Beruflich Dokumente

Kultur Dokumente

Q7. If The Annual Premium For A Plan Is 32000 and A Frequency Loading of 4% Is Added in A Quarterly Premium What Is The Amount That Needs To Be Paid

Hochgeladen von

Jagadeesh GoudOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Q7. If The Annual Premium For A Plan Is 32000 and A Frequency Loading of 4% Is Added in A Quarterly Premium What Is The Amount That Needs To Be Paid

Hochgeladen von

Jagadeesh GoudCopyright:

Verfügbare Formate

Q7.

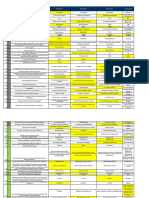

If the annual premium for a plan is 32000 and a frequency loading of 4% is added in a quarterly premium what is the amount that needs to be paid. 1. 8000 2. 8320 3. 9456 4. 9240 Q12.An insurance contract commences when 1. Quotation is signed by proposer. 2. First Premium Receipt is issued. 3. Proposal Form is signed. 4. Policy Document is received by policyholder. While calculating HLV along with future income, no Q16.of years of work, increments in salary what is also 3 to be taken in to account? 1. Inflation. 2. Interest. 3. Discount rate 4. Compounding. An investor holds a wide range of shares. If the Reserve Bank of India announces a series of Q24. significant interest rate increases, the prices of these shares are most likely to 1. Become volatile 2. Decrease 3. Increase 4. Remain unchanged Q27.In Daily hospitalization cash benefit scheme, 1. The daily amount paid is fixed and will never be more or less than the cost of actual treatment. 2. The insurance company may pay an additional amount on a daily basis if the insured is admitted to the Intensive Care Unit (ICU). 3. The insurance company will pay for doctor consultation fees incurred prior to hospitalization 4. Only surgery expenses are included in daily hospitalization benefit

2

Mr.Feroz has taken policy for critical illness worth Rs.1 lakh in health policy. He also has a term plan worth Rs.10 lakhs. Mr.Feroz was hospitalized after 1 Q42. he was detected with cancer .Unfortunately he died after 3 days of treatment. How the claim will be settled? 1. claim of critical illness and 10 lakh from term policy will be settled 2. claim of hospital charge Rs 20,000 and 1 lakh for death will be settled 3. Claim will not be settled as he died due to cancer 4. Claim will be settled as per the instructions of underwriter Mr.Baskar had taken a Term plan for a sum assured of Rs. 7 lakhs. He also has an ADB rider Q43.worth Rs. 4 lakhs. Unfortunately Baskar died in a 3 car accident. How much will be the death claim settlement? 1. Total 7 lakhs will be paid as death had taken place 2. Total 4 lakhs will be paid as death had happened due to car accident 3. Total 11 lakhs will be paid 4. Total 7 lakhs will be paid without any deduction.

Q20. Where annually increasing flexible premiums operate under a life insurance policy, what rate of increase will generally apply? 0.025 0.03 0.05 0.075 Q39. Which one of the following factor does not help in the Persistency ?

Regular reminders about the premium to the customer Flexibility of Premium payment to the customer

[1 Marks]

[1 Marks]

Dispatching Discharge voucher to the customer Continuous servicing of the policy

Das könnte Ihnen auch gefallen

- Secreg - Gun Jumping Exam SheetDokument5 SeitenSecreg - Gun Jumping Exam SheetRaj VashiNoch keine Bewertungen

- Morgan MotorsDokument17 SeitenMorgan MotorsKashaanNazikBalochNoch keine Bewertungen

- Zurich Agency Network: Easy Reference HandbookDokument28 SeitenZurich Agency Network: Easy Reference HandbookIkhwanul Shafiq0% (1)

- C12 Study 4: Anatomy of A Property Policy: Overview: Answer KeyDokument5 SeitenC12 Study 4: Anatomy of A Property Policy: Overview: Answer KeyStef CNoch keine Bewertungen

