Beruflich Dokumente

Kultur Dokumente

APT vs CAPM: Which Model Is More Practical

Hochgeladen von

kaps2385Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

APT vs CAPM: Which Model Is More Practical

Hochgeladen von

kaps2385Copyright:

Verfügbare Formate

FINANCIAL ECONOMICS PRESENTATION ESSAY: GROUP 3

TOPIC 3: THE ARBITRAGE PRICING MODEL STRUCTURE Arbitrage pricing theory: what is it ? How does it differ from the CAPM? Which is the more appropriate of the model? Which is more practical to use?

APT: WHAT IS IT? Arbitrage pricing theory is a new and different approach to determining asset prices. It is based on the law of one price: two items that are the same cant sell at different prices. Unlike CAPM (one factor model) the ATP is a multi-index/factor model. The primary contribution of the APT is explaining how one goes from the multi-index model to an economic equilibrium. Assumptions underlying the APT include: 1. Capital markets are perfectly competitive ( no transaction costs) 2. Investors always prefer more wealth to less wealth with certainty expectations) 3. Assumes there is a stochastic process generating asset returns 4. APT assumes a multi-factor model of asset returns (homogenous

The APT equation is as follows:

Ri ai bi1 I1 bi 2 I 2 ... bij I j i

= return on asset i during a specified time period

=expected return for asset I

= reaction/sensitivity in asset is returns to movements in a common factor

Ij

=a common factor with a zero mean that influences the returns on all assets

= a random error term with a mean of zero and a variance

2 ei

This equation is analogous to the next equation.

ai 0 1bi1 2bi 2 ... J biJ

0 = the expected return on an asset with zero systematic risk. This means it is not sensitive to

shocks.

The APT model also states that the risk premium of a stock depends on two factors: The risk premiums associated with each of the included factors; and The stocks sensitivity to each of the factors.

Riskpremium ( Ri 0 ) (1 0 )bi1 (2 0 )bi 2 ... (J 0 )biJ

If the expected risk premium on a stock were lower than the calculated risk premium in terms of the formula, the investor will sell the stock. If the expected risk premium were higher than the value, then investors would buy stocks until both sides of the equation were in balance. Arbitrage is the term used to describe how investors could go about getting this formula.

DIFFERENCES BETWEEN THE CAPM AND APT The main difference between APT and CAPM is that the CAPM approach uses a single noncompany factor and a single beta, whereas arbitrage pricing theory separates out non-company factors into as many as proves necessary. Each of these requires a separate beta. The beta of each factor is the sensitivity of the price of the security to that factor. Arbitrage pricing theory does not rely on measuring the performance of the market. Instead, APT directly relates the price of the security to the fundamental factors driving it. The problem with this is that the theory in itself provides no indication of what these factors are, so they need to be empirically determined APT is also more recent and uses a different approach to determining the asset prices. APT is a more general approach to asset pricing than CAPM which takes into account mean and variance

of asset returns, while APT instead employs various systematic risk functions to determine asset price risk and return. APT also does not rely on as many assumptions as CAPM as the design of the equation allows it to assess risk and return without them.

WHICH IS THE MOST APPROPRIATE MODEL A lot of empirical work has been done comparing the APT and CAPM to test which one is the better model. Most of the findings suggest that APT is a better model than the CAPM, such findings extend to emerging markets as well (Muzir et al, 2010: 10). However there are few studies which show that the CAPM is a better model than the APT. Muzir et al (2010: 11) did a study on the Istanbul stock exchange to compare the APT and CAPM models on their ability to predict asset returns during periods of economic crises and also comparing the performance of the two models with each other. Their sample data consists of monthly rates of return on stocks of 45 listed companies on the Istanbul stock exchange and ranges from January 1996 to December 2004. Muzit et al (2010: 15) test the hypothesis in their paper that the APT is more accurate than CAPM. Their results suggest that the APT is more accurate than CAPM in predicting stock returns when considering R2 statistics. They reach the conclusion that the APT has a higher degree of explanatory power than CAPM. Their results on the informative role of both models during economic crises seem to suggest that APT is more superior than CAPM. The results suggest that APT outperforms CAPM in reflecting the effects of economic crisis on return variation. Dhankar and Singh (2005: 14) also show that the APT is a better model than CAPM in predicting stock returns in the Indian stock exchange on weekly and monthly return data. A test that was aimed at contrasting the two models APT and CAPM was carried out by Haugen (2000). The aim of this paper was to investigate which between these two models was the best predictor of returns on assets. The period that they looked at was between 1980 and 1999 in which they analysed stocks of the largest 3500 companies in the United States. Haugen (200) regressed stock returns against the Standard & Poors 500 which is a free-float capitalization-

weighted index and recalculated betas each month, betas were used to rank the stocks and were divided into deciles. This was done in the estimation of the CAPM. In the Implementation of the

