Beruflich Dokumente

Kultur Dokumente

Credit Default Swaps

Hochgeladen von

Abhijeit BhosaleCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Credit Default Swaps

Hochgeladen von

Abhijeit BhosaleCopyright:

Verfügbare Formate

CREDIT DEFAULT SWAPS

A credit default swap (CDS) is a swap contract in which the buyer of the CDS makes a series of payments to the seller and, in exchange, receives a payoff if a credit instrument (typically a bond or loan) goes into default (fails to pay). Less commonly, the credit event that triggers the payoff can be a company undergoing restructuring, bankruptcy, or even just having its credit rating downgraded. CDS contracts have been compared with insurance, because the buyer pays a premium and, in return, receives a sum of money if one of the events specified in the contract occurs. However, there are a number of differences between CDS and insurance, for example: 1.The buyer of a CDS does not need to own the underlying security or other form of credit exposure; in fact the buyer does not even have to suffer a loss from the default event.In contrast, to purchase insurance, the insured is generally expected to have an insurable interest such as owning a debt obligation; 2. The seller need not be a regulated entity; 3. The seller is not required to maintain any reserves to pay off buyers, although major CDS dealers are subject to bank capital requirements; PARTIES INVOLVED IN SWAP 1. Protectiuon Buyer PB 2. Protection Seller PS 3. Reference entity RE

If the reference entity defaults, one of two things can happen: 1. Either the investor delivers a defaulted asset to PS for a payment of the par value. This is known as physical settlement. 2. PS pays the investor the difference between the par value and the market price of a specified debt obligation (even if RE defaults, there is usually some recovery, i.e., not all your money will be lost.) This is known as cash settlement CDS SPREAD The "spread" of a CDS is the annual amount the protection buyer must pay the protection seller over the length of the contract, expressed as a percentage of the notional amount. For example, if the CDS spread of RE is 50 basis points, or 0.5% (1 basis point = 0.01%), then an investor buying $10 million worth of protection from PB must pay the bank $50,000 per year. These payments continue until either the CDS contract expires or RE defaults. HISTORY Forms of Credit Default Swaps had been in existence from at least the early 1990s, but the modern Credit Default Swaps were invented in 1997 by a team working for JPMorgan Chase. The first CDS involved JPMorgan selling the credit risk of Exxon to the European Bank of Reconstruction and Development

MARKETS IN 2008 The market size for Credit Default Swaps began to grow rapidly from 2003; by the end of 2007, the CDS market had a notional value of $45 trillion. But notional amount began to fall during 2008

The market for Credit Default Swaps attracted considerable concern from regulators after a number of large scale incidents in 2008 , starting with the collapse of Bear Stearns In September the bankruptcy of Lehman Brothers caused a total close to $400 billion to become payable to the buyers of CDS protection referenced against the insolvent bank. However the net amount that changed hands was around $7.2 billion [16] This difference is due to the process of 'netting'. Market participants co-operated so that CDS sellers were allowed to deduct from their payouts the inbound funds due to them from their hedging positions Also in September American International Group (AIG) required a federal bailout because it had been excessively selling CDS protection without hedging against the possibility that the reference entities might decline in value, which exposed the insurance giant to potential losses over $100 Billion In 2008 there was no centralized exchange or clearing house for CDS transactions; they were all done over the counter (OTC). This led to recent calls for the market to open up in terms of transparency and regulation[18]. In November, DTCC, which runs a warehouse for CDS trade confirmations accounting for around 90% of the total market[19], announced that it will release market data on the outstanding notional of CDS trades on a weekly basis.

2009 There are some globally agreed standards falling into place in March 2009, administered by International Swaps and Derivatives Association (ISDA). The key changes are: 1. The introduction of central clearing houses, one for the US and one for Europe. A clearing house acts as the central counterparty to both sides of a CDS transaction, thereby reducing the counterparty risk that both buyer and seller face. 2. The international standardization of CDS contracts, to prevent legal disputes in ambiguous cases where its not clear what the payout should be. 3. A naked CDS is one where the buyer has no risk exposure to the underlying entity; hence naked CDSs do not hedge risk per se, but are mere speculative bets that actually create risk. Some suggest that buyers be required to have a "stake," or element of risk exposure, in the underlying entity that the CDS pays out on MARKET DATA http://www.dtcc.com/products/derivserv/data_table_i.php? id=table6_previous

