer the 2nd is the bank, maker of the instrument (Drawer) the third is the bank (Drawee) and the fourth one is beneficiary means payee to whom the payment is to be made, The pay order is a Quasi Instrument means lie in the mid of negotiability and nonnegotiability. Demand Draft is a negotiable instrument. That can easily be transferable to any other party. The purposes of payments through pay order and demand draft are confirming payments, easily traceable by any time and less risky. The AKBL act as an intermediary between the maker and the payee, The AKBL deduct charges on pay order and demand draft up to the amount of one million. More than the amount of one million no charges are deducted on transfer of funds through these instruments. Government taxes are always deducted on both the instruments.

3.4) Sixth Week In Deposit Department In sixth week of my internship I worked in Deposit or Cash Department. They assigned me to work in cash department. The in charge of deposit department Mr. Zulfiqar trained me very efficiently about the cash payments and cash collections of AKBL. When a person comes to the

An Internship Report

29

cash counter of the bank and presents a cheque of amount to be paid to him is called cash payment of the bank. When a bank make a payment of cash it credits the customer and debit itself because payments to the account holders decrease liability of the bank and when a customer come to deposit some amount of cash in his/her account the bank credit itself and debit its customer because deposits are the liabilities for the bank . In cash department I learned about cash Receipts and Payments and about to record all the cash payment entries that appeared as a credit Vouchers in front of me in a register and then I further recorded them in the computer system of the AKBL for the proper evaluation of total cash payments and deposits at the end of every day. However most of the customers come to cash counters for online fund transfer from one city to another and the charges for online fund transfer are Rs.116 for civilians while no online charges are deducted from army personals 3.5) Seventh Week In Accounts Department In sixth week I was assigned to work in Accounts Department in accounts department I learned that: How to sort the cheques according to the account numbers and account types in ascending and descending orders then to sort the vouchers enclosed with the cheques as according to the order of cheques. When the cheques and credit vouchers are sorted the time comes to tally each and every cheque and voucher with daily movement report of the bank for the purpose to find out all the entries are correctly mentioned in the report or not. And all of this is done by ticking each and every cheques and vouchers amount, account number cheque number and account holder name. The cheques represent debit entries in the report while voucher represents credit entries in the report.

3.6) Eight Week In Foreign Exchange, ATM Card & Lockers Issuance Department

In Eight Week I worked in Foreign Exchange department as well as ATM card and Lockers

An Internship Report

30

Issuance department. The in charge of foreign exchange department briefly introduced me about foreign exchange department functions. In this department I learned that the foreign exchange department performs two types of functions one is of foreign currency handling also called foreign remittances and 2nd is foreign trade. In foreign currency; foreign currency accounts are opened for the customers those want foreign currency only and to deal with in it only. For foreign currency accounts opening the necessary requirements are as same as PKR account opening but the difference is, in foreign currency account opening the nominee should be clarified as well as the business proof or salary slip of the sender of foreign is necessary. In foreign trade the bank issues letter of credit and letter of guarantee on behalf of its customers to facilitate them in import and exports.

3.6.1) ATM Card & Lockers Issuance Department In ATM card issuance and lockers issuance department. Miss Nadia Waqas introduced me very well about this department and about its workings.in this department I learned that: An ATM card is a plastic money and key of account holders account so it is very sensitive thing so it should be used carefully otherwise It bring the cause of generating very sensitive matters. ATM is only issued to individual account holder and to the Type B account holders Means or Survivor account holders. Lockers of AKBL are only available to the account holders of AKBL of Cantt Branch, there are three types of lockers; small, medium, large are offered by the AKBL to its customers, these lockers are insured and in case of occurrence of any damage the customers can claim for the insurance amount as according to the type of lockers they held.

3.7) NOWLEDGE ACQUIRED DURRING MY INTERNSHIP During the internship there was a practical knowledge acquired about the banking sector. What activities are performed by banks and how to deal with public? Also, commitment about work

An Internship Report

31

and operations of banks. How financing and credits and other public services are performed by the banks? What are implementations of banking rules in banking sector? And more so learnt about the various executives experiences and their skills. What is role of higher authority (manager) in decision-making and how to solve the problems? How much money or reserves are used to meet the requirements in the branch. What are the duties of operation manager and how to pay cheques and all procedures relating to opening account in the banks?

