Beruflich Dokumente

Kultur Dokumente

Changes Net Sales Volume: Findings of The Study

Hochgeladen von

GauravOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Changes Net Sales Volume: Findings of The Study

Hochgeladen von

GauravCopyright:

Verfügbare Formate

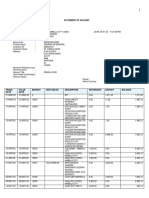

FINDINGS OF THE STUDY

FINDINGS There has been a significant decline in volume over the years from 2001-02 to 2005-06 as can be seen in the graph below:

CHANGES NET SALES VOLUME

NET SALE IN (Cr)

5000 1588 0 2005- 2006- 200706 07 08 YEAR

Table 4.3

1896

2300

The Net sales of Tractor has increased considerably from 2004-05 to 2007-08,

75

This can be mainly attributed to changes in Variable and material costs and in the price. The Net sale of Tractor has increased considerably from 2004-05 to 2007-08,

that is an decrease of Rs.7216 per tractor. This can be mainly attributed to changes in Variable and material costs and in the prices. The current ratio has shown in a fluctuating trend as 7.41, 2.19, 4.48, 1.98, and 3.82 during 2003 of which indicates a continuous increase in both current assets and current liabilities. The quick ratio is also in a fluctuating trend through out the period 2003 07 resulting as 7.41, 1.65, 4.35, 1.9, and 3.81. The companys present liquidity position is satisfactory. The absolute liquid ratio has been decreased from 3.92 to 1.18, from 2003 07. The proprietory ratio has shown a fluctuating trend. The proprietory ratio is increased compared with the last year. The long term solvency of the firm is increased. The working capital increased from 0.72 to 1.13 in the year 2003 07. The fixed assets turnover ratio is in increasing trend from the year 2003 07 (1.26, 1.82, 4.24, 3.69, and 6.82). It indicates that the company is efficiently utilizing the fixed assets. The capital turnover ratio is increased form 2003 05 (0.98, 1.01, and 1.04) and decreased in 2006 to 0.98. It increased in the current year as 1.00. The current assets to fixed assets ratio is increasing gradually from 2003 07 as 2.93, 3.74, 4.20, 6.07 and 8.17. It shows that the current assets are increased than fixed assets. 76

The net profit ratio is in fluctuation manner. It increased in the current year compared with the previous year form 0.33 to 0.42.

The net profit is increased greaterly in the current year. So the return on total assets ratio is increased from 0.17 to 0.31.

The Reserves and Surplus to Capital ratio is increased to 4.19 from 2.02. The capital is constant, but the reserves and surplus is increased in the current year.

The earnings per share was very high in the year 2003 i.e., 101.56. That is decreased in the following years because number of equity shares are increased and the net profit is decreased.

In the current year the net profit is increased due to the increase in operating and maintenance fee.

The earnings per share is increased. The operating profit ratio is in fluctuating manner as 0.99, 0.51, 0.41, 0.57 and 0.69 from 2003 07 respectively.

Price Earnings ratio is reduced when compared with the last year. It is reduced from 3.09 to 2.39, because the earnings per share is increased.

The return on investment is increased from 0.32 to 0.42 compared with the previous year.

The profit and shareholders funds increase cause an increase in the ratio.

77

Das könnte Ihnen auch gefallen

- Analysis of Financial StatementsDokument14 SeitenAnalysis of Financial StatementsSonia ChughtaiNoch keine Bewertungen

- Bluestar Limited: Annual Report AnalysisDokument16 SeitenBluestar Limited: Annual Report AnalysisKunal NegiNoch keine Bewertungen

- Financial Statement AnalysisDokument18 SeitenFinancial Statement AnalysisSikandar SaleemNoch keine Bewertungen

- Income Statement OldDokument9 SeitenIncome Statement OldjhanzabNoch keine Bewertungen

- Motor Industry AnalysisDokument23 SeitenMotor Industry AnalysisDenisJose2014Noch keine Bewertungen