Das könnte Ihnen auch gefallen

- The Declaration of Independence: A Play for Many ReadersVon EverandThe Declaration of Independence: A Play for Many ReadersNoch keine Bewertungen

- Office Assistant I (Keyboarding): Passbooks Study GuideVon EverandOffice Assistant I (Keyboarding): Passbooks Study GuideNoch keine Bewertungen

- Off Shore CompaniesDokument9 SeitenOff Shore Companieskainat safdarNoch keine Bewertungen

- AAOD Affiant Affidavit of Denial Versus Instrument ClaimDokument5 SeitenAAOD Affiant Affidavit of Denial Versus Instrument ClaimAshely BlackwelNoch keine Bewertungen

- PrintableDokument2 SeitenPrintableapi-309082881Noch keine Bewertungen

- Death ClaimsDokument60 SeitenDeath ClaimsSiddhartha SinhaNoch keine Bewertungen

- Doctorine of Equitable ConversionDokument1 SeiteDoctorine of Equitable ConversionZarba Khan100% (1)

- 18-10-05 - Loan Procedure 2015Dokument198 Seiten18-10-05 - Loan Procedure 2015molla fentayeNoch keine Bewertungen

- Keyes - NOTICE of Deficiency Re Proof of Service (#12, June 10, 2009)Dokument1 SeiteKeyes - NOTICE of Deficiency Re Proof of Service (#12, June 10, 2009)tesibriaNoch keine Bewertungen

- Letters of Credit Cases FTDokument67 SeitenLetters of Credit Cases FTeNoch keine Bewertungen

- Clarkson14e - PPT - ch28 Skip Banking in The Digital AgeDokument65 SeitenClarkson14e - PPT - ch28 Skip Banking in The Digital AgeBao PhamNoch keine Bewertungen

- Advantages of Trade CreditDokument22 SeitenAdvantages of Trade CredityadavgunwalNoch keine Bewertungen

- Defences Available in Defamation ClaimsDokument3 SeitenDefences Available in Defamation Claimsrajarshi raghuvanshiNoch keine Bewertungen

- Exhibit DocumentDokument38 SeitenExhibit DocumentDinSFLANoch keine Bewertungen

- This Content Downloaded From 141.211.4.224 On Wed, 05 Aug 2020 17:16:17 UTCDokument28 SeitenThis Content Downloaded From 141.211.4.224 On Wed, 05 Aug 2020 17:16:17 UTCRaymond Behnke [STUDENT]Noch keine Bewertungen

- BlockFi-Loan-Template-9 26 19 2Dokument27 SeitenBlockFi-Loan-Template-9 26 19 2Andrés MuñozNoch keine Bewertungen

- CreditDokument62 SeitenCreditapi-262728967Noch keine Bewertungen

- Application For Corporate Net BankingDokument9 SeitenApplication For Corporate Net BankingGosswin Gnanam G100% (1)

- D C O A O T S O F: Istrict Ourt F Ppeal F HE Tate F LoridaDokument7 SeitenD C O A O T S O F: Istrict Ourt F Ppeal F HE Tate F LoridaForeclosure FraudNoch keine Bewertungen

- Defamation PDFDokument3 SeitenDefamation PDFRanjan BaradurNoch keine Bewertungen

- 08 ReinertDokument29 Seiten08 ReinertKNOWLEDGE SOURCENoch keine Bewertungen

- New I-9 Forms RequiredDokument5 SeitenNew I-9 Forms RequiredBruce CrossNoch keine Bewertungen

- Banking MaterialDokument87 SeitenBanking Materialmuttu&moonNoch keine Bewertungen

- Applicant Guidance NotesDokument29 SeitenApplicant Guidance NotesJervan KhouNoch keine Bewertungen

- Veale v. CITIBANK, F.S.B., 85 F.3d 577, 11th Cir. (1996)Dokument6 SeitenVeale v. CITIBANK, F.S.B., 85 F.3d 577, 11th Cir. (1996)Scribd Government DocsNoch keine Bewertungen

- Undertaking of BorrowersDokument1 SeiteUndertaking of BorrowersInes Hamoy JunioNoch keine Bewertungen

- Letters of Credit and Trust Receipts LawDokument7 SeitenLetters of Credit and Trust Receipts Lawpaul esparagozaNoch keine Bewertungen