APT model six macroeconomics factors were used which were: 1. The monthly return on Treasury bills 2. The difference in the monthly return on long- and short- term Treasury bills 3. The difference in the monthly return on the Treasury bonds and low-grade corporate bonds of the same maturity 4. The monthly change in the consumer price index 5. The monthly change in industrial production 6. The beginning-of-month dividend-to-price ratio for the S&P 500 These six factors were regressed against returns on stocks in the construction of the APT model. The conclusion of the paper by Haugen (2000) was that APT model was found to predict the return on assets better than the CAPM. Lastly a paper by Singh (2008) was analysed. This paper by Singh (2008) compared CAPM and APT using macro economic variables to represent the APT factors. Singh (2008) analysed 158 Stocks listed on the Bombay stock exchange from 1991-2002. The returns were regressed on each of the macroeconomic factor separately. In his paper Singh (2008) concluded that that the APT using principal components analysis was able to explain the cross section of returns much better than the CAPM. However the factors did not have an economic interpretation. The macroeconomic factors used in this study were able to explain returns marginally better than beta alone. While this confirms that risk is multidimensional and that one should not depend on beta alone, Singh (2008) advocated for further research to identify other variables that can help explain the cross section of returns.

WHICH IS THE MORE PRACTICAL TO USE The article that we use is A multifactor approach of APT versus CAPM for the Greek stock market by Grigoris (2007).

The purpose of this article is to examine if these models work for the Greek stock market. Tests of these equilibrium models are important since they influence how the market is viewed. If either is correct, then that gives a direct influence upon how investment decisions are made and evaluated. For instance, if CAPM is true then its unnecessary to purchase anything but the market portfolio. Sample and Data Selection The data set consists of 100 stocks traded continuously on the Athens stock exchange for the period January 1997 to December 2003. This period was specifically chosen because it is characterized by intense return volatility. The period consisted of historically high returns for the Greek Stock market as well as significant decrease in asset returns. These market return characteristics make it possible to have an empirical investigation of the pricing models on differing financial conditions thus obtaining conclusions under varying stock return volatility. The paper excluded financial firms because of the high leverage that is normal for these firms do not have the same meaning as for non financial firms, where high leverage is more likely to indicate distress. Shares not included in the sample are either thinly traded or do not have accounting and financial information on a continuous basis. Athens composite share index was used as a world portfolio proxy. The world portfolio represents the total market value of all stocks (or bonds or any financial or non-financial instruments) that an investor would own if he or she bought the total of all marketable stocks on all the major stock exchanges. When choosing a proxy of world stock American market indices such as the S&P500, Dow Jones Industrial Average (DJIA) or the New York Stock Exchange (NYSE) has been rejected since reliable financial data show that a typical American investor avoids investing into foreign financial markets such as Greece.

The estimation of characteristic lines

The 100 stocks that were used were divided into portfolios according to their size as it was calculated at the end of June each year (Michailidis et al. 2007:12). Portfolios, rather than individual stocks, were used to reduce the noisiness of the data in order to diversify away most of the firm-specific part of returns and mitigate the problems that arise from measurement error in beta estimates. The first type of evidence is in what APT and CAPM can explain of the returns used in their estimation. As the single market index factor for the Capital Asset Price Model, we use the ASE Composite Share Index. To calculate APT ( arbitrage pricing model), factor scores from the monthly returns we use a multifactor pricing model in order to identify which factors best capture systematic return co-variation (risk) of the Greek equity returns (Michailidis et al. 2007:12). The linkages between equity prices and variables such as money supply, inflation and industrial production are of crucial importance not only in analyzing equity returns, but also in understanding the connections between expected returns and the real economy. From the standpoint of both the academic researcher and the investment practitioner, therefore, it is crucial to be able to identify which factors best capture the systematic components of stock return variation (Michailidis et al. 2007:12). A central empirical issue, therefore, is which factors best account for the common movements in returns. The list of candidates for factors is a long one, so a sensible process of elimination is essential. In accordance with the rational expectations and market efficiency hypothesis, the innovations in the macroeconomic series are estimated; the variables included in the return generating process are then selected on the basis of their ability to predict the factor scores estimated using Factor Analysis. The approach is to extract the principal components from the data and apply formal statistical tests to discriminate between the factors (Michailidis et al. 2007:13). The rule for selecting the variables is based on the eigenvalues that exceeds 1. The values in the column initial eigenvalues-total indicate the proportion of each variable's variance that can be explained by the principal components. Variables with values greater than 1 are well represented in the common factor space, while variables with values less than 1 are not well represented as shown by the total column of the table 1 below (Michailidis et al. 2007:13).

