Beruflich Dokumente

Kultur Dokumente

CH 18 Sol

Hochgeladen von

Silviu TrebuianOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CH 18 Sol

Hochgeladen von

Silviu TrebuianCopyright:

Verfügbare Formate

CHAPTER 18 EARNINGS MULTIPLES

Problem 1 A. Payout Ratio = 1.06/$2.40 = 44.17 % Expected Growth Rate = 6% Cost of Equity = 7% + 1.05 * 5.5% = 12.775% P/E Ratio = 0.4417 * 1.06/(.12775 - .06) = 6.91 B. The stock is trading at ten times earnings. P/E Ratio = 10 = 0.4417 (1+g)/(.12775-g) Solving for g in this equation, g = (1.2775 - 0.4417)/10.4417 = 8.00% Problem 2 A. Dividend Payout Ratio

= Dividend Yield/(1/P/E) = 0.025/(1/16.9) = 0.4225

Expected Growth Rate = (1+Real Growth Rate) (1+ Expected Inflation) - 1 = 1.035 * 1.025 -1 = 6.09% Cost of Equity = 6.95% + 5.5% = 12.45% Expected P/E Ratio = Payout * (1 + g)/(r - g) = 0.4225 * 1.0609/(.1245 - .0609) = 7.05 B. P/E Ratio = 16.9 = 0.4225 (1+g)/(.1245 - g) Solving for g, g = (16.9 * .1245 - 0.4225)/(16.9 + 0.4225) = 9.71% In fact, this cannot be a stable growth rate.. It has to be valued using a high growth model. C. Yes. It has to be real growth. If the growth arises because of higher inflation, interest rates will also rise, erasing much of the benefits of higher growth. Problem 3 A. Dividend Payout Ratio = Return On Equity = First 5 Years After Year 5 55.49% 60.00% 20.00% 15.00%

Price/Earnings Multiples

Expected Growth Rate = Cost Of Equity =

8.90% 13.05%

6.00% 13.05%

(1.0890) 5 0.5549 * (1.0890) * 1 (1.1305) 5 0.6 * (1.089) 5 *(1.06) PE = + (.1305 - .0890) (.1305-.06) (1.1305)5 = 9.97

B. P/E Ratio Based Upon Stable Growth (6%; 60% dividend payout) = 0.6 * 1.06/(.1305 - .06) = 9.02 Difference Due to High Growth = 9.97 - 9.02 = 0.95 Problem 4

(1.15)5 0.10 * (1.15) * 1 5 0.5 * (1.15)5 *(1.06) (1.1388) A. PE = + (.1388 - .15) (.1305-.06) (1.1388)5 = 8.41

B.

Growth Rate from 1983 to 1993 = (0.78/0.08) (1/10) -1 = 25.57%

(1.2557) 5 0.10 * (1.2557) * 1 (1.1388)5 0.5 * (1.2557) 5 *(1.06) PE = + (.1388 - .2557) (.1305-.06) (1.1388)5 = 12.94 (1.10)5 0.10 * (1.10) * 1 (1.1388)5 0.5 * (1.10) 5 *(1.06) C. PE = + = 6.77 (.1388 - .10) (.1305 -.06) (1.1388)5

Problem 5 A. Dividend Payout Ratio = 0.0274/(1/21.2) = 0.581 Cost of Equity = 6% + 5.5% = 11.5% Solving for the Implied Growth Rate g = (21.2 * .115 - 0.581)/(21.2 + .581) = 8.53% 1+g = (1+ Expected Inflation Rate) (1+ Real Growth Rate) Solving for Expected Inflation 1.0853 = (1+Expected Inflation rate) (1.025) Expected Inflation Rate = 1.0853/1.025 - 1 = 5.88%