- Assignment of Personal FinancingDokument11 SeitenAssignment of Personal FinancingRimpy GeraNoch keine Bewertungen

- 1.3 Describe Factors That May Impact Upon The Development of The Baby During: Pre-ConceptionDokument2 Seiten1.3 Describe Factors That May Impact Upon The Development of The Baby During: Pre-Conceptionjoel TorresNoch keine Bewertungen

- Pew Prepaid Checking Report - 9'12Dokument39 SeitenPew Prepaid Checking Report - 9'12Tarjeta 24/7Noch keine Bewertungen

- Zarro Inference 3 The Affidavits of Michael ZarroDokument190 SeitenZarro Inference 3 The Affidavits of Michael ZarroDeontosNoch keine Bewertungen

- Buczek Habeas Corpus Petition 54 & 121 & 141Dokument68 SeitenBuczek Habeas Corpus Petition 54 & 121 & 141Bob HurtNoch keine Bewertungen

- The Nature of Credit Instruments - A Credit InstrumentDokument2 SeitenThe Nature of Credit Instruments - A Credit Instrumentjoshua aguirreNoch keine Bewertungen

- 0 Ebook 8 Templates 3Dokument12 Seiten0 Ebook 8 Templates 3Glenn MozleyNoch keine Bewertungen

- Quarterly Federal Excise Tax Return: For Irs Use OnlyDokument7 SeitenQuarterly Federal Excise Tax Return: For Irs Use OnlyIRSNoch keine Bewertungen

- RBC Mortgage Discharge - LienDokument14 SeitenRBC Mortgage Discharge - Liencondomadness13Noch keine Bewertungen

- Credit Derivatives Not InsuranceDokument59 SeitenCredit Derivatives Not InsuranceGlobalMacroForumNoch keine Bewertungen

- Secured Credit CardsDokument4 SeitenSecured Credit Cardsjeremyyu2003Noch keine Bewertungen

- Duke Energy PremierNotes ProspectusDokument37 SeitenDuke Energy PremierNotes ProspectusshoppingonlyNoch keine Bewertungen

- Dispute Resolution FormDokument3 SeitenDispute Resolution Formmerlin masterchiefNoch keine Bewertungen

- Return Instructions: Upload/Secure MessageDokument9 SeitenReturn Instructions: Upload/Secure MessageRemyNoch keine Bewertungen

- Mode of SecurityDokument5 SeitenMode of SecurityFazle MahmudNoch keine Bewertungen

- US SignUp Forms 9-9-9Dokument17 SeitenUS SignUp Forms 9-9-9anysia0Noch keine Bewertungen

- Law - Trust AccountingDokument2 SeitenLaw - Trust AccountingjoanabudNoch keine Bewertungen

- Financing An Overseas Veterinary Education For U.S. CitizensDokument7 SeitenFinancing An Overseas Veterinary Education For U.S. Citizensscott quakkelaar100% (1)

- Everything You Wanted TO Know About Construction Bonds: An Ebook Written by Thomas M. HesterDokument14 SeitenEverything You Wanted TO Know About Construction Bonds: An Ebook Written by Thomas M. HesterlachuchaferozNoch keine Bewertungen

- CAP Regulation 60-1 - 10/19/2004Dokument43 SeitenCAP Regulation 60-1 - 10/19/2004CAP History LibraryNoch keine Bewertungen

- Weintraub v. QUICKEN LOANS, INC, 594 F.3d 270, 4th Cir. (2010)Dokument12 SeitenWeintraub v. QUICKEN LOANS, INC, 594 F.3d 270, 4th Cir. (2010)Scribd Government DocsNoch keine Bewertungen

- Preview 2780 10Dokument2 SeitenPreview 2780 10Sylvester MooreNoch keine Bewertungen

- When A Non Bank Issues A Letter of CreditDokument3 SeitenWhen A Non Bank Issues A Letter of Creditvodka_taste2882Noch keine Bewertungen

- Did You Receive A Proper Notice of AccelerationDokument2 SeitenDid You Receive A Proper Notice of AccelerationwicholacayoNoch keine Bewertungen

- Important Notes in Constitutional Law IIDokument147 SeitenImportant Notes in Constitutional Law IIThe man with a Square stacheNoch keine Bewertungen

- Account Opening FormDokument3 SeitenAccount Opening FormJoseph VJNoch keine Bewertungen