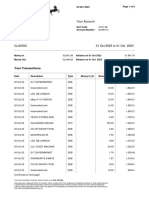

Table 1 Initial Eigenvalues

Component OILPR INDPR INF EXRA TERSTR RISKPR

Total 1.534 1.234 1.071 .848 .699 .614

% Variance 25.568 20.564 17.848 14.134 11.658 10.228

of

Cumulative % 25.568 46.132 63.980 78.114 89.772 100.000

In the second column of table (total eigenvalue) we find the variance of the factors that explain the higher percent of the total variance. As it can be seen factor 1 accounts for 26% of the variance, factor 2 for 21%, and so on (Michailidis et al. 2007:13). The third column contains the cumulative variance extracted. For example, the third factor has a cumulative value of 63.98 meaning that the first three components together account for almost 64% of the total variance. So according to the results of the PCA the macroeconomic variables of oil prices, industrial production and inflation has been selected as the macro-variables for the Arbitrage pricing model (Michailidis et al. 2007:14).

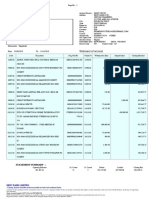

Estimates of Expected Returns For one to be concerned with the CAPMs challenge to the APT, the models must suggest different policy choices. In the study an estimated CAPM equation for all companies was made for the period 1997 to 2003 using monthly return data and each year a portfolio was then created in accordance with the portfolio size. To acquire the expected return associated with the varying levels of risk, they made use of a CAPM equation comprising of the average risk free rate and the average annual equivalent of the average relationship of return to systematic risk for all stocks on the Athens stock exchange (ref page 10).

The Rf represents the risk free rate and the Rm represents the expected return on the market. The systematic risk and required returns for each portfolio are also calculated and shown above. An analysis of the calculations made shows that low capitalisation portfolios provide better returns and less systematic risk is associated with higher returns.

The same calculations were made for the APT. it included all stocks traded on a regular basis on the Athens Stock exchange between 1997 and 2003. It was made to analyse three sectors and their various portfolio returns. These included oil prices, industrial production and inflation.

Conclusion In the study carried out it was shown that low capitalisation portfolios provided better returns than those portfolios which comprised of a big size of stocks. Small to medium sized portfolios showed less systematic risk which led to higher returns for the periods 1997 to 2003. The average mean values of the CAPM which were worked out for both models indicated that the CAPM would higher returns than the APT. The APT is clearly an improved version of the CAPM but the use of the CAPM is still necessary.

The CAPM is still necessary as in practise the APT does not work better than the CAPM. This is because the APT has estimation errors associated with it. It also does not tell the user how many factors need to be used and what those factors should be. The CAPM is much simpler and the estimation of 1 and Rm is much simpler . As advanced as the APT might be its estimation errors would seem to cancel it out. The required return acquired from it is not as accurate as that of the CAPM. The APT is much harder to understand and use and is therefore rarely used in the computation of required returns, but it does have helpful applications in investment management .

Based on evidence gathered the CAPM cannot be rejected in favour of any alternative hypothesis and performs very well against the APT as shown in the study of the Athens stock exchange. The CAPM is a reasonable model for explaining cross sectional variations in asset returns. The study can be seen as a possibly method of solving the problem as to what determines the expected returns of assets. Two approaches can be taken for this.