- Pru HI 6th Edition (4 Sets of Mock Combined)Dokument51 SeitenPru HI 6th Edition (4 Sets of Mock Combined)thth943Noch keine Bewertungen

- MCQ Chapter5645644645632Dokument15 SeitenMCQ Chapter5645644645632bharath834Noch keine Bewertungen

- Traditional Life Licensing Mock Exam (Set D) : Instructions: Please Encircle The Correct AnswerDokument8 SeitenTraditional Life Licensing Mock Exam (Set D) : Instructions: Please Encircle The Correct AnswerKenneth QuiranteNoch keine Bewertungen

- Digital Banking Playbook Final 1Dokument21 SeitenDigital Banking Playbook Final 1hiteshgoel100% (2)

- Preqin - Corp Investor - IndiaDokument21 SeitenPreqin - Corp Investor - Indiasavan anvekarNoch keine Bewertungen

- Working Capital Management - VizagDokument93 SeitenWorking Capital Management - VizagSahil Goutham100% (1)

- Sample Paper Irda ExamDokument19 SeitenSample Paper Irda ExamPrateek GargNoch keine Bewertungen

- Rnis College of Insurance: New Ic 33 - Model Test 4Dokument6 SeitenRnis College of Insurance: New Ic 33 - Model Test 4Raj Kumar DepalliNoch keine Bewertungen

- LIC-IRDA Exam-1Dokument10 SeitenLIC-IRDA Exam-1umesh50% (2)

- LIC ExamDokument11 SeitenLIC ExamumeshNoch keine Bewertungen

- Mock Test AnswersDokument19 SeitenMock Test Answerstoll_meNoch keine Bewertungen

- Insurance Objective Qtn&AnsDokument26 SeitenInsurance Objective Qtn&AnsSsengondo100% (1)

- Principles of Insurance (Chapter - Unit 2) Solved MCQs (Set-1)Dokument5 SeitenPrinciples of Insurance (Chapter - Unit 2) Solved MCQs (Set-1)ANURAGNoch keine Bewertungen

- Rnis College of Insurance: New Ic 33 - Model Test 3Dokument6 SeitenRnis College of Insurance: New Ic 33 - Model Test 3Raj Kumar DepalliNoch keine Bewertungen

- Online+trad.+ic+mock+exam 09262023Dokument9 SeitenOnline+trad.+ic+mock+exam 09262023Sonny CandidoNoch keine Bewertungen

- RCM QuestionsDokument2 SeitenRCM Questionsbaljeet.kaur.mumNoch keine Bewertungen

- Traditional Life ReviewerDokument25 SeitenTraditional Life ReviewerTrisha AllysonNoch keine Bewertungen

- Practice QuestionsDokument109 SeitenPractice QuestionsDc Maxx37% (19)

- Insurance CFPDokument166 SeitenInsurance CFPAbhinav MandlechaNoch keine Bewertungen

- Practicer TestsDokument3 SeitenPracticer TestsJoydeep BhattacharyyaNoch keine Bewertungen

- Mock Exam Questions WUEDokument37 SeitenMock Exam Questions WUEMr. Ahsan Jamal ahsan.jamal0% (1)

- QUESTION One (Multiple Choice) : Insurance Company OperationsDokument14 SeitenQUESTION One (Multiple Choice) : Insurance Company Operationsmamush fikaduNoch keine Bewertungen

- PCE Mock Examination - Set 2: Hong Leong Assurance Berhad (94613-X) Financial Services Academy (Jul 2011Dokument19 SeitenPCE Mock Examination - Set 2: Hong Leong Assurance Berhad (94613-X) Financial Services Academy (Jul 2011Zarina GhazaliNoch keine Bewertungen

- M5 V1.5 Combined 1 Oct 2022Dokument717 SeitenM5 V1.5 Combined 1 Oct 2022AshNoch keine Bewertungen

- Presented By: Mr. Rashmi Ranjan PanigrahiDokument35 SeitenPresented By: Mr. Rashmi Ranjan PanigrahiRashmi Ranjan PanigrahiNoch keine Bewertungen