Price/Earnings Multiples

(This assumes that the earnings are in stable growth. The analysis becomes much more complicated if you have a period of high growth) B. The P/E ratio would go down. For instance, in the formulation above, Dividend Payout Ratio = 0.581 Cost of Equity = 12.5% Expected Growth Rate =8.53% The new P/E ratio would be P/E = 0.581 (1.0853)/(.125 - .0853) = 15.88 C. Not necessarily. If the increase in expected real growth is greater than the increase in interest rates, P/E ratios may go up as interest rates go up. Problem 6 A. Average P/E Ratio for the Industry = 13.2 Median P/E Ratio for the Industry = 12.25 If the firms in this group are homogeneous, the average P/E ratio provides an estimate of how much the market values earnings in this sector, given the expected growth potential and the risk in the sector. The average P/E ratio can be skewed by extreme values (usually high, since P/E cannot be less than zero). The median corrects for this by looking at the median firm in the sector. B. This statement is likely to be true only if (1) Thiokol has the same growth prospects and risk profile of the typical firm in the industry. It also generates cash flows for disbursement as dividends which are similar to the typical firm in the industry. (2) Thiokol has higher growth potential and/or lower risk than the typical firm in the industry. C. The regression of P/E ratios on fundamentals yields the following: P/E = -2.33 + 35.74 Growth Rate + 11.97 Beta + 2.90 Payout Ratio R2= 0.4068 The following table provides predicted P/E ratios for the firms in the group:

Price/Earnings Multiples

Predicted Difference P/E Boeing 17.30 12.90 4.40 General Dynamics 15.50 17.90 -2.40 GM- Hughes 16.50 13.68 2.82 Grumman 11.40 12.07 -0.67 Lockheed Corp. 10.20 12.31 -2.11 Logicon 12.40 13.17 -0.77 Loral Corporation 13.30 13.21 0.09 Martin Marietta 11.00 11.34 -0.34 McDonnell Doug. 22.60 17.15 5.45 Northrop 9.50 14.82 -5.32 Raytheon 12.10 10.85 1.25 Rockwell 13.90 14.85 -0.95 Thiokol 8.70 11.44 -2.74 United Industrial 10.40 9.11 1.29 Again, negative numbers indicate that the stock is undervalued. The problem with a regression like this one is that it has relatively few observations and is likely to be thrown off by a few extreme observations. Problem 7 A. Expected Growth Rate = 25% Unlevered Beta = 1.15/(1 + 0.6 * 0.25) = 1.00 FCFE = Net Income + Depreciation - Capital Spending = 10 + 5 - 12 = 3 Estimated Dividend Payout Ratio = 3/10 = 30% P/E = 18.69 + 0.0695 * 25 - 0.5082 (1.00) - 0.4262 * 0.30 = 19.79 B. 1. The cross-sectional relationship between P/E ratio and the fundamentals may change over time. 2. The market might be overvaluing all stocks. 3. Some of the fundamentals, such as growth rate or beta, might be estimated with error. 4. We are assuming that private companies are valued like publicly traded stocks. (In other words, we are not allowing for diversification and illiquidity discounts)

Actual P/E

Das könnte Ihnen auch gefallen

- Basel II FrameworkDokument347 SeitenBasel II Frameworked_nycNoch keine Bewertungen

- Samsonite International S A SEHK 1910 Compustat Financials RatiosDokument8 SeitenSamsonite International S A SEHK 1910 Compustat Financials RatiosSilviu TrebuianNoch keine Bewertungen

- TalebDokument5 SeitenTalebjadarginNoch keine Bewertungen

- Quotes TalebDokument2 SeitenQuotes TalebSilviu TrebuianNoch keine Bewertungen

- SamsoniteInternationalSASEHK1910 PublicCompanyDokument1 SeiteSamsoniteInternationalSASEHK1910 PublicCompanySilviu TrebuianNoch keine Bewertungen

- FRM Prep Handbook 2013-080913-WebDokument15 SeitenFRM Prep Handbook 2013-080913-WebSilviu TrebuianNoch keine Bewertungen

- 02-Charting Our Water Future Exec Summary 001Dokument32 Seiten02-Charting Our Water Future Exec Summary 001Basanth KandpalNoch keine Bewertungen