The first of these includes making assumptions and producing a theory that states which variables should be used in the equation and then testing it. The second of these is the examination of assets realized returns and determining empirically to which macro variables they correspond. The APT seems to be more in the spirit of the second. After accessing both models one can draw to the conclusion that putting one against the other would lead to a situation were you win some on one hand and lose some on the other hand. Instead of trying to find out which of the two models is better, one should thoroughly understand their weaknesses and strengths, so that we will know when and how, which model we can rely on in making financial decisions .

SUMMARY OF THE MAIN CONCLUSIONS: Two models must suggest different policies Low vs. Big size Stocks Why still use CAPM? Simple minded but more precise ATP has greater estimation errors ATP difficult to use Therefore: Cannot reject CAPM 2 ways to solve problem of Expected Returns on Assets Win some lose some situation

YOU TUBE LINK FOR THE VIDEO FOR MORE CLARITY http://www.youtube.com/watch?v=-0EgQ97whWg

MAIN REFERENCE: ELTON, E.J., GRUBER, M.J., BROWN, S.J. & GOETZMANN, W.N., 2007. Modern Portfolio Theory and Investment Analysis. Wiley. ADDITIONIAL REFERENCES: DHANKAR, R.S., and SINGH, R., (2005). Arbitrage Pricing Theory and The Capital Asset Pricing Model Evidence from The Indian Stock Market. Journal of Financial Management and Analysis, 18 (1): 14-27 MUZIR, E., BULUT,N., and SENGUL, S., (2010). The Prediction Performance of Asset Pricing Models and Their Capability of Capturing the Effects of Economic Crises: The Case of Istanbul Stock Exchange. Isletme Arastirmalaria Dergisi. 2 (3): 3-4 HAUGEN, RA., 2000. The secrets of the bag, how to predict results and profit shares. New York: Pearson Education. Singh, R. 2008. CAPM vs. APT with macro economic variables: evidence from the Indian stock market. Asia-Pacific Business Review. [Online]. ntent [Accessed 6 May 2010]. Available: http://findarticles.com/p/articles/mi_6771/is_1_4/ai_n28532457/pg_12/?tag=mantle_skin;co

Das könnte Ihnen auch gefallen

- Applied Econometrics: A Simple IntroductionVon EverandApplied Econometrics: A Simple IntroductionBewertung: 5 von 5 Sternen5/5 (2)

- Dissertation ProposalDokument7 SeitenDissertation ProposalAnshul RathiNoch keine Bewertungen

- An Application of Arbitrage Pricing TheoDokument7 SeitenAn Application of Arbitrage Pricing TheoHamza AlmostafaNoch keine Bewertungen

- Valuation Stocks Using DCF TechniqueDokument9 SeitenValuation Stocks Using DCF TechniqueDaris Purnomo JatiNoch keine Bewertungen

- Arbitrage Pricing Theory (APT) IntroductionDokument5 SeitenArbitrage Pricing Theory (APT) IntroductionromanaNoch keine Bewertungen

- Group Assignment CompletedDokument68 SeitenGroup Assignment CompletedHengyi LimNoch keine Bewertungen

- The APT Formula: Expected Return RF + b1 X (Factor 1) + b2 X (Factor 2) ... + BN X (Factor N)Dokument5 SeitenThe APT Formula: Expected Return RF + b1 X (Factor 1) + b2 X (Factor 2) ... + BN X (Factor N)Nisanth PramodNoch keine Bewertungen

- Econometrics - Submission M1 PDFDokument2 SeitenEconometrics - Submission M1 PDFvikrantNoch keine Bewertungen

- ProjectDokument12 SeitenProjectsumayaNoch keine Bewertungen

- Arbitrage Pricing Theory and Its Relevance in Modelling MarketDokument36 SeitenArbitrage Pricing Theory and Its Relevance in Modelling MarketHamza AlmostafaNoch keine Bewertungen

- International Journals Call For Paper HTTP://WWW - Iiste.org/journalsDokument12 SeitenInternational Journals Call For Paper HTTP://WWW - Iiste.org/journalsAlexander DeckerNoch keine Bewertungen

- FIN604 - Project - Farhan Zubair - 18164052Dokument12 SeitenFIN604 - Project - Farhan Zubair - 18164052ZNoch keine Bewertungen

- Market Microstructure Term PaperDokument20 SeitenMarket Microstructure Term PaperMburu SNoch keine Bewertungen