- Debt Validation LetterDokument1 SeiteDebt Validation LetterRichardNoch keine Bewertungen

- 1951 DDokument8 Seiten1951 Datp5eNoch keine Bewertungen

- INSERT # Senate DistrictDokument10 SeitenINSERT # Senate District83jjmack100% (1)

- Recipe and subpoena duces tecum formDokument2 SeitenRecipe and subpoena duces tecum formAnatoly Mazi Moore ElNoch keine Bewertungen

- Construction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerVon EverandConstruction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerNoch keine Bewertungen

- Internet Download Manager A Complete Guide - 2019 EditionVon EverandInternet Download Manager A Complete Guide - 2019 EditionNoch keine Bewertungen

- Amended Regulations ATKTDokument3 SeitenAmended Regulations ATKTAbhijeit BhosaleNoch keine Bewertungen

- A Summer Internship Project On Investment Pattern On The Basis of Risk Profile of InvestorsDokument84 SeitenA Summer Internship Project On Investment Pattern On The Basis of Risk Profile of InvestorsprashantNoch keine Bewertungen

- Cost Sheet FormatDokument1 SeiteCost Sheet FormatAbhijeit BhosaleNoch keine Bewertungen

- Copper FuturesDokument4 SeitenCopper FuturesAbhijeit BhosaleNoch keine Bewertungen

- A Summer Internship Project On Investment Pattern On The Basis of Risk Profile of InvestorsDokument84 SeitenA Summer Internship Project On Investment Pattern On The Basis of Risk Profile of InvestorsprashantNoch keine Bewertungen

- SebiDokument7 SeitenSebiAbhijeit BhosaleNoch keine Bewertungen

- A Summer Internship Project On Investment Pattern On The Basis of Risk Profile of InvestorsDokument84 SeitenA Summer Internship Project On Investment Pattern On The Basis of Risk Profile of InvestorsprashantNoch keine Bewertungen

- SIES College of Com. & Eco.: Exit WelcomeDokument20 SeitenSIES College of Com. & Eco.: Exit WelcomeAbhijeit BhosaleNoch keine Bewertungen

- Research PaperDokument4 SeitenResearch PaperAbhijeit BhosaleNoch keine Bewertungen

- Microfinance in IndiaDokument65 SeitenMicrofinance in IndiaAbhijeit Bhosale100% (1)

- Mutual FundsDokument32 SeitenMutual Fundsapi-3702030100% (3)

- Interest Rate SwapsDokument4 SeitenInterest Rate SwapsAbhijeit BhosaleNoch keine Bewertungen

- MCX SXDokument3 SeitenMCX SXAbhijeit BhosaleNoch keine Bewertungen

- 634221160665942500Dokument18 Seiten634221160665942500Mustakim Al RashidNoch keine Bewertungen

- Laws of Nature Are Descriptive Not PrescriptiveDokument14 SeitenLaws of Nature Are Descriptive Not PrescriptiveAbhijeit BhosaleNoch keine Bewertungen

- Currency SwapDokument7 SeitenCurrency SwapAbhijeit BhosaleNoch keine Bewertungen

- Case Study BondsDokument5 SeitenCase Study BondsAbhijeit BhosaleNoch keine Bewertungen

- 10 Merchant BankingDokument68 Seiten10 Merchant Bankingpoojamacwan67% (3)

- Contract For DifferencesDokument3 SeitenContract For DifferencesAbhijeit BhosaleNoch keine Bewertungen

- IbpspoDokument46 SeitenIbpspoRaghuNoch keine Bewertungen

- CarDokument3 SeitenCarmanudon07Noch keine Bewertungen

- Mutual FundsDokument32 SeitenMutual Fundsapi-3702030100% (3)

- Liked This FAQDokument91 SeitenLiked This FAQAbhijeit BhosaleNoch keine Bewertungen

- Traditional & Modern Theory ApproachDokument12 SeitenTraditional & Modern Theory Approachyash shah78% (9)

- Dcom510 Financial DerivativesDokument238 SeitenDcom510 Financial DerivativesRavi Kant sfs 1Noch keine Bewertungen

- Corporate Accounting TransactionsDokument7 SeitenCorporate Accounting TransactionsJohncel Tawat100% (1)

- Assessing A Company's Future Financial HealthDokument2 SeitenAssessing A Company's Future Financial Healthdump119100% (2)