- Sample FRM Part 1Dokument6 SeitenSample FRM Part 1Silviu TrebuianNoch keine Bewertungen

- Interviewing at Google Zurich PGMDokument7 SeitenInterviewing at Google Zurich PGMSilviu TrebuianNoch keine Bewertungen

- FRM - Syllabus PDFDokument64 SeitenFRM - Syllabus PDFAnonymous x5odvnNVNoch keine Bewertungen

- CFA Level 1 - Economics Flashcards - QuizletDokument20 SeitenCFA Level 1 - Economics Flashcards - QuizletSilviu Trebuian100% (3)

- Samsonite International S A SEHK 1910 新秀麗國際有限公司 Public Company ProfileDokument3 SeitenSamsonite International S A SEHK 1910 新秀麗國際有限公司 Public Company ProfileSilviu TrebuianNoch keine Bewertungen

- CFA Formula Cheat SheetDokument9 SeitenCFA Formula Cheat SheetChingWa ChanNoch keine Bewertungen

- FRM Study Guide 2013-WebDokument19 SeitenFRM Study Guide 2013-WebSandeep SajuNoch keine Bewertungen

- Financial Book ListDokument3 SeitenFinancial Book ListSilviu TrebuianNoch keine Bewertungen

- CAIA Level I Workbook March 2014Dokument86 SeitenCAIA Level I Workbook March 2014Silviu Trebuian100% (1)

- Chapter 11: Arbitrage Pricing TheoryDokument7 SeitenChapter 11: Arbitrage Pricing TheorySilviu TrebuianNoch keine Bewertungen

- CAIA Level I Study Guide March 2014Dokument81 SeitenCAIA Level I Study Guide March 2014Silviu Trebuian100% (1)

- CH 24 SolDokument5 SeitenCH 24 SolSilviu TrebuianNoch keine Bewertungen

- Soln CH 01 Financ EnvironDokument4 SeitenSoln CH 01 Financ EnvironSilviu TrebuianNoch keine Bewertungen

- McKinsey's Big Data Full ReportDokument156 SeitenMcKinsey's Big Data Full ReportdocdumpsterNoch keine Bewertungen

- Disruptive Technologies McKinsey May 2013Dokument176 SeitenDisruptive Technologies McKinsey May 2013mattb411Noch keine Bewertungen

- 02-Charting Our Water Future Exec Summary 001Dokument32 Seiten02-Charting Our Water Future Exec Summary 001Basanth KandpalNoch keine Bewertungen

- CH 25 SolDokument5 SeitenCH 25 SolSilviu TrebuianNoch keine Bewertungen

- CH 22 SolDokument5 SeitenCH 22 SolSilviu TrebuianNoch keine Bewertungen

- CH 23 SolDokument2 SeitenCH 23 SolSilviu TrebuianNoch keine Bewertungen

- CH 21 SolDokument3 SeitenCH 21 SolSilviu TrebuianNoch keine Bewertungen

- CH 22 SolDokument5 SeitenCH 22 SolSilviu TrebuianNoch keine Bewertungen

- Revenue Multiples and Sector-Specific Multiples: Problem 1Dokument5 SeitenRevenue Multiples and Sector-Specific Multiples: Problem 1Silviu TrebuianNoch keine Bewertungen

- CH 21 SolDokument3 SeitenCH 21 SolSilviu TrebuianNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Report - Divis LabDokument7 SeitenReport - Divis LabAnonymous y3hYf50mTNoch keine Bewertungen

- 48 Suspicious Banker DeathsDokument5 Seiten48 Suspicious Banker DeathsJuandelaCruzNoch keine Bewertungen

- Forecasting and Valuing Cash FlowDokument31 SeitenForecasting and Valuing Cash FlowIshitta SardaNoch keine Bewertungen

- MBA SyllabusDokument18 SeitenMBA SyllabusShaheen MahmudNoch keine Bewertungen

- Geographical Pricing Strategy FinalDokument10 SeitenGeographical Pricing Strategy FinalSeif ElkhoulyNoch keine Bewertungen