- Simsr International Finance Conference (SIFICODokument8 SeitenSimsr International Finance Conference (SIFICOTamalNoch keine Bewertungen

- Asset Pricing ModelDokument23 SeitenAsset Pricing ModelNirati AroraNoch keine Bewertungen

- 345 DanielDokument39 Seiten345 Danielsajidobry_847601844Noch keine Bewertungen

- Does CAPM Hold Good For Indian Stocks A Case Study of CNX Nifty ConstituentsDokument14 SeitenDoes CAPM Hold Good For Indian Stocks A Case Study of CNX Nifty Constituentsarcherselevators100% (1)

- Capm Evidence Indian Stock MarketDokument15 SeitenCapm Evidence Indian Stock MarketnipuntrikhaNoch keine Bewertungen

- Research Proposal Event StudyDokument5 SeitenResearch Proposal Event StudyTheodor Octavian GhineaNoch keine Bewertungen

- A Research Project By: Nidhi Sharma: ROLL NO.: IM-98-35 Course: Mms (5yrs.) - Vii SemDokument29 SeitenA Research Project By: Nidhi Sharma: ROLL NO.: IM-98-35 Course: Mms (5yrs.) - Vii SemkiranbjNoch keine Bewertungen

- Case Closed: Stock Market Highly Inefficient According to 45-Year StudyDokument27 SeitenCase Closed: Stock Market Highly Inefficient According to 45-Year StudybreveteNoch keine Bewertungen

- Testing The Capital Asset Pricing Model: An Econometric ApproachDokument26 SeitenTesting The Capital Asset Pricing Model: An Econometric Approachgaziz_s100% (3)

- Capital Asset Pricing ModelDokument29 SeitenCapital Asset Pricing Modelapi-3798769100% (4)

- Business Finance AssignmentDokument15 SeitenBusiness Finance AssignmentIbrahimNoch keine Bewertungen

- Perf Assignment 1Dokument7 SeitenPerf Assignment 1Blessed NyamaNoch keine Bewertungen

- Objectives: TITLE: Size and Return A Study On Indian Stock Market COMPANY NAME: SharewealthDokument5 SeitenObjectives: TITLE: Size and Return A Study On Indian Stock Market COMPANY NAME: Sharewealthanon_578178848Noch keine Bewertungen

- Predicting ETF Returns - Final ReportDokument10 SeitenPredicting ETF Returns - Final ReportNNoch keine Bewertungen

- PG 1-18 Pankaj Chaudhary Testing of CAPM in Indian ContextjjjDokument18 SeitenPG 1-18 Pankaj Chaudhary Testing of CAPM in Indian ContextjjjArka DasNoch keine Bewertungen

- Arbitrage Pricing Theory, CAPMDokument11 SeitenArbitrage Pricing Theory, CAPMMazhar HossainNoch keine Bewertungen

- An Empirical Investigation of Arbitrage Pricing Theory: A Case ZimbabweDokument14 SeitenAn Empirical Investigation of Arbitrage Pricing Theory: A Case ZimbabweZhang LongxiangNoch keine Bewertungen

- 1 SMDokument9 Seiten1 SMlongNoch keine Bewertungen

- Arbitrage Pricing TheoryDokument20 SeitenArbitrage Pricing TheoryDeepti PantulaNoch keine Bewertungen

- Efficient Market TheoryDokument6 SeitenEfficient Market TheoryRahul BisenNoch keine Bewertungen

- RB Vye Ch6 SW Q&answersDokument5 SeitenRB Vye Ch6 SW Q&answersAira Estalane100% (8)

- Journal 8 Yong112Dokument10 SeitenJournal 8 Yong112Lisa AmruNoch keine Bewertungen

- A Test of Market Efficiency Based On Share Repurchase AnnouncementsDokument13 SeitenA Test of Market Efficiency Based On Share Repurchase AnnouncementsiisteNoch keine Bewertungen

- Crafting and Validation of A Portfolio Model Predicting Market Indices Using Apt ModelDokument16 SeitenCrafting and Validation of A Portfolio Model Predicting Market Indices Using Apt ModelamitjoshiNoch keine Bewertungen

- SSRN Id1431923Dokument16 SeitenSSRN Id1431923Arwok RangonNoch keine Bewertungen

