Beruflich Dokumente

Kultur Dokumente

Marketing TFC

Hochgeladen von

Sanmitra MallickOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Marketing TFC

Hochgeladen von

Sanmitra MallickCopyright:

Verfügbare Formate

Interpretion of consumer and market data as Dana Wheeler: Since the very initial days when TFC was

founded in 1996, TFC (The Fashion Channel) reached to almost 80 million US households who subscribed to cable thereby enjoying constant revenue generation and profit growth above the industry average. But then competitors Lifetime and CNN launched fashion-specific programming blocks which achieved notable ratings. Consumers now have options to choose from and the data shows that certain segment of customers are preferring CNN and Lifetime more than TFC. This was happening since when it comes to consumers interest, perceived value and interest CNN and Lifetime scored more than TFC. TFCs two major revenue generation streams were cable affiliate fees and advertising and these have been posed a threat by the competitors fashion programming since they targeted specific market segments and TFC was unable to differentiate the same. The survey by GFE Associates show that there are four major potential viewers segment: The Fashionistas (highly engaged in fashion: 15%), Planners and shoppers (regular participants in fashion): 35%, Situationalists (participate in fashion for specific needs): 30% and the basic disengaged ones: 20%. The demographic highlights show that male consumers fall in the group of basics, while 61% of the Fashionistas are female. Also 50% of the Fashionistas fall in age group of 18-34 years. Expected outcome of each of the targeting scenarios: Dana Wheeler developed three different scenarios to mix their most popular viewing segments and the results it would have on CPM: 1) 1st scenario: To target the Fashionistas, the Shoppers/Planners and Situationalists. This will help to create a wider market base. In this scenario the viewership would increase over time from 1% to 1.2% but the average CPM would decrease from $2.00 to $1.80 (exhibit 4). Overall this scenario would give an increase in advertising revenue of 8% from 2006 to $249 million. 2) 2nd scenario: Focus only on Fashionistas. In this scenario, the average viewership would reduce from 1% to 0.8% due to narrowed focus, but CPM would increase much from $2.00 to $3.50 and thus 40% rise in advertising revenue around $92million (exhibit 4). For this scenario an additional programming cost of $15million per year needs to be incurred, but since it would generate additional revenue, it seems like a good option 3) 3rd scenario: Focuses on Fashionistas and the Shoppers/Planners. This approach will increase the viewership from 1% to 1.20% and CPM from $2.00 to $2.50 (Exhibit 4). The advertising revenue increases by 50% over $115million but at additional investment in programming costs of $20million The filled Exhibits 4 & 5 are on Page 2. Factual analysis of segmentation options & Evaluation: Each of the segmentation options provides increased net income, but there are pros and cons of each:

Segmentation option

Fashionistas,Shoppers/Planners & Situationalists Fashionistas alone Fashionistas and Shoppers/Planners

Pros

Wider market Increase in viewership Increase in advertising revenue Increase in CPM Rise in advertising revenue Increase in viewership Increase in CPM Increase in advertising revenue

Cons

Decrease in CPM

Decrease in average viewership Addtional programming cost Additional investment in programming

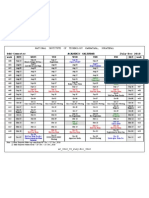

Recommendations: Of the 3 scenarios the third is the most likely to meet the needs of TFC. It targets two consumer groups: the Fashionistas containing highly valued 18-34 age female group, and the Planners & Shoppers. This option gives the highest profit margin and net income of $168,867,232. It focuses on a specific segment of viewers and thus the viewers are less likely to go to the hands of competitors. It increases viewership, CPM and advertising revenue. So looking at all these pros, this option is the best for TFC. EXHIBIT 4:

EXHIBIT 5:

Das könnte Ihnen auch gefallen

- The Fashion Channel PDFDokument4 SeitenThe Fashion Channel PDFBharath RaghunathNoch keine Bewertungen

- The Fashion ChannelDokument4 SeitenThe Fashion ChannelmiranirfanNoch keine Bewertungen

- Fashion Case StudyDokument4 SeitenFashion Case StudySneha Daswani100% (1)

- Fashion Channel-Morteza MoghaddamDokument9 SeitenFashion Channel-Morteza MoghaddamMorteza MoghaddamNoch keine Bewertungen

- The Fashion Channel: Section-A Group - 6Dokument4 SeitenThe Fashion Channel: Section-A Group - 6Aviral SankhyadharNoch keine Bewertungen

- 03 TheFashionChannel 13Dokument6 Seiten03 TheFashionChannel 13omkar gharatNoch keine Bewertungen