- Derivatives Market Finmar ReportDokument2 SeitenDerivatives Market Finmar ReportLyra Joy CalayanNoch keine Bewertungen

- 1.1 Introduction of Working Capital Management: Chapter - 1Dokument67 Seiten1.1 Introduction of Working Capital Management: Chapter - 1raisNoch keine Bewertungen

- Security Valuation: Learning OutcomesDokument38 SeitenSecurity Valuation: Learning OutcomesMadhuratha MuraliNoch keine Bewertungen

- Clearing and Settlement PPT: Financial DerivativesDokument24 SeitenClearing and Settlement PPT: Financial DerivativesAnkush SheeNoch keine Bewertungen

- Fill in The Blank Sentence and TransletDokument2 SeitenFill in The Blank Sentence and TransletDesta PutraNoch keine Bewertungen

- Active and Passive Investment PDFDokument4 SeitenActive and Passive Investment PDFmuktaNoch keine Bewertungen

- Northern RockDokument15 SeitenNorthern RockÁi PhươngNoch keine Bewertungen

- Winfield Refuse Waste ManagementDokument6 SeitenWinfield Refuse Waste ManagementAakash Singh BJ22162Noch keine Bewertungen

- CH 6 - LBODokument23 SeitenCH 6 - LBOVrutika ShahNoch keine Bewertungen

- Case Study Analysis of Learning and Development at Tata MotorsDokument5 SeitenCase Study Analysis of Learning and Development at Tata MotorsShanaya SinghaniyaNoch keine Bewertungen

- Build Operate Transfer Scheme EtcDokument4 SeitenBuild Operate Transfer Scheme EtcRehan YakobNoch keine Bewertungen

- IBD RockDokument1 SeiteIBD RockSpencer AnteNoch keine Bewertungen

- Oakland Raiders Las Vegas NFL Stadium Spreadsheet by Zennie AbrahamDokument11 SeitenOakland Raiders Las Vegas NFL Stadium Spreadsheet by Zennie AbrahamZennie AbrahamNoch keine Bewertungen

- How The Rich Stay Rich - Using A Family Trust Company To Secure ADokument51 SeitenHow The Rich Stay Rich - Using A Family Trust Company To Secure Aspcbanking100% (4)

- Fs ExerciseDokument6 SeitenFs ExerciseDIVINE GRACE ROSALESNoch keine Bewertungen

- Corporate Finance Exam QuestionsDokument4 SeitenCorporate Finance Exam QuestionsciaoNoch keine Bewertungen

- Islamic Venture Capital CompleteDokument14 SeitenIslamic Venture Capital CompleteGobinath Mann100% (1)

- Taxpnl EMS991Dokument34 SeitenTaxpnl EMS991sagar yadavNoch keine Bewertungen

- Mps (Jul Dec2023)Dokument43 SeitenMps (Jul Dec2023)JasimNoch keine Bewertungen

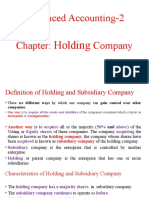

- Advanced Accounting-2 Company: HoldingDokument20 SeitenAdvanced Accounting-2 Company: HoldingTB AhmedNoch keine Bewertungen

- Quiz No 2 Fsa Oral Recits Quiz PDF FreeDokument13 SeitenQuiz No 2 Fsa Oral Recits Quiz PDF FreeTshina Jill BranzuelaNoch keine Bewertungen

- ABFM - Course OutlineDokument3 SeitenABFM - Course OutlinemuhammadannasNoch keine Bewertungen

- Economic Survey 2006-07Dokument94 SeitenEconomic Survey 2006-07Kamran KhanNoch keine Bewertungen

- Cma NotesDokument51 SeitenCma NotesAnshul BajajNoch keine Bewertungen

- PW TrengkasDokument20 SeitenPW TrengkasFit Rah641349Noch keine Bewertungen