- Macroeconomic Factors and The Stock Market: Journal Buriness Financc &accountingDokument18 SeitenMacroeconomic Factors and The Stock Market: Journal Buriness Financc &accountingalfianaNoch keine Bewertungen

- Arbitrage Pricing TheoryDokument4 SeitenArbitrage Pricing TheoryShabbir NadafNoch keine Bewertungen

- APT-What Is It? Estimating and Testing APT Apt and Capm ConclusionDokument19 SeitenAPT-What Is It? Estimating and Testing APT Apt and Capm ConclusionMariya FilimonovaNoch keine Bewertungen

- SHARPE SINGLE INDEX MODEL - HarryDokument12 SeitenSHARPE SINGLE INDEX MODEL - HarryEguanuku Harry EfeNoch keine Bewertungen

- A Dea Comparison of Systematic and Lump Sum Investment in Mutual FundsDokument10 SeitenA Dea Comparison of Systematic and Lump Sum Investment in Mutual FundspramodppppNoch keine Bewertungen

- CAPM ReviewDokument24 SeitenCAPM Reviewmohsen55Noch keine Bewertungen

- AptDokument21 SeitenAptBushra HaroonNoch keine Bewertungen

- Profit Margin and Capital Structure: An Empirical RelationshipDokument4 SeitenProfit Margin and Capital Structure: An Empirical Relationshiprizki taxNoch keine Bewertungen

- Arbitrage Pricing TheoryDokument4 SeitenArbitrage Pricing TheoryRitesh JainNoch keine Bewertungen

- Efficient Market HypothesisDokument6 SeitenEfficient Market HypothesisAndrie Andycesc Amstrong LeeNoch keine Bewertungen

- 1465815374Dokument22 Seiten1465815374NeemaNoch keine Bewertungen

- Cross Section of Expected Stock Returns in Ise: June 2000Dokument28 SeitenCross Section of Expected Stock Returns in Ise: June 2000epsieurigaNoch keine Bewertungen

- Stock Market Event Studies and Competition Commission InquiriesDokument32 SeitenStock Market Event Studies and Competition Commission InquiriesDongqi QianNoch keine Bewertungen

- Equity Valuation Using MultiplesDokument38 SeitenEquity Valuation Using MultiplesHuicai MaiNoch keine Bewertungen

- Arbitrage Pricing Theory FinalDokument8 SeitenArbitrage Pricing Theory Finalshrudit SinghviNoch keine Bewertungen

- Example Paper 4Dokument6 SeitenExample Paper 4Rajendra Gibran Alvaro RamadhanNoch keine Bewertungen

- FFTFM and CAPM From ThailandDokument10 SeitenFFTFM and CAPM From ThailandKeroro GunsoNoch keine Bewertungen

- Presentation PPT (Finance)Dokument21 SeitenPresentation PPT (Finance)Muhammad Ahmed HaroonNoch keine Bewertungen

- Stock Market Portfolio Optimization Using RNNDokument58 SeitenStock Market Portfolio Optimization Using RNNShivashish BorahNoch keine Bewertungen

- Political Events Impact on Stock MarketsDokument3 SeitenPolitical Events Impact on Stock MarketsUtsav Raj PantNoch keine Bewertungen

- CAPM Vs APTDokument2 SeitenCAPM Vs APTHo Thanh QuyenNoch keine Bewertungen

- Harvard Referencing ManualsDokument29 SeitenHarvard Referencing ManualsUdithaKekulawalaNoch keine Bewertungen

- Function Hire Booking Form 2013Dokument1 SeiteFunction Hire Booking Form 2013kaps2385Noch keine Bewertungen

- Sexual Healing-Marvin GayeDokument2 SeitenSexual Healing-Marvin Gayekaps2385Noch keine Bewertungen

- UK Size GuideDokument3 SeitenUK Size Guidekaps2385Noch keine Bewertungen

- Application Form Oppidan Sub WardenDokument3 SeitenApplication Form Oppidan Sub Wardenkaps2385Noch keine Bewertungen

- AMO Potential Membership ListDokument1 SeiteAMO Potential Membership Listkaps2385Noch keine Bewertungen

- Common Core Skills Followed by Choice Why Study at UCT?Dokument3 SeitenCommon Core Skills Followed by Choice Why Study at UCT?kaps2385Noch keine Bewertungen