I have gained a lot from my Internship. In AKBL Bank I have learned a lot of work which I didnt learn in my specialization in Finance. My communication and negotiation skills are very much improved by learning how to communicate with the professional people.

An Internship Report

32

CHAPTER 4: SWOT ANALYSIS & ASKARI BANKS FIVE YEARS PERFORMANCE GLANCE

4.1) SWOT Analysis

The strength, weaknesses, opportunities and threats of AKBL, one by one are described below. 1) Strengths A) Network Network is a major strength AKBL has. AKBL is a Pakistani Bank with the most extensive and comprehensive global network that open up new opportunities in near future. Their up graded technological infrastructure is also important which provides uniform service system across the Banks network that will allow much higher levels of efficiency and customer service. B) CUSTOMER RELATIONSHIP The Bank has a distinctive client focus with a view of attaining greater customer satisfaction. Continual efforts are made by the Bank to revisit customer needs and for improving customer services. Management continues to further rationalize Banks network with a view of improving efficiency. The trust associated with AKBL is also its strength to stand out. The bank continues to re-engineer processes and centralize functions to make AKBL services more cost efficient to improve customer response. AKBL commitment to provide customers with banking facilities of an international standard and its policies towards modernization helps them gain more strength. The survival of a service organization like AKBL is dependent on superior customer service and relevant products. AKBL strong culture of customer service and satisfaction reflects ABL distinctive competence. They value their customers business and want to seek satisfaction. Thats why a very strong population of 1.5 million users supports them. C) International Operations The international operations of AKBL allow it to get benefit from synergies of countries within specific geographical areas. International operations are segmented into regional businesses by

An Internship Report

33

formation of six major regional centers viz UK, continental Europe, Africa, Middle East, Asia Pacific and USA. D) Online Banking The bank always remain online through a proper network so the customer can avail the facility of transferring of funds online from one place to another rather with in the same city or to other cities. The bank has also started ATM facility in most of its branches. 24-hour banking is new trend in Pakistan and AKBL has also taken apart in this trend. E) Customer Suggestions Customer gives suggestion for the improvement of bank and these suggestions are listened carefully and communicated to the higher management so that action taken on relative deficiencies immediately. F) Innovative Products Askari Commercial Bank developing & delivering the most innovative products, manage customer experience, deliver quality service that contribute to brand strength, establishes a competitive advantage and enhances profitability, thus providing value to the stakeholders of the bank. G) Secure Banking The online banking facility provides less chances of fraud. Because the receipts of any online transaction are given to customers at the time transaction takes place and also can be checked any time. To make it much more secure the NIC copy of the person is Also submitted at the time of online transaction but those customers who also have their accounts in the same branch do not need to submit the copy of NIC as their copy is already attached with their account opening forms.

2) WEAKNESSES

An Internship Report

34

A) Cash Withdrawal Limit from ATM One of the weaknesses of AKBLs ATM is that they have prescribed cash withdrawal limit for all kinds of customers. They have cyclic withdrawal limit which allows each customer to have his own cash withdrawal limit, so the customers in case of emergency cannot withdraw cash above from their limits and feel unsatisfied from AKBL. B) Waiting Line for Payment OF Utility Bills There is a facility offered by AKBL for payment of utility bills but customers have to wait in waiting line for a long period of time due to short number of service providers. C) Transfer of Funds Through ATM No facility on behalf of AKBLs ATM is offered regarding transfer of funds between PLS savings account and current account of same customer through same ATM card. D) Shortage of ATMS ATMs, despite of AKBLs extensive and comprehensive network is still unavailable in many of its branches. Similarly there are some profitable geographical locations where there are prospects of increased profitability for example an ATM at Murree means new segment for AKBL. E) ATMS Working ABL ATMs are usually out of work without any notification to customers as compared to MCB, which advertises in newspapers that a certain machine is out of order. Moreover one of their customers also mentioned in a survey that the ATM machine is out of order mostly at weekends. F) Recruitment System The human resource department is not performing fair function of selection and recruitment very effectively. Selection process is not on merit due to which competent persons cannot be selected. E) Improper Guidelines

An Internship Report

35

Proper guideline should be given to the customer about bank products. They should be informed with current information. Many of the customers complaint that there should be two or more person on reception who should guide people at entrance where they have to move, concerned person and department, teach how to fill forms, slips and cheques.