- Abbott Laboratories Pakistan LimitedDokument12 SeitenAbbott Laboratories Pakistan Limitedsins2008Noch keine Bewertungen

- Toyota Common Size Balance Sheet For The Years 2005 & 2006 (Rs. in Crores)Dokument25 SeitenToyota Common Size Balance Sheet For The Years 2005 & 2006 (Rs. in Crores)balki123Noch keine Bewertungen

- Ratio Analysis of NCLDokument12 SeitenRatio Analysis of NCLAsad KhanNoch keine Bewertungen

- Atlas Honda Limited PresentationDokument14 SeitenAtlas Honda Limited PresentationusmanjuttNoch keine Bewertungen

- Engro Foods Engro Foods Engro FoodsDokument37 SeitenEngro Foods Engro Foods Engro FoodsAli haiderNoch keine Bewertungen

- Data Analysis and Interpretation Calculation and Interpretation of RatiosDokument27 SeitenData Analysis and Interpretation Calculation and Interpretation of RatiosGGUULLSSHHAANNNoch keine Bewertungen

- Working Capital Management atDokument29 SeitenWorking Capital Management atNavkesh GautamNoch keine Bewertungen

- Term Paper of Reliance Weaving LTDDokument12 SeitenTerm Paper of Reliance Weaving LTDadeelasghar091Noch keine Bewertungen

- Chapter-V: Findings, Suggestions & Conclusion FindingsDokument4 SeitenChapter-V: Findings, Suggestions & Conclusion FindingsGLOBAL INFO-TECH KUMBAKONAMNoch keine Bewertungen

- Comparative and Common Size FindingsDokument4 SeitenComparative and Common Size FindingsHarsh KothariNoch keine Bewertungen

- FM Ratio Analysis UnileverDokument14 SeitenFM Ratio Analysis UnileverZohaib IrshadNoch keine Bewertungen

- Financial Statements Ratio Analysis of InfosysDokument15 SeitenFinancial Statements Ratio Analysis of InfosysVishal KushwahaNoch keine Bewertungen

- A Study On Asset Management of Shanthigram Dairy Promotion at NathamDokument35 SeitenA Study On Asset Management of Shanthigram Dairy Promotion at Nathamramohan2121Noch keine Bewertungen

- DMPDokument4 SeitenDMPJaymin PatelNoch keine Bewertungen

- Accounting and Finance For Managers: Profitability Analysis RatiosDokument20 SeitenAccounting and Finance For Managers: Profitability Analysis RatiosRiz KhanNoch keine Bewertungen

- Dupont Analysis For 3 Automobile CompaniesDokument6 SeitenDupont Analysis For 3 Automobile Companiesradhika chaudharyNoch keine Bewertungen

- "Financial Analysis of Kilburn Chemicals": Case Study OnDokument20 Seiten"Financial Analysis of Kilburn Chemicals": Case Study Onshraddha mehtaNoch keine Bewertungen

- NSU FALL 2012 FIN254.9 Term Paper On Aramit LimitedDokument24 SeitenNSU FALL 2012 FIN254.9 Term Paper On Aramit LimitedSamaan RishadNoch keine Bewertungen

- Financial Analysis of BhelDokument17 SeitenFinancial Analysis of BhelGeetank JunejaNoch keine Bewertungen

- Profitability RatiosDokument6 SeitenProfitability RatiosdanyalNoch keine Bewertungen

- KPIT Technologies Fundamental AnalysisDokument15 SeitenKPIT Technologies Fundamental AnalysisvvpvarunNoch keine Bewertungen

- Report Sample To Board of DirectorsDokument5 SeitenReport Sample To Board of Directorskerepekpisang100% (3)

- Ratio Analysis of Shinepukur Ceremics Ltd.Dokument0 SeitenRatio Analysis of Shinepukur Ceremics Ltd.Saddam HossainNoch keine Bewertungen