- Passing - Mantra: C. Section 39Dokument24 SeitenPassing - Mantra: C. Section 39Mahesh AgrawalNoch keine Bewertungen

- The Pre Contract Examination: English Sample Question Chapter by ChapterDokument33 SeitenThe Pre Contract Examination: English Sample Question Chapter by ChapterKishenthi KerisnanNoch keine Bewertungen

- Employee Benefits: Qualified Retirement Plans: OverviewDokument14 SeitenEmployee Benefits: Qualified Retirement Plans: OverviewAtticus SinNoch keine Bewertungen

- Mock Test - 1-1473080346944 PDFDokument7 SeitenMock Test - 1-1473080346944 PDFSonali DulwaniNoch keine Bewertungen

- Insurance Exam Text B.CDokument18 SeitenInsurance Exam Text B.CbdndjNoch keine Bewertungen

- Aiibf MCQ Ic 14 Chap 8Dokument2 SeitenAiibf MCQ Ic 14 Chap 8AMIT BHATIANoch keine Bewertungen

- IRDA Agent Exam Sample Paper 1Dokument12 SeitenIRDA Agent Exam Sample Paper 1Awdhesh SoniNoch keine Bewertungen

- IRDA Workbook PDFDokument662 SeitenIRDA Workbook PDFNancy Singh100% (1)

- CLAIM NOTES pdf-1 PDFDokument9 SeitenCLAIM NOTES pdf-1 PDFJackson Mkwasa100% (1)

- Ic 14Dokument3 SeitenIc 14Saurabh Singh50% (2)

- IC 11 PractisesDokument287 SeitenIC 11 PractisesaashishNoch keine Bewertungen

- Chapter 9 Test Risk ManagementDokument18 SeitenChapter 9 Test Risk ManagementNicole LabbaoNoch keine Bewertungen

- Ic38 Mock Test EnglishDokument3 SeitenIc38 Mock Test Englishmanish0% (1)

- Mock TestDokument11 SeitenMock TestSnehil SinghNoch keine Bewertungen

- Chapter 9 Test Risk ManagementDokument18 SeitenChapter 9 Test Risk ManagementEymard Siojo0% (1)

- 200 IC 33 Test QuestionsDokument36 Seiten200 IC 33 Test QuestionsDinesh KatochNoch keine Bewertungen

- IC 33 Mock TestDokument66 SeitenIC 33 Mock TestAnkur K ZaverriNoch keine Bewertungen

- Ic33 Print Out 660 English PDFDokument54 SeitenIc33 Print Out 660 English PDFumesh100% (1)

- 613a - Principles of Insurance IIDokument23 Seiten613a - Principles of Insurance IIRavi ShankarNoch keine Bewertungen

- Life Ic Reviewer 2017Dokument9 SeitenLife Ic Reviewer 2017SHENNA ALLAM0% (1)

- Department of Business Administration 16 UBM 515 - Insurance Principles and Practices Multiple Choice Questions Unit-IDokument18 SeitenDepartment of Business Administration 16 UBM 515 - Insurance Principles and Practices Multiple Choice Questions Unit-IAman SharmaNoch keine Bewertungen

- Credit Point SystemDokument3 SeitenCredit Point Systemshanmuga89Noch keine Bewertungen

- ReinsuranceDokument20 SeitenReinsuranceJay KoliNoch keine Bewertungen

- CEILLI New Edition Questions English Set 1 PDFDokument19 SeitenCEILLI New Edition Questions English Set 1 PDFTillie LeongNoch keine Bewertungen

- Essentials of Life InsuranceDokument15 SeitenEssentials of Life InsuranceAayush AgrawalNoch keine Bewertungen

- General Insurance PPTDokument25 SeitenGeneral Insurance PPTmr_gangsterNoch keine Bewertungen