3) OPPORTUNITIES A) Use of ATM as A Credit Card It can be an opportunity for AKBL to introduce ATM card also as a credit card which will invite a different segment and which will improve profitability. The Bank can also earn income in this way. B) Technological Improvements Various technological improvements may lead to success for AKBL. If AKBL opens up its deposit box facility for customers it can heavily increase its profitability. If implemented this opportunity can be a competitive advantage as well. AKBL can also implement the conversion facility for example if the ATM receives the request for payment of amount in dollars then it should pay the customer in Dollars. They can make ATM more attractive and enjoyable place to come rather than a bossy bore environment. To provide customers with an enjoyable event whenever they visit the ATM they can change their machine styles, have variations in colors and add audio instructions following the transactions. As Internet and World Wide Web usage continues to increase AKBL should extend its exploitation of this market by acquiring and merging with companies with specialized technological expertise. C) Improving Customer Focus AKBLs commitment to making substantial investment in technology (planned expenditure of USD 20-25 million over next three years) to provide customers with banking facilities of an international standard is an opportunity for making technological improvements in this business so the customer focus will be increase that is an opportunity for AKBL.

An Internship Report

36

D) Illiterate People Illiterate people are also an opportunity for AKBL in regarding this service. ABL can serve these people by giving instructions in Audio and in Urdu. They can also have instructions written in Urdu on card or even they can have a display in Urdu. They can increase their target market, market share and profitability. E) Entertainment Facilities Entertainment facilities should be available in the Bank, when customer comes to the Bank and wait for a long period of time to be served he will enjoy newspaper, magazines, television and serve with tea, soft drink etc.so in this way he will not feel dis satisfied from the bank. 4) THREATS

A) Economic Environment Economic environment is a major threat to AKBLs success. For example in 2000 when the government embarked on an economic revival plan with a complete task of resource mobilization, GDP growth and poverty alleviation in a different economic environment with continued international sanctions. During the year domestic demand though improving still remained weak and fiscal constraints did not allow the government to increase development expenditure and boost demand. The biggest threat in the banking sector is the continuous downfall of the country economy since the last few years. If this downfall remains for more few years then it may be the great hindrance in achieving the Banks objectives B) Political/Legal Environment Law and order situation has a direct impact on how frequently or how many people use ATM. Also legal obligations also hinder/pose threat to ATM availability. For example there is a rule that the two ATMs should be at least 3 kilometers away from each other. If there are strict regulations on this policy then it is a threat to ATM availability for example there is an ATM in

An Internship Report

37

Saddar and also at ChowkYadgar so it is important that legal environment is positive and firm enough to pose threat to Banks activities. C) Expense Base The expense base will be a major threat to the ATM because it will impact the need to spend in order to modernize ABLs customer interface. Expenditure has to be incurred on Branch rationalization and computerization. This expenditure is essential, given poor infra-structure at Branch level resulting from years of underinvestment. Because 90 million is sufficient money to invest to open an ATM there should be a strong expense base to support the expansion of ATM.

An Internship Report

38

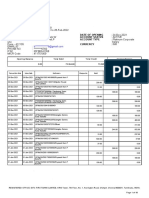

ASKAIR BANKS FIVE YEAR PERFORMANCE GLANCE

Rupees In Million

Description December 31,2008 December 31,2009 December 31, 2010 December 31, 2011 December 31,2012

Total Assets

206191

254327

314744

343756

353056

Total Liabilities

193220

239,378

298,740

325,980

333,368

Total Equity

12971

14949

16004

17776

19688

Shareholders Fund

12,971

14,949

16,004

17,776

19,688

Total Income

21,101

25,131

30,129

35,669

36,520

Total Expenditures

20,640

23,499

28,856

33,257

34,790

An Internship Report

39

Description

December 31,2008

December 31,2009

December 31, 2010

December 31, 2011

December 31,2012

Total Cash Flows

20,659

27,850

26,350

32,403

33,299

Total Employees (Regular)

4,252

4,393

4,473

4,470

4,272

Total Number of Branches/Sub Branches 200 226 235 245 261

Business transacted Imports Exports Guarantees 148.24 99.70 55.77 140.16 105.41 58.55 177.32 105.11 67.55 166.51 112.71 59.63 143.30 98.03 69.92