- Asyad Financial AnalysisDokument9 SeitenAsyad Financial AnalysisshawktNoch keine Bewertungen

- Final Profect of FMDokument22 SeitenFinal Profect of FMZubair MalikNoch keine Bewertungen

- Horizontal Analysis / CommentsDokument6 SeitenHorizontal Analysis / Commentsfarrukh_kanyalNoch keine Bewertungen

- AnalysisDokument8 SeitenAnalysisAnjali AnandNoch keine Bewertungen

- FSA (Financial Statement Analysis) - Eicher Motors LTDDokument3 SeitenFSA (Financial Statement Analysis) - Eicher Motors LTDvhoraalbax1110Noch keine Bewertungen

- CF K C ChandanDokument10 SeitenCF K C ChandanChandan K CNoch keine Bewertungen

- Earnings Quality Microsoft. Jet. RentWayDokument25 SeitenEarnings Quality Microsoft. Jet. RentWayDebasis DashNoch keine Bewertungen

- ImmanuelDokument25 SeitenImmanuelManojManuNoch keine Bewertungen

- Financial Analysis Report (Sonu)Dokument2 SeitenFinancial Analysis Report (Sonu)ronaldweasley6Noch keine Bewertungen

- Prashanth VivaDokument22 SeitenPrashanth Vivabest video of every timeNoch keine Bewertungen

- Interpretation FinalDokument6 SeitenInterpretation FinalFarzana YasminNoch keine Bewertungen

- GentingDokument9 SeitenGentingEena WasymNoch keine Bewertungen

- Ratios Analysis MBA Project: SuggestionsDokument1 SeiteRatios Analysis MBA Project: SuggestionsSam SmartNoch keine Bewertungen

- Efficiency RatiosDokument6 SeitenEfficiency Ratiosabhi vermaNoch keine Bewertungen

- Mitchell's Ratio AnalysisDokument3 SeitenMitchell's Ratio Analysismadnansajid8765Noch keine Bewertungen

- 1) Ratio Calculations: (1) CurrentDokument13 Seiten1) Ratio Calculations: (1) CurrentRahul KumarNoch keine Bewertungen

- Financial Statement Analysis of Ibm (Real)Dokument15 SeitenFinancial Statement Analysis of Ibm (Real)Maneet SinghNoch keine Bewertungen

- Financial Analysis presentaTIONDokument18 SeitenFinancial Analysis presentaTIONRaj MishraNoch keine Bewertungen

- Fake PDFDokument15 SeitenFake PDFAkshay AggarwalNoch keine Bewertungen

- IB Bm2tr 3 Resources Answers5Dokument4 SeitenIB Bm2tr 3 Resources Answers5Gabriel FungNoch keine Bewertungen

- Accounting Assignment: Company Name:-Bajaj AutoDokument6 SeitenAccounting Assignment: Company Name:-Bajaj Autonand bhushanNoch keine Bewertungen

- Assignment Final Copy of VodafoneDokument13 SeitenAssignment Final Copy of VodafoneprahladtripathiNoch keine Bewertungen

- Financial Ratio Analysis Infosys PresentationDokument44 SeitenFinancial Ratio Analysis Infosys PresentationSushanth VarmaNoch keine Bewertungen

- Financial Ratio AnalysisDokument26 SeitenFinancial Ratio AnalysisMujtaba HassanNoch keine Bewertungen

- Great Eastern Shipping Company Limited (Case Study) : Submitted To:-Submitted ByDokument6 SeitenGreat Eastern Shipping Company Limited (Case Study) : Submitted To:-Submitted ByAbhishek ChaurasiaNoch keine Bewertungen

- Annual Report 2003 04Dokument52 SeitenAnnual Report 2003 04Kiran VishuNoch keine Bewertungen

- Group 1 Pranav Shukla Kunal Jha Navdeep Sangwan Mansi Bharadwaj Nainika NarulaDokument42 SeitenGroup 1 Pranav Shukla Kunal Jha Navdeep Sangwan Mansi Bharadwaj Nainika NarulaDarek LinonNoch keine Bewertungen