- Student Name: Kapembwa Nakazwe Student Number: 08N0375 Supervisor: Pro Hugo NelDokument12 SeitenStudent Name: Kapembwa Nakazwe Student Number: 08N0375 Supervisor: Pro Hugo Nelkaps2385Noch keine Bewertungen

- Companies To Look atDokument4 SeitenCompanies To Look atkaps2385Noch keine Bewertungen

- Risk-Return Relationship Is An Important Topic in The Field of Financial EconomicsDokument1 SeiteRisk-Return Relationship Is An Important Topic in The Field of Financial Economicskaps2385Noch keine Bewertungen

- Visa FormDokument1 SeiteVisa Formkaps2385Noch keine Bewertungen

- A Woman Purchases The Security of Marriage With Her Name, Her Privacy and Her CareerDokument1 SeiteA Woman Purchases The Security of Marriage With Her Name, Her Privacy and Her Careerkaps2385Noch keine Bewertungen

- LearnerRecordStandard - PDF - Adobe ReaderDokument2 SeitenLearnerRecordStandard - PDF - Adobe Readerkaps2385Noch keine Bewertungen

- Myuk Rates 2013 RebasedDokument1 SeiteMyuk Rates 2013 Rebasedkaps2385Noch keine Bewertungen

- APL Service LTD: TradingDokument2 SeitenAPL Service LTD: Tradingkaps2385Noch keine Bewertungen

- Apl Letter Head NewDokument2 SeitenApl Letter Head Newkaps2385Noch keine Bewertungen

- Apl Letter Head New 1Dokument2 SeitenApl Letter Head New 1kaps2385Noch keine Bewertungen

- District Financial Report 2013Dokument22 SeitenDistrict Financial Report 2013kaps2385Noch keine Bewertungen

- APL Trading Service Ltd - Importers & Distributors of Electrical, Mechanical Spares & Industrial ChemicalsDokument1 SeiteAPL Trading Service Ltd - Importers & Distributors of Electrical, Mechanical Spares & Industrial Chemicalskaps2385Noch keine Bewertungen

- APL Trading Service Ltd - Electrical, Mechanical and Mining Equipment SuppliesDokument1 SeiteAPL Trading Service Ltd - Electrical, Mechanical and Mining Equipment Supplieskaps2385Noch keine Bewertungen

- District Financial Report 2013Dokument22 SeitenDistrict Financial Report 2013kaps2385Noch keine Bewertungen

- APL Blank Quote NEW 2Dokument1 SeiteAPL Blank Quote NEW 2kaps2385Noch keine Bewertungen

- Freedom Park Sda Departmental Plan For Amo 2013Dokument4 SeitenFreedom Park Sda Departmental Plan For Amo 2013kaps2385Noch keine Bewertungen

- Sub: Visitation To The HospitalDokument1 SeiteSub: Visitation To The Hospitalkaps2385Noch keine Bewertungen

- Seventh Day Adventist Church AMO Report Q4 2012Dokument2 SeitenSeventh Day Adventist Church AMO Report Q4 2012kaps2385Noch keine Bewertungen

- AMO Membership EldersDokument1 SeiteAMO Membership Elderskaps2385Noch keine Bewertungen

- South African Rally 2Dokument1 SeiteSouth African Rally 2kaps2385Noch keine Bewertungen

- Adventist Men's Organization 1st Quarter Report 2013Dokument3 SeitenAdventist Men's Organization 1st Quarter Report 2013kaps2385Noch keine Bewertungen

- Amo Plan 2014Dokument4 SeitenAmo Plan 2014kaps2385Noch keine Bewertungen

- FREEDOM PARK SDA MEMBERSHIP FORMDokument3 SeitenFREEDOM PARK SDA MEMBERSHIP FORMkaps2385Noch keine Bewertungen

- Lloyds Bank 1Dokument8 SeitenLloyds Bank 1KabanNoch keine Bewertungen

- StandardDokument29 SeitenStandardlpsw2007Noch keine Bewertungen

- Unit 4 Derivatives Part 1Dokument19 SeitenUnit 4 Derivatives Part 1UnathiNoch keine Bewertungen

- Saraswat Bank ServicesDokument6 SeitenSaraswat Bank ServicesSukant PawaskarNoch keine Bewertungen