An Internship Report

40

CHAPTER 5: FINDINGS AND RECOMMENDATION

FINDINGS I observed the Askari Bank Limited a sound financial bank. Its profits are increasing year-byyear. Its staff is very good and sincere with the bank. Askari Bank Limited Peshawar cantt branch has made significant progress in building and strengthening both the corporate and retail banking sectors in Pakistan. Askari Bank Limited views specialization and service excellence as the cornerstone of its strategy. The people at bank realize that innovation, creativity, reliability, customized services and their execution are their key ingredients for future growth. Revenues from these activities have started yielding dividends and they expect significant growth. They are aware that they have stepped into the 21st century and they must meet its challenges by acquiring the highest level of the technology. They will thus be accelerating their technological advance to enable them to distribute their products and services through most efficient and high tech means. They say that they will continue to invest in the modern tools and substantial allocation to resources will be made to achieve this objective during the current year. Online banking has been started and the introduction of ATM at strategic locations has been firmed up. RECOMMENDATIONS This is the fact that in this universe nothing is perfect. In every field of life there are some pluses and minuses. But the best institutions are those, which learn from the changing environment and competition. So it is necessary for them to keep them updated with the changing environment. Although ABL Peshawar cantt branch is one of the good branches in Peshawar, but there are few points that should be improved for more perfection. Keeping this aspect in view, I have made following recommendations:

An Internship Report

41

Marketing department is very active but the feedback or the follow up of the customers should be improved. As everything is computerized in AKBL, the employees should be properly trained in the computer systems.

AKBL is one of the busy bank in the banks market, its building is not as per the requirements of the branch. So the building should be further expanded and there should be more space for the sitting arrangements for the employees as well as for customers.

The ATM service should be provided 24 hours to the customers. Because customers feel upset when most of the times the machine is out of order .

The number of staff should be decreased in Foreign exchange department and Credit department. Because the building under operation is in adequate for such a large staff.

Under no circumstances cheque book should be given to the customer if the account formalities are incomplete.

Cheques, which are drawn on Askari Bank Branch and returned unpaid in clearing, are not reflected in the statement of account of the customers.

These cheques must be reflected in the accounts so that credibility of the customers may be assessed.

Audit should be held internally, rather there should be an audit department in the branches to make audit on daily basis. This can become as helpful as different banks are having this department of their own.

When giving the loan, the Bank must carefully analyze the past six months transaction history of the borrower. This will help in the judgment of the dealing behavior and

An Internship Report

42

financial status of the client. In most cases, this thing is not properly done and this is the major reason for the default of many clients.

The Bank should try to give more loans to the small businesses to fulfill their financial need because they also take part in the economic development as the past history of the bank shows that most of the loans granted to the corporate businesses and more often that loans converted into bad debts.

Evening banking should also be started in this branch so the customer can be served.

In AKBL more importance is given to army personnels as compare to civilians, so that concept needs to be changed otherwise the bank will loss more of its valuable customers.

An Internship Report

43

CHAPTER 6: REFRENCES

Askari Bank Annual Report 2012. Askari Banks employees training Program, computer based training guide. Charles H. Gibson, (1987)Financial statement analysis (Ed.7), New York, NY Gerald white, Sondhi, fried, (1991) Financial statement (Ed. 3), Wiley India Pvt Ltd Horne, James C. (1998), Fundamentals of financial management, (10th Ed), Prentice-Hall Inc. Block, Stanley. B. (1978), Foundations of financial management, (9th Ed), Irwin McGraw Hill. Ross, Stephen A. (1988), Corporate Finance, (7th Ed), Irwin McGraw Hill. Saunders, M. (2003), Business research methods for students , (3rd ed), Anand sons, India, www.blurtit.com www.sbp.org.net.pk www.scribed.com www.dostoc.com www.vu.com.pk

An Internship Report

Das könnte Ihnen auch gefallen

- MCB Bank Internship Report 2012Dokument58 SeitenMCB Bank Internship Report 2012Vegabond Nwaar100% (1)

- Banking India: Accepting Deposits for the Purpose of LendingVon EverandBanking India: Accepting Deposits for the Purpose of LendingNoch keine Bewertungen

- Aa - MCB 1620 Internship ReportDokument46 SeitenAa - MCB 1620 Internship ReportMaryam KhadimNoch keine Bewertungen

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaVon EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaNoch keine Bewertungen

- Ittrat JehanDokument69 SeitenIttrat JehanRana Muhammad YaseenNoch keine Bewertungen