- The Fashion ChannelDokument11 SeitenThe Fashion ChannelMuzamil Naeem100% (3)

- The Fashion Channel: Case Analysis IDokument11 SeitenThe Fashion Channel: Case Analysis IMeli161283Noch keine Bewertungen

- The Fashion ChannelDokument6 SeitenThe Fashion ChannelSankha BhattacharyaNoch keine Bewertungen

- The Fashion ChannelDokument11 SeitenThe Fashion ChannelPuneet Jaggi100% (2)

- The Fashion Channel Case StudyDokument3 SeitenThe Fashion Channel Case StudyMadhur PahujaNoch keine Bewertungen

- The Fashion ChannelDokument4 SeitenThe Fashion ChannelVarun LalaNoch keine Bewertungen

- Segment 2: Single Segment Approach: Fashionistas: RatingsDokument1 SeiteSegment 2: Single Segment Approach: Fashionistas: RatingsRaju SharmaNoch keine Bewertungen

- TFCDokument3 SeitenTFCRupa MishraNoch keine Bewertungen

- Analyse Exhibits 1 and 2 and Report Your Inferences.: Exhibit 1Dokument2 SeitenAnalyse Exhibits 1 and 2 and Report Your Inferences.: Exhibit 1Aratrika PaulNoch keine Bewertungen

- TFC Decision SheetDokument2 SeitenTFC Decision SheetSiddharthNoch keine Bewertungen

- Section3 TFC Group1Dokument7 SeitenSection3 TFC Group1Kenny AlphaNoch keine Bewertungen

- The Fashion ChannelDokument19 SeitenThe Fashion ChannelAmit Mehra100% (1)

- The Fashion Channel: Group 5Dokument2 SeitenThe Fashion Channel: Group 5Meme MBANoch keine Bewertungen

- Fashion Channel CaseDokument3 SeitenFashion Channel Casetahreem sultanNoch keine Bewertungen

- Current Scenario: Positioning StrategyDokument29 SeitenCurrent Scenario: Positioning Strategyshanmugamoorthy88_74Noch keine Bewertungen

- Ashish Patel Roll No. - 190101033 Section - E Q1. Calculate Margin For All Scenarios Answer: AnswerDokument3 SeitenAshish Patel Roll No. - 190101033 Section - E Q1. Calculate Margin For All Scenarios Answer: AnswerAshish PatelNoch keine Bewertungen

- The Fashion Channel: Case Analysis: Statement of The ProblemDokument2 SeitenThe Fashion Channel: Case Analysis: Statement of The ProblemShikha ThakurNoch keine Bewertungen

- The Fashion Channel - Case StudyDokument12 SeitenThe Fashion Channel - Case StudyFoshan E-MartNoch keine Bewertungen

- Case Study Analysis The Fashion ChannelDokument2 SeitenCase Study Analysis The Fashion ChannelGovind AshokkumarNoch keine Bewertungen

- Report On The Fashion ChannelDokument5 SeitenReport On The Fashion ChannelAnish AnishNoch keine Bewertungen

- The Fashion Channel: Consumer Behavior and Market SegmentationDokument1 SeiteThe Fashion Channel: Consumer Behavior and Market SegmentationLalit SapkaleNoch keine Bewertungen

- Case 5Dokument4 SeitenCase 5abhilashNoch keine Bewertungen

- TFCDokument1 SeiteTFCAyush parasharNoch keine Bewertungen

- The Fashion ChannelDokument4 SeitenThe Fashion ChannelKundan KNoch keine Bewertungen

- 1fashion TVDokument5 Seiten1fashion TVshik171294Noch keine Bewertungen

- FASHION MM9 (Ultimate Version)Dokument17 SeitenFASHION MM9 (Ultimate Version)PiyushNoch keine Bewertungen

- Problem StatementDokument2 SeitenProblem StatementRishabh JainNoch keine Bewertungen

- C2G10 TheFashionChannelDokument5 SeitenC2G10 TheFashionChannelDebankar MoulikNoch keine Bewertungen

- Fashion Channel D01Dokument7 SeitenFashion Channel D01Chitralekha SharmaNoch keine Bewertungen

- The Fashion Channel Case StudyDokument4 SeitenThe Fashion Channel Case StudyAnuj ChandaNoch keine Bewertungen

- The Fashion Channel - 10Dokument5 SeitenThe Fashion Channel - 10MISS_ARORANoch keine Bewertungen

- Section-C, Group-7 (The Fashion Channel)Dokument4 SeitenSection-C, Group-7 (The Fashion Channel)Aman kumar JhaNoch keine Bewertungen