- M5 Mock Exam 4Dokument23 SeitenM5 Mock Exam 4miracaronsNoch keine Bewertungen

- Soalan Pce ExamDokument8 SeitenSoalan Pce Examsukahati0% (1)

- A-Plus HospitalIncome and HospitalIncome Extra Brochure 201306 v2Dokument8 SeitenA-Plus HospitalIncome and HospitalIncome Extra Brochure 201306 v2nusthe2745Noch keine Bewertungen

- IC-24 - Legal Aspects of Life AssuranceDokument1 SeiteIC-24 - Legal Aspects of Life Assuranceaman vermaNoch keine Bewertungen

- QuestionDokument82 SeitenQuestionGanesha Murthi RamasamyNoch keine Bewertungen

- Pivot Table Practice TestDokument62 SeitenPivot Table Practice TestShakthivel K ShakthiNoch keine Bewertungen

- Arogyadhan Application PDFDokument10 SeitenArogyadhan Application PDFMaddhu DusariNoch keine Bewertungen

- Saral Pension Brochure For ReferenceDokument12 SeitenSaral Pension Brochure For ReferenceKarthikeyan SakthivelNoch keine Bewertungen

- TESTDokument3 SeitenTESTSurekhaNoch keine Bewertungen

- Week 1 Lesson 2 Investment AvenuesDokument4 SeitenWeek 1 Lesson 2 Investment AvenuesAnanthi DNoch keine Bewertungen

- NDTV 24x7: Watch Live TV, Live News, India News Free: Headlines Entertainment The Times of India SportsDokument3 SeitenNDTV 24x7: Watch Live TV, Live News, India News Free: Headlines Entertainment The Times of India SportsJagadeesh GoudNoch keine Bewertungen

- NDTV 24x7: Watch Live TV, Live News, India News Free: FffffsDokument3 SeitenNDTV 24x7: Watch Live TV, Live News, India News Free: FffffsJagadeesh GoudNoch keine Bewertungen

- The New Yorker: New Is The Sixteenth Studio Album by Paul Mccartney, Released On 14 October 2013 inDokument2 SeitenThe New Yorker: New Is The Sixteenth Studio Album by Paul Mccartney, Released On 14 October 2013 inJagadeesh GoudNoch keine Bewertungen

- Complete Scenario of LSMW: Direct Method Batch Input - Record Method BAPI Method Idoc/AleDokument22 SeitenComplete Scenario of LSMW: Direct Method Batch Input - Record Method BAPI Method Idoc/AleJagadeesh GoudNoch keine Bewertungen

- Complete Scenario of LSMW: Direct Method Batch Input - Record Method BAPI Method Idoc/AleDokument22 SeitenComplete Scenario of LSMW: Direct Method Batch Input - Record Method BAPI Method Idoc/AleJagadeesh GoudNoch keine Bewertungen

- Sap GapsDokument1 SeiteSap GapsJagadeesh GoudNoch keine Bewertungen

- No Hard Feelings: ThingDokument2 SeitenNo Hard Feelings: ThingJagadeesh GoudNoch keine Bewertungen

- Index: S.No: Chapter Page NoDokument1 SeiteIndex: S.No: Chapter Page NoJagadeesh GoudNoch keine Bewertungen

- No Hard Feelings: ChallengesDokument2 SeitenNo Hard Feelings: ChallengesJagadeesh GoudNoch keine Bewertungen

- Sales Distribution 1aDokument2 SeitenSales Distribution 1aJagadeesh GoudNoch keine Bewertungen

- BRAND Small PaperDokument1 SeiteBRAND Small PaperJagadeesh GoudNoch keine Bewertungen

- AmaronPowerzone NetworkDokument1 SeiteAmaronPowerzone NetworkJagadeesh GoudNoch keine Bewertungen

- 108 - Post Mortem ConsentDokument6 Seiten108 - Post Mortem ConsentJagadeesh GoudNoch keine Bewertungen

- CGEITDokument10 SeitenCGEITikrudis100% (1)