- Weathering the Global Crisis: Can the Traits of Islamic Banking System Make a Difference?Von EverandWeathering the Global Crisis: Can the Traits of Islamic Banking System Make a Difference?Noch keine Bewertungen

- Intern Ship Report of Bank Alfalah Pakistan On Marketing (MBA)Dokument39 SeitenIntern Ship Report of Bank Alfalah Pakistan On Marketing (MBA)Yasir Khan50% (4)

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Von EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Noch keine Bewertungen

- Internship Report On MCB Bank Ltd. (Specialization in Banking & Finance)Dokument95 SeitenInternship Report On MCB Bank Ltd. (Specialization in Banking & Finance)Khurram JavedNoch keine Bewertungen

- Report On Askari BankDokument64 SeitenReport On Askari Bankzorish87% (15)

- Access to Finance: Microfinance Innovations in the People's Republic of ChinaVon EverandAccess to Finance: Microfinance Innovations in the People's Republic of ChinaNoch keine Bewertungen

- Internship Report On Bank Alfalah Garden Town LahoreDokument60 SeitenInternship Report On Bank Alfalah Garden Town LahoreNauman ZaheerNoch keine Bewertungen

- Marketing of Consumer Financial Products: Insights From Service MarketingVon EverandMarketing of Consumer Financial Products: Insights From Service MarketingNoch keine Bewertungen

- Credit Management System of IFIC Bank LTDDokument73 SeitenCredit Management System of IFIC Bank LTDHasib SimantoNoch keine Bewertungen

- Asian Development Bank–Japan Scholarship Program: 2014 Annual ReportVon EverandAsian Development Bank–Japan Scholarship Program: 2014 Annual ReportNoch keine Bewertungen

- Internship Report ON Muslim Commercial Bank: Branch ManagerDokument35 SeitenInternship Report ON Muslim Commercial Bank: Branch ManagerRida FatimaNoch keine Bewertungen

- Type Listed On NBP Industry: PKR 50.569 BillionDokument12 SeitenType Listed On NBP Industry: PKR 50.569 BillionLovely JeniNoch keine Bewertungen

- Meezan Bank AbidDokument67 SeitenMeezan Bank Abidim.abid1Noch keine Bewertungen

- Ijaz KhanDokument78 SeitenIjaz Khanwaqar ahmadNoch keine Bewertungen

- Bank Alflah Internship Report 2009 (Adjusted)Dokument72 SeitenBank Alflah Internship Report 2009 (Adjusted)Wajahat HussainNoch keine Bewertungen

- Report On HBL PDFDokument60 SeitenReport On HBL PDFWaseem AkbarNoch keine Bewertungen

- Investment Policy of AIBLDokument70 SeitenInvestment Policy of AIBLSobuj BernardNoch keine Bewertungen

- MCB Internship ReportDokument31 SeitenMCB Internship ReportShakeel QureshiNoch keine Bewertungen

- BNK LhbibDokument33 SeitenBNK LhbibHammad HussainNoch keine Bewertungen

- 1.1 Background: Organization ProfileDokument21 Seiten1.1 Background: Organization ProfileAnish GiriNoch keine Bewertungen

- Internship Report of Allied Bank by Asim MalikDokument57 SeitenInternship Report of Allied Bank by Asim MalikAsim Malik100% (3)

- Chapter #1 I T R: Ntroduction O EportDokument93 SeitenChapter #1 I T R: Ntroduction O Eportriffatshaheen865921Noch keine Bewertungen

- MCBDokument84 SeitenMCBTari Baba100% (2)

- Internship Report: Southeast Bank LimiterDokument25 SeitenInternship Report: Southeast Bank Limiterggmu_utdNoch keine Bewertungen

- Internship: First Women Bank LimitedDokument71 SeitenInternship: First Women Bank LimitedAnum SeherNoch keine Bewertungen

- Internship Report On Bank Alfalah LimitedDokument63 SeitenInternship Report On Bank Alfalah LimitedAneeqUzZamanNoch keine Bewertungen

- Shah Abdul Latif University Khairpur: Department of Business AdministrationDokument28 SeitenShah Abdul Latif University Khairpur: Department of Business AdministrationFurqan ShafiqNoch keine Bewertungen

- Final Copy of Bank Alfalah ProjectDokument58 SeitenFinal Copy of Bank Alfalah ProjectAqeel GillNoch keine Bewertungen