- Fixed Assets Turnover RatioDokument6 SeitenFixed Assets Turnover RatioRishika RaghuwanshiNoch keine Bewertungen

- Debtor and EpsDokument4 SeitenDebtor and EpsHiren GoswamiNoch keine Bewertungen

- 9711 SOLUTIONS UpdatedDokument20 Seiten9711 SOLUTIONS Updatedhaseeb ahmedNoch keine Bewertungen

- Fsa F8Dokument7 SeitenFsa F8Sujit Kumar SahuNoch keine Bewertungen

- Government College For Women Faridabad: Roject EportDokument42 SeitenGovernment College For Women Faridabad: Roject EportGauravNoch keine Bewertungen

- Marketing Mix in Shukla IndustriesDokument65 SeitenMarketing Mix in Shukla IndustriesBirjesh KumarNoch keine Bewertungen

- Anjali BbaDokument81 SeitenAnjali BbaGaurav100% (1)

- Reprot Auto HRDokument73 SeitenReprot Auto HRGauravNoch keine Bewertungen

- Whirlpool MarketingDokument72 SeitenWhirlpool MarketingGaurav100% (1)

- Marketing Mix in Shukla IndustriesDokument65 SeitenMarketing Mix in Shukla IndustriesBirjesh KumarNoch keine Bewertungen

- Imperial Auto SoroutDokument83 SeitenImperial Auto SoroutGauravNoch keine Bewertungen

- Whirlpool 142Dokument75 SeitenWhirlpool 142GauravNoch keine Bewertungen

- Dee PipingDokument74 SeitenDee PipingGauravNoch keine Bewertungen

- Ecocat Labor WelfareDokument66 SeitenEcocat Labor WelfareGauravNoch keine Bewertungen

- Sadhu ForgeDokument5 SeitenSadhu ForgeGauravNoch keine Bewertungen

- Marketing Mix in Shukla IndustriesDokument65 SeitenMarketing Mix in Shukla IndustriesBirjesh KumarNoch keine Bewertungen

- Customer Satisfaction-JCB 1Dokument70 SeitenCustomer Satisfaction-JCB 1Ankita_Rules_867067% (3)

- Customer SatisfactionDokument73 SeitenCustomer Satisfactionchandhu529Noch keine Bewertungen

- Computers Application in Business: CommunicationDokument25 SeitenComputers Application in Business: CommunicationGauravNoch keine Bewertungen

- Ms WordDokument19 SeitenMs WordGauravNoch keine Bewertungen

- Mohit Summer Training ReportDokument6 SeitenMohit Summer Training ReportGauravNoch keine Bewertungen

- Bata Shoe Organization-OverviewDokument20 SeitenBata Shoe Organization-OverviewMayank SharmaNoch keine Bewertungen

- Project Report of HyundaiDokument79 SeitenProject Report of HyundaiGauravNoch keine Bewertungen

- Mohit Summer Training ReportDokument6 SeitenMohit Summer Training ReportGauravNoch keine Bewertungen

- Sumit BatejaDokument57 SeitenSumit BatejaGauravNoch keine Bewertungen

- Computers Application in Business: CommunicationDokument25 SeitenComputers Application in Business: CommunicationGauravNoch keine Bewertungen

- Decent Amit Kumar CV 03Dokument2 SeitenDecent Amit Kumar CV 03GauravNoch keine Bewertungen

- WhirL HRDokument55 SeitenWhirL HRGauravNoch keine Bewertungen

- Chandan SinghDokument74 SeitenChandan SinghGauravNoch keine Bewertungen

- Mba Project Report On Stress Management of Employees 2Dokument64 SeitenMba Project Report On Stress Management of Employees 2nazimahmad8679% (105)

- Dominos HR ReportDokument73 SeitenDominos HR ReportGaurav83% (6)