- HandbookDokument3 SeitenHandbookparadise_27Noch keine Bewertungen

- 016 - Express Investments V Bayan TelecommunicationsDokument3 Seiten016 - Express Investments V Bayan Telecommunicationsjacaringal1Noch keine Bewertungen

- July 15, 2015Dokument12 SeitenJuly 15, 2015The Delphos HeraldNoch keine Bewertungen

- Askari Asset Allocation Term SheetDokument1 SeiteAskari Asset Allocation Term SheethakkanisirajNoch keine Bewertungen

- Horticulture Report FinalDokument57 SeitenHorticulture Report Finalbig john100% (1)

- Chapter 10Dokument36 SeitenChapter 10chiny0% (1)

- Thinesh Gorden Dividend PolicyDokument7 SeitenThinesh Gorden Dividend PolicyKirithiga SrinivasanNoch keine Bewertungen

- Theory: Management Advisory Services Questions and Answers Compiled By: Ma. Cristina P. Obeso, CpaDokument21 SeitenTheory: Management Advisory Services Questions and Answers Compiled By: Ma. Cristina P. Obeso, CpaJyasmine Aura V. AgustinNoch keine Bewertungen

- Capital Market IntermediariesDokument17 SeitenCapital Market IntermediariesRaksha PathakNoch keine Bewertungen

- Regulatory Deferral Accounts: IFRS Standard 14Dokument24 SeitenRegulatory Deferral Accounts: IFRS Standard 14Teja JurakNoch keine Bewertungen

- Practical Steps To Financial Freedom and Independence: Your Road Map To Exiting The Rat Race and Living Your DreamsDokument7 SeitenPractical Steps To Financial Freedom and Independence: Your Road Map To Exiting The Rat Race and Living Your DreamsUsiere UkoNoch keine Bewertungen

- Some Strategies For Managing Working Capital: Duke Ghosh IIFT, 2015Dokument44 SeitenSome Strategies For Managing Working Capital: Duke Ghosh IIFT, 2015Ishu GargNoch keine Bewertungen

- Team 7 Kra&kpiDokument7 SeitenTeam 7 Kra&kpishashank shekharNoch keine Bewertungen

- 2021 Catalonia BioRegion ReportDokument40 Seiten2021 Catalonia BioRegion ReportDaniel FusterNoch keine Bewertungen

- Tutorial 5 - Money Market - QuestionDokument4 SeitenTutorial 5 - Money Market - QuestionSHU WAN TEHNoch keine Bewertungen

- Disclosure Requirements of AsDokument75 SeitenDisclosure Requirements of AsVelayudham ThiyagarajanNoch keine Bewertungen

- The Role of Sustainability in Brand Equity Value in The Financial SectorDokument19 SeitenThe Role of Sustainability in Brand Equity Value in The Financial SectorPrasiddha PradhanNoch keine Bewertungen

- Summer Training Project Report On: Investors Behaviour in Insurance and Their Likeliness in Aegon LifeDokument30 SeitenSummer Training Project Report On: Investors Behaviour in Insurance and Their Likeliness in Aegon LifeavnishNoch keine Bewertungen

- Book Value Per Common ShareDokument2 SeitenBook Value Per Common SharepriteechauhanNoch keine Bewertungen

- Premium Case DigestsDokument8 SeitenPremium Case DigestsGladysAnneMiqueNoch keine Bewertungen

- Micro and Small Enterprises in India PDFDokument23 SeitenMicro and Small Enterprises in India PDFSuryamaniNoch keine Bewertungen

- IBPS Clerk Prelimsl Previous PaperDokument26 SeitenIBPS Clerk Prelimsl Previous PapershakthiNoch keine Bewertungen

- Canvass: Capturing News With An Analytical EdgeDokument6 SeitenCanvass: Capturing News With An Analytical EdgeRanjith RoshanNoch keine Bewertungen

- Indraprastha Gas Limited - SWOT AnalysisDokument27 SeitenIndraprastha Gas Limited - SWOT Analysissujaysarkar850% (1)