- Edited ReportDokument93 SeitenEdited ReportSohail KhanNoch keine Bewertungen

- MCB Internship ReportDokument132 SeitenMCB Internship ReportSohail KhanNoch keine Bewertungen

- Introduction To The ReportDokument34 SeitenIntroduction To The ReportTalha Iftekhar Khan SwatiNoch keine Bewertungen

- Report SampleDokument106 SeitenReport SampleJane EatonNoch keine Bewertungen

- General Banking Activities of Al-Arafah Islami Bank Limited: View With Charts and ImagesDokument14 SeitenGeneral Banking Activities of Al-Arafah Islami Bank Limited: View With Charts and ImagesMd. Shahriar Kabir RishatNoch keine Bewertungen

- Chapter-1 Internship Report On Bank of KhyberDokument37 SeitenChapter-1 Internship Report On Bank of KhyberAhmad AliNoch keine Bewertungen

- Background of The StudyDokument11 SeitenBackground of The StudyAnu SahNoch keine Bewertungen

- Report On "Evaluating Bank Performance and Finding Out Opportunities and Threats"Dokument23 SeitenReport On "Evaluating Bank Performance and Finding Out Opportunities and Threats"Md.Imran HossainNoch keine Bewertungen

- Bank Alfalah 1Dokument36 SeitenBank Alfalah 1smartahmedNoch keine Bewertungen

- DedicationDokument28 SeitenDedicationTahiraIkhlaqNoch keine Bewertungen

- Faysal Bank Internship Report OmerDokument81 SeitenFaysal Bank Internship Report OmerMirza Omer SaleemNoch keine Bewertungen

- Hailey College of Commerce: University of The PunjabDokument59 SeitenHailey College of Commerce: University of The Punjabwahidbc09001Noch keine Bewertungen

- Internship Report On National Bank of Pakistan: Name of Student: Ghazala Nawaz Roll Number:10012454-013Dokument84 SeitenInternship Report On National Bank of Pakistan: Name of Student: Ghazala Nawaz Roll Number:10012454-013Sana JavaidNoch keine Bewertungen

- Internship Report ON MCB Bank Limited: SpecializationDokument31 SeitenInternship Report ON MCB Bank Limited: SpecializationAli Adnan NaqviNoch keine Bewertungen

- Sui Northern Gas Pipeline Limited: Internship ReportDokument7 SeitenSui Northern Gas Pipeline Limited: Internship ReportPrince ShahNoch keine Bewertungen

- General Banking and Loan System of IFIC Bank LimitedDokument40 SeitenGeneral Banking and Loan System of IFIC Bank LimitedFaquir Sanoar SanyNoch keine Bewertungen

- Askari Bank Internship Report 2010Dokument77 SeitenAskari Bank Internship Report 2010Shafaq Khurram50% (2)

- NBP ReportDokument28 SeitenNBP ReportNoor Nabi ShaikhNoch keine Bewertungen

- Ayesha Internship 2 PDFDokument59 SeitenAyesha Internship 2 PDFAisha rashidNoch keine Bewertungen

- Asad CH 1 2Dokument12 SeitenAsad CH 1 2Abrar Alam ChowdhuryNoch keine Bewertungen

- R.F.SHARAN FinalDokument53 SeitenR.F.SHARAN Finalreduan ferdousNoch keine Bewertungen

- Saroj Intern ReportDokument47 SeitenSaroj Intern ReportAwshib BhandariNoch keine Bewertungen

- Internship Report: Main Branch Tatta Pani Aj&KDokument54 SeitenInternship Report: Main Branch Tatta Pani Aj&KHasnain ParvezNoch keine Bewertungen

- Internship Report On Askari Bank LimitedDokument28 SeitenInternship Report On Askari Bank LimitedRahatullah Mallick55% (11)

- Ex, Ack. Tble, Body PartDokument34 SeitenEx, Ack. Tble, Body PartArefin RifathNoch keine Bewertungen

- Chapter On ZakatDokument19 SeitenChapter On Zakatimranhaq23Noch keine Bewertungen

- MR JohnbuilderDokument8 SeitenMR JohnbuilderPenielle SaguindanNoch keine Bewertungen

- TcsDokument21 SeitenTcsSyedadam HasnainNoch keine Bewertungen

- UCO BankDokument128 SeitenUCO BankRitesh TyagiNoch keine Bewertungen

- Sales ContractDokument5 SeitenSales ContractDemoBriliyanto0% (1)