- The Fashion Channel: Problem Statement and ChallengesDokument3 SeitenThe Fashion Channel: Problem Statement and Challengesajay mishraNoch keine Bewertungen

- The Fashion ChannelDokument8 SeitenThe Fashion Channelankitmehta23Noch keine Bewertungen

- WFA Compendium of Ad Fraud KnowledgeDokument24 SeitenWFA Compendium of Ad Fraud KnowledgeBianca IoanaNoch keine Bewertungen

- The Fashion Channel: BackgroundDokument3 SeitenThe Fashion Channel: Backgroundseptian dhanuNoch keine Bewertungen

- The Fashion Channel - Case AnalysisDokument7 SeitenThe Fashion Channel - Case AnalysisPrakarsh Aren100% (5)

- The Fashion Channel: Case StudyDokument4 SeitenThe Fashion Channel: Case StudyRachit SrivastavaNoch keine Bewertungen

- Cheaptalk Executive Summary: 1998 Mit $50K Entrepreneurship CompetitionDokument7 SeitenCheaptalk Executive Summary: 1998 Mit $50K Entrepreneurship CompetitionYiseul ChoNoch keine Bewertungen

- Group - 3 - Clean Edge Razor - Section - EDokument8 SeitenGroup - 3 - Clean Edge Razor - Section - ESalil Aggarwal100% (1)

- The Fashion ChannelDokument11 SeitenThe Fashion ChannelTejas ShahNoch keine Bewertungen

- The Fashion Channel CaseDokument2 SeitenThe Fashion Channel CaseHimanshu ChauhanNoch keine Bewertungen

- How To Set An Effective Media BudgetDokument6 SeitenHow To Set An Effective Media Budgetbernie1902Noch keine Bewertungen

- Retail 2nd AssignmentDokument3 SeitenRetail 2nd Assignmentdevi ghimireNoch keine Bewertungen

- Metabical Case SolutionDokument6 SeitenMetabical Case Solutionc_dezinz89% (19)

- Fashion Channel PDFDokument3 SeitenFashion Channel PDFPulakrit BokalialNoch keine Bewertungen

- THE DTC ADVERTISING HANDBOOK: What Works, What Doesn't, and WhyVon EverandTHE DTC ADVERTISING HANDBOOK: What Works, What Doesn't, and WhyNoch keine Bewertungen

- The Fall of Advertising and the Rise of PR (Review and Analysis of the Ries' Book)Von EverandThe Fall of Advertising and the Rise of PR (Review and Analysis of the Ries' Book)Noch keine Bewertungen

- No Sales, No Sleep: The $10 billion transform sales process to help corporate bankers and financial services salespeople win big transactions fasterVon EverandNo Sales, No Sleep: The $10 billion transform sales process to help corporate bankers and financial services salespeople win big transactions fasterNoch keine Bewertungen

- Countering Fraud for Competitive Advantage: The Professional Approach to Reducing the Last Great Hidden CostVon EverandCountering Fraud for Competitive Advantage: The Professional Approach to Reducing the Last Great Hidden CostNoch keine Bewertungen

- Banking 2020: Transform yourself in the new era of financial servicesVon EverandBanking 2020: Transform yourself in the new era of financial servicesNoch keine Bewertungen

- Life Sciences Sales Incentive Compensation: Sales Incentive CompensationVon EverandLife Sciences Sales Incentive Compensation: Sales Incentive CompensationNoch keine Bewertungen

- Indian Tourism MKTDokument4 SeitenIndian Tourism MKTSanmitra MallickNoch keine Bewertungen

- Decision Sheet Group E7 CaseDokument1 SeiteDecision Sheet Group E7 CaseSanmitra MallickNoch keine Bewertungen

- Indian Tourism MKTDokument4 SeitenIndian Tourism MKTSanmitra MallickNoch keine Bewertungen

- Business Strategy Using Financial Statements: Depreciation at Delta Air Lines and Singapore Airlines (A) Case AnalysisDokument10 SeitenBusiness Strategy Using Financial Statements: Depreciation at Delta Air Lines and Singapore Airlines (A) Case AnalysisLuo YanhanNoch keine Bewertungen

- Chetan Bhagat - Three Mistakes of My LifeDokument144 SeitenChetan Bhagat - Three Mistakes of My LifeGayathri ParthasarathyNoch keine Bewertungen

- Learning Sheet DhaniramDokument3 SeitenLearning Sheet DhaniramSanmitra MallickNoch keine Bewertungen

- AC 2010 OS July-Dec 2010Dokument1 SeiteAC 2010 OS July-Dec 2010Sanmitra MallickNoch keine Bewertungen