- Yamaha Working CapitalDokument49 SeitenYamaha Working CapitalGaurav100% (2)

- Summer Training Report: Personnel ManagementDokument67 SeitenSummer Training Report: Personnel ManagementGauravNoch keine Bewertungen

- HPL Final - 1Dokument73 SeitenHPL Final - 1GauravNoch keine Bewertungen

- Business Intelligence and BankingDokument12 SeitenBusiness Intelligence and BankingniklasNoch keine Bewertungen

- Insurance Law Aquino 2018Dokument528 SeitenInsurance Law Aquino 2018Israel Bandonill100% (12)

- An Assignment OnDokument25 SeitenAn Assignment OnJalal HossainNoch keine Bewertungen

- Government Finance Statistics (GFSX) : Valuation of TransactionsDokument2 SeitenGovernment Finance Statistics (GFSX) : Valuation of TransactionsKhenneth BalcetaNoch keine Bewertungen

- Credit Risk Modelling Literature ReviewDokument5 SeitenCredit Risk Modelling Literature Reviewea3h1c1p100% (1)

- Pag Ibig Foreclosed Properties Pubbid 2016-09-14 NCR No DiscountDokument11 SeitenPag Ibig Foreclosed Properties Pubbid 2016-09-14 NCR No DiscountChristian D. OrbeNoch keine Bewertungen

- Q.P. Code:36461: Activity Preceding Activity NT (Days) CT (Days) Blenders Packers FillersDokument3 SeitenQ.P. Code:36461: Activity Preceding Activity NT (Days) CT (Days) Blenders Packers Fillersmms a19Noch keine Bewertungen

- Principle CH 8 Ed.23 Oxley Internal Control, and Cash)Dokument8 SeitenPrinciple CH 8 Ed.23 Oxley Internal Control, and Cash)Heri SiringoringoNoch keine Bewertungen

- Export 09 - 07 - 2020 00 - 39Dokument59 SeitenExport 09 - 07 - 2020 00 - 39Kalle AhiNoch keine Bewertungen

- Chapter 12 Insurance Tax PowerpointDokument30 SeitenChapter 12 Insurance Tax Powerpointapi-302252730Noch keine Bewertungen

- Value Investing: Guide ToDokument19 SeitenValue Investing: Guide ToDomo TagubaNoch keine Bewertungen

- Performance Evaluation of Mutual Funds in India: Literature ReviewDokument12 SeitenPerformance Evaluation of Mutual Funds in India: Literature Reviewritik bumbakNoch keine Bewertungen

- p.21 Case 1-1 Ribbons An' Bows, IncDokument3 Seitenp.21 Case 1-1 Ribbons An' Bows, Incrajo_onglao50% (2)

- Riiitzaiit6F5T-L I: R1 Official Form 1) (12/11Dokument41 SeitenRiiitzaiit6F5T-L I: R1 Official Form 1) (12/11Chapter 11 DocketsNoch keine Bewertungen

- SSS' EE and ER DefinitionsDokument4 SeitenSSS' EE and ER Definitionspaula_bagnesNoch keine Bewertungen

- 14TH Annual Report: Year Ended - 3 (. O3.2Oo9Dokument19 Seiten14TH Annual Report: Year Ended - 3 (. O3.2Oo9ravalmunjNoch keine Bewertungen

- Namra Finance LimitedDokument5 SeitenNamra Finance LimitedPramila TyagiNoch keine Bewertungen

- Ja TinderDokument6 SeitenJa TinderHitlisted VasuNoch keine Bewertungen

- E1.developments in The Indian Money MarketDokument16 SeitenE1.developments in The Indian Money Marketrjkrn230% (1)

- Muhammad Aslam - JulyDokument1 SeiteMuhammad Aslam - JulyNajma KanwalNoch keine Bewertungen

- 4 Capital Budgeting PDFDokument45 Seiten4 Capital Budgeting PDFmichael christianNoch keine Bewertungen