- IDFCFIRSTBankstatement 10081906550 235126745Dokument18 SeitenIDFCFIRSTBankstatement 10081906550 235126745Bajrang mirwadNoch keine Bewertungen

- Bar Graph Unit MonthDokument2 SeitenBar Graph Unit MonthshrikantNoch keine Bewertungen

- Agent/Broker/Producer Name: SARAL INSURANCE BROKING PVT LTD Agent/Broker License Code: 562; Agent/Broker Contact No.: 9001821888Dokument1 SeiteAgent/Broker/Producer Name: SARAL INSURANCE BROKING PVT LTD Agent/Broker License Code: 562; Agent/Broker Contact No.: 9001821888kashanaNoch keine Bewertungen

- ObliCon - Cases - 1240 To 1258Dokument159 SeitenObliCon - Cases - 1240 To 1258Bianca BeltranNoch keine Bewertungen

- Resume - 3 Suhail Ahmad SheikhDokument2 SeitenResume - 3 Suhail Ahmad SheikhRafee RasoolNoch keine Bewertungen

- Paintball City Waiver FormDokument1 SeitePaintball City Waiver FormAndrew HalsteadNoch keine Bewertungen

- Basics HR Induction For Bba & MbaDokument41 SeitenBasics HR Induction For Bba & MbaAnilNoch keine Bewertungen

- Model ContractDokument9 SeitenModel ContractBren SanCorNoch keine Bewertungen

- Marine InsuranceDokument23 SeitenMarine InsuranceRishabh DubeyNoch keine Bewertungen

- Dear AuthorDokument2 SeitenDear Authorvijay9994Noch keine Bewertungen

- Your Accounts at A Glance: Your Balances On 22 Feb 2022Dokument4 SeitenYour Accounts at A Glance: Your Balances On 22 Feb 2022mohamed elmakhzniNoch keine Bewertungen

- Schemes PDFDokument15 SeitenSchemes PDFSoorajKrishnanNoch keine Bewertungen

- Langfield-Smith7e IRM Ch18Dokument45 SeitenLangfield-Smith7e IRM Ch18Rujun Wu100% (3)

- 1.1history of BankingDokument18 Seiten1.1history of BankingHarika KollatiNoch keine Bewertungen

- Investment PatternDokument11 SeitenInvestment PatternAvantika01Noch keine Bewertungen

- PNBONE Mpassbook 114911 5-5-2023 28-11-2023 1780XXXXXXXX83Dokument5 SeitenPNBONE Mpassbook 114911 5-5-2023 28-11-2023 1780XXXXXXXX83jattkhatri4Noch keine Bewertungen

- General Banking System of IFIC Bank LTDDokument68 SeitenGeneral Banking System of IFIC Bank LTDMd. Monirul IslamNoch keine Bewertungen

- ACS-01 2019 emDokument18 SeitenACS-01 2019 emNEW THINK CLASSESNoch keine Bewertungen

- SCB Tariff 2021Dokument15 SeitenSCB Tariff 2021Fuaad DodooNoch keine Bewertungen

- Dich Hop DongDokument52 SeitenDich Hop DongTruy Menh100% (2)

- 1,2,3reading Material - MABDokument25 Seiten1,2,3reading Material - MABsambit samantaNoch keine Bewertungen

- The History of Reading - 50% OffDokument2 SeitenThe History of Reading - 50% OffvonjobiNoch keine Bewertungen

- 13 May 2022 To 11 Aug 2022 FCMB StatementDokument8 Seiten13 May 2022 To 11 Aug 2022 FCMB StatementCwfc GloryNoch keine Bewertungen

- Airtel PDFDokument2 SeitenAirtel PDFNoorNoch keine Bewertungen

- MCBDokument16 SeitenMCBTariq SiddiqNoch keine Bewertungen

- For the Thrill of It: Leopold, Loeb, and the Murder That Shocked Jazz Age ChicagoVon EverandFor the Thrill of It: Leopold, Loeb, and the Murder That Shocked Jazz Age ChicagoBewertung: 4 von 5 Sternen4/5 (97)

- Perversion of Justice: The Jeffrey Epstein StoryVon EverandPerversion of Justice: The Jeffrey Epstein StoryBewertung: 4.5 von 5 Sternen4.5/5 (10)

- Here, Right Matters: An American StoryVon EverandHere, Right Matters: An American StoryBewertung: 4 von 5 Sternen4/5 (24)