- Managing Diversification SSRN-id1358533Dokument23 SeitenManaging Diversification SSRN-id1358533mshuffma971518Noch keine Bewertungen

- IFA-II CH-3 InvestmentDokument61 SeitenIFA-II CH-3 InvestmentBikila MalasaNoch keine Bewertungen

- Assignment 3 ECON 401Dokument4 SeitenAssignment 3 ECON 401aleena asifNoch keine Bewertungen

- Company Law Ii Maintenance of CapitalDokument4 SeitenCompany Law Ii Maintenance of CapitalIntanNoch keine Bewertungen

- Overview of Financial Management and The Financial EnvironmentDokument27 SeitenOverview of Financial Management and The Financial EnvironmentsoochwelfareNoch keine Bewertungen

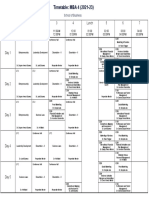

- SOB TIME TABLE W.E.F. 16-1-2023Dokument6 SeitenSOB TIME TABLE W.E.F. 16-1-2023Shreshth Gupta 21bce053Noch keine Bewertungen

- International Finance Final ProjectDokument2 SeitenInternational Finance Final ProjectAshna KoshalNoch keine Bewertungen

- Purchasing Objectives and ResponsibilitiesDokument10 SeitenPurchasing Objectives and ResponsibilitiesSanskar AgrawalNoch keine Bewertungen

- Portfolio's KPIs Calculations TemplateDokument7 SeitenPortfolio's KPIs Calculations TemplateGARVIT GoyalNoch keine Bewertungen

- STT-ExplosiveProfitGuide v1c PDFDokument23 SeitenSTT-ExplosiveProfitGuide v1c PDFIoannis Michelis100% (2)

- Philippine Management Review 2020, Vol. 27, 17-36Dokument20 SeitenPhilippine Management Review 2020, Vol. 27, 17-36stephen_palmer_uy6978Noch keine Bewertungen

- Q Mar22Dokument9 SeitenQ Mar22user mrmysteryNoch keine Bewertungen

- Answers To The Chapter ExercisesDokument14 SeitenAnswers To The Chapter ExercisesSamina MahmoodNoch keine Bewertungen

- Week 1 GroupDokument2 SeitenWeek 1 GroupConner Becker100% (1)

- Prelim Exam - For PrintingDokument4 SeitenPrelim Exam - For PrintingThat's FHEVulousNoch keine Bewertungen

- Statement of Cash Flows: Learning ObjectivesDokument49 SeitenStatement of Cash Flows: Learning ObjectivesPrima Rosita AriniNoch keine Bewertungen

- CF ReformDokument40 SeitenCF ReformJerry LoNoch keine Bewertungen

- Intermidiate Accounting 4Dokument4 SeitenIntermidiate Accounting 4BABANoch keine Bewertungen

- Understanding the Importance of Accurate Binomial Option Pricing ModelsDokument17 SeitenUnderstanding the Importance of Accurate Binomial Option Pricing ModelsresbickrayNoch keine Bewertungen

- Barrons - 2020 12 21Dokument77 SeitenBarrons - 2020 12 21scribdggg100% (1)

- Bruce Berkowitz's Fairholme Fund 2015 Semi-Annual Portfolio Manager's LettersDokument5 SeitenBruce Berkowitz's Fairholme Fund 2015 Semi-Annual Portfolio Manager's LettersCharlie Tian100% (1)

- UntitledDokument102 SeitenUntitledPrima AditNoch keine Bewertungen

- 5 FIN555 2 Format Assignment 1 Chap 11-16 2022 PJJDokument11 Seiten5 FIN555 2 Format Assignment 1 Chap 11-16 2022 PJJAzrul IkhwanNoch keine Bewertungen

- Comparing CAPM and APT Methods for Calculating Expected Returns of Manufacturing CompaniesDokument9 SeitenComparing CAPM and APT Methods for Calculating Expected Returns of Manufacturing CompaniesAyu WidiaNoch keine Bewertungen

- Black-Scholes Option Pricing Formulas GuideDokument11 SeitenBlack-Scholes Option Pricing Formulas Guidebodong408Noch keine Bewertungen

- IA2 06 - Handout - 1 PDFDokument5 SeitenIA2 06 - Handout - 1 PDFMelchie RepospoloNoch keine Bewertungen