- StatementDokument2 SeitenStatementkasmarproNoch keine Bewertungen

- Balance Sheet AnalysisDokument6 SeitenBalance Sheet AnalysisSatishNoch keine Bewertungen

- Bank Statement FinalDokument2 SeitenBank Statement FinalShemeem SNoch keine Bewertungen

- Finance Function in Global ScenrioDokument15 SeitenFinance Function in Global ScenrioAmit SinhaNoch keine Bewertungen

- Quiz 562Dokument5 SeitenQuiz 562Haris NoonNoch keine Bewertungen

- Methods of Note IssueDokument8 SeitenMethods of Note IssueNeelabh KumarNoch keine Bewertungen

- Aggregation Policy SummaryDokument5 SeitenAggregation Policy SummaryjosephmeawadNoch keine Bewertungen

- Ebook College Accounting Chapters 1 15 22Nd Edition Heintz Test Bank Full Chapter PDFDokument60 SeitenEbook College Accounting Chapters 1 15 22Nd Edition Heintz Test Bank Full Chapter PDFconvive.unsadden.hgp2100% (12)

- Classifying Accounts Into Assets, Liabilities, Owners Equity, Revenue or ExpenseDokument1 SeiteClassifying Accounts Into Assets, Liabilities, Owners Equity, Revenue or ExpenseSaif Ali KhanNoch keine Bewertungen

- Cpa Review School of The Philippines: Auditing Problems Audit of Investments - Quizzers Problem No. 1Dokument4 SeitenCpa Review School of The Philippines: Auditing Problems Audit of Investments - Quizzers Problem No. 1Anthoni BacaniNoch keine Bewertungen

- BARODA - 390 003 Application Form For The Withdrawal From Provident Fund A/C Particulars of ApplicantDokument1 SeiteBARODA - 390 003 Application Form For The Withdrawal From Provident Fund A/C Particulars of Applicantmanas satapathyNoch keine Bewertungen

- Personal FinanceDokument32 SeitenPersonal FinancePrincess MogulNoch keine Bewertungen

- Registration With SEBI As Merchant Banker and Other MaterialDokument5 SeitenRegistration With SEBI As Merchant Banker and Other Materialapi-3727090100% (3)

- BaringsDokument24 SeitenBaringsmnar2056481100% (1)

- Transaction Slip LatestDokument1 SeiteTransaction Slip LatestIrene Rechelle Rebanal-FajaritoNoch keine Bewertungen

- Module 5 - Cost of Capital - QuestionsDokument7 SeitenModule 5 - Cost of Capital - QuestionsLAKSHYA AGARWALNoch keine Bewertungen

- CH 1 Quantitative - Methods RVF45YESAU PDFDokument308 SeitenCH 1 Quantitative - Methods RVF45YESAU PDFSiravit AriiazNoch keine Bewertungen

- QA Cash Flow Statement 25.1.2010 PDFDokument8 SeitenQA Cash Flow Statement 25.1.2010 PDFJanine padronesNoch keine Bewertungen

- Bank Al Habib Effective AssignmentDokument35 SeitenBank Al Habib Effective AssignmentAhmed Jan DahriNoch keine Bewertungen

- Global Power and Global Government by Andrew Gavin MarshallDokument96 SeitenGlobal Power and Global Government by Andrew Gavin MarshallsylodhiNoch keine Bewertungen

- Lecture Course Week 2Dokument61 SeitenLecture Course Week 2juanpablooriolNoch keine Bewertungen

- Tobin's Portfolio Approach To Demand For MoneyDokument15 SeitenTobin's Portfolio Approach To Demand For MoneyKushagra Pratap SinghNoch keine Bewertungen

- PGP37235 BDC Assignment 8Dokument1 SeitePGP37235 BDC Assignment 8mavin avengersNoch keine Bewertungen

- Mission and Vision of The BSPDokument3 SeitenMission and Vision of The BSPAnonymous loixthr100% (1)

- Republic of The Philippines Department of Education Public Technical - Vocational High SchoolsDokument10 SeitenRepublic of The Philippines Department of Education Public Technical - Vocational High SchoolsKristel AcordonNoch keine Bewertungen

- Sub Order Labels PDFDokument90 SeitenSub Order Labels PDFVishal ChauhanNoch keine Bewertungen