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesVon EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesNoch keine Bewertungen

- Insider's Guide To Your First Year Of Law School: A Student-to-Student Handbook from a Law School SurvivorVon EverandInsider's Guide To Your First Year Of Law School: A Student-to-Student Handbook from a Law School SurvivorBewertung: 3.5 von 5 Sternen3.5/5 (3)

- The Executive Juris Doctor: Learn to Think Like a LawyerVon EverandThe Executive Juris Doctor: Learn to Think Like a LawyerBewertung: 4 von 5 Sternen4/5 (6)

- Hunting Whitey: The Inside Story of the Capture & Killing of America's Most Wanted Crime BossVon EverandHunting Whitey: The Inside Story of the Capture & Killing of America's Most Wanted Crime BossBewertung: 3.5 von 5 Sternen3.5/5 (6)

- Lady Killers: Deadly Women Throughout HistoryVon EverandLady Killers: Deadly Women Throughout HistoryBewertung: 4 von 5 Sternen4/5 (154)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingVon EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingBewertung: 4.5 von 5 Sternen4.5/5 (97)

- Reading the Constitution: Why I Chose Pragmatism, not TextualismVon EverandReading the Constitution: Why I Chose Pragmatism, not TextualismNoch keine Bewertungen

- Summary: Surrounded by Idiots: The Four Types of Human Behavior and How to Effectively Communicate with Each in Business (and in Life) by Thomas Erikson: Key Takeaways, Summary & AnalysisVon EverandSummary: Surrounded by Idiots: The Four Types of Human Behavior and How to Effectively Communicate with Each in Business (and in Life) by Thomas Erikson: Key Takeaways, Summary & AnalysisBewertung: 4 von 5 Sternen4/5 (2)

- Chokepoint Capitalism: How Big Tech and Big Content Captured Creative Labor Markets and How We'll Win Them BackVon EverandChokepoint Capitalism: How Big Tech and Big Content Captured Creative Labor Markets and How We'll Win Them BackBewertung: 5 von 5 Sternen5/5 (20)

- Learning to Disagree: The Surprising Path to Navigating Differences with Empathy and RespectVon EverandLearning to Disagree: The Surprising Path to Navigating Differences with Empathy and RespectNoch keine Bewertungen

- Get Outta Jail Free Card “Jim Crow’s last stand at perpetuating slavery” Non-Unanimous Jury Verdicts & Voter SuppressionVon EverandGet Outta Jail Free Card “Jim Crow’s last stand at perpetuating slavery” Non-Unanimous Jury Verdicts & Voter SuppressionBewertung: 5 von 5 Sternen5/5 (1)

- Reasonable Doubts: The O.J. Simpson Case and the Criminal Justice SystemVon EverandReasonable Doubts: The O.J. Simpson Case and the Criminal Justice SystemBewertung: 4 von 5 Sternen4/5 (25)

- Conviction: The Untold Story of Putting Jodi Arias Behind BarsVon EverandConviction: The Untold Story of Putting Jodi Arias Behind BarsBewertung: 4.5 von 5 Sternen4.5/5 (16)

- All You Need to Know About the Music Business: Eleventh EditionVon EverandAll You Need to Know About the Music Business: Eleventh EditionNoch keine Bewertungen

- The Law of the Land: The Evolution of Our Legal SystemVon EverandThe Law of the Land: The Evolution of Our Legal SystemBewertung: 4.5 von 5 Sternen4.5/5 (11)

- The Killer Across the Table: Unlocking the Secrets of Serial Killers and Predators with the FBI's Original MindhunterVon EverandThe Killer Across the Table: Unlocking the Secrets of Serial Killers and Predators with the FBI's Original MindhunterBewertung: 4.5 von 5 Sternen4.5/5 (456)

- The Invention of Murder: How the Victorians Revelled in Death and Detection and Created Modern CrimeVon EverandThe Invention of Murder: How the Victorians Revelled in Death and Detection and Created Modern CrimeBewertung: 3.5 von 5 Sternen3.5/5 (142)

- The Internet Con: How to Seize the Means of ComputationVon EverandThe Internet Con: How to Seize the Means of ComputationBewertung: 5 von 5 Sternen5/5 (6)

- All You Need to Know About the Music Business: 11th EditionVon EverandAll You Need to Know About the Music Business: 11th EditionNoch keine Bewertungen