- Sherry Hunt Case - Team CDokument4 SeitenSherry Hunt Case - Team CMariano BonillaNoch keine Bewertungen

- 02 Project SelectionDokument32 Seiten02 Project SelectionShamsul AlamNoch keine Bewertungen

- MyGlamm Invoice 1671638258-96Dokument1 SeiteMyGlamm Invoice 1671638258-96ShruNoch keine Bewertungen

- (Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in HedgingDokument79 Seiten(Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in Hedgingsarvesh dhatrakNoch keine Bewertungen

- TATA MOTORS Atif PDFDokument9 SeitenTATA MOTORS Atif PDFAtif Raza AkbarNoch keine Bewertungen

- Quarterly Report (Q3 2023) - 13 November 2023Dokument59 SeitenQuarterly Report (Q3 2023) - 13 November 2023judy jace thaddeus AlejoNoch keine Bewertungen

- Payment InstructionDokument2 SeitenPayment Instructionjiachendu.caNoch keine Bewertungen

- 14643post 819 WircDokument945 Seiten14643post 819 WircRonak ShahNoch keine Bewertungen

- Model Asset and Liability Affidavit D. VDokument12 SeitenModel Asset and Liability Affidavit D. VsavagecommentorNoch keine Bewertungen

- You Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherVon EverandYou Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherNoch keine Bewertungen

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)

- Welcome to the United States of Anxiety: Observations from a Reforming NeuroticVon EverandWelcome to the United States of Anxiety: Observations from a Reforming NeuroticBewertung: 3.5 von 5 Sternen3.5/5 (10)

- The Importance of Being Earnest: Classic Tales EditionVon EverandThe Importance of Being Earnest: Classic Tales EditionBewertung: 4.5 von 5 Sternen4.5/5 (44)

- The House at Pooh Corner - Winnie-the-Pooh Book #4 - UnabridgedVon EverandThe House at Pooh Corner - Winnie-the-Pooh Book #4 - UnabridgedBewertung: 4.5 von 5 Sternen4.5/5 (5)

- The Book of Bad:: Stuff You Should Know Unless You’re a PussyVon EverandThe Book of Bad:: Stuff You Should Know Unless You’re a PussyBewertung: 3.5 von 5 Sternen3.5/5 (3)

- The Inimitable Jeeves [Classic Tales Edition]Von EverandThe Inimitable Jeeves [Classic Tales Edition]Bewertung: 5 von 5 Sternen5/5 (3)

- The Comedians in Cars Getting Coffee BookVon EverandThe Comedians in Cars Getting Coffee BookBewertung: 4.5 von 5 Sternen4.5/5 (8)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisVon EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisBewertung: 5 von 5 Sternen5/5 (6)

- The Most Forbidden Knowledge: 151 Things NO ONE Should Know How to DoVon EverandThe Most Forbidden Knowledge: 151 Things NO ONE Should Know How to DoBewertung: 4.5 von 5 Sternen4.5/5 (6)

- The Best Joke Book (Period): Hundreds of the Funniest, Silliest, Most Ridiculous Jokes EverVon EverandThe Best Joke Book (Period): Hundreds of the Funniest, Silliest, Most Ridiculous Jokes EverBewertung: 3.5 von 5 Sternen3.5/5 (4)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNVon Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNBewertung: 4.5 von 5 Sternen4.5/5 (3)

- 1,001 Facts that Will Scare the S#*t Out of You: The Ultimate Bathroom ReaderVon Everand1,001 Facts that Will Scare the S#*t Out of You: The Ultimate Bathroom ReaderBewertung: 3.5 von 5 Sternen3.5/5 (48)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successVon EverandReady, Set, Growth hack:: A beginners guide to growth hacking successBewertung: 4.5 von 5 Sternen4.5/5 (93)

![The Inimitable Jeeves [Classic Tales Edition]](https://imgv2-1-f.scribdassets.com/img/audiobook_square_badge/711420909/198x198/ba98be6b93/1712018618?v=1)