- South Asia On Mediumwave and Shortwave - Oct 2017 - British SW ClubDokument29 SeitenSouth Asia On Mediumwave and Shortwave - Oct 2017 - British SW ClubKasi XswlNoch keine Bewertungen

- 11 November 1997Dokument108 Seiten11 November 1997Monitoring TimesNoch keine Bewertungen

- WateenDokument35 SeitenWateenNoor E SaherNoch keine Bewertungen

- Cyber JournalismDokument85 SeitenCyber JournalismRichard SinghNoch keine Bewertungen

- Letter of IntentDokument3 SeitenLetter of Intentroi_mauricio100% (1)

- The Children's Television ActDokument10 SeitenThe Children's Television ActRizza CervantesNoch keine Bewertungen

- Carol Burnett ShowDokument13 SeitenCarol Burnett ShowJason HowardNoch keine Bewertungen

- 4 P'S of Marketing of Hero Motocorp: ProductDokument8 Seiten4 P'S of Marketing of Hero Motocorp: Productkg101981100% (1)

- Getpdf AspxDokument68 SeitenGetpdf AspxwirelesssoulNoch keine Bewertungen

- Specifications RUNCODokument4 SeitenSpecifications RUNCOSergio Diaz PereiraNoch keine Bewertungen

- Globolisation and CultureDokument4 SeitenGlobolisation and CultureDavide MwaleNoch keine Bewertungen

- Application of Statistics in Entertainment IndustryDokument20 SeitenApplication of Statistics in Entertainment IndustryBilal60% (5)

- 2016 Brooklyn Cyclones Marketing DeckDokument38 Seiten2016 Brooklyn Cyclones Marketing DeckBrooklyn CyclonesNoch keine Bewertungen

- Mass MediaDokument4 SeitenMass Medianeviem ako sa volamNoch keine Bewertungen

- Voip - Terms of Service Agreement: DisclosureDokument2 SeitenVoip - Terms of Service Agreement: DisclosureWarren WarrenNoch keine Bewertungen

- TNB The Handbook-Bulk Supply Interconnection Guideline 132kV 275kVDokument35 SeitenTNB The Handbook-Bulk Supply Interconnection Guideline 132kV 275kVMohd Azraei Mohd KhairaniNoch keine Bewertungen

- 6f52362f5df243f9ad6ee758a997114cDokument3 Seiten6f52362f5df243f9ad6ee758a997114ctetraprimigNoch keine Bewertungen

- Case 3 2 Swifter Higher Stronger DearerDokument4 SeitenCase 3 2 Swifter Higher Stronger DearerMary Rose C. LodricoNoch keine Bewertungen

- RX F10 ManualDokument45 SeitenRX F10 ManualRick LaststandNoch keine Bewertungen

- Business PlanDokument42 SeitenBusiness PlanSacHina Varshney100% (4)

- Compilation of Suggested Answers To Theory Questions Set in The Institute'S Examinations MAY, 2010 - MAY, 2017Dokument51 SeitenCompilation of Suggested Answers To Theory Questions Set in The Institute'S Examinations MAY, 2010 - MAY, 2017VenkataRajuNoch keine Bewertungen

- BMW Z3 Roadster Product Launch Case AnalysisDokument24 SeitenBMW Z3 Roadster Product Launch Case AnalysisAtin Mehra0% (1)

- Big Finish Vortex 55Dokument24 SeitenBig Finish Vortex 55P RollinsNoch keine Bewertungen

- Mini Marketing Plan For Comcast Cable 1309382047Dokument15 SeitenMini Marketing Plan For Comcast Cable 1309382047Moh SaadNoch keine Bewertungen

- Chapter 10 - Budgetary Control & Responsibility AcctDokument82 SeitenChapter 10 - Budgetary Control & Responsibility AcctPadlah Riyadi. SE., Ak., CA., MM.Noch keine Bewertungen

- Leveraging Secondary Brand Knowledge To Build Brand EquityDokument14 SeitenLeveraging Secondary Brand Knowledge To Build Brand EquityRanaKhalidTahirNoch keine Bewertungen

- PID Tel Guide - 2017 For WebDokument307 SeitenPID Tel Guide - 2017 For Webnakib sarker60% (5)

- Theory of InnovationDokument13 SeitenTheory of Innovationnagendra9900Noch keine Bewertungen

- Assembly DWG PDFDokument12 SeitenAssembly DWG PDFedn_mj1645Noch keine Bewertungen

- Project Report: Comparative Study of MARKETING Strategies of Vodafone & AIRTELDokument80 SeitenProject Report: Comparative Study of MARKETING Strategies of Vodafone & AIRTELutuutkarshNoch keine Bewertungen